Financial literacy around the world: insights from the S&P’s rating services global financial literacy survey

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey is based on interviews with more than 150,000 adults in over 140 countries. In 2014 McGraw Hill Financial worked with Gallup, Inc., the World Bank Development Research Group, and GFLEC on the S&P Global FinLit Survey.

Empower U Evaluation Report

For a family living in poverty, every day is about making tough choices – to pay rent or buy groceries? Having the means to attain the basic necessities, is one thing. Having the skills, confidence and access to resources to manage finances in ways that build pathways out of poverty is something far different. Thanks to the generosity of partners, supporters and donors of Empower U, families can move beyond just managing the day-to-day challenges of poverty. Participants in the program learn valuable money management skills and are given the means to build savings and assets to create financial stability. A future where they and their families can thrive.

Access to Identification for Low-income Manitobans

Government-issued identification (ID) is essential to gain access to a wide range of government entitlements, commercial services and financial systems. Lack of ID on the other hand, represents a critical barrier that prevents low-income Manitobans from accessing these services and benefits, and ultimately results in further marginalization and deepening poverty. Other provinces are now recognizing that ID is necessary to navigate the modern world and are doing something to support those who fall through the cracks. A new study, Access to Identification for Low-Income Manitobans researches what can be done to address these challenges and offers recommendations to reduce barriers to ID for low-income Manitobans.

Understanding Systems: The 2021 report of the National Advisory Council on Poverty

Canada’s National Advisory Council on Poverty’s second Annual Report, Understanding Systems, is the first report to provide a glimpse into poverty since COVID-19. Based on community engagements with Canadians and provinces/territories over the last year, the Council has recommended five broad strategies to reduce poverty in Canada. The pillars of the strategy are as follows: In a recent webinar, three Council members shared what strategies can make the greatest impact. Read more to learn about the key takeaways from the discussion.

Household food insecurity during the COVID-19 pandemic

This study presents data on levels of household food insecurity in the 10 provinces from the September to December 2020 cycle of the Canadian Community Health Survey. In this survey, household food security status within the previous 12 months was measured using a scale that has been routinely used to monitor levels of household food insecurity in Canada. This provided the ability to draw comparisons with pre-pandemic levels. Both before and during the pandemic, certain population groups were more vulnerable to food insecurity in their household. They included people with lower levels of education, those who rent their dwelling, those in lone-parent-led households and those in households reliant on social assistance as their primary source of income. Compared with the pre-pandemic period of 2017/2018, levels of household food insecurity were either unchanged or slightly lower in fall 2020 among groups vulnerable to food insecurity.

Dimensions of poverty hub

Statistics Canada has created an "Opportunity for All"; a dashboard of 12 indicators to track progress on deep income poverty as well as the aspects of poverty other than income, including indicators of material deprivation, lack of opportunity and resilience. These indicators are broadly grouped into three categories: dignity, opportunity and inclusion and resilience and security.

Low-income persistence in Canada and the provinces

Each year, some Canadians fall into low income, while others rise out of it. For example, over one-quarter (28.1%) of Canadians who were in low income in 2017 had exited it by 2018. This study examines the low income exit rate in Canada—an indicator that can be used to track the amount of time it takes for people to rise out of low income. Although a potential surge in low income in 2020 as a result of the COVID-19 pandemic was avoided by temporary government support programs, the rising long-term unemployment rate in 2021 suggests a possible increase in poverty and low-income persistence in the future.

Guaranteed Income Community of Practice resources

The Guaranteed Income Community of Practice (GICP) convenes guaranteed income stakeholders, including policy experts, researchers, community and program leaders, funders, and elected officials to learn and collaborate on guaranteed income pilots, programs and policy. The GICP website includes resources on:

Cash Back: A Yellowhead Institute Red Paper

This report looks at how the dispossession of Indigenous lands nearly destroyed Indigenous economic livelihoods and discusses restitution from the perspective of stolen wealth.

The relationship between COVID-19 pandemic and people in poverty: Exploring the impact scale and potential policy responses

This research project aims to identify the relationship between COVID-19 pandemic and poverty in Vancouver, by analyzing how the COVID-19 pandemic has pushed people into poverty and the impact of COVID-19 on people already living in poverty. Several examples of COVID-19 recovery policies and projects being implemented elsewhere that could support people experiencing poverty in Vancouver are also provided.

Building Understanding: The First Report of the National Advisory Council on Poverty

In August 2018, the Government of Canada announced Opportunity for All – Canada's First Poverty Reduction Strategy. The Strategy included a commitment to the UN Sustainable Development Goal's target of reducing poverty by 20% by 2020 and 50% by 2030. Opportunity for All included the adoption of the Market Basket Measure (MBM) as Canada's Official Poverty Line and the creation of the National Advisory Council on Poverty (Council) to report on progress made toward the poverty reduction targets. This is the first report of the National Advisory Council on Poverty. It continues Canada's discussion on poverty by bringing forward the voices of individuals with lived expertise of poverty. It details progress toward our poverty targets and recommends improvements to our poverty reduction efforts.

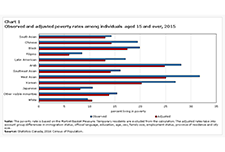

Opportunity for All – Canada’s First Poverty Reduction Strategy

Canada is a prosperous country, yet in 2015 roughly 1 in 8 Canadians lived in poverty. The vision of Opportunity for All – Canada's First Poverty Reduction Strategy is a Canada without poverty, because we all suffer when our fellow citizens are left behind. We are all in this together, from governments, to community organizations, to the private sector, to all Canadians who are working hard each and every day to provide for themselves and their families. For the first time in Canada's history, the Strategy sets an official measure of poverty: Canada's Official Poverty Line, based on the cost of a basket of goods and services that individuals and families require to meet their basic needs and achieve a modest standard of living in communities across the country. Opportunity for All sets, for the first time, ambitious and concrete poverty reduction targets: a 20% reduction in poverty by 2020 and a 50% reduction in poverty by 2030, which, relative to 2015 levels, will lead to the lowest poverty rate in Canada's history. Through Opportunity for All, we are putting in place a National Advisory Council on Poverty to advise the Minister of Families, Children and Social Development on poverty reduction and to publicly report, in each year, on the progress that has been made toward poverty reduction. The Government also proposes to introduce the first Poverty Reduction Act in Parliament in Canada’s history. This Act would entrench the targets, Canada's Official Poverty Line, and the Advisory Council into legislation.

Yukon Poverty Report Card 2020

This report was released as part of public education movement Campaign 2000's annual assessment of child and family poverty in Canada, providing an overview of the following key issues relating to poverty in Yukon:

The Cost of Poverty in the Atlantic Provinces

This report costs poverty based on three broad measurable components: opportunity costs, remedial costs and intergenerational costs. The authors state that these costs could potentially be reallocated, and benefits could potentially be realized if all poverty were eliminated. The total cost of poverty in the Atlantic region ranges from $2 billion per year in Nova Scotia to $273 million in Prince Edward Island. It is close to a billion in Newfoundland and Labrador, $959 million, and $1.4 billion in New Brunswick. These costs represent a significant loss of economic growth of 4.76% of Nova Scotia’s GDP to 2.9% in Newfoundland and Labrador. The impact on Prince Edward Island’s GDP is 4.10%, and 3.71% in New Brunswick.

The purpose of this costing exercise is to illustrate the shared economic burden of poverty, and the urgency that exists for Atlantic Canadian governments to act to eradicate it.

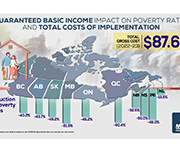

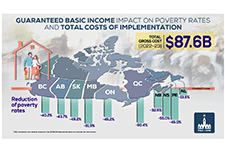

Distributional and Fiscal Analysis of a National Guaranteed Basic Income

Several parliamentarians requested that the PBO prepare a distributional analysis of Guaranteed Basic Income using parameters set out in Ontario’s basic income pilot project, examine the impact across income quintiles, family types and gender, and identify the net federal revenue increase required to offset the net cost of the new program. This analysis also accounts for the behavioural response.

Study: Association between food insecurity and stressful life events among Canadian adults

The COVID-19 pandemic and the related business closures and lockdowns have given rise to a series of unprecedented socioeconomic and health-related challenges, one of which is increasing food insecurity. Throughout the pandemic, Statistics Canada has continued to collect and release data on food insecurity in Canada—including exploring the link between food insecurity and mental health, financial stability and Indigenous people living in urban areas. This study looks at the characteristics of food insecure Canadians, focusing on how losing a job, suffering an injury or illness, or a combination of events can increase the risk of food insecurity. This release compares the food security outcomes of two different subpopulations: those who had experienced a stressful life event and those who had not.

Social Determinants of Health: The Canadian Facts (2nd edition)

Social Determinants of Health: The Canadian Facts, 2nd edition, provides Canadians with an updated introduction to the social determinants of our health. We first explain how living conditions “get under the skin” to either promote health or cause disease. We then explain, for each of the 17 social determinants of health: Improving the health of Canadians is possible but requires Canadians to think about health and its determinants in a more sophisticated manner than has been the case to date. The purpose of this second edition of Social Determinants of Health: The Canadian Facts is to stimulate research, advocacy, and public debate about the social determinants of health and means of improving their quality and making their distribution more equitable.

The Inequality of Poverty

This report explores the connections between low income, poverty and protected characteristics, how these can shape the experience of poverty, and whether this can result in a similar inequality in terms of when and how poverty premiums are incurred. COVID-19 has thrown light on the link between insecure work, low incomes and protected characteristics, with an opportunity for this link to be formally recognised. The pandemic, and the economic consequences look likely to throw many more people into poverty, and this poverty is falling hardest on those with protected characteristics.

The Pivotal Role of Human Service Practitioners in Building Financial Capability

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American experience—is one that far too often ensnares people at the insecurity stage, particularly those communities or neighborhoods that have historically been marginalized and deliberately excluded from the traditional pathway towards prosperity. Fraught with debt and credit crises, alongside a myriad of predatory products and lending practices, to a sense of stigma and shame many Americans feel because of their economic status, financial insecurity involves navigating a world on a daily basis where everyday needs are at the mercy of unjust and uncontrollable variables.

Overcoming Poverty Together 3: The New Brunswick Economic and Social Inclusion Plan 2020-2025

The new Economic and Social Inclusion plan for New Brunswick builds upon progress accomplished over the past 10 years. It includes nine priority actions divided into three pillars: The objective of the plan is to reduce income poverty by at least 50 per cent by 2030, in line with the objectives of Opportunity for All, Canada’s first poverty reduction strategy, and those of the 2030 Agenda for Sustainability of the United Nations.

State of the Child Report 2019

This report's release was part of Child Rights Education Week and also in celebration of the 30th anniversary of the United Nations Convention on the Rights of the Child (UNCRC). 2019 was declared the International Year of Indigenous Languages by the United Nations. The report contains an overview of some of the serious challenges facing New Brunswick children and youth, including more than 200 statistics presented in the report’s Child Rights Indicators Framework. A special emphasis was placed on education rights. Some of the concerning findings revealed in the report include:

The Impact of COVID-19 on Women living with Disabilities in Canada

DisAbled Women’s Network (DAWNRAFH) Canada is a national, feminist, cross-disability organization whose mission is to end the poverty, isolation, discrimination and violence experienced People with disabilities, specifically women with disabilities face unique barriers related to Covid-19. This includes both the increased risk oftransmission and death from COVID-19, as well as the unique ways policies targeting COVID-19 impact this group. Prior to COVID-19 more than 50% of human rights complaints at the Federal, Provincial and Territorial levels in Canada for the last four years have been disability related, which speaks to systemic failures that have been exacerbated under COVID-19. In this brief, DAWN Canada highlights these unique considerations, as well as significant and existing policy gaps facing this group.

by Canadian women with disabilities and Deaf women.

The poverty premium: a customer perspective

Fair By Design and Turn2Us (in the United Kingdom) commissioned this research to explore recent changes in the poverty premium landscape, to understand if they are having any impact on the cost of premiums, or the number of people who pay them. Importantly, we did this through the lens of the low-income customer in order to hear first-hand how they experience these extra costs; how they see the problems with the current system; how they respond to initiatives and interventions designed to reduce poverty premiums; and the changes they feel would make the most difference to them and their household. This research report:

Cities Reducing Poverty: 2020 Impact Report

The Vibrant Communities – Cities Reducing Poverty 2020 Impact Report is the Tamarack Institute's first attempt at capturing and communicating national trends in poverty reduction and the important ways in which member Cities Reducing Poverty collaboratives are contributing to those changes. This impact report is meant for poverty reduction organizers and advocates, and public decision-makers to get a sense for how collaborative, multi-sectoral local roundtables with comprehensive plans contribute to poverty reduction in their communities and beyond; and spotlights high-impact initiatives that are demonstrating promising results.

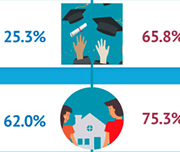

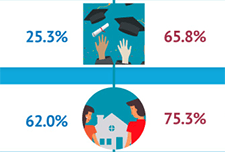

Growing up in a lower-income family can have lasting effects

The infographic "Intergenerational income mobility: The lasting effects of growing up in a lower-income family" based on the article "Exploration of the role of education in intergenerational income mobility in Canada: Evidence from the Longitudinal and International Study of Adults," published in the Canadian Public Policy journal presents the effects of growing up in a lower-income family based on a longitudinal study of a cohort of Canadians born between 1963 and 1979.

Canada’s Forgotten Poor? Putting Singles Living in Deep Poverty on the Policy Radar

This report presents the findings of extensive research about employable singles on social assistance undertaken by Toronto Employment and Social Services, in partnership with the Ontario Centre for Workforce Innovation. Drawing on data from 69,000 singles who were receiving social assistance in Toronto in 2016, and 51 interviews with randomly selected participants, the report highlights these individuals’ characteristics, their complex needs, and the barriers they face in moving off social assistance and into employment. Complementing the quantitative analysis, the interviews provide important insights into the daily realities of participants’ lives and their journeys on and off assistance.

Hunger Lives Here: Risks and Challenges Faced by Food Bank Clients During COVID-19

This report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto during COVID-19. Based on phone surveys with over 220 food bank clients in May and June 2020 and an analysis of food bank client intake data, the report demonstrates that COVID-19 has led to increased reliance on food banks. The rate of new clients accessing food banks has tripled since the pandemic began. Among new clients, 76% report that they began accessing food banks as a result of COVID-19 and the associated economic downturn.

How Are the Most Vulnerable Households Navigating the Financial Impact of COVID-19?

The COVID-19 pandemic has already had an unprecedented impact on the financial lives of households across the United States. During June and July 2020, Prosperity Now conducted a national survey of lower-income households to better understand the circumstances these households are confronted with and the strategies they use to secure resources to navigate this crisis.

Costing a Guaranteed Basic Income During the COVID Pandemic

The Parliamentary Budget Officer (PBO) supports Parliament by providing economic and financial analysis for the purposes of raising the quality of parliamentary debate and promoting greater budget transparency and accountability. This report responds to a request from Senator Yuen Pau Woo to estimate the post-COVID cost of a guaranteed basic income (GBI) program, using parameters set out in Ontario’s basic income pilot project. In addition, the report provides an estimate of the federal and provincial programs for low-income individuals and families, including many non-refundable and refundable tax credits that could be replaced by the GBI program.

Economic impact of COVID-19 among visible minority groups

Since visible minorities often have more precarious employment and higher poverty rates than the White population, their ability to adjust to income losses due to work interruptions is likely more limited. Based on a large crowdsourcing data collection initiative, this study examines the economic impact of the COVID-19 pandemic on visible minority groups. Among the crowdsourcing participants who were employed prior to work stoppages, Whites and most visible minority groups reported similar rates of job loss or reduced work hours. However, visible minority participants were more likely than White participants to report that the COVID-19 pandemic had affected their ability to meet financial obligations or essential needs, such as rent or mortgage payments, utilities, and groceries.

Economic and Fiscal Snapshot 2020

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the country.

Locked down, not locked out: An eviction prevention plan for Ontario

Voice of Experience: Engaging people with lived experience of poverty in consultations

Canadian Income Survey, 2018

This report from Statistics Canada shares data on median after-tax income and overall poverty rate decline based on 2018 data.

Basic Income: Some Policy Options for Canada

As the need for basic income grows, the Basic Income Canada Network (BICN) is often asked how Canada could best design and pay for it. To answer that in a detailed way, BICN asked a team to model some options that are fair, effective and feasible in Canada. The three options in this report do just that. The three options demonstrate that it is indeed possible for Canada to have a basic income that is progressively structured and progressively funded. BICN wants governments, especially the federal government, to take this seriously—and to act.

Community Benefits of Supportive Housing

This report highlights mostly B.C.-based research and includes key information, facts, and statistics to answer common questions that neighbours, local government, and other stakeholders may have about supportive housing. The easy-to-read question and answer format also includes infographics to showcase the benefits of supportive housing in neighbourhoods across British Columbia and beyond.

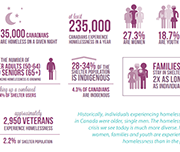

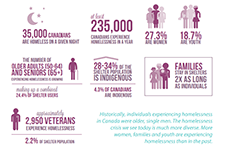

State of homelessness in Canada 2016

Ending homelessness in Canada requires partnerships across public, private, and not-for-profit sectors. Preventative measures, and providing safe, appropriate, and affordable housing with supports for those experiencing homelessness is needed. This paper provides a series of joint recommendations – drafted by the Canadian Observatory on Homelessness and the Canadian Alliance to end Homelessness – for the National Housing Strategy.

Comparison of Provincial and Territorial Child Benefits and Recommendations for British Columbia

First Call BC Child and Youth Advocacy Coalition has been tracking child and family poverty rates in BC for more than two decades. Every November, with the support of the Social Planning and Research Council of BC (SPARC BC), a report card is released with the latest statistics on child and family poverty in BC and recommendations for policy changes that would reduce these poverty levels. This report presents data from the latest report card released by First Call on a cross-Canada comparison of child benefits.

OECD/INFE Report on Financial Education in APEC Economies: Policy and practice in a digital world

This report responds to a call made by APEC Finance Ministers at their 23rd Ministerial Meeting in Lima in 2016 to advance “the design and implementation of financial literacy policies building on the expertise and standards developed by the OECD International Network on Financial Education”. The findings illustrate that the majority of APEC economies are well-advanced in their efforts to collect relevant data, implement appropriate financial education policies, and address the remaining issues related to financial literacy, inclusion and consumer

protection. They are applying international best practices and making good use of available tools and resources to develop and refine strategic approaches and specific initiatives. However, there is still some way to go in ensuring that everyone living in an APEC

economy has the financial literacy that they need and concerns about financial fraud or abuse, the high complexity of financial services and the low financial literacy of specific population groups are driving policy interest in improving financial education.

Urban Spotlight: Neighbourhood Financial Health Index findings for Canada’s cities

This report examines the financial health and vulnerability of households in Canada’s 35 largest cities, using a new composite index of household financial health at the neighbourhood level, the Neighbourhood Financial Health Index or NFHI. The NFHI is designed to shine a light on the dynamics underlying national trends, taking a closer look at what is happening at the provincial/territorial, community and neighbourhood levels. Update July 22, 2022: Please note that the Neighbourhood Financial Health Index is no longer available

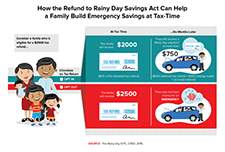

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Chronic Low Income Among Immigrants in Canada and its Communities

This study examines the rate of chronic low income among adult immigrants (aged 25 or older) in Canada during the 2000s. Data is taken from the Longitudinal Immigration Database (IMDB) for the period from 1993 to 2012, with regional adjustments used for the analysis. Chronic low income is categorized as having a family income under a low-income cut-off for five consecutive years or more. The study found that for immigrants were in in low-income in any given year, half were in chronic low-income. Including spells of low income which become chronic in later years, this number rises to two-thirds. The highest chronic rates were found in immigrant seniors and immigrants who were unattached or lone parents. Chronic low income is a large component of income disparity and overall low income among immigrants.

An Evaluation of Financial Empowerment Centers: Building People’s Financial Stability as a Public Service

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free public service. The evaluation draws on data from 22,000 clients who participated in 57,000 counseling sessions across these first 5 city replication partners, and provides additional evidence of the program’s success.

The Who’s Hungry Report

The Who’s Hungry Report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto. To create the reports, trained volunteers conduct face-to-face interviews with over 1,400 food bank clients at nearly 40 member agencies, collecting demographic data as well as information about the day-to-day experience of living with hunger.

Poverty Trends 2018 report

This annual report on poverty in Canada reports that a staggering 5.8 million people in Canada (or 16.8%) live in poverty. The report uses several low-income indicators, including the Low-Income Measure (LIM), the Census Family Low Income Measure (CFLIM) and the Market Basket Measure (MBM). Each measure of low income provides different information on poverty using different methodologies to calculate rates of poverty.

Get Your Benefits! Diagnose and Treat Poverty

In this presentation, Noralou P. Roos, Co-Director, GetYourBenefits! and Professor, Manitoba Centre for Health Policy, explains how access to tax filing and benefits is an important poverty intervention. This presentation is from the panel discussion 'National and regional strategies to boost tax filing', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

2018 Report Card on Child and Family Poverty in Canada: Bold Ambitions for Child and Family Poverty Eradication

The 2018 national report card “Bold Ambitions for Child Poverty Eradication in Canada,” provides a current snapshot of child and family poverty and demonstrates the need for a costed implementation plan to eradicate child poverty in this generation. In advance of the 30th year of the all-party commitment to eliminate child poverty by the year 2000 and the federal election in 2019, our spotlight is on the central role of universal childcare in the eradication of child poverty. The lack of affordable, high quality childcare robs children of valuable learning environments and keeps parents, mainly women, out of the workforce, education and training. Without childcare, parents cannot lift themselves out of poverty and improve their living standards.

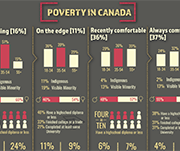

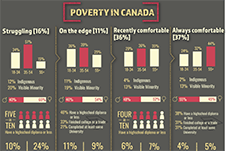

What does poverty look like in Canada? Survey finds one-in-four experience notable economic hardship

What does it mean to be poor in Canada? Does it mean having to rely on food banks and payday loans to make ends meet? Does it mean struggling to afford warm clothes for the winter? What about having to live far away from work or school? A new, two-part study from the Angus Reid Institute examines the state of poverty in Canada by looking at lived experiences, rather than income, with some striking results.

Cross Canada Check-up: Provincial/territorial findings from Canada’s Neighbourhood Financial Health Index

Canada ranks consistently as one of the best places to live in the world and one of the wealthiest. When it comes to looking at the financial health of Canadian households, however, we are often forced to rely on incomplete measures, like income alone, or aggregate national statistics that tell us little about the distribution of financial health and vulnerability in our neighbourhoods, communities or provinces/territories. The purpose of this report is to examine the financial heath and vulnerability of Canadian households in different provinces and territories using a new composite index of household financial health, the Neighbourhood Financial Health Index or NFHI. The NFHI has been designed to shine a light on the dynamics underlying these national trends, taking a closer look at what is happening at the provincial/territorial, community and neighbourhood levels. Update July 22, 2022: Please note that the Neighbourhood Financial Health Index is no longer available

Neighbourhood Financial Health Index: Making the Invisible Visible

In this video presentation Katherine Scott from the Canadian Council on Social Development (CCSD) shares the new Neighbourhood Financial Health Index, a mapping tool which uses composite data about income, assets, debt, and poverty to show levels of financial health at the neighbourhood scale. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium. Update July 22, 2022: Please note that the Neighbourhood Financial Health Index is no longer available

Financial Empowerment: Improving financial outcomes for low-income households

Financial Empowerment is a new approach to poverty reduction that focuses on improving the financial security of low-income people. It is an evidence-driven set of interventions that have proven successful at both eliminating systemic barriers to the full financial inclusion of low-income people and providing enabling supports that help them to acquire and practice the financial skills and behaviours that tangibly improve their financial outcomes and build their financial security. The Financial Empowerment approach focuses on community level strategies that encompass five main types of interventions that have been identified as both necessary for low-income households to improve their financial outcomes, and effective at helping them to do so.