Resources

Handouts, videos and time stamps

Resources

Presentation slides and video time stamps

View the Making the most of your money course.

View the Investing with interest booklet.

Read the presentation slides for this webinar.

Time stamps for the video:

0:50 – Welcome, introductions, and warm-up

3:10 – Making the most of your money overview

12:57 – Demo

25:26 – Investing with interest overview

40:00 – Other resources

44:04 – Q&A

Resources

Handouts, slides and video time stamps

Read the presentation slides for this webinar.

Download the promotional postcard.

Download the promotional poster.

Time-stamps for the video recording:

1:26 – Welcome and introductions

3:30 – Our goals for today’s session

5:04 – Why these tools were created

7:12 – The Benefits Wayfinder and the Disability Benefits Compass

46:11 – Ways to use the Benefits Wayfinder – tax clinics

49:37 – Access to Benefits training available

Resources

Presentation slides and video time stamps

Read the presentation slides for this webinar.

Time stamps for the video recording:

-

- 5:20 – Start

- 6:12 – Land acknowledgement

- 7:24 – Introduction of speakers

- 9:42 – Today’s presentation

- 10:45 – Barriers to access to benefits

- 15:12 – Designing for benefit accessibility

- 21:53 – ESDC pilot project

- 32:46 –Demo of the disability benefit compass

- 44:36 – Importance of evaluation

- 50:58 – What’s next? What’s possible?

- 58:55 – Questions

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

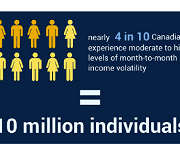

Download the Overview of Financial vulnerability of Low-Income Canadians: A Rising Tide

Time-stamps for the video recording:

00:00 – Start

6:05 – Agenda and Introductions

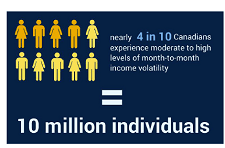

8:24 – Overview of Financial vulnerability, of low-income Canadians: A rising tide (Speaker: Eloise Duncan)

25:40 – Panel discussion: how increasing financial vulnerability is playing out in community and how policy makers should respond.

45:35 – Q&A

Resources

Presentation slides, handouts, and video time stamps

Read the presentation slides for this webinar.

Download resources provided by webinar speakers:

Time-stamps for the video recording:

3:24 – Agenda and Introductions

6:36 – Audience poll questions

9:33 – FAIR Canada presentation (speaker: Tasmin Waley)

24:07 – Ontario Securities Commission presentation (speaker: Christine Allum)

39:10 – Investor Protection Clinic at Osgoode Hall Law School (speaker: Brigitte Catellier)

51:34 – Q&A

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Flyer for ‘Redefining Financial Vulnerability in Canada: The Embedded Experience of Households’.

Time-stamps for the video recording:

3:31 – Agenda and Introductions

7:15 – Redefining financial vulnerability in Canada (speaker: Jerry Buckland and Brenda Spotton Visano)

24:33 – Audience poll question 1

27:07– Audience poll questions 2 & 3

33:57 – Audience poll question 4

38:00 – Financial Empowerment (Speaker: Margaret Yu)

52:15– Q&A

Recognizing and responding to economic abuse

With speakers from CCFWE, Johannah Brockie - Program Manager for Advocacy and System Change and Jessica Tran - Program Manager for Education and Awareness, this webinar will guide you through the definition of economic abuse, how to identify an economic abuser, impacts of economic abuse, Covid-19 impacts, tactics, what you should do if you are a victim of economic abuse, and key safety tips. Economic Abuse occurs when a domestic partner interferes with a partner’s access to finances, employment or social benefits, such as fraudulently racking up credit card debt in their partner’s name or preventing their partner from going to work has a devastating effect on victims and survivors of domestic partner violence, yet it’s rarely talked about in Canada. It’s experienced by women from all backgrounds, regions and income levels but women from marginalized groups, including newcomers, refugees, racialized and Indigenous women, are at a higher risk of economic abuse due to other systemic factors.

Mapping the road toward increased accessibility to the child tax credit

Last year, the expanded Child Tax Credit (CTC) helped to lift nearly four million children out of poverty and provided economic relief to millions of struggling households. However, many first-time and lapsed filers from underserved and vulnerable populations missed out on these critical benefits. Locating and serving eligible low-income youth, formerly incarcerated individuals, people experiencing homelessness, immigrants, survivors of domestic violence, and isolated tribal populations has presented a challenging opportunity to free tax prep service providers across the country. This research highlights the key findings and recommendations to increase the accessibility to the CTC.

How women can save more money

This webinar hosted by FCAC (originally broadcast on November 17, 2021) targets women who want to learn more about managing money and building saving habits. Guest speaker, personal financial expert, Rubina Ahmed-Haq has also contributed to Canada's financial literacy blog on "Women face unique money challenges". Helpful links related to the content matter in this video: Getting help from a credit counsellor

Resources

Opening and Welcome

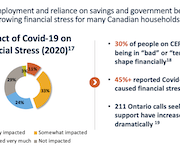

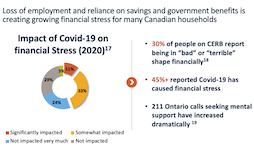

Session: Tackling pandemic hardship: The financial impact of COVID-19 on low-income households

Tackling pandemic hardship: The financial impact of COVID-19 on low-income households – YouTube

Download summary and detailed reports: The financial resilience and financial well-being of Canadians with low incomes: insights and analysis to support the financial empowerment sector

Download slide deck: The differential impact of the pandemic on low income families

Booth Chats: Big ideas for a more equitable recovery

Resolve Financial and Credit Counselling

Video Pitch: Booth chat: Jeri Bittorf, Resolve Financial and Credit Counselling Services Coordinator – YouTube

Slide Deck: K3C Credit Counselling (ablefinancialempowerment.org)

Seniors Financial Empowerment Network

Video Pitch: Booth Chat: Sarah Ramsey, City of Edmonton, Community Development Social Worker – YouTube

Seneca College

Video Pitch: Booth Chat: Varinder Gill, Seneca College, Professor & Program Co-ordinator – YouTube

Prosper Canada: Integrating Financial Empowerment into Ontario Works

Video Pitch: Booth Chat: Ana Fremont, Prosper Canada Manager, Program Delivery and Integration – YouTube

Slide Deck: Thunder Bay Financial Empowerment Integration (ablefinancialempowerment.org)

Prosper Canada: Prosperity Gateways – Cities for Financial Empowerment, Toronto Public Library

Video Pitch: Booth Chat: John Stephenson, Manager, Program Delivery and Integration – YouTube

Slide Deck: PowerPoint Presentation (ablefinancialempowerment.org)

Session: Measuring the divide: Has COVID-19 widened economic disparities for Canada’s BIPOC communities

Download slide deck: Income Support During COVID-19and ongoing challenges

Download slide deck: Re thinking income adequacy in the COVID-19 recovery

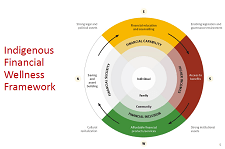

Session: Financial wellness and healing: Can building financial wellness help Indigenous communities?

Session recording: Financial wellness and healing: Can building financial wellness help Indigenous communities? – YouTube

Download slide deck: Indigenous Financial Literacy: Behaviour Insights from an Indigenous Perspective

Download slide deck: Financial wellness and Indigenous Healing

Session: When money meets race: Addressing systemic racism through financial empowerment

Session: Tous ensemble maintenant : Rétablissement de la santé financière de la population canadienne : l’affaire de tous les secteurs/ All together now: How all sectors have a role to play in rebuilding Canadians’ financial health

Session: When opportunity knocks: Poverty, disability, and Canada’s proposed new disability benefit

Session recording unavailable

Download slide deck: When Opportunity Knocks: Disability without Poverty

Session: The good, the bad and the innovation: The pandemic redesign of tax filing and benefit assistance

Closing remarks from Adam Fair, Vice President, Strategy and Impact, Prosper Canada; Helen Bobiwash

Why the Time is Right for a Guaranteed Income with an Equity Lens

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders involved in GI initiatives including practitioners, government representatives and philanthropy were heard. Panelists shared outcomes and new research results from some of the most successful GI pilots in the country (Stockton and Mississippi); goals for the newly launched Mayor’s for Guaranteed Income; how philanthropy can play a catalytic role and what this moment tells us about the future of guaranteed income initiatives.

Resources

Webinar (May 19th): Self-care for practitioners - strategies and challenges

Connect and Share (May 27th): Self-care strategies

Webinar (June 9, 2021): Virtual one-on-one client support

Read the slides for the ‘Virtual one-on-one client support’ webinar.

Watch the video recording for ‘Virtual one-on-one client support’

Download the handouts:

Client tool: Information to remember

Tip sheet: Supporting client intake, triage, and referral in virtual financial help services

Financial coaching at a distance: Tips for practitioners

Connect and Share (June 17, 2021): Tax-time debrief

Read the slides for ‘Connect and Share: Tax time debrief’.

View additional resources in Prosper Canada’s Tax filing toolkit.

Workshop (June 21, 2001): Beyond bubble baths - self-care during a pandemic

Workshop slides: Beyond bubble baths – self-care during a pandemic

Handout: Beyond bubble baths – Self-care during a pandemic

Resources shared during session:

Native-land.ca

Indigenous languages list in British Columbia

Self-compassion.org

Tara Brach mindfulness resources

Headspace

Boho beautiful guided meditations

Webinar (June 23, 2021): Diversity and inclusion - A conversation with SEED Winnipeg

Workshop (June 24, 2021): Visualizing client experiences - Using journey maps

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Click ‘Get it’ above for video link for this webinar.

Handout: Implementing a practice of self-care

Responding to Client’s “Now, Soon, & Later” Needs

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their current and future needs are discussed.

Intersectionality and Economic Justice

Widespread financial precarity for women of color with disabilities existed before the pandemic. Rooted in existing systemic inequities, COVID worsened the situation and created new access barriers. Race, gender, and disability impact financial stability in complex ways. Having a disability may increase living costs and limit economic opportunities. At the same time, women of color face significant disparities in education, income, employment, financial services, and wealth. Faced with institutional barriers that limit earning and wealth building, disabled women of color are more likely to be unbanked, use alternative financial services, have medical debt, lack access to affordable health care, and experience food insecurity. Given these challenges and the dire need to address them, this webinar explored:

Recordkeepers’ Role in Providing Emergency Savings for an Inclusive Recovery

In this webinar, Commonwealth in partnership with DCIIA Retirement Research Center (RRC) and SPARK Institute present findings from our new research about drivers and considerations of recordkeeper-provided emergency savings and host a discussion with industry experts.

Taking Stock and Looking Ahead: The Impact of COVID-19 on Communities of Color

Nearly a year since the outbreak began, and eight months since it was declared a global pandemic, COVID-19 has devastated hundreds of thousands of lives and millions of people’s economic prospects throughout the country. To date, the effects of this crisis have been wide-reaching and profound, impacting every individual and sector throughout the U.S. For communities of color, however, the pandemic has been particularly damaging as these communities have not only been more likely to contract and succumb to the virus, but also more likely to bear the brunt of the many economic impacts that have come from it—including more likely to be unemployed and slower to regain jobs lost. The Asset Building Policy Network and a panel of experts discuss the impact COVID-19 has had on communities of color, the fiscal policy measures congress has enacted to curtail those impacts and what can be done through policy and programs to foster an equitable recovery and more inclusive economy moving forward.

Connecting to Reimagine: Money & COVID-19 webinar series

This webinar series released by the Global Financial Literacy Excellence Center (GFLEC) features speakers from the public, private, and academic sectors. Past and upcoming webinar topics include: Optimizing National Strategies for Financial Education Crafting Policies that Address Inequality in Saving, Wealth, and Economic Opportunities Investor Knowledge and Behaviors in Times of Crisis Increasing Financial Knowledge for Better Rebuilding Designing an Inclusive Recovery Millennials: Buttressing a Generation at Risk

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

Resources

Handouts, slides, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Process map: Virtual Self-File model overview

Time-stamps for the video recording:

4:01 – Agenda and introductions

5:59 – Audience polls

10:27 – Project introduction (Speaker: Ana Fremont, Prosper Canada)

14:31 – Tour of TurboTax for Tax Clinics (Speaker: Guy Labelle, Intuit)

17:59 – Woodgreen project pilot (Speaker: Ansley Dawson, Woodgreen Community Services)

27:35 – EBO 2-step process (Speaker: Marc D’Orgeville, EBO)

39:26 – Woodgreen program modifications (Speaker: Ansley Dawson, Woodgreen)

46:03 – Q&A

Real Money, Real Experts Podcasts

Real Money, Real Experts is a personal finance podcast written and produced by AFCPE (Association for Financial Counseling & Planning Education). Their membership community offers a place for financial counsellors and financial fitness coaches to share best practices, solve similar struggles, and access tools and resources. Recent episodes include the following topics:

Resources

Handouts, slides, and time-stamps

Managing Financial Health in Challenging Times

Managing financial health is difficult during ordinary times—and especially so in challenging times like the ones we're currently facing. Guest speaker RuthAnne Corley, the Senior Stakeholder Engagement Officer with the Financial Consumer Agency of Canada (FCAC), discusses how to manage your financial health despite external challenges. RuthAnne joined FCAC in 2015 where she’s been instrumental in the development of Canada’s "National Strategy for Financial Literacy - Count me in, Canada" and its implementation. Prior to joining FCAC in 2015, RuthAnne managed stakeholder engagement and outreach activities at numerous federal departments and agencies.

Budgeting resources webinar

This webinar hosted by Credit Canada features guest expert Prosper Canada's Manager of Learning and Training, Glenna Harris. She shares some of their tried-and-true resources to help get people started on budgeting and debt management. She also provides a new tool - Financial Relief Navigator - that can help connect people with income supports they might be eligible for.

Pressure Creates Diamonds: Money Management During Coronavirus

The town hall with CFPB Director Kraninger and Pro Linebacker Brandon Copeland includes steps, and tools to help people plan and persevere during financial challenges. The page also includes access to free resources on a number of topics including mortgage help, dealing with student loans, paying bills, building savings and more.

Four Actions That Can Hurt Credit Scores

During the Four Actions that Can Hurt Credit Scores webinar, you'll learn about: Their guest speaker is Julie Kuzmic, the Director of Consumer Advocacy at Equifax Canada, and a recognized authority on consumer credit. In her role leading consumer advocacy within the organization, Julie helps Canadians build credit confidence.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

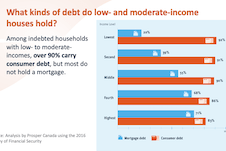

Report: Roadblock to recovery: Consumer debt of low- and moderate-income Canadian households in the time of COVID-19 (Prosper Canada)

Survey results: Canadians with incomes under $40K bearing the financial brunt of COVID-19 (Leger and Prosper Canada)

Time-stamps for the video recording:

4:42 – Agenda and introductions

7:52 – Audience polls

10:55 – Researching consumer debt (Speaker: Alex Bucik)

18:55 – How much does debt cost? (Speaker: Alex Bucik)

23:17 – How do different kinds of debt work? (Speaker: Alex Bucik)

29:17 – What are people using their credit for? (Speaker: Vivian Odu)

40:49 – What help is available to Canadian borrowers? (Speaker: Alex Bucik)

45:22 – Q&A

Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help

More than 44 million people in America have taken on student debt to pursue a post-secondary education. These borrowers collectively owe around $1.6 trillion in student loan debt. Borrowers exist in every community, but some are particularly vulnerable to its impact. Women hold two-thirds of all outstanding student debt and Black and Latinx borrowers disproportionately struggle with repayment. This webinar discussed the disparate impact of student loan debt on black and Latinx students and the following topics:

Resources

Webinar series on remote program delivery

A series of webinars hosted by ABC Life Literacy Canada to support literacy practitioners across the country to implement remote program delivery. Topics include:

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

Online financial tools and calculators (Prosper Canada)

Virtual tools for participant engagement (Prosper Canada)

Online delivery check-list (Momentum)

Jeopardy game template (SEED)

Time-stamps for the video recording:

3:26 – Agenda and introductions

5:10 – Audience polls

8:19 – Virtual delivery considerations (Speaker: Glenna Harris, Prosper Canada)

12:39 – Virtual workshops best practices (Speaker: Fatima Esmail, Momentum)

33:12 – Online money management training (Speaker: Millie Acuna, SEED)

49:07 – Q&A

From the Margins to Center: Responding to COVID-19 with an Equity and Gender Lens

On June 30th, AFN presented an Expert Insights briefing on what it takes to center women of color in the relief, recovery, and rebuild plans for the current health and economic crisis and beyond. The speaker is Dominique Derbigny, deputy director of Closing the Women’s Wealth Gap (CWWG) and author of the report, On the Margins: Economic Security for Women of Color through the Coronavirus Crisis and Beyond. Learn why women of color are suffering severely from the COVID-19 public health and economic crisis, opportunities to advance gender economic equity in near-term recovery efforts, and possible strategies to prevent wealth extraction and foster long-term economic security for women of color.

Expert Insights: Preventing Evictions in Communities of Color During COVID-19

COVID-19 is radically reshaping many aspects of people’s financial health in America, including their housing security. The economic fallout is disproportionately impacting communities of color due to systemic inequities related to race, housing, employment, and more. As the protections put in place at the start of the pandemic fade away, the United States are facing an eviction tsunami that will disparately displace Black and Latinx families. On August 25, AFN’s summer Expert Insights briefed attendees on rental risks and evictions related to COVID-19. Speakers were Solomon Greene with The Urban Institute and Dr. Christie Cade of NeighborWorks America.

Five good ideas for remote client service work

Employer Solutions: From Emergency to Resiliency

In light of COVID-19, the financial security of workers has never been more in question. The workplace is an important delivery channel for tailored financial products and services that can help meet employee’s immediate financial needs and build long-term financial stability. The workplace is a unique platform to identify, target, and meet the specific financial needs of employees. This webinar gives funders the tools and inspiration to respond effectively to the low- and moderate-income workforce in this moment and beyond.

Are charities ready for social finance? Investment readiness in Canada’s charitable sector

While social finance could have a transformative impact on the funding and financial landscape, relatively little is understood about its implications for charities. This webinar presents the results of a national survey of over 1,000 registered charities undertaken by Imagine Canada to better understand charities’ current readiness to participate in Canada’s growing social finance market

Keys to financial inclusion (podcast series)

The Center for Disability-Inclusive Community Development’s (CDICD) Keys to Financial Inclusion podcast series brings awareness to disability-inclusive community development. The CDICD works to improve the financial health and well-being of low- and moderate-income (LMI) individuals with disabilities and their families by increasing awareness and usage of opportunities available under the Community Reinvestment Act.

Présentation de l’Explorateur d’allègements financiers (EAF)

L’Explorateur d’allègements financiers : un outil pour connaître les mesures d’aide et d’allègement liées à la COVID-19 dont vos clients pourraient bénéficier En réponse à la pandémie de COVID-19 et en raison de la complexité des mesures d’aide et d’allègement offertes à la population canadienne, nous avons créé l’Explorateur d’allègements financiers (EAF), un outil en ligne qui aide les gens vulnérables au Canada et ceux qui les accompagnent à accéder aux mesures d’aide d’urgence et d’allègement financier proposées par les gouvernements, les établissements financiers, les fournisseurs de services de télécommunication, de services publics et de services Internet. Soyez des nôtres pour assister à notre webinaire d’une heure animé par Elodie Young, de Prospérité Canada, qui vous présentera l’EAF et vous donnera des conseils sur la manière d’aider vos clients à accéder aux mesures d’aide et d’allègement financier. Que vous travailliez dans le secteur de la salubrité des aliments, de la santé mentale, de l'autonomisation financière, de l’établissement ou encore dans le secteur privé, venez apprendre comment aider vos clients à augmenter leur revenu et à réduire leurs dépenses pendant la crise. Ce webinaire concerne tous les fournisseurs de services de première ligne qui gagnent un faible revenu et les populations vulnérables du Canada.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar

Introducing the Financial Relief Navigator (FRN)

Access the Financial Relief Navigator here.

Time-stamps for the video recording:

3:22 – Agenda and Introductions

6:00 – Audience poll

9:00 – Why we created the Financial Relief Navigator (Speaker: Janet Flynn)

11:55 – What’s in the Financial Relief Navigator (Speaker: Janet Flynn)

16:35 – FRN Walkthrough using a Persona (Speaker: Galen McLusky)

33:15 – Tips for using the FRN (Speaker: Galen McLusky)

36:00 – The Working Centre experience using the FRN (Speaker: Sue Collison)

41:15 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

How Savings Circles Works

Information about the Strive program

Time-stamps for the video recording:

3:35 – Agenda and introductions

6:00 – Audience polls

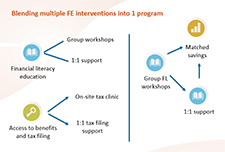

10:58 – Financial empowerment interventions (Speaker: Glenna Harris)

14:00 – Savings Circles program at Momentum (Speaker: Anna Jordan)

33:18 – Strive program (Speaker: Monica daPonte)

55:50 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Access the handouts for this webinar:

Poster presentation: Financial Empowerment for Newcomers project

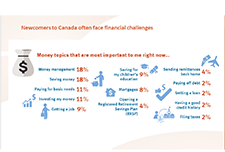

Infographics: Newcomer settlement stages, money matters, and client personas

Time-stamps for the video recording:

3:11 – Agenda and introductions

5:21 – Audience poll

8:25 – Introduction to Financial Empowerment for Newcomers project (Speaker: Glenna Harris)

11:25 – AXIS financial coaching program (Speaker: Sheri Abbot)

30:05 – North York Community House financial coaching program (Speaker: Noemi Garcia)

45:40 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar:

- Prosper Canada: Webinar introduction / Improving the Benefits Screening Tool

- Bridgeable: Introduction to Service Design

Bridgeable’s handouts for this webinar:

Key takeaways for Service Design

Prosper Canada’s handouts for this webinar:

Benefits Screening Tool Phase 2 report

Pathways to benefits

Client Journey Map for ODSP application

Practitioner Workflows

Time-stamps for the video recording:

3:14 – Agenda and introductions

5:51 – Audience polls

9:19 – All about service design (Speaker: Glenna Harris)

11:00 – Bridgeable: Introduction to service design (Speakers: Bonnie Tang and Minyan Wong)

35:00 – Benefits Screening tool design process (Speaker: Trisha Islam)

50:20 – Q&A

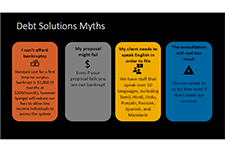

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Access the handouts for this webinar:

How we help people – An overview (Webinar handout) – Credit Counselling Society

Our services (Webinar handout) – Credit Counselling Society

Debt solutions 101 (Webinar handout) – msi Spergel Inc

Time-stamps for the video-recording:

4:13 – Agenda and introductions

7:00 – Audience polls

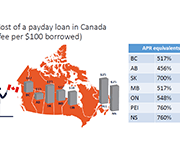

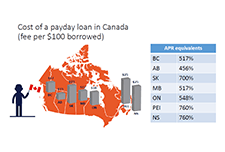

12:31 – Debt in Canada (Speaker: Glenna Harris)

15:20 – Credit Counselling Society on debt management plans (Speaker: Anne Arbour)

34:05 – Spergel Msi on Consumer Proposals and Bankruptcy plans (Speaker: Gillian Goldblatt)

56:00 – Q&A

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Handouts for this webinar:

Tax time insights research report – webinar handout (Prosper Canada)

Income tax checklist – webinar handout (The Working Centre)

Form for missing income information – webinar handout (The Working Centre)

Income tax return summary sheet – webinar handout (The Working Centre)

Host checklist for tax clinics – webinar handout (The Working Centre)

Forms for rental information – webinar handout (The Working Centre)

Referral to FEPS – webinar handout (The Working Centre)

Time-stamps for the video-recording:

3:10 – Introductions and Agenda

6:32 – Audience polls

10:52 – Tax time insights: Experiences of people living on low incomes (Speaker: Nirupa Varatharasan)

26:00 – The Working Centre tax clinic experiences (Speaker: Jen Smerdon)

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

Brief: Matched Savings programs – webinar handout (Momentum)

Matched Savings programs chart – webinar handout (Momentum)

Budget Tracker – webinar handout (Credit Counselling Sudbury)

Monthly Budget – webinar handout (Credit Counselling Sudbury)

Time-stamps for the video-recording:

3:26 – Agenda and introduction

6:17 – Audience polls

9:41 – Reasons to save (Speaker: Glenna Harris)

12:08 – Effectiveness of Matched Savings (Speaker: Dean Estrella from Momentum)

32:10 – Savings strategies for clients on low incomes (Speaker: John Cockburn from Credit Counselling Sudbury)

47:50 – Q&A

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

RESP case plan – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP tracking sheet – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP quick reference sheet – webinar handout (from FSGV)

RESP sample letter to schools – webinar handout (from Credit Counselling Sault Ste. Marie)

Time-stamps for the video recording:

3:00 – Agenda and introductions

5:05 – Audience polls

9:00 – Importance of education savings (Speaker: Glenna Harris)

16:00 – Credit Counselling Services Sault Ste. Marie and District (Speaker: Allyson Schmidt)

33:00 – Family Services of Greater Vancouver (Speaker: Rocio Vasquez)

54:45 – Q&A