Resources

Webinar (May 19th): Self-care for practitioners - strategies and challenges

Connect and Share (May 27th): Self-care strategies

Webinar (June 9, 2021): Virtual one-on-one client support

Read the slides for the ‘Virtual one-on-one client support’ webinar.

Watch the video recording for ‘Virtual one-on-one client support’

Download the handouts:

Client tool: Information to remember

Tip sheet: Supporting client intake, triage, and referral in virtual financial help services

Financial coaching at a distance: Tips for practitioners

Connect and Share (June 17, 2021): Tax-time debrief

Read the slides for ‘Connect and Share: Tax time debrief’.

View additional resources in Prosper Canada’s Tax filing toolkit.

Workshop (June 21, 2001): Beyond bubble baths - self-care during a pandemic

Workshop slides: Beyond bubble baths – self-care during a pandemic

Handout: Beyond bubble baths – Self-care during a pandemic

Resources shared during session:

Native-land.ca

Indigenous languages list in British Columbia

Self-compassion.org

Tara Brach mindfulness resources

Headspace

Boho beautiful guided meditations

Webinar (June 23, 2021): Diversity and inclusion - A conversation with SEED Winnipeg

Workshop (June 24, 2021): Visualizing client experiences - Using journey maps

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Click ‘Get it’ above for video link for this webinar.

Handout: Implementing a practice of self-care

Providing one-on-one financial coaching to newcomers: Insights for frontline service providers

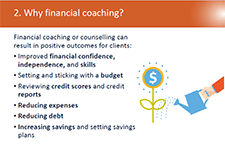

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE interventions include financial coaching and supports that assist people to build money management skills, access income benefits, tackle debt, learn about safe financial products and services and find ways to save for emergencies. This report shares insights on providing one-on-one financial coaching to newcomers captured through two financial coaching pilot projects that Prosper Canada conducted in collaboration with several frontline community partners.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Handouts for this webinar:

Tax time insights research report – webinar handout (Prosper Canada)

Income tax checklist – webinar handout (The Working Centre)

Form for missing income information – webinar handout (The Working Centre)

Income tax return summary sheet – webinar handout (The Working Centre)

Host checklist for tax clinics – webinar handout (The Working Centre)

Forms for rental information – webinar handout (The Working Centre)

Referral to FEPS – webinar handout (The Working Centre)

Time-stamps for the video-recording:

3:10 – Introductions and Agenda

6:32 – Audience polls

10:52 – Tax time insights: Experiences of people living on low incomes (Speaker: Nirupa Varatharasan)

26:00 – The Working Centre tax clinic experiences (Speaker: Jen Smerdon)

Family-Centred Coaching Toolkit

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families. (Note: Accessing the toolkit requires submitting user information).

Managing your money: Tools and tips to help you meet your goals (English)

MYM Worksheet 1: Your money goals

MYM Worksheet 1: Your money goals – Fillable PDF

MYM Worksheet 2: Tracking your regular income

MYM Worksheet 2: Tracking your regular income – Fillable PDF

MYM Worksheet 3: Tracking your spending

MYM Worksheet 3: Tracking your spending – Fillable PDF

MYM Worksheet 4: Tracking your bills

MYM Worksheet 4: Tracking your bills – Fillable PDF

MYM Worksheet 5: Monthly budgeting

MYM Worksheet 5: Monthly budgeting – Fillable PDF

MYM Worksheet 6: Setting a savings goal

MYM Worksheet 6: Setting a savings goal – Fillable PDF

MYM Worksheet 7: Preparing for tax filing

MYM Worksheet 7: Preparing for tax filing

About the ‘Managing your money’ resource

All ‘Managing your money’ worksheets

Facilitator resources (English)

Gérer votre argent: Outils et conseils pour vous aider à atteindre vos objectifs (French)

Feuille de travail #1: Vos objectifs en lien à l’argent (MYM)

Feuille de travail #2: Suivi de votre revenu régulier (MYM)

Feuille de travail #3: Suivi de vos dépenses (MYM)

Feuille de travail #4: Suivi de vos factures (MYM)

Feuille de travail #5: Budget mensuel (MYM)

Feuille de travail #6: Fixer un objectif d’épargne (MYM)

Feuille de travail #7: Préparation pour la déclaration de revenus (MYM)

Note pour les communautés et les organismes (MYM)

Feuilles de travail complètes

Ka-paminit kisôniyâm (Plains Cree)

Financial Empowerment: Improving financial outcomes for low-income households

Financial Empowerment is a new approach to poverty reduction that focuses on improving the financial security of low-income people. It is an evidence-driven set of interventions that have proven successful at both eliminating systemic barriers to the full financial inclusion of low-income people and providing enabling supports that help them to acquire and practice the financial skills and behaviours that tangibly improve their financial outcomes and build their financial security. The Financial Empowerment approach focuses on community level strategies that encompass five main types of interventions that have been identified as both necessary for low-income households to improve their financial outcomes, and effective at helping them to do so.

Lead By Design: Deepen Understanding of Program Design & Models to Better Meet People Where They Are