The COVID-19 Wildfire: Nonprofit Organizational Challenge and Opportunity

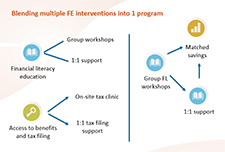

Nonprofit organizations in Canada were significantly impacted by COVID-19, including lost revenue and needing to adjust the program delivery. The lack of technology capacity in the nonprofit sector is a key barrier for many nonprofit organizations to adapt to delivering programs online. Momentum, a Calgary-based nonprofit organization, experienced both financial and programmatic challenges due to COVID-19. Momentum pivoted program delivery to provide supports during the COVID-19 lockdown and developed innovative approaches to online programming. Since the start of the COVID-19 pandemic in Canada, Momentum was able to rapidly develop its capacity to use technology for online programming with the support of critical new funding. Many nonprofits will have to transform their business models to not only survive but thrive in the post-COVID world.