Housing insecurity

Read more about homelessness, affordability, at risk-populations and human rights on the Government of Canada's website. Learn about: Housing and human rights: the Federal Housing Advocate's work on the right to adequate housing, unmet housing needs and systemic homelessness. Canada's Homelessness Strategy: funding to help urban, Indigenous, rural and remote communities address their local homelessness needs. Understanding Veteran homelessness: Information for organizations and individuals working to support the homeless, including homeless Veterans.

Missing for those who need it most: Canada’s financial help gap

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable, appropriate and trustworthy financial help for people with low incomes is a critical but missing piece in Canada's financial services landscape. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere to a budget, set and pursue saving goals, file their taxes outside of tax season, and access income benefits. Executive summary: Canada's financial help gap L’aide qui manque pour ceux qui en ont le plus besoin Sommaire Exécutif: L’écart en matière d’aide financière au Canada

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the Overview of Financial vulnerability of Low-Income Canadians: A Rising Tide

Time-stamps for the video recording:

00:00 – Start

6:05 – Agenda and Introductions

8:24 – Overview of Financial vulnerability, of low-income Canadians: A rising tide (Speaker: Eloise Duncan)

25:40 – Panel discussion: how increasing financial vulnerability is playing out in community and how policy makers should respond.

45:35 – Q&A

Canada’s Disability Inclusion Action Plan

Canada’s Disability Inclusion Action Plan is a comprehensive, whole-of-government approach to disability inclusion. It embeds disability considerations across our programs while identifying targeted investments in key areas to drive change. It builds on existing programs and measures that have sought to improve the inclusion of persons with disabilities, and establishes new and meaningful actions.

National Indigenous Economic Strategy 2022

This National Indigenous Economic Strategy for Canada is the blueprint to achieve the meaningful engagement and inclusion of Indigenous Peoples in the Canadian economy. It has been initiated and developed by a coalition of national Indigenous organizations and experts in the field of economic development. The Strategy is supported by four Strategic Pathways: People, Lands, Infrastructure, and Finance. Each pathway is further defined by a Vision that describes the desired outcomes for the actions and results of individual Strategic Statements. The Calls to Economic Prosperity recommend specific actions to achieve the outcomes described in the Strategic Statements. This document is not intended as a strategic plan specifically, but rather a strategy that others can incorporate into their own strategic plans.

Rising adoption of contactless payments and digital wallets: 3 key takeaways

Over the last two years, digital payment solutions, including peer-to-peer apps, digital wallets, and contactless payment solutions, have grown in popularity and adoption. With 125 million American mobile payment users predicted by 2025 Commonwealth sought to understand the potential for these payment apps as a channel to advance inclusive and equitable financial access.

Recognizing and responding to economic abuse

With speakers from CCFWE, Johannah Brockie - Program Manager for Advocacy and System Change and Jessica Tran - Program Manager for Education and Awareness, this webinar will guide you through the definition of economic abuse, how to identify an economic abuser, impacts of economic abuse, Covid-19 impacts, tactics, what you should do if you are a victim of economic abuse, and key safety tips. Economic Abuse occurs when a domestic partner interferes with a partner’s access to finances, employment or social benefits, such as fraudulently racking up credit card debt in their partner’s name or preventing their partner from going to work has a devastating effect on victims and survivors of domestic partner violence, yet it’s rarely talked about in Canada. It’s experienced by women from all backgrounds, regions and income levels but women from marginalized groups, including newcomers, refugees, racialized and Indigenous women, are at a higher risk of economic abuse due to other systemic factors.

Translated financial terms

The Consumer Finance Protection Bureau has developed resources to help multilingual communities and newcomers in a selection of languages. The translated financial terms are available in Chinese, Spanish, Vietnamese, Korean and Tagalog. This website has many other multi-lingual resources, covering a range of topics from opening a bank account, money transfers, money management, debt collection and many others. Some terms are US based but most are universal.

Innovations in Financial Capability: Culturally Responsive & Multigenerational Wealth Building Practices in Asian Pacific Islander (API) Communities

The Innovations in Financial Capability report is a collaborative report by National CAPACD and the Institute of Assets and Social Policy (IASP) at Brandeis University’s Heller School for Social Policy and Management, in partnership with Hawaiian Community Assets (HCA), and the Council for Native Hawaiian Advancement (CNHA). This survey report builds upon the 2017 report Foundations for the Future: Empowerment Economics in the Native Hawaiian Context and features the financial capability work of over 40 of our member organizations and other AAPI serving organizations from across the US. IASP’s research found that AAPI leaders are adopting innovative multigenerational and culturally responsive approaches to financial capability programming, but they want and need more supports for their work.

Measuring the Financial Well-Being of Hispanics: 2018 Financial Well-Being Score Benchmarks

This report provides a foundational set of benchmarks of the financial well-being of Hispanics ages 18 and older in the United States in 2018, as measured by the CFPB Financial Well-Being Scale, that practitioners and researchers can use in their work. The benchmarks were developed using data from the FINRA Foundation’s 2018 National Financial Capability Survey. This report specifically shows financial well-being score patterns for Hispanic adults by socio-demographics, financial inclusion, safety nets, and financial literacy factors. The report highlights key findings in the data and the implications for organizations that are planning to use the benchmarks.

Taking Stock and Looking Ahead: The Impact of COVID-19 on Communities of Color

Nearly a year since the outbreak began, and eight months since it was declared a global pandemic, COVID-19 has devastated hundreds of thousands of lives and millions of people’s economic prospects throughout the country. To date, the effects of this crisis have been wide-reaching and profound, impacting every individual and sector throughout the U.S. For communities of color, however, the pandemic has been particularly damaging as these communities have not only been more likely to contract and succumb to the virus, but also more likely to bear the brunt of the many economic impacts that have come from it—including more likely to be unemployed and slower to regain jobs lost. The Asset Building Policy Network and a panel of experts discuss the impact COVID-19 has had on communities of color, the fiscal policy measures congress has enacted to curtail those impacts and what can be done through policy and programs to foster an equitable recovery and more inclusive economy moving forward.

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

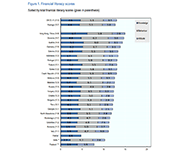

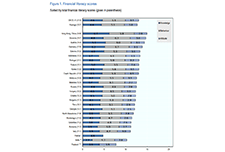

Launch of the OECD/INFE 2020 International Survey of Adult Financial Literacy

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018 OECD/INFE toolkit to collect cross-comparable data. The survey results report the overall financial literacy scores, as computed following the OECD/INFE methodology and definition, and their elements of knowledge, behaviour, and attitudes. The data used in this report are drawn from national surveys undertaken using and submitted to the OECD as part of a co-ordinated measurement exercise; as well as data gathered as part of the OECD/INFE Technical Assistance Project for Financial Education in South East Europe.

From the Margins to Center: Responding to COVID-19 with an Equity and Gender Lens

On June 30th, AFN presented an Expert Insights briefing on what it takes to center women of color in the relief, recovery, and rebuild plans for the current health and economic crisis and beyond. The speaker is Dominique Derbigny, deputy director of Closing the Women’s Wealth Gap (CWWG) and author of the report, On the Margins: Economic Security for Women of Color through the Coronavirus Crisis and Beyond. Learn why women of color are suffering severely from the COVID-19 public health and economic crisis, opportunities to advance gender economic equity in near-term recovery efforts, and possible strategies to prevent wealth extraction and foster long-term economic security for women of color.

Imagine Canada pre-budget consultation toolkit

The House of Commons Finance Committee recently released its call for pre-budget consultation briefs as the government considers its policy priorities for the 2021 federal budget. This toolkit created by Imagine Canada provides information on the reasons to submit a pre-budget consultation brief as well as tips on how to do so.

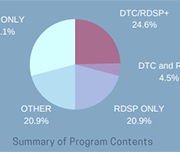

Infographic: An overview of Canadian financial programs for people with disabilities

One in five Canadians are currently living with a disability. This infographic provides an overview of financial programs for people with disabilities in Canada based on findings in Morris et al. (2018) "A demographic, employment and income profile of Canadians with disabilities aged 15 years and over, 2017".

Ageing and Financial Inclusion: 8 key steps to design a better future

The G20 Fukuoka Policy Priorities for Ageing and Financial Inclusion is jointly prepared by the GPFI and the OECD. The document identifies eight priorities to help policy makers, financial service providers, consumers and other actors in the real economy to identify and address the challenges associated with ageing populations and the global increase in longevity. They reflect policies and practices to improve the outcomes of both current generations of older people and future generations.

Using Research to Improve the Financial Well-being of Canadians: Post-symposium Report

The Financial Consumer Agency of Canada (FCAC) co-hosted the 2018 National Research Symposium on Financial Literacy on November 26 and 27, 2018 at the University of Toronto, in partnership with Behavioural Economics in Action at Rotman (BEAR). This report presents the key ideas and takeaways from the event, while shining a light on the research shaping new solutions designed to enhance financial well-being in Canada and around the world.

English

Download in English

French

Download in French

Saving for Now and Saving for Later: Rainy Day Savings Accounts to Boost Low-Wage Workers’ Financial Security

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial shocks.

The Present and Future of Bank On Account Data: Pilot Results and Prospective Data Collection

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This report details the Bank On Data Pilot, which collected and measured quantitative data on 2017 Bank On account usage at four pilot financial institutions with certified accounts: Bank of America, JPMorgan Chase, U.S. Bank, and Wells Fargo.

2017 Bank On Data Pilot: Accessing Local Data

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This tool details the 2017 Bank On Data Pilot and includes instructions for accessing the local Bank On data at the city and zip code level.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

Account Comparison Tool

Compare features for different chequing and savings accounts, including interest rates, monthly fees and transactions. Find an account that best suits your needs. Narrow your search, view search results, and compare your results using this account comparison tool from the Financial Consumer Agency of Canada.

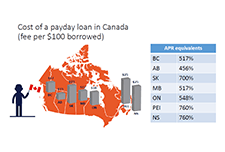

Summary Brief: High-Cost Alternative Financial Services

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial institutions. High-cost alternative financial services contribute to a two-tiered banking system, in which the poor often pay more for inferior services. Without more stringent regulation, and in the absence of safe and affordable short-term credit options, Albertans living on lower-incomes will continue to experience financial exclusion and take on heavy debt loads – both of which are major contributors to long-term poverty.

Building consumer financial health: The role of financial institutions and FinTech

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

2017 Financially Underserved Market Size Study