Ten frugal habits to save money

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said they would put it in savings or invest it. With inflation as high as it has been in over 40 years, saving money is becoming increasingly difficult for some. This article lists ten frugal habits to help you save.

Managing debt

Managing debt doesn't have to be overwhelming. These tips and tools from the Ontario Securities commission can help you borrow wisely and pay off debt more quickly.

Social influencers and your finances

Just because someone has a lot of followers doesn’t mean their advice is right for you. Social media influencers are increasingly sharing information about investing. This can be done by ordinary people or by celebrities who have taken an interest in a specific product or investment. They are often called “finfluencers” — financial influencers whose media accounts are focused on money and investing. This article will outline some questions to ask yourself before you choose to invest.

Investing and saving during a recession

If a recession seems likely, consider how your investing and savings plans may be affected. Increases in the cost of living and borrowing, combined with the overall financial uncertainty over the impact of a potential recession, can be enough to cause personal and financial stress. There is no single best way to respond to such times.

Canada’s Disability Inclusion Action Plan

Canada’s Disability Inclusion Action Plan is a comprehensive, whole-of-government approach to disability inclusion. It embeds disability considerations across our programs while identifying targeted investments in key areas to drive change. It builds on existing programs and measures that have sought to improve the inclusion of persons with disabilities, and establishes new and meaningful actions.

Beware: Crypto scams on the rise

Fraudsters often use emotions to lure people in, making a person feel afraid of missing out on an opportunity that others are profiting from. With all the cryptocurrency hype in the media and online, it’s no surprise that scammers are taking note and trying to cash in on investors’ interest in digital currencies. Read this article for more information on the top crypto-related scams you should know.

National financial literacy strategy video gallery

View the 8 videos created by the Financial Consumer Association of Canada (FCAC) as part of the National Financial Literacy Strategy 2021-2026. Videos include:

National Indigenous Economic Strategy 2022

This National Indigenous Economic Strategy for Canada is the blueprint to achieve the meaningful engagement and inclusion of Indigenous Peoples in the Canadian economy. It has been initiated and developed by a coalition of national Indigenous organizations and experts in the field of economic development. The Strategy is supported by four Strategic Pathways: People, Lands, Infrastructure, and Finance. Each pathway is further defined by a Vision that describes the desired outcomes for the actions and results of individual Strategic Statements. The Calls to Economic Prosperity recommend specific actions to achieve the outcomes described in the Strategic Statements. This document is not intended as a strategic plan specifically, but rather a strategy that others can incorporate into their own strategic plans.

Beware of One Time Passcode scams with these tips

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts securely.

Social prescribing: A holistic approach to improving the health and well-being of Canadians

Social prescribing is a means of connecting people to a range of community services and activities to improve their health and well-being. These services vary based on each person’s needs and interests, and can include food subsidies, transportation, fitness classes, arts and culture engagement, educational classes, peer-run social groups, employment or debt counseling, and more. Social prescribing is a holistic approach to healthcare that looks to address the social determinants of health, which are the non-medical factors that play a role in an individual’s overall health. These factors may include socioeconomic status, social inclusion, housing, and education.

Canadian Institute for Social Prescribing

The Canadian Institute for Social Prescribing (CISP) is a new national hub to link people and share practices that connect people to community-based supports and services that can help improve their health and wellbeing.

Investment products

There are many investment products, here's some information about them: Annuities: a contract with a life insurance company. Annuities are most commonly used to generate retirement income. Bonds: when you buy a bond, you’re lending your money to a company or a government for a set period of time. In return, the issuer pays you interest. On the date the bond becomes due, the issuer is supposed to pay back the face value of the bond to you in full. Complex investments: these investments may have the potential for higher gains, but carry greater risks. ETFs: when you buy a share or unit of an ETF, you’re investing in a portfolio that holds a number of different stocks or other investments. GICs: when you buy a guaranteed investment certificate (GIC), you are agreeing to lend the bank or financial institution your money for a set number of months or years. You are guaranteed to get the amount you deposited back at the end of the term. Mutual funds & segregated funds: when you buy a mutual fund, your money is combined with the money from other investors, and allows you to buy part of a pool of investments. Real estate: While real estate investments can offer a range of benefits, there is no guarantee that you will earn an income or profit and, like any investment, there are a number of risks and uncertainties that you need to carefully consider before investing. Stocks: The stock market brings together people who want to sell stock with those who want to buy stock. When you buy stock (or equity) in a company, you receive a piece of the company and become a part owner. Pensions & saving plans: if your employer offers contributions to your retirement or other savings plan, take advantage. Cannabis: Emerging sectors like the cannabis industry have often attracted investors hoping to be among the first to capitalize on the potential growth and high returns of what they believe are untapped markets or products that may be popular in the future. Cryptoassets: Cryptoassets primarily designed to be a store of value or medium of exchange (e.g., Bitcoin) are often referred to as “digital coins.

Grandparent scams and how to avoid them

Imagine a loved one is in trouble or hurt. You get a call asking for urgent help. You’d likely want to act right away because you care about them. Exploiting family ties is the driving force behind grandparent scams — or emergency scams. This article from the OSC can help you to protect yourself from becoming a victim of an emergency scam. Watch this new video to learn more about grandparent scams.

How women can save more money

This webinar hosted by FCAC (originally broadcast on November 17, 2021) targets women who want to learn more about managing money and building saving habits. Guest speaker, personal financial expert, Rubina Ahmed-Haq has also contributed to Canada's financial literacy blog on "Women face unique money challenges". Helpful links related to the content matter in this video: Getting help from a credit counsellor

Tools for 2022: Tamarack’s Top 10 Resources Published in 2021

The Tamarack Institute develops and supports collaborative strategies that engage citizens and institutions to solve major community issues across Canada and beyond. Our belief is that when we are effective in strengthening community capacity to engage citizens, lead collaboratively, deepen community and end poverty, our work contributes to the building of peace and a more equitable society. This toolkit contains the top ten resources they published in 2021 including: index of community engagement techniques, the community engagement planning canvas, a guide for community-based COVID recovery, a guide for engaging people with lived and living experience, asset-based community development, a guide for advancing the sustainable development goals in your community and much more.

Government response to the Countervailing Power: Review of the coordination and funding for financial counselling services across Australia

In 2019, a comprehensive review (The Countervailing Power: Review of the coordination and funding for financial counselling services across Australia) of financial counselling services in Australia was undertaken and recommendations to ensure the long-term viability of the financial counselling sector, including the establishment of a nationally coordinated approach, and industry funding to strengthen the predictability and stability of funding for financial counselling were made. This document is the Australian Government's response to the review, outlining their response to each of the recommendations, and sets out their commitment to the following:

Strengthening Canada’s External Complaint Handling System

Canada’s external complaint handing structures and processes play a critical role in levelling the playing field for consumers and financial service providers, helping to offset the inevitable imbalance of power between large financial institutions and individual consumers. Prosper Canada welcomes the opportunity to provide recommendations for strengthening what is currently a weak and inadequate alternative dispute resolution system.

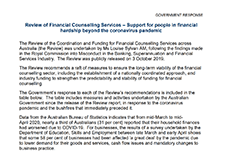

Make Change that Counts: National Financial Literacy Strategy 2021-2026

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in meaningful ways. The National Strategy is focused on how financial literacy stakeholders can reduce barriers, catalyze action, and work together, to collectively help Canadians build financial resilience.

Why the Time is Right for a Guaranteed Income with an Equity Lens

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders involved in GI initiatives including practitioners, government representatives and philanthropy were heard. Panelists shared outcomes and new research results from some of the most successful GI pilots in the country (Stockton and Mississippi); goals for the newly launched Mayor’s for Guaranteed Income; how philanthropy can play a catalytic role and what this moment tells us about the future of guaranteed income initiatives.

Cash Back: A Yellowhead Institute Red Paper

This report looks at how the dispossession of Indigenous lands nearly destroyed Indigenous economic livelihoods and discusses restitution from the perspective of stolen wealth.

3 Principles for an Antiracist, Equitable State Response to COVID-19 — and a Stronger Recovery

COVID-19’s effects have underscored the ways that racism, bias, and discrimination are embedded in health, social, and economic systems. Black, Indigenous, and Latinx people are experiencing higher rates of infection, hospitalization, and death, and people of color are also overrepresented in jobs that are at higher infection risk and hardest hit economically. Shaping these outcomes are structural barriers like wealth and income disparities, inadequate access to health care, and racial discrimination built into the health system and labor market. This article discusses three recommended principles for guiding policymakers in making equity efforts.

Emerging Technology for All: Conversational AI’s Pivotal Role

This infographic is a preview of Commonwealth's research survey of 1290 lower-and moderate-income people to understand their perceptions, needs, and uses of conversational AI.

Responding to Client’s “Now, Soon, & Later” Needs

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their current and future needs are discussed.

Racial Equity In Philanthropy: Closing the Funding Gap

The Bridgespan Group is a social impact consultant and advisor to nonprofits and NGOs, philanthropists, and investors. This collection of resources discuss the barriers that leaders of color face in securing philanthropic funding.

Impacts of the Covid-19 Pandemic on Women: Report of the Standing Committee on the Status of Women

The effects of the COVID-19 pandemic have been profound and far-reaching. Beyond endangering the health of Canadians, the pandemic has worsened inequalities among groups of people. Women, girls and gender-diverse people have faced unique challenges during the pandemic. The Committee recommends that the Government of Canada take various actions to assist women, girls and gender-diverse people during and after the COVID-19 pandemic. Many recommendations relate to improving women’s health and labour force participation. Some recommendations focus specifically on women’s paid and unpaid care work. The Committee also recommends interventions to help reduce trafficking and violence against women.

Budget 2021: A Recovery Plan for Jobs, Growth, and Resilience

The federal budget released on April 19, 2021 covers the Canadian government's plan for:

2020 Second Annual Report of the Disability Advisory Committee

In November 2017, the Minister of National Revenue, the Honourable Diane Lebouthillier, announced the creation of the Disability Advisory Committee to provide advice to the Canada Revenue Agency (CRA) on interpreting and administering tax measures for persons with disabilities in a fair, transparent and accessible manner. The committee’s full mandate is attached as Appendix A. Key disability tax measures are described in Appendix B. Our first annual report, Enabling access to disability tax measures, was published in May 2019. Since that time, we believe there has been important progress with respect to the administration of and communications about the disability tax credit (DTC). Our second annual report describes in detail the many improvements that the CRA has introduced over the past year in response to the recommendations in our 2019 report. These changes are summarized in “The Client Experience” on the following pages. Section 1 of this second annual report presents a review of the 42 recommendations made in our first annual report. Each recommendation summarizes the relevant context and associated follow-up actions. Section 2 covers the new areas of conversation during the second year of our mandate. Selected topics focus, for example, on DTC data, concerns of Indigenous peoples and eligibility for a registered disability savings plan. Section 3 includes the appendices, which provide details not covered in the text.

Opportunity for All – Canada’s First Poverty Reduction Strategy

Canada is a prosperous country, yet in 2015 roughly 1 in 8 Canadians lived in poverty. The vision of Opportunity for All – Canada's First Poverty Reduction Strategy is a Canada without poverty, because we all suffer when our fellow citizens are left behind. We are all in this together, from governments, to community organizations, to the private sector, to all Canadians who are working hard each and every day to provide for themselves and their families. For the first time in Canada's history, the Strategy sets an official measure of poverty: Canada's Official Poverty Line, based on the cost of a basket of goods and services that individuals and families require to meet their basic needs and achieve a modest standard of living in communities across the country. Opportunity for All sets, for the first time, ambitious and concrete poverty reduction targets: a 20% reduction in poverty by 2020 and a 50% reduction in poverty by 2030, which, relative to 2015 levels, will lead to the lowest poverty rate in Canada's history. Through Opportunity for All, we are putting in place a National Advisory Council on Poverty to advise the Minister of Families, Children and Social Development on poverty reduction and to publicly report, in each year, on the progress that has been made toward poverty reduction. The Government also proposes to introduce the first Poverty Reduction Act in Parliament in Canada’s history. This Act would entrench the targets, Canada's Official Poverty Line, and the Advisory Council into legislation.

GFLEC – Finlit Talks

This video series offers concise summaries of in-depth academic and practitioner presentations, in plain English, for dissemination to a worldwide audience. For convenient viewing, most videos are between three and six minutes long.

2021 Reports of the Auditor General of Canada to the Parliament of Canada – Report 4 – Canada Child Benefit

A report from Auditor General Karen Hogan concludes that the Canada Revenue Agency (CRA) managed the Canada Child Benefit (CCB) program so that millions of eligible families received accurate and timely payments. The audit also reviewed the one-time additional payment of up to $300 per child issued in May 2020 to help eligible families during the COVID‑19 pandemic. The audit noted areas where the agency could improve the administration of the program by changing how it manages information it uses to assess eligibility to the CCB. For example, better use of information received from other federal organizations would help ensure that the agency is informed when a beneficiary has left the country. This would avoid cases where payments are issued on the basis of outdated information. To enhance the integrity of the program, the agency should request that all applicants provide a valid proof of birth when they apply for the benefit. The audit also raised the concept of female presumption and noted that given the diversity of families in Canada today, this presumption has had an impact on the administration of the Canada Child Benefit program.

Creating Change: Momentum’s Contribution to High-Cost Credit Reform in Alberta

As part of Momentum’s systems change planning process that was grounded in both participant and community experience, the issue of payday loans and other forms of high-cost credit (e.g., pawn, installment, rent-to-own, title and car loans) emerged as a priority issue for Momentum to address the financial barriers for people living on low incomes to exit poverty and build sustainable livelihoods.

To evaluate its work for high-cost credit reform in Calgary and Alberta in the period of 2012 to 2019, an outcome harvest was conducted. This evaluation reflects the collective efforts of multiple partners, identifies outcomes achieved as well as Momentum’s contribution to these outcomes.

Together BC: British Columbia’s Poverty Reduction Strategy

British Columbia’s Poverty Reduction Strategy, sets a path to reduce overall poverty in B.C. by 25% and child poverty by 50% by 2024. With investments from across Government, TogetherBC reflects government’s commitment to reduce poverty and make life more affordable for British Columbians. It includes policy initiatives and investments designed to lift people up, break the cycle of poverty and build a better B.C. for everyone. Built on the principles of Affordability, Opportunity, Reconciliation, and Social Inclusion, TogetherBC focuses on six priority action areas:

Taking Stock and Looking Ahead: The Impact of COVID-19 on Communities of Color

Nearly a year since the outbreak began, and eight months since it was declared a global pandemic, COVID-19 has devastated hundreds of thousands of lives and millions of people’s economic prospects throughout the country. To date, the effects of this crisis have been wide-reaching and profound, impacting every individual and sector throughout the U.S. For communities of color, however, the pandemic has been particularly damaging as these communities have not only been more likely to contract and succumb to the virus, but also more likely to bear the brunt of the many economic impacts that have come from it—including more likely to be unemployed and slower to regain jobs lost. The Asset Building Policy Network and a panel of experts discuss the impact COVID-19 has had on communities of color, the fiscal policy measures congress has enacted to curtail those impacts and what can be done through policy and programs to foster an equitable recovery and more inclusive economy moving forward.

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

Cities Reducing Poverty: 2020 Impact Report

The Vibrant Communities – Cities Reducing Poverty 2020 Impact Report is the Tamarack Institute's first attempt at capturing and communicating national trends in poverty reduction and the important ways in which member Cities Reducing Poverty collaboratives are contributing to those changes. This impact report is meant for poverty reduction organizers and advocates, and public decision-makers to get a sense for how collaborative, multi-sectoral local roundtables with comprehensive plans contribute to poverty reduction in their communities and beyond; and spotlights high-impact initiatives that are demonstrating promising results.

Costing a Guaranteed Basic Income During the COVID Pandemic

The Parliamentary Budget Officer (PBO) supports Parliament by providing economic and financial analysis for the purposes of raising the quality of parliamentary debate and promoting greater budget transparency and accountability. This report responds to a request from Senator Yuen Pau Woo to estimate the post-COVID cost of a guaranteed basic income (GBI) program, using parameters set out in Ontario’s basic income pilot project. In addition, the report provides an estimate of the federal and provincial programs for low-income individuals and families, including many non-refundable and refundable tax credits that could be replaced by the GBI program.

Economic and Fiscal Snapshot 2020

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the country.

Transformation through disruption: Taxpayers’ Ombudsman Annual Report 2019-20

The mandate of the Taxpayers’ Ombudsman is to assist, advise, and inform the Minister about any matter relating to services provided by the CRA. The Taxpayers’ Ombudsman fulfills this mandate by raising awareness, upholding taxpayer service rights, and facilitating the resolution of CRA service complaints issues. Through independent and objective reviews of service complaints and systemic issues, the Ombudsman and her Office work to enhance the CRA’s accountability and improve its service to, and treatment of, people. and systemic issues. This is the Annual Report of the Taxpayers' Ombudsman for 2019-20.

Five good ideas for remote client service work

How does the Canada Emergency Response Benefit (CERB) impact eligibility of provincial benefits?

This policy backgrounder provides an overview of how provincial and territorial governments have decided to treat receipt of the Canada Emergency Response Benefit (CERB) for those receiving social assistance and/or living in subsidized housing. It also looks at provisions for youth aging out of care during the COVID-19 pandemic.

Employer Solutions: From Emergency to Resiliency

In light of COVID-19, the financial security of workers has never been more in question. The workplace is an important delivery channel for tailored financial products and services that can help meet employee’s immediate financial needs and build long-term financial stability. The workplace is a unique platform to identify, target, and meet the specific financial needs of employees. This webinar gives funders the tools and inspiration to respond effectively to the low- and moderate-income workforce in this moment and beyond.

Are charities ready for social finance? Investment readiness in Canada’s charitable sector

While social finance could have a transformative impact on the funding and financial landscape, relatively little is understood about its implications for charities. This webinar presents the results of a national survey of over 1,000 registered charities undertaken by Imagine Canada to better understand charities’ current readiness to participate in Canada’s growing social finance market

Keys to financial inclusion (podcast series)

The Center for Disability-Inclusive Community Development’s (CDICD) Keys to Financial Inclusion podcast series brings awareness to disability-inclusive community development. The CDICD works to improve the financial health and well-being of low- and moderate-income (LMI) individuals with disabilities and their families by increasing awareness and usage of opportunities available under the Community Reinvestment Act.

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of the Canada Revenue Agency (CRA). The Office of the Taxpayers’ Ombudsman hears first-hand the concerns of individuals, tax practitioners, and community support organizations. The Ombudsman visited with Community Volunteer Income Tax Program (CVITP) partner organizations, volunteers, and the Canada Revenue Agency’s (CRA) CVITP coordinators to learn more about the program and to understand the success stories and challenges they all experience. This report gives voice to what they have heard and provides recommendations on how to address the issues raised.

A workplace-based economic response to COVID-19

This brief emerged from a conversation, held in late March 2020, among a number of individuals and organizations who work on issues of household financial security. Employers with financial resources and governments have an opportunity to use the workplace as a significant channel to deliver financial relief as part of the economic response to COVID-19, complementing critical supports governments are providing to individuals and businesses.

Seniors: tips to help you this tax season

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada resources.

Infographic: Avoid financial stress, save for emergencies

This infographic illustrates the importance of having an emergency fund and how to build one.

Using Research to Improve the Financial Well-being of Canadians: Post-symposium Report

The Financial Consumer Agency of Canada (FCAC) co-hosted the 2018 National Research Symposium on Financial Literacy on November 26 and 27, 2018 at the University of Toronto, in partnership with Behavioural Economics in Action at Rotman (BEAR). This report presents the key ideas and takeaways from the event, while shining a light on the research shaping new solutions designed to enhance financial well-being in Canada and around the world.

Investor Protection Clinic and Living Lab: 2019 Annual Report

The Investor Protection Clinic, the first clinic of its kind in Canada, provides free legal advice to people who believe their investments were mishandled and who cannot afford a lawyer. The Clinic was founded together with the Canadian Foundation for Advancement of Investor Rights (FAIR Canada), an organization that aims to enhance the rights of Canadian shareholders and individual investors. The 2019 Annual Report summarizes the work of The Clinic, including description of the work and types of cases, example case scenarios of the clients who benefited from The Clinic's services, client data and demographics, and recommendations.

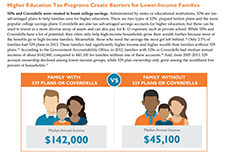

Expanding Educational Opportunity Through Savings

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and impact.

State of Cities Reducing Poverty

How has the Vibrant Communities – Cities Reducing Poverty (VC – CRP) network contributed to poverty reduction in Canada? In seeking to answer this central question, the State of Cities Reducing Poverty paper highlights the network’s numerous and varied impacts.

2018 Report Card on Child and Family Poverty in Canada: Bold Ambitions for Child and Family Poverty Eradication

The 2018 national report card “Bold Ambitions for Child Poverty Eradication in Canada,” provides a current snapshot of child and family poverty and demonstrates the need for a costed implementation plan to eradicate child poverty in this generation. In advance of the 30th year of the all-party commitment to eliminate child poverty by the year 2000 and the federal election in 2019, our spotlight is on the central role of universal childcare in the eradication of child poverty. The lack of affordable, high quality childcare robs children of valuable learning environments and keeps parents, mainly women, out of the workforce, education and training. Without childcare, parents cannot lift themselves out of poverty and improve their living standards.

Asset Building: An Effective Poverty-Reduction Strategy

This brief explains the asset-building approach to poverty reduction. While many families who live on low incomes struggle to meet basic needs, they miss out on opportunities to save and invest - opportunities that are critical in overcoming poverty. Without income, people are unable to get by and without assets, people are unable to get ahead. At Momentum, we call opportunities to save or invest, Asset Building.

With financial assets, individuals can pay down debt, save more, earn a good credit rating, save for a down payment on a home, and build a sustainable livelihood.

Complaints Related to Service from the CRA: Lessons Learned and Working Towards Better Service

Operating at arm’s length from the Canada Revenue Agency, the Office of the Taxpayers' Ombudsman (OTO) works to enhance the Canada Revenue Agency's (CRA) accountability in its service to, and treatment of, taxpayers through independent and impartial reviews of service-related complaints and systemic issues. OTO receives complaints and concerns from members of First Nations, Inuit and Métis communities. In this conference presentation, the Taxpayers’ Ombudsman provides examples of the types of issues her Office receives in order to provide community leaders with her insights in helping Indigenous people get better service from the CRA. In support of the AFOA Canada 2018 National Conference theme of Human Capital – Balancing Indigenous Culture and Creativity with Modern Workplaces, this presentation will provide participants with information on the types of issues and trends her office sees from members of the Indigenous communities and on better ways of serving these populations.

High-Cost Alternative Financial Services: The Customer Experience

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty Talks! and Sunrise Community Link Resource Centre. The following document summarizes what we learned from these conversations and the loan contracts that borrowers shared with us. It also identifies several themes that emerged from these discussions.

Summary Brief: High-Cost Alternative Financial Services

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial institutions. High-cost alternative financial services contribute to a two-tiered banking system, in which the poor often pay more for inferior services. Without more stringent regulation, and in the absence of safe and affordable short-term credit options, Albertans living on lower-incomes will continue to experience financial exclusion and take on heavy debt loads – both of which are major contributors to long-term poverty.

High-Cost Alternative Financial Services: Policy Options

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or credit union, access comes at a steep price and with a high degree of risk. On its own, one high-cost loan has the potential to trap a borrower in a cycle of debt, not only amplifying their short-term problem, but also limiting their ability to secure the income and assets needed to thrive in the long term. The policy recommendations presented in this brief, and summarized in the chart on page two, are inspired by the regulatory initiatives across the country, and reflect ways in which all three levels of government can contribute to better consumer protection for all Canadians.

The Complaints Process for Retail Investments in Canada: A Handbook for Investors

Canadian investors need more and better information to protect themselves both when they act on their own and when they retain lawyers. This handbook is intended to help Canadian investors better understand the choices they face when making a complaint and the impact of those choices. It can also serve as a guide to assist them when they work with lawyers, particularly those whose law practice does not focus on assisting Canadian investors in obtaining financial compensation.

Implementing Financial Coaching

A presentation on how financial coaching is different, client interaction and program evaluation and coaching as presented by Richard Simonds of Family Services of Greater Houston.

What to do when you get an income tax refund

Handout 5-6: Savings tools (basic)

This handout is from Module 5 of the Financial Literacy facilitator curriculum. Basic description of savings accounts and financial products available in Canada. To view full Financial Literacy facilitator curriculum, click here.

Unstuck: How to Get Out of Your Money Rut and Start Living the Life You Want. Complimentary Workbook

Your Money, Your Goals: A Financial Empowerment Toolkit for community volunteers

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money. Module 6-7: Debt and credit reports. Module 8: Money services, cards, accounts, and loans. Module 9: Protecting your money.

The Financially At Risk: Understanding the 12% of America That Experiences the Most Financial Stress