Beware of One Time Passcode scams with these tips

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts securely.

Cyber security toolkit

There are also simple steps you can take to recognize cyber threats and protect yourself. With a cyber hygiene checklist and tips on how to spot common scams, the CBA’s Cyber Security Toolkit can help you protect against online financial fraud.

Cyber security checklist

Getting cyber safe doesn't have to be complicated. With the right resources and tools, you can stay safe and secure online. Here's a handy checklist for protecting your data online.

How Canadians bank

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world. This survey and other findings form the basis of How Canadians Banks, a biannual study by the Canadian Bankers Association and Abacus Data that examines the banking trends and attitudes of Canadians.

Overcoming Digital Divides Workshop Series: Framing Paper

Canada’s digital divide has often been narrowly defined as the gap that exists between urban and rural broadband internet availability — Canadian urban centres have significantly greater internet subscription levels at faster speeds than rural communities.(Government of Canada, 2019). The cost of building new internet infrastructure in less developed areas continues to impede equitable access to sufficient internet services. This series aims to engage people living in Canada, industry, academia and policymakers to advance a deeper, more nuanced understanding of the circumstances that precipitate the conditions that shape digital inequities in Canada. Through expert panel discussions and thoughtful participatory dialogue, the series aims to drive toward innovative solutions to greater digital inclusion across Canada. The series will be presented in six parts, each tackling a specific theme with unique concerns. The series will also build on intersectional connections across themes while identifying new issues and impacted communities.

The COVID-19 Wildfire: Nonprofit Organizational Challenge and Opportunity

Nonprofit organizations in Canada were significantly impacted by COVID-19, including lost revenue and needing to adjust the program delivery. The lack of technology capacity in the nonprofit sector is a key barrier for many nonprofit organizations to adapt to delivering programs online. Momentum, a Calgary-based nonprofit organization, experienced both financial and programmatic challenges due to COVID-19. Momentum pivoted program delivery to provide supports during the COVID-19 lockdown and developed innovative approaches to online programming. Since the start of the COVID-19 pandemic in Canada, Momentum was able to rapidly develop its capacity to use technology for online programming with the support of critical new funding. Many nonprofits will have to transform their business models to not only survive but thrive in the post-COVID world.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Supporting Financial Health Fintechs in Canada: Trends, Challenges, and Opportunities

Technology can play a key role in addressing some of the financial challenges that Canadians face on a day-to-day basis. Over the last five to ten years we have seen a growing number of companies, called fintechs, that primarily use technology to change and enhance the way we do banking or access financial advice and services. Many of these companies are building products that are specifically meant to help Canadians improve their financial health. The purpose of this report is to explore the existing financial health fintech landscape in Canada, the challenges that these companies face, and how an accelerator program that provides mentorship and resource supports over a defined time-frame can better help these financial health fintechs grow and thereby help improve the financial health of people across Canada.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar

Introducing the Financial Relief Navigator (FRN)

Access the Financial Relief Navigator here.

Time-stamps for the video recording:

3:22 – Agenda and Introductions

6:00 – Audience poll

9:00 – Why we created the Financial Relief Navigator (Speaker: Janet Flynn)

11:55 – What’s in the Financial Relief Navigator (Speaker: Janet Flynn)

16:35 – FRN Walkthrough using a Persona (Speaker: Galen McLusky)

33:15 – Tips for using the FRN (Speaker: Galen McLusky)

36:00 – The Working Centre experience using the FRN (Speaker: Sue Collison)

41:15 – Q&A

Voice of Experience: Engaging people with lived experience of poverty in consultations

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

My Budget Coach Pilot Evaluation

This pilot study explores the delivery and effectiveness of MyBudgetCoach, a financial coaching program designed to help low- and moderate-income adults develop budgeting skills, set financial goals, and work towards those goals. Specifically, this study compares two modes of program delivery, traditional in-person coaching and fully remote coaching. By testing financial coaching in these two contexts, this project seeks to generate a deeper understanding of the mechanisms that underpin coaching and the role technology may play in facilitating behavior change.

Using Design to Deepen Relationships in the Financial Sector

This publication reveals the outcomes of Bridgable's work with a federal credit union, cutting through their overwhelming number of offerings to better engage with their low-income members. It also discusses why agility is a better bet than digitization when it comes to our changing financial ecosystem. Finally, it will break down their approach to one of the most popular design methods today, the design sprint, and how it can produce results while also lowering risk. Note: This link will allow you to download the document from the Bridgeable website.

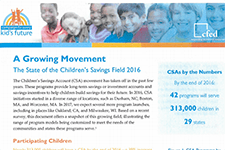

A Growing Movement: The State of the Children’s Savings Field 2016

The Children’s Savings Account (CSA) movement has taken off in the past few years. These programs provide long-term savings or investment accounts and savings incentives to help children build savings for their future. In 2016, CSA initiatives started in a diverse range of locations, such as Durham, NC; Boston, MA; and Worcester, MA. In 2017, we expect several more program launches, including in places like Oakland, CA, and Milwaukee, WI. Based on a recent survey, this document offers a snapshot of this growing field, illustrating the range of program models being customized to meet the needs of the communities and states these programs serve.