Resources

Supported tax filing (STF) model general documents

This section contains resources that describe the supported tax file model and includes sample scripts and documents relevant to both virtual and in-person supported tax filing. These documents may be customized for your own agency.

Resources specific to in-person supported tax filing

This section contains documents that have been tailored for in-person supported tax filing.

Resources specific to virtual supported tax filing

This section contains documents that have been tailored for virtual supported tax filing.

Additional resources

This section contains additional resources to support at tax time. Be sure to also review our Tax filing toolkit and Financial Coaching toolkit for other relevant resources.

Sample client profiles (WoodGreen)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Encouraging tax filing at virtual clinics

Community volunteer income tax program (CVITP)

Need help filing your taxes? You may be able to avail of the Community Volunteer Income Tax Program. The Community Volunteer Income Tax Program (CVITP) has existed since 1971 and is a longstanding partnership between the Canada Revenue Agency (CRA), and community organizations and their volunteers. Tax clinic volunteers complete tax and benefit returns for eligible individuals to ensure they receive, or continue to receive, their entitled benefit payments. In Québec, volunteers prepare both the federal and provincial tax return. The CVITP service is offered free of charge to everyone who meets the eligibility criteria, and includes doing taxes for the current and previous years. For the 2022 tax season, community organizations are hosting free in-person and virtual tax clinics.

Encouraging tax filing at virtual clinics

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual clinics.

Tax Credit Outreach Resources

The Get It Back Campaign helps eligible workers in the United States claim tax credits and use free tax filing assistance to maximize tax time. A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial institutions to conduct outreach nationally. For 30 years, these partnerships have connected lower and moderate-income workers to tax benefits like the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and Volunteer Income Tax Assistance (VITA). Their website contain a variety of outreach materials that can be adapted for your organization, including:

Tax Prep Dispatch: Alternative Service Delivery Tips!

Tips and considerations for providing alternative tax filing service delivery.

Tax Prep Dispatch: The Drop-Off Process

Considerations and best practices for drop-off and virtual tax filing services.

Virtual VITA Toolkit: Program Strategies

Program strategies grounded in an understanding of your community can increase the likelihood of engagement and follow-through. The following resources are intended to support VITA programs with implementation strategies at key program stages, like outreach and intake, and offer examples of how other virtual VITA programs have addressed critical challenges.

Resources

Handouts, slides, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Process map: Virtual Self-File model overview

Time-stamps for the video recording:

4:01 – Agenda and introductions

5:59 – Audience polls

10:27 – Project introduction (Speaker: Ana Fremont, Prosper Canada)

14:31 – Tour of TurboTax for Tax Clinics (Speaker: Guy Labelle, Intuit)

17:59 – Woodgreen project pilot (Speaker: Ansley Dawson, Woodgreen Community Services)

27:35 – EBO 2-step process (Speaker: Marc D’Orgeville, EBO)

39:26 – Woodgreen program modifications (Speaker: Ansley Dawson, Woodgreen)

46:03 – Q&A

Resources

Handouts, slides, and time-stamps

Disability Alliance BC

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered Disability Savings Plans (RDSP) and more.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits designed to support them. This report illustrates that the CRA needs to take a broad, country-wide perspective of the CVITP, while also taking into consideration regional and other differences. Services offered and training provided to volunteers need to reflect the realities of the diverse regional, geographic, socio-economic, workforce, and vulnerable, sectors throughout Canada. Different areas of the country will have different primary needs from the CVITP. The CRA needs to address those needs, both in its actions through the CVITP, as well as in the training provided to CVITP volunteers and the support given to partner organizations.

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of the Canada Revenue Agency (CRA). The Office of the Taxpayers’ Ombudsman hears first-hand the concerns of individuals, tax practitioners, and community support organizations. The Ombudsman visited with Community Volunteer Income Tax Program (CVITP) partner organizations, volunteers, and the Canada Revenue Agency’s (CRA) CVITP coordinators to learn more about the program and to understand the success stories and challenges they all experience. This report gives voice to what they have heard and provides recommendations on how to address the issues raised.

Virtual tax filing: Piloting a new way to file taxes for homebound seniors

WoodGreen Community Services, a large multi-service frontline social service agency in Toronto, provides free tax preparation services year-round to people living on low incomes. WoodGreen was interested in designing a novel solution to address the tax filing needs of homebound seniors who are unable to access WoodGreen’s free in-person tax-preparation services due to physical or mental health challenges. Specifically, WoodGreen wanted to know… How might we provide high-quality professional tax preparation services to all clients whether or not they are onsite? Prosper Canada and a leading commercial tax preparation software company partnered with WoodGreen Community Services in order to answer this design question.

English

Supported self-file process maps: English

French

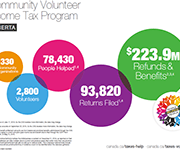

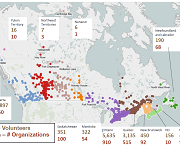

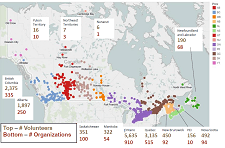

Community Volunteer Income Tax Program (CVITP) provincial snapshots

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les informations sont présentées en anglais et en français.

Giving Savings Advice

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at a specific point in the tax preparation process: when entering dependent information. The video also includes examples of commonly heard reasons tax filers give for not wanting to save, and possible responses.

Talking About Savings

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video discusses why promoting savings at tax time is a critical component of VITA volunteers.

VITA: A step-by-step guide to increase your impact

In this report, The Common Cents Lab and MetLife Foundation share findings from the experiments we have run over the past several years with VITA providers to improve tax-related outcomes. We encourage you to consider implementing these ideas and engaging in additional conversations about how to use behavioral science to increase financial capability for all taxpayers. The report outlines a series of interventions that exemplify

ways these best practices have been implemented in the field and

how to use behavioral science to further extend their impact. We’ve

organized these interventions into two categories:

More Than Just Taxes

Tax time financial capability services offered at Volunteer Income Tax Assistance (VITA) sites range from encouraging taxpayers to save a portion of their refund to free credit reviews, to referrals to financial coaching, and others in between. This report from Prosperity Now summarizes research findings on VITA programs offering asset-building and financial capability services. Specifically, findings address barriers to be overcome, facilitating factors, and the opportunities for targeted outreach, tailored messages, and policy improvements to move the needle on Earned Income Tax Credit (EITC) take-up rates.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Handouts for this webinar:

Tax time insights research report – webinar handout (Prosper Canada)

Income tax checklist – webinar handout (The Working Centre)

Form for missing income information – webinar handout (The Working Centre)

Income tax return summary sheet – webinar handout (The Working Centre)

Host checklist for tax clinics – webinar handout (The Working Centre)

Forms for rental information – webinar handout (The Working Centre)

Referral to FEPS – webinar handout (The Working Centre)

Time-stamps for the video-recording:

3:10 – Introductions and Agenda

6:32 – Audience polls

10:52 – Tax time insights: Experiences of people living on low incomes (Speaker: Nirupa Varatharasan)

26:00 – The Working Centre tax clinic experiences (Speaker: Jen Smerdon)

Resources

Barriers to tax filing experienced by people with low incomes

Income tax filing and benefits take-up: Challenges and opportunities for Canadians living on low income, Uttam Bajwa, University of Toronto

Tax time insights, Nirupa Varatharasan, Prosper Canada

“Stories from the field”: Contextualizing the barriers Indigenous People face, Erin Jeffery, Canada Revenue Agency (CRA)

Closing the tax-filing gap: Challenges and opportunities

The Community Volunteer Income Tax Program, Nancy McKenna, CVITP, Canada Revenue Agency

Supporting organizations in the CVITP, Aaron Kozak, Employment and Social Development Canada, and Melissa Valencia, Canada Revenue Agency

A Realist analysis of nonprofit tax filing services, Kevin Schachter, University of Manitoba and SEED Winnipeg

National and regional strategies to boost tax filing

The Community Volunteer Income Income Tax Program, Nancy McKenna, Canada Revenue Agency

GetYourBenefits! Diagnose and Treat Poverty, Dr. Noralou Roos, Manitoba Centre for Health Policy

Get your piece of the money pie, Althea Arsenault, New Brunswick Economic and Social Inclusion Corporation

Innovations in tax filing assistance

Scaling tax filing assistance, John Silver, Community Financial Counselling Service (CFCS)

Virtual Tax Filing Pilot, Radya Cherkaoui, Intuit Canada, and Steve Vanderherberg, Woodgreen Community Services

Innovative use of technology for VITA, German Tejeda,

Innovative use of technology for VITA

In this presentation, German Tejeda, National Director of Financial Programs, Single Stop USA, shares results from the Virtual VITA Program in the United States since 2012. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Virtual Tax Filing Pilot

In this presentation, Radya Chaerkaoui, Senior Product Manager and Innovation Catalyst, Intuit Canada, and Steve Vanderherberg, Director-Strategic Initiatives, WoodGreen Community Services, share insights from their Virtual Tax Filing Pilot program. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Scaling tax filing assistance

In this presentation, John Silver, Executive Director, Community Financial Counselling Service (CFCS), Winnipeg, shares insights from the low income tax program at CFCS. This program files almost 10,000 returns each year, and also provides tax clinic support to other agencies and delivers detailed training for tax clinic volunteers. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Get Your Piece of the Money Pie

In this presentation, Althea Arsenault, Manager of Resource Development, NB Economic and Social Inclusion Corporation, shares insights from the 'Get Your Piece of the Money Pie' tax clinic program. This program has operated since 2010, and currently files over 23,000 returns each year. This presentation is from the panel discussion 'National and regional strategies to boost tax filing', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

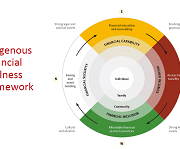

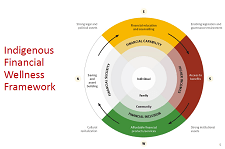

Providing tax filing and benefits assistance to Indigenous communities

In this presentation, Simon Brascoupé, Vice President, Education and Training, AFOA Canada, explains the financial wellness framework and how tax filing presents opportunities for building financial wellness in Indigenous communities. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Supporting Organizations in the CVITP

In this presentation, Aaron Kozak, ESDC and Melissa Valencia, CRA, present findings from their research on the Community Volunteer Income Tax Program (CVITP). This includes recommendations for structural changes to the program, review of CVITP training, changes to registration, and more. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

The Community Volunteer Income Tax Program (CVITP)

In this presentation, Nancy McKenna, Manager, CVITP, Canada Revenue Agency, explains how the Community Volunteer Income Tax Program (CVITP) works. This includes eligibility requirements, the size of the program in 2017/2018, and partnerships. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

English

Download in English

French

English

2023 Tax Resources: Canada Revenue Agency

The Canada Revenue Agency kicks off the 2023 Tax filing season

- Factsheet – Students

- Factsheet – Persons with disabilities

- Factsheet – Modest income individuals

- Factsheet – Housing insecure individuals

- Factsheet – Adults 65 and older

- Factsheet – Indigenous peoples

- Factsheet: Northern residents deductions

- Factsheet: Individuals experiencing gender based violence

- Factsheet – Newcomers

Resources

- Infographic: Child-related benefits

- Infographic: Newcomers

- Tear sheet: Register for my account

- Tear sheet: Doing your taxes

- Service option card

- Video: Individuals with a modest income

- Video: Persons with disabilities

- Video: International Students

- Video: Students, it pays to do your taxes!

- SimpleFile by Phone automated phone service (formerly called File my Return)

2022 Tax Resources: Canada Revenue Agency

- Benefits and credits fact sheet – Students

- Benefits and credits fact sheet – Persons with disabilities

- Benefits and credits fact sheet – Modest income individuals

- Benefits and credits fact sheet – Housing insecure individuals

- Benefits and credits fact sheet – Adults 65 and older

- Benefits and credits fact sheet – Women in shelters

- Benefits and credits fact sheet – Indigenous peoples

- Benefits and credits fact sheet – Newcomers

Canada Dental Benefit

One-time top-up to the Canada Housing Benefit

Get your taxes done for free at a tax clinic

Canada workers benefit

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

2021 Tax Resources - Canada Revenue Agency

Last-minute tax tips (Canada Revenue Agency) – April 13, 2021

New Canada Recovery Benefits – What to Expect

Answers to your questions on paying back the Canada Emergency Response Benefit (CERB)

Benefits and credits fact sheet – Indigenous people living in Canada

Benefits and credits fact sheet – Modest income

Benefits and credits fact sheet – Newcomers

Benefits and credits fact sheet – Newcomers in Quebec

Benefits, credits, and deductions for Seniors

COVID-19 Measures for Persons with Disabilities

Benefits and credits – Persons with Disabilities

Canada Workers Benefit – Infographic

Canada Workers Benefit – promotion card

Get your taxes done for free – promotion card

Income tax basics

Why file? The benefits of tax filing (Tax toolkit)

Getting government payments by direct deposit

Income tax 101: What are tax deductions, benefits, credits, exemptions, and brackets? (Tax toolkit)

Considerations for Indigenous people at tax time (Tax toolkit)

Resources about tax filing in Canada (Tax toolkit)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Community tax clinic guides

About volunteer tax clinics: Help your community members file their taxes (Tax toolkit)

Getting started as a community tax clinic (Tax toolkit)

Tax clinic staff and volunteer roles (Tax toolkit)

Tax clinic preparation: Recommended timeline (Tax toolkit)

Insights on planning free tax clinics in Indigenous communities: Infographic (Tax toolkit)

Encouraging tax filing at virtual clinics (sample “active choice” email) – The Behavioural Insights Team *NEW*

Tax clinic resources for practitioners

The tax clinic resources below are from our community partner organizations. These are examples that may be adapted to your own community tax clinic needs. Whenever possible, we have credited the original author of each document and included contact information if you would like to find out more about using and adapting the resource.

Resources to support tax clinic delivery and tax filing

Simplified Intake Form 2019 (ACSA, Scarborough, ON)

Tax Clinic Host Checklist (The Working Centre, Kitchener-Waterloo, ON)

Income tax checklist for participants (The Working Centre, Kitchener-Waterloo, ON)

Intake form for Couples (E4C, Edmonton, AB)

Tax Prep Quick Reference Guide (E4C, Edmonton, AB)

Other resources to support participants at tax time

Income tax summary (The Working Centre, Kitchener-Waterloo, ON)

Form for Missing Income Info for Revenue Canada (The Working Centre, Kitchener-Waterloo, ON)

Forms for rental information (The Working Centre, Kitchener-Waterloo, ON)

Referral to FEPS (The Working Centre, Kitchener-Waterloo, ON)

Envelope checklist (E4C, Edmonton, AB)

Seniors Info Sheet – Federal and provincial benefits (E4C, Edmonton, AB)

Resources for outreach and promotion

Tax clinic flyer (ACSA, Scarborough, ON)

2019 tax clinic flyer (Jane Finch Centre, Toronto, ON)

2019 tax clinic flyer (North York Community House, Toronto, ON)

Resources to support tracking and evaluation

Tax data entry sheet – Tax toolkit (Sunrise Community Centre, Calgary, AB)

Anonymous tax tracking sheet (Aspire collective, Calgary, AB)

Additional information and resources on tax filing

Benefits, credits and financial support: CRA and COVID-19 – Canada Revenue Agency (CRA)

Covid-19: Free virtual tax clinics – Canada Revenue Agency (CRA)

Get ready to do your taxes – Canada Revenue Agency (CRA)

Taking care of your tax and benefit affairs can pay off (tax filing info sheet) – Canada Revenue Agency (CRA) *NEW

Slam the scam – Protect yourself against fraud – Canada Revenue Agency (CRA)

Supported Self: File Piloting a new way to empower individuals to file taxes independently – Prosper Canada

Virtual Tax Filing: Piloting a new way to file taxes for homebound seniors – Prosper Canada

Webinar Series on Taxes (May 2020) – Momentum

SimpleFile by Phone automated phone service (formerly called File my Return) – Prosper Canada Learning Hub

Tax season prep – Plan Institute

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

What to do if your tax return is reviewed or audited – OSC

French

Ressources de déclaration de revenus 2023 - Agence du revenu du Canada

L’Agence du revenu du Canada lance la saison des impôts 2023

- Fiche descriptive: Étudiants

- Fiche descriptive: Les personnes handicapées

- Fiche descriptive: Les personnes à revenu modeste

- Fiche descriptive: Les personnes en situation de logement précaire

- Fiche descriptive: Les personnes âgées de 65 ans et plus

- Fiche descriptive: Les personnes autochtones

- Fiche descriptive : Déductions pour les habitants de régions éloignées

- Fiche descriptive : Personnes aux prises avec la violence fondée sur le sexe

- Fiche descriptive: Les nouveaux arrivants

Ressources

- Infographie – Prestations pour enfants

- Infographie – Prestations et crédits pour les nouveaux arrivants

- Feuille détachable : Inscrivez-vous à Mon dossier

- Feuille détachable : Produire votre déclaration de revenus

- Carte d’option de service

- Webinaire – Les personnes à revenu modeste

- Video: Persons with disabilities

- Webinaire – Les étudiants étrangers

- Webinaire – Avis aux étudiants : c’est payant de faire vos impôts!

Ressources de déclaration de revenus 2022 - Agence du revenu du Canada

Fiche descriptive : Étudiants

Fiche descriptive : Les personnes handicapées

Fiche descriptive : Les personnes à revenu modeste

Fiche descriptive : Les personnes en situation de logement précaire

Fiche descriptive : Les personnes âgées de 65 ans et plus

Fiche descriptive : Femmes dans les refuges

Fiche descriptive : Les personnes autochtones

Fiche descriptive : Les nouveaux arrivants

Prestation dentaire canadienne

Supplément unique à l’Allocation canadienne pour le logement

Faites faire vos impôts à un comptoir d’impôts gratuit

Allocation canadienne pour les travailleurs

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone, Inuit ou Métis

Ressources de déclaration de revenus 2021 - Agence du revenu du Canada

Nouvelles prestations canadiennes de la relance économique – À quoi s’attendre

Réponses à vos questions sur le remboursement de la Prestation canadienne d’urgence (PCU)

Recevez vos versements de prestations et de crédits! – Les les autochtones qui habitent au Canada

Prestations et crédits – Revenu modeste

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits!

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits! (Quebec)

Il y a des avantages à faire ses impôts! – Personnes agées

Mesures relatives à la COVID-19 à l’intention des personnes handicapées

Des prestations et des crédits pour vous! – Les personnes handicapées

Chaque dollar compte! – L’allocation canadienne pour les travailleurs (ACT)

Chaque dollar compte! Carte promotionnelle pour l’allocation canadienne pour les travailleurs (ACT)

Faites faire vos impôts gratuitement – Carte promotionnelle

Fondements de l’impôt sur le revenu

Pouruoi declarer? Les avantages de produire une declaration de revenus

Recevoir des paiements du gouvernement par dépôt direct

Que sont les déductions, les avantages fiscaux et les crédits d’impôt?

Considérations sur la période d’impôt pour lesautochtones qui habitent au Canada

Ressources pour en savoir plus

Comptoirs d’impôt bénévoles : Aidez les membres de votre communauté

Ressources

S’occuper de ses impôts et de ses prestations peut être payant – Agence du revenu du Canada

Service automatisé Déclarer simplement par téléphone (anciennement Produire ma déclaration)– Agence du revenu du Canada

Démystifier le crédit d’impôt pour personnes handicapées – Agence du revenu du Canada

Insights on planning free tax clinics in Indigenous communities

This infographic by Prosper Canada features advice to help Indigenous communities and organizations set up free income tax clinics. Advice was shared by clinic volunteers through a roundtable and interviews as part of the First Nations Financial Wellness project.

How Improved Training Strategies can Benefit Taxpayers Using VITA Programs

Virtual VITA: Expanding Free Tax Preparation. Program Insights

This brief highlights findings from a small-scale pilot that integrated Virtual Volunteer Income Tax Assistance (VITA) services at two New York City Head Start programs during the 2013 tax season. The New York City Department of Consumer Affairs Office of Financial Empowerment (OFE) coordinated the pilot in partnership with the Administration for Children & Families (ACF) Region Food Bank For New York City was the VITA provider. Participating Head Start programs included The Children’s Aid Society and Kingsbridge Heights Community Center (KHCC).