Control, Sufficiency, and Social Support Lessons from Low-income Canadians about Financial Wellbeing

This report examines how diary participants achieve the financial wellbeing that they have. The evidence we found is that low-income people work very hard to manage their finances. They endeavor to control their finances so that, as one participant said, their finances don’t control them. They must prioritize needs and wants because there is not enough for both. One participant talked about her goal of having a ‘little bit more’ than her needs so that there was a little extra for savings or small purchases or trips. Finally, we saw that family and friends are terribly important for achieving financial wellbeing because social supports can provide loans, gifts, and emotional support. Having a low-income means that banks offer few financial supports. Of course, family and friends also make demands.

State of Fair Banking in Canada 2020: Borrower and Lender Perspectives

The DUCA Impact Lab defines fair banking as any financial product or service that lives up to the following set of principles: Their Fair Banking 2020 report presents data on the following areas:

Trading Equity for Liquidity: Bank Data on the Relationship Between Liquidity and Mortgage Default

For many, homeownership is a vital part of the American dream. Buying a home represents one of the largest lifetime expenditures for most homeowners, and the mortgage has generally become the financing instrument of choice. For many families, their mortgage will be their greatest debt and their mortgage payment will be their largest recurring monthly expense. In this report, we present a combination of new analysis and previous findings from the JPMorgan Chase Institute body of housing finance research to answer important questions about the role of liquidity, equity, income levels, and payment burden as determinants of mortgage default. Our analysis suggests that liquidity may have been a more important predictor of mortgage default than equity, income level, or payment burden.

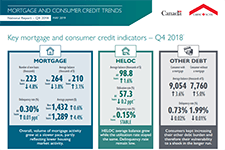

Mortgage and Consumer Credit Trends Report

The Canada Mortgage and Housing Corporation (CMHC) publishes a quarterly report on Canadian trends relating to mortgage debt and consumer borrowing. Find out the level of Canadian household indebtedness, and emerging trends in outstanding debt balances in different urban areas and by age group.

High-Cost Alternative Financial Services: The Customer Experience

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty Talks! and Sunrise Community Link Resource Centre. The following document summarizes what we learned from these conversations and the loan contracts that borrowers shared with us. It also identifies several themes that emerged from these discussions.

Summary Brief: High-Cost Alternative Financial Services

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial institutions. High-cost alternative financial services contribute to a two-tiered banking system, in which the poor often pay more for inferior services. Without more stringent regulation, and in the absence of safe and affordable short-term credit options, Albertans living on lower-incomes will continue to experience financial exclusion and take on heavy debt loads – both of which are major contributors to long-term poverty.

Building consumer financial health: The role of financial institutions and FinTech

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

2017 Financially Underserved Market Size Study

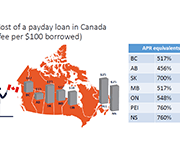

The Real Cost of Payday Lending

Since the early 1990s payday lending businesses have become increasingly prolific in most parts of Canada, including Calgary. Social agencies and advocates working to reduce poverty view payday lenders and other fringe financial businesses as problematic for those looking to exit the cycle of poverty. Payday lenders charge interest rates that, when annualized, top 400%. The industry justifies this by stating that comparisons to an annual rate are unfair as loans are not meant to or allowed to last longer than two months. However, the fact remains that these businesses charge far more for credit than mainstream financial institutions and are more prevalent in lower income neighbourhoods.