Making the most of your money

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share or use with your clients to help them access tools and resources to support their daily money management. Making the most of your money is an easy-to-use, accessible, online course to help people living on a low income organize their finances and explore ways to increase the amount of money coming in and reduce what is going out. This interactive course has activities, videos, handouts and resources that are also downloadable.

5 benefits of paying down debt with your tax refund

The average Canadian tax return amount in 2023 is $2,072 and that money can go a long way when it comes to meeting your financial goals. But remember, this isn’t a cash windfall; it’s YOUR money that the government borrowed from you, so Credit Canada recommends using it for needs versus wants. More specifically, consider using it to help pay down your debt.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

Navigating Finances: Paying Down Debt vs. Investing, CIRO

Loan and Trust, FSRA

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

Managing your money in a changing world

Managing your finances means finding the right balance. Inflation and higher interest rates signal that you may need to adjust your budget to find the right balance between daily spending and paying down debt. The right balance will depend on your financial situation and goals. This selection of tools from the FCAC provides information and tips on: How to manage your money when interest rates rise Make a plan to pay off your debt

Managing debt

Managing debt doesn't have to be overwhelming. These tips and tools from the Ontario Securities commission can help you borrow wisely and pay off debt more quickly.

Accessible financial services incubator

Drive through a low-income neighborhood in virtually any American city and it quickly becomes apparent that the area’s financial health is at risk. The giveaway? The abundance of payday lenders. According to the St. Louis Federal Reserve, there are now more than 20,000 of these organizations across the country—which tops even the ubiquitous McDonald’s storefront by roughly 40%.1 These alternative financial services providers offer short-term loans at interest rates that can top 400%. They appeal to desperate consumers with no access to traditional, more affordable credit and offer an immediate fix that can lead to months, if not years, of financial pain. In its Payday Lending in America series, the Pew Charitable Trusts reports that Americans spend roughly $7.4 billion (B) on payday loans each year. Could traditional financial institutions find a way to deliver credit to this consumer niche without compromising their own health? The Filene Research Institute, a consumer finance think-and-do tank, hypothesized that the answer was yes. Read the full report.

Pilot study: Buy now, pay later services in Canada

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have resulted in a steady increase in retail e-commerce sales over the past several years, and the COVID-19 pandemic has had a significant impact on how consumers make retail purchases. Retail e-commerce sales reached record levels during the pandemic. This has further contributed to the proliferation of buy now, pay later (BNPL) services in Canada.

Empower U Financial Coaching

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and asset building intervention (although partners also contribute to the other interventions). The Sustainable Livelihood Model identifies five distinct sets of assets including personal, human, social, physical and financial. The Empower U program activities are grounded by two overarching philosophies: Financial Empowerment (as defined by Prosper Canada) and the Sustainable Livelihood Model (adapted by the Canadian Women’s Foundation, based on the work of the University of Sussex Institute for Development Studies). Focusing on financial literacy and coaching, Empower U has developed an individual financial coaching component to the overall program.

Debt consolidation calculator

Debt Consolidation is the process of combining multiple debts into one. Use this calculator to calculate what your new monthly payments would be, how soon you could be debt free, and how much your total interest amount would be when you consolidate your debts.

8 ways to prepare financially for retirement

This article from OSC provides 8 tips to help you plan for retirement. Transitioning from working life to retirement takes careful financial planning and decision-making – give yourself plenty of time to prepare. Here are some things you can do ahead of time.

Pay down debt or invest tool

If you have extra money, this calculator helps you decide whether to invest or pay off debt.

Debt got you down?

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling financially. Take a short “Yes” or “No” quiz to find out if you need support managing money and debt. See how you compare with other quiz respondents.

Debt Relief Options in Canada – Long Term Outcome Comparison

This research report compares the long-term financial outcomes of Canadians, based on a study comparing consumers who used a debt management program (DMP), bankruptcy (BK), or a consumer proposal (CP) to obtain relief from debt.

Budgeting resources webinar

This webinar hosted by Credit Canada features guest expert Prosper Canada's Manager of Learning and Training, Glenna Harris. She shares some of their tried-and-true resources to help get people started on budgeting and debt management. She also provides a new tool - Financial Relief Navigator - that can help connect people with income supports they might be eligible for.

Debt settlement and financial recovery companies: too risky an option?

This report presents a study of the debt settlement and financial recovery industry and examines Canadian consumer issues from these services. Data is gathered from company websites and contracts as well as customer surveys and questionnaires completed by governmental and non-governmental organizations. A comparative study of legislation applicable to the industry is also conducted.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Financial Health Index: 2019 Findings and 3-Year Trends Report

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from 2017 to 2019.

Using Research to Improve the Financial Well-being of Canadians: Post-symposium Report

The Financial Consumer Agency of Canada (FCAC) co-hosted the 2018 National Research Symposium on Financial Literacy on November 26 and 27, 2018 at the University of Toronto, in partnership with Behavioural Economics in Action at Rotman (BEAR). This report presents the key ideas and takeaways from the event, while shining a light on the research shaping new solutions designed to enhance financial well-being in Canada and around the world.

2018 White Paper: Financial Wellbeing Remains Challenged in Canada

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income variability and the extent to which Canadians have access to and lever their social capital (i.e. their family and friends who can provide financial advice and/or support in times of hardship). The study also explores consumer financial product and service usage, debt management and debt stress, access to financial products, services, advice and tools, usage of more predatory financial services (e.g. payday lending) and perceived levels of support by consumers’ primary Financial Institution for their financial wellness. The study also provides benefits of improved support for financial providers improving the financial wellness of their customers – including from a banking share of wallet and brand perspective.

Resources

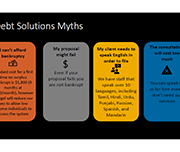

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Access the handouts for this webinar:

How we help people – An overview (Webinar handout) – Credit Counselling Society

Our services (Webinar handout) – Credit Counselling Society

Debt solutions 101 (Webinar handout) – msi Spergel Inc

Time-stamps for the video-recording:

4:13 – Agenda and introductions

7:00 – Audience polls

12:31 – Debt in Canada (Speaker: Glenna Harris)

15:20 – Credit Counselling Society on debt management plans (Speaker: Anne Arbour)

34:05 – Spergel Msi on Consumer Proposals and Bankruptcy plans (Speaker: Gillian Goldblatt)

56:00 – Q&A

Handout 8-4: Steps to debt repayment

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Steps for debt repayment. To view full Financial Literacy Facilitator Resources, click here.