Discover financial empowerment resources

Discover financial empowerment resources

FSRA regulates the credit unions/caisses populaires sector in Ontario. Learn about how this sector is regulated through a comprehensive regulatory framework, and access portals to register a new credit union and...

A new OSC behavioural science experiment reveals Canadians are equally open to investment suggestions from AI systems and human advisors. As the use of AI increases, understanding the role of AI in supporting retail investor decision-making is important. While AI presents a range of opportunities...

CIRO works within the Canadian regulatory framework to help contribute to investor confidence and security. In collaboration with these other organizations, CIRO is committed to the protection of investors and maintaining the integrity of the Canadian capital markets. We want to build Canadians’...

Renters across Canada are facing exorbitant rental housing costs, driven by excessive rent increases and the loss of affordable homes. Many renters are left with so few housing options that they can afford, leaving them vulnerable to “economic eviction,” or being forced to live in a home that...

While there is no official definition of responsible or sustainable investing, many investors would like to adopt an investment approach that combines environmental, socials and governance (ESG) factors with traditional financial research. The Autorité des marchés financiers has compiled...

Financial Services Regulatory Authority of Ontario commissioned a research study that focused on consumer attitudes, how consumers are engaging with financial services, and consumer characteristics such as vulnerability. Insights from the research are allowing FSRA to better understand the...

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional...

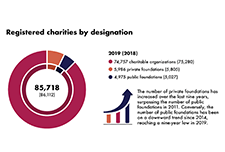

The charitable sector is a major social and economic force, offering vital services to Canadians and people around the world. The Canada Revenue Agency's Charities Directorate employs an education-first approach and client-centric philosophy. It aims to promote compliance with the charity-related...

This report presents a study of the debt settlement and financial recovery industry and examines Canadian consumer issues from these services. Data is gathered from company websites and contracts as well as customer surveys and questionnaires completed by governmental and non-governmental...

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These...

The United Kingdom is at the forefront of the global finance industry and is a leader in the fields of financial services, technology and innovation. Despite this high standing, a sizeable number of UK citizens lack access to even the most basic financial services, while still more are forced to...

Aboriginal individuals, entrepreneurs and communities have been affected by financial literacy challenges in many of the same ways that lower-income people and remote populations in Canada have. However, there is the additional weight of specific cultural and structural barriers and the additional...

In 2014, the licensed Canadian payday loan industry provided nearly 4.5 million short-term loans to Canadian households, at a total value of $2.2 billion. Despite its unfavourable reputation, the licensed payday loans industry provides a necessary service for cash-strapped Canadians. Placing...

All banks, and trust, loan and insurance companies and retail associations that are federally regulated (or that are incorporated at the federal level) must have a complaint-handling process in place for individuals and small businesses. This process details how a customer may make a complaint, and...

Mobile payments (m-payments) are an important aspect of mobile banking, which is a form of retail financial services that is growing rapidly around the world. Canadian consumers are increasingly migrating away from branch-based banking towards online and mobile banking. Research suggests that the...

You’ve decided to get that cell phone, credit card, or gym membership – but do you know exactly what you are getting into? Before you sign any contract, here are 10 things you need to...

Despite the fact that, with only basic identification, all Canadians have the legal right to open a bank account, there has been an explosive growth in fringe financial institutions (FFIs) over the past decade or so which offer financial services such as cheque cashing, payday loans, and income...

The microfinance industry began with the intent to help poor clients help themselves. That’s one reason so many microfinance institutions have embraced the Smart Campaign, which strives to embed a set of client protection principles into the fabric of the microfinance sector. This synthesis...

Ensuring the economic well-being of Canada’s growing population of seniors is an important and complex public policy challenge that the new federal government must grapple with. Few disagree with the goal of providing all citizens with the means for a dignified and economically secure retirement....

Increasingly, the notion of “Housing First” has been promulgated internationally as the turnkey solution to homelessness. In Canada, government investment in Housing First has become de rigueur from coast to coast. This paper proposes the extension of Housing First as a guiding philosophy...

This brief is the joint submission of the Canadian Literacy and Learning Network (CLLN), Momentum Calgary, SEED Winnipeg, Social and Enterprise Development Innovations (SEDI), and St. Christopher House in Toronto – five non-profit organizations working to strengthen the financial inclusion and...

Registered disability savings plans (RDSPs) were announced in the 2007 federal budget in response to recommendations by the Expert Panel on Financial Security for Children with Severe Disabilities. The objective of the RDSP program is to enable parents and others to save for the medium- and...

This is a submission paper by SEDI to the Ontario Ministry of Child and Youth Services. Social and Enterprise Development Innovations (SEDI) is a national charity dedicated to expanding economic opportunity for Canadians living in poverty through program and policy innovation. We are pleased to...

There is a large and sophisticated industry of financial professionals available to give financial information and advice to Canadians who can afford their services, but Canadians with low or modest incomes and wealth lack the means to purchase that help. What’s more, sometimes mainstream...

For Canadians with low-incomes, tax time is an important opportunity to boost their incomes by accessing a wide range of government benefits. This can be done by claiming benefits directly when they tax file or by using tax filing to establish their eligibility for benefits that they can then apply...