Responsible or sustainable investing

While there is no official definition of responsible or sustainable investing, many investors would like to adopt an investment approach that combines environmental, socials and governance (ESG) factors with traditional financial research. The Autorité des marchés financiers has compiled information about ESG factors, the challenges of investing while taking ESG factors into account.

Research to help FSRA improve the lives of vulnerable consumers

Financial Services Regulatory Authority of Ontario commissioned a research study that focused on consumer attitudes, how consumers are engaging with financial services, and consumer characteristics such as vulnerability. Insights from the research are allowing FSRA to better understand the realities of consumers’ changing financial lives and helping to identify key opportunities to respond to the needs of vulnerable consumers. 2022 Consumer Research Study highlights. 2022 Consumer Research Study full report

Financial consumer protection framework

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional promotional toolkits can be found on the FCAC website.

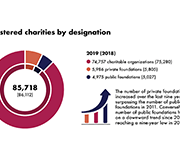

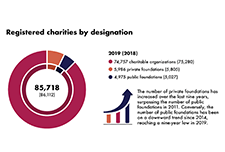

Report on the Charities Program 2018 to 2020

The charitable sector is a major social and economic force, offering vital services to Canadians and people around the world. The Canada Revenue Agency's Charities Directorate employs an education-first approach and client-centric philosophy. It aims to promote compliance with the charity-related income tax legislation and regulations in order to support charitable giving and development of the sector, while protecting charities and the public from abuse. This report provides an update on the Directorate’s activities over the past two years, including the initial impact of the COVID-19 pandemic.

Debt settlement and financial recovery companies: too risky an option?

This report presents a study of the debt settlement and financial recovery industry and examines Canadian consumer issues from these services. Data is gathered from company websites and contracts as well as customer surveys and questionnaires completed by governmental and non-governmental organizations. A comparative study of legislation applicable to the industry is also conducted.

Core competencies frameworks on financial literacy

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These documents describe the types of knowledge that youth aged 15 to 18, and adults aged 18 and up, could benefit from.