The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx, Indigenous, and Asian people, who are struggling due to deep financial disparities. Today’s disparities are built on, and exacerbated by, long-standing inequities created by structural racism, sexism, and classism, which have limited financial security and overall well-being for those affected. This brief responds to the urgency of this moment, reimagining and building on past recommendations to map more just paths to economic resilience moving forward.

Women living in subsidized housing in Canada

Using data primarily from the 2021 Canadian Housing Survey, this study applies a gender lens to examine the characteristics of Canadians living in subsidized housing. It examines the experiences of renters in subsidized housing and their satisfaction with their dwelling and neighbourhood, drawing comparisons with their counterparts living in non-subsidized rental housing.

Missing for those who need it most: Canada’s financial help gap

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable, appropriate and trustworthy financial help for people with low incomes is a critical but missing piece in Canada's financial services landscape. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere to a budget, set and pursue saving goals, file their taxes outside of tax season, and access income benefits. Executive summary: Canada's financial help gap L’aide qui manque pour ceux qui en ont le plus besoin Sommaire Exécutif: L’écart en matière d’aide financière au Canada

Sustainable Development Goals: Goal 10, Reduced Inequalities

An infographic from Statistics Canada highlighting the advances made in reaching Goal 10, reducing inequalities, of the sustainable development goals.

Canada’s Disability Inclusion Action Plan

Canada’s Disability Inclusion Action Plan is a comprehensive, whole-of-government approach to disability inclusion. It embeds disability considerations across our programs while identifying targeted investments in key areas to drive change. It builds on existing programs and measures that have sought to improve the inclusion of persons with disabilities, and establishes new and meaningful actions.

National Indigenous Economic Strategy 2022

This National Indigenous Economic Strategy for Canada is the blueprint to achieve the meaningful engagement and inclusion of Indigenous Peoples in the Canadian economy. It has been initiated and developed by a coalition of national Indigenous organizations and experts in the field of economic development. The Strategy is supported by four Strategic Pathways: People, Lands, Infrastructure, and Finance. Each pathway is further defined by a Vision that describes the desired outcomes for the actions and results of individual Strategic Statements. The Calls to Economic Prosperity recommend specific actions to achieve the outcomes described in the Strategic Statements. This document is not intended as a strategic plan specifically, but rather a strategy that others can incorporate into their own strategic plans.

Financial wellness tools

The National Disability Institute's Financial Wellness Toolkit is full of free resources for disability service providers, nonprofits, financial professionals and municipalities, including Financial Education Handouts and Quick Reference Guides. This infographic highlights income, banking and credit inequality based on disability, race and ethnicity.

Eyeing the ID: Bio-metric Banking for Saint John

NB Social Pediatrics and the Saint John Community Loan Fund recently surveyed 157 New Brunswick and Nova Scotia residents about their experiences with finances, banking, and ID to better understand if biometrics or ID banks could be effective solutions for people living without ID. Eyeing the ID: Bio-metric Banking for Saint John identifies access to identification, as well as stringent identification requirements as the most prevalent barriers to receiving services in the community and were also inherently linked to other barriers, such as housing and finances. For example, lack of address was identified as a barrier to accessing an ID because government agencies require a mailing address to send ID documents to customers, but lack of ID is also directly linked to precarious housing because you often need ID to be placed on local subsidized housing lists, and to set up power and utilities. Cyclical barriers to services could be improved by addressing ID requirements and making ID more accessible. The top three solutions identified to mitigate ID barriers were biometrics, ID banks, and an ID acquisition service. Also available in French: Un regard sur l’identification : Services bancaires à identification biométrique à Saint John

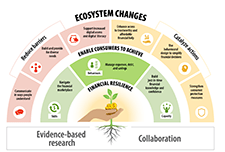

Make Change that Counts: National Financial Literacy Strategy 2021-2026

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in meaningful ways. The National Strategy is focused on how financial literacy stakeholders can reduce barriers, catalyze action, and work together, to collectively help Canadians build financial resilience.

Early Planning Toolkit

A toolkit for parents/caregivers with a child with a disability ages 2 to 10, containing:

Innovations in Financial Capability: Culturally Responsive & Multigenerational Wealth Building Practices in Asian Pacific Islander (API) Communities

The Innovations in Financial Capability report is a collaborative report by National CAPACD and the Institute of Assets and Social Policy (IASP) at Brandeis University’s Heller School for Social Policy and Management, in partnership with Hawaiian Community Assets (HCA), and the Council for Native Hawaiian Advancement (CNHA). This survey report builds upon the 2017 report Foundations for the Future: Empowerment Economics in the Native Hawaiian Context and features the financial capability work of over 40 of our member organizations and other AAPI serving organizations from across the US. IASP’s research found that AAPI leaders are adopting innovative multigenerational and culturally responsive approaches to financial capability programming, but they want and need more supports for their work.

Intersectionality and Economic Justice

Widespread financial precarity for women of color with disabilities existed before the pandemic. Rooted in existing systemic inequities, COVID worsened the situation and created new access barriers. Race, gender, and disability impact financial stability in complex ways. Having a disability may increase living costs and limit economic opportunities. At the same time, women of color face significant disparities in education, income, employment, financial services, and wealth. Faced with institutional barriers that limit earning and wealth building, disabled women of color are more likely to be unbanked, use alternative financial services, have medical debt, lack access to affordable health care, and experience food insecurity. Given these challenges and the dire need to address them, this webinar explored:

Study: A labour market snapshot of Black Canadians during the pandemic

In the context of the COVID-19 pandemic, many Canadians, including Black Canadians, have experienced significant economic hardship, while others put themselves at risk through their work in essential industries such as health care and social assistance. Statistics Canada looked at how the 1 million Black Canadians aged 15 to 69 are faring in the labour market during one of the most disruptive times in our economic history. Analysis of the recent labour market situation of population groups designated as visible minorities is now possible as a result of a new question added to the Labour Force Survey (LFS) in July 2020. Unless otherwise stated, all data in this release are unadjusted for seasonality and are based on three-month averages ending in January 2021.

Taking Stock and Looking Ahead: The Impact of COVID-19 on Communities of Color

Nearly a year since the outbreak began, and eight months since it was declared a global pandemic, COVID-19 has devastated hundreds of thousands of lives and millions of people’s economic prospects throughout the country. To date, the effects of this crisis have been wide-reaching and profound, impacting every individual and sector throughout the U.S. For communities of color, however, the pandemic has been particularly damaging as these communities have not only been more likely to contract and succumb to the virus, but also more likely to bear the brunt of the many economic impacts that have come from it—including more likely to be unemployed and slower to regain jobs lost. The Asset Building Policy Network and a panel of experts discuss the impact COVID-19 has had on communities of color, the fiscal policy measures congress has enacted to curtail those impacts and what can be done through policy and programs to foster an equitable recovery and more inclusive economy moving forward.

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

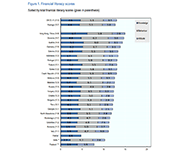

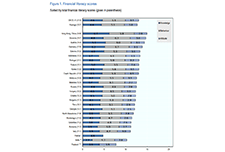

Launch of the OECD/INFE 2020 International Survey of Adult Financial Literacy

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018 OECD/INFE toolkit to collect cross-comparable data. The survey results report the overall financial literacy scores, as computed following the OECD/INFE methodology and definition, and their elements of knowledge, behaviour, and attitudes. The data used in this report are drawn from national surveys undertaken using and submitted to the OECD as part of a co-ordinated measurement exercise; as well as data gathered as part of the OECD/INFE Technical Assistance Project for Financial Education in South East Europe.

A Feminist Economic Recovery Plan for Canada: Making the Economy Work for Everyone

This report offers an intersectional perspective on how Canada can recover from the COVID-19 crisis and weather difficult times in the future, while ensuring the needs of all people in Canada are considered in the formation of policy.

YWCA Canada and the University of Toronto’s Institute for Gender and the Economy (GATE) offer this joint assessment to highlight the important principles that all levels of government should consider as they develop and implement policies to spur post-pandemic recovery.

From the Margins to Center: Responding to COVID-19 with an Equity and Gender Lens

On June 30th, AFN presented an Expert Insights briefing on what it takes to center women of color in the relief, recovery, and rebuild plans for the current health and economic crisis and beyond. The speaker is Dominique Derbigny, deputy director of Closing the Women’s Wealth Gap (CWWG) and author of the report, On the Margins: Economic Security for Women of Color through the Coronavirus Crisis and Beyond. Learn why women of color are suffering severely from the COVID-19 public health and economic crisis, opportunities to advance gender economic equity in near-term recovery efforts, and possible strategies to prevent wealth extraction and foster long-term economic security for women of color.

Imagine Canada pre-budget consultation toolkit

The House of Commons Finance Committee recently released its call for pre-budget consultation briefs as the government considers its policy priorities for the 2021 federal budget. This toolkit created by Imagine Canada provides information on the reasons to submit a pre-budget consultation brief as well as tips on how to do so.

Defining disability for social assistance in Ontario: Options for moving forward

Narrowing the definition of disability used by the Ontario Disability Support Program (ODSP) could have serious implications. Improving the program’s assessment process would yield better results for applicants, Ontario's social safety net, and the government. This report explores the role of ODSP, the risks of narrowing the definition of disability, models of disability assessment from other jurisdictions, and alternative ways that the government could reform the program. Most importantly, the paper recommends that the Ministry focus on improving ODSP’s initial application process. A simplified assessment system would save time and money for applicants, medical professionals, legal clinics, adjudicators, and the Social Benefits Tribunal. These savings should be reinvested back into social assistance.

Ageing and Financial Inclusion: 8 key steps to design a better future

The G20 Fukuoka Policy Priorities for Ageing and Financial Inclusion is jointly prepared by the GPFI and the OECD. The document identifies eight priorities to help policy makers, financial service providers, consumers and other actors in the real economy to identify and address the challenges associated with ageing populations and the global increase in longevity. They reflect policies and practices to improve the outcomes of both current generations of older people and future generations.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

Investor Protection Clinic and Living Lab: 2019 Annual Report

The Investor Protection Clinic, the first clinic of its kind in Canada, provides free legal advice to people who believe their investments were mishandled and who cannot afford a lawyer. The Clinic was founded together with the Canadian Foundation for Advancement of Investor Rights (FAIR Canada), an organization that aims to enhance the rights of Canadian shareholders and individual investors. The 2019 Annual Report summarizes the work of The Clinic, including description of the work and types of cases, example case scenarios of the clients who benefited from The Clinic's services, client data and demographics, and recommendations.

English

Download in English

French

Download in French

Consumer Perspectives on Fintech

This brief raises consumer perspectives on financial technology (fintech), and offers guidance for fintech developers on how to best serve low- to moderate-income clients.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

Account Comparison Tool

Compare features for different chequing and savings accounts, including interest rates, monthly fees and transactions. Find an account that best suits your needs. Narrow your search, view search results, and compare your results using this account comparison tool from the Financial Consumer Agency of Canada.

High-Cost Alternative Financial Services: The Customer Experience

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty Talks! and Sunrise Community Link Resource Centre. The following document summarizes what we learned from these conversations and the loan contracts that borrowers shared with us. It also identifies several themes that emerged from these discussions.

Summary Brief: High-Cost Alternative Financial Services

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial institutions. High-cost alternative financial services contribute to a two-tiered banking system, in which the poor often pay more for inferior services. Without more stringent regulation, and in the absence of safe and affordable short-term credit options, Albertans living on lower-incomes will continue to experience financial exclusion and take on heavy debt loads – both of which are major contributors to long-term poverty.

Activity sheet 4-10: Goals (Banking and financial services)

This activity sheet is from Module 4 of the Prosper Canada Financial Literacy Facilitator resources. Take a few minutes to how this workshop relates to your life, and set one or two goals for your use of banks and other financial services. To view the full Financial Literacy Facilitator resources, click here.

Building consumer financial health: The role of financial institutions and FinTech

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

The Complaints Process for Retail Investments in Canada: A Handbook for Investors

Canadian investors need more and better information to protect themselves both when they act on their own and when they retain lawyers. This handbook is intended to help Canadian investors better understand the choices they face when making a complaint and the impact of those choices. It can also serve as a guide to assist them when they work with lawyers, particularly those whose law practice does not focus on assisting Canadian investors in obtaining financial compensation.

Canada Islamic Finance Outlook 2016

Islamic finance is growing rapidly, outpacing the growth of the conventional finance industry and even grabbing market share from it. This success has been driven in part by the internationalisation of Islamic finance as it reaches beyond its core markets of the Middle East, North Africa and Southeast Asia, and into new ones such as Europe and the Americas, including Canada, which is the focus of this report.

This report provides an introduction to Islamic banking in Canada.

The Ever Growing Gap: Without Change, African American and Latino Families Won’t Match White Wealth for Centuries

This report examines the growing racial wealth divide for Black and Latino and the ways that accelerating concentrations of wealth at the top compound and exacerbate this divide. It looks at trends in wealth accumulation from 1983 to 2013, as well as projections of what the next thirty years might bring. It also considers the impact public policy has had in contributing to the racial wealth divide and how new policies can close this gap.

Using Design to Deepen Relationships in the Financial Sector

This publication reveals the outcomes of Bridgable's work with a federal credit union, cutting through their overwhelming number of offerings to better engage with their low-income members. It also discusses why agility is a better bet than digitization when it comes to our changing financial ecosystem. Finally, it will break down their approach to one of the most popular design methods today, the design sprint, and how it can produce results while also lowering risk. Note: This link will allow you to download the document from the Bridgeable website.

2017 Financially Underserved Market Size Study