Discover financial empowerment resources

Discover financial empowerment resources

There are many different actions that can be taken to improve financial wellbeing. The Financial Wellbeing Framework offers 17 entry points to action to inform government, organizations, policymakers, decision-makers, practitioners, and researchers in their efforts to address financial...

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

Momentum is a Calgary-based community organization that works with people living on low incomes and partners in the community to create a thriving local economy for all. For over 20 years, Momentum has offered matched savings programs that build financial stability by working with participants to...

Bridge to benefits: Implementing benefits access in social service has been created for organizations that are interested in starting, refining or expanding their work in access to benefits services. This includes benefits services such as helping to fill out applications, providing access to...

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said...

Financial empowerment (FE) is an approach to poverty reduction that focuses on improving the financial security of people living on low income. Evidence shows that embedding FE interventions into municipal welfare, employment, housing, shelter and health services can significantly boost service...

For a family living in poverty, every day is about making tough choices – to pay rent or buy groceries? Having the means to attain the basic necessities, is one thing. Having the skills, confidence and access to resources to manage finances in ways that build pathways out of poverty is something...

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and...

Maytree released the 2020 edition of the Welfare in Canada report. For each province and territory, this report provides data and analysis on the total welfare income that households receiving social assistance would have qualified for in 2020, including COVID-19 pandemic-related supports. Welfare...

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open...

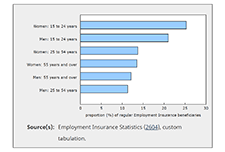

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and...

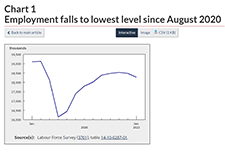

February Labour Force Survey (LFS) data reflect labour market conditions during the week of February 14 to 20. In early February, public health restrictions put in place in late December were eased in many provinces. This allowed for the re-opening of many non-essential businesses, cultural and...

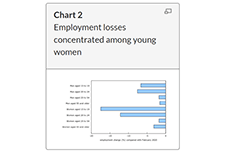

After the December Labour Force Survey (LFS) reference week—December 6 to 12—a number of provinces extended public health measures in response to increasing COVID-19 cases. January LFS data reflect the impact of these new restrictions and provide a portrait of labour market conditions as...

As part of Momentum’s systems change planning process that was grounded in both participant and community experience, the issue of payday loans and other forms of high-cost credit (e.g., pawn, installment, rent-to-own, title and car loans) emerged as a priority issue for Momentum to address the...

Creating Communities Where We Live - A Good Practices Guide is a locally-driven community-based researched project conducted in Edmonton, Alberta, by e4c and the University of Alberta Community Service-Learning program. The project seeks to add to the knowledge and practice of community care around...

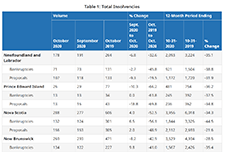

The Office of the Superintendent of Bankruptcy Canada releases statistics on insolvency (bankruptcies and proposals) numbers in Canada. The latest statistics released on November 4, 2020 show that the number of insolvencies in Canada increased in the third quarter of 2020 by 7.9% compared to the...

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit...

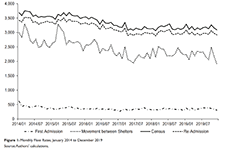

Social distancing and self-isolation are two of the key responses asked of citizens during a pandemic. For people without a home, this advice is rather more difficult to follow. This article uses daily data describing the movements of 36,855 unique individuals who used emergency homeless shelters...

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

This report presents an analysis of the impact of COVID-19 on the nonprofit sector drawn from data collected in CCVO's Alberta Nonprofit Survey, data from surveys by the Alberta Nonprofit Network, Imagine Canada, and partner organizations across the country. The analysis in this report shows that...

While social finance could have a transformative impact on the funding and financial landscape, relatively little is understood about its implications for charities. This webinar presents the results of a national survey of over 1,000 registered charities undertaken by Imagine Canada to better...

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth...

In response to the COVID-19 pandemic and the complexities of the benefits and financial relief measures available to Canadians, we developed the Financial Relief Navigator (FRN), an online resource that helps vulnerable Canadians and those that work with them access critical emergency benefits and...

The Social Assistance Summaries series tracks the number of recipients of social assistance (welfare payments) in each province and territory. It was established by the Caledon Institute of Social Policy to maintain data previously published by the federal government as the Social Assistance...

Benefits and credits provide income and financial support for many individuals. This toolkit contains information on common tax credits and benefits, benefits for specific populations, and practitioner resources including case studies and information on identification documentation for accessing...