Financial literacy courses for Canadian students

Teachers may incorporate two gamified financial literacy courses that are currently freely available into their lessons. Students can now access two age-appropriate courses designed to help boost students' financial knowledge and confidence at any stage of their financial journey. Course titles: Students will explore resources and tools on the FCAC website that they will be able to use well beyond high school. *Students can earn a completion certificate issued by the FCAC and ChatterHigh!

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Flyer for ‘Redefining Financial Vulnerability in Canada: The Embedded Experience of Households’.

Time-stamps for the video recording:

3:31 – Agenda and Introductions

7:15 – Redefining financial vulnerability in Canada (speaker: Jerry Buckland and Brenda Spotton Visano)

24:33 – Audience poll question 1

27:07– Audience poll questions 2 & 3

33:57 – Audience poll question 4

38:00 – Financial Empowerment (Speaker: Margaret Yu)

52:15– Q&A

Translated financial terms

The Consumer Finance Protection Bureau has developed resources to help multilingual communities and newcomers in a selection of languages. The translated financial terms are available in Chinese, Spanish, Vietnamese, Korean and Tagalog. This website has many other multi-lingual resources, covering a range of topics from opening a bank account, money transfers, money management, debt collection and many others. Some terms are US based but most are universal.

Financial Coaching Initiative: Results and Lessons Learned

In 2015, the Consumer Financial Protection Bureau launched the Financial Coaching Initiative, a pilot program that provided financial coaching services to veterans and economically vulnerable consumers. Professional coaches were embedded into 60 host sites across the country, where they provided free, one-on-one help to consumers to address their personal financial goals. A range of organizations served as host sites, such as one-stop career centers, social services organizations, and legal aid groups. Over four years, the Financial Coaching Initiative served over 23,000 consumers, demonstrating that financial coaching can be successfully implemented at scale in many different settings for a wide range of consumers. This report and summary brief describe the basic structure of the Initiative, present data about the program’s results, and summarize key lessons learned for practitioners and organizations interested in coaching.

Practitioner tools for navigating financial exchanges with family and friends

Financial educators are particularly aware of the prevalence of these types of financial arrangements – otherwise known as family financial exchanges (FFEs). To support practitioners helping clients through these often sensitive conversations about these arrangements, the Consumer Financial Protection Bureau released the Friends and Family Exchanges Toolkit , a four-part guide for coaching clients in asking for financial help or changing an existing agreement due to their own financial hardship.

Resources

Project reports, journey maps, and toolkit

Reports

These slide decks describe the goals and outcomes of this project.

Socialization deck: Supporting the design of a remote financial help service (Bridgeable)

Client Journey maps

These journey maps offer a visual explanation of the process used by the 3 participating community agencies offering one-on-one client support.

Family Services of Greater Vancouver

SEED Winnipeg

Thunder Bay Counselling

Toolkit

This toolkit was developed in collaboration with community partners, and shares tools for coaches and clients in the virtual one-on-one process.

Virtual service delivery tools (Toolkit)

Responding to Client’s “Now, Soon, & Later” Needs

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their current and future needs are discussed.

2019 Financial Coaching Network Bi-Monthly Peer Call Series

These calls, featuring guest practitioners, cover a variety of topics most pressing to the financial coaching field, provide useful tips and resources and serve as a peer-learning platform. Topics include:

Investing in Financial Coaching with a Racial Equity Lens

In this moment, it is pivotal for philanthropy to support communities of color in achieving financial well-being. Combined with systems-change efforts that would create fairer economic opportunities and conditions, financial coaching is a vital component of providing needed support. Through background information, case stories, and key investment considerations, this brief focuses on financial coaching with a racial equity lens as an important strategy for helping people of color achieve equitable outcomes.

The Pivotal Role of Human Service Practitioners in Building Financial Capability

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American experience—is one that far too often ensnares people at the insecurity stage, particularly those communities or neighborhoods that have historically been marginalized and deliberately excluded from the traditional pathway towards prosperity. Fraught with debt and credit crises, alongside a myriad of predatory products and lending practices, to a sense of stigma and shame many Americans feel because of their economic status, financial insecurity involves navigating a world on a daily basis where everyday needs are at the mercy of unjust and uncontrollable variables.

Real Money, Real Experts Podcasts

Real Money, Real Experts is a personal finance podcast written and produced by AFCPE (Association for Financial Counseling & Planning Education). Their membership community offers a place for financial counsellors and financial fitness coaches to share best practices, solve similar struggles, and access tools and resources. Recent episodes include the following topics:

Wealth and Health Equity: Investing in Structural Change

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: On September 29th, AFN hosted a webinar to release the paper with featured speakers: Dr. Annie Harper, Ph.D., Program for Recovery and Community Health, Yale School of Medicine

Joelle-Jude Fontaine, Sr. Program Officer, Human Services, The Kresge Foundation

Dedrick Asante-Muhammad, Chief of Race, Wealth, and Community, National Community Reinvestment Coalition

English

French

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

Providing one-on-one financial coaching to newcomers: Insights for frontline service providers

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE interventions include financial coaching and supports that assist people to build money management skills, access income benefits, tackle debt, learn about safe financial products and services and find ways to save for emergencies. This report shares insights on providing one-on-one financial coaching to newcomers captured through two financial coaching pilot projects that Prosper Canada conducted in collaboration with several frontline community partners.

Client Engagement and Retention—The Secret Ingredient in Successful Financial Capability Programs

Grantmakers and practitioners recognize the importance of financial security for individuals and families, and many organizations therefore offer financial capability programs aimed at strengthening the financial well-being of the people they serve. But good financial capability programs are often high-touch and costly to provide for program administrators, and time consuming for clients to participate in. To benefit fully from such programs’ offerings, clients must actively participate in the program’s coaching, counseling, or other sessions, and engage in related activities to boost their financial health. Thus, understanding what drives client engagement is critical to helping programs improve program retention and outcomes, and concurrently, helps funders maximize the value of philanthropic dollars and customers’ time. Grantmakers concerned about best practices for funding effective financial capability efforts must therefore understand the vital role of client retention and the strategies for supporting the nonprofit sector to address this challenge. The brief explains the importance of client retention and engagement for financial capability program success, describes three key barriers to effective program participation, offers strategies to overcome those barriers, and closes with recommendations for philanthropy.

Creating a Strong Foundation for Change

This guide is designed to be a resource for programs working with low income families to use when anticipating or implementing a new approach, such as coaching, to doing business. It helps you to systematically – and honestly – look at your foundational readiness for change, so that the improvements you want to make will take root and grow in fertile ground. Making time and space to look deeply into your organization can offer the opportunity to reconsider what quality service delivery looks like, help you discover how coaching (or other techniques) could be a tool, and plan efficiently on where it fits best into your existing context.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Access the handouts for this webinar:

Poster presentation: Financial Empowerment for Newcomers project

Infographics: Newcomer settlement stages, money matters, and client personas

Time-stamps for the video recording:

3:11 – Agenda and introductions

5:21 – Audience poll

8:25 – Introduction to Financial Empowerment for Newcomers project (Speaker: Glenna Harris)

11:25 – AXIS financial coaching program (Speaker: Sheri Abbot)

30:05 – North York Community House financial coaching program (Speaker: Noemi Garcia)

45:40 – Q&A

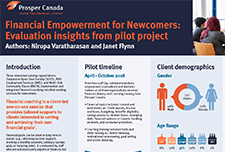

Financial Empowerment for Newcomers: Evaluation insights from pilot project

This fact sheet provides insights from Prosper Canada's Financial Empowerment for Newcomers pilot project conducted with three newcomer-serving organizations, Saskatoon Open Door Society (SODS), AXIS Employment Services (AXIS), and North York Community House (NYCH), who implemented and integrated financial coaching into their existing services for newcomers. The project objectives were to provide newcomer-serving front-line staff with training and resources to enable them to accurately assess newcomers’ financial literacy and connect them to appropriate information and resources and to coach newcomers to achieve successful financial independence.

Financial Empowerment for Newcomers infographic

This infographic displays data gathered from interviewing 53 newcomer participants in three provinces (Saskatchewan, Ontario, and Newfoundland) between August and October 2017. Learn more about the stages of newcomer settlement, key money topics and experiences of newcomers, and three types of newcomer client personas.

Money Circle toolkit

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a brief, interactive exercise, to initiate conversations about the feelings and personal relationships that shape financial choices.

Habit Change: Literature Review

Habits are incredibly powerful. Good habits can make people highly successful, and bad habits can ruin people’s lives. Still, it is important to go beyond the anecdotal evidence of the many self-help books on habit, and to take stock of the scientific evidence. This literature review discusses we discuss how habits are formed, how bad habits can be abandoned, how approach-avoidance training can help adopting good habits and abandoning bad habits, and, finally, how habits can be measured properly.

My money in Canada

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use. The tool is intended to be used with clients and settlement workers together, but can also be used by the client on their own if they are comfortable.

An Evaluation of Financial Empowerment Centers: Building People’s Financial Stability as a Public Service

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free public service. The evaluation draws on data from 22,000 clients who participated in 57,000 counseling sessions across these first 5 city replication partners, and provides additional evidence of the program’s success.

Overview: Financial Empowerment Center Counselor Training Standards

This overview summarizes the Financial Empowerment Center (FEC) model’s Counselor Training Standards. The Standards delineate the breadth and depth of the financial content areas, counseling and coaching skills, practice and experiential learning, and socio-economic and cultural context setting necessary to serve the diverse needs and backgrounds of FEC clients. The Standards also include a Code of Ethics that promotes responsible, professional and ethical financial counseling, furthering the profession of one on-one financial counseling.

Financial Coaching Program Design Guide: A Participant-Centred Approach

This comprehensive resource from Prosperity Now supports organizations in developing a participant-centered financial coaching program. Grounded in a field survey, over 100 interviews, expert advice and beta-testing with six new financial coaching programs, the Coaching Guide highlights the strengths and limitations of financial coaching, offers designs tools, showcases promising models and practices, and includes resources from program leaders and financial coaches.

English

Financial coaching tools - Exploring client needs and priorities

Tools for exploring client priorities

Urgent vs. important – fillable PDF

Dreams for the future

Financial wheel of life

First coaching meeting checklist

My money priorities

Values worksheet

My ‘money personality’ – fillable PDF

Key coaching skills

Coaching skills: Active listening

Coaching skills: The art of acknowledgement

COACH-ing moments

Program support tools

These are some example tools to support the coach in assessing client readiness for coaching, guiding clients towards potential actions to meet their goals, and in discovering referral support in their community.

Milestones, actions, and tools

Client readiness assessment – PDF

Client readiness assessment – fillable PDF

Financial health pre-assessment – PDF

Financial health pre-assessment – fillable PDF

Developing a referrals network

Virtual tools for participant engagement

Resources:

Virtual service delivery tools

We are grateful to Family Services Greater Vancouver in British Columbia, Thunder Bay Counselling in Ontario, and SEED Winnipeg Inc. in Manitoba for their content consultation support and resource sharing.

Supporting client intake, triage, and referral in virtual financial help services

Virtual tools for participant engagement

Implementing a practice of self-care for practitioners – PDF

Implementing a practice of self-care for practitioners – fillable PDF

Participant tools:

Action plan – PDF

Action plan – fillable PDF

Contact list – PDF

Contact list – fillable PDF

Information to remember – PDF

Information to remember – fillable PDF

Action items – PDF

Action items – fillable PDF

Please note that some of the resources below were developed prior to the COVID-19 pandemic and serve as samples only. Current materials used by community agencies may have been revised to reflect updates to services and to meet public health guidelines.

Intake and assessment tools:

Intake Form – Family Services Greater Vancouver

First Financial Coaching Session Survey – Family Services Greater Vancouver

Financial Health Assessment – Thunder Bay Counselling

Financial Assessment Spreadsheet – Thunder Bay Counselling

Consent forms:

Consent to Service – Thunder Bay Counselling

Consent to Release and Obtain Information – Thunder Bay Counselling

Promotional materials:

Welcome and introduction to services brochure – Thunder Bay Counselling

Community Financial Helpline social media material (image 1, image 2, image 3) – SEED Winnipeg Inc.

Case studies and common questions

Use these case studies and common questions to practice or develop your coaching skills. Try them on your own or with your fellow staff.

Case study: Linda

Case study: Jacob

Case study: Nina

Common questions 1: “Just tell me what to do!”

Common questions 2: “There’s no point.”

Saving tools

Debt tools

Coaching conversation tips – Debt

Guide for talking to creditors

Determining debt payoff order (FC toolkit)

Debt list tool (FC toolkit) – PDF

Debt list tool (FC toolkit) – fillable PDF

Net worth tool (FC toolkit) – PDF

Net worth tool (FC toolkit) – fillable PDF

Payment arrangements worksheet (FC toolkit) – PDF

Payment arrangements worksheet (FC toolkit) – fillable PDF

Who do you owe? (FC toolkit) – PDF

Who do you owe? (FC toolkit) – fillable PDF

French

Outils de coaching financier

Fixation d‘objectifs et planification d’actions

Outils de déclaration de revenue

Supporting Employee Financial Stability: How Philanthropy Catalyzes Workplace Financial Coaching Programs

More than half of all employees in the United States report that they are This report describes different workplace models, the common characteristics and challenges of programs, and provides recommendations for funders who want to invest in workplace approaches to help workers achieve financial stability.

financially stressed, and nearly one in three employees reports being distracted by personal financial issues while at work. This financial stress impacts individuals’ health, relationships, productivity, and time away from work.

Measuring Financial Capability and Well-Being in Financial Coaching Programs

This brief describes the data collected and lessons gleaned from the Financial Coaching Impact & Evaluation Fellowship, which took place over the course of 10 months in 2017. Ultimately, this brief argues that the Financial Well-Being Scale and the Financial Capability Scale are promising tools for financial capability programs seeking to understand the impact of their programs.

Financial Capability Scale

The Center for Financial Security (CFS) and Annie E. Casey Foundation have developed a short set of standardized client outcome measures to create the Financial Capability Scale (FCS). In 2011, CFS worked with four organizations to collect data on client outcome measures, with the goal of refining a small set of measures that can be used across programs. The project aimed to increase coordination across organizations so the financial coaching field can improve its capacity to demonstrate client impacts. The findings from the project extend beyond the coaching field and can be applied to other financial capability services.

Financial Coaching Process Evaluation Report

This report presents the findings of the process evaluation of the Financial Coaching pilot, a part of the Financial Empowerment Collaborative in Calgary. In documenting the procedures and early thoughts of participating programs on the implementation of this pilot project, we assessed how well early goals are being met, documented some promising best practices, identified common roadblocks encountered by agencies, and compiled solutions developed in response to those roadblocks.

My Budget Coach Pilot Evaluation

This pilot study explores the delivery and effectiveness of MyBudgetCoach, a financial coaching program designed to help low- and moderate-income adults develop budgeting skills, set financial goals, and work towards those goals. Specifically, this study compares two modes of program delivery, traditional in-person coaching and fully remote coaching. By testing financial coaching in these two contexts, this project seeks to generate a deeper understanding of the mechanisms that underpin coaching and the role technology may play in facilitating behavior change.

Family Centered Coaching: A toolkit to Transform Practice & Engage Families

The Family-Centered Coaching Toolkit offers a set of strategies, tools, and resources that can help programs, agencies, case managers, coaches, and others change the ways they work with families striving to reach their goals. This set of resources, can undo, and redo, how one approaches working with families – to see families holistically, even though the funding streams and programs within which we work may not.

Implementing Financial Coaching

A presentation on how financial coaching is different, client interaction and program evaluation and coaching as presented by Richard Simonds of Family Services of Greater Houston.

An Evaluation of Financial Empowerment Centers Building People’s Financial Stability as a Public Service

This report provides information on the Financial Empowerment Center model, the people it served, the outcomes they achieved, the impact services had on nonprofit and city partners, and lessons learned for others looking to replicate or support this model. The evaluation was designed as a utilization-focused, foundational and exploratory study, aimed at creating an evaluation report that was useful to stakeholders. The report includes both qualitative and quantitative sources

A Missing Element of Financial Capability – Your Money Mindset

Leaders of workforce development programs have been taking the initiative to integrate financial literacy and capability services into their own curriculum and services. However, this requires resources, knowledge, and capacity that workforce development programs may not have. With support from JPMorgan Chase & Co., The Prosperity Agenda partnered with two workforce development programs with the goal of answering, “How might we improve the financial wellness of graduates in career development programs?”

A Much Closer Look: Enhancing Savings Counseling at Financial Empowerment Centers

Building savings is a fundamental strategy for empowering individuals and families with low incomes. Even relatively small amounts of savings can serve as a buffer against inevitable financial shocks that can otherwise undermine social service efforts and successes – and short-term savings offer realistic first steps toward building longer-term savings and acquiring assets. The CFE Fund conducted a research pilot at municipal Financial Empowerment Centers to better understand how clients are saving, and inform new savings indicators for financial counseling success. This report explains the insights of this research pilot, and client outcomes in savings and goal setting.

MPower Money Coaching Program

This is the final report on the MPower Money Coaching Program. This program was a unique collaboration that brought together Prosper Canada, a national charity, Canada’s leading investment firms and investment industry associations, and the City of Toronto’s Employment and Social Services Division (TESS) to provide neutral, high quality financial help to people living on low incomes.

Family-Centred Coaching Toolkit

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families. (Note: Accessing the toolkit requires submitting user information).

Unstuck: How to Get Out of Your Money Rut and Start Living the Life You Want. Complimentary Workbook

Financial Coaching: An Asset-Building Strategy

Financial coaching is a promising strategy to help people improve their financial well-being, but is often not yet universally understood. Practitioners are turning to coaching strategies to better facilitate behaviour change as opposed to the disappointing results often found when only financial education or financial access programs are introduced. Shared insights on financial coaching can help shape collective action by funders seeking to facilitate greater financial capability among targeted populations.