Housing law: free legal information

This resource produced by Community Legal Education Ontario (CLEO) provides a list of free legal information about paying rent, eviction procedures and much more.

Benefits & credits: factsheets from the CRA

The CRA has compiled benefits and credits factsheets for: These are available in English and French.

Consumer Vulnerability: Evidence from the Monthly COVID-19 Financial Well-being Survey

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day financial management and financial well-being. As of September 2022, the survey results show that over the past several months, financial hardships have increased for many Canadians due to the rapidly evolving economic environment. While financial vulnerability can affect anyone regardless of income, background or education, hardships have increased more for those living on a low income, Indigenous peoples, recent immigrants, and women, due to the disproportionate financial impact of the pandemic on these groups (households with low income, Indigenous people, new immigrants, and women.) This brief report provides an overview of survey results collected between August 2020 and September 2022. In publishing this report, FCAC’s goal is to provide insight into the financial well-being of Canadians, to identify which groups are experiencing greater vulnerabilities and hardships, and to inform and target our collective response as financial ecosystem stakeholders.

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. Here is some basic information to get you started. A list of bank resources at the end of this article may also help with the financial transition to Canada.

Multicultural and newcomer charitable giving study

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving and volunteerism.

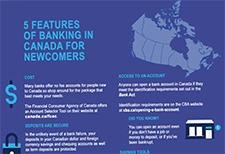

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the Canadian banking system.

Ethnography of vulnerable newcomers’ experiences with taxes and benefits

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of this study is to develop the CRA’s understanding of newcomers’ experiences as they first encounter the Canadian tax and benefit system. These findings illuminate potential directions for improving tax and benefit information and services available for newcomers.

Taxpayer Rights in the Digital Age

This paper explores the intersection of digital innovation, digital services, access, and taxpayer rights in the Canadian context, in light of the experiences of vulnerable populations in Canada, from the perspective of the Taxpayers’ Ombudsman. Many aspects of the CRA’s digitalization can further marginalize vulnerable populations but there are also opportunities for digital services to help vulnerable persons in accessing the CRA’s services.

Providing one-on-one financial coaching to newcomers: Insights for frontline service providers

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE interventions include financial coaching and supports that assist people to build money management skills, access income benefits, tackle debt, learn about safe financial products and services and find ways to save for emergencies. This report shares insights on providing one-on-one financial coaching to newcomers captured through two financial coaching pilot projects that Prosper Canada conducted in collaboration with several frontline community partners.

English

Benefits 101

What are tax credits and benefits

Reasons to file a tax return

List of common benefits

Getting government payments by direct deposit

Common benefits and credits Benefits pathways (for practitioner reference only – some illustrations presented are Ontario benefits)

Pathways to accessing government benefits

Overview of tax benefits and other income supports (adults, children, seniors)

Overview of tax benefits and other income supports (people with disabilities or survivors)

Income support programs for immigrants and refugees

Glossary of terms – Benefits 101

Resources – Benefits 101

Key benefits you may be eligible for

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

Benefits of Filing a Tax Return: Infographic

Common benefits and credits

Resource links:

Benefits and credits for newcomers to Canada – Canada Revenue Agency

Benefit Finder – Government of Canada

Electronic Benefits and credits date reminders – Canada Revenue Agency (CRA)

Income Assistance Handbook – Government of Northwest Territories

What to do when you get money from the government – Financial Consumer Agency of Canada (FCAC)

Emergency benefits

General emergency government benefits information & navigation

Financial Relief Navigator tool (Prosper Canada)

Changes to taxes and benefits: CRA and COVID-19 – Government of Canada

Canada Emergency Response Benefit (CERB)

Apply for Canada Emergency Response Benefit (CERB) with CRA – Canada Revenue Agency (CRA)

Questions & Answers on CERB – Government of Canada

What is the CERB? – Prosper Canada

FAQ: Canada Emergency Response Benefit – Prosper Canada (updated June 10th)

CERB: What you need to know about cashing your cheque – FCAC

COVID-19 Benefits (summary, includes Ontario) – CLEO/Steps to Justice

COVID-19 Employment and Work – CLEO/Steps to Justice

GST/HST credit and Canada Child Benefit

COVID-19 – Increase to the GST/HST amount – Government of Canada

Canada Child Benefit Payment Increase – Government of Canada

Benefits payments for eligible Canadians to extend to Fall 2020 – Government of Canada

Support for students

Support for students and recent graduates – Government of Canada

Canada Emergency Student Benefit (CESB) – Government of Canada

Benefits and credits for families with children

Benefits and credits for families with children

Resource links:

Child and family benefits – Government of Canada

Child and family benefits calculator – Government of Canada

Benefits and credits for people with disabilities

Benefits and credits for people with disabilities

RDSP, grants and bonds

Resource links:

Canada Pension Plan disability benefit toolkit – Employment and Social Development Canada (ESDC)

Disability benefits – Government of Canada

Disability tax credit (DTC) – Canada Revenue Agency (CRA)

Free RDSP Calculator for Canadians – Plan Institute

Future Planning Tool – Plan Institute

Creating Financial Security: Financial Planning in Support of a Relative with a Disability (handbook) – Partners for Planning

Nurturing Supportive Relationships: The Foundation to a Secure Future (handbook) – Partners for Planning

RDSP – Plan Institute

Disability Tax Credit Tool – Disability Alliance BC

ODSP Appeal Handbook – CLEO

Disability Inclusion Analysis of Government of Canada’s Response to COVID-19 (report and fact sheets) – Live Work Well Research Centre

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

Benefits and credits for seniors

Benefits and credits for seniors

Resource links:

Canadian Retirement Income Calculator – Government of Canada

Comparing Retirement Savings Options – Financial Consumer Agency of Canada (FCAC)

Federal Provincial Territorial Ministers Responsible for Seniors Forum – Employment and Social Services Canada (ESDC)

Retiring on a low income – Open Policy Ontario

RRSP vs GIS Calculator – Daniela Baron

Sources of income for seniors handout – West Neighbourhood House

What every older Canadian should know about: Income and benefits from government programs – Employment and Social Services Canada (ESDC)

French

Comprendre les prestations

Que sont les crédits d’impôt et les prestations?

Pourquoi produire une déclaration de revenus?

Processus d’accès aux prestations (simple, complexe ou laborieux)

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu : personnes handicapées ou survivants

Programmes d’aide au revenu pour immigrants et réfugiés – Admissibilité et processus de demande

Glossaire – Prestations et credits

Ressources : Prestations et credits

Principales mesures d’aide auxquelles vous pouvez être admissibles

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone,

Infographie sur les avantages de produire une déclaration de revenus

Prestations et crédits courants

Prestations et crédits pour familles avec enfants

Prestations et crédits pour personnes handicapées

Prestations et crédits pour les personnes âgées

Informations d’identification pour accéder aux prestations

Études de cas

Trends in the Citizenship Rate Among New Immigrants to Canada

This Economic Insights article examines trends in the citizenship rate (the percent of immigrants who become Canadian citizens) among recent immigrants who arrived in Canada five to nine years before a given census. The citizenship rate among recent immigrants aged 18 and over peaked in 1996 and declined continuously to 2016. Most of this decline occurred after 2006. The citizenship rate declined most among immigrants with low family income, poor official language skills, and lower levels of education. There was also significant variation in the decline among immigrants from different source regions, with the decline largest among Chinese immigrants.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Access the handouts for this webinar:

Poster presentation: Financial Empowerment for Newcomers project

Infographics: Newcomer settlement stages, money matters, and client personas

Time-stamps for the video recording:

3:11 – Agenda and introductions

5:21 – Audience poll

8:25 – Introduction to Financial Empowerment for Newcomers project (Speaker: Glenna Harris)

11:25 – AXIS financial coaching program (Speaker: Sheri Abbot)

30:05 – North York Community House financial coaching program (Speaker: Noemi Garcia)

45:40 – Q&A

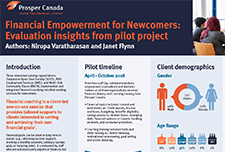

Financial Empowerment for Newcomers: Evaluation insights from pilot project

This fact sheet provides insights from Prosper Canada's Financial Empowerment for Newcomers pilot project conducted with three newcomer-serving organizations, Saskatoon Open Door Society (SODS), AXIS Employment Services (AXIS), and North York Community House (NYCH), who implemented and integrated financial coaching into their existing services for newcomers. The project objectives were to provide newcomer-serving front-line staff with training and resources to enable them to accurately assess newcomers’ financial literacy and connect them to appropriate information and resources and to coach newcomers to achieve successful financial independence.

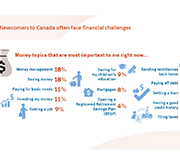

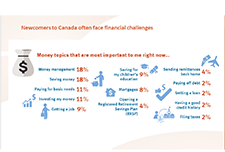

Financial Empowerment for Newcomers infographic

This infographic displays data gathered from interviewing 53 newcomer participants in three provinces (Saskatchewan, Ontario, and Newfoundland) between August and October 2017. Learn more about the stages of newcomer settlement, key money topics and experiences of newcomers, and three types of newcomer client personas.

My money in Canada

Are you a newcomer to Canada, or someone who works with newcomers? This online tool will help you explore five money modules to better manage your finances in Canada. Learn about the financial system in Canada, income and expenses, setting goals and saving, credit and credit reports, and filing taxes. Updated July 26, 2022: My money in Canada provides important information about Canada’s financial system and promotes positive money management habits to support Canadians to succeed financially. Interactive exercises and checklists support you to make informed choices and to create a customized financial plan that works for you. Originally designed to support newcomers to Canada as they settle and establish themselves financially, My money in Canada has been updated to serve all Canadians, including those who are new to Canada.

Chronic Low Income Among Immigrants in Canada and its Communities

This study examines the rate of chronic low income among adult immigrants (aged 25 or older) in Canada during the 2000s. Data is taken from the Longitudinal Immigration Database (IMDB) for the period from 1993 to 2012, with regional adjustments used for the analysis. Chronic low income is categorized as having a family income under a low-income cut-off for five consecutive years or more. The study found that for immigrants were in in low-income in any given year, half were in chronic low-income. Including spells of low income which become chronic in later years, this number rises to two-thirds. The highest chronic rates were found in immigrant seniors and immigrants who were unattached or lone parents. Chronic low income is a large component of income disparity and overall low income among immigrants.

My money in Canada

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use. The tool is intended to be used with clients and settlement workers together, but can also be used by the client on their own if they are comfortable.

Evaluation of the Guaranteed Income Supplement

The Old Age Security program is the largest statutory program of the Government of Canada, and consists of the Old Age Security pension, the Guaranteed Income Supplement, and the Allowance. The Guaranteed Income Supplement is provided to low-income seniors aged 65 years and over who receive the Old Age Security pension and are below a low-income cut-off level. This evaluation examines take-up of the Guaranteed Income Supplement by various socioeconomic groups, the characteristics of those who are eligible for the Supplement but do not receive it, and barriers faced by vulnerable groups.

Tax time insights: Experiences of people living on low income in Canada

In this presentation, Nirupa Varatharasan, Research & Evaluation Officer with Prosper Canada, explains the research methods and insights gathered in the report 'Tax time insights: Experiences of people living on low income in Canada.' This includes demographic information, the type of tax filing resources accessed by this population, and insights on the types of challenges and opportunities that result from their tax filing processes. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Income tax filing and benefits take-up: Challenges and opportunities for Canadians living on low incomes

In this presentation, Uttam Bajwa, Global Health and Research Associate with the Dalla Lana School of Public Health, University of Toronto, reports on tax filing challenges and opportunities for Canadians living on low incomes. This includes the challenges of not knowing what to do, fear and mistrust, and challenges accessing supports. This presentation is based on the research conducted for the Prosper Canada report 'Tax time insights: Experiences of people living on low incomes in Canada'. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.