Resources

Resources will be provided here post-webinar.

Resources

Handouts, videos and time stamps

Resources

Handouts, videos and time stamps

Resources

Handouts, videos and time stamps

Video and time stamps

1:59 – Welcome and introduction

7:55 – Warm up poll

10:06 – Access to benefits project overview and barriers to access

19:46 – Live demo of the Disability Benefits Compass tool

24:20 – Evaluation: what is it and project outcomes and learnings

40:48 – What’s next? What is possible? Call to action!

52:18 – Activity: Poll

54:26 – Questions and Wrap-up

Resources

Handouts, video and time stamps

Read the presentation slides for this webinar.

Time stamps for the video:

Welcome and introductions

2:52 – Goals for webinar

4:39 – Context: Benefits Wayfinder and Disability Benefits Navigator

10:46 – Intro to the Bridge to Benefits tool

19:31 – Development process

24:10 – Demo – Walkthrough of the features

40:17 – Evaluation

44:12 – How to share this tool with others/Other resources

49:12 – Questions and feedback

Resources

Reports, presentation slides and video time stamps

Read the presentation slides for this webinar.

Download the executive summary.

Time stamps for the video:

0.38 – Welcome and housekeeping

5:59 – Canada’s financial help gap overview

35:35 – Panel discussion

1:20 – Q&A

Resources

Presentation slides and video time stamps

View the Making the most of your money course.

View the Investing with interest booklet.

Read the presentation slides for this webinar.

Time stamps for the video:

0:50 – Welcome, introductions, and warm-up

3:10 – Making the most of your money overview

12:57 – Demo

25:26 – Investing with interest overview

40:00 – Other resources

44:04 – Q&A

Resources

Handouts, slides and video time stamps

Read the presentation slides for this webinar.

Download the promotional postcard.

Download the promotional poster.

Time-stamps for the video recording:

1:26 – Welcome and introductions

3:30 – Our goals for today’s session

5:04 – Why these tools were created

7:12 – The Benefits Wayfinder and the Disability Benefits Compass

46:11 – Ways to use the Benefits Wayfinder – tax clinics

49:37 – Access to Benefits training available

Resources

Presentation slides and video time stamps

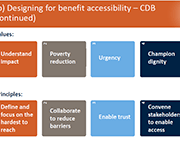

Read the presentation slides for this webinar.

Time stamps for the video recording:

-

- 5:20 – Start

- 6:12 – Land acknowledgement

- 7:24 – Introduction of speakers

- 9:42 – Today’s presentation

- 10:45 – Barriers to access to benefits

- 15:12 – Designing for benefit accessibility

- 21:53 – ESDC pilot project

- 32:46 –Demo of the disability benefit compass

- 44:36 – Importance of evaluation

- 50:58 – What’s next? What’s possible?

- 58:55 – Questions

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

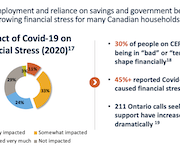

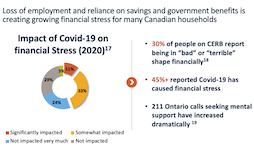

Download the Overview of Financial vulnerability of Low-Income Canadians: A Rising Tide

Time-stamps for the video recording:

00:00 – Start

6:05 – Agenda and Introductions

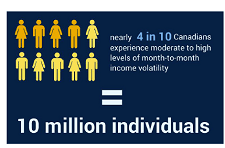

8:24 – Overview of Financial vulnerability, of low-income Canadians: A rising tide (Speaker: Eloise Duncan)

25:40 – Panel discussion: how increasing financial vulnerability is playing out in community and how policy makers should respond.

45:35 – Q&A

Resources

Presentation slides, handouts, and video time stamps

Read the presentation slides for this webinar.

Download resources provided by webinar speakers:

Time-stamps for the video recording:

3:24 – Agenda and Introductions

6:36 – Audience poll questions

9:33 – FAIR Canada presentation (speaker: Tasmin Waley)

24:07 – Ontario Securities Commission presentation (speaker: Christine Allum)

39:10 – Investor Protection Clinic at Osgoode Hall Law School (speaker: Brigitte Catellier)

51:34 – Q&A

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Flyer for ‘Redefining Financial Vulnerability in Canada: The Embedded Experience of Households’.

Time-stamps for the video recording:

3:31 – Agenda and Introductions

7:15 – Redefining financial vulnerability in Canada (speaker: Jerry Buckland and Brenda Spotton Visano)

24:33 – Audience poll question 1

27:07– Audience poll questions 2 & 3

33:57 – Audience poll question 4

38:00 – Financial Empowerment (Speaker: Margaret Yu)

52:15– Q&A

Resources

Handouts, slides, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Process map: Virtual Self-File model overview

Time-stamps for the video recording:

4:01 – Agenda and introductions

5:59 – Audience polls

10:27 – Project introduction (Speaker: Ana Fremont, Prosper Canada)

14:31 – Tour of TurboTax for Tax Clinics (Speaker: Guy Labelle, Intuit)

17:59 – Woodgreen project pilot (Speaker: Ansley Dawson, Woodgreen Community Services)

27:35 – EBO 2-step process (Speaker: Marc D’Orgeville, EBO)

39:26 – Woodgreen program modifications (Speaker: Ansley Dawson, Woodgreen)

46:03 – Q&A

Resources

Handouts, slides, and time-stamps

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

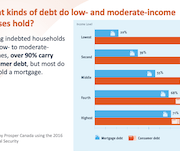

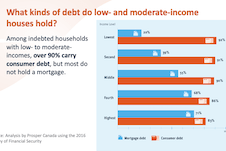

Report: Roadblock to recovery: Consumer debt of low- and moderate-income Canadian households in the time of COVID-19 (Prosper Canada)

Survey results: Canadians with incomes under $40K bearing the financial brunt of COVID-19 (Leger and Prosper Canada)

Time-stamps for the video recording:

4:42 – Agenda and introductions

7:52 – Audience polls

10:55 – Researching consumer debt (Speaker: Alex Bucik)

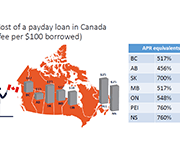

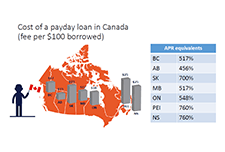

18:55 – How much does debt cost? (Speaker: Alex Bucik)

23:17 – How do different kinds of debt work? (Speaker: Alex Bucik)

29:17 – What are people using their credit for? (Speaker: Vivian Odu)

40:49 – What help is available to Canadian borrowers? (Speaker: Alex Bucik)

45:22 – Q&A

Resources

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

Online financial tools and calculators (Prosper Canada)

Virtual tools for participant engagement (Prosper Canada)

Online delivery check-list (Momentum)

Jeopardy game template (SEED)

Time-stamps for the video recording:

3:26 – Agenda and introductions

5:10 – Audience polls

8:19 – Virtual delivery considerations (Speaker: Glenna Harris, Prosper Canada)

12:39 – Virtual workshops best practices (Speaker: Fatima Esmail, Momentum)

33:12 – Online money management training (Speaker: Millie Acuna, SEED)

49:07 – Q&A

Présentation de l’Explorateur d’allègements financiers (EAF)

L’Explorateur d’allègements financiers : un outil pour connaître les mesures d’aide et d’allègement liées à la COVID-19 dont vos clients pourraient bénéficier En réponse à la pandémie de COVID-19 et en raison de la complexité des mesures d’aide et d’allègement offertes à la population canadienne, nous avons créé l’Explorateur d’allègements financiers (EAF), un outil en ligne qui aide les gens vulnérables au Canada et ceux qui les accompagnent à accéder aux mesures d’aide d’urgence et d’allègement financier proposées par les gouvernements, les établissements financiers, les fournisseurs de services de télécommunication, de services publics et de services Internet. Soyez des nôtres pour assister à notre webinaire d’une heure animé par Elodie Young, de Prospérité Canada, qui vous présentera l’EAF et vous donnera des conseils sur la manière d’aider vos clients à accéder aux mesures d’aide et d’allègement financier. Que vous travailliez dans le secteur de la salubrité des aliments, de la santé mentale, de l'autonomisation financière, de l’établissement ou encore dans le secteur privé, venez apprendre comment aider vos clients à augmenter leur revenu et à réduire leurs dépenses pendant la crise. Ce webinaire concerne tous les fournisseurs de services de première ligne qui gagnent un faible revenu et les populations vulnérables du Canada.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar

Introducing the Financial Relief Navigator (FRN)

Access the Financial Relief Navigator here.

Time-stamps for the video recording:

3:22 – Agenda and Introductions

6:00 – Audience poll

9:00 – Why we created the Financial Relief Navigator (Speaker: Janet Flynn)

11:55 – What’s in the Financial Relief Navigator (Speaker: Janet Flynn)

16:35 – FRN Walkthrough using a Persona (Speaker: Galen McLusky)

33:15 – Tips for using the FRN (Speaker: Galen McLusky)

36:00 – The Working Centre experience using the FRN (Speaker: Sue Collison)

41:15 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

How Savings Circles Works

Information about the Strive program

Time-stamps for the video recording:

3:35 – Agenda and introductions

6:00 – Audience polls

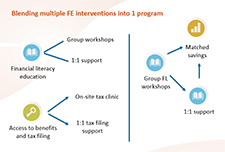

10:58 – Financial empowerment interventions (Speaker: Glenna Harris)

14:00 – Savings Circles program at Momentum (Speaker: Anna Jordan)

33:18 – Strive program (Speaker: Monica daPonte)

55:50 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Access the handouts for this webinar:

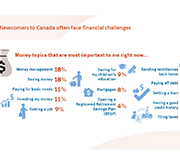

Poster presentation: Financial Empowerment for Newcomers project

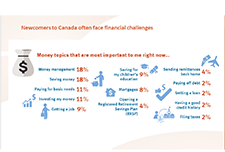

Infographics: Newcomer settlement stages, money matters, and client personas

Time-stamps for the video recording:

3:11 – Agenda and introductions

5:21 – Audience poll

8:25 – Introduction to Financial Empowerment for Newcomers project (Speaker: Glenna Harris)

11:25 – AXIS financial coaching program (Speaker: Sheri Abbot)

30:05 – North York Community House financial coaching program (Speaker: Noemi Garcia)

45:40 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar:

- Prosper Canada: Webinar introduction / Improving the Benefits Screening Tool

- Bridgeable: Introduction to Service Design

Bridgeable’s handouts for this webinar:

Key takeaways for Service Design

Prosper Canada’s handouts for this webinar:

Benefits Screening Tool Phase 2 report

Pathways to benefits

Client Journey Map for ODSP application

Practitioner Workflows

Time-stamps for the video recording:

3:14 – Agenda and introductions

5:51 – Audience polls

9:19 – All about service design (Speaker: Glenna Harris)

11:00 – Bridgeable: Introduction to service design (Speakers: Bonnie Tang and Minyan Wong)

35:00 – Benefits Screening tool design process (Speaker: Trisha Islam)

50:20 – Q&A

Resources

Handouts, slides, and time-stamps

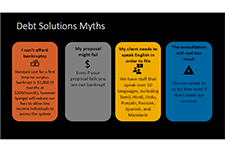

Read the presentation slides for this webinar.

Access the handouts for this webinar:

How we help people – An overview (Webinar handout) – Credit Counselling Society

Our services (Webinar handout) – Credit Counselling Society

Debt solutions 101 (Webinar handout) – msi Spergel Inc

Time-stamps for the video-recording:

4:13 – Agenda and introductions

7:00 – Audience polls

12:31 – Debt in Canada (Speaker: Glenna Harris)

15:20 – Credit Counselling Society on debt management plans (Speaker: Anne Arbour)

34:05 – Spergel Msi on Consumer Proposals and Bankruptcy plans (Speaker: Gillian Goldblatt)

56:00 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Handouts for this webinar:

Tax time insights research report – webinar handout (Prosper Canada)

Income tax checklist – webinar handout (The Working Centre)

Form for missing income information – webinar handout (The Working Centre)

Income tax return summary sheet – webinar handout (The Working Centre)

Host checklist for tax clinics – webinar handout (The Working Centre)

Forms for rental information – webinar handout (The Working Centre)

Referral to FEPS – webinar handout (The Working Centre)

Time-stamps for the video-recording:

3:10 – Introductions and Agenda

6:32 – Audience polls

10:52 – Tax time insights: Experiences of people living on low incomes (Speaker: Nirupa Varatharasan)

26:00 – The Working Centre tax clinic experiences (Speaker: Jen Smerdon)

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

Brief: Matched Savings programs – webinar handout (Momentum)

Matched Savings programs chart – webinar handout (Momentum)

Budget Tracker – webinar handout (Credit Counselling Sudbury)

Monthly Budget – webinar handout (Credit Counselling Sudbury)

Time-stamps for the video-recording:

3:26 – Agenda and introduction

6:17 – Audience polls

9:41 – Reasons to save (Speaker: Glenna Harris)

12:08 – Effectiveness of Matched Savings (Speaker: Dean Estrella from Momentum)

32:10 – Savings strategies for clients on low incomes (Speaker: John Cockburn from Credit Counselling Sudbury)

47:50 – Q&A

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

RESP case plan – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP tracking sheet – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP quick reference sheet – webinar handout (from FSGV)

RESP sample letter to schools – webinar handout (from Credit Counselling Sault Ste. Marie)

Time-stamps for the video recording:

3:00 – Agenda and introductions

5:05 – Audience polls

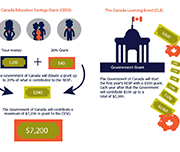

9:00 – Importance of education savings (Speaker: Glenna Harris)

16:00 – Credit Counselling Services Sault Ste. Marie and District (Speaker: Allyson Schmidt)

33:00 – Family Services of Greater Vancouver (Speaker: Rocio Vasquez)

54:45 – Q&A