Resources and Tools

Managing the cost of goods and paying bills

Budgeting resources

Five different budgeting methods – Prosper Canada

Cash flow budget template – PDF – Prosper Canada

Cash flow budget template – fillable PDF – Prosper Canada

Simple budget template – PDF – Prosper Canada

Simple budget template – fillable PDF – Prosper Canada

Ten ways to trim expenses – Prosper Canada

Ways to save at the grocery store – Prosper Canada

5 budgeting app ideas – Prosper Canada

Tracking spending/bills

Expenses tracking sheet – PDF – Prosper Canada

Expenses tracking sheet – fillable PDF – Prosper Canada

Tracking fluctuating expenses – Prosper Canada

Prioritizing Bills tool – Consumer Financial Protection Bureau (CFPB)

Spending tracker tool – CFPB

Cutting expenses tool – CFPB

Online budgeting tools

Budget Planner (free) – Financial Consumer Agency of Canada (FCAC)

Budget Calculator Spreadsheet (downloadable Excel sheet) – MyMoneyCoach.ca

Spending Habits Calculator – GetSmarterAboutMoney.ca

Personal Budgeting Course (no cost) – Momentum

Debt

Action planning

Steps to debt repayment – Prosper Canada

Determining debt payoff order – Prosper Canada

Dealing with debt– Prosper Canada

Making a plan to be debt free– Government of Canada

The 4 cornerstones of debt reduction strategies & budgeting– Credit Counselling Society

Getting out of debt– Credit Counselling Society

Information for consumers on the insolvency process– Office of the Superintendent of Bankruptcy (available in multiple languages)

More resources

Options you can trust to help with your debt – Office of the Superintendent of Bankruptcy

1:1 debt counselling – Credit Counselling Canada

Sample letters to creditors – Credit Counselling Society

Ways to build or rebuild credit and manage debt course (no cost) – Momentum

How to improve your credit score: proven steps to success – Credit Canada

Housing and homelessness

Listing of agencies across Canada that may be able to help – The Canadian Alliance to End Homelessness

211 – United Way Canada

Subsidized housing in ON – Ontario Non-profit Housing Association

Benefits for housing

Housing benefits – Government of Canada

Benefits wayfinder – Prosper Canada

Factsheet: Housing insecure individuals – Government of Canada

Resources for renters

Your rights when being evicted for renovations – Community Legal Education Ontario (CLEO)

Resources for renters facing eviction – Centre for Equality Rights in Accommodation

Moving checklist – Community Legal Education Ontario (CLEO)

Ontario Renters’ guide – Community Legal Education Ontario (CLEO)

How to negotiate a repayment plan with your landlord – Community Legal Education Ontario (CLEO)

Know your rights: eviction prevention – Canadian Centre for Housing Rights

Know your rights: rental housing basics – Canadian Centre for Housing Rights

Know your rights: record keeping for tenants – Canadian Centre for Housing Rights

Rent-Geared-to-Income Subsidy – City of Toronto

An infographic that explains when rent increases are legal – CLEO

A guide that explains when landlords can apply for an above guideline rent increase (AGI), how to prepare for a hearing to fight an AGI, and what happens after the hearing – CLEO

Resources for specific groups

Housing options for seniors – Government of Canada

Toolkit for medical professionals in ON writing disability accommodation letters – Canadian Centre for Housing Rights

Friendship Centres for Indigenous people – National Association of Friendship Centres

Support services for victims of abuse – New Brunswick Government

Housing for youth – 360º (York Region)

Support for young mothers– Albion Centre (Toronto)

Newcomer Information Centre Online– Achēv

Shelters

Housing and shelters – Salvation Army (Canada)

Disaster relief help – Canadian Red Cross (Canada)

Emergency and short-term housing in Ontario – Ontario Council of Agencies Serving Immigrants (Ontario)

For women facing domestic abuse – Shelter Safe (Canada)

Survivors of domestic violence – CAMH (Toronto)

Shelters – CAMH (Toronto)

Shelters for youth – Rest Centres (Peel Region)

Food insecurity

Access to food

Find a food bank – Food Banks Canada

Regional food banks – Website Planet

Meals on wheels – Ontario Community Support Association

211 – United Way Canada

Drop-in meal resource list for Toronto – Toronto Drop-in Network

Food exchange – Quest Vancouver

Good food organizations – Community Food Centres Canada

Akwe:go – Wasa-Nabin Student Nutrition Program – Ontario Federation of Indigenous Friendship Centres

Friendship Centres for Indigenous people – Ontario Federation of Indigenous Friendship Centres

Understanding food insecurity

Tool for older adults: rate your eating habits! – Older Adult Nutrition Screening

Poverty Screening (Food Insecurity) – Canadian Nutrition Society

Ressources et outils

Gérer le coût des biens et les dépenses

Ressources pour établir un budget

5 façons différentes de faire un budget – Prospérité Canada

Budget de caisse – Prospérité Canada

Modèle de budget simple – Prospérité Canada

10 façons de réduire ses dépenses – Prospérité Canada

Moyens pour économiser à l’épicerie – Prospérité Canada

Suivre les dépenses/le paiement des factures

Fichier de suivi des dépenses – Prospérité Canada

Suivi des dépenses variables – Prospérité Canada

Outils d’établissement de budget en ligne

Planificateur budgétaire – Agence de la consommation en matière financière du Canada (ACFC)

Budget mensuel – Commission des valeurs mobilières de l’Ontario

Calculateur des Habitudes de Consommation – GerezMieuxVotreArgent.ca

Vidéos d’apprentissage en ligne — Notions de base sur les finances – Agence de la consommation en matière financière du Canada (ACFC)

Consultation budgétaire – Espace Finances

Dette

Planification des mesures

Les étapes pour rembourser des dettes– Prospérité Canada

Une dette envers qui? – Prospérité Canada

Gestion de la dette : Livret complet– Prospérité Canada

Faire un plan pour gérer vos dettes– Gouvernement du Canada

Croulez-vous sous les dettes? Information sur la procédure d’insolvabilité à l’intention des consommateurs– Bureau du surintendant des faillites

Autres ressources

Des options fiables pour vous aider avec vos dettes – Bureau du surintendant des faillites

Conseil en crédit – Conseil en crédit du Canada

Exemples de lettres aux créanciers – Conseil en crédit du Canada (disponible seulement en anglais)

Emprunter de l’argent- cours (gratuit) – Plateforme de compétences ABC

Qu’est-ce qu’un pointage de crédit?– TransUnion

Associations de consommateurs de Québec – toutbiencalcule.ca

Logement et itinérance

Recherche d’aide – Alliance canadienne pour mettre fin à l’itinérance

211 – Centreaide United Way

Logement subventionné en Ontario – Association du logement sans but lucratif de l’Ontario (disponible seulement en anglais)

Prestations pour le logement

Prestations relatives au logement – Gouvernement du Canada

Orienteur en mesures d’aide – Prospérité Canada

Personnes en situation de logement précaire – Gouvernement du Canada

Accès au logement – Centre Francophone du Grand Toronto

Répertoire des ressources en hébergement communcautaire et en logement social avec soutien communautaire, Réseau d’aide aux personnes seules et itinérantes de Montréal

Ressources pour les locataires

Être expulsé de son logement en raison de rénovations – Éducation juridique communautaire Ontario

Comment s’opposer à une expulsion – Éducation juridique communautaire Ontario

Louer un logement – Éducation juridique communautaire Ontario

Comment négocier un plan de remboursement avec votre locateur – Centre ontarien de défense des droits des locataires

Votre propriétaire veut-il que vous déménagiez? – Éducation juridique communautaire Ontario

Droit du logement (vidéos) – Éducation juridique communautaire Ontario

Entretien et réparations – Éducation juridique communautaire Ontario

Déménager : Donner un préavis – Éducation juridique communautaire Ontario

Logements à loyer indexés sur le revenu – Ville de Toronto

Les comités logement et associations de locataires du Québec – Regroupement des comités logement et associations de locataires du Québec (RCLALQ) Comités logement – Le Front d’action populaire en réaménagement urbain (FRAPRU)

Ressources pour des groupes particuliers

Coût des résidences pour les aînés – Gouvernement du Canada

Trousse d’outils pour les professionnels de la santé sur la rédaction de lettres concernant des mesures d’adaptation pour une personne en situation de handicap – Centre canadien pour le droit au logement (disponible seulement en anglais)

Association nationale des centres d’amitié – L’Association nationale des centres d’amitié

Services de soutien pour les victimes de violence – Gouvernement du Nouveau-Brunswick

Logement pour les jeunes – 360º (Région de York)

Soutien aux jeunes mères– Centre Albion (Toronto)

Maison d’amitié– Maison d’amitié (Ottawa)

Refuges

Services d’hébergement – l’Armée du Salut (Canada)

Aide aux personnes sinistrées – La Croix-Rouge canadienne (Canada)

Logement d’urgence et à court terme en Ontario – Ontario Council of Agencies Serving Immigrants (disponible seulement en anglais)

Pour les femmes victimes de violence – Hebergementfemmes.ca (Canada)

Survivants de violence familiale – Centre de toxicomanie et de santé mentale, Toronto (disponible seulement en anglais)

Insécurité alimentaire

Accès à la nourriture

Trouver une banque alimentaire – Banques alimentaires de Canada

La Popote roulante – Croix-Rouge canadienne

211 – Centraide United Way

Organisations pour la bonne nourriture – Centres communautaires d’alimentation du Canada

Banques alimentaires – Banques alimentaires de Québec

Dépannage alimentaire – Macommunaute.ca

Comprendre l’insécurité alimentaire

Évaluez vos habitudes alimentaires ! – Vérification de l’alimentation des adultes plus âgés

Dépistage de la pauvreté (insécurité alimentaire) – Société canadienne de nutrition

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the Overview of Financial vulnerability of Low-Income Canadians: A Rising Tide

Time-stamps for the video recording:

00:00 – Start

6:05 – Agenda and Introductions

8:24 – Overview of Financial vulnerability, of low-income Canadians: A rising tide (Speaker: Eloise Duncan)

25:40 – Panel discussion: how increasing financial vulnerability is playing out in community and how policy makers should respond.

45:35 – Q&A

Advancing equity: the power and promise of credit building

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that anyone has access to credit and can build economic security, wealth, and intergenerational transfer. This brief will analyze what is not working within our credit system and identify what philanthropy can do to reimagine a system that builds economic security and mobility for everyone, especially people of color and immigrants. An equitable credit system would create pathways to narrow the racial wealth gap instead of continuing to widen it. Solutions include nonprofit organizations and community A webinar is also available and you can view the webinar slides here.

development financial institutions (CDFIs) delivering financial products that are designed for the people who have been most excluded from the credit system, seeding their journey toward economic security, as well as systemic changes to make economic security and mobility more fairly attainable.

2022 Canadian Retirement Survey

The key takeaways from the 2022 Canadian Retirement Survey are: Read the full presentation conducted for Healthcare of Ontario Pension Plan.

Financial Coaching Initiative: Results and Lessons Learned

In 2015, the Consumer Financial Protection Bureau launched the Financial Coaching Initiative, a pilot program that provided financial coaching services to veterans and economically vulnerable consumers. Professional coaches were embedded into 60 host sites across the country, where they provided free, one-on-one help to consumers to address their personal financial goals. A range of organizations served as host sites, such as one-stop career centers, social services organizations, and legal aid groups. Over four years, the Financial Coaching Initiative served over 23,000 consumers, demonstrating that financial coaching can be successfully implemented at scale in many different settings for a wide range of consumers. This report and summary brief describe the basic structure of the Initiative, present data about the program’s results, and summarize key lessons learned for practitioners and organizations interested in coaching.

The Comeback Generation: Pandemic is inspiring Gen Z to build financial resilience

The coronavirus pandemic has tested the limits of Canadians over the past 20 months. What began as a health crisis quickly morphed into an economic crisis, with the spread of COVID‑19 shocking large segments of the economy and leaving many without paycheques. While no generation has been unaffected by the pandemic, the economic impact was distributed unevenly. Many younger Canadians in Generation Z, or Gen Z, have had their education disrupted, career plans changed, and financial prospects diminished largely because they are overrepresented in the highly affected service sector, according to a new survey by the Canadian Bankers Association (CBA). The survey was published to mark Financial Literacy Month, which takes place each November, and found that more than half (53 per cent) of Gen Z respondents (aged 18‑25) felt the pandemic upended their financial security, with that number rising to 73 per cent for those in less stable financial situations. At the same time, nine‑in‑ten (88 per cent) Gen Zers are feeling optimistic about their financial futures, and nearly all of them (98 per cent) are actively making plans to strengthen their financial resilience. "Gen Z was dealt a disproportionately tough hand during the pandemic, but it has also shown incredible resilience in channeling its natural gifts for perseverance, adaptability and motivation," says Neil Parmenter, President and CEO, Canadian Bankers Association. "Despite the setbacks, younger Canadians are eager to forge ahead, be prepared for the unexpected and build bright futures as our economy recovers."

Make Change that Counts: National Financial Literacy Strategy 2021-2026

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in meaningful ways. The National Strategy is focused on how financial literacy stakeholders can reduce barriers, catalyze action, and work together, to collectively help Canadians build financial resilience.

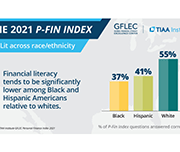

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index)

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) measures knowledge and understanding that enable sound financial decision making and effective management of personal finances among U.S. adults. The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with Greenwald & Associates. It is unique in its breadth of questions and its coverage of the topics that measure financial literacy. The index is based on responses to 28 questions across eight functional areas: earning, consuming, saving, investing, borrowing/managing debt, insuring, comprehending risk, and go-to information sources.

Creating Change: Momentum’s Contribution to High-Cost Credit Reform in Alberta

As part of Momentum’s systems change planning process that was grounded in both participant and community experience, the issue of payday loans and other forms of high-cost credit (e.g., pawn, installment, rent-to-own, title and car loans) emerged as a priority issue for Momentum to address the financial barriers for people living on low incomes to exit poverty and build sustainable livelihoods.

To evaluate its work for high-cost credit reform in Calgary and Alberta in the period of 2012 to 2019, an outcome harvest was conducted. This evaluation reflects the collective efforts of multiple partners, identifies outcomes achieved as well as Momentum’s contribution to these outcomes.

Housing insecurity and the COVID-19 pandemic

CFPB released their first analysis of the impacts of the COVID-19 pandemic on housing in the United States. Actions taken by both the public and private sector have, so far, prevented many families from losing their homes during the height of the public health crisis. However, as legal protections expire in the months ahead, over 11 million families — nearly 10 percent of U.S. households — are at risk of eviction and foreclosure.

Cross Canada Check-up (updated March 2021)

Canada ranks consistently as one of the best places to live in the world and one of the wealthiest. When it comes to looking at the financial health of Canadian households, however, we are often forced to rely on incomplete measures, like income alone, or aggregate national statistics that tell us little about the distribution of financial health and vulnerability in our neighbourhoods, communities or provinces/territories. The purpose of this report is to examine the financial heath and vulnerability of Canadian households in different provinces and territories using a new composite index of household financial health, the Neighbourhood Financial Health Index or NFHI.

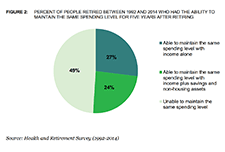

Retirement Security and Financial Decision-making: Research Brief

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level of spending for at least five consecutive years after retiring. The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring. In addition, the Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years. The study helps identify ways to protect retirees from overspending their savings in early retirement.

Cash Value: How The Financial Clinic Puts Money into the Pockets of Working Poor Families

Practitioners engaged in the nascent field of financial development lack a shared system of tracking and analyzing customer progress toward financial security. Practice leaders—ranging from direct service organizations such as the Chicago-based LISC to NeighborWorks America of Washington, D.C.—define customer progress by their individual outcomes frameworks. But without uniform outcomes measures to assess our customers’ progress—and thus, our own performance—the field as a whole is handicapped. Many factors contribute to this problem, two being most prominent: organizations are grounded in distinct theories of change, are funded by a variety of sources with their own expectations, and lack of clarity about how to measure aspects of our work.

The Pivotal Role of Human Service Practitioners in Building Financial Capability

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American experience—is one that far too often ensnares people at the insecurity stage, particularly those communities or neighborhoods that have historically been marginalized and deliberately excluded from the traditional pathway towards prosperity. Fraught with debt and credit crises, alongside a myriad of predatory products and lending practices, to a sense of stigma and shame many Americans feel because of their economic status, financial insecurity involves navigating a world on a daily basis where everyday needs are at the mercy of unjust and uncontrollable variables.

CPA Canada 2020 Canadian Finance Study

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these unprecedented times. Nielsen conducted the CPA Canada 2020 Canadian Finance Study via an online questionnaire, from September 4 to 16, 2020 with 2,008 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. Among the key pandemic-related findings:

Inter-generational comparisons of household economic well-being, 1999 to 2019

This study of data from the Distributions of Household Economic Accounts compares households' economic well-being from a macro-economic accounts perspective, as measured by net saving and net worth for each generation when the major income earner for a household in one generation reached the same point in the life cycle as the major income earner for a household in another generation. The study finds that while younger generations have higher disposable income and higher consumption expenditure than older generations when they reached the same age, their net saving is relatively similar. As well, younger generations' economic well-being may be more at risk due to the COVID-19 pandemic since they depend more on employment as a primary source of income, they have higher debt relative to income, and they have less equity in financial and real estate assets from which to draw upon when needed.

Financial Literacy Month – 10th anniversary Resources

For the 10th anniversary of Financial Literacy Month in Canada, Financial Consumer Agency of Canada (FCAC) has released resources to help Canadians learn how to manage their finances in challenging times. Resources include the following topics:

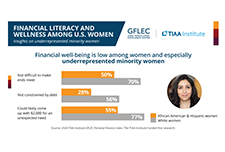

Financial Literacy and Wellness Among U.S. Women: Insights on Underrepresented Minority Women

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined understanding of financial literacy among women, including areas of strength and weakness and variations among subgroups, can inform initiatives to improve financial wellness, particularly as the United States moves forward from the pandemic and its economic consequences.

COVID-19 Financial Resilience Hub

The Global Financial Literacy Excellence Center (GFLEC) focuses on financial literacy research, policy, and solutions. This toolkit contains suggestions and resources for managing personal finances and protection against the financial emergencies caused by COVID-19.

Millennials and money: Financial preparedness and money management practices before COVID-19

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed over the ten years following the Great Recession of 2008 and the situation they were in on the cusp of the current economic crisis (in 2018) due to the COVID-19 pandemic. Findings from the National Financial Capability Study (NFCS) show that millennials tend to rely heavily on debt, engage frequently in expensive short- and long-term money management, and display shockingly low levels of financial literacy. Moreover, student loan burden and expensive financial decision making increased significantly from 2009 to 2018 among young adults.

Financial literacy and financial resilience: Evidence from around the world

This study presents findings from a measurement of financial literacy using questions assessing basic knowledge of four fundamental concepts in financial decision making: knowledge of interest rates, interest compounding, inflation, and risk diversification. Worldwide, just one in three adults are financially literate—that is, they know at least three out of the four financial concepts. Women, poor adults, and lower educated respondents are more likely to suffer from gaps in financial knowledge.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

Financial Consumer Protection responses to COVID-19

This policy brief provides recommendations that can assist policy makers in their consideration of appropriate measures to help financial consumers, depending on the contexts and circumstances of individual jurisdictions, during the COVID-19 crisis. These options are consistent with the G20/OECD High Level Principles on Financial Consumer Protection that set out the foundations for a comprehensive financial consumer protection framework.

Supporting the financial resilience of citizens throughout the COVID-19 crisis

This policy brief outlines initial the measures that policy makers can make to increase citizen awareness about effective means of mitigation for the impact of the COVID-19 pandemic and its potential consequences on their financial resilience and well-being.

G20/OECD INFE Core Competencies Framework on financial literacy for Adults (aged 18+)

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to inform the development of a national strategy on financial education, improve programme design, identify gaps in provision, and create assessment, measurement and evaluation tools.

From Surviving to Thriving – Ensuring the Golden Years Remain Golden for Older Women

This brief explores the drivers of economic insecurity for older women and sets forth a number of strategies and promising practices for funders to consider which address the needs of older women. Doing so will ensure this generation and future generations of men and women in this country can age financially secure and with dignity. This publication is the fourth in a series of briefs that build on AFN’s publication, Women & Wealth, to explore how the gender wealth gap impacts women, particularly low-income women and women of color, throughout their life cycle, and provides responsive strategies and best practices that funders can employ to create greater economic security for women.

Women and Wealth: Insights for Grantmakers

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for Grantmakers examines the causes and dimensions of the women’s wealth gap and provides recommendations and best practices for grantmakers to reduce the women’s wealth gap and improve women’s access to the wealth escalator. Improving women’s ability to build wealth is not only good for women, but is essential for the economic well-being of children, families, and our nation. The webinar, included Mariko Chang, PhD, K. Sujata, President and CEO, Chicago Foundation for Women, and Dena L. Jackson, PhD, Vice President – Grants & Research, Texas Women’s Foundation.

Four Actions That Can Hurt Credit Scores

During the Four Actions that Can Hurt Credit Scores webinar, you'll learn about: Their guest speaker is Julie Kuzmic, the Director of Consumer Advocacy at Equifax Canada, and a recognized authority on consumer credit. In her role leading consumer advocacy within the organization, Julie helps Canadians build credit confidence.

Race, Ethnicity, and the Financial Lives of Young Adults: Exploring Disparities in Financial Health Outcomes

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults, focusing on Black and Latinx young adults, in order to inform policies, programs, and solutions that can improve financial health for all.

Quarterly Consumer Credit Trends: Recent trends in debt settlement and credit counseling

This report used a longitudinal, nationally-representative sample of approximately five million de-identified credit records maintained by one of the three nationwide consumer reporting agencies. Trends in debt settlement and credit counseling during the Great Recession and in recent years are presented. This report shows that nearly one in thirteen consumers with a credit record had at least one account settled through a creditor or had account payments managed by a credit counseling agency from 2007 through 2019. Since 2016, the number of debt settlements has increased steadily, while credit counseling numbers are relatively unchanged.

Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help

More than 44 million people in America have taken on student debt to pursue a post-secondary education. These borrowers collectively owe around $1.6 trillion in student loan debt. Borrowers exist in every community, but some are particularly vulnerable to its impact. Women hold two-thirds of all outstanding student debt and Black and Latinx borrowers disproportionately struggle with repayment. This webinar discussed the disparate impact of student loan debt on black and Latinx students and the following topics: