English

Soaring with savings - Tips and tools to help you save

SWS Worksheet #1 – The importance of saving (Fillable PDF)

SWS Worksheet #2 – Create a savings goal (Fillable PDF)

SWS Worksheet #3 – Savings support network (Fillable PDF)

SWS Worksheet #4 – Saving for emergencies (Fillable PDF)

SWS Worksheet #5 – Saving for unstable income (Fillable PDF)

SWS Worksheet #6 – Saving for education (Fillable PDF)

SWS Worksheet #7 – Saving for retirement (Fillable PDF)

Soaring with Savings- Full booklet

Soaring with savings - Training tools

French

Encourager l’épargne - Conseils et outils pour vous aider à épargner

Encourager l’épargne - l’aide d’animation

Ressources

CELI calculatrice, La Commission des valeurs mobilières de l’Ontario

REER, La Commission des valeurs mobilières de l’Ontario

Épargnez plus facilement, CVMO

Investir et épargner pendant une récession, La Commission des valeurs mobilières de l’Ontario

Evaluating the impact of income volatility benefits on gig workers

Gig workers account for approximately 25 to 35% of the national workforce. When considering workers earning low to moderate incomes (LMI), these percentages are likely higher. Gig work provides reported advantages including flexibility, supplemental income, and independence. However, it also brings unique financial challenges such as complicated taxes, low and unpredictable wages, and difficulty accessing benefits. Due to these barriers to financial security, gig workers are often unable to build an emergency savings reserve. Commonwealth launched the Financial Benefits Project pre-pilot to further explore the financial needs of gig workers and to outline recommendations for employer benefits that reduce the impact of income volatility. In combination with schedule stability and predictable wages, income volatility benefits have the potential to help workers earning LMI manage from day to day, particularly given the reduction of COVID-19 supports. Across two cohorts, Commonwealth evaluated the impact of three interventions on financial hardships for 138 gig workers enrolled in the project. Participants were eligible for up to $1,000 in funds over a four-month period through weekly stipends, emergency grants, and emergency loans.

Growing household financial instability: Is income volatility the hidden culprit?

On March 9th, 2018, leading American and Canadian researchers and policy makers from all sectors gathered in Toronto to explore the question: Growing household financial instability: Is income volatility the hidden culprit? The policy research symposium was an invitational event co-hosted by the Investment Industry Regulatory Organization of Canada (IIROC) and Prosper Canada. Its purpose was to shine a light on an issue that has gained prominence in US economic and policy circles but was just emerging as a topic for exploration in Canada in the context of This report summarizes key insights, conclusions and next steps from the symposium in the hopes that it will inform, catalyse and support further action on this issue. To view the conference agenda and links to all conference presentations, please see Appendix 1. Presentation videos can be found online at

growing household financial instability.

https://www.youtube.com/playlist?list=PLC0J2kAG0MZZ5gd_6ZaHjqqEcenL2jCtP

Change Matters Volume 2: Assets

This is the second brief in a new series from The Financial Clinic. Change Matters leverages the data gathered through our revolutionary financial coaching platform, Change Machine, alongside the voices, wisdom, and lived experiences of Change Machine customers. We hope that our action oriented analysis will lead to positive social change. We believe we have a responsibility to ask the right questions, to use our data for good, and to inspire products, practice, and policy innovations that centralize the needs of the working-poor in building economic mobility.

Achieving financial resilience in the face of financial setbacks

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Weathering Volatility 2.0: A Monthly Stress Test to Guide Savings

In this report, the JPMorgan Chase Institute uses administrative bank account data to measure income and spending volatility and the minimum levels of cash buffer families need to weather adverse income and spending shocks. Inconsistent or unpredictable swings in families’ income and expenses make it difficult to plan spending, pay down debt, or determine how much to save. Managing these swings, or volatility, is increasingly acknowledged as an important component of American families’ financial security. This report makes further progress toward understanding how volatility affects families and what levels of cash buffer they need to weather adverse income and spending shocks.

U.S. Financial Health Pulse: 2019 Trends Report

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning -- to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable”. The data in the Pulse report provide critical insights that go beyond aggregate economic indicators, such as employment and market performance, to provide a more accurate picture of the financial lives of people in the U.S.

Income Volatility: Why it Destabilizes Working Families and How Philanthropy Can Make a Difference

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique role for philanthropy. This brief helps grantmakers understand the enormous challenges income volatility presents in America and provides an array of strategies for philanthropy to leverage both investments and leadership to empower families to protect themselves from volatility’s worst effects.

A workplace-based economic response to COVID-19

This brief emerged from a conversation, held in late March 2020, among a number of individuals and organizations who work on issues of household financial security. Employers with financial resources and governments have an opportunity to use the workplace as a significant channel to deliver financial relief as part of the economic response to COVID-19, complementing critical supports governments are providing to individuals and businesses.

Economic volatility in childhood and subsequent adolescent mental health problems: a longitudinal population based study of adolescents

This research paper investigates the association between the patterns of duration, timing and sequencing of exposure to low family income during childhood, and symptoms of mental health problems in adolescence.

Financial Health Index: 2019 Findings and 3-Year Trends Report

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from 2017 to 2019.

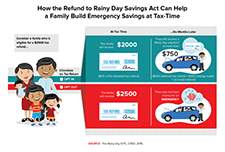

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Saving for Now and Saving for Later: Rainy Day Savings Accounts to Boost Low-Wage Workers’ Financial Security

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial shocks.

Short-term financial stability: A foundation for security and well-being

Short-term cushions are key to longer-term financial security and well-being. This report shines a light on the central role that short-term financial stability plays in a person’s ability to reach broader financial security and upward economic mobility, a measurement of whether an individual moves up the economic ladder over one’s lifetime or across generations. The insights presented in this report draw primarily on evidence provided by members of the Consumer Insights Collaborative (CIC), a group of nine leading nonprofits across the United States convened by the Aspen Institute Financial Security Program. These diverse organizations offer a window into the financial lives of the low- and moderate-income individuals they serve.

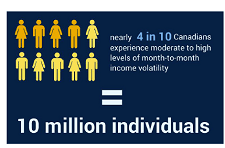

Pervasive and Profound: The Impact of Income Volatility on Canadians

In this video presentation Derek Burleton of TD Economics shares findings from the report 'Pervasive and Profound,' which examines income volatility trends in Canada. The survey found that nearly 40% of Canadians experience moderate to high income volatility. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

The Perils of Living Paycheque to Paycheque

This report, 'The Perils of Living Paycheque to Paycheque: The relationship between income volatility and financial insecurity', examines the relationship between income instability and broader measures of financial well-being. This study makes use of a unique dataset that collected self-reported month-to-month volatility in household income, measures of capability, financial knowledge and psychological variables. One in three adult Canadians reported at least some volatility in their monthly incomes, with six per cent reporting that the source and amount were both uncertain. Income volatility is present across a wide swath of the survey respondents, regardless of gender, family status, region of the country, education level and even income sources. Income volatility is correlated with lower financial knowledge, lower financial capability, and stronger beliefs that financial outcomes are up to fate and outside of personal control.

Strengthening retirement security for low- and moderate-income workers

In this video presentation Johnathan Weisstub from Common Wealth discusses recent improvements in senior Canadians' poverty levels due to benefits such as OAS and GIS, and the challenges that still remain in ensuring retirement security for modest-earning and low-income Canadians. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Redesigning Social Policy for the 21st Century

In this video presentation Sunil Johal from the Mowat Centre explains how social policy in the 21st century could be redesigned to accommodate the changing nature of work and income in Canada. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Building consumer financial health: The role of financial institutions and FinTech

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Income volatility: Strategies for helping families reduce or manage it

In this video presentation David Mitchell from the Aspen Institute explains strategies for mitigating and preventing income volatility at the household level. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Do we have the data we need to tackle household financial instability?

In this presentation Catherine Van Rompaey of Statistics Canada examines the data we have available to measure financial instability in Canada - household debt, savings, and credit. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Neighbourhood Financial Health Index: Making the Invisible Visible

In this video presentation Katherine Scott from the Canadian Council on Social Development (CCSD) shares the new Neighbourhood Financial Health Index, a mapping tool which uses composite data about income, assets, debt, and poverty to show levels of financial health at the neighbourhood scale. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium. Update July 22, 2022: Please note that the Neighbourhood Financial Health Index is no longer available

Income and Expense Volatility Survey Results

In this video presentation Patrick Ens from Capital One explains the impact of income and expense volatility on consumers. Capital One found that half of Canadian households surveyed experience some amount of income fluctuation month to month. This impacts their ability to save, cope with emergencies, and other aspects of their lives. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Canada’s household balance sheets

In this video presentation Andrew Heisz from Statistics Canada explains the changing household assets, debt, and income levels of Canadians of different age generations. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Up Close and Personal: Findings from the U.S. Financial Diaries

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) shares some of the findings from the U.S. Financial Diaries project. He explains how the households in the study experience multiple "spikes" and "dips" in income and spending over the course of a single year. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Income volatility: What banking data can tell us, if we ask

In this video presentation Fiona Greig from the JP Morgan Chase Institute explains what banking data can tell us about income volatility in the United States. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Household Financial Stability and Income Volatility

In this video presentation Ray Boshara of the Federal Reserve Bank of St. Louis explains how household financial stability has changed in the United States. He shows how education, age, and racial identity influence financial stability and wealth. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

We Tracked Every Dollar 235 U.S. Households Spent for a Year, and Found Widespread Financial Vulnerability

Income inequality in the United States is growing, but the most common economic statistics hide a significant portion of Americans’ financial instability by drawing on annual aggregates of income and spending. Annual numbers can hide fluctuations that determine whether families have trouble paying bills or making important investments at a given moment. The lack of access to stable, predictable cash flows is the hard-to-see source of much of today’s economic insecurity.

Responses to and Repercussions from Income Volatility in Low- and Moderate-Income Households: Results from a National Survey

Pervasive and profound: The impact of income volatility on Canadians

Income volatility describes income which is inconsistent (not received on a regular and predictable basis), unstable (amount varies each time it is received), and that fluctuates month to month by a significant percentage. TD’s report, Pervasive and Profound, has found that Canadians experiencing income volatility are more likely to report feelings of financial stress and lower overall financial health. They are also significantly more likely to see themselves falling behind financially and much less likely to feel confidence in their financial future. The survey findings show that income volatility is more likely to be experienced by part-time, self-employed, seasonal workers and the unemployed. The TD report uses Canadians’ reported behaviours and perceptions in the areas of saving, spending, borrowing and planning to gauge their overall financial health. In all four categories, those with higher income volatility show significantly lower financial health.