Ottawa should soften bite of benefit clawbacks for low-income families

Canada’s tax system has a punitive impact on lower income families with children hoping to earn more money, according to a new report from the C.D. Howe Institute. In “Softening the Bite: The Impact of Benefit Clawbacks on Low-Income Families and How to Reduce It,” authors Alex Laurin and Nicholas Dahir reveal how benefit reductions serve as hidden tax rates and reduce the effective gain from working to generate additional income. Read full report here.

COVID-19: Exclusive resources for service provider heroes

Families Canada is the national association of Family Support Centres. With a network of 500+ member agencies and thousands of frontline family service workers across Canada, they committed to providing leadership and support in the campaign for Canada’s children. Families Canada has compiled resources for service providers to support families during COVID-19.

Youth Reconnect Program Guide: An Early Intervention Approach to Preventing Youth Homelessness

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth Reconnect. This document describes the key elements of the YR program model, including program elements and objectives, case examples of YR in practice, and necessary conditions for implementation. It is intended for communities who are interested in pursuing similar early intervention strategies. The key to success, regardless of the approaches taken, lies in building and nurturing community partnerships with service providers, educators, policy professionals, and young people.

English

Introduction to asset building

Asset building for your future (fillable PDF)

Asset building for your future (print version)

My long-term goal action plan (fillable PDF)

My long-term goal action plan (print version)

Introduction to savings accounts

Registered savings accounts

Investing in registered accounts

Seven tips to help you stick to your goals

Glossary – asset building

Resources – asset building

Making it easier to save

Types of investments and types of accounts

Investing basics

Education savings

RESPs and how they can help

Before you open an RESP

Individual, family and group RESPs

Federal education grants and bonds

Provincial education grants and bonds

Family income to receive RESP government incentives

RESP sample scenarios

Plan for your RESP bank visit

My RESP action plan (fillable PDF)

My RESP action plan (print version)

Glossary – education savings

Resources – education savings

Employment and Social Development Canada (ESDC) resources for the Canada Learning Bond (CLB):

Canada Learning Bond Application for Adult Beneficiaries

Q&A about the Canada Learning Bond for adult beneficiaries

Revised income brackets for Canada Learning Bond (July 2022 to June 2023)

French

L‘accumulation d’actifs

L’accumulation d’actifs pour votre avenir – fillable

L’accumulation d’actifs pour votre avenir – nonfillable

Mon plan d’action axé sur mon objectif à long terme – fillable

Mon plan d’action axé sur mon objectif à long terme – nonfillable

Introduction aux comptes d’épargne

Comptes d’épargne enregistrés (REEI, REEE, REER et CELI)

Investir dans les comptes enregistrés :les options et les questions à poser à votre banque

Sept conseils pour vous aider à respecter vos objectifs

Epargne-études

Les REEE : comment peuvent-ils vous aider?

Comment choisir entre unREEE individuel, familial et collectif

Les subventions et les bons d’études du gouvernement fédéral

Les subventions et les bons d’études du gouvernement provincial

Le REEE : comment peut-il vous aider à faire fructifier vos épargnes pour les études?

Arrivez préparé à votre rendez-vous à la banque pour ouvrir un REEE

Mon plan d’action en matière de REEE – fillable

Mon plan d’action en matière de REEE – nonfillable

Infographic: The impact of the COVID-19 pandemic on Canadian families and children

This infographic describes parents' experiences during the COVID-19 pandemic including balancing work and schooling, their children's activities and parents' concerns.

Impacts of COVID-19 on Canadian families and children

The COVID-19 pandemic has dramatically altered the way of life for Canadian families, parents and children. Because of physical distancing and employment impacts, parents have altered their usual routines and supports, and many children and families have been isolated in their homes for months. Children, in particular, may not have left their homes or seen any friends or family members other than their parents for an extended period, since children do not typically have to leave their homes for essential services. However, the impact of the pandemic on families has yet to be described. The purpose of this report is to provide a snapshot of the experiences of Canadian parents and families during this unprecedented time.

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of parents opening RESP accounts has increased steadily over time, as of 2016, participation rates remained more than twice as high among parents in the top income quartile (top 25%) compared with those in the bottom quartile. This study provides insight into the factors behind the gap in (RESP) participation between higher and lower-income families.

Income Volatility: Why it Destabilizes Working Families and How Philanthropy Can Make a Difference

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique role for philanthropy. This brief helps grantmakers understand the enormous challenges income volatility presents in America and provides an array of strategies for philanthropy to leverage both investments and leadership to empower families to protect themselves from volatility’s worst effects.

English

Benefits 101

What are tax credits and benefits

Reasons to file a tax return

List of common benefits

Getting government payments by direct deposit

Common benefits and credits Benefits pathways (for practitioner reference only – some illustrations presented are Ontario benefits)

Pathways to accessing government benefits

Overview of tax benefits and other income supports (adults, children, seniors)

Overview of tax benefits and other income supports (people with disabilities or survivors)

Income support programs for immigrants and refugees

Glossary of terms – Benefits 101

Resources – Benefits 101

Key benefits you may be eligible for

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

Benefits of Filing a Tax Return: Infographic

Common benefits and credits

Resource links:

Benefits and credits for newcomers to Canada – Canada Revenue Agency

Benefit Finder – Government of Canada

Electronic Benefits and credits date reminders – Canada Revenue Agency (CRA)

Income Assistance Handbook – Government of Northwest Territories

What to do when you get money from the government – Financial Consumer Agency of Canada (FCAC)

Emergency benefits

General emergency government benefits information & navigation

Financial Relief Navigator tool (Prosper Canada)

Changes to taxes and benefits: CRA and COVID-19 – Government of Canada

Canada Emergency Response Benefit (CERB)

Apply for Canada Emergency Response Benefit (CERB) with CRA – Canada Revenue Agency (CRA)

Questions & Answers on CERB – Government of Canada

What is the CERB? – Prosper Canada

FAQ: Canada Emergency Response Benefit – Prosper Canada (updated June 10th)

CERB: What you need to know about cashing your cheque – FCAC

COVID-19 Benefits (summary, includes Ontario) – CLEO/Steps to Justice

COVID-19 Employment and Work – CLEO/Steps to Justice

GST/HST credit and Canada Child Benefit

COVID-19 – Increase to the GST/HST amount – Government of Canada

Canada Child Benefit Payment Increase – Government of Canada

Benefits payments for eligible Canadians to extend to Fall 2020 – Government of Canada

Support for students

Support for students and recent graduates – Government of Canada

Canada Emergency Student Benefit (CESB) – Government of Canada

Benefits and credits for families with children

Benefits and credits for families with children

Resource links:

Child and family benefits – Government of Canada

Child and family benefits calculator – Government of Canada

Benefits and credits for people with disabilities

Benefits and credits for people with disabilities

RDSP, grants and bonds

Resource links:

Canada Pension Plan disability benefit toolkit – Employment and Social Development Canada (ESDC)

Disability benefits – Government of Canada

Disability tax credit (DTC) – Canada Revenue Agency (CRA)

Free RDSP Calculator for Canadians – Plan Institute

Future Planning Tool – Plan Institute

Creating Financial Security: Financial Planning in Support of a Relative with a Disability (handbook) – Partners for Planning

Nurturing Supportive Relationships: The Foundation to a Secure Future (handbook) – Partners for Planning

RDSP – Plan Institute

Disability Tax Credit Tool – Disability Alliance BC

ODSP Appeal Handbook – CLEO

Disability Inclusion Analysis of Government of Canada’s Response to COVID-19 (report and fact sheets) – Live Work Well Research Centre

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

Benefits and credits for seniors

Benefits and credits for seniors

Resource links:

Canadian Retirement Income Calculator – Government of Canada

Comparing Retirement Savings Options – Financial Consumer Agency of Canada (FCAC)

Federal Provincial Territorial Ministers Responsible for Seniors Forum – Employment and Social Services Canada (ESDC)

Retiring on a low income – Open Policy Ontario

RRSP vs GIS Calculator – Daniela Baron

Sources of income for seniors handout – West Neighbourhood House

What every older Canadian should know about: Income and benefits from government programs – Employment and Social Services Canada (ESDC)

French

Comprendre les prestations

Que sont les crédits d’impôt et les prestations?

Pourquoi produire une déclaration de revenus?

Processus d’accès aux prestations (simple, complexe ou laborieux)

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu : personnes handicapées ou survivants

Programmes d’aide au revenu pour immigrants et réfugiés – Admissibilité et processus de demande

Glossaire – Prestations et credits

Ressources : Prestations et credits

Principales mesures d’aide auxquelles vous pouvez être admissibles

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone,

Infographie sur les avantages de produire une déclaration de revenus

Prestations et crédits courants

Prestations et crédits pour familles avec enfants

Prestations et crédits pour personnes handicapées

Prestations et crédits pour les personnes âgées

Informations d’identification pour accéder aux prestations

Études de cas

Canadian Income Survey, 2018

This report from Statistics Canada shares data on median after-tax income and overall poverty rate decline based on 2018 data.

Accessing the Canada Learning Bond: Meeting Identification and Income Eligibility Requirements

Not having a Social Insurance Number (SIN) and not filing taxes may represent challenges to access government programs and supports such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). Limited data availability has prevented a full assessment of the extent of these access challenges. This study attempts to address this knowledge gap by analyzing overall differences in SIN possession and tax-filing uptake by family income, levels of parental education, family type and Indigenous identity of the child and age of children using the 2016 Census data augmented with tax-filing and Social Insurance Number possession indicator flags.

Accessing the Canada Learning Bond: Meeting Identification and Income Eligibility Requirements

Introduced in 1998, the Canadian Education Savings Program (CESP) was designed as an incentive to encourage education savings for the post-secondary education of a child. The program is centred on Registered Education Savings Plans (RESPs), where savings accumulate tax-free until withdrawn, to pay for full- or part-time postsecondary studies such as a trade school, CEGEP, college, or university, or in an apprenticeship program. The CLB was introduced in 2004 specifically for children from low income families. CLB provides, without family contribution being required, eligible families with an initial RESP payment which may be followed by annual payments up until the child is aged 15 years old. The objective of this paper is to assess the extent to which not tax-filing and not having a SIN for a child could pose a challenge to accessing the CLB and the CESG. This study will address the knowledge gap by analyzing overall differences in SIN and tax-filing uptake by family income, levels of parental education, family type and Indigenous identity of the child. The findings will help understand access issues related to the CLB but also to other programs with similar administrative conditions. En francais: Accéder au Bon d’études canadien: l’atteinte des critères d’identification et d’éligibilité selon le revenu.

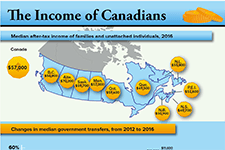

The income of Canadians

This infographic from Statistics Canada shows the median after-tax income of households, by province, as of 2016. It also shows changes in median government transfers, and number of people living on low incomes according to the after-tax low income measure.

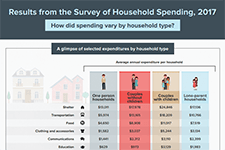

Results from the Survey of Household Spending, 2017 (Infographic)

This infographic from Statistics Canada summarizes the results of the Survey of Household Spending, 2017, including average annual expenditures by household type.

Economic Well-being Across Generations of Young Canadians: Are Millenials Better or Worse Off?

This article in the Economic Insights series from Statistics Canada examines the economic well-being of millennials by comparing their household balance sheets to those of previous generations of young Canadians. Measured at the same point in their life course, millennials were relatively better off than young Gen-Xers in terms of net worth, but also had higher debt levels. Higher values for principal residences and mortgage debt mainly explain these patterns. Financial outcomes varied considerably among millennial households. Home ownership, living in Toronto or Vancouver, and having a higher education were three factors associated with higher net worth.

Financial Expectations and Household Debt

This Economic Insights article quantifies the degree to which families who expect their financial situation to get better in the next two years have, all else equal, more debt than comparable families. The study shows that even after a large set of socioeconomic characteristics is controlled for, families who expect their financial situation to improve in the near future have significantly more debt and generally higher debt-to-income ratios than other families.

The Economic Well-Being of Women in Canada

Economic well-being has both a present component and a future component. In the present, economic well-being is characterized by the ability of individuals and small groups, such as families or households, to consistently meet their basic needs, including food, clothing, housing, utilities, health care, transportation, education, and paid taxes. It is also characterized by the ability to make economic choices and feel a sense of security, satisfaction, and personal fulfillment with respect to finances and employment pursuits. Using Statistics Canada data from a variety of sources, including the Survey of Labour and Income Dynamics, the Canadian Income Survey, the Survey of Financial Security, and the 2016 Census of Population, this chapter of Women in Canada examines women’s economic well-being in comparison with men’s and, where relevant, explores how it has evolved over the past 40 years. In addition to gender, age and family type (i.e., couple families with or without children; lone mothers and fathers; and single women and men without children) are important determinants of economic well-being. Hence, many of the analyses distinguish between women and men in different age groups and/or types of families.

Tax time insights: Experiences of people living on low income in Canada

In this presentation, Nirupa Varatharasan, Research & Evaluation Officer with Prosper Canada, explains the research methods and insights gathered in the report 'Tax time insights: Experiences of people living on low income in Canada.' This includes demographic information, the type of tax filing resources accessed by this population, and insights on the types of challenges and opportunities that result from their tax filing processes. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Income tax filing and benefits take-up: Challenges and opportunities for Canadians living on low incomes

In this presentation, Uttam Bajwa, Global Health and Research Associate with the Dalla Lana School of Public Health, University of Toronto, reports on tax filing challenges and opportunities for Canadians living on low incomes. This includes the challenges of not knowing what to do, fear and mistrust, and challenges accessing supports. This presentation is based on the research conducted for the Prosper Canada report 'Tax time insights: Experiences of people living on low incomes in Canada'. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

2018 Report Card on Child and Family Poverty in Canada: Bold Ambitions for Child and Family Poverty Eradication

The 2018 national report card “Bold Ambitions for Child Poverty Eradication in Canada,” provides a current snapshot of child and family poverty and demonstrates the need for a costed implementation plan to eradicate child poverty in this generation. In advance of the 30th year of the all-party commitment to eliminate child poverty by the year 2000 and the federal election in 2019, our spotlight is on the central role of universal childcare in the eradication of child poverty. The lack of affordable, high quality childcare robs children of valuable learning environments and keeps parents, mainly women, out of the workforce, education and training. Without childcare, parents cannot lift themselves out of poverty and improve their living standards.

Asset Building: An Effective Poverty-Reduction Strategy

This brief explains the asset-building approach to poverty reduction. While many families who live on low incomes struggle to meet basic needs, they miss out on opportunities to save and invest - opportunities that are critical in overcoming poverty. Without income, people are unable to get by and without assets, people are unable to get ahead. At Momentum, we call opportunities to save or invest, Asset Building.

With financial assets, individuals can pay down debt, save more, earn a good credit rating, save for a down payment on a home, and build a sustainable livelihood.

Improving Education Outcomes through Children’s Education Savings

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career expectations, and future financial capability. This brief explains why RESPs are so important, and how parents can use RESPs to save for their children's education.

Boosting the Earned Income Tax Credit for Singles

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income workers without dependent children. The program, which provides a bonus of up to $2,000 at tax time, is being evaluated using a randomized controlled trial in New York City and Atlanta. This report presents findings through three years from New York, where over 6,000 low-income single adults without dependent children enrolled in the study in late 2013. The findings are consistent with other research on the federal EITC, indicating that an effective work-based safety net program can increase incomes for vulnerable and low-income individuals and families while encouraging and rewarding work.

The Canada Learning Bond: What you need to know

This one-page fact sheet tells you everything you need to know to make your child's future possibilities grow! The Canada Learning Bond (CLB) is a grant of $500 up to $2000 from the Government of Canada to eligible families to help with the cost of a child’s education after high school. It is deposited directly into a child’s Registered Education Savings Plan (RESP). Children born January 1, 2004 or later, whose family’s annual income is less than $46,000 can receive the CLB.

Income volatility: Strategies for helping families reduce or manage it

In this video presentation David Mitchell from the Aspen Institute explains strategies for mitigating and preventing income volatility at the household level. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Family Centered Coaching: A toolkit to Transform Practice & Engage Families

The Family-Centered Coaching Toolkit offers a set of strategies, tools, and resources that can help programs, agencies, case managers, coaches, and others change the ways they work with families striving to reach their goals. This set of resources, can undo, and redo, how one approaches working with families – to see families holistically, even though the funding streams and programs within which we work may not.

SmartSAVER: Canada Learning Bond Infographic

An infographic highlighting how to attend post-secondary education with no student debt. It shows how a family eligible for the Canada Learning Bond, with average family savings, student earnings and available grants can cover the cost of post-secondary education (PSE) with no need to borrow.

Financial Capability of Children, Young People and their Parents in the UK 2016

This new research study: the 2016 UK Children and Young People’s Financial Capability Survey, is the first of its kind: a nationally representative survey of the financial knowledge, attitudes and behaviours of 4- to 17-year-olds and their parents, living in the UK. A total of 4,958 children and young people aged 4–17, and their parents, were interviewed as part of this research. This report presents an initial analysis of the findings of this new survey and covers: ■ how children get money ■ how children spend and save money ■ children’s attitudes to spending, saving and debt ■ children’s confidence about managing their money ■ children’s understanding of the value of money and the need to make trade-offs ■ children’s knowledge and education about financial products, concepts, and terminology ■ parents’ beliefs and attitudes towards their own financial capability and the skills, abilities and attitudes of their children.

We Tracked Every Dollar 235 U.S. Households Spent for a Year, and Found Widespread Financial Vulnerability

Income inequality in the United States is growing, but the most common economic statistics hide a significant portion of Americans’ financial instability by drawing on annual aggregates of income and spending. Annual numbers can hide fluctuations that determine whether families have trouble paying bills or making important investments at a given moment. The lack of access to stable, predictable cash flows is the hard-to-see source of much of today’s economic insecurity.

Family-Centred Coaching Toolkit

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families. (Note: Accessing the toolkit requires submitting user information).

What can we learn about low-income dynamics in Canada from the Longitudinal Administrative Databank?

“We’re Going to Do This Together”: Examining the Relationship between Parental Educational Expectations and a Community-Based Children’s Savings Account Program

This paper presents quantitative and qualitative evidence of the relationship between exposure to a community-based Children’s Savings Account (CSA) program and parents’ educational expectations for their children. First, we examine survey data collected as part of the rollout and implementation of The Promise Indiana CSA program. Second, we augment these findings with qualitative data gathered from interviews with parents whose children have Promise Indiana accounts. Though results differ by parental income and education, the quantitative results using the full sample suggest that parents are more likely to expect their elementary-school children to attend college if they have a 529 account or were exposed to the additional aspects of The Promise Indiana program (i.e., the marketing campaign, college and career classroom activities, information about engaging champions, trip to a University, and the opportunity to enroll into The Promise).