Resources

Handouts, slides, and time-stamps

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits designed to support them. This report illustrates that the CRA needs to take a broad, country-wide perspective of the CVITP, while also taking into consideration regional and other differences. Services offered and training provided to volunteers need to reflect the realities of the diverse regional, geographic, socio-economic, workforce, and vulnerable, sectors throughout Canada. Different areas of the country will have different primary needs from the CVITP. The CRA needs to address those needs, both in its actions through the CVITP, as well as in the training provided to CVITP volunteers and the support given to partner organizations.

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of the Canada Revenue Agency (CRA). The Office of the Taxpayers’ Ombudsman hears first-hand the concerns of individuals, tax practitioners, and community support organizations. The Ombudsman visited with Community Volunteer Income Tax Program (CVITP) partner organizations, volunteers, and the Canada Revenue Agency’s (CRA) CVITP coordinators to learn more about the program and to understand the success stories and challenges they all experience. This report gives voice to what they have heard and provides recommendations on how to address the issues raised.

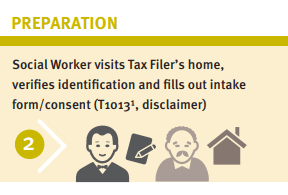

Virtual tax filing: Piloting a new way to file taxes for homebound seniors

WoodGreen Community Services, a large multi-service frontline social service agency in Toronto, provides free tax preparation services year-round to people living on low incomes. WoodGreen was interested in designing a novel solution to address the tax filing needs of homebound seniors who are unable to access WoodGreen’s free in-person tax-preparation services due to physical or mental health challenges. Specifically, WoodGreen wanted to know… How might we provide high-quality professional tax preparation services to all clients whether or not they are onsite? Prosper Canada and a leading commercial tax preparation software company partnered with WoodGreen Community Services in order to answer this design question.

English

Supported self-file process maps: English

French

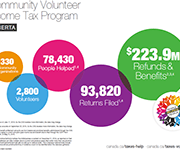

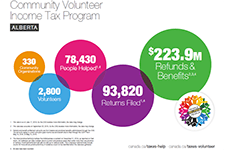

Community Volunteer Income Tax Program (CVITP) provincial snapshots

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les informations sont présentées en anglais et en français.

Virtual Tax Filing Pilot

In this presentation, Radya Chaerkaoui, Senior Product Manager and Innovation Catalyst, Intuit Canada, and Steve Vanderherberg, Director-Strategic Initiatives, WoodGreen Community Services, share insights from their Virtual Tax Filing Pilot program. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Get Your Piece of the Money Pie

In this presentation, Althea Arsenault, Manager of Resource Development, NB Economic and Social Inclusion Corporation, shares insights from the 'Get Your Piece of the Money Pie' tax clinic program. This program has operated since 2010, and currently files over 23,000 returns each year. This presentation is from the panel discussion 'National and regional strategies to boost tax filing', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Get Your Benefits! Diagnose and Treat Poverty

In this presentation, Noralou P. Roos, Co-Director, GetYourBenefits! and Professor, Manitoba Centre for Health Policy, explains how access to tax filing and benefits is an important poverty intervention. This presentation is from the panel discussion 'National and regional strategies to boost tax filing', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Providing tax filing and benefits assistance to Indigenous communities

In this presentation, Simon Brascoupé, Vice President, Education and Training, AFOA Canada, explains the financial wellness framework and how tax filing presents opportunities for building financial wellness in Indigenous communities. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Supporting Organizations in the CVITP

In this presentation, Aaron Kozak, ESDC and Melissa Valencia, CRA, present findings from their research on the Community Volunteer Income Tax Program (CVITP). This includes recommendations for structural changes to the program, review of CVITP training, changes to registration, and more. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

The Community Volunteer Income Tax Program (CVITP)

In this presentation, Nancy McKenna, Manager, CVITP, Canada Revenue Agency, explains how the Community Volunteer Income Tax Program (CVITP) works. This includes eligibility requirements, the size of the program in 2017/2018, and partnerships. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

English

Download in English

French

English

2023 Tax Resources: Canada Revenue Agency

The Canada Revenue Agency kicks off the 2023 Tax filing season

- Factsheet – Students

- Factsheet – Persons with disabilities

- Factsheet – Modest income individuals

- Factsheet – Housing insecure individuals

- Factsheet – Adults 65 and older

- Factsheet – Indigenous peoples

- Factsheet: Northern residents deductions

- Factsheet: Individuals experiencing gender based violence

- Factsheet – Newcomers

Resources

- Infographic: Child-related benefits

- Infographic: Newcomers

- Tear sheet: Register for my account

- Tear sheet: Doing your taxes

- Service option card

- Video: Individuals with a modest income

- Video: Persons with disabilities

- Video: International Students

- Video: Students, it pays to do your taxes!

- SimpleFile by Phone automated phone service (formerly called File my Return)

2022 Tax Resources: Canada Revenue Agency

- Benefits and credits fact sheet – Students

- Benefits and credits fact sheet – Persons with disabilities

- Benefits and credits fact sheet – Modest income individuals

- Benefits and credits fact sheet – Housing insecure individuals

- Benefits and credits fact sheet – Adults 65 and older

- Benefits and credits fact sheet – Women in shelters

- Benefits and credits fact sheet – Indigenous peoples

- Benefits and credits fact sheet – Newcomers

Canada Dental Benefit

One-time top-up to the Canada Housing Benefit

Get your taxes done for free at a tax clinic

Canada workers benefit

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

2021 Tax Resources - Canada Revenue Agency

Last-minute tax tips (Canada Revenue Agency) – April 13, 2021

New Canada Recovery Benefits – What to Expect

Answers to your questions on paying back the Canada Emergency Response Benefit (CERB)

Benefits and credits fact sheet – Indigenous people living in Canada

Benefits and credits fact sheet – Modest income

Benefits and credits fact sheet – Newcomers

Benefits and credits fact sheet – Newcomers in Quebec

Benefits, credits, and deductions for Seniors

COVID-19 Measures for Persons with Disabilities

Benefits and credits – Persons with Disabilities

Canada Workers Benefit – Infographic

Canada Workers Benefit – promotion card

Get your taxes done for free – promotion card

Income tax basics

Why file? The benefits of tax filing (Tax toolkit)

Getting government payments by direct deposit

Income tax 101: What are tax deductions, benefits, credits, exemptions, and brackets? (Tax toolkit)

Considerations for Indigenous people at tax time (Tax toolkit)

Resources about tax filing in Canada (Tax toolkit)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Community tax clinic guides

About volunteer tax clinics: Help your community members file their taxes (Tax toolkit)

Getting started as a community tax clinic (Tax toolkit)

Tax clinic staff and volunteer roles (Tax toolkit)

Tax clinic preparation: Recommended timeline (Tax toolkit)

Insights on planning free tax clinics in Indigenous communities: Infographic (Tax toolkit)

Encouraging tax filing at virtual clinics (sample “active choice” email) – The Behavioural Insights Team *NEW*

Tax clinic resources for practitioners

The tax clinic resources below are from our community partner organizations. These are examples that may be adapted to your own community tax clinic needs. Whenever possible, we have credited the original author of each document and included contact information if you would like to find out more about using and adapting the resource.

Resources to support tax clinic delivery and tax filing

Simplified Intake Form 2019 (ACSA, Scarborough, ON)

Tax Clinic Host Checklist (The Working Centre, Kitchener-Waterloo, ON)

Income tax checklist for participants (The Working Centre, Kitchener-Waterloo, ON)

Intake form for Couples (E4C, Edmonton, AB)

Tax Prep Quick Reference Guide (E4C, Edmonton, AB)

Other resources to support participants at tax time

Income tax summary (The Working Centre, Kitchener-Waterloo, ON)

Form for Missing Income Info for Revenue Canada (The Working Centre, Kitchener-Waterloo, ON)

Forms for rental information (The Working Centre, Kitchener-Waterloo, ON)

Referral to FEPS (The Working Centre, Kitchener-Waterloo, ON)

Envelope checklist (E4C, Edmonton, AB)

Seniors Info Sheet – Federal and provincial benefits (E4C, Edmonton, AB)

Resources for outreach and promotion

Tax clinic flyer (ACSA, Scarborough, ON)

2019 tax clinic flyer (Jane Finch Centre, Toronto, ON)

2019 tax clinic flyer (North York Community House, Toronto, ON)

Resources to support tracking and evaluation

Tax data entry sheet – Tax toolkit (Sunrise Community Centre, Calgary, AB)

Anonymous tax tracking sheet (Aspire collective, Calgary, AB)

Additional information and resources on tax filing

Benefits, credits and financial support: CRA and COVID-19 – Canada Revenue Agency (CRA)

Covid-19: Free virtual tax clinics – Canada Revenue Agency (CRA)

Get ready to do your taxes – Canada Revenue Agency (CRA)

Taking care of your tax and benefit affairs can pay off (tax filing info sheet) – Canada Revenue Agency (CRA) *NEW

Slam the scam – Protect yourself against fraud – Canada Revenue Agency (CRA)

Virtual Tax Filing: Piloting a new way to file taxes for homebound seniors – Prosper Canada

Webinar Series on Taxes (May 2020) – Momentum

SimpleFile by Phone automated phone service (formerly called File my Return) – Prosper Canada Learning Hub

Tax season prep – Plan Institute

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

What to do if your tax return is reviewed or audited – OSC

French

Ressources de déclaration de revenus 2024 - Agence du revenu du Canada

Ressources de déclaration de revenus 2023 - Agence du revenu du Canada

L’Agence du revenu du Canada lance la saison des impôts 2023

- Fiche descriptive: Étudiants

- Fiche descriptive: Les personnes handicapées

- Fiche descriptive: Les personnes à revenu modeste

- Fiche descriptive: Les personnes en situation de logement précaire

- Fiche descriptive: Les personnes âgées de 65 ans et plus

- Fiche descriptive: Les personnes autochtones

- Fiche descriptive : Déductions pour les habitants de régions éloignées

- Fiche descriptive : Personnes aux prises avec la violence fondée sur le sexe

- Fiche descriptive: Les nouveaux arrivants

Ressources

- Infographie – Prestations pour enfants

- Infographie – Prestations et crédits pour les nouveaux arrivants

- Feuille détachable : Inscrivez-vous à Mon dossier

- Feuille détachable : Produire votre déclaration de revenus

- Carte d’option de service

- Webinaire – Les personnes à revenu modeste

- Video: Persons with disabilities

- Webinaire – Les étudiants étrangers

- Webinaire – Avis aux étudiants : c’est payant de faire vos impôts!

Ressources de déclaration de revenus 2022 - Agence du revenu du Canada

Fiche descriptive : Étudiants

Fiche descriptive : Les personnes handicapées

Fiche descriptive : Les personnes à revenu modeste

Fiche descriptive : Les personnes en situation de logement précaire

Fiche descriptive : Les personnes âgées de 65 ans et plus

Fiche descriptive : Femmes dans les refuges

Fiche descriptive : Les personnes autochtones

Fiche descriptive : Les nouveaux arrivants

Prestation dentaire canadienne

Supplément unique à l’Allocation canadienne pour le logement

Faites faire vos impôts à un comptoir d’impôts gratuit

Allocation canadienne pour les travailleurs

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone, Inuit ou Métis

Ressources de déclaration de revenus 2021 - Agence du revenu du Canada

Nouvelles prestations canadiennes de la relance économique – À quoi s’attendre

Réponses à vos questions sur le remboursement de la Prestation canadienne d’urgence (PCU)

Recevez vos versements de prestations et de crédits! – Les les autochtones qui habitent au Canada

Prestations et crédits – Revenu modeste

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits!

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits! (Quebec)

Il y a des avantages à faire ses impôts! – Personnes agées

Mesures relatives à la COVID-19 à l’intention des personnes handicapées

Des prestations et des crédits pour vous! – Les personnes handicapées

Chaque dollar compte! – L’allocation canadienne pour les travailleurs (ACT)

Chaque dollar compte! Carte promotionnelle pour l’allocation canadienne pour les travailleurs (ACT)

Faites faire vos impôts gratuitement – Carte promotionnelle

Fondements de l’impôt sur le revenu

Pouruoi declarer? Les avantages de produire une declaration de revenus

Recevoir des paiements du gouvernement par dépôt direct

Que sont les déductions, les avantages fiscaux et les crédits d’impôt?

Considérations sur la période d’impôt pour lesautochtones qui habitent au Canada

Ressources pour en savoir plus

Comptoirs d’impôt bénévoles : Aidez les membres de votre communauté

Ressources

S’occuper de ses impôts et de ses prestations peut être payant – Agence du revenu du Canada

Service automatisé Déclarer simplement par téléphone (anciennement Produire ma déclaration)– Agence du revenu du Canada

Démystifier le crédit d’impôt pour personnes handicapées – Agence du revenu du Canada