Why care about care? Our economy depends on it

This brief lays out how care impacts economic recovery, family economic security and asset building, equity and justice, and the well-being of children, older adults, and people with disabilities. COVID-19 highlighted the importance of caregivers, as parents have become remote learning facilitators and professional caregivers have become front-line workers. Investing $77.5 billion per year in the care economy would support more than two million new jobs— 22.5 million new jobs over 10 years. And that number does not include return of family caregivers to the workforce, enabled by adequate support. A $77.5 billion annual investment in new jobs translates into $220 billion in new economic activity. Read the brief Watch the webinar View the webinar slides

National Indigenous Economic Strategy 2022

This National Indigenous Economic Strategy for Canada is the blueprint to achieve the meaningful engagement and inclusion of Indigenous Peoples in the Canadian economy. It has been initiated and developed by a coalition of national Indigenous organizations and experts in the field of economic development. The Strategy is supported by four Strategic Pathways: People, Lands, Infrastructure, and Finance. Each pathway is further defined by a Vision that describes the desired outcomes for the actions and results of individual Strategic Statements. The Calls to Economic Prosperity recommend specific actions to achieve the outcomes described in the Strategic Statements. This document is not intended as a strategic plan specifically, but rather a strategy that others can incorporate into their own strategic plans.

The Role of Credit Unions in Providing Alternatives to Payday Lending

Countervailing Power: Review of the coordination and funding for financial counselling services across Australia

In 2019, the Australian Government committed to additional actions to improve the financial outcomes of Australians, including undertaking an immediate review of the coordination and funding of financial counselling services that disadvantaged Australians rely on. The review noted the benefits of financial counselling to the community, including early intervention and prevention of further financial hardship, advocacy support, and referral to other services for complex issues. The review also highlighted the challenges faced by the financial counselling sector, including increasing demand, fragmented delivery, and the array of complex situations and financial products that can lead to financial hardship. The review:

Strengthening Canada’s External Complaint Handling System

Canada’s external complaint handing structures and processes play a critical role in levelling the playing field for consumers and financial service providers, helping to offset the inevitable imbalance of power between large financial institutions and individual consumers. Prosper Canada welcomes the opportunity to provide recommendations for strengthening what is currently a weak and inadequate alternative dispute resolution system.

3 Principles for an Antiracist, Equitable State Response to COVID-19 — and a Stronger Recovery

COVID-19’s effects have underscored the ways that racism, bias, and discrimination are embedded in health, social, and economic systems. Black, Indigenous, and Latinx people are experiencing higher rates of infection, hospitalization, and death, and people of color are also overrepresented in jobs that are at higher infection risk and hardest hit economically. Shaping these outcomes are structural barriers like wealth and income disparities, inadequate access to health care, and racial discrimination built into the health system and labor market. This article discusses three recommended principles for guiding policymakers in making equity efforts.

Yukon Poverty Report Card 2020

This report was released as part of public education movement Campaign 2000's annual assessment of child and family poverty in Canada, providing an overview of the following key issues relating to poverty in Yukon:

2021 Reports of the Auditor General of Canada to the Parliament of Canada – Report 4 – Canada Child Benefit

A report from Auditor General Karen Hogan concludes that the Canada Revenue Agency (CRA) managed the Canada Child Benefit (CCB) program so that millions of eligible families received accurate and timely payments. The audit also reviewed the one-time additional payment of up to $300 per child issued in May 2020 to help eligible families during the COVID‑19 pandemic. The audit noted areas where the agency could improve the administration of the program by changing how it manages information it uses to assess eligibility to the CCB. For example, better use of information received from other federal organizations would help ensure that the agency is informed when a beneficiary has left the country. This would avoid cases where payments are issued on the basis of outdated information. To enhance the integrity of the program, the agency should request that all applicants provide a valid proof of birth when they apply for the benefit. The audit also raised the concept of female presumption and noted that given the diversity of families in Canada today, this presumption has had an impact on the administration of the Canada Child Benefit program.

Resources

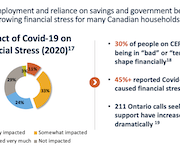

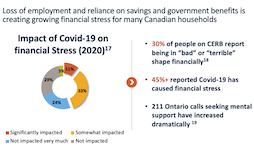

A Feminist Economic Recovery Plan for Canada: Making the Economy Work for Everyone

This report offers an intersectional perspective on how Canada can recover from the COVID-19 crisis and weather difficult times in the future, while ensuring the needs of all people in Canada are considered in the formation of policy.

YWCA Canada and the University of Toronto’s Institute for Gender and the Economy (GATE) offer this joint assessment to highlight the important principles that all levels of government should consider as they develop and implement policies to spur post-pandemic recovery.

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Locked down, not locked out: An eviction prevention plan for Ontario

Basic Income: Some Policy Options for Canada

As the need for basic income grows, the Basic Income Canada Network (BICN) is often asked how Canada could best design and pay for it. To answer that in a detailed way, BICN asked a team to model some options that are fair, effective and feasible in Canada. The three options in this report do just that. The three options demonstrate that it is indeed possible for Canada to have a basic income that is progressively structured and progressively funded. BICN wants governments, especially the federal government, to take this seriously—and to act.

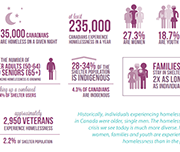

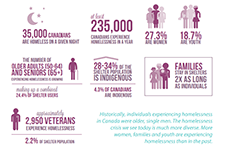

State of homelessness in Canada 2016

Ending homelessness in Canada requires partnerships across public, private, and not-for-profit sectors. Preventative measures, and providing safe, appropriate, and affordable housing with supports for those experiencing homelessness is needed. This paper provides a series of joint recommendations – drafted by the Canadian Observatory on Homelessness and the Canadian Alliance to end Homelessness – for the National Housing Strategy.

Comparison of Provincial and Territorial Child Benefits and Recommendations for British Columbia

First Call BC Child and Youth Advocacy Coalition has been tracking child and family poverty rates in BC for more than two decades. Every November, with the support of the Social Planning and Research Council of BC (SPARC BC), a report card is released with the latest statistics on child and family poverty in BC and recommendations for policy changes that would reduce these poverty levels. This report presents data from the latest report card released by First Call on a cross-Canada comparison of child benefits.

Working Without a Net: Rethinking Canada’s social policy in the new age of work

This report explores the implications of new technologies on Canada’s economy and labour market and the adequacy of current social programs and policies supporting workers.

Canada’s Colour Coded Income Inequality

Canada’s population is increasingly racialized. The 2016 census counted 7.7 million racialized individuals in Canada. That number represented 22% of the population, up sharply from 16% just a decade earlier. Unfortunately, the rapid growth in the racialized population is not being matched by a corresponding increase in economic equality. This paper uses 2016 census data to paint a portrait of income inequality between racialized and non-racialized Canadians. It also looks at the labour market discrimination faced by racialized workers in 2006 and 2016. These data provide a glimpse of the likely differences in wealth between racialized and non-racialized Canadians. This paper also explores the relationship between race, immigration and employment incomes. Taken together, the data point to an unequivocal pattern of racialized economic inequality in Canada. In the absence of bold policies to combat racism, this economic inequality shows no signs of disappearing.

System transformation in Ontario Works: Considerations for Ontario

This paper focuses on proposed system transformation in Ontario Works, and explores the possibilities and limitations associated with the proposed changes in 2018. First, it looks at the broader context within which the government’s social assistance reforms are taking place. Second, it provides an overview of what is known about some of the structural changes in social assistance to date, as well as an overview of experiences in other jurisdictions that have undertaken similar reforms. In conclusion, the paper outlines some key considerations and unresolved questions that the government will need to address before it can move forward with a plan for reform.

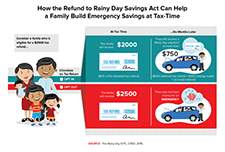

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Removing Savings Penalties for Temporary Assistance for Needy Families

This brief discusses the savings penalties in public assistance programs in the United States, also known as asset limits, and that actions that can be taken to eliminate these limits and the barriers towards building savings for families living on low income.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

Debt and mental health: A statistical update

Financial problems can be a significant source of distress, putting pressure on people's mental health, particularly if they are treated insensitively by creditors. Some people in financial difficulty cut back on essentials, such as heating and eating, or social activities that support their well being, to try and balance their budget. In many cases this has a negative impact on people's mental health. This policy note from draws on nationally representative data to update key statistics on the relationship between debt and mental health problems, and sets out implications for policymakers, service providers and essential services firms.

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

A Realist Analysis of Nonprofit Tax Filing Services

In this presentation, Kevin Schachter, Graduate Student at University of Manitoba and Information Manager at SEED Winnipeg, presents a realist analysis of nonprofit tax filing services. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Supporting Organizations in the CVITP

In this presentation, Aaron Kozak, ESDC and Melissa Valencia, CRA, present findings from their research on the Community Volunteer Income Tax Program (CVITP). This includes recommendations for structural changes to the program, review of CVITP training, changes to registration, and more. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Complaints Related to Service from the CRA: Lessons Learned and Working Towards Better Service

Operating at arm’s length from the Canada Revenue Agency, the Office of the Taxpayers' Ombudsman (OTO) works to enhance the Canada Revenue Agency's (CRA) accountability in its service to, and treatment of, taxpayers through independent and impartial reviews of service-related complaints and systemic issues. OTO receives complaints and concerns from members of First Nations, Inuit and Métis communities. In this conference presentation, the Taxpayers’ Ombudsman provides examples of the types of issues her Office receives in order to provide community leaders with her insights in helping Indigenous people get better service from the CRA. In support of the AFOA Canada 2018 National Conference theme of Human Capital – Balancing Indigenous Culture and Creativity with Modern Workplaces, this presentation will provide participants with information on the types of issues and trends her office sees from members of the Indigenous communities and on better ways of serving these populations.

High-Cost Alternative Financial Services: Policy Options

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or credit union, access comes at a steep price and with a high degree of risk. On its own, one high-cost loan has the potential to trap a borrower in a cycle of debt, not only amplifying their short-term problem, but also limiting their ability to secure the income and assets needed to thrive in the long term. The policy recommendations presented in this brief, and summarized in the chart on page two, are inspired by the regulatory initiatives across the country, and reflect ways in which all three levels of government can contribute to better consumer protection for all Canadians.

Breaking down barriers: A critical analysis of the Disability Tax Credit and the Registered Disability Savings Plan

The Disability Tax Credit helps Canadians by reducing the amount of income tax they are required to pay. The Registered Disability Savings Plan helps people with a disability or their caregiver save for the future by putting money into a fund that grows tax free until the beneficiary makes a withdrawal. This report, released by the Senate Committee on Social Affairs, Science and Technology, makes 16 recommendations aimed at improving both programs. They are divided into short-term objective to make the process for the two programs simpler and clearer, and a long-term philosophical shift in the way Canada deals with people who are in financial distress but cannot advocate for themselves. Recommendations include removing barriers that prevent people from taking advantage of the Disability Tax Credit and making enrolment in the Registered Disability Savings Plan automatic for eligible people under 60 years of age.

Redesigning Social Policy for the 21st Century

In this video presentation Sunil Johal from the Mowat Centre explains how social policy in the 21st century could be redesigned to accommodate the changing nature of work and income in Canada. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Enhancing access to the Canada Learning Bond

This discussion paper responds to a request from ESDC to develop options for reforms to the Canada Education Savings Program and, more specifically to improve access to the Canada Learning Bond. It reviews individual and institutional challenges to participation in the current system and consider three approaches for reform. It presents a case study of the United Kingdom’s Child Trust Fund, which included an auto-enrolment default mechanism. It concludes that the model used in the UK is not suitable for Canada and instead make a series of recommendations for both incremental and more ambitious reforms to fulfill the Government’s commitment to improve access to the Bond.

Child Welfare and Youth Homelessness in Canada: A Proposal for Action

Policy Brief – Why is Uptake of the Disability Tax Credit Low in Canada?

Disability supports should be designed to provide benefit and not burdens to eligible recipients. Unfortunately, this is not a reality when it comes to one of the main benefits open to Canadians with disability: the federal Disability Tax Credit (DTC). Designed to recognize some of the higher costs faced by people with severe disabilities and their caregivers, the DTC appears to be more of a burden for many, with estimated utilisation unacceptably low at around 40 per cent of working-aged adults with qualifying disabilities. Low uptake is a concern not only because people are missing out on the credit itself but also because eligibility to the DTC – which is not automatic – is a gateway to other important and more valuable benefits such as the Child Disability Benefit and Registered Disability Savings Plans (RDSP).