Resources

Resources will be provided here post-webinar.

Resources

Handouts, videos and time stamps

Resources

Handouts, video and time stamps

Read the presentation slides for this webinar.

Time stamps for the video:

Welcome and introductions

2:52 – Goals for webinar

4:39 – Context: Benefits Wayfinder and Disability Benefits Navigator

10:46 – Intro to the Bridge to Benefits tool

19:31 – Development process

24:10 – Demo – Walkthrough of the features

40:17 – Evaluation

44:12 – How to share this tool with others/Other resources

49:12 – Questions and feedback

Resources

Handouts, slides and video time stamps

Read the presentation slides for this webinar.

Download the promotional postcard.

Download the promotional poster.

Time-stamps for the video recording:

1:26 – Welcome and introductions

3:30 – Our goals for today’s session

5:04 – Why these tools were created

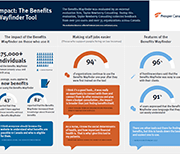

7:12 – The Benefits Wayfinder and the Disability Benefits Compass

46:11 – Ways to use the Benefits Wayfinder – tax clinics

49:37 – Access to Benefits training available

Missing for those who need it most: Canada’s financial help gap

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable, appropriate and trustworthy financial help for people with low incomes is a critical but missing piece in Canada's financial services landscape. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere to a budget, set and pursue saving goals, file their taxes outside of tax season, and access income benefits. Executive summary: Canada's financial help gap L’aide qui manque pour ceux qui en ont le plus besoin Sommaire Exécutif: L’écart en matière d’aide financière au Canada

Economic abuse screening tool (a toolkit for social service providers)

Women’s shelters are often the first point of contact for victim-survivors fleeing abusive relationships. Therefore, safety and shelter are logically at the forefront of staff members’ immediate concerns. Once the victim-survivor is in a place of safety, it is crucial to explore the patterns of abuse the person has experienced. Economic security is an often overlooked pattern of abuse linked to physical safety. It is, therefore, crucial and the goal of this screening tool for shelter workers to identify potential Economic and Financial Abuse amongst their clients and to assist victim-survivors in accessing essential economic resources. Watch the webinar: Recognizing and responding to economic abuse; empowering survivors to thrive and succeed.

Canada workers benefit

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility requirements, how to apply and how much you can expect to receive by clicking on the Get It button below.

Service Matters: Numbers Speak Volumes

The Annual Report by the Office of the taxpayer's ombudsman provides key achievements, identifies Canada Revenue Agency (CRA) service issues and outlines trends in complaints. In addition, the report includes three recommendations to the Minister of National Revenue and the Chair of the Board of Management to improve the CRA’s service to Canadians.

Weathering the storms: modernizing the U.S. benefits system to support household financial resilience

For most households in America, financial shocks are inevitable. The car will break down. The house will need a repair. A key earner for a household will be laid off. These shocks can be devastating to household finances. And while the COVID-19 pandemic, which we are still recovering from, was a once-in-a-generation economic and health shock for households and our economy, we also know that it is just one example of the uncertainty and volatility of the world we now live in. When public and private benefits—such as unemployment insurance and paid sick leave—are not accessible and not designed or delivered in a timely manner to effectively support families in weathering financial shocks, families suffer. To effectively modernize our benefits system to help people weather financial shocks—both small and large— requires an evidence-based framework focused on what households need to be financially resilient and on opportunities for benefit leaders to address those needs. This paper lays out the framework by:

Ottawa should soften bite of benefit clawbacks for low-income families

Canada’s tax system has a punitive impact on lower income families with children hoping to earn more money, according to a new report from the C.D. Howe Institute. In “Softening the Bite: The Impact of Benefit Clawbacks on Low-Income Families and How to Reduce It,” authors Alex Laurin and Nicholas Dahir reveal how benefit reductions serve as hidden tax rates and reduce the effective gain from working to generate additional income. Read full report here.

The impact of COVID-19 on financial capability and asset building services.

The forced transition from in-person to online activities as a result of the COVID-19 pandemic has had a profound impact on how families and communities buy groceries, acquire medical care, and utilize social services. This rapid shift has raised important questions about how to address access and equity. AFN and the University of Wisconsin-Madison Center for Financial Security (CFS) conducted this study to better understand the transition to remote services among financial capability and asset building (FCAB) programs, which includes financial education, counseling, coaching, emergency assistance, benefits navigation, housing supports, workforce development, and other related services. The insights from this study can inform strategies for FCAB services going forward. This brief reviews recommendations for funders and organizations seeking to learn from the financial capability service delivery models employed in the COVID-19 pandemic, especially related to replication of findings that lead to more equitable delivery practices, improved accessibility of services, and greater financial improvements for clients. Six region-specific briefs complement the national findings - Indiana, Louisiana, North and South Carolina, Oregon, Texas, and Washington. This brief is generously supported by JPMorgan Chase & Co., MetLife Foundation, and Wells Fargo. If you missed the live webinar, watch the recording here.

Connecting families initiative

Daily aspects of Canadians' lives are increasingly touched by digital technology, and access to high-speed Internet has become an essential service and a key driver for improving our economic and social well-being. The Government of Canada originally announced Connecting Families in Budget 2017 to help bridge the digital divide for Canadian families who struggled to afford access to home Internet. Learn more about the next phase of this initiative.

8 ways to prepare financially for retirement

This article from OSC provides 8 tips to help you plan for retirement. Transitioning from working life to retirement takes careful financial planning and decision-making – give yourself plenty of time to prepare. Here are some things you can do ahead of time.

Access to Identification for Low-income Manitobans

Government-issued identification (ID) is essential to gain access to a wide range of government entitlements, commercial services and financial systems. Lack of ID on the other hand, represents a critical barrier that prevents low-income Manitobans from accessing these services and benefits, and ultimately results in further marginalization and deepening poverty. Other provinces are now recognizing that ID is necessary to navigate the modern world and are doing something to support those who fall through the cracks. A new study, Access to Identification for Low-Income Manitobans researches what can be done to address these challenges and offers recommendations to reduce barriers to ID for low-income Manitobans.

Mapping the road toward increased accessibility to the child tax credit

Last year, the expanded Child Tax Credit (CTC) helped to lift nearly four million children out of poverty and provided economic relief to millions of struggling households. However, many first-time and lapsed filers from underserved and vulnerable populations missed out on these critical benefits. Locating and serving eligible low-income youth, formerly incarcerated individuals, people experiencing homelessness, immigrants, survivors of domestic violence, and isolated tribal populations has presented a challenging opportunity to free tax prep service providers across the country. This research highlights the key findings and recommendations to increase the accessibility to the CTC.

Understanding Systems: The 2021 report of the National Advisory Council on Poverty

Canada’s National Advisory Council on Poverty’s second Annual Report, Understanding Systems, is the first report to provide a glimpse into poverty since COVID-19. Based on community engagements with Canadians and provinces/territories over the last year, the Council has recommended five broad strategies to reduce poverty in Canada. The pillars of the strategy are as follows: In a recent webinar, three Council members shared what strategies can make the greatest impact. Read more to learn about the key takeaways from the discussion.

Welfare in Canada, 2020

Maytree released the 2020 edition of the Welfare in Canada report. For each province and territory, this report provides data and analysis on the total welfare income that households receiving social assistance would have qualified for in 2020, including COVID-19 pandemic-related supports. Welfare in Canada is a series that presents the total incomes of four example households who qualify for social assistance benefits in each of Canada’s provinces and territories in a given year. Welfare in Canada, 2020 looks at the maximum total amount that a household would have received over the course of the 2020 calendar year, assuming they had no other source of income and no assets. Some households may have received less if they had income from other sources, while some households may have received more if they had special health- or disability-related needs. The report looks at: In addition, this year the report includes a new section that looks at the adequacy of welfare incomes in each province over time, an analysis that hearkens back to past reports prepared by the National Council of Welfare. Also, please note that this report measures the adequacy of welfare incomes relative to both the Market Basket Measure (MBM) – Canada’s Official Poverty Line – and the Deep Income Poverty threshold (MBM-DIP), which is equivalent to 75 per cent of the MBM. This analysis will replace the low-income threshold comparisons in future reports. We hope these additions will be helpful for those using the report. In each jurisdiction, the total welfare income for which a household is eligible depends on its specific composition. For illustrative purposes, this resource focuses on the welfare incomes of four example household types:

Early Planning Toolkit

A toolkit for parents/caregivers with a child with a disability ages 2 to 10, containing:

Workers receiving payments from the Canada Emergency Response Benefit program in 2020

The Canada Emergency Response Benefit program (CERB) was introduced to provide financial support to employees and self-employed workers in Canada who were directly impacted by the COVID-19 pandemic. This article examines the proportion of 2019 workers who received CERB payments in 2020 by various characteristics. CERB take-up rates are presented by industry, earnings group in 2019, sex, age group and province, as well as for population groups designated as visible minorities, immigrants and Indigenous people. Some factors that help explain differences in take-up rates among these groups of workers are also examined.

Employment Insurance, February 2021

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and various other public health requirements. Public health measures were relaxed in Quebec, Alberta, Nova Scotia and New Brunswick on February 8, although a curfew remained in effect in Quebec. Measures were loosened in many regions of Ontario on February 10 and 15, although stay-at-home orders remained in place in the health regions of Toronto, Peel, York and North Bay Parry Sound. In Manitoba, various measures were eased on February 12. In contrast, Newfoundland and Labrador reintroduced a lockdown on February 12, requiring the widespread closure of non-essential businesses and services.

Financial Relief Navigator

The Financial Relief Navigator is an online tool that can help you find support to raise your income or lower your expenses in these challenging times. The tool will suggest income benefits or other support programs you may be eligible for in your province/territory in Canada.

2020 Second Annual Report of the Disability Advisory Committee

In November 2017, the Minister of National Revenue, the Honourable Diane Lebouthillier, announced the creation of the Disability Advisory Committee to provide advice to the Canada Revenue Agency (CRA) on interpreting and administering tax measures for persons with disabilities in a fair, transparent and accessible manner. The committee’s full mandate is attached as Appendix A. Key disability tax measures are described in Appendix B. Our first annual report, Enabling access to disability tax measures, was published in May 2019. Since that time, we believe there has been important progress with respect to the administration of and communications about the disability tax credit (DTC). Our second annual report describes in detail the many improvements that the CRA has introduced over the past year in response to the recommendations in our 2019 report. These changes are summarized in “The Client Experience” on the following pages. Section 1 of this second annual report presents a review of the 42 recommendations made in our first annual report. Each recommendation summarizes the relevant context and associated follow-up actions. Section 2 covers the new areas of conversation during the second year of our mandate. Selected topics focus, for example, on DTC data, concerns of Indigenous peoples and eligibility for a registered disability savings plan. Section 3 includes the appendices, which provide details not covered in the text.

Roadblocks and Resilience

This report, Roadblocks and Resilience Insights from the Access to Benefits for Persons with Disabilities project, provides insights on the barriers people with disabilities in British Columbia face in accessing key income benefits. These insights, and the accompanying service principles that participants identified, were obtained by reviewing existing research, directly engaging 16 B.C. residents with disabilities and interviewing 18 researchers and service providers across Canada. We will use these insights to inform development and testing of a pilot service to support people with disabilities to access disability benefits. The related journey map Common steps to get disability benefits also illustrates the complexities of this benefits application process. This journey map illustrates the process of applying for the Disability Tax Credit. The journey map Persons with Disability (PWD) status illustrates the process of preparing for and applying for and maintaining Persons with Disabilities Status and disability assistance in B.C.

Social Listening: Covid-19, Social Media, and The Path to a Better Safety Net

This brief outlines how beneficiaries are using online platforms to identify breakdowns in public services, celebrate the positive impact of public policy and urge reform. Ways in which government can capitalize on widespread social media feedback and begin to build long-term measures to center people’s experience as an important component of policy design are explored.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

English

French

Canada Revenue Agency Child and Family Benefits Calculator

This online tool released by the Canada Revenue Agency can be used to determine the eligibility and payment amounts of child and family benefits. Additional information on child and family benefit programs may be found on the Canada Revenue Agency's child and family benefits page.