English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

Early Planning Toolkit

A toolkit for parents/caregivers with a child with a disability ages 2 to 10, containing:

Practitioner tools for navigating financial exchanges with family and friends

Financial educators are particularly aware of the prevalence of these types of financial arrangements – otherwise known as family financial exchanges (FFEs). To support practitioners helping clients through these often sensitive conversations about these arrangements, the Consumer Financial Protection Bureau released the Friends and Family Exchanges Toolkit , a four-part guide for coaching clients in asking for financial help or changing an existing agreement due to their own financial hardship.

National Indigenous History Month 2021

In June, we commemorate National Indigenous History Month 2021 to recognize the history, heritage and diversity of First Nations, Inuit and Métis peoples in Canada. The Crow-Indigenous Relations and Northern Affairs Canada website contains resources on Indigenous history, promotional and educational materials, and information on how the Government of Canada is responding to the Truth and Reconciliation Commission's Calls to Action.

Guaranteed Income Community of Practice resources

The Guaranteed Income Community of Practice (GICP) convenes guaranteed income stakeholders, including policy experts, researchers, community and program leaders, funders, and elected officials to learn and collaborate on guaranteed income pilots, programs and policy. The GICP website includes resources on:

Money Mentors – Savings & Debt Resources

Collection of money management resources, including how create effective budgets, realistic spending plans, deal with your debts, save more money, build a stronger credit rating, and prepare for retirement.

COVID-19: Exclusive resources for service provider heroes

Families Canada is the national association of Family Support Centres. With a network of 500+ member agencies and thousands of frontline family service workers across Canada, they committed to providing leadership and support in the campaign for Canada’s children. Families Canada has compiled resources for service providers to support families during COVID-19.

Financial Literacy Month – 10th anniversary Resources

For the 10th anniversary of Financial Literacy Month in Canada, Financial Consumer Agency of Canada (FCAC) has released resources to help Canadians learn how to manage their finances in challenging times. Resources include the following topics:

COVID-19 Resources for people with disabilities

National Disability Institute (NDI)'s Financial Resilience Center offers resources and assistance to help those with disabilities and chronic health conditions navigate financially through the COVID-19 crisis. Resource topics include:

COVID-19 Financial Resilience Hub

The Global Financial Literacy Excellence Center (GFLEC) focuses on financial literacy research, policy, and solutions. This toolkit contains suggestions and resources for managing personal finances and protection against the financial emergencies caused by COVID-19.

National Strategies for Financial Education: OECD/INFE Policy Handbook

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools to support policy makers and public authorities to design and implement national strategies for financial education. This handbook provides an overview of the status of national strategies worldwide, an analysis of relevant practices and case studies and identifies key lessons learnt. The policy handbook also includes a checklist for action, intended as a self-assessment tool for governments and public authorities.

COVID-19 Financial Resource Centre

Credit Canada has pulled together financial information from trusted sources and released original content to help Canadians manage their finances during COVID-19.

Human Insights Tools & Resources

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from clients’ point of view, designing solutions to meet those needs, and testing your ideas to ensure they bring about the needed change. Tools and resources are presented for each of the discover, design, and test phases.

Data literacy training

Statistics Canada presents a learning catalogue to share knowledge on data literacy. Data literacy is the ability to derive meaningful information from data. It focuses on the competencies involved in working with data including the knowledge and skills to read, analyze, interpret, visualize and communicate data as well as understand the use of data in decision-making. Their aim is to provide learners with information on the basic concepts and skills with regard to a range of data literacy topics. The training is aimed at those who are new to data or those who have some experience with data but may need a refresher or want to expand their knowledge.

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

Service Design Tools

This website shares tools, tutorials, and resources on service design. The tools will help you prepare for different stages of the service design process, think through who to engage and how, and plan or improve a service. Includes templates for tools such as empathy maps, personas, service blueprints, and more.

Money Circle toolkit

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a brief, interactive exercise, to initiate conversations about the feelings and personal relationships that shape financial choices.

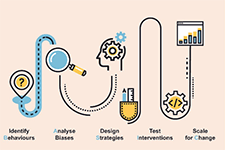

Tools and Ethics for Applied Behavioural Insights: The BASIC Toolkit

A better understanding of human behaviour can lead to better policies. If you are looking for a more data-driven and nuanced approach to policy making, then you should consider what actually drives the decisions and behaviours of citizens rather than relying on assumptions of how they should act. You can start applying behavioural insights (BI) to policy now. No matter where you are in the policy cycle, policies can be improved with BI through a process that looks at Behaviours, Analysis, Strategies, Interventions, Change (BASIC). This allows you to get to the root of the policy problem, gather evidence on what works, show your support for government innovation, and ultimately improve policy outcomes. This toolkit guides policy officials through these BASIC stages to start using an inductive and experimental approach for more effective policy making.

Family-Centred Coaching Toolkit

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families. (Note: Accessing the toolkit requires submitting user information).

Your Money, Your Goals: A Financial Empowerment Toolkit for community volunteers

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money. Module 6-7: Debt and credit reports. Module 8: Money services, cards, accounts, and loans. Module 9: Protecting your money.