Economic abuse screening tool (a toolkit for social service providers)

Women’s shelters are often the first point of contact for victim-survivors fleeing abusive relationships. Therefore, safety and shelter are logically at the forefront of staff members’ immediate concerns. Once the victim-survivor is in a place of safety, it is crucial to explore the patterns of abuse the person has experienced. Economic security is an often overlooked pattern of abuse linked to physical safety. It is, therefore, crucial and the goal of this screening tool for shelter workers to identify potential Economic and Financial Abuse amongst their clients and to assist victim-survivors in accessing essential economic resources. Watch the webinar: Recognizing and responding to economic abuse; empowering survivors to thrive and succeed.

Research to help FSRA improve the lives of vulnerable consumers

Financial Services Regulatory Authority of Ontario commissioned a research study that focused on consumer attitudes, how consumers are engaging with financial services, and consumer characteristics such as vulnerability. Insights from the research are allowing FSRA to better understand the realities of consumers’ changing financial lives and helping to identify key opportunities to respond to the needs of vulnerable consumers. 2022 Consumer Research Study highlights. 2022 Consumer Research Study full report

Ten frugal habits to save money

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said they would put it in savings or invest it. With inflation as high as it has been in over 40 years, saving money is becoming increasingly difficult for some. This article lists ten frugal habits to help you save.

Social influencers and your finances

Just because someone has a lot of followers doesn’t mean their advice is right for you. Social media influencers are increasingly sharing information about investing. This can be done by ordinary people or by celebrities who have taken an interest in a specific product or investment. They are often called “finfluencers” — financial influencers whose media accounts are focused on money and investing. This article will outline some questions to ask yourself before you choose to invest.

Multicultural and newcomer charitable giving study

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving and volunteerism.

Behavioural bias checker

Being aware of potential biases can help you become a better decision-maker. Use this tool to improve your awareness of different behavioural biases or “blind spots” that may influence your decisions.

Economic Abuse: Coercive Control Tactics in Intimate Relationships

This infographic explores 3 forms of economic abuse and associated tactics used to coercively control intimate partners. These abusive tactics are compounded by economic systems that systemically oppress groups including Black, Indigenous, and people of colour; people with disabilities; people with precarious immigration status; and gender-oppressed people. Economic abuse consists of behaviours to control, exploit, and sabotage an individual’s resources. It limits the individual’s independence and autonomy. Compared to financial abuse which usually only focuses on money, economic abuse includes a more expansive range of behaviour that affects things like employment, food, medicine, and housing. Economic abuse is often used to coercively control individuals, such as intimate partners. It occurs in conjunction with further forms of abuse, like physical and sexual violence. Economic abuse can make it more difficult for survivors to escape violence since they may not have the resources to secure long-term housing and employment while meeting basic needs for themselves and potentially their children.

The Comeback Generation: Pandemic is inspiring Gen Z to build financial resilience

The coronavirus pandemic has tested the limits of Canadians over the past 20 months. What began as a health crisis quickly morphed into an economic crisis, with the spread of COVID‑19 shocking large segments of the economy and leaving many without paycheques. While no generation has been unaffected by the pandemic, the economic impact was distributed unevenly. Many younger Canadians in Generation Z, or Gen Z, have had their education disrupted, career plans changed, and financial prospects diminished largely because they are overrepresented in the highly affected service sector, according to a new survey by the Canadian Bankers Association (CBA). The survey was published to mark Financial Literacy Month, which takes place each November, and found that more than half (53 per cent) of Gen Z respondents (aged 18‑25) felt the pandemic upended their financial security, with that number rising to 73 per cent for those in less stable financial situations. At the same time, nine‑in‑ten (88 per cent) Gen Zers are feeling optimistic about their financial futures, and nearly all of them (98 per cent) are actively making plans to strengthen their financial resilience. "Gen Z was dealt a disproportionately tough hand during the pandemic, but it has also shown incredible resilience in channeling its natural gifts for perseverance, adaptability and motivation," says Neil Parmenter, President and CEO, Canadian Bankers Association. "Despite the setbacks, younger Canadians are eager to forge ahead, be prepared for the unexpected and build bright futures as our economy recovers."

Encouraging tax filing at virtual clinics

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual clinics.

Financial Well-Being: A Conceptual Model and Preliminary Analysis

Based on an extensive literature review and re-analysis of existing qualitative data, this report offers a working definition and an a priori conceptual model of financial well-being and its possible determinants. Using survey data from Norway (2016), ten regression models have been conducted to identify the key drivers of financial well-being and enhance the understanding of the underlying mechanisms responsible for the unequal spread of well-being across the population. The preliminary analyses in this report were consistent with both the definition and the model, albeit with some nuances and unexplained effects. The empirical analysis identified three sub-domains of financial well-being. It was found that all three measures share three behaviours as their main drivers: ‘active saving’, ‘spending restraints’ and ‘not borrowing for daily expenses’. Also, ‘locus of control’ stood out as an important explanatory variable, with significant impacts on all three levels of well-being. Beyond that, some distinguishing characteristics were identified for each of the measures.

Financial Education Affects Financial Knowledge and Downstream Behaviors

This study covers the rapidly growing literature on the causal effects of financial education programs in a meta-analysis of 76 randomized experiments with a total sample size of over 160,000 individuals. The evidence shows that financial education programs have, on average, positive causal treatment effects on financial knowledge and downstream financial behaviors. Treatment effects are economically meaningful in size, similar to those realized by educational interventions in other domains and are at least three times as large as the average effect documented in earlier work. These results are robust to the method used, restricting the sample to papers published in top economics journals, including only studies with adequate power, and accounting for publication selection bias in the literature. The study concludes with a discussion of the cost-effectiveness of financial education interventions.

Fearless Woman: Financial Literacy and Stock Market Participation

Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. This survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response option is unavailable, they often choose the correct answer. The authors find that about one-third of the financial literacy gender gap can be explained by women’s lower confidence levels. Both financial knowledge and confidence explain stock market participation.

Testing the use of the Mint app in an interactive personal finance module

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s effectiveness at improving students’ financial knowledge, attitudes, and behavior. Students at the George Washington University participated in a half-day budgeting workshop and were exposed to either Mint, which is a real-time, automated platform, or Excel, which is an offline, static tool. The authors found that participation in both workshops was associated with improved preparedness to have conversations about money matters with parents, a greater sense of financial autonomy, and an increased awareness of the importance of budgeting, but that participants in the Mint workshop were more likely to have a positive experience using the budgeting tool, to feel confident that they could achieve a financial goal, and to be engaged in budgeting one month after the workshop. Results show that even short financial education interventions can meaningfully influence students’ financial attitudes and behavior and that an interactive tool like Mint may have advantages over a more static tool like Excel.

Attitudes Toward Debt and Debt Behavior

This paper introduces a novel survey measure of attitude toward debt. Survey results with panel data on Swedish household balance sheets from registry data are matched, showing that debt attitude measure helps explain individual variation in indebtedness as well as debt build-up and spending behavior in the period 2004–2007. As an explanatory variable, debt attitude compares well to a number of other determinants of debt, including education, risk-taking, and financial literacy. Evidence that suggests that debt attitude is passed down along family lines and has a cultural element is also presented.

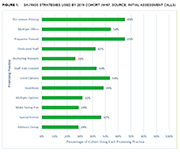

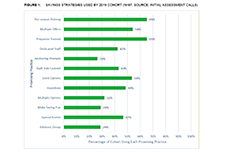

Tax Time: An opportunity to Start Small and Save Up

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being. This paper also provides a few examples of how Volunteer Income Tax Assistance (VITA) programs creatively used Bureau tools, resources and technical assistance to encourage savings as well as some of the results they reported. It provides insights from a subgroup of the programs in the cohort that collected additional information from consumers on their intent to save, the various types of accounts into which they saved, and the goals they were striving for by saving. Finally, this paper offers recommendations on some strategies that can be employed to increase people’s interest and commitment to saving during the tax preparation process.

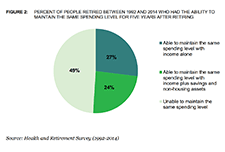

Retirement Security and Financial Decision-making: Research Brief

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level of spending for at least five consecutive years after retiring. The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring. In addition, the Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years. The study helps identify ways to protect retirees from overspending their savings in early retirement.

Behavioural insights: key concepts, applications and regulatory considerations

There are numerous factors that influence the decisions that people make. Behavioural insights (BI) recognizes this and, through a combination of psychology, economic and more recently other behavioural research, examines how people are often neither deliberate nor rational in their decisions in the way that traditional models, strategies and policies assume. Behavioural insights recognize how people actually behave versus traditional economic and market theory of people as rational actors. This report discusses how leading practitioners and regulators around the world are using behavioural insights to address issues in capital markets and improve outcomes for investors and market participants.

Encouraging Retirement Planning through Behavioural Insights

This research report identifies behaviourally informed ways that government, regulators, employers, and financial institutions can encourage retirement planning. Thirty different initiatives and tactics that could be implemented by a variety of stakeholders to encourage retirement planning are proposed, and interventions are organized around four primary challenges people face in moving from having the intention to create a retirement plan to the action of making a plan: (1) it’s hard to start, (2) it’s easy to put off, (3) it’s easy to get overwhelmed and drop out, and (4) it’s hard to get the right advice. The report also includes the results of a randomized experiment that evaluated several of the approaches proposed in the report. This report was published as part of the Ontario Securities Commission’s strategy and action plan to respond to the needs and priorities of Ontario seniors.

Millennials and money: Financial preparedness and money management practices before COVID-19

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed over the ten years following the Great Recession of 2008 and the situation they were in on the cusp of the current economic crisis (in 2018) due to the COVID-19 pandemic. Findings from the National Financial Capability Study (NFCS) show that millennials tend to rely heavily on debt, engage frequently in expensive short- and long-term money management, and display shockingly low levels of financial literacy. Moreover, student loan burden and expensive financial decision making increased significantly from 2009 to 2018 among young adults.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

Launch of the OECD/INFE 2020 International Survey of Adult Financial Literacy

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018 OECD/INFE toolkit to collect cross-comparable data. The survey results report the overall financial literacy scores, as computed following the OECD/INFE methodology and definition, and their elements of knowledge, behaviour, and attitudes. The data used in this report are drawn from national surveys undertaken using and submitted to the OECD as part of a co-ordinated measurement exercise; as well as data gathered as part of the OECD/INFE Technical Assistance Project for Financial Education in South East Europe.

How to really build financial capability

Recent years have seen an explosion in interventions designed to improve financial outcomes of participants. Yet on-the-ground evidence suggests that not all financial education programs are equally successful at achieving this aim. This paper examines the difference between interventions that work, and those than do not. It attempts to answer the question: “How do you actually build financial capability?” In doing so, we aim to help interested parties enhance the effectiveness of their programs and policies by providing them with evidence-based recommendations to drive positive outcomes in participants.

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Understanding the Pathways to Financial Well-Being

The National Financial Well-Being Survey Report is the second report in a series from the Understanding the Pathways to Financial Well-Being project. In order to measure and study the factors that support consumer financial well-being, in 2015, the Bureau of Consumer Financial Protection (the Bureau) contracted with Abt Associates to field a large, national survey to collect information on the financial well-being of U.S. adults. The present report uses data collected from that survey to answer a series of questions on the relationship among financial well-being and four key factors: objective financial situation, financial behavior, financial skill, and financial knowledge. In this study, we aim to enhance understanding of financial well-being and the factors that may support it by exploring these relationships.

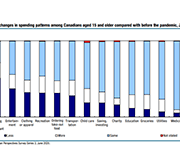

Expected changes in spending habits during the recovery period

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How our economy evolves going forward will largely depend upon the spending choices Canadians make over the coming weeks and months. This study presents results from a recent web panel survey conducted in June, looks at how spending habits may change.

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

Providing one-on-one financial coaching to newcomers: Insights for frontline service providers

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE interventions include financial coaching and supports that assist people to build money management skills, access income benefits, tackle debt, learn about safe financial products and services and find ways to save for emergencies. This report shares insights on providing one-on-one financial coaching to newcomers captured through two financial coaching pilot projects that Prosper Canada conducted in collaboration with several frontline community partners.

Evaluating Tax Time Savings Interventions and Behaviors

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife (formerly EARN) during the 2019 tax season are presented. This analysis is unique in that it compares tax filers' outcomes over time across three different tax-filing and savings program platforms: volunteer income tax assistance (VITA) sites, online tax filing through the Turbo Tax Free File Product (TTFFP), and SaverLife's saving program.

Infographic: Avoid financial stress, save for emergencies

This infographic illustrates the importance of having an emergency fund and how to build one.

State of Fair Banking in Canada

Everyone needs to bank and nearly everyone has a relationship with at least one financial institution. Financial Institutions need relationships with consumers too, in order to thrive as businesses. The role these relationships play in financial decision making for Canadians is an important consideration for anyone seeking to understand the financial health of Canadians and the impact of the banking sector in Canada. This report discusses the findings from a national sample of both banking consumers and lenders who were asked about their perspectives on fairness, access, credibility and transparency.

Smarter Financial Education: Key lessons from behavioural insights for financial literacy initiatives

This publication presents key findings for financial education, drawn from the IOSCO/OECD joint report “The Application of Behavioural Insights to Financial Literacy and Investor Education Programmes and Initiatives”. It gives a short overview of the ways in which behavioural insights are relevant for financial education and then summarises five key lessons that policy makers can follow, illustrated with the experiences of OECD/INFE members.

Using Research to Improve the Financial Well-being of Canadians: Post-symposium Report

The Financial Consumer Agency of Canada (FCAC) co-hosted the 2018 National Research Symposium on Financial Literacy on November 26 and 27, 2018 at the University of Toronto, in partnership with Behavioural Economics in Action at Rotman (BEAR). This report presents the key ideas and takeaways from the event, while shining a light on the research shaping new solutions designed to enhance financial well-being in Canada and around the world.

2018 White Paper: Financial Wellbeing Remains Challenged in Canada

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income variability and the extent to which Canadians have access to and lever their social capital (i.e. their family and friends who can provide financial advice and/or support in times of hardship). The study also explores consumer financial product and service usage, debt management and debt stress, access to financial products, services, advice and tools, usage of more predatory financial services (e.g. payday lending) and perceived levels of support by consumers’ primary Financial Institution for their financial wellness. The study also provides benefits of improved support for financial providers improving the financial wellness of their customers – including from a banking share of wallet and brand perspective.

How personality traits and economic beliefs shape financial capability and literacy

An emerging body of international literature is beginning to reveal a significant connection between financial capability metrics and personality, suggesting that what influences our financial well-being may be more nuanced than we previously thought. This report investigates how the inclusion of personality traits impacts the analysis of the gender difference in financial capability scores.

The impact of personality traits: a fresh look at gender differences in financial literacy

An emerging body of international literature is beginning to reveal a significant connection between financial capability metrics and personality, suggesting that what influences our financial well-being may be more nuanced than we previously thought. This study investigates how the inclusion of personality traits impacts the analysis of the gender difference in financial capability scores.

Financial well-being in Canada

Financial well-being is the extent to which you can comfortably meet all of your current financial commitments and needs while also having the financial resilience to continue doing so in the future. But it is not only about income. It is also about having control over your finances, being able to absorb a financial setback, being on track to meet your financial goals, and—perhaps most of all—having the financial freedom to make choices that allow you to enjoy life. The Financial Consumer Agency of Canada (FCAC) participated in a multi-country initiative that sought to measure financial well-being. FCAC conducted this survey to understand and describe the realities of Canadians across the financial well-being spectrum and help policy-makers, practitioners and Canadians themselves achieve better financial well-being. This is in keeping with the Agency’s ongoing work to monitor trends and emerging issues that affect Canadians and their finances.

Giving Savings Advice

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at a specific point in the tax preparation process: when entering dependent information. The video also includes examples of commonly heard reasons tax filers give for not wanting to save, and possible responses.

Talking About Savings

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video discusses why promoting savings at tax time is a critical component of VITA volunteers.

Money Circle toolkit

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a brief, interactive exercise, to initiate conversations about the feelings and personal relationships that shape financial choices.

The Effects of Education on Canadians’ Retirement Savings Behaviour

This paper assesses the extent to which education level affects how Canadians save and accumulate wealth for retirement. Data from administrative income-tax records and responses from the 1991 and 2006 censuses of Canada show that individuals with more schooling are more likely to contribute to a tax-preferred savings account and have higher saving rates, have higher home values, and are less likely to rent housing.

Money stories: Financial resilience among Aboriginal and Torres Strait Islander Australians

This report builds on previous work on financial resilience in Australia and represents the beginning of an exploration of the financial resilience of Aboriginal and Torres Strait Islander peoples. Overall, we found significant economic disparity between Indigenous and non-Indigenous Australians. This is not surprising, given the histories of land dispossession, stolen wages and the late entry of Indigenous Australians into free participation in the economy (it is only 50 years since the referendum to include Aboriginal and Torres Strait Islander peoples as members of the Australian population). Specifically, we found: Severe financial stress is present for half the Indigenous population, compared with one in ten in the broader Australian population. Read the report to find out more about the financial barriers faced by Indigenous people in Australia, and the sharing economy in which money as a commodity can both help and hurt financial resilience.

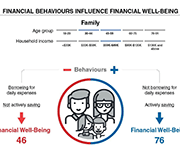

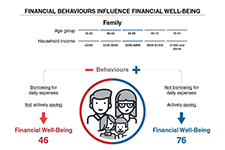

Backgrounder: Preliminary findings from Canada’s Financial Well-Being Survey

This backgrounder reports preliminary findings from a survey of financial well-being among Canadian adults. Preliminary analysis of the survey data indicates that two behaviours are particularly important in supporting the financial well-being of Canadians. First, our analysis indicates that Canadians who practice active savings behaviour have higher levels of financial resilience as well as higher levels of overall financial well-being. In other words, regardless of the amount of money someone makes, regular efforts to save for unexpected expenses and other future priorities appears to be the key to feeling and being in control of personal finances. Secondly, Canadians who often use credit to pay for daily expenses because they have run short of money have lower levels of financial well-being. While this behaviour is likely symptomatic of low levels of financial well-being, our analysis indicates that a person can substantially improve their financial resilience and financial well-being by implementing strategies to reduce the frequency of running out of money and of having to rely on credit to get by.

Short-term financial stability: A foundation for security and well-being

Short-term cushions are key to longer-term financial security and well-being. This report shines a light on the central role that short-term financial stability plays in a person’s ability to reach broader financial security and upward economic mobility, a measurement of whether an individual moves up the economic ladder over one’s lifetime or across generations. The insights presented in this report draw primarily on evidence provided by members of the Consumer Insights Collaborative (CIC), a group of nine leading nonprofits across the United States convened by the Aspen Institute Financial Security Program. These diverse organizations offer a window into the financial lives of the low- and moderate-income individuals they serve.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

VITA: A step-by-step guide to increase your impact

In this report, The Common Cents Lab and MetLife Foundation share findings from the experiments we have run over the past several years with VITA providers to improve tax-related outcomes. We encourage you to consider implementing these ideas and engaging in additional conversations about how to use behavioral science to increase financial capability for all taxpayers. The report outlines a series of interventions that exemplify

ways these best practices have been implemented in the field and

how to use behavioral science to further extend their impact. We’ve

organized these interventions into two categories:

Habit Change: Literature Review

Habits are incredibly powerful. Good habits can make people highly successful, and bad habits can ruin people’s lives. Still, it is important to go beyond the anecdotal evidence of the many self-help books on habit, and to take stock of the scientific evidence. This literature review discusses we discuss how habits are formed, how bad habits can be abandoned, how approach-avoidance training can help adopting good habits and abandoning bad habits, and, finally, how habits can be measured properly.

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.

Tools and Ethics for Applied Behavioural Insights: The BASIC Toolkit

A better understanding of human behaviour can lead to better policies. If you are looking for a more data-driven and nuanced approach to policy making, then you should consider what actually drives the decisions and behaviours of citizens rather than relying on assumptions of how they should act. You can start applying behavioural insights (BI) to policy now. No matter where you are in the policy cycle, policies can be improved with BI through a process that looks at Behaviours, Analysis, Strategies, Interventions, Change (BASIC). This allows you to get to the root of the policy problem, gather evidence on what works, show your support for government innovation, and ultimately improve policy outcomes. This toolkit guides policy officials through these BASIC stages to start using an inductive and experimental approach for more effective policy making.

Are Low-Income Savers Still in the Lurch? TFSAs at 10 Years

The introduction of Tax-Free Savings Accounts (TFSAs) in 2009 transformed how Canadians save. One of the main reasons for creating TFSAs was to provide a taxassisted savings instrument for low-income Canadians to enable them to improve their retirement income. Now, 10 years later, many low-income savers are still not using TFSAs in ways that would allow them to benefit fully from the government transfer programs intended for them in retirement, such as the Guaranteed Income Supplement. Consequently, intended benefits from TFSAs are going untapped. Improving public education and financial literacy may be part of the solution to this problem, but built-in policy nudges and tax adjustments will be more effective.

Consumer Insights on Managing Spending

The CFPB conducted research on consumer challenges in tracking spending and keeping to a budget. The research found that consumers aspire to manage their spending but for many reasons, many consumers spend more than intended and sometimes have\ difficulty in staying within their budgets. In addition, we found that although most people would like to use budgets and plans, they often don’t use them to guide spending decisions in the moment. Budgeting and tracking spending are often considered to be overwhelming or too much of a hassle, and even those consumers who have a budget generally do not benchmark their spending to their budget frequently or regularly.

Effective financial education: Five principles and how to use them

Because of the key role that financial education can play in people’s lives, the CFPB has conducted research over its first five years into what makes financial education effective for consumers. What do we mean by “effective?” It does not just mean training that helps people perform better on a test of financial facts. It means equipping consumers to understand the financial marketplace and make sound financial choices in pursuit of their life goals.

Pervasive and Profound: The Impact of Income Volatility on Canadians

In this video presentation Derek Burleton of TD Economics shares findings from the report 'Pervasive and Profound,' which examines income volatility trends in Canada. The survey found that nearly 40% of Canadians experience moderate to high income volatility. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

Canadian Millenial Social Values Study

A major national survey conducted in 2016 reveals a bold portrait of Canada’s Millennials (those born between 1980 and 1995), that for the first time presents the social values of this generation, and the distinct segments that help make sense of the different and often contradictory stereotypes that so frequently are applied to today’s young adults. Key findings from the survey explore Millennials' relationship with money, education, work and career interests, voting turnout, and engagement with social justice.

National Investor Research Study

This presentation shows the results of a quantitative study undertaken by the Ontario Securities Commission to assess attitudes, behaviour and knowledge among Canadians pertaining to a variety of investment topics. These topics include retirement planning and conversations about finances.

Increasing Take-Up of the Canada Learning Bond

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible population. The Impact and Innovation Unit (IIU), in collaboration with the Learning Branch and the Innovation Lab at Employment and Social Development Canada (ESDC) conducted a randomized controlled trial to test the effectiveness of behavioural insights (BI) in correspondence sent to primary caregivers of children eligible for the CLB. This trial demonstrates the effectiveness of BI interventions tailored to the particular behavioural barriers that affect specific populations in increasing take-up of programs like the CLB. If scaled across the eligible population, the best performing letter would result in thousands more children receiving this education savings incentive on an annual basis.

Core competencies frameworks on financial literacy

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These documents describe the types of knowledge that youth aged 15 to 18, and adults aged 18 and up, could benefit from.

Do we have the data we need to tackle household financial instability?

In this presentation Catherine Van Rompaey of Statistics Canada examines the data we have available to measure financial instability in Canada - household debt, savings, and credit. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Debt and High Interest Resource Portal

This is ACORN Canada's debt and high-interest lending resource portal. It contains links and resources on debt, credit, banking, and other topics.

Financial well-being in America

There is wide variation in how people in the U.S. feel about their financial well-being. This report presents findings from a survey by the Consumer Financial Protection Bureau (CFPB) on the distribution of financial well-being scores for the U.S. adult population overall and for selected subgroups defined by these additional measures. These descriptive findings provide insight into which subgroups are faring relatively well and which ones are facing greater financial challenges.