Resources

Supported tax filing (STF) model general documents

This section contains resources that describe the supported tax file model and includes sample scripts and documents relevant to both virtual and in-person supported tax filing. These documents may be customized for your own agency.

Resources specific to in-person supported tax filing

This section contains documents that have been tailored for in-person supported tax filing.

Resources specific to virtual supported tax filing

This section contains documents that have been tailored for virtual supported tax filing.

Additional resources

This section contains additional resources to support at tax time. Be sure to also review our Tax filing toolkit and Financial Coaching toolkit for other relevant resources.

Sample client profiles (WoodGreen)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Encouraging tax filing at virtual clinics

Resources

Handouts, video and time stamps

Read the presentation slides for this webinar.

Time stamps for the video:

Welcome and introductions

2:52 – Goals for webinar

4:39 – Context: Benefits Wayfinder and Disability Benefits Navigator

10:46 – Intro to the Bridge to Benefits tool

19:31 – Development process

24:10 – Demo – Walkthrough of the features

40:17 – Evaluation

44:12 – How to share this tool with others/Other resources

49:12 – Questions and feedback

Resources

Handouts, slides and video time stamps

Read the presentation slides for this webinar.

Download the promotional postcard.

Download the promotional poster.

Time-stamps for the video recording:

1:26 – Welcome and introductions

3:30 – Our goals for today’s session

5:04 – Why these tools were created

7:12 – The Benefits Wayfinder and the Disability Benefits Compass

46:11 – Ways to use the Benefits Wayfinder – tax clinics

49:37 – Access to Benefits training available

Making the most of your money

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share or use with your clients to help them access tools and resources to support their daily money management. Making the most of your money is an easy-to-use, accessible, online course to help people living on a low income organize their finances and explore ways to increase the amount of money coming in and reduce what is going out. This interactive course has activities, videos, handouts and resources that are also downloadable.

5 benefits of paying down debt with your tax refund

The average Canadian tax return amount in 2023 is $2,072 and that money can go a long way when it comes to meeting your financial goals. But remember, this isn’t a cash windfall; it’s YOUR money that the government borrowed from you, so Credit Canada recommends using it for needs versus wants. More specifically, consider using it to help pay down your debt.

Benefits & credits: factsheets from the CRA

The CRA has compiled benefits and credits factsheets for: These are available in English and French.

Canada workers benefit

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility requirements, how to apply and how much you can expect to receive by clicking on the Get It button below.

Investment knowledge quiz

Most people know a little about investing, but they need to know more to be able to manage their investments to meet their goals. Try this quiz by the FCAC to see if your knowledge is basic or more advanced.

Mapping the road toward increased accessibility to the child tax credit

Last year, the expanded Child Tax Credit (CTC) helped to lift nearly four million children out of poverty and provided economic relief to millions of struggling households. However, many first-time and lapsed filers from underserved and vulnerable populations missed out on these critical benefits. Locating and serving eligible low-income youth, formerly incarcerated individuals, people experiencing homelessness, immigrants, survivors of domestic violence, and isolated tribal populations has presented a challenging opportunity to free tax prep service providers across the country. This research highlights the key findings and recommendations to increase the accessibility to the CTC.

Community volunteer income tax program (CVITP)

Need help filing your taxes? You may be able to avail of the Community Volunteer Income Tax Program. The Community Volunteer Income Tax Program (CVITP) has existed since 1971 and is a longstanding partnership between the Canada Revenue Agency (CRA), and community organizations and their volunteers. Tax clinic volunteers complete tax and benefit returns for eligible individuals to ensure they receive, or continue to receive, their entitled benefit payments. In Québec, volunteers prepare both the federal and provincial tax return. The CVITP service is offered free of charge to everyone who meets the eligibility criteria, and includes doing taxes for the current and previous years. For the 2022 tax season, community organizations are hosting free in-person and virtual tax clinics.

How income tax works

Filing your taxes might be one of the most important financial actions you’ll take each year. It can also feel confusing or stressful at times. Find out more about how income tax works, including tax deductions and tax credits using the Ontario Securities Commission's interactive chart to see what tax bracket you are in.

It’s time to get ready for taxes!

Intuit is committed to helping students across the country work towards a more prosperous financial future by equipping them with the education they need to feel confident about their taxes. Through the Intuit TurboTax Simulation, we are helping students overcome the fear of Tax Day. You do not need to be an expert to teach taxes, and we recommend teaching to grade levels 9-12.

Ethnography of vulnerable newcomers’ experiences with taxes and benefits

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of this study is to develop the CRA’s understanding of newcomers’ experiences as they first encounter the Canadian tax and benefit system. These findings illuminate potential directions for improving tax and benefit information and services available for newcomers.

Learn about your taxes (free CRA online course)

A free online course to learn about personal income taxes in Canada, developed by the Canada Revenue Agency. Contents include: Additional resources for teachers and facilitators are available.

Who Doesn’t File a Tax Return? A Portrait of Non-Filers

The Canada Revenue Agency administers dozens of cash transfer programs that require an annual personal income tax return to establish eligibility. Approximately 10–12 percent of Canadians, however, do not file a return; as a result, they will not receive the benefits for which they are otherwise eligible. In this article, we provide the first estimates of the number and characteristics of non-filers. We also estimate that the value of cash benefits lost to working-age non-filers was $1.7 billion in 2015. Previous literature suggests either a rational choice model of tax compliance (in which the costs of filing are weighed against its benefits) or a more complex behavioural model. Our study has important consequences for policy-making in terms of the administrative design and fiscal costs of public cash benefits attached to tax filing, the measurement of household incomes, and poverty rates.

Encouraging tax filing at virtual clinics

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual clinics.

Tax Credit Outreach Resources

The Get It Back Campaign helps eligible workers in the United States claim tax credits and use free tax filing assistance to maximize tax time. A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial institutions to conduct outreach nationally. For 30 years, these partnerships have connected lower and moderate-income workers to tax benefits like the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and Volunteer Income Tax Assistance (VITA). Their website contain a variety of outreach materials that can be adapted for your organization, including:

Disability Tax Credit Tool

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to give them the information they need to fill out that form

Tax Prep Dispatch: Alternative Service Delivery Tips!

Tips and considerations for providing alternative tax filing service delivery.

Tax Prep Dispatch: The Drop-Off Process

Considerations and best practices for drop-off and virtual tax filing services.

Virtual VITA Toolkit: Program Strategies

Program strategies grounded in an understanding of your community can increase the likelihood of engagement and follow-through. The following resources are intended to support VITA programs with implementation strategies at key program stages, like outreach and intake, and offer examples of how other virtual VITA programs have addressed critical challenges.

Questions and answers about filing your taxes

Questions and answers released by the Canada Revenue Agency (CRA) about filing your taxes, including information on:

Resources

Handouts, slides, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Process map: Virtual Self-File model overview

Time-stamps for the video recording:

4:01 – Agenda and introductions

5:59 – Audience polls

10:27 – Project introduction (Speaker: Ana Fremont, Prosper Canada)

14:31 – Tour of TurboTax for Tax Clinics (Speaker: Guy Labelle, Intuit)

17:59 – Woodgreen project pilot (Speaker: Ansley Dawson, Woodgreen Community Services)

27:35 – EBO 2-step process (Speaker: Marc D’Orgeville, EBO)

39:26 – Woodgreen program modifications (Speaker: Ansley Dawson, Woodgreen)

46:03 – Q&A

Resources

Handouts, slides, and time-stamps

Disability Alliance BC

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered Disability Savings Plans (RDSP) and more.

English

French

Taxpayer Rights in the Digital Age

This paper explores the intersection of digital innovation, digital services, access, and taxpayer rights in the Canadian context, in light of the experiences of vulnerable populations in Canada, from the perspective of the Taxpayers’ Ombudsman. Many aspects of the CRA’s digitalization can further marginalize vulnerable populations but there are also opportunities for digital services to help vulnerable persons in accessing the CRA’s services.

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits designed to support them. This report illustrates that the CRA needs to take a broad, country-wide perspective of the CVITP, while also taking into consideration regional and other differences. Services offered and training provided to volunteers need to reflect the realities of the diverse regional, geographic, socio-economic, workforce, and vulnerable, sectors throughout Canada. Different areas of the country will have different primary needs from the CVITP. The CRA needs to address those needs, both in its actions through the CVITP, as well as in the training provided to CVITP volunteers and the support given to partner organizations.

Transformation through disruption: Taxpayers’ Ombudsman Annual Report 2019-20

The mandate of the Taxpayers’ Ombudsman is to assist, advise, and inform the Minister about any matter relating to services provided by the CRA. The Taxpayers’ Ombudsman fulfills this mandate by raising awareness, upholding taxpayer service rights, and facilitating the resolution of CRA service complaints issues. Through independent and objective reviews of service complaints and systemic issues, the Ombudsman and her Office work to enhance the CRA’s accountability and improve its service to, and treatment of, people. and systemic issues. This is the Annual Report of the Taxpayers' Ombudsman for 2019-20.

Reaching Out: Improving the Canada Revenue Agency’s Community Volunteer Income Tax Program

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of the Canada Revenue Agency (CRA). The Office of the Taxpayers’ Ombudsman hears first-hand the concerns of individuals, tax practitioners, and community support organizations. The Ombudsman visited with Community Volunteer Income Tax Program (CVITP) partner organizations, volunteers, and the Canada Revenue Agency’s (CRA) CVITP coordinators to learn more about the program and to understand the success stories and challenges they all experience. This report gives voice to what they have heard and provides recommendations on how to address the issues raised.

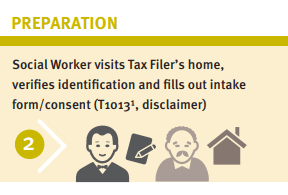

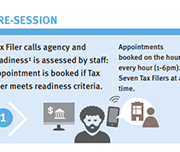

Virtual tax filing: Piloting a new way to file taxes for homebound seniors

WoodGreen Community Services, a large multi-service frontline social service agency in Toronto, provides free tax preparation services year-round to people living on low incomes. WoodGreen was interested in designing a novel solution to address the tax filing needs of homebound seniors who are unable to access WoodGreen’s free in-person tax-preparation services due to physical or mental health challenges. Specifically, WoodGreen wanted to know… How might we provide high-quality professional tax preparation services to all clients whether or not they are onsite? Prosper Canada and a leading commercial tax preparation software company partnered with WoodGreen Community Services in order to answer this design question.

English

Supported self-file process maps: English

French

English

Benefits 101

What are tax credits and benefits

Reasons to file a tax return

List of common benefits

Getting government payments by direct deposit

Common benefits and credits Benefits pathways (for practitioner reference only – some illustrations presented are Ontario benefits)

Pathways to accessing government benefits

Overview of tax benefits and other income supports (adults, children, seniors)

Overview of tax benefits and other income supports (people with disabilities or survivors)

Income support programs for immigrants and refugees

Glossary of terms – Benefits 101

Resources – Benefits 101

Key benefits you may be eligible for

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

Benefits of Filing a Tax Return: Infographic

Common benefits and credits

Resource links:

Benefits and credits for newcomers to Canada – Canada Revenue Agency

Benefit Finder – Government of Canada

Electronic Benefits and credits date reminders – Canada Revenue Agency (CRA)

Income Assistance Handbook – Government of Northwest Territories

What to do when you get money from the government – Financial Consumer Agency of Canada (FCAC)

Emergency benefits

General emergency government benefits information & navigation

Financial Relief Navigator tool (Prosper Canada)

Changes to taxes and benefits: CRA and COVID-19 – Government of Canada

Canada Emergency Response Benefit (CERB)

Apply for Canada Emergency Response Benefit (CERB) with CRA – Canada Revenue Agency (CRA)

Questions & Answers on CERB – Government of Canada

What is the CERB? – Prosper Canada

FAQ: Canada Emergency Response Benefit – Prosper Canada (updated June 10th)

CERB: What you need to know about cashing your cheque – FCAC

COVID-19 Benefits (summary, includes Ontario) – CLEO/Steps to Justice

COVID-19 Employment and Work – CLEO/Steps to Justice

GST/HST credit and Canada Child Benefit

COVID-19 – Increase to the GST/HST amount – Government of Canada

Canada Child Benefit Payment Increase – Government of Canada

Benefits payments for eligible Canadians to extend to Fall 2020 – Government of Canada

Support for students

Support for students and recent graduates – Government of Canada

Canada Emergency Student Benefit (CESB) – Government of Canada

Benefits and credits for families with children

Benefits and credits for families with children

Resource links:

Child and family benefits – Government of Canada

Child and family benefits calculator – Government of Canada

Benefits and credits for people with disabilities

Benefits and credits for people with disabilities

RDSP, grants and bonds

Resource links:

Canada Pension Plan disability benefit toolkit – Employment and Social Development Canada (ESDC)

Disability benefits – Government of Canada

Disability tax credit (DTC) – Canada Revenue Agency (CRA)

Free RDSP Calculator for Canadians – Plan Institute

Future Planning Tool – Plan Institute

Creating Financial Security: Financial Planning in Support of a Relative with a Disability (handbook) – Partners for Planning

Nurturing Supportive Relationships: The Foundation to a Secure Future (handbook) – Partners for Planning

RDSP – Plan Institute

Disability Tax Credit Tool – Disability Alliance BC

ODSP Appeal Handbook – CLEO

Disability Inclusion Analysis of Government of Canada’s Response to COVID-19 (report and fact sheets) – Live Work Well Research Centre

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

Benefits and credits for seniors

Benefits and credits for seniors

Resource links:

Canadian Retirement Income Calculator – Government of Canada

Comparing Retirement Savings Options – Financial Consumer Agency of Canada (FCAC)

Federal Provincial Territorial Ministers Responsible for Seniors Forum – Employment and Social Services Canada (ESDC)

Retiring on a low income – Open Policy Ontario

RRSP vs GIS Calculator – Daniela Baron

Sources of income for seniors handout – West Neighbourhood House

What every older Canadian should know about: Income and benefits from government programs – Employment and Social Services Canada (ESDC)

French

Comprendre les prestations

Que sont les crédits d’impôt et les prestations?

Pourquoi produire une déclaration de revenus?

Processus d’accès aux prestations (simple, complexe ou laborieux)

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu : personnes handicapées ou survivants

Programmes d’aide au revenu pour immigrants et réfugiés – Admissibilité et processus de demande

Glossaire – Prestations et credits

Ressources : Prestations et credits

Principales mesures d’aide auxquelles vous pouvez être admissibles

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone,

Infographie sur les avantages de produire une déclaration de revenus

Prestations et crédits courants

Prestations et crédits pour familles avec enfants

Prestations et crédits pour personnes handicapées

Prestations et crédits pour les personnes âgées

Informations d’identification pour accéder aux prestations

Études de cas

Seniors: tips to help you this tax season

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada resources.

How to use your tax refund to build your emergency savings

If you file your taxes in the United States, you can learn how your tax return can kickstart your savings. This guide from the Consumer Financial Protection Bureau walks you through some fast and easy ways to use your tax refund to increase your savings. This guide covers multiple topics including: why save your tax return, how to save money fast, affordable ways to file your taxes, and how to protect yourself from tax fraud.

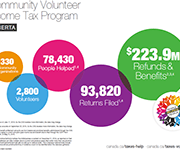

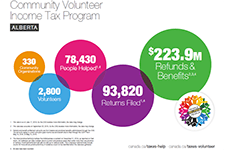

Community Volunteer Income Tax Program (CVITP) provincial snapshots

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les informations sont présentées en anglais et en français.

Evaluating Tax Time Savings Interventions and Behaviors

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife (formerly EARN) during the 2019 tax season are presented. This analysis is unique in that it compares tax filers' outcomes over time across three different tax-filing and savings program platforms: volunteer income tax assistance (VITA) sites, online tax filing through the Turbo Tax Free File Product (TTFFP), and SaverLife's saving program.

English

Download in English

French

Download in French

Incentivized Savings: An Effective Approach at Tax Time

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through a dedicated collaboration with ATB Financial, Aspire Calgary, Sunrise Community Link Resource Centre, Centre for Newcomers, and First Lutheran Church Calgary that made it all possible. This report shares results and highlights from the 2018 Tax Time Savings program. 93% of participants earned the maximum match of $500.

My money in Canada

Are you a newcomer to Canada, or someone who works with newcomers? This online tool will help you explore five money modules to better manage your finances in Canada. Learn about the financial system in Canada, income and expenses, setting goals and saving, credit and credit reports, and filing taxes. Updated July 26, 2022: My money in Canada provides important information about Canada’s financial system and promotes positive money management habits to support Canadians to succeed financially. Interactive exercises and checklists support you to make informed choices and to create a customized financial plan that works for you. Originally designed to support newcomers to Canada as they settle and establish themselves financially, My money in Canada has been updated to serve all Canadians, including those who are new to Canada.

Tax Time: An opportunity to Start Small and Save Up

The Consumer Financial Protection Bureau’s continuing effort to encourage saving at tax time is now part of a larger Bureau initiative to support people in building liquid savings. The new initiative is called Start Small, Save Up. The vision for Start Small, Save Up is to increase people’s financial well-being through education, partnerships, research, and policy or regulatory improvements that increase people's opportunities to save and empower them to realize their personal savings goals. This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being.

Canadian Financial Diaries

The Canadian Financial Diaries Research Project is using the financial diaries methodology to understand the financial dynamics of vulnerable Canadians in a rapidly changing socio-economic context. This includes understanding the barriers and opportunities that people face in trying to improve their financial and overall well-being. The website shares research insights and news about the project as the different phases of research are synthesized.

Accessing the Canada Learning Bond: Meeting Identification and Income Eligibility Requirements

Introduced in 1998, the Canadian Education Savings Program (CESP) was designed as an incentive to encourage education savings for the post-secondary education of a child. The program is centred on Registered Education Savings Plans (RESPs), where savings accumulate tax-free until withdrawn, to pay for full- or part-time postsecondary studies such as a trade school, CEGEP, college, or university, or in an apprenticeship program. The CLB was introduced in 2004 specifically for children from low income families. CLB provides, without family contribution being required, eligible families with an initial RESP payment which may be followed by annual payments up until the child is aged 15 years old. The objective of this paper is to assess the extent to which not tax-filing and not having a SIN for a child could pose a challenge to accessing the CLB and the CESG. This study will address the knowledge gap by analyzing overall differences in SIN and tax-filing uptake by family income, levels of parental education, family type and Indigenous identity of the child. The findings will help understand access issues related to the CLB but also to other programs with similar administrative conditions. En francais: Accéder au Bon d’études canadien: l’atteinte des critères d’identification et d’éligibilité selon le revenu.

VITA: A step-by-step guide to increase your impact

In this report, The Common Cents Lab and MetLife Foundation share findings from the experiments we have run over the past several years with VITA providers to improve tax-related outcomes. We encourage you to consider implementing these ideas and engaging in additional conversations about how to use behavioral science to increase financial capability for all taxpayers. The report outlines a series of interventions that exemplify

ways these best practices have been implemented in the field and

how to use behavioral science to further extend their impact. We’ve

organized these interventions into two categories:

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.

More Than Just Taxes

Tax time financial capability services offered at Volunteer Income Tax Assistance (VITA) sites range from encouraging taxpayers to save a portion of their refund to free credit reviews, to referrals to financial coaching, and others in between. This report from Prosperity Now summarizes research findings on VITA programs offering asset-building and financial capability services. Specifically, findings address barriers to be overcome, facilitating factors, and the opportunities for targeted outreach, tailored messages, and policy improvements to move the needle on Earned Income Tax Credit (EITC) take-up rates.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Handouts for this webinar:

Tax time insights research report – webinar handout (Prosper Canada)

Income tax checklist – webinar handout (The Working Centre)

Form for missing income information – webinar handout (The Working Centre)

Income tax return summary sheet – webinar handout (The Working Centre)

Host checklist for tax clinics – webinar handout (The Working Centre)

Forms for rental information – webinar handout (The Working Centre)

Referral to FEPS – webinar handout (The Working Centre)

Time-stamps for the video-recording:

3:10 – Introductions and Agenda

6:32 – Audience polls

10:52 – Tax time insights: Experiences of people living on low incomes (Speaker: Nirupa Varatharasan)

26:00 – The Working Centre tax clinic experiences (Speaker: Jen Smerdon)

Resources

Barriers to tax filing experienced by people with low incomes

Income tax filing and benefits take-up: Challenges and opportunities for Canadians living on low income, Uttam Bajwa, University of Toronto

Tax time insights, Nirupa Varatharasan, Prosper Canada

“Stories from the field”: Contextualizing the barriers Indigenous People face, Erin Jeffery, Canada Revenue Agency (CRA)

Closing the tax-filing gap: Challenges and opportunities

The Community Volunteer Income Tax Program, Nancy McKenna, CVITP, Canada Revenue Agency

Supporting organizations in the CVITP, Aaron Kozak, Employment and Social Development Canada, and Melissa Valencia, Canada Revenue Agency

A Realist analysis of nonprofit tax filing services, Kevin Schachter, University of Manitoba and SEED Winnipeg

National and regional strategies to boost tax filing

The Community Volunteer Income Income Tax Program, Nancy McKenna, Canada Revenue Agency

GetYourBenefits! Diagnose and Treat Poverty, Dr. Noralou Roos, Manitoba Centre for Health Policy

Get your piece of the money pie, Althea Arsenault, New Brunswick Economic and Social Inclusion Corporation

Innovations in tax filing assistance

Scaling tax filing assistance, John Silver, Community Financial Counselling Service (CFCS)

Virtual Tax Filing Pilot, Radya Cherkaoui, Intuit Canada, and Steve Vanderherberg, Woodgreen Community Services

Innovative use of technology for VITA, German Tejeda,

Innovative use of technology for VITA

In this presentation, German Tejeda, National Director of Financial Programs, Single Stop USA, shares results from the Virtual VITA Program in the United States since 2012. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Virtual Tax Filing Pilot

In this presentation, Radya Chaerkaoui, Senior Product Manager and Innovation Catalyst, Intuit Canada, and Steve Vanderherberg, Director-Strategic Initiatives, WoodGreen Community Services, share insights from their Virtual Tax Filing Pilot program. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Scaling tax filing assistance

In this presentation, John Silver, Executive Director, Community Financial Counselling Service (CFCS), Winnipeg, shares insights from the low income tax program at CFCS. This program files almost 10,000 returns each year, and also provides tax clinic support to other agencies and delivers detailed training for tax clinic volunteers. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Get Your Benefits! Diagnose and Treat Poverty

In this presentation, Noralou P. Roos, Co-Director, GetYourBenefits! and Professor, Manitoba Centre for Health Policy, explains how access to tax filing and benefits is an important poverty intervention. This presentation is from the panel discussion 'National and regional strategies to boost tax filing', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

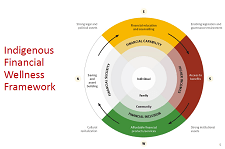

Providing tax filing and benefits assistance to Indigenous communities

In this presentation, Simon Brascoupé, Vice President, Education and Training, AFOA Canada, explains the financial wellness framework and how tax filing presents opportunities for building financial wellness in Indigenous communities. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

A Realist Analysis of Nonprofit Tax Filing Services

In this presentation, Kevin Schachter, Graduate Student at University of Manitoba and Information Manager at SEED Winnipeg, presents a realist analysis of nonprofit tax filing services. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Supporting Organizations in the CVITP

In this presentation, Aaron Kozak, ESDC and Melissa Valencia, CRA, present findings from their research on the Community Volunteer Income Tax Program (CVITP). This includes recommendations for structural changes to the program, review of CVITP training, changes to registration, and more. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

The Community Volunteer Income Tax Program (CVITP)

In this presentation, Nancy McKenna, Manager, CVITP, Canada Revenue Agency, explains how the Community Volunteer Income Tax Program (CVITP) works. This includes eligibility requirements, the size of the program in 2017/2018, and partnerships. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Stories from the field: Contextualizing the barriers Indigenous People face

In this presentation, Erin Jeffery, Outreach Officer with Canada Revenue Agency (CRA) shares what the CRA Outreach team has learned about tax filing barriers facing Indigeous People in Canada. These barriers include lack of documentation, lack of trust, access to services, and challenges around accessing Canada Child Benefit. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Tax time insights: Experiences of people living on low income in Canada

In this presentation, Nirupa Varatharasan, Research & Evaluation Officer with Prosper Canada, explains the research methods and insights gathered in the report 'Tax time insights: Experiences of people living on low income in Canada.' This includes demographic information, the type of tax filing resources accessed by this population, and insights on the types of challenges and opportunities that result from their tax filing processes. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Income tax filing and benefits take-up: Challenges and opportunities for Canadians living on low incomes

In this presentation, Uttam Bajwa, Global Health and Research Associate with the Dalla Lana School of Public Health, University of Toronto, reports on tax filing challenges and opportunities for Canadians living on low incomes. This includes the challenges of not knowing what to do, fear and mistrust, and challenges accessing supports. This presentation is based on the research conducted for the Prosper Canada report 'Tax time insights: Experiences of people living on low incomes in Canada'. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

English

Download in English

French

English

2023 Tax Resources: Canada Revenue Agency

The Canada Revenue Agency kicks off the 2023 Tax filing season

- Factsheet – Students

- Factsheet – Persons with disabilities

- Factsheet – Modest income individuals

- Factsheet – Housing insecure individuals

- Factsheet – Adults 65 and older

- Factsheet – Indigenous peoples

- Factsheet: Northern residents deductions

- Factsheet: Individuals experiencing gender based violence

- Factsheet – Newcomers

Resources

- Infographic: Child-related benefits

- Infographic: Newcomers

- Tear sheet: Register for my account

- Tear sheet: Doing your taxes

- Service option card

- Video: Individuals with a modest income

- Video: Persons with disabilities

- Video: International Students

- Video: Students, it pays to do your taxes!

- SimpleFile by Phone automated phone service (formerly called File my Return)

2022 Tax Resources: Canada Revenue Agency

- Benefits and credits fact sheet – Students

- Benefits and credits fact sheet – Persons with disabilities

- Benefits and credits fact sheet – Modest income individuals

- Benefits and credits fact sheet – Housing insecure individuals

- Benefits and credits fact sheet – Adults 65 and older

- Benefits and credits fact sheet – Women in shelters

- Benefits and credits fact sheet – Indigenous peoples

- Benefits and credits fact sheet – Newcomers

Canada Dental Benefit

One-time top-up to the Canada Housing Benefit

Get your taxes done for free at a tax clinic

Canada workers benefit

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

2021 Tax Resources - Canada Revenue Agency

Last-minute tax tips (Canada Revenue Agency) – April 13, 2021

New Canada Recovery Benefits – What to Expect

Answers to your questions on paying back the Canada Emergency Response Benefit (CERB)

Benefits and credits fact sheet – Indigenous people living in Canada

Benefits and credits fact sheet – Modest income

Benefits and credits fact sheet – Newcomers

Benefits and credits fact sheet – Newcomers in Quebec

Benefits, credits, and deductions for Seniors

COVID-19 Measures for Persons with Disabilities

Benefits and credits – Persons with Disabilities

Canada Workers Benefit – Infographic

Canada Workers Benefit – promotion card

Get your taxes done for free – promotion card

Income tax basics

Why file? The benefits of tax filing (Tax toolkit)

Getting government payments by direct deposit

Income tax 101: What are tax deductions, benefits, credits, exemptions, and brackets? (Tax toolkit)

Considerations for Indigenous people at tax time (Tax toolkit)

Resources about tax filing in Canada (Tax toolkit)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Community tax clinic guides

About volunteer tax clinics: Help your community members file their taxes (Tax toolkit)

Getting started as a community tax clinic (Tax toolkit)

Tax clinic staff and volunteer roles (Tax toolkit)

Tax clinic preparation: Recommended timeline (Tax toolkit)

Insights on planning free tax clinics in Indigenous communities: Infographic (Tax toolkit)

Encouraging tax filing at virtual clinics (sample “active choice” email) – The Behavioural Insights Team *NEW*

Tax clinic resources for practitioners

The tax clinic resources below are from our community partner organizations. These are examples that may be adapted to your own community tax clinic needs. Whenever possible, we have credited the original author of each document and included contact information if you would like to find out more about using and adapting the resource.

Resources to support tax clinic delivery and tax filing

Simplified Intake Form 2019 (ACSA, Scarborough, ON)

Tax Clinic Host Checklist (The Working Centre, Kitchener-Waterloo, ON)

Income tax checklist for participants (The Working Centre, Kitchener-Waterloo, ON)

Intake form for Couples (E4C, Edmonton, AB)

Tax Prep Quick Reference Guide (E4C, Edmonton, AB)

Other resources to support participants at tax time

Income tax summary (The Working Centre, Kitchener-Waterloo, ON)

Form for Missing Income Info for Revenue Canada (The Working Centre, Kitchener-Waterloo, ON)

Forms for rental information (The Working Centre, Kitchener-Waterloo, ON)

Referral to FEPS (The Working Centre, Kitchener-Waterloo, ON)

Envelope checklist (E4C, Edmonton, AB)

Seniors Info Sheet – Federal and provincial benefits (E4C, Edmonton, AB)

Resources for outreach and promotion

Tax clinic flyer (ACSA, Scarborough, ON)

2019 tax clinic flyer (Jane Finch Centre, Toronto, ON)

2019 tax clinic flyer (North York Community House, Toronto, ON)

Resources to support tracking and evaluation

Tax data entry sheet – Tax toolkit (Sunrise Community Centre, Calgary, AB)

Anonymous tax tracking sheet (Aspire collective, Calgary, AB)

Additional information and resources on tax filing

Benefits, credits and financial support: CRA and COVID-19 – Canada Revenue Agency (CRA)

Covid-19: Free virtual tax clinics – Canada Revenue Agency (CRA)

Get ready to do your taxes – Canada Revenue Agency (CRA)

Taking care of your tax and benefit affairs can pay off (tax filing info sheet) – Canada Revenue Agency (CRA) *NEW

Slam the scam – Protect yourself against fraud – Canada Revenue Agency (CRA)

Virtual Tax Filing: Piloting a new way to file taxes for homebound seniors – Prosper Canada

Webinar Series on Taxes (May 2020) – Momentum

SimpleFile by Phone automated phone service (formerly called File my Return) – Prosper Canada Learning Hub

Tax season prep – Plan Institute

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

What to do if your tax return is reviewed or audited – OSC

French

Ressources de déclaration de revenus 2024 - Agence du revenu du Canada

Ressources de déclaration de revenus 2023 - Agence du revenu du Canada

L’Agence du revenu du Canada lance la saison des impôts 2023

- Fiche descriptive: Étudiants

- Fiche descriptive: Les personnes handicapées

- Fiche descriptive: Les personnes à revenu modeste

- Fiche descriptive: Les personnes en situation de logement précaire

- Fiche descriptive: Les personnes âgées de 65 ans et plus

- Fiche descriptive: Les personnes autochtones

- Fiche descriptive : Déductions pour les habitants de régions éloignées

- Fiche descriptive : Personnes aux prises avec la violence fondée sur le sexe

- Fiche descriptive: Les nouveaux arrivants

Ressources

- Infographie – Prestations pour enfants

- Infographie – Prestations et crédits pour les nouveaux arrivants

- Feuille détachable : Inscrivez-vous à Mon dossier

- Feuille détachable : Produire votre déclaration de revenus

- Carte d’option de service

- Webinaire – Les personnes à revenu modeste

- Video: Persons with disabilities

- Webinaire – Les étudiants étrangers

- Webinaire – Avis aux étudiants : c’est payant de faire vos impôts!

Ressources de déclaration de revenus 2022 - Agence du revenu du Canada

Fiche descriptive : Étudiants

Fiche descriptive : Les personnes handicapées

Fiche descriptive : Les personnes à revenu modeste

Fiche descriptive : Les personnes en situation de logement précaire

Fiche descriptive : Les personnes âgées de 65 ans et plus

Fiche descriptive : Femmes dans les refuges

Fiche descriptive : Les personnes autochtones

Fiche descriptive : Les nouveaux arrivants

Prestation dentaire canadienne

Supplément unique à l’Allocation canadienne pour le logement

Faites faire vos impôts à un comptoir d’impôts gratuit

Allocation canadienne pour les travailleurs

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone, Inuit ou Métis

Ressources de déclaration de revenus 2021 - Agence du revenu du Canada

Nouvelles prestations canadiennes de la relance économique – À quoi s’attendre

Réponses à vos questions sur le remboursement de la Prestation canadienne d’urgence (PCU)

Recevez vos versements de prestations et de crédits! – Les les autochtones qui habitent au Canada

Prestations et crédits – Revenu modeste

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits!

Nouveaux arrivants, vous pourriez recevoir des prestations et des crédits! (Quebec)

Il y a des avantages à faire ses impôts! – Personnes agées

Mesures relatives à la COVID-19 à l’intention des personnes handicapées

Des prestations et des crédits pour vous! – Les personnes handicapées

Chaque dollar compte! – L’allocation canadienne pour les travailleurs (ACT)

Chaque dollar compte! Carte promotionnelle pour l’allocation canadienne pour les travailleurs (ACT)

Faites faire vos impôts gratuitement – Carte promotionnelle

Fondements de l’impôt sur le revenu

Pouruoi declarer? Les avantages de produire une declaration de revenus

Recevoir des paiements du gouvernement par dépôt direct

Que sont les déductions, les avantages fiscaux et les crédits d’impôt?

Considérations sur la période d’impôt pour lesautochtones qui habitent au Canada

Ressources pour en savoir plus

Comptoirs d’impôt bénévoles : Aidez les membres de votre communauté

Ressources

S’occuper de ses impôts et de ses prestations peut être payant – Agence du revenu du Canada

Service automatisé Déclarer simplement par téléphone (anciennement Produire ma déclaration)– Agence du revenu du Canada

Démystifier le crédit d’impôt pour personnes handicapées – Agence du revenu du Canada

Insights on planning free tax clinics in Indigenous communities

This infographic by Prosper Canada features advice to help Indigenous communities and organizations set up free income tax clinics. Advice was shared by clinic volunteers through a roundtable and interviews as part of the First Nations Financial Wellness project.

Complaints Related to Service from the CRA: Lessons Learned and Working Towards Better Service

Operating at arm’s length from the Canada Revenue Agency, the Office of the Taxpayers' Ombudsman (OTO) works to enhance the Canada Revenue Agency's (CRA) accountability in its service to, and treatment of, taxpayers through independent and impartial reviews of service-related complaints and systemic issues. OTO receives complaints and concerns from members of First Nations, Inuit and Métis communities. In this conference presentation, the Taxpayers’ Ombudsman provides examples of the types of issues her Office receives in order to provide community leaders with her insights in helping Indigenous people get better service from the CRA. In support of the AFOA Canada 2018 National Conference theme of Human Capital – Balancing Indigenous Culture and Creativity with Modern Workplaces, this presentation will provide participants with information on the types of issues and trends her office sees from members of the Indigenous communities and on better ways of serving these populations.

Boosting the Earned Income Tax Credit for Singles

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income workers without dependent children. The program, which provides a bonus of up to $2,000 at tax time, is being evaluated using a randomized controlled trial in New York City and Atlanta. This report presents findings through three years from New York, where over 6,000 low-income single adults without dependent children enrolled in the study in late 2013. The findings are consistent with other research on the federal EITC, indicating that an effective work-based safety net program can increase incomes for vulnerable and low-income individuals and families while encouraging and rewarding work.

What to do when you get an income tax refund

How Improved Training Strategies can Benefit Taxpayers Using VITA Programs

Managing your money #7: Preparing for tax filing

Even if you make no money, you should file a tax return each year. You may be eligible for a refund (money back). Filing your taxes triggers access to government benefits that you can’t get any other way. This worksheet will help you gather the information you will need at tax time. You will need a file folder, an envelope, or a small box to put all of your paperwork in. This is worksheet #7 from the booklet 'Managing your money'.

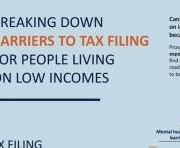

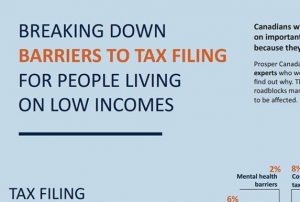

Breaking down barriers to tax filing for people living on low incomes – Infographic

This infographic by Prosper Canada summarizes the barriers to filing taxes faced by people living on low incomes. These barriers include access challenges, fear, lower literacy, and other challenges.

Financial Empowerment: Improving financial outcomes for low-income households

Financial Empowerment is a new approach to poverty reduction that focuses on improving the financial security of low-income people. It is an evidence-driven set of interventions that have proven successful at both eliminating systemic barriers to the full financial inclusion of low-income people and providing enabling supports that help them to acquire and practice the financial skills and behaviours that tangibly improve their financial outcomes and build their financial security. The Financial Empowerment approach focuses on community level strategies that encompass five main types of interventions that have been identified as both necessary for low-income households to improve their financial outcomes, and effective at helping them to do so.

Virtual VITA: Expanding Free Tax Preparation. Program Insights

This brief highlights findings from a small-scale pilot that integrated Virtual Volunteer Income Tax Assistance (VITA) services at two New York City Head Start programs during the 2013 tax season. The New York City Department of Consumer Affairs Office of Financial Empowerment (OFE) coordinated the pilot in partnership with the Administration for Children & Families (ACF) Region Food Bank For New York City was the VITA provider. Participating Head Start programs included The Children’s Aid Society and Kingsbridge Heights Community Center (KHCC).