English

For frontline staff - Quick tools you can use with clients

Starting the conversation

Here are 7 questions to help you start a conversation about money with your client. Based on what you learn about your clients’ needs, the remaining links on this page to help you find answers and next steps.

Try this coaching readiness checklist to help your client ascertain if they have the time and are interested in receiving financial coaching.

Worksheets & tip sheets

Here are some “go to” worksheets and tip sheets that frontline staff have found very helpful with their clients. They focus on budgeting, saving, and debt management – common FE needs that come up. Try them out for yourself first and see which ones might work for your clients.

The Budget Spreadsheet is an excellent tool for capturing the full picture of an individual’s financial picture. The individual inputs information according to different categories and the tool calculates totals in a summary page to show how much money is left over at the end of the month. [Thunder Bay Counselling]

The Simple budget template is an alternative monthly budget tool clients can use. It includes links to an Income tracking worksheet and Expenses tracking worksheet. [Prosper Canada / Trove]

The Urgent vs Important worksheet can help clients prioritize their spending. This, in turn, can help them save or “find money” for necessary expenses. [Prosper Canada / Trove]

Knowing how to set a SMART goal is important for planning and achieving targets. In the Set a SMART financial goal, clients learn what a SMART goal is and write SMART financial goals that are important to them. [Prosper Canada / Trove]

Making a spending plan is a worksheet clients can use to create a spending plan for each week based on money coming in and out each month. [Prosper Canada / Trove]

Making a debt action plan is a worksheet to help your clients get a handle on their debt. [Prosper Canada / Trove]

Tips for Managing Debt and Bills is a reference sheet you can give clients during tough times when managing cash flow is a challenge.

Prioritizing bills helps clients prioritize what bills to pay when it’s not possible to pay for everything. Note that this tool is from the Consumer Financial Protection Bureau (CFPB), an American government agency and includes a link to their website. Let clients know the information on the website is geared to the US context. [Consumer Financial Protection Bureau]

Online sites and tools

Here are great online tools you can also share and use in your FE work with clients.

Benefits wayfinder [benefitswayfinder.org]

Support with access to benefits is another powerful FE intervention. The Benefits wayfinder is a simple, easy to use, plain language tool that helps people on low and modest incomes find and track benefits they could get. Clients can use it on their own or with your support.

Read the Benefits wayfinder fact sheet to learn more.

Then watch the How to use this tool video. It highlights and demonstrates how to navigate through the key features of the tool.

If you would like additional training on how to support your clients with access to benefits and use the Benefits wayfinder tool in your money conversations, you can sign up for Prosper Canada’s self-directed online course and/or live workshop.

Trove [yourtrove.org]

Trove is a free bilingual website that clients can visit on their own or with your support. Many of the tools you were introduced to above can be found on Trove, along with a wealth of other user-friendly financial tools, worksheets, and education information to help clients take charge of their spending, learn about tax filing and benefits, and manage debt.

Along with a link to the Benefits wayfinder, you can also find these online tools:

- My money in Canada is a website that can help clients build healthy money habits with simple, easy to use learning modules on a range of money topics. The site also includes videos and a financial wellness checklist for clients.

- The RDSP Calculator for Canadians can be used to assess the potential of opening and contributing to a Registered Disability Savings Plan.

For managers - Tools for getting started with financial empowerment

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Tool 1. Making the case for financial empowerment

For FE to be successful, it’s critical to get buy-in from staff and stakeholders.

Below are great resources to share with key players who are new to FE. They can help you get others quickly up to speed on what FE is and the value of embedding FE as you onboard them or work to build interest in FE in your municipality.

- Prosperity Gateways Primer gives a quick overview of the “what” and “why” of embedding FE into municipal services.

- FE Brochure provides a more detailed introduction to FE and embedding FE.

- Here are three case examples you can use to show the powerful impact embedding FE into municipal services can have:

- Case example: York region

- Case example: TESS

- Case example: Edmonton

Tool 2. Getting started: the internal scan

Take the time to learn about common FE interventions. Then, assess conditions, capacity and considerations in your municipality for providing these kinds of financial help to your clients.

This tool guides you through an internal scan as you envision what embedding FE might look like in your service delivery context. Consider Tool 2: Getting started: the internal scan a starting point that will continue to evolve as you move through the process.

Tool 3. Exploring partnerships: the external scan

Municipalities do not have to deliver FE supports themselves to turn their services into Prosperity Gateways. In many cases, especially at the outset, it may be more cost-effective and less resource intensive to establish referral pathways to other local service providers or to partner with non-profit organizations, foundations, or financial service providers to deliver the financial help to meet your clients’ needs.

Use Tool 3: Exploring collaborations and partnerships to perform a scan of FE services in your local community and identify potential collaborations and partnerships.

Two additional partnership resources are ‘Elements of Integration‘ and ‘Partnership Tip Sheet‘

Tool 4. Designing the initiative: the service blueprint

Having completed an internal and external scan of barriers and opportunities, you are now ready to design an FE initiative to suit your municipality’s context. Designing the initiative is an important phase where you work out the service model, clarify partnerships, and imagine the ideal client experience.

Tool 4: Designing the initiative guides you through choosing the best service delivery model for your context and designing the client and staff journey.

We hope this toolkit will grow and improve with use and feedback. Current ideas for upcoming tools include:

- Understanding your clients’ financial capability

- Building a successful team

- Supporting staff for success

- Setting up effective data collection and evaluation processes

Tool 5. Designing the initiative: a shadowing guide

Tool 5: A shadowing guide can help frontline staff understand the process from intake to service delivery.

Feedback / Suggestions

We’d love to hear your feedback and suggestions for tools that you would find useful. Please email: Helen Payne Watt at [email protected]

Learn more about FE

Canadian Publications

Prosperity Gateways: Cities for financial empowerment – Building the case outlines evidence for embedding FE.

Read the report How financial empowerment services are helping Ontarians build financial health for more supporting evidence and personal stories.

Financial Empowerment – What is it and how it helps reduce poverty [national] suggests that FE is a critical missing piece of federal government policy that can significantly boost client outcomes when it is embedded into other programs and services.

Financial Empowerment – What is it and how it helps reduce poverty [Alberta] provides an overview of provincial government action on FE in Alberta. The Alberta government adapted the national document (by the same name) to use in their internal discussions with municipal decision-makers. Create a document that you can use for your internal discussions using this as an example.

U.S. Publications

The municipal integration of FE in Canada is grounded in influential work in the US by the Cities for Financial Empowerment (CFE) Fund. Launched in 2012 in New York the CFE Fund showed that embedding FE strategies into local government infrastructure can have a “supervitamin effect” on public programs, increasing the financial stability of low to moderate income households.

- Read the pioneering article: “Municipal Financial Empowerment: A Supervitamin for Public Programs”

- Learn more about their Financial Empowerment Centers model in this 4-minute video

- Visit their website to see resources and sign up for their quarterly newsletter

- See a three-year evaluation of the model in 5 cities across the US. “An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service”

The Urban Institute examined the cost of residents’ financial insecurity to city budgets in 10 American cities in this 2017 research. Across these cities, the costs range from the tens to hundreds of millions of dollars, suggesting that cities have an economic interest in improving their residents’ financial health.

A report by JP Morgan Chase reviews municipal efforts to integrate financial capability into public services in several US locations in “A Scan of Municipal Financial Capability Efforts.”

French

Pour le personnel de première ligne — Outils rapides que vous pouvez utiliser avec les clients

Amorcer la conversation

Voici sept questions qui vous aideront à entamer une conversation à propos de l’argent avec votre client. En fonction de ce que vous avez appris sur les besoins de vos clients, les autres liens de cette page vous aideront à trouver des réponses et à connaître les prochaines étapes.

Utilisez cette liste de vérification pour aider votre client à décider s’il a le temps et s’il souhaite recevoir un accompagnement financier.

Fiches de travail et fiches de conseils

Voici quelques feuilles de travail et des feuilles de conseils que le personnel de première ligne a trouvé très utiles pour ses clients. Elles portent principalement sur la planification budgétaire, l’épargne et la gestion des dettes — les besoins courants en matière d’AF qui se présentent. Essayez-les d’abord pour vous-même et voyez ceux qui pourraient convenir à vos clients.

La feuille de calcul du budget (anglais seulement) est un excellent outil pour saisir le portrait complet de la situation financière d’un individu. La personne saisit les données selon différentes catégories et l’outil calcule les totaux dans une page de synthèse pour montrer combien d’argent il reste à la fin du mois. [Thunder Bay Counselling]

Le modèle de budget simple est un outil alternatif de budget mensuel que les clients peuvent utiliser. Il comprend des liens vers une feuille de calcul de suivi des revenus et une feuille de calcul de suivi des dépenses. [Prospérité Canada/Trove]

La feuille de calcul Urgent versus Important peut aider les clients à établir des priorités dans leurs dépenses. Cela peut ensuite les aider à économiser ou à « trouver de l’argent » pour les dépenses nécessaires. [Prospérité Canada/Trove]

Il est important de savoir comment établir un objectif INTELLIGENT pour mettre en place et atteindre des objectifs. Avec l’outil Comment établir des objectifs financiers INTELLIGENTS, les clients apprennent ce qu’est un objectif INTELLIGENT et choisissent des objectifs financiers INTELLIGENTS qui sont importants pour eux. [Prospérité Canada/Trove]

La feuille de calcul Comment établir un plan de dépenses est un outil que les clients peuvent utiliser pour créer un plan de dépenses pour chaque semaine en fonction des entrées et sorties d’argent du mois. [Prospérité Canada/Trove]

La feuille de calcul Élaboration d’un plan d’action en matière de dettes est un outil pour aider vos clients à prendre le contrôle sur leurs dettes. [Prospérité Canada/Trove]

Conseils pour la gestion des dettes et des factures est une feuille de référence que vous pouvez donner à vos clients dans les moments difficiles où la gestion des fonds est un défi.

Le classement des factures par ordre de priorité (anglais seulement) aide les clients à déterminer les factures à payer en premier lorsqu’il n’est pas possible de tout payer. Notez que cet outil provient du Consumer Financial Protection Bureau (CFPB), une agence gouvernementale américaine, et comprend un lien vers son site Web. Expliquez aux clients que les renseignements figurant sur le site Web sont adaptés au contexte américain. [Consumer Financial Protection Bureau]

Sites et outils en ligne

Voici d’excellents outils en ligne que vous pouvez également faire connaître et utiliser dans votre travail en matière d’AF avec les clients.

Orienteur en mesures d’aide [benefitswayfinder.org/fr]

L’aide à l’accès aux mesures d’aide est une autre façon puissante d’intervenir en matière d’AF. L’Orienteur en mesures d’aide est un outil simple, facile à utiliser et rédigé en langage clair qui aide les personnes à revenus faibles ou modestes à trouver et à répertorier les mesures d’aide auxquelles elles peuvent prétendre. Les clients peuvent l’utiliser seuls ou avec votre aide.

Pour en savoir plus, lisez la fiche d’information sur l’Orienteur en mesures d’aide. (anglais seulement)

Ensuite, regardez la vidéo Comment utiliser cet outil (anglais seulement). Elle explique et démontre comment naviguer à travers les principales caractéristiques de l’outil.

Si vous souhaitez obtenir une formation supplémentaire sur la façon d’aider vos clients à accéder aux mesures d’aide et d’utiliser l’Orienteur en mesures d’aide dans vos conversations au sujet de l’argent, vous pouvez vous inscrire au cours autodidacte en ligne ou à l’atelier en direct de Prospérité Canada.

Trove [yourtrove.org/fr]

Trove est un site Web bilingue gratuit que les clients peuvent visiter par eux-mêmes ou avec votre aide. La plupart des outils qui vous ont été présentés ci-dessus se trouvent sur Trove, ainsi qu’une multitude d’autres outils financiers conviviaux, des feuilles de calcul et des renseignements éducatifs pour aider les clients à prendre en charge leurs dépenses, à se renseigner sur la déclaration et les avantages fiscaux et à gérer leurs dettes.

En plus d’un lien vers l’Orienteur en mesures d’aide, vous trouverez également ces outils en ligne :

- Mon argent au Canada est un site Web qui peut aider les clients à acquérir de bonnes habitudes en matière de gestion de l’argent grâce à des modules d’apprentissage simples et faciles à utiliser sur toute une série de sujets liés à l’argent. Le site comprend également des vidéos (anglais seulement) et un questionnaire relatif au bien-être financier pour les clients.

- La calculatrice du REEI pour les Canadiens peut être utilisée pour évaluer la possibilité d’ouvrir et de cotiser à un régime enregistré d’épargne-invalidité.

Pour les gestionnaires — Outils pour démarrer avec l’autonomisation financière

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Outil 1. Argumenter en faveur de l’autonomisation financière.

Pour que l’AF soit un succès, il est essentiel d’obtenir l’adhésion du personnel et des intervenants.

Vous trouverez ci-dessous d’excellentes ressources à faire connaître aux acteurs clés qui ne connaissent pas encore l’AF. Elles peuvent vous aider à faire comprendre rapidement aux autres ce qu’est l’AF et la pertinence d’intégrer l’AF lorsque vous les accueillez ou lorsque vous travaillez à susciter l’intérêt pour l’AF dans votre municipalité.

● L’abécédaire des passerelles pour la prospérité (anglais seulement) donne un aperçu de « qu’est-ce que c’est » et du « pourquoi » au sujet de l’intégration de l’AF dans les services municipaux.

● La brochure de l’AF (anglais seulement) fournit une introduction plus détaillée à l’AF et à l’intégration de l’AF.

● Voici trois exemples de cas que vous pouvez utiliser pour montrer l’impact puissant que peut avoir l’intégration de l’AF dans les services municipaux :

o Exemple de cas : Région de York

o Exemple de cas : Services sociaux et d’emploi de Toronto

o Exemple de cas : Edmonton

Outil 2. Commencer : l’analyse interne

Prenez le temps de vous renseigner sur les types d’interventions courantes en matière d’AF. Ensuite, évaluez les conditions, la capacité et les considérations dans votre municipalité pour fournir ces types d’aide financière à vos clients.

Cet outil vous guide à travers une analyse interne qui vous permet d’envisager ce que pourrait être l’intégration de l’AF dans votre contexte de prestation de services.

Considérez l’outil 2 : Commencer : l’analyse interne un point de départ qui continuera à évoluer à mesure que vous avancerez dans le processus.

Outil 3. Explorer les partenariats : l’analyse externe

Les municipalités ne sont pas obligées de fournir elles-mêmes des mesures d’aides en matière d’AF pour transformer leurs services en passerelles pour la prospérité. Dans de nombreux cas, surtout au début, il peut être plus rentable et moins exigeant sur le plan des ressources d’établir des liens de référence vers d’autres prestataires de services locaux ou de s’associer à des organismes à but non lucratif, des fondations ou des prestataires de services financiers pour fournir l’aide financière répondant aux besoins de vos clients.

Utilisez l’outil 3 : Explorer les collaborations et les partenariats pour effectuer une analyse des services en matière d’AF dans votre communauté locale et identifier les collaborations et partenariats potentiels.

Deux autres ressources à propos du partenariat sont les « Éléments de l’intégration » et les « Conseils pour le partenariat » .

Outil 4. Concevoir l’initiative : le plan de service

Après avoir effectué une analyse interne et externe des obstacles et des opportunités, vous êtes maintenant prêt à concevoir une initiative d’AF adaptée au contexte de votre municipalité. La conception de l’initiative est une phase importante où vous élaborez le modèle de service, clarifiez les partenariats et imaginez l’expérience client idéale.

L’outil 4 : Conception de l’initiative vous guide dans le choix du meilleur modèle de prestation de services pour votre contexte et dans la conception du parcours du client et du personnel.

Nous espérons que cette boîte à outils se développera et s’améliorera avec l’utilisation et les commentaires. Les idées actuelles pour les outils à venir incluent :

- Comprendrela capacité financière de vos clients

- Mettresur pied une équipe performante

- Soutenirle personnel pour qu’il réussisse

- Mettreen place des processus efficaces de collecte de données et d’évaluation

Outil 5. Concevoir l’initiative : un guide d’observation

L’outil 5 : Un guide d’observation peut aider le personnel de première ligne à comprendre le processus, de l’accueil à la mise en œuvre du service.

Commentaires et suggestions

Nous serions ravis d’entendre vos commentaires et vos suggestions d’outils que vous trouveriez utiles. Veuillez nous envoyer un courriel : Helen Payne Watt à l’adresse [email protected].

En savoir plus en matière d’AF

Publications canadiennes

Passerelles de prospérité : Les villes pour l’autonomisation financière — établir le dossier (anglais seulement) décrit les preuves qui sont pour l’intégration de l’AF.

Lisez le rapport intitulé Comment les services d’autonomisation financière aident les Ontariens à renforcer leur santé financière (anglais seulement) pour obtenir plus de preuves et de récits personnels.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [national] (anglais seulement) suggère que l’autonomisation financière est une pièce manquante essentielle de la politique du gouvernement fédéral qui peut considérablement améliorer les conditions de vie des clients lorsqu’elle est intégrée à d’autres programmes et services.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [Alberta] (anglais seulement) donne un aperçu de la démarche du gouvernement provincial en matière d’AF en Alberta. Le gouvernement de l’Alberta a adapté le document national (du même nom) pour l’utiliser dans ses discussions internes avec les décideurs municipaux. Créez un document que vous pourrez utiliser pour vos discussions internes en utilisant cet exemple.

Publications américaines

L’intégration municipale de l’AF au Canada est fondée sur les travaux influents réalisés aux États-Unis par le Fonds Cities for Financial Empowerment (CFE). Lancé en 2012 à New York, le Fonds CFE Fund a montré que l’intégration de stratégies d’AF dans l’infrastructure des gouvernements locaux peut avoir un « effet super vitaminé » sur les programmes publics, en augmentant la stabilité financière des ménages à revenu faible ou modéré.

- Lisez l’article pionnier : « Municipal Financial Empowerment: A Supervitamin for Public Programs » (anglais seulement)

- Apprenez-en davantage sur leur modèle de centres d’autonomisation financière (anglais seulement) dans cette vidéo de quatre minutes.

- Visitez leur site Web (anglais seulement) pour voir les ressources et vous inscrire à leur infolettre trimestrielle.

- Découvrez une évaluation de trois ans du modèle dans cinq villes des États-Unis. « An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service » (anglais seulement)

L’Urban Institute a examiné le coût de l’insécurité financière des résidents sur les budgets municipaux de dix villes américaines dans cette recherche de 2017 (anglais seulement). Dans ces villes, les coûts vont de dizaines à des centaines de millions de dollars, ce qui suggère que les villes ont un intérêt économique à améliorer la santé financière de leurs résidents.

Un rapport de JP Morgan Chase passe en revue les efforts déployés par les municipalités pour intégrer la capacité financière dans les services publics dans plusieurs villes américaines dans « A Scan of Municipal Financial Capability Efforts » (anglais seulement).

Household economic well-being during the COVID-19 pandemic, experimental estimates, fourth quarter 2020

A highlight of some of the findings reported in this briefing:

Why the Time is Right for a Guaranteed Income with an Equity Lens

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders involved in GI initiatives including practitioners, government representatives and philanthropy were heard. Panelists shared outcomes and new research results from some of the most successful GI pilots in the country (Stockton and Mississippi); goals for the newly launched Mayor’s for Guaranteed Income; how philanthropy can play a catalytic role and what this moment tells us about the future of guaranteed income initiatives.

Trans PULSE Canada COVID Data Dashboard

In September – October 2020, the Trans PULSE Canada study team conducted the COVID Cohort to assess the social, economic, and health impacts of the COVID-19 pandemic on trans and non-binary people in Canada. This dashboard serves as an interactive tool for community members and researchers to explore key findings from the Trans PULSE Canada COVID survey, and to break down the results by one or more socio-demographic characteristics. The proportions in the dashboard are weighted to represent the 2019 Trans PULSE Canada sample.

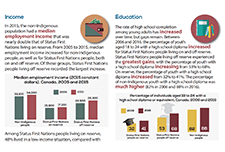

A snapshot: Status First Nations people in Canada

This is a custom report produced in collaboration between the Assembly of First Nations and Statistics Canada. It includes a variety of social and economic statistics for Status First Nations people living on and off reserve and includes comparisons with the non-Indigenous population.

Budget 2021: A Recovery Plan for Jobs, Growth, and Resilience

The federal budget released on April 19, 2021 covers the Canadian government's plan for:

Study: A labour market snapshot of Black Canadians during the pandemic

In the context of the COVID-19 pandemic, many Canadians, including Black Canadians, have experienced significant economic hardship, while others put themselves at risk through their work in essential industries such as health care and social assistance. Statistics Canada looked at how the 1 million Black Canadians aged 15 to 69 are faring in the labour market during one of the most disruptive times in our economic history. Analysis of the recent labour market situation of population groups designated as visible minorities is now possible as a result of a new question added to the Labour Force Survey (LFS) in July 2020. Unless otherwise stated, all data in this release are unadjusted for seasonality and are based on three-month averages ending in January 2021.

Aboriginal Peoples Survey: Data tables, 2017

New data tables on the labour activities of Indigenous Peoples are now available. Data are from the 2017 Aboriginal Peoples Survey and include information on labour force status, job satisfaction, skills training, skills that limit job opportunities, job permanency, part-time or full-time job status, mismatch of skills for current job, disability status and disability severity class, by Indigenous identity, age group and sex. Data are available for Canada, the provinces (Atlantic provinces combined) and the territories.

Yukon Poverty Report Card 2020

This report was released as part of public education movement Campaign 2000's annual assessment of child and family poverty in Canada, providing an overview of the following key issues relating to poverty in Yukon:

Housing insecurity and the COVID-19 pandemic

CFPB released their first analysis of the impacts of the COVID-19 pandemic on housing in the United States. Actions taken by both the public and private sector have, so far, prevented many families from losing their homes during the height of the public health crisis. However, as legal protections expire in the months ahead, over 11 million families — nearly 10 percent of U.S. households — are at risk of eviction and foreclosure.

Disability Inclusion Analysis of Lessons Learned and Best Practices of the Government of Canada’s Response to the COVID-19 Pandemic

This report provides the findings of research conducted to assist Employment and Social Development Canada in identifying good or best practices and lessons learned from the response to the COVID-19 pandemic in Canada. Conducted in partnership with the DisAbled Women’s Network of Canada (DAWN), this research helps us better understand how diverse people with disabilities in Canada have been affected by the COVID-19 pandemic and the effects of government COVID-19 measures on diverse people with disabilities in Canada.

Social Determinants of Health: The Canadian Facts (2nd edition)

Social Determinants of Health: The Canadian Facts, 2nd edition, provides Canadians with an updated introduction to the social determinants of our health. We first explain how living conditions “get under the skin” to either promote health or cause disease. We then explain, for each of the 17 social determinants of health: Improving the health of Canadians is possible but requires Canadians to think about health and its determinants in a more sophisticated manner than has been the case to date. The purpose of this second edition of Social Determinants of Health: The Canadian Facts is to stimulate research, advocacy, and public debate about the social determinants of health and means of improving their quality and making their distribution more equitable.

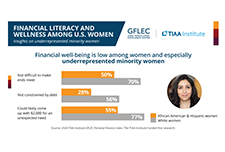

Financial Well-being among Black and Hispanic Women

This paper provides an in-depth examination of the financial well-being of Black and Hispanic women and the factors contributing to it, using the 2018 wave of the National Financial Capability Study. Differences between Black and Hispanic women versus White women are documented, in that the former are more likely to face economic challenges that depress financial well-being. Controlling for differences in socio-demographic characteristics, there are important differences in the factors that contribute to financial well-being for Black and Hispanic women compared to White women. This includes distinct impacts of education, family structure, employment, and financial literacy. Results imply that extant financial education programs inadequately address the needs of Black and Hispanic women.

Statistic Canada’s Longitudinal Immigration Database: Birth area and income table, 2018

Statistics Canada's Longitudinal Immigration Database (IMDB) Interactive Application has been updated to include data on citizenship intake rates and income by birth area, sex, pre-admission experience and admission category. This table includes income measures up to 2018 for immigrants admitted to Canada since 2008.

Statistics on Indigenous peoples

This data hub includes data on the following subjects:

Creating Communities Where We Live – A Good Practices Guide

Creating Communities Where We Live - A Good Practices Guide is a locally-driven community-based researched project conducted in Edmonton, Alberta, by e4c and the University of Alberta Community Service-Learning program. The project seeks to add to the knowledge and practice of community care around supporting people to achieve a safe, secure, and affordable housing experience. The 10 good practices in this guide describe structures, roles, and relationships which promote community and wellbeing for tenants who live in affordable housing. The practices are informed, in part, by research into tenant and staff experiences at affordable housing complexes run by four Edmonton housing providers.

CPA Canada 2020 Canadian Finance Study

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these unprecedented times. Nielsen conducted the CPA Canada 2020 Canadian Finance Study via an online questionnaire, from September 4 to 16, 2020 with 2,008 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. Among the key pandemic-related findings:

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

COVID-19 Resources for people with disabilities

National Disability Institute (NDI)'s Financial Resilience Center offers resources and assistance to help those with disabilities and chronic health conditions navigate financially through the COVID-19 crisis. Resource topics include:

Financial Literacy and Wellness Among U.S. Women: Insights on Underrepresented Minority Women

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined understanding of financial literacy among women, including areas of strength and weakness and variations among subgroups, can inform initiatives to improve financial wellness, particularly as the United States moves forward from the pandemic and its economic consequences.

Millennials and money: Financial preparedness and money management practices before COVID-19

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed over the ten years following the Great Recession of 2008 and the situation they were in on the cusp of the current economic crisis (in 2018) due to the COVID-19 pandemic. Findings from the National Financial Capability Study (NFCS) show that millennials tend to rely heavily on debt, engage frequently in expensive short- and long-term money management, and display shockingly low levels of financial literacy. Moreover, student loan burden and expensive financial decision making increased significantly from 2009 to 2018 among young adults.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

Women and Wealth: Insights for Grantmakers

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for Grantmakers examines the causes and dimensions of the women’s wealth gap and provides recommendations and best practices for grantmakers to reduce the women’s wealth gap and improve women’s access to the wealth escalator. Improving women’s ability to build wealth is not only good for women, but is essential for the economic well-being of children, families, and our nation. The webinar, included Mariko Chang, PhD, K. Sujata, President and CEO, Chicago Foundation for Women, and Dena L. Jackson, PhD, Vice President – Grants & Research, Texas Women’s Foundation.

COVID-19 financial literacy resources

CPA Canada has put together resources to help manage your finances and provide you with the tools you need during this crisis – and beyond.

Race, Ethnicity, and the Financial Lives of Young Adults: Exploring Disparities in Financial Health Outcomes

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults, focusing on Black and Latinx young adults, in order to inform policies, programs, and solutions that can improve financial health for all.

Beyond Hunger: the hidden impacts of food insecurity

This report illustrates the hidden impacts of food insecurity in people’s lives through a survey of 561 people in 22 communities across Canada. The people interviewed shared that food insecurity makes them ill, breaks down relationships, makes it harder to get stable work, and fully participate in society.