Resources

Presentation slides and video time stamps

View the Making the most of your money course.

View the Investing with interest booklet.

Read the presentation slides for this webinar.

Time stamps for the video:

0:50 – Welcome, introductions, and warm-up

3:10 – Making the most of your money overview

12:57 – Demo

25:26 – Investing with interest overview

40:00 – Other resources

44:04 – Q&A

Resources

Presentation slides, handouts, and video time stamps

Read the presentation slides for this webinar.

Download resources provided by webinar speakers:

Time-stamps for the video recording:

3:24 – Agenda and Introductions

6:36 – Audience poll questions

9:33 – FAIR Canada presentation (speaker: Tasmin Waley)

24:07 – Ontario Securities Commission presentation (speaker: Christine Allum)

39:10 – Investor Protection Clinic at Osgoode Hall Law School (speaker: Brigitte Catellier)

51:34 – Q&A

Resources

Handouts, slides, and time-stamps

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

Online financial tools and calculators (Prosper Canada)

Virtual tools for participant engagement (Prosper Canada)

Online delivery check-list (Momentum)

Jeopardy game template (SEED)

Time-stamps for the video recording:

3:26 – Agenda and introductions

5:10 – Audience polls

8:19 – Virtual delivery considerations (Speaker: Glenna Harris, Prosper Canada)

12:39 – Virtual workshops best practices (Speaker: Fatima Esmail, Momentum)

33:12 – Online money management training (Speaker: Millie Acuna, SEED)

49:07 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

How Savings Circles Works

Information about the Strive program

Time-stamps for the video recording:

3:35 – Agenda and introductions

6:00 – Audience polls

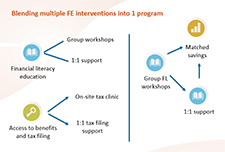

10:58 – Financial empowerment interventions (Speaker: Glenna Harris)

14:00 – Savings Circles program at Momentum (Speaker: Anna Jordan)

33:18 – Strive program (Speaker: Monica daPonte)

55:50 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Access the handouts for this webinar:

Poster presentation: Financial Empowerment for Newcomers project

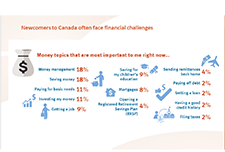

Infographics: Newcomer settlement stages, money matters, and client personas

Time-stamps for the video recording:

3:11 – Agenda and introductions

5:21 – Audience poll

8:25 – Introduction to Financial Empowerment for Newcomers project (Speaker: Glenna Harris)

11:25 – AXIS financial coaching program (Speaker: Sheri Abbot)

30:05 – North York Community House financial coaching program (Speaker: Noemi Garcia)

45:40 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Access the handouts for this webinar:

How we help people – An overview (Webinar handout) – Credit Counselling Society

Our services (Webinar handout) – Credit Counselling Society

Debt solutions 101 (Webinar handout) – msi Spergel Inc

Time-stamps for the video-recording:

4:13 – Agenda and introductions

7:00 – Audience polls

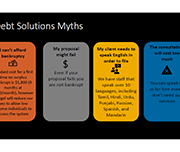

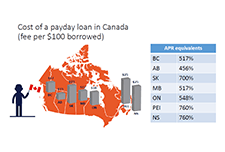

12:31 – Debt in Canada (Speaker: Glenna Harris)

15:20 – Credit Counselling Society on debt management plans (Speaker: Anne Arbour)

34:05 – Spergel Msi on Consumer Proposals and Bankruptcy plans (Speaker: Gillian Goldblatt)

56:00 – Q&A

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

Brief: Matched Savings programs – webinar handout (Momentum)

Matched Savings programs chart – webinar handout (Momentum)

Budget Tracker – webinar handout (Credit Counselling Sudbury)

Monthly Budget – webinar handout (Credit Counselling Sudbury)

Time-stamps for the video-recording:

3:26 – Agenda and introduction

6:17 – Audience polls

9:41 – Reasons to save (Speaker: Glenna Harris)

12:08 – Effectiveness of Matched Savings (Speaker: Dean Estrella from Momentum)

32:10 – Savings strategies for clients on low incomes (Speaker: John Cockburn from Credit Counselling Sudbury)

47:50 – Q&A

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

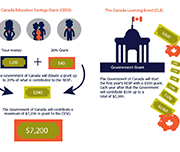

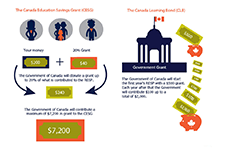

RESP case plan – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP tracking sheet – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP quick reference sheet – webinar handout (from FSGV)

RESP sample letter to schools – webinar handout (from Credit Counselling Sault Ste. Marie)

Time-stamps for the video recording:

3:00 – Agenda and introductions

5:05 – Audience polls

9:00 – Importance of education savings (Speaker: Glenna Harris)

16:00 – Credit Counselling Services Sault Ste. Marie and District (Speaker: Allyson Schmidt)

33:00 – Family Services of Greater Vancouver (Speaker: Rocio Vasquez)

54:45 – Q&A