Economic abuse screening tool (a toolkit for social service providers)

Women’s shelters are often the first point of contact for victim-survivors fleeing abusive relationships. Therefore, safety and shelter are logically at the forefront of staff members’ immediate concerns. Once the victim-survivor is in a place of safety, it is crucial to explore the patterns of abuse the person has experienced. Economic security is an often overlooked pattern of abuse linked to physical safety. It is, therefore, crucial and the goal of this screening tool for shelter workers to identify potential Economic and Financial Abuse amongst their clients and to assist victim-survivors in accessing essential economic resources. Watch the webinar: Recognizing and responding to economic abuse; empowering survivors to thrive and succeed.

Income in retirement: Expectations versus reality

In 2014, a group of non-retired Canadians aged 55 or older was asked about their financial expectations for retirement. New data from 2020 reveal how this same group of Canadians - now retired- is doing financially.

Ten frugal habits to save money

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said they would put it in savings or invest it. With inflation as high as it has been in over 40 years, saving money is becoming increasingly difficult for some. This article lists ten frugal habits to help you save.

Social influencers and your finances

Just because someone has a lot of followers doesn’t mean their advice is right for you. Social media influencers are increasingly sharing information about investing. This can be done by ordinary people or by celebrities who have taken an interest in a specific product or investment. They are often called “finfluencers” — financial influencers whose media accounts are focused on money and investing. This article will outline some questions to ask yourself before you choose to invest.

Canada’s new working class: A modern understanding of the 6.5 million Canadians in the working class

The pandemic has accelerated a polarization of jobs that has become a structural trend in the Canadian economy. Previous Cardus research has shown that this polarization of the labour market between low- and high-skilled occupations, with a declining share of jobs available for mid-skilled workers, has led to an “hourglass economy.”

Yet, even while the share of the labour force employed in professional occupations rises, the working class retains the largest share of workers in the Canadian economy, making them an important political economy constituency. But who is the working class in Canada? This paper seeks to answer this question by proposing a modern taxonomy of the workforce and a picture of the working class that draws on a rich body of demographic, economic, and labour-market data.

Pilot study: Buy now, pay later services in Canada

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have resulted in a steady increase in retail e-commerce sales over the past several years, and the COVID-19 pandemic has had a significant impact on how consumers make retail purchases. Retail e-commerce sales reached record levels during the pandemic. This has further contributed to the proliferation of buy now, pay later (BNPL) services in Canada.

Income support, inflation, and homelessness

A good deal of attention has been paid to the question of what these high rates of inflation in housing and food costs mean for Canadians. Much of the concern has focused on the implications for middle-income Canadians hoping to purchase a home, while squeezing their household budgets. But what do these rates of inflation mean for Canadians with very low income? For them, high rates of inflation in the price of food and shelter mean more than having to delay thoughts of homeownership. For them, the threats are considerably more serious.

How Canadians bank

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world. This survey and other findings form the basis of How Canadians Banks, a biannual study by the Canadian Bankers Association and Abacus Data that examines the banking trends and attitudes of Canadians.

Multicultural and newcomer charitable giving study

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving and volunteerism.

Introduction to behavioural insights for the social sector: a capacity building course

This self-paced online course will help you learn about behavioural insights and how they can help you increase impact in simple, practical ways. In this self-paced learning experience, you will learn foundational skills and tools that you can apply immediately to your work, creating a long-lasting social impact.

2022 Canadian Retirement Survey

The key takeaways from the 2022 Canadian Retirement Survey are: Read the full presentation conducted for Healthcare of Ontario Pension Plan.

Retirement budget worksheet

Good financial planning starts with knowing what you spend. Try out this budget worksheet, prepared by the Ontario Securities Commission, to see the difference in your costs before you retire and after you stop working.

Pay down debt or invest tool

If you have extra money, this calculator helps you decide whether to invest or pay off debt.

Singles in deep poverty neglected by pandemic supports

In 2020, the federal government spent over $160 billion on COVID-19 pandemic response measures. These expenses were critical in supporting recently unemployed workers and affected businesses in a time of uncertainty. However, supports through programs like the Canada Emergency Response Benefit (CERB) and the Canada Recovery Benefit (CRB) were not extended to those who had less attachment to the labour market, such as a large proportion of social assistance recipients. This pattern of exclusion has continued with the more recent Canada Worker Lockdown Benefit, which was created to support workers affected by new pandemic-related shutdowns, and not people who were already living in deep poverty before the pandemic. The pandemic benefits are intended to support people during a specific time of crisis — but what about those who have been living with low and insecure incomes for decades? This report analyzes the welfare incomes of 53 example households, divided into four types, focusing here on unattached singles considered employable, as they are the most likely to be living in poverty.

The Comeback Generation: Pandemic is inspiring Gen Z to build financial resilience

The coronavirus pandemic has tested the limits of Canadians over the past 20 months. What began as a health crisis quickly morphed into an economic crisis, with the spread of COVID‑19 shocking large segments of the economy and leaving many without paycheques. While no generation has been unaffected by the pandemic, the economic impact was distributed unevenly. Many younger Canadians in Generation Z, or Gen Z, have had their education disrupted, career plans changed, and financial prospects diminished largely because they are overrepresented in the highly affected service sector, according to a new survey by the Canadian Bankers Association (CBA). The survey was published to mark Financial Literacy Month, which takes place each November, and found that more than half (53 per cent) of Gen Z respondents (aged 18‑25) felt the pandemic upended their financial security, with that number rising to 73 per cent for those in less stable financial situations. At the same time, nine‑in‑ten (88 per cent) Gen Zers are feeling optimistic about their financial futures, and nearly all of them (98 per cent) are actively making plans to strengthen their financial resilience. "Gen Z was dealt a disproportionately tough hand during the pandemic, but it has also shown incredible resilience in channeling its natural gifts for perseverance, adaptability and motivation," says Neil Parmenter, President and CEO, Canadian Bankers Association. "Despite the setbacks, younger Canadians are eager to forge ahead, be prepared for the unexpected and build bright futures as our economy recovers."

Encouraging tax filing at virtual clinics

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual clinics.

Financial Education Affects Financial Knowledge and Downstream Behaviors

This study covers the rapidly growing literature on the causal effects of financial education programs in a meta-analysis of 76 randomized experiments with a total sample size of over 160,000 individuals. The evidence shows that financial education programs have, on average, positive causal treatment effects on financial knowledge and downstream financial behaviors. Treatment effects are economically meaningful in size, similar to those realized by educational interventions in other domains and are at least three times as large as the average effect documented in earlier work. These results are robust to the method used, restricting the sample to papers published in top economics journals, including only studies with adequate power, and accounting for publication selection bias in the literature. The study concludes with a discussion of the cost-effectiveness of financial education interventions.

Fearless Woman: Financial Literacy and Stock Market Participation

Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. This survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response option is unavailable, they often choose the correct answer. The authors find that about one-third of the financial literacy gender gap can be explained by women’s lower confidence levels. Both financial knowledge and confidence explain stock market participation.

Testing the use of the Mint app in an interactive personal finance module

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s effectiveness at improving students’ financial knowledge, attitudes, and behavior. Students at the George Washington University participated in a half-day budgeting workshop and were exposed to either Mint, which is a real-time, automated platform, or Excel, which is an offline, static tool. The authors found that participation in both workshops was associated with improved preparedness to have conversations about money matters with parents, a greater sense of financial autonomy, and an increased awareness of the importance of budgeting, but that participants in the Mint workshop were more likely to have a positive experience using the budgeting tool, to feel confident that they could achieve a financial goal, and to be engaged in budgeting one month after the workshop. Results show that even short financial education interventions can meaningfully influence students’ financial attitudes and behavior and that an interactive tool like Mint may have advantages over a more static tool like Excel.

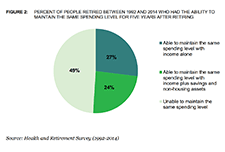

Retirement Security and Financial Decision-making: Research Brief

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level of spending for at least five consecutive years after retiring. The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring. In addition, the Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years. The study helps identify ways to protect retirees from overspending their savings in early retirement.

Behavioural insights: key concepts, applications and regulatory considerations

There are numerous factors that influence the decisions that people make. Behavioural insights (BI) recognizes this and, through a combination of psychology, economic and more recently other behavioural research, examines how people are often neither deliberate nor rational in their decisions in the way that traditional models, strategies and policies assume. Behavioural insights recognize how people actually behave versus traditional economic and market theory of people as rational actors. This report discusses how leading practitioners and regulators around the world are using behavioural insights to address issues in capital markets and improve outcomes for investors and market participants.

Encouraging Retirement Planning through Behavioural Insights

This research report identifies behaviourally informed ways that government, regulators, employers, and financial institutions can encourage retirement planning. Thirty different initiatives and tactics that could be implemented by a variety of stakeholders to encourage retirement planning are proposed, and interventions are organized around four primary challenges people face in moving from having the intention to create a retirement plan to the action of making a plan: (1) it’s hard to start, (2) it’s easy to put off, (3) it’s easy to get overwhelmed and drop out, and (4) it’s hard to get the right advice. The report also includes the results of a randomized experiment that evaluated several of the approaches proposed in the report. This report was published as part of the Ontario Securities Commission’s strategy and action plan to respond to the needs and priorities of Ontario seniors.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

How to really build financial capability

Recent years have seen an explosion in interventions designed to improve financial outcomes of participants. Yet on-the-ground evidence suggests that not all financial education programs are equally successful at achieving this aim. This paper examines the difference between interventions that work, and those than do not. It attempts to answer the question: “How do you actually build financial capability?” In doing so, we aim to help interested parties enhance the effectiveness of their programs and policies by providing them with evidence-based recommendations to drive positive outcomes in participants.

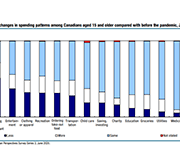

Expected changes in spending habits during the recovery period

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How our economy evolves going forward will largely depend upon the spending choices Canadians make over the coming weeks and months. This study presents results from a recent web panel survey conducted in June, looks at how spending habits may change.

Evaluating Tax Time Savings Interventions and Behaviors

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife (formerly EARN) during the 2019 tax season are presented. This analysis is unique in that it compares tax filers' outcomes over time across three different tax-filing and savings program platforms: volunteer income tax assistance (VITA) sites, online tax filing through the Turbo Tax Free File Product (TTFFP), and SaverLife's saving program.

Smarter Financial Education: Key lessons from behavioural insights for financial literacy initiatives

This publication presents key findings for financial education, drawn from the IOSCO/OECD joint report “The Application of Behavioural Insights to Financial Literacy and Investor Education Programmes and Initiatives”. It gives a short overview of the ways in which behavioural insights are relevant for financial education and then summarises five key lessons that policy makers can follow, illustrated with the experiences of OECD/INFE members.

How personality traits and economic beliefs shape financial capability and literacy

An emerging body of international literature is beginning to reveal a significant connection between financial capability metrics and personality, suggesting that what influences our financial well-being may be more nuanced than we previously thought. This report investigates how the inclusion of personality traits impacts the analysis of the gender difference in financial capability scores.

Money Circle toolkit

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a brief, interactive exercise, to initiate conversations about the feelings and personal relationships that shape financial choices.

The Effects of Education on Canadians’ Retirement Savings Behaviour

This paper assesses the extent to which education level affects how Canadians save and accumulate wealth for retirement. Data from administrative income-tax records and responses from the 1991 and 2006 censuses of Canada show that individuals with more schooling are more likely to contribute to a tax-preferred savings account and have higher saving rates, have higher home values, and are less likely to rent housing.

Short-term financial stability: A foundation for security and well-being

Short-term cushions are key to longer-term financial security and well-being. This report shines a light on the central role that short-term financial stability plays in a person’s ability to reach broader financial security and upward economic mobility, a measurement of whether an individual moves up the economic ladder over one’s lifetime or across generations. The insights presented in this report draw primarily on evidence provided by members of the Consumer Insights Collaborative (CIC), a group of nine leading nonprofits across the United States convened by the Aspen Institute Financial Security Program. These diverse organizations offer a window into the financial lives of the low- and moderate-income individuals they serve.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

Habit Change: Literature Review

Habits are incredibly powerful. Good habits can make people highly successful, and bad habits can ruin people’s lives. Still, it is important to go beyond the anecdotal evidence of the many self-help books on habit, and to take stock of the scientific evidence. This literature review discusses we discuss how habits are formed, how bad habits can be abandoned, how approach-avoidance training can help adopting good habits and abandoning bad habits, and, finally, how habits can be measured properly.

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.

Tools and Ethics for Applied Behavioural Insights: The BASIC Toolkit

A better understanding of human behaviour can lead to better policies. If you are looking for a more data-driven and nuanced approach to policy making, then you should consider what actually drives the decisions and behaviours of citizens rather than relying on assumptions of how they should act. You can start applying behavioural insights (BI) to policy now. No matter where you are in the policy cycle, policies can be improved with BI through a process that looks at Behaviours, Analysis, Strategies, Interventions, Change (BASIC). This allows you to get to the root of the policy problem, gather evidence on what works, show your support for government innovation, and ultimately improve policy outcomes. This toolkit guides policy officials through these BASIC stages to start using an inductive and experimental approach for more effective policy making.

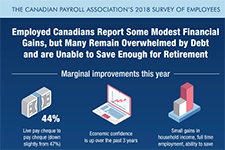

Infographic: Canadian Payroll Association’s 2018 Survey of Employees

This infographic shows results from the 2018 Survey of Employees conducted by the Canadian Payroll Association. It shows some marginal improvements but also some concerns. 44% of Canadians are living paycheque to paycheque, 40% feel overwhelmed by debt, and 72% have saved only one quarter or less of what they feel they'll need to retire. View full suite of news release and infographics from this survey, by province.

NPW 2018 Employee Research Survey

Working Canadians seem to be making some minor progress towards improving their financial health. But, while 66% report being in a better financial position than a year ago, their debt levels remain high, they chronically undersave for retirement, and put themselves at severe risk in the event of economic changes. According to the Canadian Payroll Association’s tenth annual survey, 44% of working Canadians report it would be difficult to meet their financial obligations if their pay cheque was delayed by even a single week (down from the three-year average of 48%). View full suite of news release and infographics from this survey, by province.

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

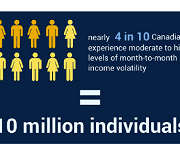

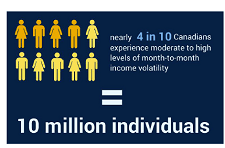

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

The Perils of Living Paycheque to Paycheque

This report, 'The Perils of Living Paycheque to Paycheque: The relationship between income volatility and financial insecurity', examines the relationship between income instability and broader measures of financial well-being. This study makes use of a unique dataset that collected self-reported month-to-month volatility in household income, measures of capability, financial knowledge and psychological variables. One in three adult Canadians reported at least some volatility in their monthly incomes, with six per cent reporting that the source and amount were both uncertain. Income volatility is present across a wide swath of the survey respondents, regardless of gender, family status, region of the country, education level and even income sources. Income volatility is correlated with lower financial knowledge, lower financial capability, and stronger beliefs that financial outcomes are up to fate and outside of personal control.

Canadian Millenial Social Values Study

A major national survey conducted in 2016 reveals a bold portrait of Canada’s Millennials (those born between 1980 and 1995), that for the first time presents the social values of this generation, and the distinct segments that help make sense of the different and often contradictory stereotypes that so frequently are applied to today’s young adults. Key findings from the survey explore Millennials' relationship with money, education, work and career interests, voting turnout, and engagement with social justice.

National Investor Research Study

This presentation shows the results of a quantitative study undertaken by the Ontario Securities Commission to assess attitudes, behaviour and knowledge among Canadians pertaining to a variety of investment topics. These topics include retirement planning and conversations about finances.

Increasing Take-Up of the Canada Learning Bond

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible population. The Impact and Innovation Unit (IIU), in collaboration with the Learning Branch and the Innovation Lab at Employment and Social Development Canada (ESDC) conducted a randomized controlled trial to test the effectiveness of behavioural insights (BI) in correspondence sent to primary caregivers of children eligible for the CLB. This trial demonstrates the effectiveness of BI interventions tailored to the particular behavioural barriers that affect specific populations in increasing take-up of programs like the CLB. If scaled across the eligible population, the best performing letter would result in thousands more children receiving this education savings incentive on an annual basis.

Strengthening retirement security for low- and moderate-income workers

In this video presentation Johnathan Weisstub from Common Wealth discusses recent improvements in senior Canadians' poverty levels due to benefits such as OAS and GIS, and the challenges that still remain in ensuring retirement security for modest-earning and low-income Canadians. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Redesigning Social Policy for the 21st Century

In this video presentation Sunil Johal from the Mowat Centre explains how social policy in the 21st century could be redesigned to accommodate the changing nature of work and income in Canada. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Income volatility: Strategies for helping families reduce or manage it

In this video presentation David Mitchell from the Aspen Institute explains strategies for mitigating and preventing income volatility at the household level. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Do we have the data we need to tackle household financial instability?

In this presentation Catherine Van Rompaey of Statistics Canada examines the data we have available to measure financial instability in Canada - household debt, savings, and credit. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Neighbourhood Financial Health Index: Making the Invisible Visible

In this video presentation Katherine Scott from the Canadian Council on Social Development (CCSD) shares the new Neighbourhood Financial Health Index, a mapping tool which uses composite data about income, assets, debt, and poverty to show levels of financial health at the neighbourhood scale. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium. Update July 22, 2022: Please note that the Neighbourhood Financial Health Index is no longer available

Income and Expense Volatility Survey Results

In this video presentation Patrick Ens from Capital One explains the impact of income and expense volatility on consumers. Capital One found that half of Canadian households surveyed experience some amount of income fluctuation month to month. This impacts their ability to save, cope with emergencies, and other aspects of their lives. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Canada’s household balance sheets

In this video presentation Andrew Heisz from Statistics Canada explains the changing household assets, debt, and income levels of Canadians of different age generations. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Up Close and Personal: Findings from the U.S. Financial Diaries

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) shares some of the findings from the U.S. Financial Diaries project. He explains how the households in the study experience multiple "spikes" and "dips" in income and spending over the course of a single year. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Using Design to Deepen Relationships in the Financial Sector

This publication reveals the outcomes of Bridgable's work with a federal credit union, cutting through their overwhelming number of offerings to better engage with their low-income members. It also discusses why agility is a better bet than digitization when it comes to our changing financial ecosystem. Finally, it will break down their approach to one of the most popular design methods today, the design sprint, and how it can produce results while also lowering risk. Note: This link will allow you to download the document from the Bridgeable website.

Pervasive and profound: The impact of income volatility on Canadians

Income volatility describes income which is inconsistent (not received on a regular and predictable basis), unstable (amount varies each time it is received), and that fluctuates month to month by a significant percentage. TD’s report, Pervasive and Profound, has found that Canadians experiencing income volatility are more likely to report feelings of financial stress and lower overall financial health. They are also significantly more likely to see themselves falling behind financially and much less likely to feel confidence in their financial future. The survey findings show that income volatility is more likely to be experienced by part-time, self-employed, seasonal workers and the unemployed. The TD report uses Canadians’ reported behaviours and perceptions in the areas of saving, spending, borrowing and planning to gauge their overall financial health. In all four categories, those with higher income volatility show significantly lower financial health.