Financial wellness guide: questionnaire

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial goals.

The mastering money podcast

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help prepare you for retirement and give you the tools to get there, no matter your age. Season 5 of the Mastering Money podcast unpacks the hard financial conversations you need to be having with your kids, partners, financial planners and more. Season 4 of the Mastering Money podcast explores the role money plays in the lives of women from all walks of life, now and in the future. Season 3 of the Mastering Money podcast looks at the difficult financial decisions Canadians are making during the ongoing COVID-19 pandemic. Season 2 of the podcast takes listeners on a journey across various financial literacy hot topics and trends. These include how to fit financial literacy into existing programs, the financial health of future generations as well what it takes to take the plunge and start your own business. In this introductory season of the podcast, hear from financial educators on topics such as behavioral economics, the emotions of money, financial wellness, and more.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

English

Soaring with savings - Tips and tools to help you save

SWS Worksheet #1 – The importance of saving (Fillable PDF)

SWS Worksheet #2 – Create a savings goal (Fillable PDF)

SWS Worksheet #3 – Savings support network (Fillable PDF)

SWS Worksheet #4 – Saving for emergencies (Fillable PDF)

SWS Worksheet #5 – Saving for unstable income (Fillable PDF)

SWS Worksheet #6 – Saving for education (Fillable PDF)

SWS Worksheet #7 – Saving for retirement (Fillable PDF)

Soaring with Savings- Full booklet

Soaring with savings - Training tools

French

Encourager l’épargne - Conseils et outils pour vous aider à épargner

Encourager l’épargne - l’aide d’animation

Ressources

CELI calculatrice, La Commission des valeurs mobilières de l’Ontario

REER, La Commission des valeurs mobilières de l’Ontario

Épargnez plus facilement, CVMO

Investir et épargner pendant une récession, La Commission des valeurs mobilières de l’Ontario

Income in retirement: Expectations versus reality

In 2014, a group of non-retired Canadians aged 55 or older was asked about their financial expectations for retirement. New data from 2020 reveal how this same group of Canadians - now retired- is doing financially.

Registered Retirement Savings Plan (RRSP)

A Registered Retirement Savings Plan (RRSP) can help you save for retirement while also saving at tax time — or even getting a rebate. The articles from the Ontario Securities Commission (OSC) can help you understand more about opening, contributing to, and withdrawing from an RRSP.

Retirement savings course

The Association of Canadian Pension Management (ACPM) launched its new Retirement Savings Course to empower Canadians wishing to learn the basics of retirement savings and to foster awareness of the importance of retirement income savings at any age. Course highlights: The free course will provide you an overview of the building blocks of retirement savings and insight into the role that government pensions and workplace pension plans may have for your future or that of those you care about.

Financial literacy self-assessment quiz

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other Canadians.

Investment knowledge quiz

Most people know a little about investing, but they need to know more to be able to manage their investments to meet their goals. Try this quiz by the FCAC to see if your knowledge is basic or more advanced.

Investment products

There are many investment products, here's some information about them: Annuities: a contract with a life insurance company. Annuities are most commonly used to generate retirement income. Bonds: when you buy a bond, you’re lending your money to a company or a government for a set period of time. In return, the issuer pays you interest. On the date the bond becomes due, the issuer is supposed to pay back the face value of the bond to you in full. Complex investments: these investments may have the potential for higher gains, but carry greater risks. ETFs: when you buy a share or unit of an ETF, you’re investing in a portfolio that holds a number of different stocks or other investments. GICs: when you buy a guaranteed investment certificate (GIC), you are agreeing to lend the bank or financial institution your money for a set number of months or years. You are guaranteed to get the amount you deposited back at the end of the term. Mutual funds & segregated funds: when you buy a mutual fund, your money is combined with the money from other investors, and allows you to buy part of a pool of investments. Real estate: While real estate investments can offer a range of benefits, there is no guarantee that you will earn an income or profit and, like any investment, there are a number of risks and uncertainties that you need to carefully consider before investing. Stocks: The stock market brings together people who want to sell stock with those who want to buy stock. When you buy stock (or equity) in a company, you receive a piece of the company and become a part owner. Pensions & saving plans: if your employer offers contributions to your retirement or other savings plan, take advantage. Cannabis: Emerging sectors like the cannabis industry have often attracted investors hoping to be among the first to capitalize on the potential growth and high returns of what they believe are untapped markets or products that may be popular in the future. Cryptoassets: Cryptoassets primarily designed to be a store of value or medium of exchange (e.g., Bitcoin) are often referred to as “digital coins.

2022 Canadian Retirement Survey

The key takeaways from the 2022 Canadian Retirement Survey are: Read the full presentation conducted for Healthcare of Ontario Pension Plan.

8 ways to prepare financially for retirement

This article from OSC provides 8 tips to help you plan for retirement. Transitioning from working life to retirement takes careful financial planning and decision-making – give yourself plenty of time to prepare. Here are some things you can do ahead of time.

Let’s talk money- seniors edition

With a little preparation, talking about financial matters can help build trust, deepen connections, relieve stress and lead to greater peace of mind. Yet for many people, these conversations can be difficult. In some families, money is just not something you talk about. The same applies to wills, inheritances, senior living, end-of-life care and many more topics that matter most to seniors. Let's Talk About Money: Seniors' Edition -- wants to help you change that. There are tips to help parents talk with adult children and tips for adult children to have meaningful money conversations their parents. The most important thing is to have these conversations early, before there’s a crisis. So let's start talking.Open, honest conversations about money are one of the keys to building a healthy relationship with your family, across the generations.

Retirement budget worksheet

Good financial planning starts with knowing what you spend. Try out this budget worksheet, prepared by the Ontario Securities Commission, to see the difference in your costs before you retire and after you stop working.

Living your retirement

These resources from the Ontario Securities Commission are oriented towards planning for retirement. Resources include tips on insurance planning, government benefits, RRSP calculator, and more.

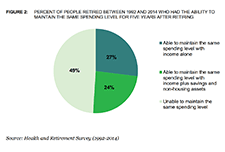

Retirement Security and Financial Decision-making: Research Brief

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level of spending for at least five consecutive years after retiring. The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring. In addition, the Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years. The study helps identify ways to protect retirees from overspending their savings in early retirement.

Financial Life Stages of Older Canadians

This study, commissioned by the Ontario Securities Commission (OSC) and conducted by the Brondesbury Group, provides some insights on the knowledge that older Canadians have about the financial realities of retirement and how they would apply that knowledge earlier in life if they are able to do so. The top financial concerns and main financial risks of older Canadians are identified for each life stage and how they are being managed are discussed.

Encouraging Retirement Planning through Behavioural Insights

This research report identifies behaviourally informed ways that government, regulators, employers, and financial institutions can encourage retirement planning. Thirty different initiatives and tactics that could be implemented by a variety of stakeholders to encourage retirement planning are proposed, and interventions are organized around four primary challenges people face in moving from having the intention to create a retirement plan to the action of making a plan: (1) it’s hard to start, (2) it’s easy to put off, (3) it’s easy to get overwhelmed and drop out, and (4) it’s hard to get the right advice. The report also includes the results of a randomized experiment that evaluated several of the approaches proposed in the report. This report was published as part of the Ontario Securities Commission’s strategy and action plan to respond to the needs and priorities of Ontario seniors.

Low Income Retirement Planning

This booklet contains information on retirement planning on a low income. Topics include four things to think about for low income retirement planning, a background paper on maximizing the Guaranteed Income Supplement (GIS), and determining Old Age Security (OAS) and GIS eligibility for people who come to Canada as adults.

A workplace-based economic response to COVID-19

This brief emerged from a conversation, held in late March 2020, among a number of individuals and organizations who work on issues of household financial security. Employers with financial resources and governments have an opportunity to use the workplace as a significant channel to deliver financial relief as part of the economic response to COVID-19, complementing critical supports governments are providing to individuals and businesses.

Retirement Literacy Website

The ACPM Retirement Literacy Program complements the financial literacy education efforts by the federal and provincial governments, and other organizations. The website contains a series of quizzes to help improve your knowledge of pensions and retirement savings plans as well as links to financial literacy resources.

Results from the 2016 Census: Examining the effect of public pension benefits on the low income of senior immigrants

This is a study released by Insights on Canadian Society based on 2016 Census data. Census information on immigration and income is used to better understand the factors associated with low income among senior immigrants. This study examines the factors associated with the low-income rate of senior immigrants, with a focus on access to Old Age Security (OAS) and Guaranteed Income Supplement (GIS) benefits.

Canadians and their money: Key findings from the 2019 Canadian Financial Capability Survey

This report provides results from the 2019 Canadian Financial Capability Survey (CFCS). It offers a first look at what Canadians are doing to take charge of their finances by budgeting, planning and saving for the future, and paying down debt. While the findings show that many Canadians are acting to improve their financial literacy and financial well-being, there are also emerging signs of financial stress for some Canadians. For example, about one third of Canadians feel they have too much debt, and a growing number are having trouble making bill, rent/mortgage and other payments on time. Over the past 5 years, about 4 in 10 Canadians found ways to increase their financial knowledge, skills and confidence. They used a wide range of methods, such as reading books or other printed material on financial issues, using online resources, and pursuing financial education through work, school or community programs. Findings from the survey support evidence that financial literacy, resources and tools are helping Canadians manage their money. For example, those who have a budget have greater financial well-being based on a number of indicators, such as managing cashflow, making bill payments and paying down debt. Further, those with a

financial plan to save are more likely to feel better prepared and more confident about their retirement.

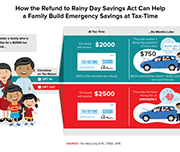

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Fact File: Women Lack Sufficient Wealth to Achieve Economic Stability

Women own, on average, only 32 cents for every $1 owned by a man in America. Women of color have even less. Both the gender wage gap and the gender wealth gap need to be taken into account to address threats to women's economic security.

The Effects of Education on Canadians’ Retirement Savings Behaviour

This paper assesses the extent to which education level affects how Canadians save and accumulate wealth for retirement. Data from administrative income-tax records and responses from the 1991 and 2006 censuses of Canada show that individuals with more schooling are more likely to contribute to a tax-preferred savings account and have higher saving rates, have higher home values, and are less likely to rent housing.

Retirement 20/20: The 2019 Fidelity Retirement Survey

The Fidelity Retirement Survey is focused on how Canadians near, and already in, retirement approach the next stage of their lives. This is the 14th year of the survey. The results indicate Canadians are retiring earlier than expected. They also show 46% of pre-retirees expect to have some long-term debt when they retire, and that 70% believe they will be working in retirement, among other results.

Video: Additional CPP

This short video from the Canadian Pension Plan Investment Board explains the new additional Canada Pension Plan (CPP).

Evaluation of the Guaranteed Income Supplement

The Old Age Security program is the largest statutory program of the Government of Canada, and consists of the Old Age Security pension, the Guaranteed Income Supplement, and the Allowance. The Guaranteed Income Supplement is provided to low-income seniors aged 65 years and over who receive the Old Age Security pension and are below a low-income cut-off level. This evaluation examines take-up of the Guaranteed Income Supplement by various socioeconomic groups, the characteristics of those who are eligible for the Supplement but do not receive it, and barriers faced by vulnerable groups.

Are Low-Income Savers Still in the Lurch? TFSAs at 10 Years

The introduction of Tax-Free Savings Accounts (TFSAs) in 2009 transformed how Canadians save. One of the main reasons for creating TFSAs was to provide a taxassisted savings instrument for low-income Canadians to enable them to improve their retirement income. Now, 10 years later, many low-income savers are still not using TFSAs in ways that would allow them to benefit fully from the government transfer programs intended for them in retirement, such as the Guaranteed Income Supplement. Consequently, intended benefits from TFSAs are going untapped. Improving public education and financial literacy may be part of the solution to this problem, but built-in policy nudges and tax adjustments will be more effective.

RRSP Savings Calculator

Use this tool by the OSC to estimate how much your registered retirement savings plan (RRSP) will be worth at retirement and how much income it will provide each year.

TFSA Calculator

This calculator will help you estimate the value of the investments in your TFSA when you’re ready to withdraw them, and compare this amount to the value of your investments in a non-registered plan to see your overall estimated tax savings.

National Investor Research Study

This presentation shows the results of a quantitative study undertaken by the Ontario Securities Commission to assess attitudes, behaviour and knowledge among Canadians pertaining to a variety of investment topics. These topics include retirement planning and conversations about finances.

Strengthening retirement security for low- and moderate-income workers

In this video presentation Johnathan Weisstub from Common Wealth discusses recent improvements in senior Canadians' poverty levels due to benefits such as OAS and GIS, and the challenges that still remain in ensuring retirement security for modest-earning and low-income Canadians. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Unfinished Business Pension Reform in Canada

Since taking office in the fall of 2015, the Liberal government has made important changes to the publicly administered components of Canada’s retirement income system (RIS). It has restored the age of eligibility for benefits under Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) to 65, it has increased the top-up on GIS benefits for single elderly persons, and it has agreed with the provinces to enhance Canada Pension Plan (CPP) benefits, starting in 2019.

Each of these changes, on its own, contributes to one of the two main objectives of the RIS: to minimize the people’s risk of poverty in old age and to enhance their ability to retain their standard of living as they move from employment to retirement. However, as Bob Baldwin and Richard Shillington show in this study, when examined together, the changes are problematic and incomplete.