Financial literacy courses for Canadian students

Teachers may incorporate two gamified financial literacy courses that are currently freely available into their lessons. Students can now access two age-appropriate courses designed to help boost students' financial knowledge and confidence at any stage of their financial journey. Course titles: Students will explore resources and tools on the FCAC website that they will be able to use well beyond high school. *Students can earn a completion certificate issued by the FCAC and ChatterHigh!

Cyber security & fraud prevention learning guide

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself, your family and your employees about cyber safety can seem overwhelming, but it doesn’t have to be that complicated and the CBA has developed a learning path to help.

Cyber security toolkit

There are also simple steps you can take to recognize cyber threats and protect yourself. With a cyber hygiene checklist and tips on how to spot common scams, the CBA’s Cyber Security Toolkit can help you protect against online financial fraud.

Let’s talk money- seniors edition

With a little preparation, talking about financial matters can help build trust, deepen connections, relieve stress and lead to greater peace of mind. Yet for many people, these conversations can be difficult. In some families, money is just not something you talk about. The same applies to wills, inheritances, senior living, end-of-life care and many more topics that matter most to seniors. Let's Talk About Money: Seniors' Edition -- wants to help you change that. There are tips to help parents talk with adult children and tips for adult children to have meaningful money conversations their parents. The most important thing is to have these conversations early, before there’s a crisis. So let's start talking.Open, honest conversations about money are one of the keys to building a healthy relationship with your family, across the generations.

Fraud Prevention Toolkits

In 2021, losses reported to the Canadian Anti-Fraud Centre reached an all time high of 379 million with Canadian losses accounting for 275 million of this. Fraud Prevention Month is a campaign held each March to inform and educate the public on protecting yourself from being a victim of fraud. This year's theme is impersonation, and focuses on scams where fraudsters will claim to be government official, critical infrastructure companies, and even law enforcement officials. This collection of fraud prevention toolkits is available in English and French. In English: En Français:

Learn about your taxes (free CRA online course)

A free online course to learn about personal income taxes in Canada, developed by the Canada Revenue Agency. Contents include: Additional resources for teachers and facilitators are available.

Early Planning Toolkit

A toolkit for parents/caregivers with a child with a disability ages 2 to 10, containing:

Practitioner tools for navigating financial exchanges with family and friends

Financial educators are particularly aware of the prevalence of these types of financial arrangements – otherwise known as family financial exchanges (FFEs). To support practitioners helping clients through these often sensitive conversations about these arrangements, the Consumer Financial Protection Bureau released the Friends and Family Exchanges Toolkit , a four-part guide for coaching clients in asking for financial help or changing an existing agreement due to their own financial hardship.

National Indigenous History Month 2021

In June, we commemorate National Indigenous History Month 2021 to recognize the history, heritage and diversity of First Nations, Inuit and Métis peoples in Canada. The Crow-Indigenous Relations and Northern Affairs Canada website contains resources on Indigenous history, promotional and educational materials, and information on how the Government of Canada is responding to the Truth and Reconciliation Commission's Calls to Action.

Guaranteed Income Community of Practice resources

The Guaranteed Income Community of Practice (GICP) convenes guaranteed income stakeholders, including policy experts, researchers, community and program leaders, funders, and elected officials to learn and collaborate on guaranteed income pilots, programs and policy. The GICP website includes resources on:

Living your retirement

These resources from the Ontario Securities Commission are oriented towards planning for retirement. Resources include tips on insurance planning, government benefits, RRSP calculator, and more.

Introduction to Indigenous Peoples’ cultures online course

This free, on-demand, introductory course provides learners with insight into the history of First Nations, Métis and Inuit Peoples; an understanding of the devastation of colonialism on Indigenous communities and economies from an Indigenous perspective and how it is critical to reconciliation; and how culturally sensitive health care models help inform how accounting and finance education can be inclusive and supportive. This course was developed to provide the writers and facilitators of CPA education programs, cases and examinations with insight, knowledge and skills to better understand the perspectives of Indigenous students, to help support their success. It will provide all learners with a valuable introduction into the deep cultural and historical foundations upon which the future prosperity of Indigenous communities must be built.

CFPB Consumer Education Resources

Resources to provide consumers up-to-date information to protect and manage their finances during the coronavirus pandemic. Resources include: And resources for specific audiences, including:

San’yas Indigenous Cultural Safety Training

Cultural safety is about fostering a climate where the unique history of Indigenous peoples is recognized and respected in order to provide appropriate care and services in an equitable and safe way, without discrimination. This website includes information about the San’yas: Indigenous Cultural Safety Training Program delivered by the Provincial Health Services Authority of British Columbia.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Click ‘Get it’ above for video link for this webinar.

Handout: Implementing a practice of self-care

Tax Credit Outreach Resources

The Get It Back Campaign helps eligible workers in the United States claim tax credits and use free tax filing assistance to maximize tax time. A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial institutions to conduct outreach nationally. For 30 years, these partnerships have connected lower and moderate-income workers to tax benefits like the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and Volunteer Income Tax Assistance (VITA). Their website contain a variety of outreach materials that can be adapted for your organization, including:

Get Smarter About Money: Financial Literacy 101 videos

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos covers different financial literacy topics., including:

Tax Prep Dispatch: Alternative Service Delivery Tips!

Tips and considerations for providing alternative tax filing service delivery.

Tax Prep Dispatch: The Drop-Off Process

Considerations and best practices for drop-off and virtual tax filing services.

Virtual VITA Toolkit: Program Strategies

Program strategies grounded in an understanding of your community can increase the likelihood of engagement and follow-through. The following resources are intended to support VITA programs with implementation strategies at key program stages, like outreach and intake, and offer examples of how other virtual VITA programs have addressed critical challenges.

2019 Financial Coaching Network Bi-Monthly Peer Call Series

These calls, featuring guest practitioners, cover a variety of topics most pressing to the financial coaching field, provide useful tips and resources and serve as a peer-learning platform. Topics include:

Colour of Poverty – Colour of Change

There is a growing "colour-coded" inequity and disparity in Ontario that has resulted in an inequality of learning outcomes, of health status, of employment opportunity and income prospects, of life opportunities, and ultimately of life outcomes. Colour of Poverty-Colour of Change believes that it is only by working together that we can make the needed change for all of our shared benefit These fact sheets provide data to help understand the racialization of poverty in Ontario.

Momentum’s Money Management Courses

The money management courses are offered online, on demand, for free. Learn at your own pace and on your own schedule on a variety of topics, including:

10: A Guide for a Community-Based COVID-19 Recovery

Our cities and communities are where people live. It is here we see the effects of public policy and it is here where we will address the issues that matter most to Canadians. The choices made today will impact Canada’s recovery from COVID-19. If we want a future where our cities are thriving, we need to work together to achieve a collective community-based response. We are all in this together and it will take all of us in a community to find our way through. If you are a community leader, such as a mayor, an elected official, a business leader, a community activist, or a concerned citizen, this guide was written for you. We created it to be accessible and easy to use, with five sections and links to resources throughout.

COVID-19 Fraud Alerts

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos increases awareness of fraudulent activity during COVID-19. Topic include:

Questions and answers about filing your taxes

Questions and answers released by the Canada Revenue Agency (CRA) about filing your taxes, including information on:

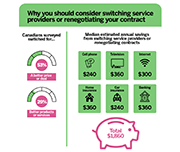

Stop Overpaying, Start Switching

In the past year, 1 in 4 Canadians surveyed renegotiated their contracts or switched providers to take advantage of better deals and services. This webpage provides information on switching or renegotiating your contract to reduce your monthly bills and get better products and services.

Bien choisir son crédit : un guide pratique [A Practical Guide to Making Smart Credit Choices]

A guide comprised of 12 fact sheets for consumers to learn more about credit, grouped into the following topics: general information, warnings, credit products, and comparison tables. (Please note this is a French-language resource.)

Connecting to Reimagine: Money & COVID-19 webinar series

This webinar series released by the Global Financial Literacy Excellence Center (GFLEC) features speakers from the public, private, and academic sectors. Past and upcoming webinar topics include: Optimizing National Strategies for Financial Education Crafting Policies that Address Inequality in Saving, Wealth, and Economic Opportunities Investor Knowledge and Behaviors in Times of Crisis Increasing Financial Knowledge for Better Rebuilding Designing an Inclusive Recovery Millennials: Buttressing a Generation at Risk

COVID-19: Exclusive resources for service provider heroes

Families Canada is the national association of Family Support Centres. With a network of 500+ member agencies and thousands of frontline family service workers across Canada, they committed to providing leadership and support in the campaign for Canada’s children. Families Canada has compiled resources for service providers to support families during COVID-19.

Financial Literacy Month – 10th anniversary Resources

For the 10th anniversary of Financial Literacy Month in Canada, Financial Consumer Agency of Canada (FCAC) has released resources to help Canadians learn how to manage their finances in challenging times. Resources include the following topics:

COVID-19 Resources for people with disabilities

National Disability Institute (NDI)'s Financial Resilience Center offers resources and assistance to help those with disabilities and chronic health conditions navigate financially through the COVID-19 crisis. Resource topics include:

Real Money, Real Experts Podcasts

Real Money, Real Experts is a personal finance podcast written and produced by AFCPE (Association for Financial Counseling & Planning Education). Their membership community offers a place for financial counsellors and financial fitness coaches to share best practices, solve similar struggles, and access tools and resources. Recent episodes include the following topics:

COVID-19 Financial Resilience Hub

The Global Financial Literacy Excellence Center (GFLEC) focuses on financial literacy research, policy, and solutions. This toolkit contains suggestions and resources for managing personal finances and protection against the financial emergencies caused by COVID-19.

National Strategies for Financial Education: OECD/INFE Policy Handbook

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools to support policy makers and public authorities to design and implement national strategies for financial education. This handbook provides an overview of the status of national strategies worldwide, an analysis of relevant practices and case studies and identifies key lessons learnt. The policy handbook also includes a checklist for action, intended as a self-assessment tool for governments and public authorities.

Managing Financial Health in Challenging Times

Managing financial health is difficult during ordinary times—and especially so in challenging times like the ones we're currently facing. Guest speaker RuthAnne Corley, the Senior Stakeholder Engagement Officer with the Financial Consumer Agency of Canada (FCAC), discusses how to manage your financial health despite external challenges. RuthAnne joined FCAC in 2015 where she’s been instrumental in the development of Canada’s "National Strategy for Financial Literacy - Count me in, Canada" and its implementation. Prior to joining FCAC in 2015, RuthAnne managed stakeholder engagement and outreach activities at numerous federal departments and agencies.

Budgeting resources webinar

This webinar hosted by Credit Canada features guest expert Prosper Canada's Manager of Learning and Training, Glenna Harris. She shares some of their tried-and-true resources to help get people started on budgeting and debt management. She also provides a new tool - Financial Relief Navigator - that can help connect people with income supports they might be eligible for.

Pressure Creates Diamonds: Money Management During Coronavirus

The town hall with CFPB Director Kraninger and Pro Linebacker Brandon Copeland includes steps, and tools to help people plan and persevere during financial challenges. The page also includes access to free resources on a number of topics including mortgage help, dealing with student loans, paying bills, building savings and more.

COVID-19 financial literacy resources

CPA Canada has put together resources to help manage your finances and provide you with the tools you need during this crisis – and beyond.

Four Actions That Can Hurt Credit Scores

During the Four Actions that Can Hurt Credit Scores webinar, you'll learn about: Their guest speaker is Julie Kuzmic, the Director of Consumer Advocacy at Equifax Canada, and a recognized authority on consumer credit. In her role leading consumer advocacy within the organization, Julie helps Canadians build credit confidence.

The Institute for Gender and the Economy

The Institute for Gender and the Economy (GATE) at the Rotman School of Management promotes an understanding of gender inequalities and how they can be remedied – by people of all genders – in the world of business and, more broadly, in the economy. Resources including research brief, videos and articles are presented on COVID-19 and inequality, the gender wage gap, parental leave and more.

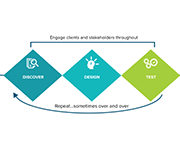

Human Insights Tools & Resources

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from clients’ point of view, designing solutions to meet those needs, and testing your ideas to ensure they bring about the needed change. Tools and resources are presented for each of the discover, design, and test phases.

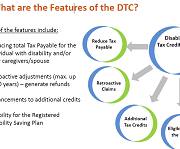

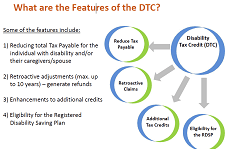

Disability Alliance BC

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered Disability Savings Plans (RDSP) and more.

Plan Institute Learning Centre

The Plan Institute Learning Centre presents workshops, webinars, publications and other resources for individuals and/or families of a person with a disability, support-care workers, and organizations.

Data literacy training

Statistics Canada presents a learning catalogue to share knowledge on data literacy. Data literacy is the ability to derive meaningful information from data. It focuses on the competencies involved in working with data including the knowledge and skills to read, analyze, interpret, visualize and communicate data as well as understand the use of data in decision-making. Their aim is to provide learners with information on the basic concepts and skills with regard to a range of data literacy topics. The training is aimed at those who are new to data or those who have some experience with data but may need a refresher or want to expand their knowledge.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Set a Goal: What to Save For

America Saves, a campaign managed by the nonprofit Consumer Federation of America, motivates, encourages, and supports low- to moderate-income households to save money, reduce debt, and build wealth. Information and tips for setting a savings goal, making a savings plan, how to save automatically, and other tools and resources are included.

Serving Individuals With Disabilities – A Day in the Life of an American Job Center

The Disability and Employment eLearning Task Force in collaboration with the Employment and Training Administration (ETA) released three eLearning Training Modules to help support the professional development needs of the workforce development staff across the United States. The first module provide tools and resources to support front-line American Job Center staff effectively serve customers with disabilities, covering strategies for effective communication and interaction with individuals with disabilities.

Global Learning Partners: Shareable Resources

Global Learning Partners (GLP) helps individuals and organizations to learn by providing practical expertise in learning assessment, design, facilitation and evaluation. Their shareable resources cover a variety of topics in learning, taking a learning-centered approach, including: Learning Design, Needs Assessment, Facilitation, Evaluation, and others.

Webinar series on remote program delivery

A series of webinars hosted by ABC Life Literacy Canada to support literacy practitioners across the country to implement remote program delivery. Topics include:

Imagine Canada pre-budget consultation toolkit

The House of Commons Finance Committee recently released its call for pre-budget consultation briefs as the government considers its policy priorities for the 2021 federal budget. This toolkit created by Imagine Canada provides information on the reasons to submit a pre-budget consultation brief as well as tips on how to do so.

A Pandemic Response and Recovery Toolkit for Homeless System Leaders in Canada

The Pandemic Response and Recovery Toolkit is intended to assist System Leaders plan and navigate the next steps in their community’s response and recovery as it pertains to people experiencing homelessness and people supported in housing programs. The Toolkit outlines phases and action steps – many that have yet to be mobilized - to help with planning, implementation and evaluation of pandemic response and recovery activities in communities. Furthermore, it contains a compendium of resources to help System Leaders along the way. This could be a time of doom and gloom. But there is a silver lining. With innovation and the courage to capitalize on emerging opportunities, the homelessness response and housing support system may emerge from this situation stronger and better than before the pandemic hit. It is possible that we can achieve Recovery for All.

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

COVID-19: Managing financial health in challenging times

This guide from the Financial Consumer Agency of Canada shares guidelines and financial tips to help Canadians during COVID-19. The topics include: getting through a financial emergency, where to ask questions or voice concerns, what to do if your branch closes, and more.

How to use your tax refund to build your emergency savings

If you file your taxes in the United States, you can learn how your tax return can kickstart your savings. This guide from the Consumer Financial Protection Bureau walks you through some fast and easy ways to use your tax refund to increase your savings. This guide covers multiple topics including: why save your tax return, how to save money fast, affordable ways to file your taxes, and how to protect yourself from tax fraud.

Smarter Financial Education: Key lessons from behavioural insights for financial literacy initiatives

This publication presents key findings for financial education, drawn from the IOSCO/OECD joint report “The Application of Behavioural Insights to Financial Literacy and Investor Education Programmes and Initiatives”. It gives a short overview of the ways in which behavioural insights are relevant for financial education and then summarises five key lessons that policy makers can follow, illustrated with the experiences of OECD/INFE members.

Canada Education Savings Program: Choosing the right RESP

This printable brochure from the Government of Canada explains the key details you need to know when choosing a Registered Education Savings Plan (RESP) for your child's education savings.

Canada Education Savings Program: Frequently Asked Questions

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans (RESPs).

Video: Debt collection scams

Dealing with debt collection issues can be challenging—especially when you’re not sure if the person you’re being contacted by is a legitimate debt collector or someone trying to scam you. This video from the Consumer Financial Protection Bureau in the United States shares useful tips on spotting debt collection scams and protecting yourself from scammers.

Giving Savings Advice

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at a specific point in the tax preparation process: when entering dependent information. The video also includes examples of commonly heard reasons tax filers give for not wanting to save, and possible responses.

Talking About Savings

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video discusses why promoting savings at tax time is a critical component of VITA volunteers.

Introduction to Program Evaluation for Public Health Programs: A Self-Study Guide

This document is a “how to” guide for planning and implementing evaluation activities. The manual, based on Centers for Disease Control and Preventions's Framework for Program Evaluation in Public Health, is intended to assist managers and staff of public, private, and community public health programs to plan, design, implement and use comprehensive evaluations in a practical way.

Coaching and Philanthropy: An Action Guide for Nonprofits

The Coaching and Philanthropy Project was created by CompassPoint in collaboration with Grantmakers for Effective Organizations, BTW informing change and Leadership. This guide uses the data collected during the project to answer a few questions including: What is coaching? How can coaching contribute to my development as a nonprofit leader? What kind of coaching is right for me and my organization? How much is coaching? to assess and advance coaching as a strategy for building effective nonprofit organizations.

Money Circle toolkit

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a brief, interactive exercise, to initiate conversations about the feelings and personal relationships that shape financial choices.

It pays to plan for a child’s education

This fact sheet from ESDC explains how to open an RESP and access the Canada Learning Bond.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

Video: Additional CPP

This short video from the Canadian Pension Plan Investment Board explains the new additional Canada Pension Plan (CPP).

Managing spending: Ideas for financial educators

As financial educators know, making day-to-day decisions on spending money is one of the biggest challenges consumers face in keeping their financial lives in order. Many people find it difficult to manage their household finances on a daily basis, let alone over the long term. This brief from the Bureau of Consumer Financial Protection identifies a few ideas to explore causes of over-spending and ideas to help prevent it.

Tout Bien Calcule

Pour souligner leurs 50 ans d’histoire, les Associations de consommateurs du Québec s’unissent pour offrir à la population québécoise un portail qui rassemble toute une gamme d’informations et d’outils développés au fil des années grâce à leur expertise en finances personnelles. Cette porte d’entrée donne accès à des services spécialisés en finances personnelles offerts par les associations, propose des outils adaptés, et à travers les différentes sections, offre une information claire, objective et critique afin de vous guider vers de meilleurs choix de consommation et une meilleure santé financière.

Indigenous Financial Literacy – AFOA 2014 Conference panel

This is the video recording of the AFOA 2014 Conference panel on Indigenous Financial Literacy. In this session, Liz Mulholland, Dr. Paulette Tremblay, Simon Brascoupe, and Darren Googoo discuss Indigneous financial wellness, financial literacy, and community education.

Debt and Consumer Rights: Credit repair

This educational brief from CLEO explains what a credit report is, and what to do if you want to fix your credit report or work with a credit repair agency.

The Little Black Book of Scams (2nd edition)

Scammers are sneaky and sly. They can target anyone, from youngsters to retirees. They can also target businesses. No one is immune to fraud. Read this booklet to find out how you can also become a fraud-fighting superhero. Share this booklet with family and friends and start powering up!

Our group of superheroes has found a way to see through the scams. Their secret is simple: knowledge is power!

Your Money, Your Goals: Focus on People with Disabilities

This is a companion guide to the 'Your Money, Your Goals' curriculum by the Consumer Financial Protection Bureau (CFPB) in the United States. This guide- Your Money, Your Goals: Focus on People with Disabilities—contains information, tips, and tools based on the insights from people with disabilities and from organizations that serve the disability community. It is based on the core philosophy that everyone has the right to control their money and make their own financial decisions. Its specialized information and tools equip staff and volunteers to adapt training on and use of the toolkit and other resources to meet the needs of people with disabilities. It also includes information and tools to enable staff and volunteers to choose accessible locations, develop appropriate and considerate training activities, and plan to provide accommodations for diverse learning styles and other needs.

The Canada Learning Bond: What you need to know

This one-page fact sheet tells you everything you need to know to make your child's future possibilities grow! The Canada Learning Bond (CLB) is a grant of $500 up to $2000 from the Government of Canada to eligible families to help with the cost of a child’s education after high school. It is deposited directly into a child’s Registered Education Savings Plan (RESP). Children born January 1, 2004 or later, whose family’s annual income is less than $46,000 can receive the CLB.

Activity sheet 4-10: Goals (Banking and financial services)

This activity sheet is from Module 4 of the Prosper Canada Financial Literacy Facilitator resources. Take a few minutes to how this workshop relates to your life, and set one or two goals for your use of banks and other financial services. To view the full Financial Literacy Facilitator resources, click here.

Group RESP Educational Materials

This document explains the basics of group RESPs, including what they are, what they may cost, what you need to know about your group RESP if you are already enrolled in a plan, and how to figure out your options. Read more about the research behind these materials here.

Debt and High Interest Resource Portal

This is ACORN Canada's debt and high-interest lending resource portal. It contains links and resources on debt, credit, banking, and other topics.

CFPB Financial Well-Being Scale Questionnaire

A financial well-being questionnaire developed by the Consumer Financial Protection Bureau.

Using Design to Deepen Relationships in the Financial Sector

This publication reveals the outcomes of Bridgable's work with a federal credit union, cutting through their overwhelming number of offerings to better engage with their low-income members. It also discusses why agility is a better bet than digitization when it comes to our changing financial ecosystem. Finally, it will break down their approach to one of the most popular design methods today, the design sprint, and how it can produce results while also lowering risk. Note: This link will allow you to download the document from the Bridgeable website.

Handout 9-12: Consumerism resources

This is the resources handout for Module 9: Consumerism, from the Prosper Canada Financial Literacy Facilitator Resources. To view full Financial Literacy Facilitator Resources, click here.

Family-Centred Coaching Toolkit

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families. (Note: Accessing the toolkit requires submitting user information).

Handout 9-13: Consumerism glossary

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Glossary of terms relating to consumerism. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-8: Dealing with consumer problems

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Examples of how to deal with consumer problems. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-7: Common frauds and scams

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Common consumer frauds and scams to look out for. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-5: Cell phone information

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Information about cell phone plans and what is involved when you purchase one. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-3: Smart shopping tips

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Smart shopping tips. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-2: Advertising techniques and sales tactics

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Explanation of different advertising and sales techniques. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-11: Consumerism goal setting

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Setting goals related to consumerism. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-10: Rate your financial knowledge, part 2

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Use this quiz to rate your financial knowledge. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-9: Complaint letter

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. A template for writing a consumer complaint letter. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-6: Cell phone checklist

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. A checklist of questions to answer when you are getting a cell phone. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-4: Find the better deal

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Figure out which item is the better deal by calculating the unit cost. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-1: Consumer quiz

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. What kind of consumer are you? Take the quiz. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-10: Debt glossary

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Glossary of terms about debt. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-9: Debt resources

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Web resources about debt in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-6: Collection rules

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Debt collection rights and what a collection agency has the right to do and not to do. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-5: Dealing with creditors

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Tips for dealing with creditors over the phone or by mail, or for creating a debt repayment plan. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-4: Steps to debt repayment

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Steps for debt repayment. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-8: Goal setting

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Goal setting for debt. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-7: Debt collection role play

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Role play activity about debt collection. To view full Financial Literacy Facilitator Resources, click here.

Activity Sheet 8-3: Ladder of debt repayment options

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Print these pages and cut into individual ‘rungs’ for use in the activity. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-2: Debt do’s and don’ts

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Group activity to talk about debt do's and don'ts. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-1: How much is TOO much?

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. How much debt is too much debt? Consider the 20/10 rule. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-13: Credit reporting glossary

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Glossary of terms for credit reporting. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-12: Credit reporting resources

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Web resources for credit reporting in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-10: Ways to improve your credit score

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Ways to improve your credit score. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-8: Correcting common errors on credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. How to correct common errors on credit reports. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-5: Credit scores

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A credit score is a score between 300 and 900 that credit bureaus use to rate the information in your credit report. Credit bureaus use a mathematical formula based on many factors to arrive at your credit score. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-4: Reading a credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. The information in an Equifax credit report varies slightly from a TransUnion credit report, but both contain the same basic sections. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-3: Sample Equifax credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A sample of a credit report received from Equifax. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-2: Credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus summarize your credit use in a report. The credit report is one of the main things lenders look at when they decide whether or not to give you credit. A credit report contains your history of credit use, and your credit ratings. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-1: Credit bureaus

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus are agencies that collect information about how we use credit. They produce personal credit reports. Credit bureaus are private companies. They are regulated by the province, but they are not part of the government. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-11: Goal setting and credit reports

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Practice setting goals related to credit reports. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-9: Credit score scenarios

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Credit score scenarios to practice learning. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-7: TransUnion sample request form

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the TransUnion request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-6: Sample Equifax request sheet

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the Equifax request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-7: Credit glossary

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Glossary of terms related to credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-6: Credit resources

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Web resources for credit and credit cards. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-4: Managing credit

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Tips for managing credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-3: The cost of credit

This handout is from Module 6 of the Financial Literacy facilitator curriculum. The cost of credit for different payment methods.

Handout 6-2: Credit card features

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The features of credit cards and what they mean. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-1: Types of credit

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The different types of credit and their lending conditions. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 6-5: Goal setting and credit

This activity sheet is from Module 6 of the Financial Literacy Facilitator Resources. Practice setting goals related to credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 5-10: Saving resources

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Website resource list for saving. To view full Financial Literacy Facilitator Resources, click here.

Handout 5-11: Glossary for saving module

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Glossary of savings terms. To view full Financial Literacy Facilitator Resources, click here.

Handout 5-7: Savings tools (detailed)

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Explains details about different kinds of savings accounts and financial products typically available in Canada. To view fill Financial Literacy Facilitator Resources, click here.

Handout 5-4: Compound interest

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Explains compound interest. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-9: Goal setting for saving

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Review the activities you did early in this session to help you get ideas about savings goals. Also, think about other goals you can set, like doing more research or making an appointment with a financial advisor. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-8: Savings tools quiz

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Savings tools quiz. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-5: Christine and Aparna

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Saving scenario with Christine and Aparna. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-3: Finding money

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Use this chart to list some of the things that you buy a lot. Note how often you buy them in a month. Put down how much they usually cost (“average price”). Then figure out how much you spend on them in a month. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-2: Needs and wants

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. List some of the things you have spent money on in the last two weeks. Which items are needs and which are wants? To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-1: Setting savings goals

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Steps to setting a savings goal. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-12: Glossary for banking and financial services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Glossary for banking and financial services. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-11: Banking and financial services resources

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Resource list of websites about banking and financial services. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-8: Alternative financial services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Alternative financial services are outside of the traditional, regulated banking system. They do not take deposits like a bank or credit union. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-7: What are my rights?

This handout is from Module 4 of the Financial Literacy Facilitator Resources. What are your rights when opening a bank account in Canada? To view full Financial Literacy Facilitator Resources, click here.

Handout 4-6: Opening a bank account

This handout is from Module 4 of the Financial Literacy Facilitator Resources. How to open a bank account in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-4: Bank accounts and services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. The different kinds of bank accounts and services available. in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-5: Choosing a bank and choosing an account

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Choosing a bank and choosing an account based on your banking needs. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-2: Deposit insurance at credit unions

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Deposit insurance amounts from credit unions in different provinces. To view full Financial Literacy Facilitator Resource, click here.

Handout 4-1: Banks and credit unions

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Banks and credit unions are places where you can safely deposit your money, cash your cheques, pay your bills, ask for a loan or credit card and use a variety of saving and investment tools. This chart explains the differences between banks and credit unions. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-10: Goal setting

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Take a few minutes to set one or two SMART goals for your use of banks and alternative financial services. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-9: Comparing alternative financial services to banking services

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Why use alternative financial services? Why use banking services? List the reasons for using the services that your group was assigned. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-3: Banks and banking services quiz

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Banks and banking services quiz: In pairs, match the items in column A to column B. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-12: Budgeting glossary

This handout is from Module 3 of the Financial Literacy Facilitator Resources. Glossary of budgeting terms. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-11: Resources – Money management websites

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Resource websites for money management. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-9: Financial record keeping

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Here are some important papers and records. You should keep them in a safe place and organize them so that you can find what you need. The chart shows their “shelf life” – how long you should keep them. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-8: Budgeting tips

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Different types of budgeting tips to help you stay on track. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-10: Goal setting

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Take a few minutes to reflect on how this workshop relates to your life. Set one or two SMART goals for your personal budgeting and financial record-keeping. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-6: Making your own budget

This activity sheet is from Module 3 of the Financial Literacy facilitator curriculum. Steps involved in making your own budget. To view full Financial Literacy Facilitator Resources, click here

Activity sheet 3-4: Budgeting scenarios

This activity sheet is from Module 3 of the Financial Literacy facilitator curriculum. Using the Monthly Budget Worksheet, put together a budget for the person in your scenario. Feel free to make up more details. You can also change or add categories to the budget to match your person’s situation. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-3: Budgeting expense categories

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Tracking your different categories of expenses. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-2: Income sources

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Tracking your income sources. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-1: The ‘B’ word – budget

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. What do you think about when you hear the word “budget’? To view full Financial Literacy Facilitator Resources, click here.

What words or feelings come to mind?

Handout 2-8: Glossary

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Glossary for income and taxes module. To view full Financial Literacy Facilitator Resources, click here.

Handout 2-7: Resources

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Resource list for income and taxes module. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 2-6: Income and taxes

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Goal setting for filing your income taxes. To view full Financial Literacy Facilitator Resources, click here.

Handout 2-4: Filing your taxes

This handout is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. How to file your taxes. To view full Financial Literacy Facilitator Resources, click here.

Handout 2-3: Reading a pay stub

This handout is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. How to read a pay stub. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 2-2: Reading David’s pay stub (quiz)

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Reading David's pay stub - a quiz. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 2-5: Maria and Fernando’s story

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Maria and her husband Fernando worked together cleaning a big office building at night. They were hired by a man who ran a large cleaning company. They each got a paycheque twice a month. In February, it was time to do income tax for their previous year’s income. To view full Financial Literacy Facilitator Resources, click here.

Managing your money #7: Preparing for tax filing

Even if you make no money, you should file a tax return each year. You may be eligible for a refund (money back). Filing your taxes triggers access to government benefits that you can’t get any other way. This worksheet will help you gather the information you will need at tax time. You will need a file folder, an envelope, or a small box to put all of your paperwork in. This is worksheet #7 from the booklet 'Managing your money'.

Managing your money #6: Setting a savings goal

Setting a savings goal means that you have decided how much money you can put away, and what you are going to save for. This activity can help you write down some money goals and when you would like to achieve them. You can build savings by putting aside small amounts on a regular basis. This is worksheet #6 from the booklet 'Managing your money'.

Managing your money #5: Monthly budgeting

When you make a budget, you give yourself a clear picture of your financial situation. A budget compares your income to your expenses, all in one place. This is worksheet #5 from the booklet 'Managing your money'.

Managing your money #4: Tracking your bills

Knowing what bills you have and when they are due can help you plan your spending. This activity will help you to be aware of two things: how much you owe each month, and at what time of the month that money is due. This will help you to pay bills on time, and avoid late fees. This is worksheet #4 from the booklet 'Managing your money.'

Managing your Money #3: Tracking your spending

Keeping track of where your money goes during the month is another helpful step towards making a budget. Then you will be able to compare your spending with your income. This is worksheet #3 from the booklet 'Managing your money.'

Managing your money #2: Tracking your regular income

Income is the money that comes into your household. This worksheet will help you see the ‘big picture’ of your income and other resources. Then you can think about how to plan your expenses. This is worksheet #2 from the booklet 'Managing your money.'