Resources and Tools

Managing the cost of goods and paying bills

Budgeting resources

Five different budgeting methods – Prosper Canada

Cash flow budget template – PDF – Prosper Canada

Cash flow budget template – fillable PDF – Prosper Canada

Simple budget template – PDF – Prosper Canada

Simple budget template – fillable PDF – Prosper Canada

Ten ways to trim expenses – Prosper Canada

Ways to save at the grocery store – Prosper Canada

5 budgeting app ideas – Prosper Canada

Tracking spending/bills

Expenses tracking sheet – PDF – Prosper Canada

Expenses tracking sheet – fillable PDF – Prosper Canada

Tracking fluctuating expenses – Prosper Canada

Prioritizing Bills tool – Consumer Financial Protection Bureau (CFPB)

Spending tracker tool – CFPB

Cutting expenses tool – CFPB

Online budgeting tools

Budget Planner (free) – Financial Consumer Agency of Canada (FCAC)

Budget Calculator Spreadsheet (downloadable Excel sheet) – MyMoneyCoach.ca

Spending Habits Calculator – GetSmarterAboutMoney.ca

Personal Budgeting Course (no cost) – Momentum

Pro bono support

Financial planning – Financial Planning Association of Canada (FPAC)

Debt

Action planning

Steps to debt repayment – Prosper Canada

Determining debt payoff order – Prosper Canada

Dealing with debt– Prosper Canada

Making a plan to be debt free– Government of Canada

The 4 cornerstones of debt reduction strategies & budgeting– Credit Counselling Society

Getting out of debt– Credit Counselling Society

Information for consumers on the insolvency process– Office of the Superintendent of Bankruptcy (available in multiple languages)

More resources

Options you can trust to help with your debt – Office of the Superintendent of Bankruptcy

1:1 debt counselling – Credit Counselling Canada

Sample letters to creditors – Credit Counselling Society

Ways to build or rebuild credit and manage debt course (no cost) – Momentum

How to improve your credit score: proven steps to success – Credit Canada

Housing and homelessness

Listing of agencies across Canada that may be able to help – The Canadian Alliance to End Homelessness

211 – United Way Canada

Subsidized housing in ON – Ontario Non-profit Housing Association

Benefits for housing

Housing benefits – Government of Canada

Benefits wayfinder – Prosper Canada

Factsheet: Housing insecure individuals – Government of Canada

Resources for renters

Your rights when being evicted for renovations – Community Legal Education Ontario (CLEO)

Resources for renters facing eviction – Centre for Equality Rights in Accommodation

Moving checklist – Community Legal Education Ontario (CLEO)

Ontario Renters’ guide – Community Legal Education Ontario (CLEO)

How to negotiate a repayment plan with your landlord – Community Legal Education Ontario (CLEO)

Know your rights: eviction prevention – Canadian Centre for Housing Rights

Know your rights: rental housing basics – Canadian Centre for Housing Rights

Know your rights: record keeping for tenants – Canadian Centre for Housing Rights

Rent-Geared-to-Income Subsidy – City of Toronto

An infographic that explains when rent increases are legal – CLEO

A guide that explains when landlords can apply for an above guideline rent increase (AGI), how to prepare for a hearing to fight an AGI, and what happens after the hearing – CLEO

Human Rights and Rental Housing in Ontario: A Self-Advocacy Toolkit – Canadian Centre for Housing Rights

Resources for specific groups

Housing options for seniors – Government of Canada

Toolkit for medical professionals in ON writing disability accommodation letters – Canadian Centre for Housing Rights

Friendship Centres for Indigenous people – National Association of Friendship Centres

Support services for victims of abuse – New Brunswick Government

Housing for youth – 360º (York Region)

Support for young mothers– Albion Centre (Toronto)

Newcomer Information Centre Online– Achēv

Paying your mortgage when experiencing financial difficulties– FCAC

Shelters

Housing and shelters – Salvation Army (Canada)

Disaster relief help – Canadian Red Cross (Canada)

Emergency and short-term housing in Ontario – Ontario Council of Agencies Serving Immigrants (Ontario)

For women facing domestic abuse – Shelter Safe (Canada)

Survivors of domestic violence – CAMH (Toronto)

Shelters – CAMH (Toronto)

Shelters for youth – Rest Centres (Peel Region)

Food insecurity

Access to food

Find a food bank – Food Banks Canada

Regional food banks – Website Planet

Meals on wheels – Ontario Community Support Association

211 – United Way Canada

Drop-in meal resource list for Toronto – Toronto Drop-in Network

Food exchange – Quest Vancouver

Good food organizations – Community Food Centres Canada

Akwe:go – Wasa-Nabin Student Nutrition Program – Ontario Federation of Indigenous Friendship Centres

Friendship Centres for Indigenous people – Ontario Federation of Indigenous Friendship Centres

Understanding food insecurity

Tool for older adults: rate your eating habits! – Older Adult Nutrition Screening

Poverty Screening (Food Insecurity) – Canadian Nutrition Society

Ressources et outils

Gérer le coût des biens et les dépenses

Ressources pour établir un budget

5 façons différentes de faire un budget – Prospérité Canada

Budget de caisse – Prospérité Canada

Modèle de budget simple – Prospérité Canada

10 façons de réduire ses dépenses – Prospérité Canada

Moyens pour économiser à l’épicerie – Prospérité Canada

Suivre les dépenses/le paiement des factures

Fichier de suivi des dépenses – Prospérité Canada

Suivi des dépenses variables – Prospérité Canada

Outils d’établissement de budget en ligne

Planificateur budgétaire – Agence de la consommation en matière financière du Canada (ACFC)

Budget mensuel – Commission des valeurs mobilières de l’Ontario

Calculateur des Habitudes de Consommation – GerezMieuxVotreArgent.ca

Vidéos d’apprentissage en ligne — Notions de base sur les finances – Agence de la consommation en matière financière du Canada (ACFC)

Consultation budgétaire – Espace Finances

Dette

Planification des mesures

Les étapes pour rembourser des dettes– Prospérité Canada

Une dette envers qui? – Prospérité Canada

Gestion de la dette : Livret complet– Prospérité Canada

Faire un plan pour gérer vos dettes– Gouvernement du Canada

Croulez-vous sous les dettes? Information sur la procédure d’insolvabilité à l’intention des consommateurs– Bureau du surintendant des faillites

Autres ressources

Des options fiables pour vous aider avec vos dettes – Bureau du surintendant des faillites

Conseil en crédit – Conseil en crédit du Canada

Exemples de lettres aux créanciers – Conseil en crédit du Canada (disponible seulement en anglais)

Emprunter de l’argent- cours (gratuit) – Plateforme de compétences ABC

Qu’est-ce qu’un pointage de crédit?– TransUnion

Associations de consommateurs de Québec – toutbiencalcule.ca

Logement et itinérance

Recherche d’aide – Alliance canadienne pour mettre fin à l’itinérance

211 – Centreaide United Way

Logement subventionné en Ontario – Association du logement sans but lucratif de l’Ontario (disponible seulement en anglais)

Prestations pour le logement

Prestations relatives au logement – Gouvernement du Canada

Orienteur en mesures d’aide – Prospérité Canada

Personnes en situation de logement précaire – Gouvernement du Canada

Accès au logement – Centre Francophone du Grand Toronto

Répertoire des ressources en hébergement communcautaire et en logement social avec soutien communautaire, Réseau d’aide aux personnes seules et itinérantes de Montréal

Ressources pour les locataires

Être expulsé de son logement en raison de rénovations – Éducation juridique communautaire Ontario

Comment s’opposer à une expulsion – Éducation juridique communautaire Ontario

Louer un logement – Éducation juridique communautaire Ontario

Comment négocier un plan de remboursement avec votre locateur – Centre ontarien de défense des droits des locataires

Votre propriétaire veut-il que vous déménagiez? – Éducation juridique communautaire Ontario

Droit du logement (vidéos) – Éducation juridique communautaire Ontario

Entretien et réparations – Éducation juridique communautaire Ontario

Déménager : Donner un préavis – Éducation juridique communautaire Ontario

Logements à loyer indexés sur le revenu – Ville de Toronto

Les comités logement et associations de locataires du Québec – Regroupement des comités logement et associations de locataires du Québec (RCLALQ) Comités logement – Le Front d’action populaire en réaménagement urbain (FRAPRU)

Ressources pour des groupes particuliers

Coût des résidences pour les aînés – Gouvernement du Canada

Trousse d’outils pour les professionnels de la santé sur la rédaction de lettres concernant des mesures d’adaptation pour une personne en situation de handicap – Centre canadien pour le droit au logement (disponible seulement en anglais)

Association nationale des centres d’amitié – L’Association nationale des centres d’amitié

Services de soutien pour les victimes de violence – Gouvernement du Nouveau-Brunswick

Logement pour les jeunes – 360º (Région de York)

Soutien aux jeunes mères– Centre Albion (Toronto)

Maison d’amitié– Maison d’amitié (Ottawa)

Payer votre hypothèque lorsque vous éprouvez des difficultés financières– ACFC

Refuges

Services d’hébergement – l’Armée du Salut (Canada)

Aide aux personnes sinistrées – La Croix-Rouge canadienne (Canada)

Logement d’urgence et à court terme en Ontario – Ontario Council of Agencies Serving Immigrants (disponible seulement en anglais)

Pour les femmes victimes de violence – Hebergementfemmes.ca (Canada)

Survivants de violence familiale – Centre de toxicomanie et de santé mentale, Toronto (disponible seulement en anglais)

Insécurité alimentaire

Accès à la nourriture

Trouver une banque alimentaire – Banques alimentaires de Canada

La Popote roulante – Croix-Rouge canadienne

211 – Centraide United Way

Organisations pour la bonne nourriture – Centres communautaires d’alimentation du Canada

Banques alimentaires – Banques alimentaires de Québec

Dépannage alimentaire – Macommunaute.ca

Comprendre l’insécurité alimentaire

Évaluez vos habitudes alimentaires ! – Vérification de l’alimentation des adultes plus âgés

Dépistage de la pauvreté (insécurité alimentaire) – Société canadienne de nutrition

Financial literacy courses for Canadian students

Teachers may incorporate two gamified financial literacy courses that are currently freely available into their lessons. Students can now access two age-appropriate courses designed to help boost students' financial knowledge and confidence at any stage of their financial journey. Course titles: Students will explore resources and tools on the FCAC website that they will be able to use well beyond high school. *Students can earn a completion certificate issued by the FCAC and ChatterHigh!

Empower U Evaluation Report

For a family living in poverty, every day is about making tough choices – to pay rent or buy groceries? Having the means to attain the basic necessities, is one thing. Having the skills, confidence and access to resources to manage finances in ways that build pathways out of poverty is something far different. Thanks to the generosity of partners, supporters and donors of Empower U, families can move beyond just managing the day-to-day challenges of poverty. Participants in the program learn valuable money management skills and are given the means to build savings and assets to create financial stability. A future where they and their families can thrive.

8 ways to prepare financially for retirement

This article from OSC provides 8 tips to help you plan for retirement. Transitioning from working life to retirement takes careful financial planning and decision-making – give yourself plenty of time to prepare. Here are some things you can do ahead of time.

How women can save more money

This webinar hosted by FCAC (originally broadcast on November 17, 2021) targets women who want to learn more about managing money and building saving habits. Guest speaker, personal financial expert, Rubina Ahmed-Haq has also contributed to Canada's financial literacy blog on "Women face unique money challenges". Helpful links related to the content matter in this video: Getting help from a credit counsellor

Financial Coaching Initiative: Results and Lessons Learned

In 2015, the Consumer Financial Protection Bureau launched the Financial Coaching Initiative, a pilot program that provided financial coaching services to veterans and economically vulnerable consumers. Professional coaches were embedded into 60 host sites across the country, where they provided free, one-on-one help to consumers to address their personal financial goals. A range of organizations served as host sites, such as one-stop career centers, social services organizations, and legal aid groups. Over four years, the Financial Coaching Initiative served over 23,000 consumers, demonstrating that financial coaching can be successfully implemented at scale in many different settings for a wide range of consumers. This report and summary brief describe the basic structure of the Initiative, present data about the program’s results, and summarize key lessons learned for practitioners and organizations interested in coaching.

The Comeback Generation: Pandemic is inspiring Gen Z to build financial resilience

The coronavirus pandemic has tested the limits of Canadians over the past 20 months. What began as a health crisis quickly morphed into an economic crisis, with the spread of COVID‑19 shocking large segments of the economy and leaving many without paycheques. While no generation has been unaffected by the pandemic, the economic impact was distributed unevenly. Many younger Canadians in Generation Z, or Gen Z, have had their education disrupted, career plans changed, and financial prospects diminished largely because they are overrepresented in the highly affected service sector, according to a new survey by the Canadian Bankers Association (CBA). The survey was published to mark Financial Literacy Month, which takes place each November, and found that more than half (53 per cent) of Gen Z respondents (aged 18‑25) felt the pandemic upended their financial security, with that number rising to 73 per cent for those in less stable financial situations. At the same time, nine‑in‑ten (88 per cent) Gen Zers are feeling optimistic about their financial futures, and nearly all of them (98 per cent) are actively making plans to strengthen their financial resilience. "Gen Z was dealt a disproportionately tough hand during the pandemic, but it has also shown incredible resilience in channeling its natural gifts for perseverance, adaptability and motivation," says Neil Parmenter, President and CEO, Canadian Bankers Association. "Despite the setbacks, younger Canadians are eager to forge ahead, be prepared for the unexpected and build bright futures as our economy recovers."

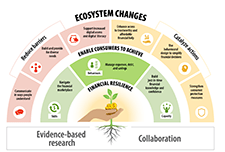

Make Change that Counts: National Financial Literacy Strategy 2021-2026

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in meaningful ways. The National Strategy is focused on how financial literacy stakeholders can reduce barriers, catalyze action, and work together, to collectively help Canadians build financial resilience.

Barriers to Digital Equality in Canada

Internet is an essential service. As technology increasingly shapes our world, it is important that Canadians can keep up with the rapid changes, latest skills and emerging industries. Unfortunately, not every resident of Canada is able to access these opportunities to unlock a potentially brighter future. AIC and ACORN partnered to undertake research with low and moderate income Canadians, in order to uncover the barriers to digital equity that exist in Canada today and shine a light on the urgent need to tackle these barriers to ensure equal access to digital opportunities.

Proposals for a Northern Market Basket Measure and its disposable income

As stated in the Poverty Reduction Act, the Market Basket Measure (MBM) is now Canada’s Official Poverty Line. The Northern Market Basket Measure (MBM-N) is an adaptation of the MBM that reflects life and conditions in two of the territories – Yukon and Northwest TerritoriesNote. As with the MBM, the MBM-N is comprised of five major components: food, clothing, transportation, shelter and other necessities. The MBM-N is intended to capture the spirit of the existing MBM (i.e., represent a modest, basic standard of living) while accounting for adjustments to the contents of the MBM to reflect life in the North. This discussion paper describes a proposed methodology for the five components found in the MBM-N, as well as its disposable income. This discussion paper also provides an opportunity for feedback and comments on the proposed methodology of the MBM-N.

Momentum’s Money Management Courses

The money management courses are offered online, on demand, for free. Learn at your own pace and on your own schedule on a variety of topics, including:

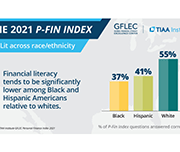

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index)

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) measures knowledge and understanding that enable sound financial decision making and effective management of personal finances among U.S. adults. The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with Greenwald & Associates. It is unique in its breadth of questions and its coverage of the topics that measure financial literacy. The index is based on responses to 28 questions across eight functional areas: earning, consuming, saving, investing, borrowing/managing debt, insuring, comprehending risk, and go-to information sources.

The COVID-19 pandemic and Indigenous people with a disability or long-term condition

This paper uses crowdsourced data to provide an overview of the impacts of the COVID-19 pandemic on the health, service access, and ability to meet basic needs of Indigenous participants with disabilities or long-term conditions. Changes in overall health and mental health are examined by disability type, age group and sex. The most commonly reported service disruptions since the start of the pandemic are also presented. The crowdsourcing data reflected health and other disparities between Indigenous and non-Indigenous participants with a disability or long-term condition. Indigenous participants were more likely to report worsened overall health and mental health, service disruption, and a greater impact on their ability to meet essential needs.

State of Fair Banking in Canada 2020: Borrower and Lender Perspectives

The DUCA Impact Lab defines fair banking as any financial product or service that lives up to the following set of principles: Their Fair Banking 2020 report presents data on the following areas:

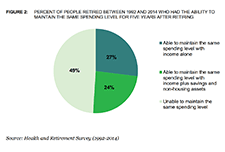

Retirement Security and Financial Decision-making: Research Brief

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level of spending for at least five consecutive years after retiring. The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring. In addition, the Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years. The study helps identify ways to protect retirees from overspending their savings in early retirement.

CPA Canada 2020 Canadian Finance Study

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these unprecedented times. Nielsen conducted the CPA Canada 2020 Canadian Finance Study via an online questionnaire, from September 4 to 16, 2020 with 2,008 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. Among the key pandemic-related findings:

Inter-generational comparisons of household economic well-being, 1999 to 2019

This study of data from the Distributions of Household Economic Accounts compares households' economic well-being from a macro-economic accounts perspective, as measured by net saving and net worth for each generation when the major income earner for a household in one generation reached the same point in the life cycle as the major income earner for a household in another generation. The study finds that while younger generations have higher disposable income and higher consumption expenditure than older generations when they reached the same age, their net saving is relatively similar. As well, younger generations' economic well-being may be more at risk due to the COVID-19 pandemic since they depend more on employment as a primary source of income, they have higher debt relative to income, and they have less equity in financial and real estate assets from which to draw upon when needed.

Financial Literacy Month – 10th anniversary Resources

For the 10th anniversary of Financial Literacy Month in Canada, Financial Consumer Agency of Canada (FCAC) has released resources to help Canadians learn how to manage their finances in challenging times. Resources include the following topics:

Millennials and money: Financial preparedness and money management practices before COVID-19

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed over the ten years following the Great Recession of 2008 and the situation they were in on the cusp of the current economic crisis (in 2018) due to the COVID-19 pandemic. Findings from the National Financial Capability Study (NFCS) show that millennials tend to rely heavily on debt, engage frequently in expensive short- and long-term money management, and display shockingly low levels of financial literacy. Moreover, student loan burden and expensive financial decision making increased significantly from 2009 to 2018 among young adults.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

G20/OECD INFE Core Competencies Framework on financial literacy for Adults (aged 18+)

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to inform the development of a national strategy on financial education, improve programme design, identify gaps in provision, and create assessment, measurement and evaluation tools.

COVID-19 financial literacy resources

CPA Canada has put together resources to help manage your finances and provide you with the tools you need during this crisis – and beyond.

COVID-19 Financial Resource Centre

Credit Canada has pulled together financial information from trusted sources and released original content to help Canadians manage their finances during COVID-19.

Beyond Hunger: the hidden impacts of food insecurity

This report illustrates the hidden impacts of food insecurity in people’s lives through a survey of 561 people in 22 communities across Canada. The people interviewed shared that food insecurity makes them ill, breaks down relationships, makes it harder to get stable work, and fully participate in society.