Housing insecurity

Read more about homelessness, affordability, at risk-populations and human rights on the Government of Canada's website. Learn about: Housing and human rights: the Federal Housing Advocate's work on the right to adequate housing, unmet housing needs and systemic homelessness. Canada's Homelessness Strategy: funding to help urban, Indigenous, rural and remote communities address their local homelessness needs. Understanding Veteran homelessness: Information for organizations and individuals working to support the homeless, including homeless Veterans.

The mastering money podcast

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help prepare you for retirement and give you the tools to get there, no matter your age. Season 5 of the Mastering Money podcast unpacks the hard financial conversations you need to be having with your kids, partners, financial planners and more. Season 4 of the Mastering Money podcast explores the role money plays in the lives of women from all walks of life, now and in the future. Season 3 of the Mastering Money podcast looks at the difficult financial decisions Canadians are making during the ongoing COVID-19 pandemic. Season 2 of the podcast takes listeners on a journey across various financial literacy hot topics and trends. These include how to fit financial literacy into existing programs, the financial health of future generations as well what it takes to take the plunge and start your own business. In this introductory season of the podcast, hear from financial educators on topics such as behavioral economics, the emotions of money, financial wellness, and more.

Women living in subsidized housing in Canada

Using data primarily from the 2021 Canadian Housing Survey, this study applies a gender lens to examine the characteristics of Canadians living in subsidized housing. It examines the experiences of renters in subsidized housing and their satisfaction with their dwelling and neighbourhood, drawing comparisons with their counterparts living in non-subsidized rental housing.

Consumer Vulnerability: Evidence from the Monthly COVID-19 Financial Well-being Survey

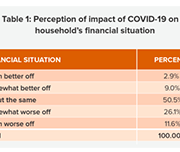

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day financial management and financial well-being. As of September 2022, the survey results show that over the past several months, financial hardships have increased for many Canadians due to the rapidly evolving economic environment. While financial vulnerability can affect anyone regardless of income, background or education, hardships have increased more for those living on a low income, Indigenous peoples, recent immigrants, and women, due to the disproportionate financial impact of the pandemic on these groups (households with low income, Indigenous people, new immigrants, and women.) This brief report provides an overview of survey results collected between August 2020 and September 2022. In publishing this report, FCAC’s goal is to provide insight into the financial well-being of Canadians, to identify which groups are experiencing greater vulnerabilities and hardships, and to inform and target our collective response as financial ecosystem stakeholders.

Welfare in Canada, 2021

Using data provided by provincial and territorial government sources, Welfare in Canada, 2021 describes the components of welfare incomes, how they have changed from previous years, and how they compared to low-income thresholds. Access the report here. During the launch event, the report’s authors, Jennefer Laidley and Mohy Tabbara, broke down the latest welfare income data from all 13 provinces and territories and presented the key takeaways. Recorded on November 24, the Welfare in Canada, 2021 launch event started with a brief presentation of the report’s key findings, followed by a panel discussion. Presenters: Moderator:

The impact of COVID-19 on financial capability and asset building services.

The forced transition from in-person to online activities as a result of the COVID-19 pandemic has had a profound impact on how families and communities buy groceries, acquire medical care, and utilize social services. This rapid shift has raised important questions about how to address access and equity. AFN and the University of Wisconsin-Madison Center for Financial Security (CFS) conducted this study to better understand the transition to remote services among financial capability and asset building (FCAB) programs, which includes financial education, counseling, coaching, emergency assistance, benefits navigation, housing supports, workforce development, and other related services. The insights from this study can inform strategies for FCAB services going forward. This brief reviews recommendations for funders and organizations seeking to learn from the financial capability service delivery models employed in the COVID-19 pandemic, especially related to replication of findings that lead to more equitable delivery practices, improved accessibility of services, and greater financial improvements for clients. Six region-specific briefs complement the national findings - Indiana, Louisiana, North and South Carolina, Oregon, Texas, and Washington. This brief is generously supported by JPMorgan Chase & Co., MetLife Foundation, and Wells Fargo. If you missed the live webinar, watch the recording here.

Canada’s new working class: A modern understanding of the 6.5 million Canadians in the working class

The pandemic has accelerated a polarization of jobs that has become a structural trend in the Canadian economy. Previous Cardus research has shown that this polarization of the labour market between low- and high-skilled occupations, with a declining share of jobs available for mid-skilled workers, has led to an “hourglass economy.”

Yet, even while the share of the labour force employed in professional occupations rises, the working class retains the largest share of workers in the Canadian economy, making them an important political economy constituency. But who is the working class in Canada? This paper seeks to answer this question by proposing a modern taxonomy of the workforce and a picture of the working class that draws on a rich body of demographic, economic, and labour-market data.

Hunger, Poverty, and Health Disparities During COVID-19 and the Federal Nutrition Programs’ Role in an Equitable Recovery

The health and economic crises brought on by the coronavirus 2019 (COVID-19) pandemic has made the federal nutrition programs more important than ever. An unacceptably high number of people in America do not have enough to eat, and it is likely that the economic recovery for families who struggle to put food on the table will take years.

Recovery will be particularly challenging for those groups that have suffered disproportionate harm from COVID-19. Inequities, also referred to as disparities, “adversely affect groups of people who have systematically experienced greater obstacles […] based on their racial or ethnic group; religion; socioeconomic status; gender; age; mental health; cognitive, sensory, or physical disability; sexual orientation or gender identity; geographic location; or other characteristics historically linked to discrimination or exclusion.”

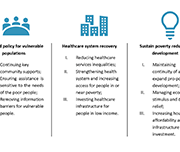

Understanding Systems: The 2021 report of the National Advisory Council on Poverty

Canada’s National Advisory Council on Poverty’s second Annual Report, Understanding Systems, is the first report to provide a glimpse into poverty since COVID-19. Based on community engagements with Canadians and provinces/territories over the last year, the Council has recommended five broad strategies to reduce poverty in Canada. The pillars of the strategy are as follows: In a recent webinar, three Council members shared what strategies can make the greatest impact. Read more to learn about the key takeaways from the discussion.

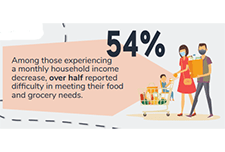

Household food insecurity during the COVID-19 pandemic

This study presents data on levels of household food insecurity in the 10 provinces from the September to December 2020 cycle of the Canadian Community Health Survey. In this survey, household food security status within the previous 12 months was measured using a scale that has been routinely used to monitor levels of household food insecurity in Canada. This provided the ability to draw comparisons with pre-pandemic levels. Both before and during the pandemic, certain population groups were more vulnerable to food insecurity in their household. They included people with lower levels of education, those who rent their dwelling, those in lone-parent-led households and those in households reliant on social assistance as their primary source of income. Compared with the pre-pandemic period of 2017/2018, levels of household food insecurity were either unchanged or slightly lower in fall 2020 among groups vulnerable to food insecurity.

Singles in deep poverty neglected by pandemic supports

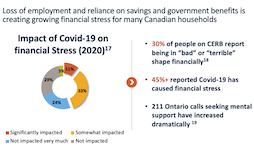

In 2020, the federal government spent over $160 billion on COVID-19 pandemic response measures. These expenses were critical in supporting recently unemployed workers and affected businesses in a time of uncertainty. However, supports through programs like the Canada Emergency Response Benefit (CERB) and the Canada Recovery Benefit (CRB) were not extended to those who had less attachment to the labour market, such as a large proportion of social assistance recipients. This pattern of exclusion has continued with the more recent Canada Worker Lockdown Benefit, which was created to support workers affected by new pandemic-related shutdowns, and not people who were already living in deep poverty before the pandemic. The pandemic benefits are intended to support people during a specific time of crisis — but what about those who have been living with low and insecure incomes for decades? This report analyzes the welfare incomes of 53 example households, divided into four types, focusing here on unattached singles considered employable, as they are the most likely to be living in poverty.

Tools for 2022: Tamarack’s Top 10 Resources Published in 2021

The Tamarack Institute develops and supports collaborative strategies that engage citizens and institutions to solve major community issues across Canada and beyond. Our belief is that when we are effective in strengthening community capacity to engage citizens, lead collaboratively, deepen community and end poverty, our work contributes to the building of peace and a more equitable society. This toolkit contains the top ten resources they published in 2021 including: index of community engagement techniques, the community engagement planning canvas, a guide for community-based COVID recovery, a guide for engaging people with lived and living experience, asset-based community development, a guide for advancing the sustainable development goals in your community and much more.

Resources

Opening and Welcome

Session: Tackling pandemic hardship: The financial impact of COVID-19 on low-income households

Tackling pandemic hardship: The financial impact of COVID-19 on low-income households – YouTube

Download summary and detailed reports: The financial resilience and financial well-being of Canadians with low incomes: insights and analysis to support the financial empowerment sector

Download slide deck: The differential impact of the pandemic on low income families

Booth Chats: Big ideas for a more equitable recovery

Resolve Financial and Credit Counselling

Video Pitch: Booth chat: Jeri Bittorf, Resolve Financial and Credit Counselling Services Coordinator – YouTube

Slide Deck: K3C Credit Counselling (ablefinancialempowerment.org)

Seniors Financial Empowerment Network

Video Pitch: Booth Chat: Sarah Ramsey, City of Edmonton, Community Development Social Worker – YouTube

Seneca College

Video Pitch: Booth Chat: Varinder Gill, Seneca College, Professor & Program Co-ordinator – YouTube

Prosper Canada: Integrating Financial Empowerment into Ontario Works

Video Pitch: Booth Chat: Ana Fremont, Prosper Canada Manager, Program Delivery and Integration – YouTube

Slide Deck: Thunder Bay Financial Empowerment Integration (ablefinancialempowerment.org)

Prosper Canada: Prosperity Gateways – Cities for Financial Empowerment, Toronto Public Library

Video Pitch: Booth Chat: John Stephenson, Manager, Program Delivery and Integration – YouTube

Slide Deck: PowerPoint Presentation (ablefinancialempowerment.org)

Session: Measuring the divide: Has COVID-19 widened economic disparities for Canada’s BIPOC communities

Download slide deck: Income Support During COVID-19and ongoing challenges

Download slide deck: Re thinking income adequacy in the COVID-19 recovery

Session: Financial wellness and healing: Can building financial wellness help Indigenous communities?

Session recording: Financial wellness and healing: Can building financial wellness help Indigenous communities? – YouTube

Download slide deck: Indigenous Financial Literacy: Behaviour Insights from an Indigenous Perspective

Download slide deck: Financial wellness and Indigenous Healing

Session: When money meets race: Addressing systemic racism through financial empowerment

Session: Tous ensemble maintenant : Rétablissement de la santé financière de la population canadienne : l’affaire de tous les secteurs/ All together now: How all sectors have a role to play in rebuilding Canadians’ financial health

Session: When opportunity knocks: Poverty, disability, and Canada’s proposed new disability benefit

Session recording unavailable

Download slide deck: When Opportunity Knocks: Disability without Poverty

Session: The good, the bad and the innovation: The pandemic redesign of tax filing and benefit assistance

Closing remarks from Adam Fair, Vice President, Strategy and Impact, Prosper Canada; Helen Bobiwash

Partnering for impact: From crisis to opportunity (Case studies of corporate-nonprofit partnerships during COVID-19)

This report delves into one of the community investment trends that emerged during the pandemic: innovative partnerships. This research follows the Wake Up Call study, released in the Fall of 2020, and continues to answer the question of: how can corporate philanthropy do better, and do more? Answers emerge through nine case studies, representing various initiatives that are either entirely new, have undergone significant change during the pandemic, or have achieved unprecedented growth. Each case study provides invaluable insights for companies looking to achieve greater impact through their partnerships. Imagine Canada conducted close to 40 interviews with the individuals involved in the partnerships, complemented by documentary evidence collected in 2020-21. The case studies involve partners from leading companies and social impact organizations, such as Cisco, AstraZeneca, RBC, CanadaHelps, and Second Harvest.

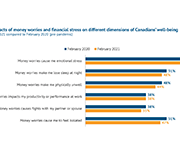

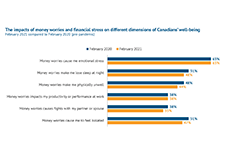

The Well-Being and Financial Well-Being of Canadians: financially vulnerable households the most challenged

This brief discusses how more financially vulnerable Canadians are most challenged based on the Seymour Financial Resilience Index TM. This E-Brief builds on Statistics Canada Canadians' Well-being in Year One of the COVID-19 Pandemic report and Seymour’s February 2021 Index Release Summary.

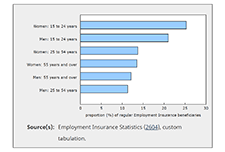

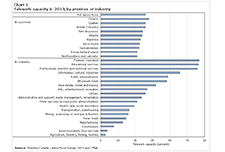

Workers receiving payments from the Canada Emergency Response Benefit program in 2020

The Canada Emergency Response Benefit program (CERB) was introduced to provide financial support to employees and self-employed workers in Canada who were directly impacted by the COVID-19 pandemic. This article examines the proportion of 2019 workers who received CERB payments in 2020 by various characteristics. CERB take-up rates are presented by industry, earnings group in 2019, sex, age group and province, as well as for population groups designated as visible minorities, immigrants and Indigenous people. Some factors that help explain differences in take-up rates among these groups of workers are also examined.

Gender differences in employment one year into the COVID-19 pandemic: An analysis by industrial sector and firm size

An important aspect of the impact of COVID-19 is its disproportional impact across gender. This Insights article proposes a year-over-year approach that compares employment from March 2020 to February 2021 to their March-2019-to-February-2020 counterparts. It uses the Labour Force Survey to study gender gaps patterns in employment by industrial sector (goods or services) and firm size.

Impacts of the COVID-19 pandemic on productivity growth in Canada

The COVID-19 pandemic has changed how production occurs in the economy in two ways. One is the full or partial closure of non-essential activities such as travel, hospitality, arts and entertainment, personal services, airlines, etc. The other is the widespread shift from in-office work to working from home. This Insights article depicts labour productivity growth in Canada and its sources by industry during the COVID-19 pandemic in order to examine the implications these changes may have had on the productivity performance of the economy.

Food Insecurity amid the COVID-19 Pandemic: Food Charity, Government Assistance, and Employment

To mitigate the effects of the coronavirus disease 2019 (COVID-19) pandemic, the federal government has implemented several financial assistance programs, including unprecedented funding to food charities. Using the Canadian Perspectives Survey Series 2, the demographic, employment, and behavioural characteristics associated with food insecurity in April–May 2020 was examined. One-quarter of job-insecure individuals experienced food insecurity that was strongly associated with pandemic-related disruptions to employment income, major financial hardship, and use of food charity was found, yet the vast majority of food-insecure households did not report receiving any charitable food assistance. Increased financial support for low-income households would reduce food insecurity and mitigate negative repercussions of the pandemic.

Economic impact of COVID-19 among Indigenous people

This article uses data from a recent crowdsourcing data initiative to report on the employment and financial impacts of the COVID-19 pandemic on Indigenous participants. It also examines the extent to which Indigenous participants applied for and received federal income support to alleviate these impacts. As Canada gradually enters a recovery phase, the article concludes by reporting on levels of trust among Indigenous participants on decisions to reopen workplaces and public spaces.

Resources

Project reports, journey maps, and toolkit

Reports

These slide decks describe the goals and outcomes of this project.

Socialization deck: Supporting the design of a remote financial help service (Bridgeable)

Client Journey maps

These journey maps offer a visual explanation of the process used by the 3 participating community agencies offering one-on-one client support.

Family Services of Greater Vancouver

SEED Winnipeg

Thunder Bay Counselling

Toolkit

This toolkit was developed in collaboration with community partners, and shares tools for coaches and clients in the virtual one-on-one process.

Virtual service delivery tools (Toolkit)

Resources

Webinar (May 19th): Self-care for practitioners - strategies and challenges

Connect and Share (May 27th): Self-care strategies

Webinar (June 9, 2021): Virtual one-on-one client support

Read the slides for the ‘Virtual one-on-one client support’ webinar.

Watch the video recording for ‘Virtual one-on-one client support’

Download the handouts:

Client tool: Information to remember

Tip sheet: Supporting client intake, triage, and referral in virtual financial help services

Financial coaching at a distance: Tips for practitioners

Connect and Share (June 17, 2021): Tax-time debrief

Read the slides for ‘Connect and Share: Tax time debrief’.

View additional resources in Prosper Canada’s Tax filing toolkit.

Workshop (June 21, 2001): Beyond bubble baths - self-care during a pandemic

Workshop slides: Beyond bubble baths – self-care during a pandemic

Handout: Beyond bubble baths – Self-care during a pandemic

Resources shared during session:

Native-land.ca

Indigenous languages list in British Columbia

Self-compassion.org

Tara Brach mindfulness resources

Headspace

Boho beautiful guided meditations

Webinar (June 23, 2021): Diversity and inclusion - A conversation with SEED Winnipeg

Workshop (June 24, 2021): Visualizing client experiences - Using journey maps

A labour market snapshot of South Asian, Chinese and Filipino Canadians during the pandemic

The COVID-19 pandemic has highlighted the varying labour market experiences and outcomes of diverse groups of Canadians. To mark Asian Heritage Month, Statistics Canada is providing a profile of the employment characteristics of the three largest Asian populations in Canada: South Asian, Chinese and Filipino Canadians. Results from the Labour Force Survey (LFS) show that South Asian men are much more likely to be employed than South Asian women, that Chinese Canadians have higher average hourly wages than other visible minority groups, and that Filipino women have among the highest employment rates of all groups, with many working on the front line in the health care sector during the pandemic. Unless otherwise stated, all data in this article reflect the population aged 15 to 69 during the three months ending in April 2021, and are not seasonally adjusted.

Labour Force Survey, April 2021

April Labour Force Survey (LFS) data reflect labour market conditions during the week of April 11 to 17.

3 Principles for an Antiracist, Equitable State Response to COVID-19 — and a Stronger Recovery

COVID-19’s effects have underscored the ways that racism, bias, and discrimination are embedded in health, social, and economic systems. Black, Indigenous, and Latinx people are experiencing higher rates of infection, hospitalization, and death, and people of color are also overrepresented in jobs that are at higher infection risk and hardest hit economically. Shaping these outcomes are structural barriers like wealth and income disparities, inadequate access to health care, and racial discrimination built into the health system and labor market. This article discusses three recommended principles for guiding policymakers in making equity efforts.

Trans PULSE Canada COVID Data Dashboard

In September – October 2020, the Trans PULSE Canada study team conducted the COVID Cohort to assess the social, economic, and health impacts of the COVID-19 pandemic on trans and non-binary people in Canada. This dashboard serves as an interactive tool for community members and researchers to explore key findings from the Trans PULSE Canada COVID survey, and to break down the results by one or more socio-demographic characteristics. The proportions in the dashboard are weighted to represent the 2019 Trans PULSE Canada sample.

Report – Social and economic impacts of COVID-19 on transgender and non-binary people in Canada

A survey led by researchers at Western University explores the experiences of trans and non-binary Canadians during the COVID-19 pandemic. Initial research from the Trans PULSE Canada survey highlighted that many trans and non-binary Canadians will avoid seeking necessary health care because of a fear of discrimination. The survey findings also show that trans and non-binary Canadians had disruptions in primary health care, mental health care and gender-affirming care during the pandemic, and a high frequency of interruptions to hormone regimens. They also found that twice as many trans and non-binary people reported that they stopped accessing mental health support than those who started accessing support. The team also looked at the social and economic impacts of the pandemic and found that a majority of trans and non-binary people in Canada are experiencing negative financial and social impacts of COVID-19. Almost 60 per cent of respondents said they their access to trans and non-binary social spaces has decreased.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Click ‘Get it’ above for video link for this webinar.

Handout: Implementing a practice of self-care

Employment Insurance, February 2021

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and various other public health requirements. Public health measures were relaxed in Quebec, Alberta, Nova Scotia and New Brunswick on February 8, although a curfew remained in effect in Quebec. Measures were loosened in many regions of Ontario on February 10 and 15, although stay-at-home orders remained in place in the health regions of Toronto, Peel, York and North Bay Parry Sound. In Manitoba, various measures were eased on February 12. In contrast, Newfoundland and Labrador reintroduced a lockdown on February 12, requiring the widespread closure of non-essential businesses and services.

Impact of the COVID-19 Crisis on Montreal “Cultural Communities”

This exploratory study aims to better understand the challenges experienced by members of cultural communities in Montreal, particularly the most disadvantaged groups, during the COVID-19 pandemic in the Spring of 2020.

Ongoing Impacts of the COVID-19 Crisis on the Charitable Sector

While most charities have been able to adapt and innovate to continue to offer services and programs to their communities since the onset of the pandemic, the situation remains challenging. For the vast majority of organizations, the constraints and uncertainty of the pandemic, paired with social distancing mandates, are driving significant shifts to organizational priorities. Nearly a year since the onset of the pandemic, the COVID-19 crisis continues to have a significant impact on demand, capacity, and revenue, and is influencing staffing decisions and volunteer contributions. The crisis is dramatically changing how many organizations operate. Findings from Imagine Canada's second COVID-19 Sector Monitor study show the ongoing effects of the pandemic on the charitable sector.

The relationship between COVID-19 pandemic and people in poverty: Exploring the impact scale and potential policy responses

This research project aims to identify the relationship between COVID-19 pandemic and poverty in Vancouver, by analyzing how the COVID-19 pandemic has pushed people into poverty and the impact of COVID-19 on people already living in poverty. Several examples of COVID-19 recovery policies and projects being implemented elsewhere that could support people experiencing poverty in Vancouver are also provided.

The Differential Impact of the Pandemic and Recession on Family Finances

This report summarizes the results of a follow-up survey with nineteen low- and modest-middle income Winnipeggers, undertaken in June through September 2020. These respondents were drawn from the 29 Canadian Financial Diaries (CFD) participants who completed a year-long diary in 2019. The results of the survey illustrate that low- and moderate-income earners are feeling stressed with increased expenses and uncertainty about future economic stability.

Investing and The COVID-19 Pandemic: Survey of Canadian Investors

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and trading activity of retail investors. Key findings include that 32 per cent of investors have experienced a decline in their financial situation during the pandemic while 16 per cent have experienced an improvement. Half of investors have not done any trading during the pandemic, but of those who have been trading, 63 per cent have increased their holdings.

Impacts of the Covid-19 Pandemic on Women: Report of the Standing Committee on the Status of Women

The effects of the COVID-19 pandemic have been profound and far-reaching. Beyond endangering the health of Canadians, the pandemic has worsened inequalities among groups of people. Women, girls and gender-diverse people have faced unique challenges during the pandemic. The Committee recommends that the Government of Canada take various actions to assist women, girls and gender-diverse people during and after the COVID-19 pandemic. Many recommendations relate to improving women’s health and labour force participation. Some recommendations focus specifically on women’s paid and unpaid care work. The Committee also recommends interventions to help reduce trafficking and violence against women.

Budget 2021: A Recovery Plan for Jobs, Growth, and Resilience

The federal budget released on April 19, 2021 covers the Canadian government's plan for:

Financial Relief Navigator

The Financial Relief Navigator is an online tool that can help you find support to raise your income or lower your expenses in these challenging times. The tool will suggest income benefits or other support programs you may be eligible for in your province/territory in Canada.

Study: A labour market snapshot of Black Canadians during the pandemic

In the context of the COVID-19 pandemic, many Canadians, including Black Canadians, have experienced significant economic hardship, while others put themselves at risk through their work in essential industries such as health care and social assistance. Statistics Canada looked at how the 1 million Black Canadians aged 15 to 69 are faring in the labour market during one of the most disruptive times in our economic history. Analysis of the recent labour market situation of population groups designated as visible minorities is now possible as a result of a new question added to the Labour Force Survey (LFS) in July 2020. Unless otherwise stated, all data in this release are unadjusted for seasonality and are based on three-month averages ending in January 2021.

Aspects of quality of employment in Canada, February and March 2020

The labour market in Canada has experienced unprecedented changes over the last 12 months. Entire sectors of the economy have been subject to temporary restrictions on business activities as a result of public health measures aimed at limiting the spread of COVID-19. At the same time, many workers have seen changes in working conditions, such as teleworking, reduced work hours and greater job insecurity. From mid-February to mid-March 2020, the 2020 Survey on Quality of Employment (SQE) collected information on aspects of job quality in Canada from the perspective of workers. Estimates reflect employment characteristics before the full onset of the COVID-19 pandemic and contribute to establishing a baseline for future analysis of quality of employment in Canada. Unless otherwise stated, the analysis focuses on the 23.5 million workers who were employed in February or March 2020 or who had last worked in 2018 or after, and excludes unpaid family workers.

Housing insecurity and the COVID-19 pandemic

CFPB released their first analysis of the impacts of the COVID-19 pandemic on housing in the United States. Actions taken by both the public and private sector have, so far, prevented many families from losing their homes during the height of the public health crisis. However, as legal protections expire in the months ahead, over 11 million families — nearly 10 percent of U.S. households — are at risk of eviction and foreclosure.

Disability Inclusion Analysis of Lessons Learned and Best Practices of the Government of Canada’s Response to the COVID-19 Pandemic

This report provides the findings of research conducted to assist Employment and Social Development Canada in identifying good or best practices and lessons learned from the response to the COVID-19 pandemic in Canada. Conducted in partnership with the DisAbled Women’s Network of Canada (DAWN), this research helps us better understand how diverse people with disabilities in Canada have been affected by the COVID-19 pandemic and the effects of government COVID-19 measures on diverse people with disabilities in Canada.

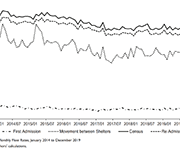

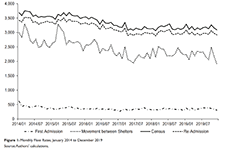

Homeless Shelter Flows in Calgary and the Potential Impact of COVID-19

Social distancing and self-isolation are two of the key responses asked of citizens during a pandemic. For people without a home, this advice is rather more difficult to follow. This article uses daily data describing the movements of 36,855 unique individuals who used emergency homeless shelters in Calgary over the period 1 January 2014–31 December 2019. The use of emergency shelters is characterized by large flows from and into the broader community and smaller flows between individual shelters. Between admissions of new people into the shelter system and multiple re-admissions of current clients, there were an average of 43,613 movements between the community and between shelters each month. The size of these flows provide a measure of the extent to which people reliant on homeless shelters are exposed to the risk of transmission of coronavirus disease 2019 (COVID-19).

Cross Canada Check-up (updated March 2021)

Canada ranks consistently as one of the best places to live in the world and one of the wealthiest. When it comes to looking at the financial health of Canadian households, however, we are often forced to rely on incomplete measures, like income alone, or aggregate national statistics that tell us little about the distribution of financial health and vulnerability in our neighbourhoods, communities or provinces/territories. The purpose of this report is to examine the financial heath and vulnerability of Canadian households in different provinces and territories using a new composite index of household financial health, the Neighbourhood Financial Health Index or NFHI.

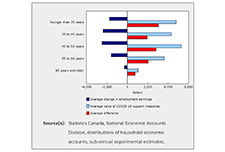

Household economic well-being during the COVID-19 pandemic, experimental estimates, first quarter to third quarter of 2020

Over the first three quarters of 2020, disposable income for the lowest-income households increased 36.8%, more than for any other households. At the same time, the youngest households recorded the largest gain in their net worth (+9.8%). These changes were driven by unprecedented increases in transfers to households, as the value of government COVID-19 support measures exceeded losses in wages and salaries and self-employment income. As the pandemic unfolded in Canada, households experienced extraordinary changes in their economic well-being. While quarterly releases of gross domestic product and the national balance sheet provide an aggregate view of these impacts, new experimental sub-annual distributions of household economic accounts (DHEA), released today, provide insight into how the pandemic and the associated government support measures have affected the economic well-being of different groups of households in Canada.

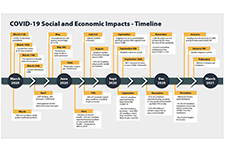

COVID-19 in Canada: A One-year Update on Social and Economic Impacts

This summary provides highlights on the work the Agency has and is undertaking using existing and new data sources to provide critical insights on the social and economic impacts of COVID-19 on Canadians. It covers the first year of the pandemic from March 2020 to March 2021.

10: A Guide for a Community-Based COVID-19 Recovery

Our cities and communities are where people live. It is here we see the effects of public policy and it is here where we will address the issues that matter most to Canadians. The choices made today will impact Canada’s recovery from COVID-19. If we want a future where our cities are thriving, we need to work together to achieve a collective community-based response. We are all in this together and it will take all of us in a community to find our way through. If you are a community leader, such as a mayor, an elected official, a business leader, a community activist, or a concerned citizen, this guide was written for you. We created it to be accessible and easy to use, with five sections and links to resources throughout.

COVID-19 Fraud Alerts

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos increases awareness of fraudulent activity during COVID-19. Topic include:

Social Listening: Covid-19, Social Media, and The Path to a Better Safety Net

This brief outlines how beneficiaries are using online platforms to identify breakdowns in public services, celebrate the positive impact of public policy and urge reform. Ways in which government can capitalize on widespread social media feedback and begin to build long-term measures to center people’s experience as an important component of policy design are explored.

Investing in Financial Coaching with a Racial Equity Lens

In this moment, it is pivotal for philanthropy to support communities of color in achieving financial well-being. Combined with systems-change efforts that would create fairer economic opportunities and conditions, financial coaching is a vital component of providing needed support. Through background information, case stories, and key investment considerations, this brief focuses on financial coaching with a racial equity lens as an important strategy for helping people of color achieve equitable outcomes.

Canadian Economic News, January 2021 edition

This module provides a concise summary of selected Canadian economic events, as well as international and financial market developments by calendar month. All information presented here is obtained from publicly available news and information sources, and does not reflect any protected information provided to Statistics Canada by survey respondents. This is the issue for January 2021.

The COVID-19 pandemic and Indigenous people with a disability or long-term condition

This paper uses crowdsourced data to provide an overview of the impacts of the COVID-19 pandemic on the health, service access, and ability to meet basic needs of Indigenous participants with disabilities or long-term conditions. Changes in overall health and mental health are examined by disability type, age group and sex. The most commonly reported service disruptions since the start of the pandemic are also presented. The crowdsourcing data reflected health and other disparities between Indigenous and non-Indigenous participants with a disability or long-term condition. Indigenous participants were more likely to report worsened overall health and mental health, service disruption, and a greater impact on their ability to meet essential needs.

The COVID-19 Wildfire: Nonprofit Organizational Challenge and Opportunity

Nonprofit organizations in Canada were significantly impacted by COVID-19, including lost revenue and needing to adjust the program delivery. The lack of technology capacity in the nonprofit sector is a key barrier for many nonprofit organizations to adapt to delivering programs online. Momentum, a Calgary-based nonprofit organization, experienced both financial and programmatic challenges due to COVID-19. Momentum pivoted program delivery to provide supports during the COVID-19 lockdown and developed innovative approaches to online programming. Since the start of the COVID-19 pandemic in Canada, Momentum was able to rapidly develop its capacity to use technology for online programming with the support of critical new funding. Many nonprofits will have to transform their business models to not only survive but thrive in the post-COVID world.

Pandemic to Prosperity – January 21, 2021: One year after the first announcement of Covid on U.S. soil

The National Conference on Citizenship (NCoC) developed the Pandemic to Prosperity series. It builds on NCoC’s data infrastructure and advocacy network developed for its national Civic Health Index, with The New Orleans Index, which informed many public and private decisions and actions post-Katrina. This series is designed to enable a solid understanding of the damage to lives and livelihoods as the pandemic continues to unfold, as the United States enters the era of vaccines, and the nation grapples with new shocks and stressors such as disasters and civil unrest; it will also examine aspirational goals around strong and accountable government, functioning institutions from child care to internet access to local news availability, effective civic participation, and outcomes for people by race regarding employment, health, housing, and more. With each new report in the series, indicators will change as the recovery transitions. This report highlights mostly state-level metrics with breakdowns by race, gender, and age where available, relying on both public and private data sources.

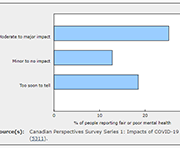

Food insecurity and mental health during the COVID-19 pandemic

Canadians living in households that experienced food insecurity (insecure or inadequate access to food because of financial constraints) during the early months of the COVID-19 pandemic were significantly more likely to perceive their mental health as fair or poor and to report moderate or severe anxiety symptoms than Canadians in food-secure households. Approximately one in seven Canadians (14.6%) were estimated to live in a food-insecure household in May 2020. This study, released in Health Reports, is the first to examine the association between household food insecurity and self-perceived mental health and anxiety among Canadians during the COVID-19 pandemic. The study also estimated that 9.3% of Canadians living in food-insecure households reported having recently accessed free food or meals from a community organization.

Taking Stock and Looking Ahead: The Impact of COVID-19 on Communities of Color

Nearly a year since the outbreak began, and eight months since it was declared a global pandemic, COVID-19 has devastated hundreds of thousands of lives and millions of people’s economic prospects throughout the country. To date, the effects of this crisis have been wide-reaching and profound, impacting every individual and sector throughout the U.S. For communities of color, however, the pandemic has been particularly damaging as these communities have not only been more likely to contract and succumb to the virus, but also more likely to bear the brunt of the many economic impacts that have come from it—including more likely to be unemployed and slower to regain jobs lost. The Asset Building Policy Network and a panel of experts discuss the impact COVID-19 has had on communities of color, the fiscal policy measures congress has enacted to curtail those impacts and what can be done through policy and programs to foster an equitable recovery and more inclusive economy moving forward.

2020 Financial Literacy Annual Report

The 2020 Financial Literacy Annual Report details the United States' Bureau of Consumer Financial Protection's financial literacy strategy and activities to improve the financial literacy of consumers. Congress specifically charged the Bureau with conducting financial education programs and ensuring consumers receive timely and understandable information to make responsible decisions about financial transactions. Empowering consumers to help themselves, protect their own interests, and choose the financial products and services that best fit their needs is vital to preventing consumer harm and building financial well-being. Overall, this report describes the Bureau’s efforts in a broad range of financial literacy areas relevant to consumers’ financial lives. It highlights our work, including the Bureau's:

State of the Child Report 2020: Protecting Child Rights in Times of Pandemic

The 2020 State of the Child Report includes six recommendations and gives a snapshot of some of the challenges New Brunswick children and youth will have to overcome as the province moves forward and juggles the new realities of public health measures to prevent the spread of COVID-19 while respecting child rights.

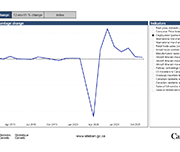

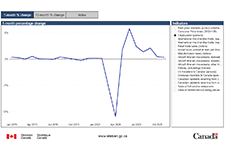

Canadian Economic Dashboard and COVID-19

This dashboard presents selected data that are relevant for monitoring the impacts of COVID-19 on economic activity in Canada. It includes data on a range of monthly indicators - real GDP, consumer prices, the unemployment rate, merchandise exports and imports, retail sales, hours worked and manufacturing sales -- as well as monthly data on aircraft movements, railway carloadings, and travel between Canada and other countries.

CPA Canada 2020 Canadian Finance Study

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these unprecedented times. Nielsen conducted the CPA Canada 2020 Canadian Finance Study via an online questionnaire, from September 4 to 16, 2020 with 2,008 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. Among the key pandemic-related findings:

Connecting to Reimagine: Money & COVID-19 webinar series

This webinar series released by the Global Financial Literacy Excellence Center (GFLEC) features speakers from the public, private, and academic sectors. Past and upcoming webinar topics include: Optimizing National Strategies for Financial Education Crafting Policies that Address Inequality in Saving, Wealth, and Economic Opportunities Investor Knowledge and Behaviors in Times of Crisis Increasing Financial Knowledge for Better Rebuilding Designing an Inclusive Recovery Millennials: Buttressing a Generation at Risk

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

Resources

Handouts, slides, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Process map: Virtual Self-File model overview

Time-stamps for the video recording:

4:01 – Agenda and introductions

5:59 – Audience polls

10:27 – Project introduction (Speaker: Ana Fremont, Prosper Canada)

14:31 – Tour of TurboTax for Tax Clinics (Speaker: Guy Labelle, Intuit)

17:59 – Woodgreen project pilot (Speaker: Ansley Dawson, Woodgreen Community Services)

27:35 – EBO 2-step process (Speaker: Marc D’Orgeville, EBO)

39:26 – Woodgreen program modifications (Speaker: Ansley Dawson, Woodgreen)

46:03 – Q&A

COVID-19: Exclusive resources for service provider heroes

Families Canada is the national association of Family Support Centres. With a network of 500+ member agencies and thousands of frontline family service workers across Canada, they committed to providing leadership and support in the campaign for Canada’s children. Families Canada has compiled resources for service providers to support families during COVID-19.

The Impact of COVID-19 on Women living with Disabilities in Canada

DisAbled Women’s Network (DAWNRAFH) Canada is a national, feminist, cross-disability organization whose mission is to end the poverty, isolation, discrimination and violence experienced People with disabilities, specifically women with disabilities face unique barriers related to Covid-19. This includes both the increased risk oftransmission and death from COVID-19, as well as the unique ways policies targeting COVID-19 impact this group. Prior to COVID-19 more than 50% of human rights complaints at the Federal, Provincial and Territorial levels in Canada for the last four years have been disability related, which speaks to systemic failures that have been exacerbated under COVID-19. In this brief, DAWN Canada highlights these unique considerations, as well as significant and existing policy gaps facing this group.

by Canadian women with disabilities and Deaf women.

COVID-19 Financial Resilience Hub

The Global Financial Literacy Excellence Center (GFLEC) focuses on financial literacy research, policy, and solutions. This toolkit contains suggestions and resources for managing personal finances and protection against the financial emergencies caused by COVID-19.

Resources

Handouts, slides, and time-stamps

Financial Consumer Protection responses to COVID-19

This policy brief provides recommendations that can assist policy makers in their consideration of appropriate measures to help financial consumers, depending on the contexts and circumstances of individual jurisdictions, during the COVID-19 crisis. These options are consistent with the G20/OECD High Level Principles on Financial Consumer Protection that set out the foundations for a comprehensive financial consumer protection framework.

Supporting the financial resilience of citizens throughout the COVID-19 crisis

This policy brief outlines initial the measures that policy makers can make to increase citizen awareness about effective means of mitigation for the impact of the COVID-19 pandemic and its potential consequences on their financial resilience and well-being.

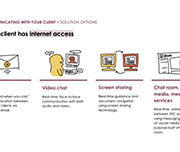

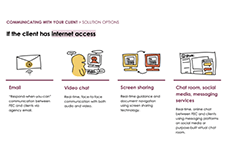

Helping financial empowerment champions deliver critical services to low-income Canadians

Service design consultancy Bridgeable provides an overview of the project partnership with Prosper Canada in April 2020 to take a design sprint approach in providing remote tax-filing and benefits application service solution. Over the course of four consecutive days, Bridgeable worked with eighteen financial empowerment champion (FEC) partners to generate solutions to four key aspects for remote service delivery:

Managing Financial Health in Challenging Times

Managing financial health is difficult during ordinary times—and especially so in challenging times like the ones we're currently facing. Guest speaker RuthAnne Corley, the Senior Stakeholder Engagement Officer with the Financial Consumer Agency of Canada (FCAC), discusses how to manage your financial health despite external challenges. RuthAnne joined FCAC in 2015 where she’s been instrumental in the development of Canada’s "National Strategy for Financial Literacy - Count me in, Canada" and its implementation. Prior to joining FCAC in 2015, RuthAnne managed stakeholder engagement and outreach activities at numerous federal departments and agencies.

Pressure Creates Diamonds: Money Management During Coronavirus

The town hall with CFPB Director Kraninger and Pro Linebacker Brandon Copeland includes steps, and tools to help people plan and persevere during financial challenges. The page also includes access to free resources on a number of topics including mortgage help, dealing with student loans, paying bills, building savings and more.

COVID-19 financial literacy resources

CPA Canada has put together resources to help manage your finances and provide you with the tools you need during this crisis – and beyond.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

Report: Roadblock to recovery: Consumer debt of low- and moderate-income Canadian households in the time of COVID-19 (Prosper Canada)

Survey results: Canadians with incomes under $40K bearing the financial brunt of COVID-19 (Leger and Prosper Canada)

Time-stamps for the video recording:

4:42 – Agenda and introductions

7:52 – Audience polls

10:55 – Researching consumer debt (Speaker: Alex Bucik)

18:55 – How much does debt cost? (Speaker: Alex Bucik)

23:17 – How do different kinds of debt work? (Speaker: Alex Bucik)

29:17 – What are people using their credit for? (Speaker: Vivian Odu)

40:49 – What help is available to Canadian borrowers? (Speaker: Alex Bucik)

45:22 – Q&A

COVID-19 Financial Resource Centre

Credit Canada has pulled together financial information from trusted sources and released original content to help Canadians manage their finances during COVID-19.

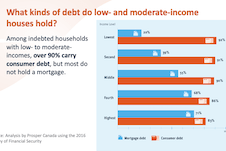

Roadblock to Recovery: Consumer debt of low- and moderate-income Canadians in the time of COVID-19

Almost half of low-income households and 62 per cent of moderate-income households carry debt, with households on low incomes spending 31 per cent of their income on debt repayments, according to a new report published by national charity, Prosper Canada.

This report analyzes the distribution, amount and composition of non-mortgage debt held by low- and moderate-income Canadian households and explores implications for federal and provincial/territorial policy makers as they develop and implement COVID-19 economic recovery plans and fulfill their respective regulatory roles.

The changes in health and well-being of Canadians with long-term conditions or disabilities since the start of the COVID-19 pandemic

This article examines how the self-reported health and mental health of people with long-term health conditions or disabilities has changed since the start of the COVID-19 pandemic explored by age, sex and type of reported difficulty. Additionally, the rates of health service disruptions are explored by type of service and region.

How are Canadians with long-term conditions and disabilities impacted by the COVID-19 pandemic?

This infographic focuses on self-reported health, unmet needs for services and therapies, and difficulties meeting certain financial obligations and essential needs since the start of the COVID-19 pandemic among participants aged 15 and older living with long-term conditions and disabilities. Results are based on the recent Statistics Canada crowdsourcing data collection completed by over 13,000 Canadians with long-term conditions or disabilities between June 23 and July 6, 2020.

Impact of the COVID-19 pandemic on the NEET (not in employment, education or training) indicator, March and April 2020

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit its spread—have affected young people in a number of ways, including high unemployment rates, school closures and education moving online.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Resources

Questions and answers to legal topics in Ontario

The Community of Legal Education Ontario (CLEO) website contains answers to common questions pertaining to a number of legal topics, including: COVID-19, debt and consumer rights, and employment and work.

Labour Force Survey, August 2020

The August Labour Force Survey (LFS) results reflect labour market conditions as of the week of August 9 to 15, five months following the onset of the COVID-19 economic shutdown. By mid-August, public health restrictions had substantially eased across the country and more businesses and workplaces had re-opened.

The mental health of population groups designated as visible minorities in Canada during the COVID-19 pandemic

This article examines the mental health outcomes (i.e., self-rated mental health, change in mental health since physical distancing began, and severity of symptoms consistent with generalized anxiety disorder in the two weeks prior to completing the survey) of participants in a recent crowdsource questionnaire who belong to population groups designated as visible minorities in Canada.

Gender, Diversity and Inclusion Statistics Hub

Launched by the Centre for Gender, Diversity and Inclusion Statistics (CGDIS), the Gender, Diversity and Inclusion Hub focuses on disaggregated data by gender and other identities to support evidence-based policy development and decision making.

Canada’s Forgotten Poor? Putting Singles Living in Deep Poverty on the Policy Radar

This report presents the findings of extensive research about employable singles on social assistance undertaken by Toronto Employment and Social Services, in partnership with the Ontario Centre for Workforce Innovation. Drawing on data from 69,000 singles who were receiving social assistance in Toronto in 2016, and 51 interviews with randomly selected participants, the report highlights these individuals’ characteristics, their complex needs, and the barriers they face in moving off social assistance and into employment. Complementing the quantitative analysis, the interviews provide important insights into the daily realities of participants’ lives and their journeys on and off assistance.

The Economic Toll of COVID-19 on SaverLife Members

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their savings program members during the COVID-19 pandemic from March to August of 2020.

Impacts of COVID-19 on persons with disabilities

This article provides a general snapshot of the employment and income impacts of COVID-19 on survey participants aged 15 to 64 living with long-term conditions and disabilities.

Transitions into and out of employment by immigrants during the COVID-19 lockdown and recovery

During the widespread lockdown of economic activities in March and April 2020, the Canadian labour market lost 3 million jobs. From May to July, as many businesses gradually resumed their operations, 1.7 million jobs were recovered. While studies in the United States and Europe suggest that immigrants are often more severely affected by economic downturns than the native born (Borjas and Cassidy 2020; Botric 2018), little is known about whether immigrants and the Canadian born fared differently in the employment disruption induced by the COVID-19 pandemic and, if so, how such differences are related to their socio-demographic and job characteristics. This paper fills this gap by comparing immigrants and the Canadian-born population in their transitions out of employment in the months of heavy contraction and into employment during the months of partial recovery. The analysis is based on individual-level monthly panel data from the Labour Force Survey and focuses on the population aged 20 to 64. Immigrants are grouped into recent immigrants who landed in Canada within 10 years or less, and long-term immigrants who landed in Canada more than 10 years earlier.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling. This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

A Feminist Economic Recovery Plan for Canada: Making the Economy Work for Everyone

This report offers an intersectional perspective on how Canada can recover from the COVID-19 crisis and weather difficult times in the future, while ensuring the needs of all people in Canada are considered in the formation of policy.

YWCA Canada and the University of Toronto’s Institute for Gender and the Economy (GATE) offer this joint assessment to highlight the important principles that all levels of government should consider as they develop and implement policies to spur post-pandemic recovery.

Hunger Lives Here: Risks and Challenges Faced by Food Bank Clients During COVID-19

This report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto during COVID-19. Based on phone surveys with over 220 food bank clients in May and June 2020 and an analysis of food bank client intake data, the report demonstrates that COVID-19 has led to increased reliance on food banks. The rate of new clients accessing food banks has tripled since the pandemic began. Among new clients, 76% report that they began accessing food banks as a result of COVID-19 and the associated economic downturn.

From Emergency to Opportunity: Building a Resilient Alberta Nonprofit Sector After COVID-19

This report presents an analysis of the impact of COVID-19 on the nonprofit sector drawn from data collected in CCVO's Alberta Nonprofit Survey, data from surveys by the Alberta The analysis in this report shows that the effects on the nonprofit sector have been magnified through increased service demand, decreased revenue, and diminished organizational capacity coupled by delays in support and inadequate recognition for the leadership role that the sector is being called upon to play.

Nonprofit Network, Imagine Canada, and partner organizations across the country.

How Are the Most Vulnerable Households Navigating the Financial Impact of COVID-19?

The COVID-19 pandemic has already had an unprecedented impact on the financial lives of households across the United States. During June and July 2020, Prosperity Now conducted a national survey of lower-income households to better understand the circumstances these households are confronted with and the strategies they use to secure resources to navigate this crisis.

From the Margins to Center: Responding to COVID-19 with an Equity and Gender Lens

On June 30th, AFN presented an Expert Insights briefing on what it takes to center women of color in the relief, recovery, and rebuild plans for the current health and economic crisis and beyond. The speaker is Dominique Derbigny, deputy director of Closing the Women’s Wealth Gap (CWWG) and author of the report, On the Margins: Economic Security for Women of Color through the Coronavirus Crisis and Beyond. Learn why women of color are suffering severely from the COVID-19 public health and economic crisis, opportunities to advance gender economic equity in near-term recovery efforts, and possible strategies to prevent wealth extraction and foster long-term economic security for women of color.

Expert Insights: Preventing Evictions in Communities of Color During COVID-19

COVID-19 is radically reshaping many aspects of people’s financial health in America, including their housing security. The economic fallout is disproportionately impacting communities of color due to systemic inequities related to race, housing, employment, and more. As the protections put in place at the start of the pandemic fade away, the United States are facing an eviction tsunami that will disparately displace Black and Latinx families. On August 25, AFN’s summer Expert Insights briefed attendees on rental risks and evictions related to COVID-19. Speakers were Solomon Greene with The Urban Institute and Dr. Christie Cade of NeighborWorks America.

Beware of scams related to the coronavirus

Scammers are taking advantage of the coronavirus (COVID-19) pandemic to con people into giving up their money. Though the reason behind their fraud is new, their tactics are familiar. It can be even harder to prevent scams right now because people 62 and older aren’t interacting with as many friends, neighbors, and senior service providers due to efforts to slow the spread of disease. This blog post presents consumer protection toolkit resources produced by Consumer Financial Protection Bureau in addition to tips for consumers regarding COVID-19 related scams.

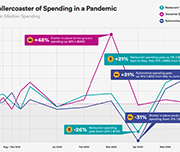

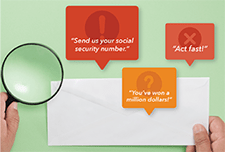

Expected changes in spending habits during the recovery period

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How our economy evolves going forward will largely depend upon the spending choices Canadians make over the coming weeks and months. This study presents results from a recent web panel survey conducted in June, looks at how spending habits may change.

Costing a Guaranteed Basic Income During the COVID Pandemic

The Parliamentary Budget Officer (PBO) supports Parliament by providing economic and financial analysis for the purposes of raising the quality of parliamentary debate and promoting greater budget transparency and accountability. This report responds to a request from Senator Yuen Pau Woo to estimate the post-COVID cost of a guaranteed basic income (GBI) program, using parameters set out in Ontario’s basic income pilot project. In addition, the report provides an estimate of the federal and provincial programs for low-income individuals and families, including many non-refundable and refundable tax credits that could be replaced by the GBI program.

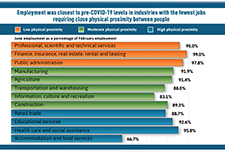

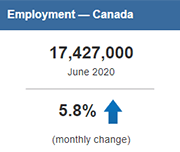

Infographic: COVID-19 and the labour market in June 2020

This infographic displays information on the Canadian labour market in June 2020 as a result of COVID-19.

Labour Force Survey, June 2020

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance payments. New questions were added to measure the extent to which COVID-19-related health risks are being mitigated through workplace adaptations and protective measures.

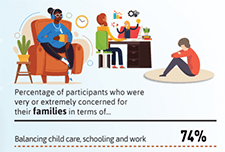

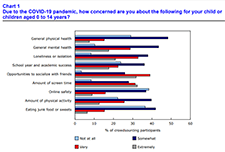

Infographic: The impact of the COVID-19 pandemic on Canadian families and children

This infographic describes parents' experiences during the COVID-19 pandemic including balancing work and schooling, their children's activities and parents' concerns.

Impacts of COVID-19 on Canadian families and children

The COVID-19 pandemic has dramatically altered the way of life for Canadian families, parents and children. Because of physical distancing and employment impacts, parents have altered their usual routines and supports, and many children and families have been isolated in their homes for months. Children, in particular, may not have left their homes or seen any friends or family members other than their parents for an extended period, since children do not typically have to leave their homes for essential services. However, the impact of the pandemic on families has yet to be described. The purpose of this report is to provide a snapshot of the experiences of Canadian parents and families during this unprecedented time.

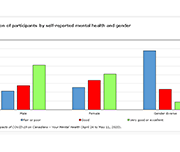

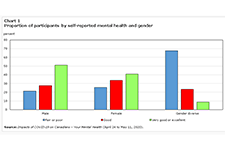

Gender differences in mental health during the COVID-19 pandemic

Previous research has demonstrated that the COVID-19 pandemic is negatively affecting the mental health of Canadians. Today, a new study highlights gender differences in the pandemic's impacts on the mental health of participants in a recent crowdsourcing survey, conducted by Statistics Canada from April 24 to May 11, 2020. Around 46,000 Canadian residents participated in this survey. Female participants were more likely than their male counterparts to report "fair" or "poor" self-rated mental health, "somewhat worse" or "much worse" mental health since physical distancing began, and symptoms consistent with moderate or severe generalized anxiety disorder in the two weeks before completing the questionnaire. Female participants were also more likely than male participants to report that their lives were "quite a bit stressful" or "extremely stressful." Gender-diverse participants—that is, participants who did not report their current gender as exclusively female or male—reported poorer mental health outcomes than both female and male participants across all measures.

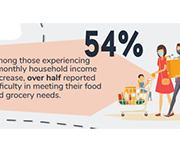

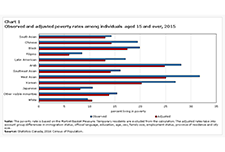

Economic impact of COVID-19 among visible minority groups

Since visible minorities often have more precarious employment and higher poverty rates than the White population, their ability to adjust to income losses due to work interruptions is likely more limited. Based on a large crowdsourcing data collection initiative, this study examines the economic impact of the COVID-19 pandemic on visible minority groups. Among the crowdsourcing participants who were employed prior to work stoppages, Whites and most visible minority groups reported similar rates of job loss or reduced work hours. However, visible minority participants were more likely than White participants to report that the COVID-19 pandemic had affected their ability to meet financial obligations or essential needs, such as rent or mortgage payments, utilities, and groceries.

Economic and Fiscal Snapshot 2020

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the country.

A Pandemic Response and Recovery Toolkit for Homeless System Leaders in Canada

The Pandemic Response and Recovery Toolkit is intended to assist System Leaders plan and navigate the next steps in their community’s response and recovery as it pertains to people experiencing homelessness and people supported in housing programs. The Toolkit outlines phases and action steps – many that have yet to be mobilized - to help with planning, implementation and evaluation of pandemic response and recovery activities in communities. Furthermore, it contains a compendium of resources to help System Leaders along the way. This could be a time of doom and gloom. But there is a silver lining. With innovation and the courage to capitalize on emerging opportunities, the homelessness response and housing support system may emerge from this situation stronger and better than before the pandemic hit. It is possible that we can achieve Recovery for All.

Five good ideas for remote client service work

How does the Canada Emergency Response Benefit (CERB) impact eligibility of provincial benefits?

This policy backgrounder provides an overview of how provincial and territorial governments have decided to treat receipt of the Canada Emergency Response Benefit (CERB) for those receiving social assistance and/or living in subsidized housing. It also looks at provisions for youth aging out of care during the COVID-19 pandemic.

Locked down, not locked out: An eviction prevention plan for Ontario

Employer Solutions: From Emergency to Resiliency

In light of COVID-19, the financial security of workers has never been more in question. The workplace is an important delivery channel for tailored financial products and services that can help meet employee’s immediate financial needs and build long-term financial stability. The workplace is a unique platform to identify, target, and meet the specific financial needs of employees. This webinar gives funders the tools and inspiration to respond effectively to the low- and moderate-income workforce in this moment and beyond.

Volunteering in Canada: Challenges and opportunities during the COVID-19 pandemic

In 2018, over 12.7 million Canadians engaged in formal volunteering, with a total of 1.6 billion hours of their time given to charities, non-profits and community organizations—equivalent to almost 858,000 full-time year-round jobs. Today, Canadians are courageously volunteering in the midst of one of the largest health, economic and social challenges of our lifetime. The study, based upon the 2018 General Social Survey on Giving, Volunteering and Participating, measures the contributions of those who have given their time. While these data are from prior to the COVID-19 pandemic, they provide insight into challenges and opportunities facing volunteerism in the current situation.

Inequality in the feasibility of working from home during and after COVID-19

The economic lockdown to stop the spread of COVID-19 has led to steep declines in employment and hours worked for many Canadians. For workers in essential services, in jobs that can be done with proper physical distancing measures or in jobs that can be done from home, the likelihood of experiencing a work interruption during the pandemic is lower than for other workers. To shed light on these issues, this article assesses how the feasibility of working from home varies across Canadian families. It also considers the implications of these differences for family earnings inequality.

Présentation de l’Explorateur d’allègements financiers (EAF)

L’Explorateur d’allègements financiers : un outil pour connaître les mesures d’aide et d’allègement liées à la COVID-19 dont vos clients pourraient bénéficier En réponse à la pandémie de COVID-19 et en raison de la complexité des mesures d’aide et d’allègement offertes à la population canadienne, nous avons créé l’Explorateur d’allègements financiers (EAF), un outil en ligne qui aide les gens vulnérables au Canada et ceux qui les accompagnent à accéder aux mesures d’aide d’urgence et d’allègement financier proposées par les gouvernements, les établissements financiers, les fournisseurs de services de télécommunication, de services publics et de services Internet. Soyez des nôtres pour assister à notre webinaire d’une heure animé par Elodie Young, de Prospérité Canada, qui vous présentera l’EAF et vous donnera des conseils sur la manière d’aider vos clients à accéder aux mesures d’aide et d’allègement financier. Que vous travailliez dans le secteur de la salubrité des aliments, de la santé mentale, de l'autonomisation financière, de l’établissement ou encore dans le secteur privé, venez apprendre comment aider vos clients à augmenter leur revenu et à réduire leurs dépenses pendant la crise. Ce webinaire concerne tous les fournisseurs de services de première ligne qui gagnent un faible revenu et les populations vulnérables du Canada.

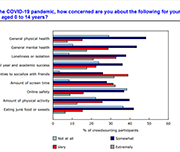

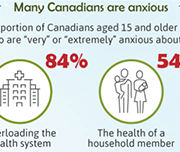

Understanding the perceived mental health of Canadians during the COVID-19 pandemic

While the physical health implications of the COVID‑19 pandemic are regularly publicly available, the mental health toll on Canadians is unknown. This article examines the self-perceived mental health of Canadians during the COVID‑19 pandemic and explores associations with various concerns after accounting for socioeconomic and health factors. Just over half of Canadians aged 15 and older (54%) reported excellent or very good mental health during the COVID‑19 pandemic. Several concerns were also associated with mental health. Notably, after considering the effects of socioeconomic and health characteristics, women, youth, individuals with a physical health condition and those who were very or extremely concerned with family stress from confinement were less likely to report excellent or very good mental health.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar

Introducing the Financial Relief Navigator (FRN)

Access the Financial Relief Navigator here.

Time-stamps for the video recording:

3:22 – Agenda and Introductions

6:00 – Audience poll

9:00 – Why we created the Financial Relief Navigator (Speaker: Janet Flynn)

11:55 – What’s in the Financial Relief Navigator (Speaker: Janet Flynn)

16:35 – FRN Walkthrough using a Persona (Speaker: Galen McLusky)

33:15 – Tips for using the FRN (Speaker: Galen McLusky)

36:00 – The Working Centre experience using the FRN (Speaker: Sue Collison)

41:15 – Q&A

COVID-19 and support for seniors: Do seniors have people they can depend on during difficult times?

In an effort to avoid the spread of COVID-19, Canadians are engaging in physical distancing to minimize their social contact with others. However, social support systems continue to play an important role during this time. In particular, seniors living in private households may depend on family, friends or neighbours to deliver groceries, medication and other essential items to their homes. This study examines the level of social support reported by seniors living in private households.

Infographic: The impact of COVID-19 on the Canadian labour market