Research study: Crypto assets 2022

This study by the Ontario Securities Commission examines Canadians’ crypto ownership and knowledge. It found 13% of Canadians currently own crypto assets or crypto funds. The study also found most Canadians did not have a working knowledge of the practical, legal and regulatory dimensions of crypto assets. Crypto assets were believed to play a key role in the financial system by 38% of those surveyed. The study provides a profile of crypto owners, their reasons for purchasing crypto assets or crypto funds, the role of financial advice, impact of advertising, and the experience of crypto owners with crypto trading platforms.

Pilot study: Buy now, pay later services in Canada

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have resulted in a steady increase in retail e-commerce sales over the past several years, and the COVID-19 pandemic has had a significant impact on how consumers make retail purchases. Retail e-commerce sales reached record levels during the pandemic. This has further contributed to the proliferation of buy now, pay later (BNPL) services in Canada.

How Canadians bank

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world. This survey and other findings form the basis of How Canadians Banks, a biannual study by the Canadian Bankers Association and Abacus Data that examines the banking trends and attitudes of Canadians.

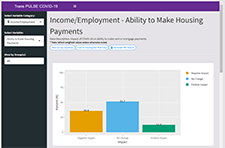

Trans PULSE Canada COVID Data Dashboard

In September – October 2020, the Trans PULSE Canada study team conducted the COVID Cohort to assess the social, economic, and health impacts of the COVID-19 pandemic on trans and non-binary people in Canada. This dashboard serves as an interactive tool for community members and researchers to explore key findings from the Trans PULSE Canada COVID survey, and to break down the results by one or more socio-demographic characteristics. The proportions in the dashboard are weighted to represent the 2019 Trans PULSE Canada sample.

Barriers to Digital Equality in Canada

Internet is an essential service. As technology increasingly shapes our world, it is important that Canadians can keep up with the rapid changes, latest skills and emerging industries. Unfortunately, not every resident of Canada is able to access these opportunities to unlock a potentially brighter future. AIC and ACORN partnered to undertake research with low and moderate income Canadians, in order to uncover the barriers to digital equity that exist in Canada today and shine a light on the urgent need to tackle these barriers to ensure equal access to digital opportunities.

Diversity of charity and non-profit boards of directors: Overview of the Canadian non-profit sector

Charities and non-profit organizations play a vital role in supporting and enriching the lives of Canadians. A crowdsourcing survey of individuals involved in the governance of charities and non-profit organizations was conducted from December 4, 2020, to January 18, 2021. The objectives of the survey were to collect timely information on the activities of these organizations and the individuals they serve and to learn more about the diversity of those who serve on their boards of directors. A total of 8,835 individuals completed the survey, 6,170 of whom were board members.

Financial Life Stages of Older Canadians

This study, commissioned by the Ontario Securities Commission (OSC) and conducted by the Brondesbury Group, provides some insights on the knowledge that older Canadians have about the financial realities of retirement and how they would apply that knowledge earlier in life if they are able to do so. The top financial concerns and main financial risks of older Canadians are identified for each life stage and how they are being managed are discussed.

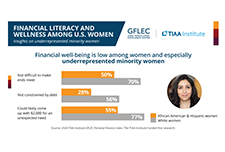

Financial Literacy and Wellness Among U.S. Women: Insights on Underrepresented Minority Women

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined understanding of financial literacy among women, including areas of strength and weakness and variations among subgroups, can inform initiatives to improve financial wellness, particularly as the United States moves forward from the pandemic and its economic consequences.

Millennials and money: Financial preparedness and money management practices before COVID-19

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed over the ten years following the Great Recession of 2008 and the situation they were in on the cusp of the current economic crisis (in 2018) due to the COVID-19 pandemic. Findings from the National Financial Capability Study (NFCS) show that millennials tend to rely heavily on debt, engage frequently in expensive short- and long-term money management, and display shockingly low levels of financial literacy. Moreover, student loan burden and expensive financial decision making increased significantly from 2009 to 2018 among young adults.

Financial literacy and financial resilience: Evidence from around the world

This study presents findings from a measurement of financial literacy using questions assessing basic knowledge of four fundamental concepts in financial decision making: knowledge of interest rates, interest compounding, inflation, and risk diversification. Worldwide, just one in three adults are financially literate—that is, they know at least three out of the four financial concepts. Women, poor adults, and lower educated respondents are more likely to suffer from gaps in financial knowledge.

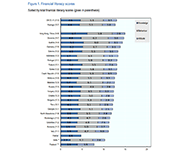

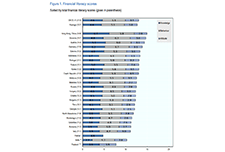

Launch of the OECD/INFE 2020 International Survey of Adult Financial Literacy

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018 OECD/INFE toolkit to collect cross-comparable data. The survey results report the overall financial literacy scores, as computed following the OECD/INFE methodology and definition, and their elements of knowledge, behaviour, and attitudes. The data used in this report are drawn from national surveys undertaken using and submitted to the OECD as part of a co-ordinated measurement exercise; as well as data gathered as part of the OECD/INFE Technical Assistance Project for Financial Education in South East Europe.

The Canadian Housing Survey, 2018: Core housing need of renter households living in social and affordable housing

This article provides a high level overview of those living in social and affordable housing by painting a portrait of them based on the results of the 2018 CHS. Socio-demographic and household characteristics are examined using housing indicators such as core housing need.

Data literacy training

Statistics Canada presents a learning catalogue to share knowledge on data literacy. Data literacy is the ability to derive meaningful information from data. It focuses on the competencies involved in working with data including the knowledge and skills to read, analyze, interpret, visualize and communicate data as well as understand the use of data in decision-making. Their aim is to provide learners with information on the basic concepts and skills with regard to a range of data literacy topics. The training is aimed at those who are new to data or those who have some experience with data but may need a refresher or want to expand their knowledge.

The mental health of population groups designated as visible minorities in Canada during the COVID-19 pandemic

This article examines the mental health outcomes (i.e., self-rated mental health, change in mental health since physical distancing began, and severity of symptoms consistent with generalized anxiety disorder in the two weeks prior to completing the survey) of participants in a recent crowdsource questionnaire who belong to population groups designated as visible minorities in Canada.

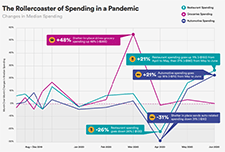

The Economic Toll of COVID-19 on SaverLife Members

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their savings program members during the COVID-19 pandemic from March to August of 2020.

Impacts of COVID-19 on persons with disabilities

This article provides a general snapshot of the employment and income impacts of COVID-19 on survey participants aged 15 to 64 living with long-term conditions and disabilities.

Hunger Lives Here: Risks and Challenges Faced by Food Bank Clients During COVID-19

This report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto during COVID-19. Based on phone surveys with over 220 food bank clients in May and June 2020 and an analysis of food bank client intake data, the report demonstrates that COVID-19 has led to increased reliance on food banks. The rate of new clients accessing food banks has tripled since the pandemic began. Among new clients, 76% report that they began accessing food banks as a result of COVID-19 and the associated economic downturn.

From Emergency to Opportunity: Building a Resilient Alberta Nonprofit Sector After COVID-19

This report presents an analysis of the impact of COVID-19 on the nonprofit sector drawn from data collected in CCVO's Alberta Nonprofit Survey, data from surveys by the Alberta The analysis in this report shows that the effects on the nonprofit sector have been magnified through increased service demand, decreased revenue, and diminished organizational capacity coupled by delays in support and inadequate recognition for the leadership role that the sector is being called upon to play.

Nonprofit Network, Imagine Canada, and partner organizations across the country.

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

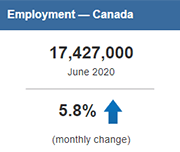

Labour Force Survey, June 2020

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance payments. New questions were added to measure the extent to which COVID-19-related health risks are being mitigated through workplace adaptations and protective measures.

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits designed to support them. This report illustrates that the CRA needs to take a broad, country-wide perspective of the CVITP, while also taking into consideration regional and other differences. Services offered and training provided to volunteers need to reflect the realities of the diverse regional, geographic, socio-economic, workforce, and vulnerable, sectors throughout Canada. Different areas of the country will have different primary needs from the CVITP. The CRA needs to address those needs, both in its actions through the CVITP, as well as in the training provided to CVITP volunteers and the support given to partner organizations.

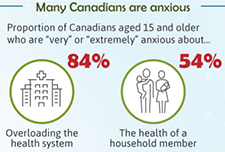

Infographic: How are Canadians coping with the COVID-19 situation?

An infographic on the findings from a web panel online survey conducted by Statistics Canada between March 29 and April 3 on how Canadians are responding to the COVID-19 situation. A summary of how many Canadians are feeling anxious, what they are doing during the crisis, and the main precautions that they are taking are presented.

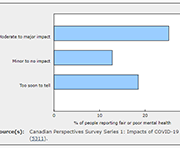

Canadian Perspectives Survey Series 1: Impacts of COVID-19 on job security and personal finances, 2020

Findings from a web panel survey developed by Statistics Canada on how Canadians are coping with COVID-19. More than 4,600 people in the 10 provinces responded to this survey from March 29 to April 3. In addition to content on the concerns of Canadians and the precautions they took to reduce the risk of exposure to COVID-19, the survey includes questions on work location, perceptions of job security, and the impact of COVID-19 on financial security.

Canadians and their money: Key findings from the 2019 Canadian Financial Capability Survey

This report provides results from the 2019 Canadian Financial Capability Survey (CFCS). It offers a first look at what Canadians are doing to take charge of their finances by budgeting, planning and saving for the future, and paying down debt. While the findings show that many Canadians are acting to improve their financial literacy and financial well-being, there are also emerging signs of financial stress for some Canadians. For example, about one third of Canadians feel they have too much debt, and a growing number are having trouble making bill, rent/mortgage and other payments on time. Over the past 5 years, about 4 in 10 Canadians found ways to increase their financial knowledge, skills and confidence. They used a wide range of methods, such as reading books or other printed material on financial issues, using online resources, and pursuing financial education through work, school or community programs. Findings from the survey support evidence that financial literacy, resources and tools are helping Canadians manage their money. For example, those who have a budget have greater financial well-being based on a number of indicators, such as managing cashflow, making bill payments and paying down debt. Further, those with a

financial plan to save are more likely to feel better prepared and more confident about their retirement.

Running in Place: Why the Racial Wealth Divide Keeps Black and Latino Families From Achieving Economic Security

This report examines data from the Federal Reserve System’s 2016 Survey of Consumer Finances to understand how the wealth of median Black, Latino and White families have changed since the findings of its previous survey were released in 2013.

Infographic: The Changing Characteristics of Canadian Jobs

This infographic released by Statistics Canada shows some of the ways the Canadian workforce has changed from 1981 to 2018. Some of these changes include industry, pension coverage, whether jobs are full-time and permanent, and whether they are unionized. These changes have also not been uniform for men and women.

Infographic: New Data on Disability in Canada, 2017

This infographic released from Statistics Canada compiles some of the data collected from the 2017 Canadian Survey on Disability. 22% of Canadians had at least one disability, representing 6.2 million people.

Low income among persons with a disability in Canada

Persons with a disability face a higher risk of low income compared to the overall population. This report uses data from the 2014 Longitudinal and International Study of Adults (LISA) to study the relationship between low income and characteristics of people aged 25 to 64 with a disability, including disability type, severity class, age of onset of disability, family composition, and other risk factors associated with low income. It also examines the composition of the low-income population in relation to disability, and provides information on the relationship between employment and low income for this population.

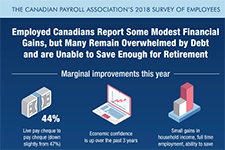

Infographic: Canadian Payroll Association’s 2018 Survey of Employees

This infographic shows results from the 2018 Survey of Employees conducted by the Canadian Payroll Association. It shows some marginal improvements but also some concerns. 44% of Canadians are living paycheque to paycheque, 40% feel overwhelmed by debt, and 72% have saved only one quarter or less of what they feel they'll need to retire. View full suite of news release and infographics from this survey, by province.

NPW 2018 Employee Research Survey

Working Canadians seem to be making some minor progress towards improving their financial health. But, while 66% report being in a better financial position than a year ago, their debt levels remain high, they chronically undersave for retirement, and put themselves at severe risk in the event of economic changes. According to the Canadian Payroll Association’s tenth annual survey, 44% of working Canadians report it would be difficult to meet their financial obligations if their pay cheque was delayed by even a single week (down from the three-year average of 48%). View full suite of news release and infographics from this survey, by province.

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

The Perils of Living Paycheque to Paycheque

This report, 'The Perils of Living Paycheque to Paycheque: The relationship between income volatility and financial insecurity', examines the relationship between income instability and broader measures of financial well-being. This study makes use of a unique dataset that collected self-reported month-to-month volatility in household income, measures of capability, financial knowledge and psychological variables. One in three adult Canadians reported at least some volatility in their monthly incomes, with six per cent reporting that the source and amount were both uncertain. Income volatility is present across a wide swath of the survey respondents, regardless of gender, family status, region of the country, education level and even income sources. Income volatility is correlated with lower financial knowledge, lower financial capability, and stronger beliefs that financial outcomes are up to fate and outside of personal control.

National Investor Research Study

This presentation shows the results of a quantitative study undertaken by the Ontario Securities Commission to assess attitudes, behaviour and knowledge among Canadians pertaining to a variety of investment topics. These topics include retirement planning and conversations about finances.

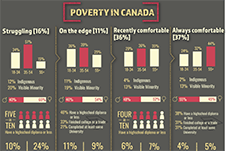

What does poverty look like in Canada? Survey finds one-in-four experience notable economic hardship

What does it mean to be poor in Canada? Does it mean having to rely on food banks and payday loans to make ends meet? Does it mean struggling to afford warm clothes for the winter? What about having to live far away from work or school? A new, two-part study from the Angus Reid Institute examines the state of poverty in Canada by looking at lived experiences, rather than income, with some striking results.

Financial Literacy of Indigenous Secondary Students in the Atlantic Provinces

Research conducted by agencies such as AFOA, Native Women’s Association of Canada, and various other Canadian entities, has identified the need for improved financial literacy education in Indigenous communities, particularly among youth and Elders. Such research reports are often equipped with a list of recommendations for improving and addressing the gaps in education around financial literacy. In the spirit of building upon this research into financial literacy and Indigenous peoples, the Purdy Crawford Chair in Aboriginal Business Studies (PCC) proposed a project focused on Atlantic Canada’s 14-18 year old Indigenous population and their levels of financial literacy. The results reveal that the majority of respondents would like to learn more about money. As well, they affirm that face-to-face learning from family members and in classroom settings remain the preferred way to learn about financial issues. Finally, based on the literature review, the environmental scan, survey data, and feedback from the community consultation process, a web application titled Seven Generations Financial Literacy was developed and is located at www.sevengenerationsfinancial.com.

Income and Expense Volatility Survey Results

In this video presentation Patrick Ens from Capital One explains the impact of income and expense volatility on consumers. Capital One found that half of Canadian households surveyed experience some amount of income fluctuation month to month. This impacts their ability to save, cope with emergencies, and other aspects of their lives. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Financial Capability of Children, Young People and their Parents in the UK 2016

This new research study: the 2016 UK Children and Young People’s Financial Capability Survey, is the first of its kind: a nationally representative survey of the financial knowledge, attitudes and behaviours of 4- to 17-year-olds and their parents, living in the UK. A total of 4,958 children and young people aged 4–17, and their parents, were interviewed as part of this research. This report presents an initial analysis of the findings of this new survey and covers: ■ how children get money ■ how children spend and save money ■ children’s attitudes to spending, saving and debt ■ children’s confidence about managing their money ■ children’s understanding of the value of money and the need to make trade-offs ■ children’s knowledge and education about financial products, concepts, and terminology ■ parents’ beliefs and attitudes towards their own financial capability and the skills, abilities and attitudes of their children.

Financial well-being in America

There is wide variation in how people in the U.S. feel about their financial well-being. This report presents findings from a survey by the Consumer Financial Protection Bureau (CFPB) on the distribution of financial well-being scores for the U.S. adult population overall and for selected subgroups defined by these additional measures. These descriptive findings provide insight into which subgroups are faring relatively well and which ones are facing greater financial challenges.

2017 Financially Underserved Market Size Study

Responses to and Repercussions from Income Volatility in Low- and Moderate-Income Households: Results from a National Survey

Pervasive and profound: The impact of income volatility on Canadians

Income volatility describes income which is inconsistent (not received on a regular and predictable basis), unstable (amount varies each time it is received), and that fluctuates month to month by a significant percentage. TD’s report, Pervasive and Profound, has found that Canadians experiencing income volatility are more likely to report feelings of financial stress and lower overall financial health. They are also significantly more likely to see themselves falling behind financially and much less likely to feel confidence in their financial future. The survey findings show that income volatility is more likely to be experienced by part-time, self-employed, seasonal workers and the unemployed. The TD report uses Canadians’ reported behaviours and perceptions in the areas of saving, spending, borrowing and planning to gauge their overall financial health. In all four categories, those with higher income volatility show significantly lower financial health.