Powerpoint, video with time stamps

Financial Health & Wealth

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money. Money is a big way that others control and influence our lives. Sometimes we need to depend on others to give us money and tell us what to do with money. Opening a bank account, understanding where your money is coming from, and saving money will help you to become financially independent and financially healthy. This report from The Native Women's Association of Canada covers the importance of financial health and has sections on financial information covering bank accounts, insurance, budgeting, saving, credit cards, car loans, income taxes and housing.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. Here is some basic information to get you started. A list of bank resources at the end of this article may also help with the financial transition to Canada.

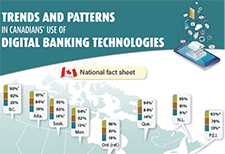

How Canadians bank

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world. This survey and other findings form the basis of How Canadians Banks, a biannual study by the Canadian Bankers Association and Abacus Data that examines the banking trends and attitudes of Canadians.

Financial consumer protection framework

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional promotional toolkits can be found on the FCAC website.

FCAC new consumer information – electronic alerts

Le français suit l’anglais. As of June 30, 2022, banks will be required to send electronic alerts to their customers to help them manage their finances and avoid unnecessary fees. Some banks have already started sending these alerts to their customers. The electronic alerts are part of the new and enhanced protections in Canada’s Financial Consumer Protection Framework (the Framework) that comes into effect on June 30, 2022. To inform Canadians about electronic alerts and their benefits, the Financial Consumer Agency of Canada (FCAC) published new consumer information on electronic alerts, developed an infographic, and prepared social media content that you can use on your own social media channels. Under the Framework, banks will be required to: À compter du 30 juin 2022, les banques seront tenues d’envoyer des alertes électroniques à leurs clients afin de les aider à gérer leurs finances et à éviter de payer inutilement des frais, ce que certaines ont déjà commencé à faire. Ces alertes font partie des mesures de protection nouvelles ou améliorées prévues dans le Cadre de protection des consommateurs de produits et services financiers du Canada (le Cadre) qui entre en vigueur le 30 juin 2022. Pour informer les Canadiens et les Canadiennes à propos des alertes électroniques et de leurs avantages, l’Agence de la consommation en matière financière du Canada (ACFC) a publié de nouveaux renseignements à ce sujet pour les consommateurs. Elle a également créé une infographie et préparé du contenu pour les réseaux sociaux que vous pouvez utiliser dans vos propres comptes de médias sociaux. En vertu des dispositions du Cadre, les banques seront tenues :

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the Canadian banking system.

State of Fair Banking in Canada 2020: Borrower and Lender Perspectives

The DUCA Impact Lab defines fair banking as any financial product or service that lives up to the following set of principles: Their Fair Banking 2020 report presents data on the following areas:

English

French

State of Fair Banking in Canada

Everyone needs to bank and nearly everyone has a relationship with at least one financial institution. Financial Institutions need relationships with consumers too, in order to thrive as businesses. The role these relationships play in financial decision making for Canadians is an important consideration for anyone seeking to understand the financial health of Canadians and the impact of the banking sector in Canada. This report discusses the findings from a national sample of both banking consumers and lenders who were asked about their perspectives on fairness, access, credibility and transparency.

Financial Health Index: 2019 Findings and 3-Year Trends Report

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from 2017 to 2019.

2018 White Paper: Financial Wellbeing Remains Challenged in Canada

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income variability and the extent to which Canadians have access to and lever their social capital (i.e. their family and friends who can provide financial advice and/or support in times of hardship). The study also explores consumer financial product and service usage, debt management and debt stress, access to financial products, services, advice and tools, usage of more predatory financial services (e.g. payday lending) and perceived levels of support by consumers’ primary Financial Institution for their financial wellness. The study also provides benefits of improved support for financial providers improving the financial wellness of their customers – including from a banking share of wallet and brand perspective.

The Present and Future of Bank On Account Data: Pilot Results and Prospective Data Collection

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This report details the Bank On Data Pilot, which collected and measured quantitative data on 2017 Bank On account usage at four pilot financial institutions with certified accounts: Bank of America, JPMorgan Chase, U.S. Bank, and Wells Fargo.

2017 Bank On Data Pilot: Accessing Local Data

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This tool details the 2017 Bank On Data Pilot and includes instructions for accessing the local Bank On data at the city and zip code level.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

My money in Canada

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use. The tool is intended to be used with clients and settlement workers together, but can also be used by the client on their own if they are comfortable.

An Evaluation of Financial Empowerment Centers: Building People’s Financial Stability as a Public Service

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free public service. The evaluation draws on data from 22,000 clients who participated in 57,000 counseling sessions across these first 5 city replication partners, and provides additional evidence of the program’s success.

Mortgage Calculator

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment schedule.

Account Comparison Tool

Compare features for different chequing and savings accounts, including interest rates, monthly fees and transactions. Find an account that best suits your needs. Narrow your search, view search results, and compare your results using this account comparison tool from the Financial Consumer Agency of Canada.

Activity sheet 4-10: Goals (Banking and financial services)

This activity sheet is from Module 4 of the Prosper Canada Financial Literacy Facilitator resources. Take a few minutes to how this workshop relates to your life, and set one or two goals for your use of banks and other financial services. To view the full Financial Literacy Facilitator resources, click here.

Income volatility: What banking data can tell us, if we ask

In this video presentation Fiona Greig from the JP Morgan Chase Institute explains what banking data can tell us about income volatility in the United States. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Canada Islamic Finance Outlook 2016

Islamic finance is growing rapidly, outpacing the growth of the conventional finance industry and even grabbing market share from it. This success has been driven in part by the internationalisation of Islamic finance as it reaches beyond its core markets of the Middle East, North Africa and Southeast Asia, and into new ones such as Europe and the Americas, including Canada, which is the focus of this report.

This report provides an introduction to Islamic banking in Canada.

What to do when you get an income tax refund

Handout 4-12: Glossary for banking and financial services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Glossary for banking and financial services. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-11: Banking and financial services resources

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Resource list of websites about banking and financial services. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-8: Alternative financial services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Alternative financial services are outside of the traditional, regulated banking system. They do not take deposits like a bank or credit union. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-7: What are my rights?

This handout is from Module 4 of the Financial Literacy Facilitator Resources. What are your rights when opening a bank account in Canada? To view full Financial Literacy Facilitator Resources, click here.

Handout 4-6: Opening a bank account

This handout is from Module 4 of the Financial Literacy Facilitator Resources. How to open a bank account in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-4: Bank accounts and services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. The different kinds of bank accounts and services available. in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-5: Choosing a bank and choosing an account

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Choosing a bank and choosing an account based on your banking needs. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-2: Deposit insurance at credit unions

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Deposit insurance amounts from credit unions in different provinces. To view full Financial Literacy Facilitator Resource, click here.

Handout 4-1: Banks and credit unions

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Banks and credit unions are places where you can safely deposit your money, cash your cheques, pay your bills, ask for a loan or credit card and use a variety of saving and investment tools. This chart explains the differences between banks and credit unions. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-9: Comparing alternative financial services to banking services

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Why use alternative financial services? Why use banking services? List the reasons for using the services that your group was assigned. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-3: Banks and banking services quiz

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Banks and banking services quiz: In pairs, match the items in column A to column B. To view full Financial Literacy Facilitator Resources, click here.

Do States Benefit From Restricting Safety-Net Eligibility Based on Wealth?