Guidance on digital delivery of financial education

Innovative uses of digital technologies in the delivery of financial education can serve multiple complementary objectives and effectively support the building blocks of financial education. This Guidance was developed to assist policy makers in deciding when to adopt digital delivery, and how to effectively design and implement digital financial education initiatives, by offering non-binding actionable directions. It builds on the work undertaken by the OECD and its International Network on Financial Education, including the G20/OECD-INFE Policy Guidance Note on Digitalisation and Financial Literacy and international comparative analyses on how public authorities design, deliver and evaluate digital financial education initiatives, notably in the context of the COVID-19 pandemic. The report on digital delivery of financial education design and practice builds on over 70 case studies from members of the OECD International Network on Financial Education, contributes to a better understanding of how public authorities worldwide are designing, delivering and evaluating digital financial education initiatives, and prepares forthcoming work on the development of high-level international guidance on the digital delivery of financial education.

Increasing education savings for families living on low incomes: An outcome harvest evaluation

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open Registered Education Savings Plans (RESPs) to access free government education savings incentives such as the Canada Learning Bond (CLB). Momentum subsequently partnered with community agencies and advocated for systems level change in order to reach more families and scale up CLB uptake. This report captures the collective efforts and outcomes of Momentum and community partners regarding increasing the Canada Learning Bond (CLB) uptake in Canada, as well as lessons learned. The report highlights include:

Evaluation of the Financial Empowerment and Problem Solving Project: Final Report

The Province of Ontario, through the former Ministry of Community and Social Services (now known as the Ministry of Children, Community and Social Services (MCCSS)) entered into a contract with Prosper Canada (PC) in 2015 to fund the Financial Empowerment and Problem Solving (FEPS) pilot project. The FEPS project provided individualized financial counselling to low income program participants along with educational workshops and free tax clinics. An evaluation of the FEPS pilot found that the project exhibited some promising practices and was well received by clients. Building off of the findings from pilot, in 2017 the former Ministry of Community and Social Services (MCSS) entered into a four-year agreement with PC to fund the program at four delivery sites.

Evaluation of the Financial Empowerment Champions Project: Final Report

The Ministry of Children, Community and Social Services (MCCSS) with funding from Ontario Works (OW) contracted with Prosper Canada (PC) in 2016 to launch the Financial Empowerment Champions (FECs) project. The project intends to build capacity (e.g., embed financial empowerment (FE) interventions) within communities and provide individualized FE services to individuals with low income. This final evaluation report includes the following lines of evidence: linked administrative data from MCCSS (Social Assistance Management System (SAMS)), FECs sites and PC; a pre-service and a postservice survey; and interviews with FECs staff, management and community partner organizations. The evaluation was initiated in August 2017 and the final data was collected in June 2020.

Measuring Health Equity: Demographic Data Collection in Health Care

The Toronto Central Local Health Integration Network (Toronto Central LHIN) provided financial support to establish the Measuring Health Equity Project and has called for recommendations on health equity data use and a sustainability approach for future data collection. This report describes the journey Toronto Central LHIN and Sinai Health System have taken to embed demographic data collection in hospitals and Community Health Centres. It also summarizes the potential impact of embedding demographic data collection into Ontario health-care delivery and planning. And finally, it describes the use of this data, the lessons learned, and provides recommendations for moving forward.

Building Understanding: The First Report of the National Advisory Council on Poverty

In August 2018, the Government of Canada announced Opportunity for All – Canada's First Poverty Reduction Strategy. The Strategy included a commitment to the UN Sustainable Development Goal's target of reducing poverty by 20% by 2020 and 50% by 2030. Opportunity for All included the adoption of the Market Basket Measure (MBM) as Canada's Official Poverty Line and the creation of the National Advisory Council on Poverty (Council) to report on progress made toward the poverty reduction targets. This is the first report of the National Advisory Council on Poverty. It continues Canada's discussion on poverty by bringing forward the voices of individuals with lived expertise of poverty. It details progress toward our poverty targets and recommends improvements to our poverty reduction efforts.

Cash Value: How The Financial Clinic Puts Money into the Pockets of Working Poor Families

Practitioners engaged in the nascent field of financial development lack a shared system of tracking and analyzing customer progress toward financial security. Practice leaders—ranging from direct service organizations such as the Chicago-based LISC to NeighborWorks America of Washington, D.C.—define customer progress by their individual outcomes frameworks. But without uniform outcomes measures to assess our customers’ progress—and thus, our own performance—the field as a whole is handicapped. Many factors contribute to this problem, two being most prominent: organizations are grounded in distinct theories of change, are funded by a variety of sources with their own expectations, and lack of clarity about how to measure aspects of our work.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

National Strategies for Financial Education: OECD/INFE Policy Handbook

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools to support policy makers and public authorities to design and implement national strategies for financial education. This handbook provides an overview of the status of national strategies worldwide, an analysis of relevant practices and case studies and identifies key lessons learnt. The policy handbook also includes a checklist for action, intended as a self-assessment tool for governments and public authorities.

The Common Approach

The Common Foundations are a minimum standard for how to do impact measurement without prescribing a particular tool or approach. This can help to overcome a widespread challenge of grantmakers, donors, lenders and investors imposing impact measurement approaches on the social purpose organizations that they give money to. They do this for assurances that the impact measurement is of a sufficient quality and comparability. The Common Foundations solves part of this problem. Funders can require social purpose organizations to demonstrate that the are doing all five essential practices while leaving the social purpose organization to choose which tools and approaches to use. In addition to the quick guide, videos, key documents, and a self-assessment are provided as tools to meet the standard of impact measurement in Canada.

Data literacy training

Statistics Canada presents a learning catalogue to share knowledge on data literacy. Data literacy is the ability to derive meaningful information from data. It focuses on the competencies involved in working with data including the knowledge and skills to read, analyze, interpret, visualize and communicate data as well as understand the use of data in decision-making. Their aim is to provide learners with information on the basic concepts and skills with regard to a range of data literacy topics. The training is aimed at those who are new to data or those who have some experience with data but may need a refresher or want to expand their knowledge.

English

French

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Providing one-on-one financial coaching to newcomers: Insights for frontline service providers

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE interventions include financial coaching and supports that assist people to build money management skills, access income benefits, tackle debt, learn about safe financial products and services and find ways to save for emergencies. This report shares insights on providing one-on-one financial coaching to newcomers captured through two financial coaching pilot projects that Prosper Canada conducted in collaboration with several frontline community partners.

The Collaborative to Advance Social Health Integration: What We’re Learning About Delivering Whole-Person Care

The Collaborative to Advance Social Health Integration (CASHI) is composed of a community of 21 innovative primary care teams and community partners committed to increasing the number of patients, families and community members who have access to the essential resources they need to be healthy. CASHI focused efforts to improve social health practices, spread them to additional sites, and work toward financial sustainability plans. This report discusses the key learnings and successes as a result of this 18-month collaboration to spread social health integration.

Financial Literacy Outcome Evaluation Tool

The Financial Literacy Outcome Evaluation Tool offers organizations a collection of evidence-based financial literacy outcomes and indicators. The tool guides users through a series of questions about their program and evaluation goals and then suggests scales (sets of questions) and individual questions they can use.

Introduction to Program Evaluation for Public Health Programs: A Self-Study Guide

This document is a “how to” guide for planning and implementing evaluation activities. The manual, based on Centers for Disease Control and Preventions's Framework for Program Evaluation in Public Health, is intended to assist managers and staff of public, private, and community public health programs to plan, design, implement and use comprehensive evaluations in a practical way.

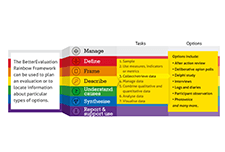

Rainbow Framework

The Rainbow Framework organizes different methods and processes that can be used in monitoring and evaluation. The range of tasks are organised into seven colour-coded clusters: Manage, Define, Frame, Describe, Understand Causes, Synthesise, and Report & Support Use. Users can use the framework to plan an evaluation that covers all necessary tasks or choose from an approach which contains a pre-packaged combination of task options.

Financial Empowerment for Newcomers: Evaluation insights from pilot project

This fact sheet provides insights from Prosper Canada's Financial Empowerment for Newcomers pilot project conducted with three newcomer-serving organizations, Saskatoon Open Door Society (SODS), AXIS Employment Services (AXIS), and North York Community House (NYCH), who implemented and integrated financial coaching into their existing services for newcomers. The project objectives were to provide newcomer-serving front-line staff with training and resources to enable them to accurately assess newcomers’ financial literacy and connect them to appropriate information and resources and to coach newcomers to achieve successful financial independence.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

Effective financial education: Five principles and how to use them

Because of the key role that financial education can play in people’s lives, the CFPB has conducted research over its first five years into what makes financial education effective for consumers. What do we mean by “effective?” It does not just mean training that helps people perform better on a test of financial facts. It means equipping consumers to understand the financial marketplace and make sound financial choices in pursuit of their life goals.

Financial Coaching Program Design Guide: A Participant-Centred Approach

This comprehensive resource from Prosperity Now supports organizations in developing a participant-centered financial coaching program. Grounded in a field survey, over 100 interviews, expert advice and beta-testing with six new financial coaching programs, the Coaching Guide highlights the strengths and limitations of financial coaching, offers designs tools, showcases promising models and practices, and includes resources from program leaders and financial coaches.

Measuring Financial Capability and Well-Being in Financial Coaching Programs

This brief describes the data collected and lessons gleaned from the Financial Coaching Impact & Evaluation Fellowship, which took place over the course of 10 months in 2017. Ultimately, this brief argues that the Financial Well-Being Scale and the Financial Capability Scale are promising tools for financial capability programs seeking to understand the impact of their programs.

Financial Capability Scale

The Center for Financial Security (CFS) and Annie E. Casey Foundation have developed a short set of standardized client outcome measures to create the Financial Capability Scale (FCS). In 2011, CFS worked with four organizations to collect data on client outcome measures, with the goal of refining a small set of measures that can be used across programs. The project aimed to increase coordination across organizations so the financial coaching field can improve its capacity to demonstrate client impacts. The findings from the project extend beyond the coaching field and can be applied to other financial capability services.

Perspectives on Evaluation in Financial Education: Landscape, Issues, and Studies

Financial education plays an important role in guiding individuals to achieve their financial goals and contribute to the economic well-being of society as a whole. While the examination on the effectiveness of financial education has many factors to consider, the National Endowment for Financial Education (NEFE) has taken measures to improve evaluation studies—both for the practitioner and the researcher. These actions include the conception of two documents what will assist in guiding practitioners and researchers in planning high-quality evaluations. The first is the Financial Education Evaluation Manual that is designed to support the evaluation of financial education programs by helping educators to understand the purpose and goals of evaluation, and to provide a basic understanding of the evaluation process. This information is designed for program managers, educators, and decision-makers, in traditional school settings or community-based programs/non-profit organizations, who are implementing financial education programs

An Evaluation of Financial Empowerment Centers Building People’s Financial Stability as a Public Service

This report provides information on the Financial Empowerment Center model, the people it served, the outcomes they achieved, the impact services had on nonprofit and city partners, and lessons learned for others looking to replicate or support this model. The evaluation was designed as a utilization-focused, foundational and exploratory study, aimed at creating an evaluation report that was useful to stakeholders. The report includes both qualitative and quantitative sources