Responsible or sustainable investing

While there is no official definition of responsible or sustainable investing, many investors would like to adopt an investment approach that combines environmental, socials and governance (ESG) factors with traditional financial research. The Autorité des marchés financiers has compiled information about ESG factors, the challenges of investing while taking ESG factors into account.

Getting Your Money Back: An Investor’s Guide to Navigating Canada’s Complaint System

If you have a complaint, it is important you fully understand your rights, so that you don’t feel taken advantage of during the process. After reading the guide, you will:

● Know how and who to contact when you first make a complaint.

● Understand your basic rights during the process, including how much time your bank or investment firm has to resolve your complaint.

● Know when and where to bring your complaint, if you are not satisfied with your bank’s or investment firm’s response.

● Learn what other options may be available to you, if you are still not happy with the outcome.

● Be aware of time limits that may affect you.

Canada workers benefit

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility requirements, how to apply and how much you can expect to receive by clicking on the Get It button below.

Money matters

Money Matters is a free introductory financial literacy program for adult learners that has been delivered to Canadians since 2011 and has reached over 80,000 adults. It was developed by ABC Life Literacy Canada in partnership with the Government of Canada and TD Bank Group and was designed by literacy practitioners. The newly released resources as part of the Money Matters program are:

Managing debt

Managing debt doesn't have to be overwhelming. These tips and tools from the Ontario Securities commission can help you borrow wisely and pay off debt more quickly.

About the Canada Learning Bond

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools, colleges, or universities. Learn more about eligibility requirements and the application process using this website.

Beware of One Time Passcode scams with these tips

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts securely.

A guide to the best robo-advisors in Canada for 2022

Robo-advisors first arrived in Canada in the beginning of 2014 presenting young and middle-income investors the option of having their savings passively managed in a bundle of exchange-traded funds (ETFs) matched to their goals and risk tolerance for about a penny on the dollar per year: A perfect set-it-and-forget it solution for people with better things to do. Fast forward to today and the honeymoon atmosphere has dissipated. Against the backdrop of an extraordinarily long-lived bull market in stocks, active management has made a comeback (not least in the ETF space), exotic asset classes like cryptocurrency are on the rise, and new competition is coming from asset-allocation ETFs that do the job of portfolio management all in one security. Suddenly robo-advisors find themselves having to prove their worth anew, all the while trying to establish a profitable business model in a low-margin corner of the investment universe. It’s surprising, really, because amid all the competition their fee structures and value proposition are as good as or better than ever. Investors now must probe deeper in their choice of robo-advisor, asking tough questions around performance, risk and the composition of portfolios. The 2022 survey of the Canadian robo industry shows, they’re not all the same.

8 ways to prepare financially for retirement

This article from OSC provides 8 tips to help you plan for retirement. Transitioning from working life to retirement takes careful financial planning and decision-making – give yourself plenty of time to prepare. Here are some things you can do ahead of time.

Introduction to investing: A primer for new investors

Whether you’re new to investing, or new to Canada, InvestingIntroduction.ca can help. Visit the Ontario Securities Commission's refreshed website and find resources to help you make more informed investment decisions and better protect your money. The information is available in 22 languages.

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the Canadian banking system.

Tools for 2022: Tamarack’s Top 10 Resources Published in 2021

The Tamarack Institute develops and supports collaborative strategies that engage citizens and institutions to solve major community issues across Canada and beyond. Our belief is that when we are effective in strengthening community capacity to engage citizens, lead collaboratively, deepen community and end poverty, our work contributes to the building of peace and a more equitable society. This toolkit contains the top ten resources they published in 2021 including: index of community engagement techniques, the community engagement planning canvas, a guide for community-based COVID recovery, a guide for engaging people with lived and living experience, asset-based community development, a guide for advancing the sustainable development goals in your community and much more.

Gathering a Bundle for Indigenous Evaluation

This guide brought together by the Indigenous Learning Circle (ILC) in Winnipeg's North End details how to conduct an Indigenous-grounded evaluation process. While not a comprehensive guide to complete an evaluation, the Bundle builds upon what is understood about evaluation and provides a guide that can be used in planning, designing, implementing and reporting based upon Indigenous values and principles. The Bundle provides a common understanding of the purpose of evaluation; how it can be beneficial for community; and Indigenous principles, values, considerations, and methods that could be used in the design and implementation of evaluation. It can be used by community organizations and staff to understand evaluation and increase community members’ capacity to actively participate in evaluation efforts in their programs and organizations.

Nurturing Supporting Relationships: The Foundation to a Secure Future

This handbook provides a guide for actions to take when nurturing supporting relationships for people living with a disability.

Communicating on Race and Racial Economic Equity

This document is a compilation of best practices and recommendations from a wide range of resources that Prosperity Now’s Racial Wealth Divide Initiative (RWDI) and Communications teams thought would be helpful for naming, framing, defining and understanding the issue of racial economic equity. Design guidelines on visually depicting diverse communities and definitions of important terms and concepts for understanding the nuance and complexity of racial economic equity, the racial wealth divide and racial wealth equity are provided.

Creating Financial Security: Financial Planning in Support of a Relative with a Disability

This handbook covers the following topics:

The MIX Challenge Toolkit: Tools & Techniques for Challenge-Based Innovation Partnerships & Procurement

The Municipal Innovation Exchange (MIX) project team created this Toolkit to assist municipalities - individual line managers or project owners, or municipal strategic teams (like a Smart Cities Office) - that are contemplating or undertaking a procurement by means of innovation partnership. The Toolkit can help municipal staff decide which projects are a good fit for this approach to procurement. It can help them initiate and manage an innovation partnership. It can also help them assess the whole experience afterwards and determine if and how to apply innovation partnership again.

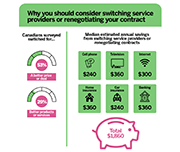

Stop Overpaying, Start Switching

In the past year, 1 in 4 Canadians surveyed renegotiated their contracts or switched providers to take advantage of better deals and services. This webpage provides information on switching or renegotiating your contract to reduce your monthly bills and get better products and services.

Northwest Territories Income Assistance Handbook

The Income Assistance Program provides Financial Assistance to Northerners to help meet basic and enhanced needs. The program encourages and supports greater self-reliance to improve the quality of lives. This plain language handbook is for people who may want to play for Income Assistance. It provides information on: The handbook also contains helpful contact information on the following resources in the Northwest Territories including:

Guide de recours : Lors d’un conflit avec un fournisseur de communication

A guide for consumers to help with problems related to communications services. Information is provided to allow consumers to better assert their rights and facilitate the resolution of a dispute with communication service providers. (Please note this is a French-language resource.)

Creating Communities Where We Live – A Good Practices Guide

Creating Communities Where We Live - A Good Practices Guide is a locally-driven community-based researched project conducted in Edmonton, Alberta, by e4c and the University of Alberta Community Service-Learning program. The project seeks to add to the knowledge and practice of community care around supporting people to achieve a safe, secure, and affordable housing experience. The 10 good practices in this guide describe structures, roles, and relationships which promote community and wellbeing for tenants who live in affordable housing. The practices are informed, in part, by research into tenant and staff experiences at affordable housing complexes run by four Edmonton housing providers.

National Strategies for Financial Education: OECD/INFE Policy Handbook

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools to support policy makers and public authorities to design and implement national strategies for financial education. This handbook provides an overview of the status of national strategies worldwide, an analysis of relevant practices and case studies and identifies key lessons learnt. The policy handbook also includes a checklist for action, intended as a self-assessment tool for governments and public authorities.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Questions and answers to legal topics in Ontario

The Community of Legal Education Ontario (CLEO) website contains answers to common questions pertaining to a number of legal topics, including: COVID-19, debt and consumer rights, and employment and work.

Youth Reconnect Program Guide: An Early Intervention Approach to Preventing Youth Homelessness

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth Reconnect. This document describes the key elements of the YR program model, including program elements and objectives, case examples of YR in practice, and necessary conditions for implementation. It is intended for communities who are interested in pursuing similar early intervention strategies. The key to success, regardless of the approaches taken, lies in building and nurturing community partnerships with service providers, educators, policy professionals, and young people.

Your rights at work

This publication explains a worker’s legal rights under the Employment Standards Act regarding hours of work and pay, overtime, breaks, holidays and vacations, and leave from your job. It also has information about how to make a claim against an employer.

Workers’ Compensation: Making a claim

This resource explains what a worker should do if they have a job-related injury or disease, how they can apply for benefits from the Workplace Safety and Insurance Board, and what happens when the Board gets a report of their injury. It also has sections about what their employer must do, and where injured workers can get legal help.

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

Elder Fraud Prevention and Response Networks Development Guide

This guide provides step-by-step materials to help communities form networks to increase their capacity to prevent and respond to elder financial exploitation. The planning tools, templates and exercises offered in this guide help stakeholders plan a stakeholder retreat and training event, host a retreat, reconvene and establish their network, and expand network capabilities in order to create a new network or to refresh or expand an existing one.

COVID-19: Managing financial health in challenging times

This guide from the Financial Consumer Agency of Canada shares guidelines and financial tips to help Canadians during COVID-19. The topics include: getting through a financial emergency, where to ask questions or voice concerns, what to do if your branch closes, and more.

Seniors: tips to help you this tax season

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada resources.

How to use your tax refund to build your emergency savings

If you file your taxes in the United States, you can learn how your tax return can kickstart your savings. This guide from the Consumer Financial Protection Bureau walks you through some fast and easy ways to use your tax refund to increase your savings. This guide covers multiple topics including: why save your tax return, how to save money fast, affordable ways to file your taxes, and how to protect yourself from tax fraud.

Smarter Financial Education: Key lessons from behavioural insights for financial literacy initiatives

This publication presents key findings for financial education, drawn from the IOSCO/OECD joint report “The Application of Behavioural Insights to Financial Literacy and Investor Education Programmes and Initiatives”. It gives a short overview of the ways in which behavioural insights are relevant for financial education and then summarises five key lessons that policy makers can follow, illustrated with the experiences of OECD/INFE members.

Getting Legal Help: A Directory of Community Legal Clinics in Ontario

This resource provides a directory of community legal clinics in Ontario. Community legal clinics provide information, advice, and representation on various legal issues, including social assistance, housing, refugee and immigration law, employment law, human rights, workers' compensation, consumer law, and the Canada Pension Plan. Some legal clinics do not handle all of these issues, but staff may be able to refer you to someone who can help. Community legal clinics are staffed by lawyers, community legal workers, and sometimes law students. Each legal clinic is run by a volunteer board of directors with members from the community. All help is private and confidential and provided free of charge.

Introduction to Program Evaluation for Public Health Programs: A Self-Study Guide

This document is a “how to” guide for planning and implementing evaluation activities. The manual, based on Centers for Disease Control and Preventions's Framework for Program Evaluation in Public Health, is intended to assist managers and staff of public, private, and community public health programs to plan, design, implement and use comprehensive evaluations in a practical way.

Coaching and Philanthropy: An Action Guide for Nonprofits

The Coaching and Philanthropy Project was created by CompassPoint in collaboration with Grantmakers for Effective Organizations, BTW informing change and Leadership. This guide uses the data collected during the project to answer a few questions including: What is coaching? How can coaching contribute to my development as a nonprofit leader? What kind of coaching is right for me and my organization? How much is coaching? to assess and advance coaching as a strategy for building effective nonprofit organizations.

2017 Bank On Data Pilot: Accessing Local Data

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This tool details the 2017 Bank On Data Pilot and includes instructions for accessing the local Bank On data at the city and zip code level.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

VITA: A step-by-step guide to increase your impact

In this report, The Common Cents Lab and MetLife Foundation share findings from the experiments we have run over the past several years with VITA providers to improve tax-related outcomes. We encourage you to consider implementing these ideas and engaging in additional conversations about how to use behavioral science to increase financial capability for all taxpayers. The report outlines a series of interventions that exemplify

ways these best practices have been implemented in the field and

how to use behavioral science to further extend their impact. We’ve

organized these interventions into two categories:

Managing spending: Ideas for financial educators

As financial educators know, making day-to-day decisions on spending money is one of the biggest challenges consumers face in keeping their financial lives in order. Many people find it difficult to manage their household finances on a daily basis, let alone over the long term. This brief from the Bureau of Consumer Financial Protection identifies a few ideas to explore causes of over-spending and ideas to help prevent it.

Debt and Consumer Rights: Credit repair

This educational brief from CLEO explains what a credit report is, and what to do if you want to fix your credit report or work with a credit repair agency.

The Little Black Book of Scams (2nd edition)

Scammers are sneaky and sly. They can target anyone, from youngsters to retirees. They can also target businesses. No one is immune to fraud. Read this booklet to find out how you can also become a fraud-fighting superhero. Share this booklet with family and friends and start powering up!

Our group of superheroes has found a way to see through the scams. Their secret is simple: knowledge is power!

Financial Coaching Program Design Guide: A Participant-Centred Approach

This comprehensive resource from Prosperity Now supports organizations in developing a participant-centered financial coaching program. Grounded in a field survey, over 100 interviews, expert advice and beta-testing with six new financial coaching programs, the Coaching Guide highlights the strengths and limitations of financial coaching, offers designs tools, showcases promising models and practices, and includes resources from program leaders and financial coaches.

Group RESP Educational Materials

This document explains the basics of group RESPs, including what they are, what they may cost, what you need to know about your group RESP if you are already enrolled in a plan, and how to figure out your options. Read more about the research behind these materials here.

The Complaints Process for Retail Investments in Canada: A Handbook for Investors

Canadian investors need more and better information to protect themselves both when they act on their own and when they retain lawyers. This handbook is intended to help Canadian investors better understand the choices they face when making a complaint and the impact of those choices. It can also serve as a guide to assist them when they work with lawyers, particularly those whose law practice does not focus on assisting Canadian investors in obtaining financial compensation.

What to do when you get an income tax refund