The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx, Indigenous, and Asian people, who are struggling due to deep financial disparities. Today’s disparities are built on, and exacerbated by, long-standing inequities created by structural racism, sexism, and classism, which have limited financial security and overall well-being for those affected. This brief responds to the urgency of this moment, reimagining and building on past recommendations to map more just paths to economic resilience moving forward.

Why care about care? Our economy depends on it

This brief lays out how care impacts economic recovery, family economic security and asset building, equity and justice, and the well-being of children, older adults, and people with disabilities. COVID-19 highlighted the importance of caregivers, as parents have become remote learning facilitators and professional caregivers have become front-line workers. Investing $77.5 billion per year in the care economy would support more than two million new jobs— 22.5 million new jobs over 10 years. And that number does not include return of family caregivers to the workforce, enabled by adequate support. A $77.5 billion annual investment in new jobs translates into $220 billion in new economic activity. Read the brief Watch the webinar View the webinar slides

The impact of COVID-19 on financial capability and asset building services.

The forced transition from in-person to online activities as a result of the COVID-19 pandemic has had a profound impact on how families and communities buy groceries, acquire medical care, and utilize social services. This rapid shift has raised important questions about how to address access and equity. AFN and the University of Wisconsin-Madison Center for Financial Security (CFS) conducted this study to better understand the transition to remote services among financial capability and asset building (FCAB) programs, which includes financial education, counseling, coaching, emergency assistance, benefits navigation, housing supports, workforce development, and other related services. The insights from this study can inform strategies for FCAB services going forward. This brief reviews recommendations for funders and organizations seeking to learn from the financial capability service delivery models employed in the COVID-19 pandemic, especially related to replication of findings that lead to more equitable delivery practices, improved accessibility of services, and greater financial improvements for clients. Six region-specific briefs complement the national findings - Indiana, Louisiana, North and South Carolina, Oregon, Texas, and Washington. This brief is generously supported by JPMorgan Chase & Co., MetLife Foundation, and Wells Fargo. If you missed the live webinar, watch the recording here.

Connecting families initiative

Daily aspects of Canadians' lives are increasingly touched by digital technology, and access to high-speed Internet has become an essential service and a key driver for improving our economic and social well-being. The Government of Canada originally announced Connecting Families in Budget 2017 to help bridge the digital divide for Canadian families who struggled to afford access to home Internet. Learn more about the next phase of this initiative.

Canada’s Disability Inclusion Action Plan

Canada’s Disability Inclusion Action Plan is a comprehensive, whole-of-government approach to disability inclusion. It embeds disability considerations across our programs while identifying targeted investments in key areas to drive change. It builds on existing programs and measures that have sought to improve the inclusion of persons with disabilities, and establishes new and meaningful actions.

Income support, inflation, and homelessness

A good deal of attention has been paid to the question of what these high rates of inflation in housing and food costs mean for Canadians. Much of the concern has focused on the implications for middle-income Canadians hoping to purchase a home, while squeezing their household budgets. But what do these rates of inflation mean for Canadians with very low income? For them, high rates of inflation in the price of food and shelter mean more than having to delay thoughts of homeownership. For them, the threats are considerably more serious.

Children’s savings accounts: a core part of the equity agenda

Education after high school, or postsecondary education (PSE), is an important determinant of individuals’ future opportunities, as well as their health and even lifespan. Children’s Savings Accounts (CSAs) are programs that aim to increase access to PSE by building parents’ and children’s educational expectations and a “college-bound identity” starting early in children’s lives. CSAs are a vital part of the equity agenda that remain critically important even as other strategies are put in place to broaden postsecondary access. CSAs programs provide children with savings accounts and financial deposits for the purpose of education after high school or other asset building. CSA program designs, enrollment procedures, and financial incentives vary widely across the U.S. CSAs have been flourishing at the local, city, and state levels over the past two decades. CSAs’ unique value comes down to programs’ financial investment in children coupled with their capacity to bring children and families into frequent contact with information about planning for PSE, savings, and high expectations for the future.

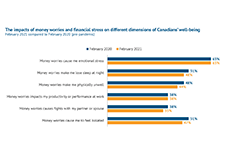

The Well-Being and Financial Well-Being of Canadians: financially vulnerable households the most challenged

This brief discusses how more financially vulnerable Canadians are most challenged based on the Seymour Financial Resilience Index TM. This E-Brief builds on Statistics Canada Canadians' Well-being in Year One of the COVID-19 Pandemic report and Seymour’s February 2021 Index Release Summary.

The Economic Reality of The Asian American Pacific Islander Community Is Marked by Diversity and Inequality, Not Universal Success

By most measures of economic success—whether it be income, education, wealth or employment—Asian Americans are doing well in the United States, both when compared to other communities of color as well to White households. But while these measures of success are noteworthy, the way they are collected, analyzed and presented all too often masks the disparate financial situations of the dozens of ethnic subgroups categorized as “Asian American.” This brief explores some of the misconceptions that feed into broadly held beliefs that all members of the AAPI community are part of one large homogenous and successful group.

Children’s Savings Account: Survey of Private and Public Funding 2019

Children’s Savings Account (CSA) programs offer a promising strategy to build a college-bound identity and make post-secondary education an achievable goal for more low- and moderate-income children. CSAs provide children (starting in elementary school or younger) with savings accounts and financial incentives for the purpose of education after high school. Beyond their financial value, CSAs are associated with beneficial effects for children and parents, including improved early child development. child health, maternal mental health, educational expectations, and academic performance. Many of these benefits are strongest for children from low-income families. This report shares a snapshot of the scale and makeup of the funding for the CSA field in 2019. It follows similar AFN reports on CSA funding in 2014-2015 and 2017 and captures the following data on CSA programs’ financial support in calendar year 2019:

Roadblocks and Resilience

This report, Roadblocks and Resilience Insights from the Access to Benefits for Persons with Disabilities project, provides insights on the barriers people with disabilities in British Columbia face in accessing key income benefits. These insights, and the accompanying service principles that participants identified, were obtained by reviewing existing research, directly engaging 16 B.C. residents with disabilities and interviewing 18 researchers and service providers across Canada. We will use these insights to inform development and testing of a pilot service to support people with disabilities to access disability benefits. The related journey map Common steps to get disability benefits also illustrates the complexities of this benefits application process. This journey map illustrates the process of applying for the Disability Tax Credit. The journey map Persons with Disability (PWD) status illustrates the process of preparing for and applying for and maintaining Persons with Disabilities Status and disability assistance in B.C.

Overcoming Digital Divides Workshop Series: Framing Paper

Canada’s digital divide has often been narrowly defined as the gap that exists between urban and rural broadband internet availability — Canadian urban centres have significantly greater internet subscription levels at faster speeds than rural communities.(Government of Canada, 2019). The cost of building new internet infrastructure in less developed areas continues to impede equitable access to sufficient internet services. This series aims to engage people living in Canada, industry, academia and policymakers to advance a deeper, more nuanced understanding of the circumstances that precipitate the conditions that shape digital inequities in Canada. Through expert panel discussions and thoughtful participatory dialogue, the series aims to drive toward innovative solutions to greater digital inclusion across Canada. The series will be presented in six parts, each tackling a specific theme with unique concerns. The series will also build on intersectional connections across themes while identifying new issues and impacted communities.

Social Listening: Covid-19, Social Media, and The Path to a Better Safety Net

This brief outlines how beneficiaries are using online platforms to identify breakdowns in public services, celebrate the positive impact of public policy and urge reform. Ways in which government can capitalize on widespread social media feedback and begin to build long-term measures to center people’s experience as an important component of policy design are explored.

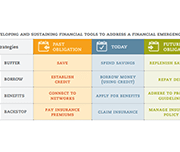

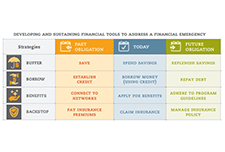

Achieving Financial Resilience in the Face of Financial Setbacks

Financial shocks like these happen to financially vulnerable families every day. Such shocks destabilize household finances and can create hardships that threaten overall well-being. Having tools to manage financial emergencies is critical for people’s long-run financial security. The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

The Impact of COVID-19 on Women living with Disabilities in Canada

DisAbled Women’s Network (DAWNRAFH) Canada is a national, feminist, cross-disability organization whose mission is to end the poverty, isolation, discrimination and violence experienced People with disabilities, specifically women with disabilities face unique barriers related to Covid-19. This includes both the increased risk oftransmission and death from COVID-19, as well as the unique ways policies targeting COVID-19 impact this group. Prior to COVID-19 more than 50% of human rights complaints at the Federal, Provincial and Territorial levels in Canada for the last four years have been disability related, which speaks to systemic failures that have been exacerbated under COVID-19. In this brief, DAWN Canada highlights these unique considerations, as well as significant and existing policy gaps facing this group.

by Canadian women with disabilities and Deaf women.

Financial Consumer Protection responses to COVID-19

This policy brief provides recommendations that can assist policy makers in their consideration of appropriate measures to help financial consumers, depending on the contexts and circumstances of individual jurisdictions, during the COVID-19 crisis. These options are consistent with the G20/OECD High Level Principles on Financial Consumer Protection that set out the foundations for a comprehensive financial consumer protection framework.

Supporting the financial resilience of citizens throughout the COVID-19 crisis

This policy brief outlines initial the measures that policy makers can make to increase citizen awareness about effective means of mitigation for the impact of the COVID-19 pandemic and its potential consequences on their financial resilience and well-being.

Clipped Wings: Closing the Wealth Gap for Millennial Women

AFN’s latest report, in collaboration with the Closing the Women’s Wealth Gap (CWWG) and the Insight Center for Community Economic Development reveals the current economic reality for millennial women and the primary drivers contributing to their wealth inequities. The report, Clipped Wings: Closing the Wealth Gap for Millennial Women is the second in a series of publications that builds off AFN’s 2015 publication, Women & Wealth, exploring how the gender wealth gap impacts women.

From Surviving to Thriving – Ensuring the Golden Years Remain Golden for Older Women

This brief explores the drivers of economic insecurity for older women and sets forth a number of strategies and promising practices for funders to consider which address the needs of older women. Doing so will ensure this generation and future generations of men and women in this country can age financially secure and with dignity. This publication is the fourth in a series of briefs that build on AFN’s publication, Women & Wealth, to explore how the gender wealth gap impacts women, particularly low-income women and women of color, throughout their life cycle, and provides responsive strategies and best practices that funders can employ to create greater economic security for women.

Women and Wealth: Insights for Grantmakers

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for Grantmakers examines the causes and dimensions of the women’s wealth gap and provides recommendations and best practices for grantmakers to reduce the women’s wealth gap and improve women’s access to the wealth escalator. Improving women’s ability to build wealth is not only good for women, but is essential for the economic well-being of children, families, and our nation. The webinar, included Mariko Chang, PhD, K. Sujata, President and CEO, Chicago Foundation for Women, and Dena L. Jackson, PhD, Vice President – Grants & Research, Texas Women’s Foundation.

Achieving financial resilience in the face of financial setbacks

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Making Safety Affordable: Intimate Partner Violence is an Asset-Building Issue

This brief explores three existing unmet needs that contribute to survivors’ inability to build wealth: money, tailored asset-building support, and safe and responsive banking and credit services. Within each identified need, specific issues facing survivors, strategic actions in response to those issues, as well as innovative ideas and existing promising practices to help funders take action to prioritize survivor wealth are discussed.

Wealth and Health Equity: Investing in Structural Change

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: On September 29th, AFN hosted a webinar to release the paper with featured speakers: Dr. Annie Harper, Ph.D., Program for Recovery and Community Health, Yale School of Medicine

Joelle-Jude Fontaine, Sr. Program Officer, Human Services, The Kresge Foundation

Dedrick Asante-Muhammad, Chief of Race, Wealth, and Community, National Community Reinvestment Coalition

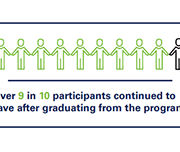

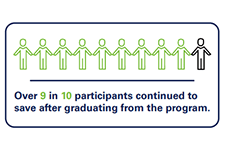

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling. This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

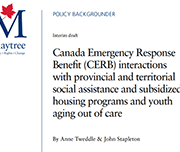

How does the Canada Emergency Response Benefit (CERB) impact eligibility of provincial benefits?

This policy backgrounder provides an overview of how provincial and territorial governments have decided to treat receipt of the Canada Emergency Response Benefit (CERB) for those receiving social assistance and/or living in subsidized housing. It also looks at provisions for youth aging out of care during the COVID-19 pandemic.

Locked down, not locked out: An eviction prevention plan for Ontario

Income Volatility: Why it Destabilizes Working Families and How Philanthropy Can Make a Difference

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique role for philanthropy. This brief helps grantmakers understand the enormous challenges income volatility presents in America and provides an array of strategies for philanthropy to leverage both investments and leadership to empower families to protect themselves from volatility’s worst effects.

When a Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy

This report sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs). Data suggests that EFWPs improve employees financial stability and help create a more productive work enviroment.

Advancing Health and Wealth Integration in the Earliest Years

Despite the well-documented connection between health and wealth, investing in this intersection is still a new approach for many grantmakers. With the goal of inspiring increased philanthropic attention, exploration, and replication, this new spotlight elevates responsive philanthropic strategies that support both health and wealth. This report focuses on the in utero-toddler stage of the life cycle (0-3 years). This age segment has some health-wealth integration activity, primarily through two-generation approaches. The goal is to inspire more philanthropic investment for this cohort by highlighting research and examples and offering recommendations.

A workplace-based economic response to COVID-19

This brief emerged from a conversation, held in late March 2020, among a number of individuals and organizations who work on issues of household financial security. Employers with financial resources and governments have an opportunity to use the workplace as a significant channel to deliver financial relief as part of the economic response to COVID-19, complementing critical supports governments are providing to individuals and businesses.

Client Engagement and Retention—The Secret Ingredient in Successful Financial Capability Programs

Grantmakers and practitioners recognize the importance of financial security for individuals and families, and many organizations therefore offer financial capability programs aimed at strengthening the financial well-being of the people they serve. But good financial capability programs are often high-touch and costly to provide for program administrators, and time consuming for clients to participate in. To benefit fully from such programs’ offerings, clients must actively participate in the program’s coaching, counseling, or other sessions, and engage in related activities to boost their financial health. Thus, understanding what drives client engagement is critical to helping programs improve program retention and outcomes, and concurrently, helps funders maximize the value of philanthropic dollars and customers’ time. Grantmakers concerned about best practices for funding effective financial capability efforts must therefore understand the vital role of client retention and the strategies for supporting the nonprofit sector to address this challenge. The brief explains the importance of client retention and engagement for financial capability program success, describes three key barriers to effective program participation, offers strategies to overcome those barriers, and closes with recommendations for philanthropy.

2018 White Paper: Financial Wellbeing Remains Challenged in Canada

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income variability and the extent to which Canadians have access to and lever their social capital (i.e. their family and friends who can provide financial advice and/or support in times of hardship). The study also explores consumer financial product and service usage, debt management and debt stress, access to financial products, services, advice and tools, usage of more predatory financial services (e.g. payday lending) and perceived levels of support by consumers’ primary Financial Institution for their financial wellness. The study also provides benefits of improved support for financial providers improving the financial wellness of their customers – including from a banking share of wallet and brand perspective.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

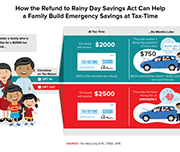

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Removing Savings Penalties for Temporary Assistance for Needy Families

This brief discusses the savings penalties in public assistance programs in the United States, also known as asset limits, and that actions that can be taken to eliminate these limits and the barriers towards building savings for families living on low income.

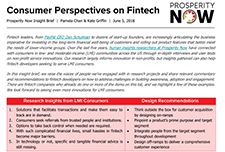

Consumer Perspectives on Fintech

This brief raises consumer perspectives on financial technology (fintech), and offers guidance for fintech developers on how to best serve low- to moderate-income clients.

Expanding Educational Opportunity Through Savings

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and impact.

Spurring Savings Innovations: Human Insight Methods for Savings Programs

This brief uses the experiences of participants in a service design process called the Savings Innovation Learning Cluster (SILC) to gather key insights into client perspectives and how it can be used to better program design. Four human insights research and design methods are explored—client interviews, client journey mapping, concept boards and prototyping—which can be used to develop more effective savings programs.

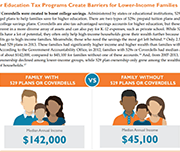

Enterprise Communities Plus: A network of financial capability services in low-income housing developments in New York City

In early 2018, Enterprise Community Partners (Enterprise) began a pilot program, Enterprise Community Plus (EC+), to provide financial capability services to residents in two neighborhoods in New York City. Enterprise is a nonprofit housing developer seeking to create opportunity for low- and moderate-income people through affordable housing in diverse, thriving communities. The pilot program seeks to develop a network of service providers dedicated to supporting the housing developments and introduce rent reporting for credit building and matched savings accounts to residents. Prosperity Now joined the implementation process in May 2018.

In this brief, we provide some initial information on the participants that currently are enrolled in the program and some lessons learned to guide other organizations in their efforts to provide financial capability services into housing programs.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

Debt and mental health: A statistical update

Financial problems can be a significant source of distress, putting pressure on people's mental health, particularly if they are treated insensitively by creditors. Some people in financial difficulty cut back on essentials, such as heating and eating, or social activities that support their well being, to try and balance their budget. In many cases this has a negative impact on people's mental health. This policy note from draws on nationally representative data to update key statistics on the relationship between debt and mental health problems, and sets out implications for policymakers, service providers and essential services firms.

Analyzing the Landscape of Saving Solutions for Low-Income Families

To address challenges around savings, the asset building and financial services fields have developed an array of solutions that attempt to support savings and wealth accumulation. However, the landscape of savings solutions is complex, difficult for households to navigate, and full of solutions that are not designed specifically for low-income and low-wealth households. This brief examines the savings challenges that households face, their underlying causes, and a vision for new solutions.

Does State-Mandated Financial Education Affect High-Cost Borrowing?

Using pooled data from the 2012 and 2015 waves of the National Financial Capability Study (NFCS), this research finds that young adults who were required to take personal finance courses in high school were significantly less likely to borrow payday loans than their peers who were not. These effects do not significantly differ by race/ethnicity or gender, suggesting that financial education may be useful regardless of demographics.

Overview: Financial Empowerment Center Counselor Training Standards

This overview summarizes the Financial Empowerment Center (FEC) model’s Counselor Training Standards. The Standards delineate the breadth and depth of the financial content areas, counseling and coaching skills, practice and experiential learning, and socio-economic and cultural context setting necessary to serve the diverse needs and backgrounds of FEC clients. The Standards also include a Code of Ethics that promotes responsible, professional and ethical financial counseling, furthering the profession of one on-one financial counseling.

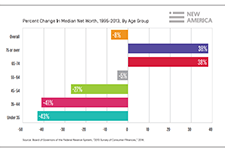

A Life-Cycle and Generational Perspective on the Wealth and Income of Millenials

Young adulthood is the life stage when the greatest increases in income and wealth typically occur, yet entering into this period during the Great Recession has put Millennials on a different trajectory. As a result, this generation will need to make very large gains in the years ahead to compensate for these shortfalls. Understanding the dynamics of how the recession has impaired the financial outlook of Millennials, such as identifying how far behind they are compared to previous

generations of young adults, the impact of the recession on their current wealth holdings and earning potential, and the pace at which they’re recovering, is essential to developing appropriate policy interventions that can put them back on track.

Asset Building: An Effective Poverty-Reduction Strategy

This brief explains the asset-building approach to poverty reduction. While many families who live on low incomes struggle to meet basic needs, they miss out on opportunities to save and invest - opportunities that are critical in overcoming poverty. Without income, people are unable to get by and without assets, people are unable to get ahead. At Momentum, we call opportunities to save or invest, Asset Building.

With financial assets, individuals can pay down debt, save more, earn a good credit rating, save for a down payment on a home, and build a sustainable livelihood.

Improving Education Outcomes through Children’s Education Savings

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career expectations, and future financial capability. This brief explains why RESPs are so important, and how parents can use RESPs to save for their children's education.

Summary Brief: High-Cost Alternative Financial Services

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial institutions. High-cost alternative financial services contribute to a two-tiered banking system, in which the poor often pay more for inferior services. Without more stringent regulation, and in the absence of safe and affordable short-term credit options, Albertans living on lower-incomes will continue to experience financial exclusion and take on heavy debt loads – both of which are major contributors to long-term poverty.

Responses to and Repercussions from Income Volatility in Low- and Moderate-Income Households: Results from a National Survey

Policy Brief – Why is Uptake of the Disability Tax Credit Low in Canada?

Disability supports should be designed to provide benefit and not burdens to eligible recipients. Unfortunately, this is not a reality when it comes to one of the main benefits open to Canadians with disability: the federal Disability Tax Credit (DTC). Designed to recognize some of the higher costs faced by people with severe disabilities and their caregivers, the DTC appears to be more of a burden for many, with estimated utilisation unacceptably low at around 40 per cent of working-aged adults with qualifying disabilities. Low uptake is a concern not only because people are missing out on the credit itself but also because eligibility to the DTC – which is not automatic – is a gateway to other important and more valuable benefits such as the Child Disability Benefit and Registered Disability Savings Plans (RDSP).

Do States Benefit From Restricting Safety-Net Eligibility Based on Wealth?

Investing in a Post Secondary Education Delivers a Stellar Rate of Return (TD Economics Topic Paper)

A Growing Movement: The State of the Children’s Savings Field 2016

The Children’s Savings Account (CSA) movement has taken off in the past few years. These programs provide long-term savings or investment accounts and savings incentives to help children build savings for their future. In 2016, CSA initiatives started in a diverse range of locations, such as Durham, NC; Boston, MA; and Worcester, MA. In 2017, we expect several more program launches, including in places like Oakland, CA, and Milwaukee, WI. Based on a recent survey, this document offers a snapshot of this growing field, illustrating the range of program models being customized to meet the needs of the communities and states these programs serve.

Cities and States Developing Creative Approaches to Fund Children’s Savings Accounts

Children’s Savings Accounts (CSA) are proving to be a powerful tool for growing college funds and building children’s aspirations for their future. CSAs are long-term, incentivized savings or investment accounts for post-secondary education that help promote economic mobility for children and youth. Advocates have found that the idea and goals of CSAs can be appealing to policymakers from across the political spectrum. However, while able to generate initial interest from policymakers, advocates often find that their efforts can stall when it comes to the question of how to fund a program. This paper provides advocates and policymakers with several funding options—including examples from the city and state-levels—for establishing publicly-supported CSA programs. For more information about CSAs in general, please visit savingsforkids.org.

Financial Empowerment: Improving financial outcomes for low-income households

Financial Empowerment is a new approach to poverty reduction that focuses on improving the financial security of low-income people. It is an evidence-driven set of interventions that have proven successful at both eliminating systemic barriers to the full financial inclusion of low-income people and providing enabling supports that help them to acquire and practice the financial skills and behaviours that tangibly improve their financial outcomes and build their financial security. The Financial Empowerment approach focuses on community level strategies that encompass five main types of interventions that have been identified as both necessary for low-income households to improve their financial outcomes, and effective at helping them to do so.