Make it Count

Make it Count is a parent's resource for youth money management provided by the Manitoba Securities Commission that provides activities and tips to help you incorporate youth money management lessons into your daily routine. You can easily turn errands into education.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

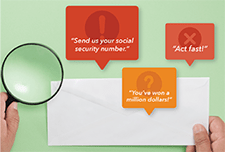

Threats and intimidation to pay your tax bill? How to spot tax season scams

During the income tax filing season, scammers pose as representatives of the Canada Revenue Agency (CRA) in an attempt to trick you into sending payment for fictitious "debts" or into providing sensitive personal information that they can use to commit fraud. Learn more on how to spot tax season scams and what to do if you are the victim of fraud.

Cyber security awareness quizzes

Discover a new quiz site to help Canadians and Canadian small businesses protect against phishing scams. The Canadian Bankers Association has created four quizzes for Canadians to learn more about cyber fraud and how to prevent becoming a victim. Quiz #2: Social engineering: a peek behind the curtain Quiz # 3: Protecting your small business from phishing attacks Quiz #4: How to protect yourself and others

Tips to keep your credit card safe

Your credit card can help you make purchases quickly without needing to have cash on hand. Follow these tips by the Ontario Securities Commission to use your credit card safely.

Fraud alert videos

Learn more about fraud in this latest set of videos by the Ontario Securities Commission.

Resources

Presentation slides, handouts, and video time stamps

Read the presentation slides for this webinar.

Download resources provided by webinar speakers:

Time-stamps for the video recording:

3:24 – Agenda and Introductions

6:36 – Audience poll questions

9:33 – FAIR Canada presentation (speaker: Tasmin Waley)

24:07 – Ontario Securities Commission presentation (speaker: Christine Allum)

39:10 – Investor Protection Clinic at Osgoode Hall Law School (speaker: Brigitte Catellier)

51:34 – Q&A

Beware: Crypto scams on the rise

Fraudsters often use emotions to lure people in, making a person feel afraid of missing out on an opportunity that others are profiting from. With all the cryptocurrency hype in the media and online, it’s no surprise that scammers are taking note and trying to cash in on investors’ interest in digital currencies. Read this article for more information on the top crypto-related scams you should know.

National financial literacy strategy video gallery

View the 8 videos created by the Financial Consumer Association of Canada (FCAC) as part of the National Financial Literacy Strategy 2021-2026. Videos include:

Beware of One Time Passcode scams with these tips

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts securely.

Cyber security toolkit

There are also simple steps you can take to recognize cyber threats and protect yourself. With a cyber hygiene checklist and tips on how to spot common scams, the CBA’s Cyber Security Toolkit can help you protect against online financial fraud.

Cyber security checklist

Getting cyber safe doesn't have to be complicated. With the right resources and tools, you can stay safe and secure online. Here's a handy checklist for protecting your data online.

Financial consumer protection framework

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional promotional toolkits can be found on the FCAC website.

Turning aces into assets

Ontario has just become the first province to open its legal gambling market to private internet gaming providers. As of April 4, 2022, Ontarians can play casino-style games online and place bets on sports, including single games, through sites regulated by iGaming Ontario. According to the provincial regulator, the launch of iGaming marks the triumph “of a legal internet gaming market” over “its previous grey market standing.” But as with all forms of gambling, this development has a dark side. It was only a matter of time before Ontario expanded its gambling market—not because of popular demand, but because the provincial government is addicted to gambling money and is eager to seize any opportunity to get more of it, regardless of the costs to the people it is supposed to protect. This report provides the background of gambling in Ontario, outlines the new risks with iGaming and offers four policy options.

Grandparent scams and how to avoid them

Imagine a loved one is in trouble or hurt. You get a call asking for urgent help. You’d likely want to act right away because you care about them. Exploiting family ties is the driving force behind grandparent scams — or emergency scams. This article from the OSC can help you to protect yourself from becoming a victim of an emergency scam. Watch this new video to learn more about grandparent scams.

Recognizing and responding to economic abuse

With speakers from CCFWE, Johannah Brockie - Program Manager for Advocacy and System Change and Jessica Tran - Program Manager for Education and Awareness, this webinar will guide you through the definition of economic abuse, how to identify an economic abuser, impacts of economic abuse, Covid-19 impacts, tactics, what you should do if you are a victim of economic abuse, and key safety tips. Economic Abuse occurs when a domestic partner interferes with a partner’s access to finances, employment or social benefits, such as fraudulently racking up credit card debt in their partner’s name or preventing their partner from going to work has a devastating effect on victims and survivors of domestic partner violence, yet it’s rarely talked about in Canada. It’s experienced by women from all backgrounds, regions and income levels but women from marginalized groups, including newcomers, refugees, racialized and Indigenous women, are at a higher risk of economic abuse due to other systemic factors.

Investing basics

Whether you’re a first-time investor, thinking of saving for your education, or planning for your retirement, FAIR Canada's investing basics may help you on your investing journey.

Your trusted contact person and why they matter

The Trusted Contact Person initiative has been adopted across Canada. It is part of new regulatory measures to support advisors in their efforts to help investors, particularly older investors and vulnerable, protect themselves and their financial interests. Canadian seniors are increasingly called upon to make complex financial decisions, with higher stakes, later in life than ever before. For many, health, mobility, or cognitive changes that can occur with age, may affect their ability to make these decisions. This can make seniors more susceptible to financial exploitation and fraud. In fact, about half of the victims of investment fraud are over age 55. Watch this new video on understanding the importance of appointing a trusted contact person.

Scam spotter tool

FCAC new consumer information – electronic alerts

Le français suit l’anglais. As of June 30, 2022, banks will be required to send electronic alerts to their customers to help them manage their finances and avoid unnecessary fees. Some banks have already started sending these alerts to their customers. The electronic alerts are part of the new and enhanced protections in Canada’s Financial Consumer Protection Framework (the Framework) that comes into effect on June 30, 2022. To inform Canadians about electronic alerts and their benefits, the Financial Consumer Agency of Canada (FCAC) published new consumer information on electronic alerts, developed an infographic, and prepared social media content that you can use on your own social media channels. Under the Framework, banks will be required to: À compter du 30 juin 2022, les banques seront tenues d’envoyer des alertes électroniques à leurs clients afin de les aider à gérer leurs finances et à éviter de payer inutilement des frais, ce que certaines ont déjà commencé à faire. Ces alertes font partie des mesures de protection nouvelles ou améliorées prévues dans le Cadre de protection des consommateurs de produits et services financiers du Canada (le Cadre) qui entre en vigueur le 30 juin 2022. Pour informer les Canadiens et les Canadiennes à propos des alertes électroniques et de leurs avantages, l’Agence de la consommation en matière financière du Canada (ACFC) a publié de nouveaux renseignements à ce sujet pour les consommateurs. Elle a également créé une infographie et préparé du contenu pour les réseaux sociaux que vous pouvez utiliser dans vos propres comptes de médias sociaux. En vertu des dispositions du Cadre, les banques seront tenues :

Annual report of credit and consumer reporting complaints: an analysis of complaint responses by Equifax, Experian and TransUnion

This report summarizes the information gathered by the Consumer Financial Protection Bureau (CFPB) regarding certain consumer complaints transmitted by the CFPB to the three largest nationwide consumer reporting agencies - Equifax, Experian and TransUnion.

Fraud Prevention Toolkits

In 2021, losses reported to the Canadian Anti-Fraud Centre reached an all time high of 379 million with Canadian losses accounting for 275 million of this. Fraud Prevention Month is a campaign held each March to inform and educate the public on protecting yourself from being a victim of fraud. This year's theme is impersonation, and focuses on scams where fraudsters will claim to be government official, critical infrastructure companies, and even law enforcement officials. This collection of fraud prevention toolkits is available in English and French. In English: En Français:

Making more purchases online? Beware of fake websites and phony retailer apps

Many of us have shifted some of our shopping online during the pandemic – it’s easy and very often you can have items delivered right to your door. Criminals are taking advantage of the increased popularity of online shopping by creating fake websites and apps that look authentic but are just a ploy to steal your personal information. The Canadian Banker's Association helps you identify fake websites and apps and shares tips on how to protect yourself while shopping online and what to do if you are a victim of an online shopping scam.

Strengthening Canada’s External Complaint Handling System

Canada’s external complaint handing structures and processes play a critical role in levelling the playing field for consumers and financial service providers, helping to offset the inevitable imbalance of power between large financial institutions and individual consumers. Prosper Canada welcomes the opportunity to provide recommendations for strengthening what is currently a weak and inadequate alternative dispute resolution system.

Make Change that Counts: National Financial Literacy Strategy 2021-2026

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in meaningful ways. The National Strategy is focused on how financial literacy stakeholders can reduce barriers, catalyze action, and work together, to collectively help Canadians build financial resilience.

CFPB Consumer Education Resources

Resources to provide consumers up-to-date information to protect and manage their finances during the coronavirus pandemic. Resources include: And resources for specific audiences, including:

Investing and The COVID-19 Pandemic: Survey of Canadian Investors

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and trading activity of retail investors. Key findings include that 32 per cent of investors have experienced a decline in their financial situation during the pandemic while 16 per cent have experienced an improvement. Half of investors have not done any trading during the pandemic, but of those who have been trading, 63 per cent have increased their holdings.

COVID-19 Fraud Alerts

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos increases awareness of fraudulent activity during COVID-19. Topic include:

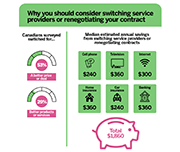

Stop Overpaying, Start Switching

In the past year, 1 in 4 Canadians surveyed renegotiated their contracts or switched providers to take advantage of better deals and services. This webpage provides information on switching or renegotiating your contract to reduce your monthly bills and get better products and services.

Consumer Price Index Personal Inflation Calculator

This interactive tool created by Statistics Canada allows you to explore your personal rate of inflation, based on the goods and services you consume. The Consumer Price Index (CPI) is the official measure of inflation in Canada. It is representative of the change in prices experienced by the average Canadian household. However, your personal experience of inflation may not perfectly match the Canadian average due to differences in your spending habits. The Personal Inflation Calculator accounts for those differences and provides a measure of inflation unique to you.

2019 Financial Literacy Annual Report

The 2019 Financial Literacy Annual Report of the Consumer Financial Protection Bureau highlights the Bureau’s Start Small, Save Up campaign, the Office of Financial Education’s foundational research, in conjunction with the Office of Older Americans, to understand the pathways to financial well-being, the Office of Servicemembers Affairs’ Misadventures in Money Management online training program, the Office of Older Americans’ Managing Someone Else’s Money guides, and the Office of Community Affairs’ Your Money, Your Goals toolkit, along with other direct to consumer tools, community outreach channels, and areas of research.

2020 Financial Literacy Annual Report

The 2020 Financial Literacy Annual Report details the United States' Bureau of Consumer Financial Protection's financial literacy strategy and activities to improve the financial literacy of consumers. Congress specifically charged the Bureau with conducting financial education programs and ensuring consumers receive timely and understandable information to make responsible decisions about financial transactions. Empowering consumers to help themselves, protect their own interests, and choose the financial products and services that best fit their needs is vital to preventing consumer harm and building financial well-being. Overall, this report describes the Bureau’s efforts in a broad range of financial literacy areas relevant to consumers’ financial lives. It highlights our work, including the Bureau's:

Guide de recours : Lors d’un conflit avec un fournisseur de communication

A guide for consumers to help with problems related to communications services. Information is provided to allow consumers to better assert their rights and facilitate the resolution of a dispute with communication service providers. (Please note this is a French-language resource.)

Bien choisir son crédit : un guide pratique [A Practical Guide to Making Smart Credit Choices]

A guide comprised of 12 fact sheets for consumers to learn more about credit, grouped into the following topics: general information, warnings, credit products, and comparison tables. (Please note this is a French-language resource.)

Financial Consumer Protection responses to COVID-19

This policy brief provides recommendations that can assist policy makers in their consideration of appropriate measures to help financial consumers, depending on the contexts and circumstances of individual jurisdictions, during the COVID-19 crisis. These options are consistent with the G20/OECD High Level Principles on Financial Consumer Protection that set out the foundations for a comprehensive financial consumer protection framework.

Quarterly Consumer Credit Trends: Recent trends in debt settlement and credit counseling

This report used a longitudinal, nationally-representative sample of approximately five million de-identified credit records maintained by one of the three nationwide consumer reporting agencies. Trends in debt settlement and credit counseling during the Great Recession and in recent years are presented. This report shows that nearly one in thirteen consumers with a credit record had at least one account settled through a creditor or had account payments managed by a credit counseling agency from 2007 through 2019. Since 2016, the number of debt settlements has increased steadily, while credit counseling numbers are relatively unchanged.

Targeting credit builder loans: Insights from a credit builder loan evaluation

This report presents the results of a Consumer Financial Protection Bureau (CFPB) funded evaluation of a Credit Builder Loan (CBL) product. CBLs are designed for consumers looking to establish a credit score or improve an existing one, while at the same time giving them a chance to build their savings. The study used random assignment to explore four research questions:

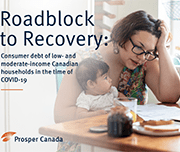

Roadblock to Recovery: Consumer debt of low- and moderate-income Canadians in the time of COVID-19

Almost half of low-income households and 62 per cent of moderate-income households carry debt, with households on low incomes spending 31 per cent of their income on debt repayments, according to a new report published by national charity, Prosper Canada.

This report analyzes the distribution, amount and composition of non-mortgage debt held by low- and moderate-income Canadian households and explores implications for federal and provincial/territorial policy makers as they develop and implement COVID-19 economic recovery plans and fulfill their respective regulatory roles.

Disability Alliance BC

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered Disability Savings Plans (RDSP) and more.

Plan Institute Learning Centre

The Plan Institute Learning Centre presents workshops, webinars, publications and other resources for individuals and/or families of a person with a disability, support-care workers, and organizations.

Lifting the Weight: Consumer Debt Solutions Framework

Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified seven specific consumer debt problems that result in decreased financial insecurity and well-being. Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees. This report presents a solutions framework to address all seven of these problems. The framework includes setting one or more tangible goals to achieve for each problem, and, for each goal, the solutions different sectors (financial services providers, governments, non-profits, employers, educational or medical institutions) can pursue.

Questions and answers to legal topics in Ontario

The Community of Legal Education Ontario (CLEO) website contains answers to common questions pertaining to a number of legal topics, including: COVID-19, debt and consumer rights, and employment and work.

Debt settlement and financial recovery companies: too risky an option?

This report presents a study of the debt settlement and financial recovery industry and examines Canadian consumer issues from these services. Data is gathered from company websites and contracts as well as customer surveys and questionnaires completed by governmental and non-governmental organizations. A comparative study of legislation applicable to the industry is also conducted.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling. This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

Credit Characteristics, Credit Engagement Tools, and Financial Well-Being

This report presents results from a joint research study between the Consumer Financial Protection Bureau (CFPB) and Credit Karma. The purpose of the study is to examine how consumers’ subjective financial well-being relates to objective measures of consumers’ financial health, specifically, consumers’ credit report characteristics. The study also seeks to relate consumers’ subjective financial well-being to consumers’ engagement with financial information through educational tools.

Identity theft

Identity thieves try to use your personal information to take money from your bank account, shop with your credit card, or even commit crimes in your name. This publication explains how to spot the warning signs of identity theft, how to protect yourself, and what you can do if it happens to you.

Beware of scams related to the coronavirus

Scammers are taking advantage of the coronavirus (COVID-19) pandemic to con people into giving up their money. Though the reason behind their fraud is new, their tactics are familiar. It can be even harder to prevent scams right now because people 62 and older aren’t interacting with as many friends, neighbors, and senior service providers due to efforts to slow the spread of disease. This blog post presents consumer protection toolkit resources produced by Consumer Financial Protection Bureau in addition to tips for consumers regarding COVID-19 related scams.

New Risks and Emerging Technologies: 2019 BBB Scam Tracker Risk Report

The Better Business Bureau Institute for Marketplace Trust (BBB Institute) is the 501(c)(3) educational foundation of the Better Business Bureau (BBB). BBB Institute works with local BBBs across North America. This report uses data submitted by consumers to BBB Scam Tracker to shed light on how scams are being perpetrated, who is being targeted, which scams have the greatest impact, and much more. The BBB Risk Index helps consumers better understand which scams pose the highest risk by looking at three factors—exposure, susceptibility, and monetary loss. The 2019 BBB Scam Tracker Risk Report is a critical part of BBB’s ongoing work to contribute new, useful data and analysis to further the efforts of all who are engaged in combating marketplace fraud. Update February 24, 2022: BBB Scam Tracker- Risk Report 2020

COVID-19: Managing financial health in challenging times

This guide from the Financial Consumer Agency of Canada shares guidelines and financial tips to help Canadians during COVID-19. The topics include: getting through a financial emergency, where to ask questions or voice concerns, what to do if your branch closes, and more.

State of Fair Banking in Canada

Everyone needs to bank and nearly everyone has a relationship with at least one financial institution. Financial Institutions need relationships with consumers too, in order to thrive as businesses. The role these relationships play in financial decision making for Canadians is an important consideration for anyone seeking to understand the financial health of Canadians and the impact of the banking sector in Canada. This report discusses the findings from a national sample of both banking consumers and lenders who were asked about their perspectives on fairness, access, credibility and transparency.

OECD/INFE Report on Financial Education in APEC Economies: Policy and practice in a digital world

This report responds to a call made by APEC Finance Ministers at their 23rd Ministerial Meeting in Lima in 2016 to advance “the design and implementation of financial literacy policies building on the expertise and standards developed by the OECD International Network on Financial Education”. The findings illustrate that the majority of APEC economies are well-advanced in their efforts to collect relevant data, implement appropriate financial education policies, and address the remaining issues related to financial literacy, inclusion and consumer

protection. They are applying international best practices and making good use of available tools and resources to develop and refine strategic approaches and specific initiatives. However, there is still some way to go in ensuring that everyone living in an APEC

economy has the financial literacy that they need and concerns about financial fraud or abuse, the high complexity of financial services and the low financial literacy of specific population groups are driving policy interest in improving financial education.

Investor Protection Clinic and Living Lab: 2019 Annual Report

The Investor Protection Clinic, the first clinic of its kind in Canada, provides free legal advice to people who believe their investments were mishandled and who cannot afford a lawyer. The Clinic was founded together with the Canadian Foundation for Advancement of Investor Rights (FAIR Canada), an organization that aims to enhance the rights of Canadian shareholders and individual investors. The 2019 Annual Report summarizes the work of The Clinic, including description of the work and types of cases, example case scenarios of the clients who benefited from The Clinic's services, client data and demographics, and recommendations.

Video: Debt collection scams

Dealing with debt collection issues can be challenging—especially when you’re not sure if the person you’re being contacted by is a legitimate debt collector or someone trying to scam you. This video from the Consumer Financial Protection Bureau in the United States shares useful tips on spotting debt collection scams and protecting yourself from scammers.

Consumer Perspectives on Fintech

This brief raises consumer perspectives on financial technology (fintech), and offers guidance for fintech developers on how to best serve low- to moderate-income clients.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

Tout Bien Calcule

Pour souligner leurs 50 ans d’histoire, les Associations de consommateurs du Québec s’unissent pour offrir à la population québécoise un portail qui rassemble toute une gamme d’informations et d’outils développés au fil des années grâce à leur expertise en finances personnelles. Cette porte d’entrée donne accès à des services spécialisés en finances personnelles offerts par les associations, propose des outils adaptés, et à travers les différentes sections, offre une information claire, objective et critique afin de vous guider vers de meilleurs choix de consommation et une meilleure santé financière.

The Little Black Book of Scams (2nd edition)

Scammers are sneaky and sly. They can target anyone, from youngsters to retirees. They can also target businesses. No one is immune to fraud. Read this booklet to find out how you can also become a fraud-fighting superhero. Share this booklet with family and friends and start powering up!

Our group of superheroes has found a way to see through the scams. Their secret is simple: knowledge is power!

Your Money, Your Goals: Focus on People with Disabilities

This is a companion guide to the 'Your Money, Your Goals' curriculum by the Consumer Financial Protection Bureau (CFPB) in the United States. This guide- Your Money, Your Goals: Focus on People with Disabilities—contains information, tips, and tools based on the insights from people with disabilities and from organizations that serve the disability community. It is based on the core philosophy that everyone has the right to control their money and make their own financial decisions. Its specialized information and tools equip staff and volunteers to adapt training on and use of the toolkit and other resources to meet the needs of people with disabilities. It also includes information and tools to enable staff and volunteers to choose accessible locations, develop appropriate and considerate training activities, and plan to provide accommodations for diverse learning styles and other needs.

Core competencies frameworks on financial literacy

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These documents describe the types of knowledge that youth aged 15 to 18, and adults aged 18 and up, could benefit from.

Debt and High Interest Resource Portal

This is ACORN Canada's debt and high-interest lending resource portal. It contains links and resources on debt, credit, banking, and other topics.

The Complaints Process for Retail Investments in Canada: A Handbook for Investors

Canadian investors need more and better information to protect themselves both when they act on their own and when they retain lawyers. This handbook is intended to help Canadian investors better understand the choices they face when making a complaint and the impact of those choices. It can also serve as a guide to assist them when they work with lawyers, particularly those whose law practice does not focus on assisting Canadian investors in obtaining financial compensation.

Handout 9-8: Dealing with consumer problems

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Examples of how to deal with consumer problems. To view full Financial Literacy Facilitator Resources, click here.

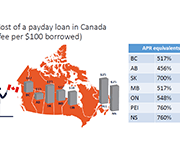

The Real Cost of Payday Lending

Since the early 1990s payday lending businesses have become increasingly prolific in most parts of Canada, including Calgary. Social agencies and advocates working to reduce poverty view payday lenders and other fringe financial businesses as problematic for those looking to exit the cycle of poverty. Payday lenders charge interest rates that, when annualized, top 400%. The industry justifies this by stating that comparisons to an annual rate are unfair as loans are not meant to or allowed to last longer than two months. However, the fact remains that these businesses charge far more for credit than mainstream financial institutions and are more prevalent in lower income neighbourhoods.