Resources

Handouts, slides and video time stamps

Read the presentation slides for this webinar.

Download the promotional postcard.

Download the promotional poster.

Time-stamps for the video recording:

1:26 – Welcome and introductions

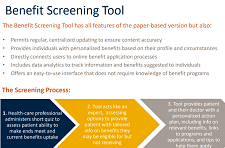

3:30 – Our goals for today’s session

5:04 – Why these tools were created

7:12 – The Benefits Wayfinder and the Disability Benefits Compass

46:11 – Ways to use the Benefits Wayfinder – tax clinics

49:37 – Access to Benefits training available

Making the most of your money

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share or use with your clients to help them access tools and resources to support their daily money management. Making the most of your money is an easy-to-use, accessible, online course to help people living on a low income organize their finances and explore ways to increase the amount of money coming in and reduce what is going out. This interactive course has activities, videos, handouts and resources that are also downloadable.

Benefits & credits: factsheets from the CRA

The CRA has compiled benefits and credits factsheets for: These are available in English and French.

Canada workers benefit

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility requirements, how to apply and how much you can expect to receive by clicking on the Get It button below.

The impact of the enhanced child tax credit on lower-income households

The American Rescue Plan, one of the most significant policy responses to alleviate child poverty in decades, made fundamental changes in enhancing the Child Tax Credit (CTC). In response to the pandemic, the law expanded the CTC for tax year 2021 to ensure a minimum level of economic support to all families raising children. Commonwealth, SaverLife, and Neighborhood Trust Financial Partners followed up with CTC-eligible families after most filed their 2021 tax returns. We conducted interviews and surveys to assess the impact of the enhanced credit on families’ financial health. Although we focused on the second half of the CTC payment, which was delivered as a lump sum payment as part of the tax refund, we also asked recipients about their tax filing experience and what a continuation of an expanded credit would mean for their families.

Mapping the road toward increased accessibility to the child tax credit

Last year, the expanded Child Tax Credit (CTC) helped to lift nearly four million children out of poverty and provided economic relief to millions of struggling households. However, many first-time and lapsed filers from underserved and vulnerable populations missed out on these critical benefits. Locating and serving eligible low-income youth, formerly incarcerated individuals, people experiencing homelessness, immigrants, survivors of domestic violence, and isolated tribal populations has presented a challenging opportunity to free tax prep service providers across the country. This research highlights the key findings and recommendations to increase the accessibility to the CTC.

How income tax works

Filing your taxes might be one of the most important financial actions you’ll take each year. It can also feel confusing or stressful at times. Find out more about how income tax works, including tax deductions and tax credits using the Ontario Securities Commission's interactive chart to see what tax bracket you are in.

Welfare in Canada, 2020

Maytree released the 2020 edition of the Welfare in Canada report. For each province and territory, this report provides data and analysis on the total welfare income that households receiving social assistance would have qualified for in 2020, including COVID-19 pandemic-related supports. Welfare in Canada is a series that presents the total incomes of four example households who qualify for social assistance benefits in each of Canada’s provinces and territories in a given year. Welfare in Canada, 2020 looks at the maximum total amount that a household would have received over the course of the 2020 calendar year, assuming they had no other source of income and no assets. Some households may have received less if they had income from other sources, while some households may have received more if they had special health- or disability-related needs. The report looks at: In addition, this year the report includes a new section that looks at the adequacy of welfare incomes in each province over time, an analysis that hearkens back to past reports prepared by the National Council of Welfare. Also, please note that this report measures the adequacy of welfare incomes relative to both the Market Basket Measure (MBM) – Canada’s Official Poverty Line – and the Deep Income Poverty threshold (MBM-DIP), which is equivalent to 75 per cent of the MBM. This analysis will replace the low-income threshold comparisons in future reports. We hope these additions will be helpful for those using the report. In each jurisdiction, the total welfare income for which a household is eligible depends on its specific composition. For illustrative purposes, this resource focuses on the welfare incomes of four example household types:

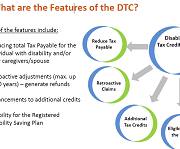

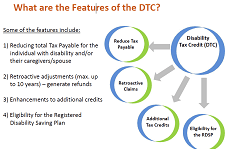

Disability Tax Credit Tool

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to give them the information they need to fill out that form

Questions and answers about filing your taxes

Questions and answers released by the Canada Revenue Agency (CRA) about filing your taxes, including information on:

Making Safety Affordable: Intimate Partner Violence is an Asset-Building Issue

This brief explores three existing unmet needs that contribute to survivors’ inability to build wealth: money, tailored asset-building support, and safe and responsive banking and credit services. Within each identified need, specific issues facing survivors, strategic actions in response to those issues, as well as innovative ideas and existing promising practices to help funders take action to prioritize survivor wealth are discussed.

Disability Alliance BC

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered Disability Savings Plans (RDSP) and more.

Costing a Guaranteed Basic Income During the COVID Pandemic

The Parliamentary Budget Officer (PBO) supports Parliament by providing economic and financial analysis for the purposes of raising the quality of parliamentary debate and promoting greater budget transparency and accountability. This report responds to a request from Senator Yuen Pau Woo to estimate the post-COVID cost of a guaranteed basic income (GBI) program, using parameters set out in Ontario’s basic income pilot project. In addition, the report provides an estimate of the federal and provincial programs for low-income individuals and families, including many non-refundable and refundable tax credits that could be replaced by the GBI program.

Présentation de l’Explorateur d’allègements financiers (EAF)

L’Explorateur d’allègements financiers : un outil pour connaître les mesures d’aide et d’allègement liées à la COVID-19 dont vos clients pourraient bénéficier En réponse à la pandémie de COVID-19 et en raison de la complexité des mesures d’aide et d’allègement offertes à la population canadienne, nous avons créé l’Explorateur d’allègements financiers (EAF), un outil en ligne qui aide les gens vulnérables au Canada et ceux qui les accompagnent à accéder aux mesures d’aide d’urgence et d’allègement financier proposées par les gouvernements, les établissements financiers, les fournisseurs de services de télécommunication, de services publics et de services Internet. Soyez des nôtres pour assister à notre webinaire d’une heure animé par Elodie Young, de Prospérité Canada, qui vous présentera l’EAF et vous donnera des conseils sur la manière d’aider vos clients à accéder aux mesures d’aide et d’allègement financier. Que vous travailliez dans le secteur de la salubrité des aliments, de la santé mentale, de l'autonomisation financière, de l’établissement ou encore dans le secteur privé, venez apprendre comment aider vos clients à augmenter leur revenu et à réduire leurs dépenses pendant la crise. Ce webinaire concerne tous les fournisseurs de services de première ligne qui gagnent un faible revenu et les populations vulnérables du Canada.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar

Introducing the Financial Relief Navigator (FRN)

Access the Financial Relief Navigator here.

Time-stamps for the video recording:

3:22 – Agenda and Introductions

6:00 – Audience poll

9:00 – Why we created the Financial Relief Navigator (Speaker: Janet Flynn)

11:55 – What’s in the Financial Relief Navigator (Speaker: Janet Flynn)

16:35 – FRN Walkthrough using a Persona (Speaker: Galen McLusky)

33:15 – Tips for using the FRN (Speaker: Galen McLusky)

36:00 – The Working Centre experience using the FRN (Speaker: Sue Collison)

41:15 – Q&A

English

Benefits 101

What are tax credits and benefits

Reasons to file a tax return

List of common benefits

Getting government payments by direct deposit

Common benefits and credits Benefits pathways (for practitioner reference only – some illustrations presented are Ontario benefits)

Pathways to accessing government benefits

Overview of tax benefits and other income supports (adults, children, seniors)

Overview of tax benefits and other income supports (people with disabilities or survivors)

Income support programs for immigrants and refugees

Glossary of terms – Benefits 101

Resources – Benefits 101

Key benefits you may be eligible for

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

Benefits of Filing a Tax Return: Infographic

Common benefits and credits

Resource links:

Benefits and credits for newcomers to Canada – Canada Revenue Agency

Benefit Finder – Government of Canada

Electronic Benefits and credits date reminders – Canada Revenue Agency (CRA)

Income Assistance Handbook – Government of Northwest Territories

What to do when you get money from the government – Financial Consumer Agency of Canada (FCAC)

Emergency benefits

General emergency government benefits information & navigation

Financial Relief Navigator tool (Prosper Canada)

Changes to taxes and benefits: CRA and COVID-19 – Government of Canada

Canada Emergency Response Benefit (CERB)

Apply for Canada Emergency Response Benefit (CERB) with CRA – Canada Revenue Agency (CRA)

Questions & Answers on CERB – Government of Canada

What is the CERB? – Prosper Canada

FAQ: Canada Emergency Response Benefit – Prosper Canada (updated June 10th)

CERB: What you need to know about cashing your cheque – FCAC

COVID-19 Benefits (summary, includes Ontario) – CLEO/Steps to Justice

COVID-19 Employment and Work – CLEO/Steps to Justice

GST/HST credit and Canada Child Benefit

COVID-19 – Increase to the GST/HST amount – Government of Canada

Canada Child Benefit Payment Increase – Government of Canada

Benefits payments for eligible Canadians to extend to Fall 2020 – Government of Canada

Support for students

Support for students and recent graduates – Government of Canada

Canada Emergency Student Benefit (CESB) – Government of Canada

Benefits and credits for families with children

Benefits and credits for families with children

Resource links:

Child and family benefits – Government of Canada

Child and family benefits calculator – Government of Canada

Benefits and credits for people with disabilities

Benefits and credits for people with disabilities

RDSP, grants and bonds

Resource links:

Canada Pension Plan disability benefit toolkit – Employment and Social Development Canada (ESDC)

Disability benefits – Government of Canada

Disability tax credit (DTC) – Canada Revenue Agency (CRA)

Free RDSP Calculator for Canadians – Plan Institute

Future Planning Tool – Plan Institute

Creating Financial Security: Financial Planning in Support of a Relative with a Disability (handbook) – Partners for Planning

Nurturing Supportive Relationships: The Foundation to a Secure Future (handbook) – Partners for Planning

RDSP – Plan Institute

Disability Tax Credit Tool – Disability Alliance BC

ODSP Appeal Handbook – CLEO

Disability Inclusion Analysis of Government of Canada’s Response to COVID-19 (report and fact sheets) – Live Work Well Research Centre

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

Benefits and credits for seniors

Benefits and credits for seniors

Resource links:

Canadian Retirement Income Calculator – Government of Canada

Comparing Retirement Savings Options – Financial Consumer Agency of Canada (FCAC)

Federal Provincial Territorial Ministers Responsible for Seniors Forum – Employment and Social Services Canada (ESDC)

Retiring on a low income – Open Policy Ontario

RRSP vs GIS Calculator – Daniela Baron

Sources of income for seniors handout – West Neighbourhood House

What every older Canadian should know about: Income and benefits from government programs – Employment and Social Services Canada (ESDC)

French

Comprendre les prestations

Que sont les crédits d’impôt et les prestations?

Pourquoi produire une déclaration de revenus?

Processus d’accès aux prestations (simple, complexe ou laborieux)

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu : personnes handicapées ou survivants

Programmes d’aide au revenu pour immigrants et réfugiés – Admissibilité et processus de demande

Glossaire – Prestations et credits

Ressources : Prestations et credits

Principales mesures d’aide auxquelles vous pouvez être admissibles

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone,

Infographie sur les avantages de produire une déclaration de revenus

Prestations et crédits courants

Prestations et crédits pour familles avec enfants

Prestations et crédits pour personnes handicapées

Prestations et crédits pour les personnes âgées

Informations d’identification pour accéder aux prestations

Études de cas

Seniors: tips to help you this tax season

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada resources.

Welfare in Canada, 2018

These reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and territory. Established by the Caledon Institute of Social Policy, Welfare in Canada is a continuation of the Welfare Incomes series originally published by the National Council of Welfare, based on the same approach.

Canada Revenue Agency Child and Family Benefits Calculator

This online tool released by the Canada Revenue Agency can be used to determine the eligibility and payment amounts of child and family benefits. Additional information on child and family benefit programs may be found on the Canada Revenue Agency's child and family benefits page.

More Than Just Taxes

Tax time financial capability services offered at Volunteer Income Tax Assistance (VITA) sites range from encouraging taxpayers to save a portion of their refund to free credit reviews, to referrals to financial coaching, and others in between. This report from Prosperity Now summarizes research findings on VITA programs offering asset-building and financial capability services. Specifically, findings address barriers to be overcome, facilitating factors, and the opportunities for targeted outreach, tailored messages, and policy improvements to move the needle on Earned Income Tax Credit (EITC) take-up rates.

Stories from the field: Contextualizing the barriers Indigenous People face

In this presentation, Erin Jeffery, Outreach Officer with Canada Revenue Agency (CRA) shares what the CRA Outreach team has learned about tax filing barriers facing Indigeous People in Canada. These barriers include lack of documentation, lack of trust, access to services, and challenges around accessing Canada Child Benefit. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

English

2023 Tax Resources: Canada Revenue Agency

The Canada Revenue Agency kicks off the 2023 Tax filing season

- Factsheet – Students

- Factsheet – Persons with disabilities

- Factsheet – Modest income individuals

- Factsheet – Housing insecure individuals

- Factsheet – Adults 65 and older

- Factsheet – Indigenous peoples

- Factsheet: Northern residents deductions

- Factsheet: Individuals experiencing gender based violence

- Factsheet – Newcomers

Resources

- Infographic: Child-related benefits

- Infographic: Newcomers

- Tear sheet: Register for my account

- Tear sheet: Doing your taxes

- Service option card

- Video: Individuals with a modest income

- Video: Persons with disabilities

- Video: International Students

- Video: Students, it pays to do your taxes!

- SimpleFile by Phone automated phone service (formerly called File my Return)

2022 Tax Resources: Canada Revenue Agency

- Benefits and credits fact sheet – Students

- Benefits and credits fact sheet – Persons with disabilities

- Benefits and credits fact sheet – Modest income individuals

- Benefits and credits fact sheet – Housing insecure individuals

- Benefits and credits fact sheet – Adults 65 and older

- Benefits and credits fact sheet – Women in shelters

- Benefits and credits fact sheet – Indigenous peoples

- Benefits and credits fact sheet – Newcomers

Canada Dental Benefit

One-time top-up to the Canada Housing Benefit

Get your taxes done for free at a tax clinic

Canada workers benefit

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

2021 Tax Resources - Canada Revenue Agency

Last-minute tax tips (Canada Revenue Agency) – April 13, 2021

New Canada Recovery Benefits – What to Expect

Answers to your questions on paying back the Canada Emergency Response Benefit (CERB)

Benefits and credits fact sheet – Indigenous people living in Canada

Benefits and credits fact sheet – Modest income

Benefits and credits fact sheet – Newcomers

Benefits and credits fact sheet – Newcomers in Quebec

Benefits, credits, and deductions for Seniors

COVID-19 Measures for Persons with Disabilities

Benefits and credits – Persons with Disabilities

Canada Workers Benefit – Infographic

Canada Workers Benefit – promotion card

Get your taxes done for free – promotion card

Income tax basics

Why file? The benefits of tax filing (Tax toolkit)

Getting government payments by direct deposit

Income tax 101: What are tax deductions, benefits, credits, exemptions, and brackets? (Tax toolkit)

Considerations for Indigenous people at tax time (Tax toolkit)

Resources about tax filing in Canada (Tax toolkit)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Community tax clinic guides

About volunteer tax clinics: Help your community members file their taxes (Tax toolkit)

Getting started as a community tax clinic (Tax toolkit)

Tax clinic staff and volunteer roles (Tax toolkit)

Tax clinic preparation: Recommended timeline (Tax toolkit)

Insights on planning free tax clinics in Indigenous communities: Infographic (Tax toolkit)

Encouraging tax filing at virtual clinics (sample “active choice” email) – The Behavioural Insights Team *NEW*

Tax clinic resources for practitioners

The tax clinic resources below are from our community partner organizations. These are examples that may be adapted to your own community tax clinic needs. Whenever possible, we have credited the original author of each document and included contact information if you would like to find out more about using and adapting the resource.

Resources to support tax clinic delivery and tax filing

Simplified Intake Form 2019 (ACSA, Scarborough, ON)

Tax Clinic Host Checklist (The Working Centre, Kitchener-Waterloo, ON)

Income tax checklist for participants (The Working Centre, Kitchener-Waterloo, ON)

Intake form for Couples (E4C, Edmonton, AB)

Tax Prep Quick Reference Guide (E4C, Edmonton, AB)

Other resources to support participants at tax time

Income tax summary (The Working Centre, Kitchener-Waterloo, ON)

Form for Missing Income Info for Revenue Canada (The Working Centre, Kitchener-Waterloo, ON)

Forms for rental information (The Working Centre, Kitchener-Waterloo, ON)

Referral to FEPS (The Working Centre, Kitchener-Waterloo, ON)

Envelope checklist (E4C, Edmonton, AB)

Seniors Info Sheet – Federal and provincial benefits (E4C, Edmonton, AB)

Resources for outreach and promotion

Tax clinic flyer (ACSA, Scarborough, ON)

2019 tax clinic flyer (Jane Finch Centre, Toronto, ON)

2019 tax clinic flyer (North York Community House, Toronto, ON)

Resources to support tracking and evaluation

Tax data entry sheet – Tax toolkit (Sunrise Community Centre, Calgary, AB)

Anonymous tax tracking sheet (Aspire collective, Calgary, AB)

Additional information and resources on tax filing

Benefits, credits and financial support: CRA and COVID-19 – Canada Revenue Agency (CRA)

Covid-19: Free virtual tax clinics – Canada Revenue Agency (CRA)

Get ready to do your taxes – Canada Revenue Agency (CRA)

Taking care of your tax and benefit affairs can pay off (tax filing info sheet) – Canada Revenue Agency (CRA) *NEW

Slam the scam – Protect yourself against fraud – Canada Revenue Agency (CRA)

Virtual Tax Filing: Piloting a new way to file taxes for homebound seniors – Prosper Canada

Webinar Series on Taxes (May 2020) – Momentum

SimpleFile by Phone automated phone service (formerly called File my Return) – Prosper Canada Learning Hub

Tax season prep – Plan Institute

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

What to do if your tax return is reviewed or audited – OSC

French

Ressources de déclaration de revenus 2024 - Agence du revenu du Canada

Ressources de déclaration de revenus 2023 - Agence du revenu du Canada

L’Agence du revenu du Canada lance la saison des impôts 2023

- Fiche descriptive: Étudiants

- Fiche descriptive: Les personnes handicapées

- Fiche descriptive: Les personnes à revenu modeste

- Fiche descriptive: Les personnes en situation de logement précaire

- Fiche descriptive: Les personnes âgées de 65 ans et plus

- Fiche descriptive: Les personnes autochtones

- Fiche descriptive : Déductions pour les habitants de régions éloignées

- Fiche descriptive : Personnes aux prises avec la violence fondée sur le sexe

- Fiche descriptive: Les nouveaux arrivants

Ressources

- Infographie – Prestations pour enfants

- Infographie – Prestations et crédits pour les nouveaux arrivants

- Feuille détachable : Inscrivez-vous à Mon dossier

- Feuille détachable : Produire votre déclaration de revenus

- Carte d’option de service

- Webinaire – Les personnes à revenu modeste

- Video: Persons with disabilities

- Webinaire – Les étudiants étrangers

- Webinaire – Avis aux étudiants : c’est payant de faire vos impôts!

Ressources de déclaration de revenus 2022 - Agence du revenu du Canada

Fiche descriptive : Étudiants

Fiche descriptive : Les personnes handicapées

Fiche descriptive : Les personnes à revenu modeste

Fiche descriptive : Les personnes en situation de logement précaire

Fiche descriptive : Les personnes âgées de 65 ans et plus

Fiche descriptive : Femmes dans les refuges

Fiche descriptive : Les personnes autochtones

Fiche descriptive : Les nouveaux arrivants

Prestation dentaire canadienne

Supplément unique à l’Allocation canadienne pour le logement

Faites faire vos impôts à un comptoir d’impôts gratuit

Allocation canadienne pour les travailleurs

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone, Inuit ou Métis

Ressources de déclaration de revenus 2021 - Agence du revenu du Canada

Nouvelles prestations canadiennes de la relance économique – À quoi s’attendre

Réponses à vos questions sur le remboursement de la Prestation canadienne d’urgence (PCU)

Recevez vos versements de prestations et de crédits! – Les les autochtones qui habitent au Canada

Prestations et crédits – Revenu modeste

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits!

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits! (Quebec)

Il y a des avantages à faire ses impôts! – Personnes agées

Mesures relatives à la COVID-19 à l’intention des personnes handicapées

Des prestations et des crédits pour vous! – Les personnes handicapées

Chaque dollar compte! – L’allocation canadienne pour les travailleurs (ACT)

Chaque dollar compte! Carte promotionnelle pour l’allocation canadienne pour les travailleurs (ACT)

Faites faire vos impôts gratuitement – Carte promotionnelle

Fondements de l’impôt sur le revenu

Pouruoi declarer? Les avantages de produire une declaration de revenus

Recevoir des paiements du gouvernement par dépôt direct

Que sont les déductions, les avantages fiscaux et les crédits d’impôt?

Considérations sur la période d’impôt pour lesautochtones qui habitent au Canada

Ressources pour en savoir plus

Comptoirs d’impôt bénévoles : Aidez les membres de votre communauté

Ressources

S’occuper de ses impôts et de ses prestations peut être payant – Agence du revenu du Canada

Service automatisé Déclarer simplement par téléphone (anciennement Produire ma déclaration)– Agence du revenu du Canada

Démystifier le crédit d’impôt pour personnes handicapées – Agence du revenu du Canada

Boosting the Earned Income Tax Credit for Singles

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income workers without dependent children. The program, which provides a bonus of up to $2,000 at tax time, is being evaluated using a randomized controlled trial in New York City and Atlanta. This report presents findings through three years from New York, where over 6,000 low-income single adults without dependent children enrolled in the study in late 2013. The findings are consistent with other research on the federal EITC, indicating that an effective work-based safety net program can increase incomes for vulnerable and low-income individuals and families while encouraging and rewarding work.

Breaking down barriers: A critical analysis of the Disability Tax Credit and the Registered Disability Savings Plan

The Disability Tax Credit helps Canadians by reducing the amount of income tax they are required to pay. The Registered Disability Savings Plan helps people with a disability or their caregiver save for the future by putting money into a fund that grows tax free until the beneficiary makes a withdrawal. This report, released by the Senate Committee on Social Affairs, Science and Technology, makes 16 recommendations aimed at improving both programs. They are divided into short-term objective to make the process for the two programs simpler and clearer, and a long-term philosophical shift in the way Canada deals with people who are in financial distress but cannot advocate for themselves. Recommendations include removing barriers that prevent people from taking advantage of the Disability Tax Credit and making enrolment in the Registered Disability Savings Plan automatic for eligible people under 60 years of age.

Policy Brief – Why is Uptake of the Disability Tax Credit Low in Canada?

Disability supports should be designed to provide benefit and not burdens to eligible recipients. Unfortunately, this is not a reality when it comes to one of the main benefits open to Canadians with disability: the federal Disability Tax Credit (DTC). Designed to recognize some of the higher costs faced by people with severe disabilities and their caregivers, the DTC appears to be more of a burden for many, with estimated utilisation unacceptably low at around 40 per cent of working-aged adults with qualifying disabilities. Low uptake is a concern not only because people are missing out on the credit itself but also because eligibility to the DTC – which is not automatic – is a gateway to other important and more valuable benefits such as the Child Disability Benefit and Registered Disability Savings Plans (RDSP).

What can we learn about low-income dynamics in Canada from the Longitudinal Administrative Databank?