Financial wellness guide: questionnaire

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial goals.

Annual report 2022

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 18 years, AFN has provided a forum for grantmakers to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects their work over the past year working across 7 issues areas:

Canada’s Disability Inclusion Action Plan

Canada’s Disability Inclusion Action Plan is a comprehensive, whole-of-government approach to disability inclusion. It embeds disability considerations across our programs while identifying targeted investments in key areas to drive change. It builds on existing programs and measures that have sought to improve the inclusion of persons with disabilities, and establishes new and meaningful actions.

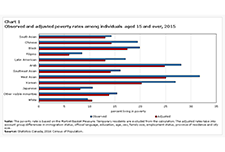

Social determinants and inequities in health for Black Canadians: a snapshot

The following snapshot aims to highlight how Anti-Black racism and systemic discrimination are key drivers of health inequalities faced by diverse Black Canadian communities. Evidence of institutional discrimination in key determinants of health is also presented, including education, income, and housing. Finally, national data is shared demonstrating inequalities in health outcomes and determinants of health. Readers are invited to reflect on how racism and discrimination may contribute to these inequalities.

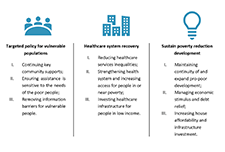

Understanding Systems: The 2021 report of the National Advisory Council on Poverty

Canada’s National Advisory Council on Poverty’s second Annual Report, Understanding Systems, is the first report to provide a glimpse into poverty since COVID-19. Based on community engagements with Canadians and provinces/territories over the last year, the Council has recommended five broad strategies to reduce poverty in Canada. The pillars of the strategy are as follows: In a recent webinar, three Council members shared what strategies can make the greatest impact. Read more to learn about the key takeaways from the discussion.

Ethnography of vulnerable newcomers’ experiences with taxes and benefits

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of this study is to develop the CRA’s understanding of newcomers’ experiences as they first encounter the Canadian tax and benefit system. These findings illuminate potential directions for improving tax and benefit information and services available for newcomers.

Gender differences in employment one year into the COVID-19 pandemic: An analysis by industrial sector and firm size

An important aspect of the impact of COVID-19 is its disproportional impact across gender. This Insights article proposes a year-over-year approach that compares employment from March 2020 to February 2021 to their March-2019-to-February-2020 counterparts. It uses the Labour Force Survey to study gender gaps patterns in employment by industrial sector (goods or services) and firm size.

Impacts of the COVID-19 pandemic on productivity growth in Canada

The COVID-19 pandemic has changed how production occurs in the economy in two ways. One is the full or partial closure of non-essential activities such as travel, hospitality, arts and entertainment, personal services, airlines, etc. The other is the widespread shift from in-office work to working from home. This Insights article depicts labour productivity growth in Canada and its sources by industry during the COVID-19 pandemic in order to examine the implications these changes may have had on the productivity performance of the economy.

Food Insecurity amid the COVID-19 Pandemic: Food Charity, Government Assistance, and Employment

To mitigate the effects of the coronavirus disease 2019 (COVID-19) pandemic, the federal government has implemented several financial assistance programs, including unprecedented funding to food charities. Using the Canadian Perspectives Survey Series 2, the demographic, employment, and behavioural characteristics associated with food insecurity in April–May 2020 was examined. One-quarter of job-insecure individuals experienced food insecurity that was strongly associated with pandemic-related disruptions to employment income, major financial hardship, and use of food charity was found, yet the vast majority of food-insecure households did not report receiving any charitable food assistance. Increased financial support for low-income households would reduce food insecurity and mitigate negative repercussions of the pandemic.

Economic impact of COVID-19 among Indigenous people

This article uses data from a recent crowdsourcing data initiative to report on the employment and financial impacts of the COVID-19 pandemic on Indigenous participants. It also examines the extent to which Indigenous participants applied for and received federal income support to alleviate these impacts. As Canada gradually enters a recovery phase, the article concludes by reporting on levels of trust among Indigenous participants on decisions to reopen workplaces and public spaces.

A labour market snapshot of South Asian, Chinese and Filipino Canadians during the pandemic

The COVID-19 pandemic has highlighted the varying labour market experiences and outcomes of diverse groups of Canadians. To mark Asian Heritage Month, Statistics Canada is providing a profile of the employment characteristics of the three largest Asian populations in Canada: South Asian, Chinese and Filipino Canadians. Results from the Labour Force Survey (LFS) show that South Asian men are much more likely to be employed than South Asian women, that Chinese Canadians have higher average hourly wages than other visible minority groups, and that Filipino women have among the highest employment rates of all groups, with many working on the front line in the health care sector during the pandemic. Unless otherwise stated, all data in this article reflect the population aged 15 to 69 during the three months ending in April 2021, and are not seasonally adjusted.

Labour Force Survey, April 2021

April Labour Force Survey (LFS) data reflect labour market conditions during the week of April 11 to 17.

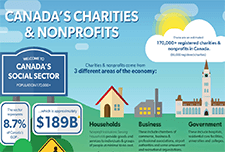

Canada’s Charities & Nonprofits

This infographic shows the size, scope, and economic contribution of charities and nonprofits across Canada.

Non-Profit Organizations and Volunteering Satellite Account: Human Resources Module, 2010 to 2019

In 2019, non-profit organizations (NPOs)—serving households, businesses and governments—employed 2.5 million people, representing 12.8% of all jobs in Canada. The employment share ranged between 12.4% and 12.8%, increasing during the 2010-to-2019 period. While the economic and social landscape of Canada is very different at the time of this release than it was in 2019, these data provide a valuable baseline to better understand the potential impacts of COVID-19 in later reference years.

Employment Insurance, February 2021

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and various other public health requirements. Public health measures were relaxed in Quebec, Alberta, Nova Scotia and New Brunswick on February 8, although a curfew remained in effect in Quebec. Measures were loosened in many regions of Ontario on February 10 and 15, although stay-at-home orders remained in place in the health regions of Toronto, Peel, York and North Bay Parry Sound. In Manitoba, various measures were eased on February 12. In contrast, Newfoundland and Labrador reintroduced a lockdown on February 12, requiring the widespread closure of non-essential businesses and services.

Impact of the COVID-19 Crisis on Montreal “Cultural Communities”

This exploratory study aims to better understand the challenges experienced by members of cultural communities in Montreal, particularly the most disadvantaged groups, during the COVID-19 pandemic in the Spring of 2020.

OpportuNext (career transition online tool)

OpportuNext from The Conference Board of Canada is a free-to-use career tool created in partnership with the Future Skills Centre. The tool can be used by anyone looking to plan a career path with a similar skillset or for anyone providing employment services.

The relationship between COVID-19 pandemic and people in poverty: Exploring the impact scale and potential policy responses

This research project aims to identify the relationship between COVID-19 pandemic and poverty in Vancouver, by analyzing how the COVID-19 pandemic has pushed people into poverty and the impact of COVID-19 on people already living in poverty. Several examples of COVID-19 recovery policies and projects being implemented elsewhere that could support people experiencing poverty in Vancouver are also provided.

The Differential Impact of the Pandemic and Recession on Family Finances

This report summarizes the results of a follow-up survey with nineteen low- and modest-middle income Winnipeggers, undertaken in June through September 2020. These respondents were drawn from the 29 Canadian Financial Diaries (CFD) participants who completed a year-long diary in 2019. The results of the survey illustrate that low- and moderate-income earners are feeling stressed with increased expenses and uncertainty about future economic stability.

Impacts of the Covid-19 Pandemic on Women: Report of the Standing Committee on the Status of Women

The effects of the COVID-19 pandemic have been profound and far-reaching. Beyond endangering the health of Canadians, the pandemic has worsened inequalities among groups of people. Women, girls and gender-diverse people have faced unique challenges during the pandemic. The Committee recommends that the Government of Canada take various actions to assist women, girls and gender-diverse people during and after the COVID-19 pandemic. Many recommendations relate to improving women’s health and labour force participation. Some recommendations focus specifically on women’s paid and unpaid care work. The Committee also recommends interventions to help reduce trafficking and violence against women.

Aspects of quality of employment in Canada, February and March 2020

The labour market in Canada has experienced unprecedented changes over the last 12 months. Entire sectors of the economy have been subject to temporary restrictions on business activities as a result of public health measures aimed at limiting the spread of COVID-19. At the same time, many workers have seen changes in working conditions, such as teleworking, reduced work hours and greater job insecurity. From mid-February to mid-March 2020, the 2020 Survey on Quality of Employment (SQE) collected information on aspects of job quality in Canada from the perspective of workers. Estimates reflect employment characteristics before the full onset of the COVID-19 pandemic and contribute to establishing a baseline for future analysis of quality of employment in Canada. Unless otherwise stated, the analysis focuses on the 23.5 million workers who were employed in February or March 2020 or who had last worked in 2018 or after, and excludes unpaid family workers.

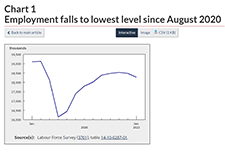

Labour Force Survey, February 2021

February Labour Force Survey (LFS) data reflect labour market conditions during the week of February 14 to 20. In early February, public health restrictions put in place in late December were eased in many provinces. This allowed for the re-opening of many non-essential businesses, cultural and recreational facilities, and some in-person dining. However, capacity limits and other public health requirements, which varied across jurisdictions, remained in place. Restrictions were eased to varying degrees in Quebec, Alberta, New Brunswick, and Nova Scotia on February 8, although a curfew remained in effect in Quebec. In Ontario, previous requirements were lifted for many regions on February 10 and 15, while the Toronto, Peel, York and North Bay Parry Sound health regions remained under stay-at-home orders through the reference week. Various measures were eased in Manitoba on February 12. In contrast, Newfoundland and Labrador re-introduced a lockdown on February 12, requiring the widespread closure of non-essential businesses and services.

Labour Force Survey, January 2021

After the December Labour Force Survey (LFS) reference week—December 6 to 12—a number of provinces extended public health measures in response to increasing COVID-19 cases. January LFS data reflect the impact of these new restrictions and provide a portrait of labour market conditions as of the week of January 10 to 16. In Ontario, restrictions already in place for many regions of southern Ontario—including the closure of non-essential retail businesses—were extended to the rest of the province effective December 26. In Quebec, non-essential retail businesses were closed effective December 25 and a curfew implemented on January 14 further affected the operating hours of some businesses. As of the January reference week, existing public health measures continued in Alberta and Manitoba, including the closure of in-person dining services, recreation facilities and personal care services, as well as restrictions on retail businesses. Restrictions were eased between the December and January reference weeks in two provinces. In Prince Edward Island, closures of in-person dining and recreational and cultural facilities were lifted on December 18. In Halifax, Nova Scotia, and the surrounding area, restrictions on in-person dining were eased on January 4.

Study: The changing nature of work in Canada amid recent advances in automation technology

While automation has changed the nature of work in Canada over the past few decades, this change was very gradual, and did not accelerate with the very recent developments in artificial intelligence. The results of this study reveal that the share of Canadians working in managerial, professional and technical occupations increased from 23.8% in 1987 to 31.2% in 2018, while the share employed in service occupations increased more moderately from 19.2% to 21.8% over the same timeframe. Jobs in both of these occupational groups are generally difficult to automate. Meanwhile, the share of workers employed in production, craft, repair and operative occupations (more automatable tasks) went from 29.7% in 1987 to 22.2% in 2018, while the share employed in sales, clerical and administrative support occupations also fell over the period (from 27.3% in 1987 to 24.9% in 2018). These jobs are generally more amenable to automation.

Labour Force Survey, December 2020

December Labour Force Survey (LFS) results reflect labour market conditions as of the week of December 6 to 12. As of the reference week, public health measures introduced earlier in the fall remained in place in Manitoba and much of Quebec. These included the closure of many recreation and cultural facilities and in-person dining services, as well as various degrees of restrictions on retail businesses.

Canadian Economic Dashboard and COVID-19

This dashboard presents selected data that are relevant for monitoring the impacts of COVID-19 on economic activity in Canada. It includes data on a range of monthly indicators - real GDP, consumer prices, the unemployment rate, merchandise exports and imports, retail sales, hours worked and manufacturing sales -- as well as monthly data on aircraft movements, railway carloadings, and travel between Canada and other countries.

Labour Force Survey, November 2020

November Labour Force Survey (LFS) results reflect labour market conditions as of the week of November 8 to 14. In September and October, many provinces began introducing targeted public health measures in response to rising COVID-19 numbers. In early November, restrictions related to indoor dining and fitness facilities were eased in Ontario, while in Manitoba new measures affecting restaurants, recreational facilities and retail businesses were introduced. Much of Quebec remained at the "red" alert level in November, leading to the ongoing closure of indoor dining and many recreational and cultural facilities.

The long-term labour market integration of refugee claimants who became permanent residents in Canada

Although refugee claimants seek asylum in Canada for humanitarian reasons, their labour market outcomes play a crucial role in their successful integration, which is why it is important to monitor the degree of labour market success achieved by refugee claimants. This study compares the long-term labour market outcomes of refugee claimants who eventually became permanent residents in Canada (RC-PRs) with those of government-assisted refugees (GARs) and privately sponsored refugees (PSRs), as well as with refugee claimants who did not become permanent residents in Canada (RC-NPRs).

Labour Force Survey, October 2020

October Labour Force Survey (LFS) results reflect labour market conditions as of the week of October 11 to 17. By then, several provinces had tightened public health measures in response to a spike in COVID-19 cases. Unlike the widespread economic shutdown implemented in March and April, these measures were targeted at businesses where the risk of COVID transmission is thought to be greater, including indoor restaurants and bars and recreational facilities. Employment increased by 84,000 (+0.5%) in October, after growing by an average of 2.7% per month since May. The unemployment rate was 8.9%, little changed from September. Employment increases in several industries were partially offset by a decrease of 48,000 in the accommodation and food services industry, largely in Quebec.

Labour Force Survey, September 2020

The September Labour Force Survey (LFS) results reflect labour market conditions as of the week of September 13 to 19. At the beginning of September, as Canadian families adapted to new back-to-school routines, public health restrictions had been substantially eased across the country and many businesses and workplaces had re-opened. Throughout the month, some restrictions were re-imposed in response to increases in the number of COVID-19 cases. In British Columbia, new rules and guidelines related to bars and restaurants were implemented on September 8. In Ontario, limits on social gatherings were tightened for the hot spots of Toronto, Peel and Ottawa on September 17 and for the rest of the province on September 19.

The Canadian Housing Survey, 2018: Core housing need of renter households living in social and affordable housing

This article provides a high level overview of those living in social and affordable housing by painting a portrait of them based on the results of the 2018 CHS. Socio-demographic and household characteristics are examined using housing indicators such as core housing need.

Impact of the COVID-19 pandemic on the NEET (not in employment, education or training) indicator, March and April 2020

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit its spread—have affected young people in a number of ways, including high unemployment rates, school closures and education moving online.

Serving Individuals With Disabilities – A Day in the Life of an American Job Center

The Disability and Employment eLearning Task Force in collaboration with the Employment and Training Administration (ETA) released three eLearning Training Modules to help support the professional development needs of the workforce development staff across the United States. The first module provide tools and resources to support front-line American Job Center staff effectively serve customers with disabilities, covering strategies for effective communication and interaction with individuals with disabilities.

Questions and answers to legal topics in Ontario

The Community of Legal Education Ontario (CLEO) website contains answers to common questions pertaining to a number of legal topics, including: COVID-19, debt and consumer rights, and employment and work.

Labour Force Survey, August 2020

The August Labour Force Survey (LFS) results reflect labour market conditions as of the week of August 9 to 15, five months following the onset of the COVID-19 economic shutdown. By mid-August, public health restrictions had substantially eased across the country and more businesses and workplaces had re-opened.

Canada’s Forgotten Poor? Putting Singles Living in Deep Poverty on the Policy Radar

This report presents the findings of extensive research about employable singles on social assistance undertaken by Toronto Employment and Social Services, in partnership with the Ontario Centre for Workforce Innovation. Drawing on data from 69,000 singles who were receiving social assistance in Toronto in 2016, and 51 interviews with randomly selected participants, the report highlights these individuals’ characteristics, their complex needs, and the barriers they face in moving off social assistance and into employment. Complementing the quantitative analysis, the interviews provide important insights into the daily realities of participants’ lives and their journeys on and off assistance.

Impacts of COVID-19 on persons with disabilities

This article provides a general snapshot of the employment and income impacts of COVID-19 on survey participants aged 15 to 64 living with long-term conditions and disabilities.

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

Transitions into and out of employment by immigrants during the COVID-19 lockdown and recovery

During the widespread lockdown of economic activities in March and April 2020, the Canadian labour market lost 3 million jobs. From May to July, as many businesses gradually resumed their operations, 1.7 million jobs were recovered. While studies in the United States and Europe suggest that immigrants are often more severely affected by economic downturns than the native born (Borjas and Cassidy 2020; Botric 2018), little is known about whether immigrants and the Canadian born fared differently in the employment disruption induced by the COVID-19 pandemic and, if so, how such differences are related to their socio-demographic and job characteristics. This paper fills this gap by comparing immigrants and the Canadian-born population in their transitions out of employment in the months of heavy contraction and into employment during the months of partial recovery. The analysis is based on individual-level monthly panel data from the Labour Force Survey and focuses on the population aged 20 to 64. Immigrants are grouped into recent immigrants who landed in Canada within 10 years or less, and long-term immigrants who landed in Canada more than 10 years earlier.

A Feminist Economic Recovery Plan for Canada: Making the Economy Work for Everyone

This report offers an intersectional perspective on how Canada can recover from the COVID-19 crisis and weather difficult times in the future, while ensuring the needs of all people in Canada are considered in the formation of policy.

YWCA Canada and the University of Toronto’s Institute for Gender and the Economy (GATE) offer this joint assessment to highlight the important principles that all levels of government should consider as they develop and implement policies to spur post-pandemic recovery.

Changes in the socioeconomic situation of Canada’s Black population

This study provides disaggregated statistics on the socioeconomic outcomes of the Black population by generation status (and immigrant status), sex and country of origin, and is intended to illustrate and contribute to the relevance of disaggregation in understanding these populations and the diversity of their situation. This study sheds light on some of the issues faced by the Black population and shows differences that exist compared with the rest of the working-age population, by sex, generation and place of origin, from 2001 to 2016.

Race to Lead: Women of Color in the Nonprofit Sector

This report reveals that women of color encounter systemic obstacles to their advancement over and above the barriers faced by white women and men of color. Education and training are not the solution—women of color with high levels of education are more likely to be in administrative roles and are more likely to report frustrations about inadequate and inequitable salaries. BMP’s call to action focuses on systems change, organizational change, and individual support for women of color in the sector.

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Weathering Volatility 2.0: A Monthly Stress Test to Guide Savings

In this report, the JPMorgan Chase Institute uses administrative bank account data to measure income and spending volatility and the minimum levels of cash buffer families need to weather adverse income and spending shocks. Inconsistent or unpredictable swings in families’ income and expenses make it difficult to plan spending, pay down debt, or determine how much to save. Managing these swings, or volatility, is increasingly acknowledged as an important component of American families’ financial security. This report makes further progress toward understanding how volatility affects families and what levels of cash buffer they need to weather adverse income and spending shocks.

U.S. Financial Health Pulse: 2019 Trends Report

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning -- to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable”. The data in the Pulse report provide critical insights that go beyond aggregate economic indicators, such as employment and market performance, to provide a more accurate picture of the financial lives of people in the U.S.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Expert Insights: Preventing Evictions in Communities of Color During COVID-19

COVID-19 is radically reshaping many aspects of people’s financial health in America, including their housing security. The economic fallout is disproportionately impacting communities of color due to systemic inequities related to race, housing, employment, and more. As the protections put in place at the start of the pandemic fade away, the United States are facing an eviction tsunami that will disparately displace Black and Latinx families. On August 25, AFN’s summer Expert Insights briefed attendees on rental risks and evictions related to COVID-19. Speakers were Solomon Greene with The Urban Institute and Dr. Christie Cade of NeighborWorks America.

Understanding the Pathways to Financial Well-Being

The National Financial Well-Being Survey Report is the second report in a series from the Understanding the Pathways to Financial Well-Being project. In order to measure and study the factors that support consumer financial well-being, in 2015, the Bureau of Consumer Financial Protection (the Bureau) contracted with Abt Associates to field a large, national survey to collect information on the financial well-being of U.S. adults. The present report uses data collected from that survey to answer a series of questions on the relationship among financial well-being and four key factors: objective financial situation, financial behavior, financial skill, and financial knowledge. In this study, we aim to enhance understanding of financial well-being and the factors that may support it by exploring these relationships.

Your rights at work

This publication explains a worker’s legal rights under the Employment Standards Act regarding hours of work and pay, overtime, breaks, holidays and vacations, and leave from your job. It also has information about how to make a claim against an employer.

Workers’ Compensation: Making a claim

This resource explains what a worker should do if they have a job-related injury or disease, how they can apply for benefits from the Workplace Safety and Insurance Board, and what happens when the Board gets a report of their injury. It also has sections about what their employer must do, and where injured workers can get legal help.

Legal Resources Catalogue: Free legal information

This resource provides a list of free legal information resources produced by Community Legal Education Ontario (CLEO).

Costing a Guaranteed Basic Income During the COVID Pandemic

The Parliamentary Budget Officer (PBO) supports Parliament by providing economic and financial analysis for the purposes of raising the quality of parliamentary debate and promoting greater budget transparency and accountability. This report responds to a request from Senator Yuen Pau Woo to estimate the post-COVID cost of a guaranteed basic income (GBI) program, using parameters set out in Ontario’s basic income pilot project. In addition, the report provides an estimate of the federal and provincial programs for low-income individuals and families, including many non-refundable and refundable tax credits that could be replaced by the GBI program.

Labour Force Survey in brief: Interactive app

Part of the Canadian Labour Market Observatory, this interactive data visualization application showcases publicly available labour market information. The fully interactive applications allow Canadians to quickly and easily personalize the information in a way that is relevant to them and their interests.

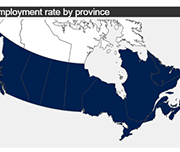

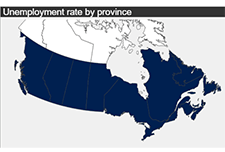

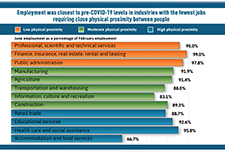

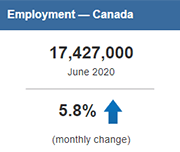

Infographic: COVID-19 and the labour market in June 2020

This infographic displays information on the Canadian labour market in June 2020 as a result of COVID-19.

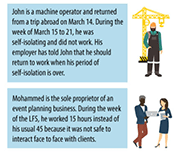

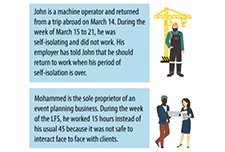

Labour Force Survey, June 2020

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance payments. New questions were added to measure the extent to which COVID-19-related health risks are being mitigated through workplace adaptations and protective measures.

Economic impact of COVID-19 among visible minority groups

Since visible minorities often have more precarious employment and higher poverty rates than the White population, their ability to adjust to income losses due to work interruptions is likely more limited. Based on a large crowdsourcing data collection initiative, this study examines the economic impact of the COVID-19 pandemic on visible minority groups. Among the crowdsourcing participants who were employed prior to work stoppages, Whites and most visible minority groups reported similar rates of job loss or reduced work hours. However, visible minority participants were more likely than White participants to report that the COVID-19 pandemic had affected their ability to meet financial obligations or essential needs, such as rent or mortgage payments, utilities, and groceries.

Income Volatility: Why it Destabilizes Working Families and How Philanthropy Can Make a Difference

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique role for philanthropy. This brief helps grantmakers understand the enormous challenges income volatility presents in America and provides an array of strategies for philanthropy to leverage both investments and leadership to empower families to protect themselves from volatility’s worst effects.

Employer Solutions: From Emergency to Resiliency

In light of COVID-19, the financial security of workers has never been more in question. The workplace is an important delivery channel for tailored financial products and services that can help meet employee’s immediate financial needs and build long-term financial stability. The workplace is a unique platform to identify, target, and meet the specific financial needs of employees. This webinar gives funders the tools and inspiration to respond effectively to the low- and moderate-income workforce in this moment and beyond.

When a Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy

This report sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs). Data suggests that EFWPs improve employees financial stability and help create a more productive work enviroment.

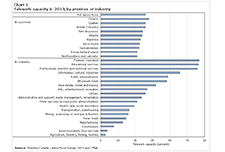

Inequality in the feasibility of working from home during and after COVID-19

The economic lockdown to stop the spread of COVID-19 has led to steep declines in employment and hours worked for many Canadians. For workers in essential services, in jobs that can be done with proper physical distancing measures or in jobs that can be done from home, the likelihood of experiencing a work interruption during the pandemic is lower than for other workers. To shed light on these issues, this article assesses how the feasibility of working from home varies across Canadian families. It also considers the implications of these differences for family earnings inequality.

Infographic: The impact of COVID-19 on the Canadian labour market

This infographic presents information on the impact of COVID-19 on the Canadian labour market, based from the Labour Force Survey conducted each month. Over three million Canadians were affected by job loss or reduced hours.

A workplace-based economic response to COVID-19

This brief emerged from a conversation, held in late March 2020, among a number of individuals and organizations who work on issues of household financial security. Employers with financial resources and governments have an opportunity to use the workplace as a significant channel to deliver financial relief as part of the economic response to COVID-19, complementing critical supports governments are providing to individuals and businesses.

The Dynamics of Disability: Progressive, Recurrent or Fluctuating Limitations

Different from common perception, many disabilities do not follow a stable pattern. Persons with disabilities may experience periods of good health in between periods of their limitations and/or experience changes in the severity of their limitations over time. These types of disabilities may be characterized as dynamic because the very nature of the disability is one of change with different possible trajectories over time. As a consequence, the collective experiences of those with disability dynamics are likely to be different than those with so-called “continuous” disabilities. In this paper, four groups of persons with different disability dynamics (or lack of dynamics) are profiled based on data from the 2017 Canadian Survey on Disability. Each group has their own unique demographic, employment, and workplace accommodation profile based on the length of time between periods of their limitations, as well as changes in their limitations over time.

Infographic: The Changing Characteristics of Canadian Jobs

This infographic released by Statistics Canada shows some of the ways the Canadian workforce has changed from 1981 to 2018. Some of these changes include industry, pension coverage, whether jobs are full-time and permanent, and whether they are unionized. These changes have also not been uniform for men and women.

Does education pay? A comparison of earnings by level of education in Canada and its provinces and territories

This report examines the relationship between the earnings of Canadians in the labour market and their post-secondary education credentials. Findings are based upon information gathered from the 2016 Census on adults between the ages of 25 to 64 with different levels of education and working in different parts of the country.

Earnings Inequality and the Gender Pay Gap in Canada

This study from Statistics Canada explores how increases in top earnings and the representation of women among top earners affect the overall gender earnings gap in Canada. Results show that even though the representation of women in top earnings groups increased from 1978 to 2015, their continued under-representation in these groups accounted for a substantial and growing share of the gender gap in total annual earnings.

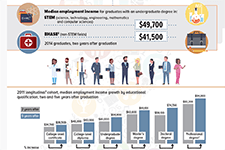

Infographic: Labour market outcomes for college and university graduates, 2010 to 2014

This infographic from Statistics Canada shows the labour market outcomes for college and university graduates between 2010 and 2014. It shows the median employment income achieved by graduates of different education levels, 2 years and 5 years post-graduation. Overall, it shows that people with higher levels of post-secondary education report higher employment income post-graduation.

Canadian Millenial Social Values Study

A major national survey conducted in 2016 reveals a bold portrait of Canada’s Millennials (those born between 1980 and 1995), that for the first time presents the social values of this generation, and the distinct segments that help make sense of the different and often contradictory stereotypes that so frequently are applied to today’s young adults. Key findings from the survey explore Millennials' relationship with money, education, work and career interests, voting turnout, and engagement with social justice.

Supporting Employee Financial Stability: How Philanthropy Catalyzes Workplace Financial Coaching Programs

More than half of all employees in the United States report that they are This report describes different workplace models, the common characteristics and challenges of programs, and provides recommendations for funders who want to invest in workplace approaches to help workers achieve financial stability.

financially stressed, and nearly one in three employees reports being distracted by personal financial issues while at work. This financial stress impacts individuals’ health, relationships, productivity, and time away from work.

Boosting the Earned Income Tax Credit for Singles

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income workers without dependent children. The program, which provides a bonus of up to $2,000 at tax time, is being evaluated using a randomized controlled trial in New York City and Atlanta. This report presents findings through three years from New York, where over 6,000 low-income single adults without dependent children enrolled in the study in late 2013. The findings are consistent with other research on the federal EITC, indicating that an effective work-based safety net program can increase incomes for vulnerable and low-income individuals and families while encouraging and rewarding work.

Redesigning Social Policy for the 21st Century

In this video presentation Sunil Johal from the Mowat Centre explains how social policy in the 21st century could be redesigned to accommodate the changing nature of work and income in Canada. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Income volatility: Strategies for helping families reduce or manage it

In this video presentation David Mitchell from the Aspen Institute explains strategies for mitigating and preventing income volatility at the household level. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Gig Workers in America: Profiles, Mindset and Financial Wellness

The Gig Worker On-Demand Economy survey was conducted online by Harris Poll on behalf of Prudential from January 5 to February 18, 2017, among a nationally representative (U.S.) sample of 1,491 workers including 514 full-time and 256 part-time traditional employees and 721 gig workers. Gig work was defined as providing a service or labor, and did not include renting out assets. Survey respondents were selected from among adults aged 18+ who had agreed to participate in online surveys from the Harris Poll Online panel and preferred sample partners.