English

Introduction

Section Two: Protecting yourself

Section Three: Supporting Health and Well-being

Additional Resources

French

Introduction

Tresser la seconde mèche : se protéger

Tresser la troisième mèche : favoriser la santé et le bien-être

Tresser la troisième mèche : favoriser la santé et le bien-être

Activité 5 : Mon journal de bien-être financier

Activité 6 : Mon argent est une médecine

Activité 7 : Visualisez vos objectifs financiers

Activité 8 : Mon plan d’investissement

Activité 9 : Partagez vos rêves avec votre famille et vos amis

Ressources supplémentaires

English

The Embedded Financial Coaching Pilot

The resources below introduce the Embedded Financial Coaching model in the context of workforce programs. They are designed to generate the interest of financial empowerment service providers and workforce programs about the promising possibilities of this model. Future phases of the toolkit will assist with initial planning and implementation stages for embedding FE into workforce programs.

- The Embedded Financial Coaching Primer gives a quick overview of the “what” and “why” of embedding financial empowerment into workforce programs

- The Integrating Financial Coaching into Employment Services Landscape Scan summarizes the literature and promising practices from the USA.

- The Literature review summarizes the promising practices to improve participant retention for multi session interventions that lead to deeper financial wellbeing outcomes (for detailed summaries refer to additional resources section).

Learn more about embedding financial empowerment

Canadian Publications

Prosperity Gateways: Cities for financial empowerment – Building the case outlines evidence for embedding FE.

US Publications

The US Department of Health and Human Services through its Office of Planning. Research and Evaluation supported MEF Associates and the Urban Institute to conduct a large-scale research project of the over 15 years of integrating financial capability and workforce programming. As part of this research project two research reports are highly relevant for attempts to replicate integrated service delivery in the Canadian context. The first report is a literature synthesis on Integrating Financial Capability into Employment Services. The second report is a summary of the approaches, motivations and types of services and participant perspectives on integrated services Understanding Financial Capability Interventions within Employment-Related Contexts for Adults with Low Incomes.

The Local Initiatives Support Corporation runs over 100 Financial Opportunity Centres across the USA. These FOCs deliver integrated financial empowerment and employment programs. A 2016 study evaluated the impacts of integrated service delivery… more recently LISC developed an Implementation Academy.

In 2015 The Administration for Children and Families, a division of the US Department of Health and Human Services, in collaboration with the Prosperity Now developed Building Financial Capability: A Planning Guide for Integrated Services. This resource is technical guide for community-based organizations that serve low- and moderate-income individuals.

Additional resources: Literature summaries

Citi Financial Capability Demonstration Project

Matched Savings Account Program Study

Financial Coaching Impact Evaluation

Pathfinders Re-Entry Mentoring Program

CFPB Financial Coaching Strategy

GreenPath Virtual Financial Coaching Pilot

Understanding Family Engagement in Home Visiting: Literature Synthesis

Study on Efficacy of Health Coaching and an Electronic Health Management Program

French

Financier intégré dans le contexte des programmes pour la main-d’œuvre

Les ressources ci-dessous présentent le modèle d’accompagnement financier intégré dans le contexte des programmes pour la main-d’œuvre. Elles ont été créées dans le cadre du projet pilote d’accompagnement financier intégré et sont destinées à susciter l’intérêt des fournisseurs de services d’autonomisation financière et des programmes d’emploi quant aux possibilités prometteuses du modèle. Les prochaines étapes de la trousse à outils contribueront à la planification initiale et aux étapes de mise en œuvre de l’intégration de l’éducation financière dans les programmes de formation de la main-d’œuvre.

- Le guide d’introduction à l’accompagnement financier intégré donne un aperçu du « quoi » et du « pourquoi » de l’intégration de l’autonomisation financière dans les programmes destinés à la main-d’œuvre.

- L’analyse documentaire sur l’intégration de l’accompagnement financier dans les programmes destinés à la main-d’œuvre présente une synthèse de la littérature et des pratiques prometteuses des États-Unis, ainsi que des connaissances acquises par les partenaires du projet d’accompagnement financier intégré.

- La revue de la littérature résume les pratiques prometteuses pour améliorer la rétention des participants dans le cadre d’interventions en plusieurs séances qui mènent à des résultats plus profonds en matière de bien-être financier.

En savoir plus sur l’intégration de l’autonomisation financière

Publications canadiennes

Sur la voie de la prospérité : les villes pour l’autonomisation financière (en anglais seulement)— Le dossier présente des données relatives à l’intégration de l’éducation financière.

Publications américaines

Le ministère de la Santé et des Services sociaux des États-Unis, par l’intermédiaire de son bureau de la planification, de la recherche et de l’évaluation a soutenu le cabinet MEF Associates et l’Urban Institute pour mener un projet de recherche de grande envergure (en anglais seulement) portant sur l’intégration des programmes de capacité financière et de main-d’œuvre sur une période de plus de 15 ans. Dans le cadre de ce projet de recherche, deux rapports de recherche sont très pertinents pour les tentatives de reproduction de la prestation de services intégrés dans le contexte canadien. Le premier rapport est une synthèse de la littérature sur l’intégration de la capacité financière dans les services d’emploi (en anglais seulement). Le deuxième rapport est un résumé des approches, des motivations et des types de services, ainsi que des points de vue des participants sur les services intégrés : Comprendre les interventions en matière de capacité financière dans les contextes liés à l’emploi pour les adultes ayant de faibles revenus (en anglais seulement).

La Local Initiatives Support Corporation (LISC) gère plus de 120 centres de ressources financières (Financial Opportunity CenterMD — FOC) à travers les États-Unis. Ces centres FOC proposent des programmes intégrés d’autonomisation financière et d’emploi depuis 2005. Une étude de 2016 a évalué les impacts de la prestation de services intégrés… La LISC a mis en œuvre un centre de ressources en ligne (en anglais seulement) pour les praticiens, qui comprend des ressources sur la prestation de services, l’accompagnement financier, leur système de gestion des clients Salesforce, ainsi que sur les opérations et l’administration. Récemment, la LISC a publié un résumé des résultats (en anglais seulement) à propos d’une académie de mise en œuvre visant à former les organismes de main-d’œuvre sur la façon d’intégrer l’accompagnement financier individuel dans leur modèle de prestation de services existant.

En 2015, l’Administration for Children and Families, une division du ministère de la Santé et des Services sociaux des États-Unis, en collaboration avec Prosperity Now, a élaboré le Guide de planification pour les services intégrés : Renforcer la capacité financière. Cette ressource est un guide technique destiné aux organismes communautaires qui s’occupent des personnes ayant de faibles revenus ou des revenus modestes.

Ressources Additionnelles : La synthèse de la littérature

Projet de démonstration de la capacité financière de Citi

L’étude portant sur le programme de compte d’épargne jumelée

L’évaluation portant sur les répercussions de l’accompagnement financier

Programme de mentorat pour la réintégration de l’organisme Pathfinders

Projet pilote d’accompagnement financier virtuel de GreenPath

L’efficacité de l’accompagnement en matière de sante et d’un programme de gestion en cyber santé

The mastering money podcast

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help prepare you for retirement and give you the tools to get there, no matter your age. Season 5 of the Mastering Money podcast unpacks the hard financial conversations you need to be having with your kids, partners, financial planners and more. Season 4 of the Mastering Money podcast explores the role money plays in the lives of women from all walks of life, now and in the future. Season 3 of the Mastering Money podcast looks at the difficult financial decisions Canadians are making during the ongoing COVID-19 pandemic. Season 2 of the podcast takes listeners on a journey across various financial literacy hot topics and trends. These include how to fit financial literacy into existing programs, the financial health of future generations as well what it takes to take the plunge and start your own business. In this introductory season of the podcast, hear from financial educators on topics such as behavioral economics, the emotions of money, financial wellness, and more.

More Canadians are finding it difficult to meet food, shelter and other necessary expenses

In 2022, the Consumer Price Index rose 6.8%, the highest increase since 1982 (+10.9%). Prices for day-to-day goods and services such as transportation (+10.6%), food (+8.9%) and shelter (+6.9%) rose the most. Canadians felt the impact of rising prices. Data from the Canadian Social Survey (CSS) show that the share of persons aged 15 and older living in a household experiencing difficulty meeting its necessary expenses trended upward from just under one-fifth (19%) in the summer of 2021 to just under one-quarter (24%) in the summer of 2022. By the end of 2022, more than one-third (35%) of the population lived in such a household.

Research to help FSRA improve the lives of vulnerable consumers

Financial Services Regulatory Authority of Ontario commissioned a research study that focused on consumer attitudes, how consumers are engaging with financial services, and consumer characteristics such as vulnerability. Insights from the research are allowing FSRA to better understand the realities of consumers’ changing financial lives and helping to identify key opportunities to respond to the needs of vulnerable consumers. 2022 Consumer Research Study highlights. 2022 Consumer Research Study full report

Resources

Presentation slides, handouts, and video time stamps

Read the presentation slides for this webinar.

Download resources provided by webinar speakers:

Time-stamps for the video recording:

3:24 – Agenda and Introductions

6:36 – Audience poll questions

9:33 – FAIR Canada presentation (speaker: Tasmin Waley)

24:07 – Ontario Securities Commission presentation (speaker: Christine Allum)

39:10 – Investor Protection Clinic at Osgoode Hall Law School (speaker: Brigitte Catellier)

51:34 – Q&A

Canadian Institute for Social Prescribing

The Canadian Institute for Social Prescribing (CISP) is a new national hub to link people and share practices that connect people to community-based supports and services that can help improve their health and wellbeing.

Financial wellness tools

The National Disability Institute's Financial Wellness Toolkit is full of free resources for disability service providers, nonprofits, financial professionals and municipalities, including Financial Education Handouts and Quick Reference Guides. This infographic highlights income, banking and credit inequality based on disability, race and ethnicity.

English

For frontline staff - Quick tools you can use with clients

Starting the conversation

Here are 7 questions to help you start a conversation about money with your client. Based on what you learn about your clients’ needs, the remaining links on this page to help you find answers and next steps.

Try this coaching readiness checklist to help your client ascertain if they have the time and are interested in receiving financial coaching.

Worksheets & tip sheets

Here are some “go to” worksheets and tip sheets that frontline staff have found very helpful with their clients. They focus on budgeting, saving, and debt management – common FE needs that come up. Try them out for yourself first and see which ones might work for your clients.

The Budget Spreadsheet is an excellent tool for capturing the full picture of an individual’s financial picture. The individual inputs information according to different categories and the tool calculates totals in a summary page to show how much money is left over at the end of the month. [Thunder Bay Counselling]

The Simple budget template is an alternative monthly budget tool clients can use. It includes links to an Income tracking worksheet and Expenses tracking worksheet. [Prosper Canada / Trove]

The Urgent vs Important worksheet can help clients prioritize their spending. This, in turn, can help them save or “find money” for necessary expenses. [Prosper Canada / Trove]

Knowing how to set a SMART goal is important for planning and achieving targets. In the Set a SMART financial goal, clients learn what a SMART goal is and write SMART financial goals that are important to them. [Prosper Canada / Trove]

Making a spending plan is a worksheet clients can use to create a spending plan for each week based on money coming in and out each month. [Prosper Canada / Trove]

Making a debt action plan is a worksheet to help your clients get a handle on their debt. [Prosper Canada / Trove]

Tips for Managing Debt and Bills is a reference sheet you can give clients during tough times when managing cash flow is a challenge.

Prioritizing bills helps clients prioritize what bills to pay when it’s not possible to pay for everything. Note that this tool is from the Consumer Financial Protection Bureau (CFPB), an American government agency and includes a link to their website. Let clients know the information on the website is geared to the US context. [Consumer Financial Protection Bureau]

Online sites and tools

Here are great online tools you can also share and use in your FE work with clients.

Benefits wayfinder [benefitswayfinder.org]

Support with access to benefits is another powerful FE intervention. The Benefits wayfinder is a simple, easy to use, plain language tool that helps people on low and modest incomes find and track benefits they could get. Clients can use it on their own or with your support.

Read the Benefits wayfinder fact sheet to learn more.

Then watch the How to use this tool video. It highlights and demonstrates how to navigate through the key features of the tool.

If you would like additional training on how to support your clients with access to benefits and use the Benefits wayfinder tool in your money conversations, you can sign up for Prosper Canada’s self-directed online course and/or live workshop.

Trove [yourtrove.org]

Trove is a free bilingual website that clients can visit on their own or with your support. Many of the tools you were introduced to above can be found on Trove, along with a wealth of other user-friendly financial tools, worksheets, and education information to help clients take charge of their spending, learn about tax filing and benefits, and manage debt.

Along with a link to the Benefits wayfinder, you can also find these online tools:

- My money in Canada is a website that can help clients build healthy money habits with simple, easy to use learning modules on a range of money topics. The site also includes videos and a financial wellness checklist for clients.

- The RDSP Calculator for Canadians can be used to assess the potential of opening and contributing to a Registered Disability Savings Plan.

For managers - Tools for getting started with financial empowerment

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Tool 1. Making the case for financial empowerment

For FE to be successful, it’s critical to get buy-in from staff and stakeholders.

Below are great resources to share with key players who are new to FE. They can help you get others quickly up to speed on what FE is and the value of embedding FE as you onboard them or work to build interest in FE in your municipality.

- Prosperity Gateways Primer gives a quick overview of the “what” and “why” of embedding FE into municipal services.

- FE Brochure provides a more detailed introduction to FE and embedding FE.

- Here are three case examples you can use to show the powerful impact embedding FE into municipal services can have:

- Case example: York region

- Case example: TESS

- Case example: Edmonton

Tool 2. Getting started: the internal scan

Take the time to learn about common FE interventions. Then, assess conditions, capacity and considerations in your municipality for providing these kinds of financial help to your clients.

This tool guides you through an internal scan as you envision what embedding FE might look like in your service delivery context. Consider Tool 2: Getting started: the internal scan a starting point that will continue to evolve as you move through the process.

Tool 3. Exploring partnerships: the external scan

Municipalities do not have to deliver FE supports themselves to turn their services into Prosperity Gateways. In many cases, especially at the outset, it may be more cost-effective and less resource intensive to establish referral pathways to other local service providers or to partner with non-profit organizations, foundations, or financial service providers to deliver the financial help to meet your clients’ needs.

Use Tool 3: Exploring collaborations and partnerships to perform a scan of FE services in your local community and identify potential collaborations and partnerships.

Two additional partnership resources are ‘Elements of Integration‘ and ‘Partnership Tip Sheet‘

Tool 4. Designing the initiative: the service blueprint

Having completed an internal and external scan of barriers and opportunities, you are now ready to design an FE initiative to suit your municipality’s context. Designing the initiative is an important phase where you work out the service model, clarify partnerships, and imagine the ideal client experience.

Tool 4: Designing the initiative guides you through choosing the best service delivery model for your context and designing the client and staff journey.

We hope this toolkit will grow and improve with use and feedback. Current ideas for upcoming tools include:

- Understanding your clients’ financial capability

- Building a successful team

- Supporting staff for success

- Setting up effective data collection and evaluation processes

Tool 5. Designing the initiative: a shadowing guide

Tool 5: A shadowing guide can help frontline staff understand the process from intake to service delivery.

Feedback / Suggestions

We’d love to hear your feedback and suggestions for tools that you would find useful. Please email: [email protected].

Learn more about FE

Canadian Publications

Prosperity Gateways: Cities for financial empowerment – Building the case outlines evidence for embedding FE.

Read the report How financial empowerment services are helping Ontarians build financial health for more supporting evidence and personal stories.

Financial Empowerment – What is it and how it helps reduce poverty [national] suggests that FE is a critical missing piece of federal government policy that can significantly boost client outcomes when it is embedded into other programs and services.

Financial Empowerment – What is it and how it helps reduce poverty [Alberta] provides an overview of provincial government action on FE in Alberta. The Alberta government adapted the national document (by the same name) to use in their internal discussions with municipal decision-makers. Create a document that you can use for your internal discussions using this as an example.

U.S. Publications

The municipal integration of FE in Canada is grounded in influential work in the US by the Cities for Financial Empowerment (CFE) Fund. Launched in 2012 in New York the CFE Fund showed that embedding FE strategies into local government infrastructure can have a “supervitamin effect” on public programs, increasing the financial stability of low to moderate income households.

- Read the pioneering article: “Municipal Financial Empowerment: A Supervitamin for Public Programs”

- Learn more about their Financial Empowerment Centers model in this 4-minute video

- Visit their website to see resources and sign up for their quarterly newsletter

- See a three-year evaluation of the model in 5 cities across the US. “An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service”

The Urban Institute examined the cost of residents’ financial insecurity to city budgets in 10 American cities in this 2017 research. Across these cities, the costs range from the tens to hundreds of millions of dollars, suggesting that cities have an economic interest in improving their residents’ financial health.

A report by JP Morgan Chase reviews municipal efforts to integrate financial capability into public services in several US locations in “A Scan of Municipal Financial Capability Efforts.”

French

Pour le personnel de première ligne — Outils rapides que vous pouvez utiliser avec les clients

Amorcer la conversation

Voici sept questions qui vous aideront à entamer une conversation à propos de l’argent avec votre client. En fonction de ce que vous avez appris sur les besoins de vos clients, les autres liens de cette page vous aideront à trouver des réponses et à connaître les prochaines étapes.

Utilisez cette liste de vérification pour aider votre client à décider s’il a le temps et s’il souhaite recevoir un accompagnement financier.

Fiches de travail et fiches de conseils

Voici quelques feuilles de travail et des feuilles de conseils que le personnel de première ligne a trouvé très utiles pour ses clients. Elles portent principalement sur la planification budgétaire, l’épargne et la gestion des dettes — les besoins courants en matière d’AF qui se présentent. Essayez-les d’abord pour vous-même et voyez ceux qui pourraient convenir à vos clients.

La feuille de calcul du budget (anglais seulement) est un excellent outil pour saisir le portrait complet de la situation financière d’un individu. La personne saisit les données selon différentes catégories et l’outil calcule les totaux dans une page de synthèse pour montrer combien d’argent il reste à la fin du mois. [Thunder Bay Counselling]

Le modèle de budget simple est un outil alternatif de budget mensuel que les clients peuvent utiliser. Il comprend des liens vers une feuille de calcul de suivi des revenus et une feuille de calcul de suivi des dépenses. [Prospérité Canada/Trove]

La feuille de calcul Urgent versus Important peut aider les clients à établir des priorités dans leurs dépenses. Cela peut ensuite les aider à économiser ou à « trouver de l’argent » pour les dépenses nécessaires. [Prospérité Canada/Trove]

Il est important de savoir comment établir un objectif INTELLIGENT pour mettre en place et atteindre des objectifs. Avec l’outil Comment établir des objectifs financiers INTELLIGENTS, les clients apprennent ce qu’est un objectif INTELLIGENT et choisissent des objectifs financiers INTELLIGENTS qui sont importants pour eux. [Prospérité Canada/Trove]

La feuille de calcul Comment établir un plan de dépenses est un outil que les clients peuvent utiliser pour créer un plan de dépenses pour chaque semaine en fonction des entrées et sorties d’argent du mois. [Prospérité Canada/Trove]

La feuille de calcul Élaboration d’un plan d’action en matière de dettes est un outil pour aider vos clients à prendre le contrôle sur leurs dettes. [Prospérité Canada/Trove]

Conseils pour la gestion des dettes et des factures est une feuille de référence que vous pouvez donner à vos clients dans les moments difficiles où la gestion des fonds est un défi.

Le classement des factures par ordre de priorité (anglais seulement) aide les clients à déterminer les factures à payer en premier lorsqu’il n’est pas possible de tout payer. Notez que cet outil provient du Consumer Financial Protection Bureau (CFPB), une agence gouvernementale américaine, et comprend un lien vers son site Web. Expliquez aux clients que les renseignements figurant sur le site Web sont adaptés au contexte américain. [Consumer Financial Protection Bureau]

Sites et outils en ligne

Voici d’excellents outils en ligne que vous pouvez également faire connaître et utiliser dans votre travail en matière d’AF avec les clients.

Orienteur en mesures d’aide [benefitswayfinder.org/fr]

L’aide à l’accès aux mesures d’aide est une autre façon puissante d’intervenir en matière d’AF. L’Orienteur en mesures d’aide est un outil simple, facile à utiliser et rédigé en langage clair qui aide les personnes à revenus faibles ou modestes à trouver et à répertorier les mesures d’aide auxquelles elles peuvent prétendre. Les clients peuvent l’utiliser seuls ou avec votre aide.

Pour en savoir plus, lisez la fiche d’information sur l’Orienteur en mesures d’aide. (anglais seulement)

Ensuite, regardez la vidéo Comment utiliser cet outil (anglais seulement). Elle explique et démontre comment naviguer à travers les principales caractéristiques de l’outil.

Si vous souhaitez obtenir une formation supplémentaire sur la façon d’aider vos clients à accéder aux mesures d’aide et d’utiliser l’Orienteur en mesures d’aide dans vos conversations au sujet de l’argent, vous pouvez vous inscrire au cours autodidacte en ligne ou à l’atelier en direct de Prospérité Canada.

Trove [yourtrove.org/fr]

Trove est un site Web bilingue gratuit que les clients peuvent visiter par eux-mêmes ou avec votre aide. La plupart des outils qui vous ont été présentés ci-dessus se trouvent sur Trove, ainsi qu’une multitude d’autres outils financiers conviviaux, des feuilles de calcul et des renseignements éducatifs pour aider les clients à prendre en charge leurs dépenses, à se renseigner sur la déclaration et les avantages fiscaux et à gérer leurs dettes.

En plus d’un lien vers l’Orienteur en mesures d’aide, vous trouverez également ces outils en ligne :

- Mon argent au Canada est un site Web qui peut aider les clients à acquérir de bonnes habitudes en matière de gestion de l’argent grâce à des modules d’apprentissage simples et faciles à utiliser sur toute une série de sujets liés à l’argent. Le site comprend également des vidéos (anglais seulement) et un questionnaire relatif au bien-être financier pour les clients.

- La calculatrice du REEI pour les Canadiens peut être utilisée pour évaluer la possibilité d’ouvrir et de cotiser à un régime enregistré d’épargne-invalidité.

Pour les gestionnaires — Outils pour démarrer avec l’autonomisation financière

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Outil 1. Argumenter en faveur de l’autonomisation financière.

Pour que l’AF soit un succès, il est essentiel d’obtenir l’adhésion du personnel et des intervenants.

Vous trouverez ci-dessous d’excellentes ressources à faire connaître aux acteurs clés qui ne connaissent pas encore l’AF. Elles peuvent vous aider à faire comprendre rapidement aux autres ce qu’est l’AF et la pertinence d’intégrer l’AF lorsque vous les accueillez ou lorsque vous travaillez à susciter l’intérêt pour l’AF dans votre municipalité.

● L’abécédaire des passerelles pour la prospérité (anglais seulement) donne un aperçu de « qu’est-ce que c’est » et du « pourquoi » au sujet de l’intégration de l’AF dans les services municipaux.

● La brochure de l’AF (anglais seulement) fournit une introduction plus détaillée à l’AF et à l’intégration de l’AF.

● Voici trois exemples de cas que vous pouvez utiliser pour montrer l’impact puissant que peut avoir l’intégration de l’AF dans les services municipaux :

o Exemple de cas : Région de York

o Exemple de cas : Services sociaux et d’emploi de Toronto

o Exemple de cas : Edmonton

Outil 2. Commencer : l’analyse interne

Prenez le temps de vous renseigner sur les types d’interventions courantes en matière d’AF. Ensuite, évaluez les conditions, la capacité et les considérations dans votre municipalité pour fournir ces types d’aide financière à vos clients.

Cet outil vous guide à travers une analyse interne qui vous permet d’envisager ce que pourrait être l’intégration de l’AF dans votre contexte de prestation de services.

Considérez l’outil 2 : Commencer : l’analyse interne un point de départ qui continuera à évoluer à mesure que vous avancerez dans le processus.

Outil 3. Explorer les partenariats : l’analyse externe

Les municipalités ne sont pas obligées de fournir elles-mêmes des mesures d’aides en matière d’AF pour transformer leurs services en passerelles pour la prospérité. Dans de nombreux cas, surtout au début, il peut être plus rentable et moins exigeant sur le plan des ressources d’établir des liens de référence vers d’autres prestataires de services locaux ou de s’associer à des organismes à but non lucratif, des fondations ou des prestataires de services financiers pour fournir l’aide financière répondant aux besoins de vos clients.

Utilisez l’outil 3 : Explorer les collaborations et les partenariats pour effectuer une analyse des services en matière d’AF dans votre communauté locale et identifier les collaborations et partenariats potentiels.

Deux autres ressources à propos du partenariat sont les « Éléments de l’intégration » et les « Conseils pour le partenariat » .

Outil 4. Concevoir l’initiative : le plan de service

Après avoir effectué une analyse interne et externe des obstacles et des opportunités, vous êtes maintenant prêt à concevoir une initiative d’AF adaptée au contexte de votre municipalité. La conception de l’initiative est une phase importante où vous élaborez le modèle de service, clarifiez les partenariats et imaginez l’expérience client idéale.

L’outil 4 : Conception de l’initiative vous guide dans le choix du meilleur modèle de prestation de services pour votre contexte et dans la conception du parcours du client et du personnel.

Nous espérons que cette boîte à outils se développera et s’améliorera avec l’utilisation et les commentaires. Les idées actuelles pour les outils à venir incluent :

- Comprendrela capacité financière de vos clients

- Mettresur pied une équipe performante

- Soutenirle personnel pour qu’il réussisse

- Mettreen place des processus efficaces de collecte de données et d’évaluation

Outil 5. Concevoir l’initiative : un guide d’observation

L’outil 5 : Un guide d’observation peut aider le personnel de première ligne à comprendre le processus, de l’accueil à la mise en œuvre du service.

Commentaires et suggestions

Nous serions ravis d’entendre vos commentaires et vos suggestions d’outils que vous trouveriez utiles. Veuillez nous envoyer un courriel : [email protected].

En savoir plus en matière d’AF

Publications canadiennes

Passerelles de prospérité : Les villes pour l’autonomisation financière — établir le dossier (anglais seulement) décrit les preuves qui sont pour l’intégration de l’AF.

Lisez le rapport intitulé Comment les services d’autonomisation financière aident les Ontariens à renforcer leur santé financière (anglais seulement) pour obtenir plus de preuves et de récits personnels.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [national] (anglais seulement) suggère que l’autonomisation financière est une pièce manquante essentielle de la politique du gouvernement fédéral qui peut considérablement améliorer les conditions de vie des clients lorsqu’elle est intégrée à d’autres programmes et services.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [Alberta] (anglais seulement) donne un aperçu de la démarche du gouvernement provincial en matière d’AF en Alberta. Le gouvernement de l’Alberta a adapté le document national (du même nom) pour l’utiliser dans ses discussions internes avec les décideurs municipaux. Créez un document que vous pourrez utiliser pour vos discussions internes en utilisant cet exemple.

Publications américaines

L’intégration municipale de l’AF au Canada est fondée sur les travaux influents réalisés aux États-Unis par le Fonds Cities for Financial Empowerment (CFE). Lancé en 2012 à New York, le Fonds CFE Fund a montré que l’intégration de stratégies d’AF dans l’infrastructure des gouvernements locaux peut avoir un « effet super vitaminé » sur les programmes publics, en augmentant la stabilité financière des ménages à revenu faible ou modéré.

- Lisez l’article pionnier : « Municipal Financial Empowerment: A Supervitamin for Public Programs » (anglais seulement)

- Apprenez-en davantage sur leur modèle de centres d’autonomisation financière (anglais seulement) dans cette vidéo de quatre minutes.

- Visitez leur site Web (anglais seulement) pour voir les ressources et vous inscrire à leur infolettre trimestrielle.

- Découvrez une évaluation de trois ans du modèle dans cinq villes des États-Unis. « An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service » (anglais seulement)

L’Urban Institute a examiné le coût de l’insécurité financière des résidents sur les budgets municipaux de dix villes américaines dans cette recherche de 2017 (anglais seulement). Dans ces villes, les coûts vont de dizaines à des centaines de millions de dollars, ce qui suggère que les villes ont un intérêt économique à améliorer la santé financière de leurs résidents.

Un rapport de JP Morgan Chase passe en revue les efforts déployés par les municipalités pour intégrer la capacité financière dans les services publics dans plusieurs villes américaines dans « A Scan of Municipal Financial Capability Efforts » (anglais seulement).

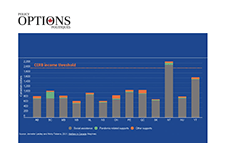

Singles in deep poverty neglected by pandemic supports

In 2020, the federal government spent over $160 billion on COVID-19 pandemic response measures. These expenses were critical in supporting recently unemployed workers and affected businesses in a time of uncertainty. However, supports through programs like the Canada Emergency Response Benefit (CERB) and the Canada Recovery Benefit (CRB) were not extended to those who had less attachment to the labour market, such as a large proportion of social assistance recipients. This pattern of exclusion has continued with the more recent Canada Worker Lockdown Benefit, which was created to support workers affected by new pandemic-related shutdowns, and not people who were already living in deep poverty before the pandemic. The pandemic benefits are intended to support people during a specific time of crisis — but what about those who have been living with low and insecure incomes for decades? This report analyzes the welfare incomes of 53 example households, divided into four types, focusing here on unattached singles considered employable, as they are the most likely to be living in poverty.

Start at the Beginning; a Person-Centered Design and Evaluation Framework for Policies to Boost Household Cashflow and Beyond

The financial hardships households faced in the midst of the pandemic reveals the scale of the precarity that millions of households were experiencing well before the crisis began. This highlights the urgency of the need to reimagine our system of benefits—both public and private—to effectively and equitably support households to recover from this pandemic and build security for the future. The Aspen Institute Financial Security Program (Aspen FSP)’s Benefits 21 initiative is dedicated to integrating and modernizing the American system of benefits to ensure all households have financial security and can live economically dignified lives.

Medical-Financial Partnerships: Cross-Sector Collaborations Between Medical and Financial Services to Improve Health

Financial stress is the root cause of many adverse health outcomes among poor and low-income children and their families, yet few clinical interventions have been developed to improve health by directly addressing patient and family finances. Medical-Financial Partnerships (MFPs) are novel cross-sector collaborations in which health care systems and financial service organizations work collaboratively to improve health by reducing patient financial stress, primarily in low-income communities. This paper describes the rationale for MFPs and examines eight established MFPs providing financial services.

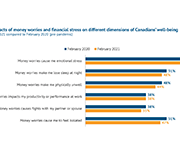

The Well-Being and Financial Well-Being of Canadians: financially vulnerable households the most challenged

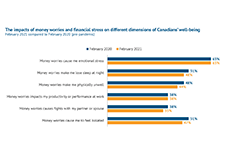

This brief discusses how more financially vulnerable Canadians are most challenged based on the Seymour Financial Resilience Index TM. This E-Brief builds on Statistics Canada Canadians' Well-being in Year One of the COVID-19 Pandemic report and Seymour’s February 2021 Index Release Summary.

Ganohonyohk (Giving Thanks): Indigenous Prosperity

The Ganohonyohk/Prosperity Research Project explored how seven Indigenous Friendship Centre communities in Ontario understood the concept of prosperity. The guiding research question of “How do urban Indigenous Friendship Centre communities in Ontario view a prosperous/wealthy life?” was used to gauge the meaning of prosperity through a community driven lens. This strength-based research explores culturally appropriate approaches to urban Indigenous prosperity and considers the role of Friendship Centres in promoting prosperity. It concludes that approaches to Indigenous prosperity need to be context-specific and allow for self-determination in establishing communities’ priorities.

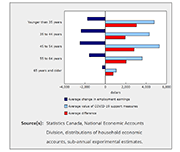

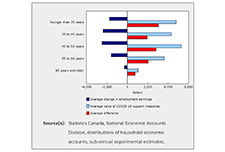

Household economic well-being during the COVID-19 pandemic, experimental estimates, fourth quarter 2020

A highlight of some of the findings reported in this briefing:

Why the Time is Right for a Guaranteed Income with an Equity Lens

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders involved in GI initiatives including practitioners, government representatives and philanthropy were heard. Panelists shared outcomes and new research results from some of the most successful GI pilots in the country (Stockton and Mississippi); goals for the newly launched Mayor’s for Guaranteed Income; how philanthropy can play a catalytic role and what this moment tells us about the future of guaranteed income initiatives.

Measuring the Financial Well-Being of Hispanics: 2018 Financial Well-Being Score Benchmarks

This report provides a foundational set of benchmarks of the financial well-being of Hispanics ages 18 and older in the United States in 2018, as measured by the CFPB Financial Well-Being Scale, that practitioners and researchers can use in their work. The benchmarks were developed using data from the FINRA Foundation’s 2018 National Financial Capability Survey. This report specifically shows financial well-being score patterns for Hispanic adults by socio-demographics, financial inclusion, safety nets, and financial literacy factors. The report highlights key findings in the data and the implications for organizations that are planning to use the benchmarks.

Nurturing Supporting Relationships: The Foundation to a Secure Future

This handbook provides a guide for actions to take when nurturing supporting relationships for people living with a disability.

Control, Sufficiency, and Social Support Lessons from Low-income Canadians about Financial Wellbeing

This report examines how diary participants achieve the financial wellbeing that they have. The evidence we found is that low-income people work very hard to manage their finances. They endeavor to control their finances so that, as one participant said, their finances don’t control them. They must prioritize needs and wants because there is not enough for both. One participant talked about her goal of having a ‘little bit more’ than her needs so that there was a little extra for savings or small purchases or trips. Finally, we saw that family and friends are terribly important for achieving financial wellbeing because social supports can provide loans, gifts, and emotional support. Having a low-income means that banks offer few financial supports. Of course, family and friends also make demands.

Impacts of the Covid-19 Pandemic on Women: Report of the Standing Committee on the Status of Women

The effects of the COVID-19 pandemic have been profound and far-reaching. Beyond endangering the health of Canadians, the pandemic has worsened inequalities among groups of people. Women, girls and gender-diverse people have faced unique challenges during the pandemic. The Committee recommends that the Government of Canada take various actions to assist women, girls and gender-diverse people during and after the COVID-19 pandemic. Many recommendations relate to improving women’s health and labour force participation. Some recommendations focus specifically on women’s paid and unpaid care work. The Committee also recommends interventions to help reduce trafficking and violence against women.

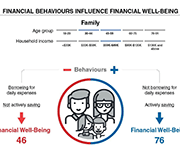

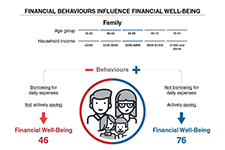

Financial Well-Being: A Conceptual Model and Preliminary Analysis

Based on an extensive literature review and re-analysis of existing qualitative data, this report offers a working definition and an a priori conceptual model of financial well-being and its possible determinants. Using survey data from Norway (2016), ten regression models have been conducted to identify the key drivers of financial well-being and enhance the understanding of the underlying mechanisms responsible for the unequal spread of well-being across the population. The preliminary analyses in this report were consistent with both the definition and the model, albeit with some nuances and unexplained effects. The empirical analysis identified three sub-domains of financial well-being. It was found that all three measures share three behaviours as their main drivers: ‘active saving’, ‘spending restraints’ and ‘not borrowing for daily expenses’. Also, ‘locus of control’ stood out as an important explanatory variable, with significant impacts on all three levels of well-being. Beyond that, some distinguishing characteristics were identified for each of the measures.

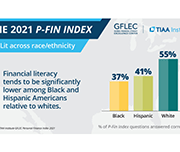

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index)

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) measures knowledge and understanding that enable sound financial decision making and effective management of personal finances among U.S. adults. The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with Greenwald & Associates. It is unique in its breadth of questions and its coverage of the topics that measure financial literacy. The index is based on responses to 28 questions across eight functional areas: earning, consuming, saving, investing, borrowing/managing debt, insuring, comprehending risk, and go-to information sources.

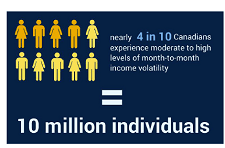

Growing household financial instability: Is income volatility the hidden culprit?

On March 9th, 2018, leading American and Canadian researchers and policy makers from all sectors gathered in Toronto to explore the question: Growing household financial instability: Is income volatility the hidden culprit? The policy research symposium was an invitational event co-hosted by the Investment Industry Regulatory Organization of Canada (IIROC) and Prosper Canada. Its purpose was to shine a light on an issue that has gained prominence in US economic and policy circles but was just emerging as a topic for exploration in Canada in the context of This report summarizes key insights, conclusions and next steps from the symposium in the hopes that it will inform, catalyse and support further action on this issue. To view the conference agenda and links to all conference presentations, please see Appendix 1. Presentation videos can be found online at

growing household financial instability.

https://www.youtube.com/playlist?list=PLC0J2kAG0MZZ5gd_6ZaHjqqEcenL2jCtP

Household economic well-being during the COVID-19 pandemic, experimental estimates, first quarter to third quarter of 2020

Over the first three quarters of 2020, disposable income for the lowest-income households increased 36.8%, more than for any other households. At the same time, the youngest households recorded the largest gain in their net worth (+9.8%). These changes were driven by unprecedented increases in transfers to households, as the value of government COVID-19 support measures exceeded losses in wages and salaries and self-employment income. As the pandemic unfolded in Canada, households experienced extraordinary changes in their economic well-being. While quarterly releases of gross domestic product and the national balance sheet provide an aggregate view of these impacts, new experimental sub-annual distributions of household economic accounts (DHEA), released today, provide insight into how the pandemic and the associated government support measures have affected the economic well-being of different groups of households in Canada.

Financial Well-being among Black and Hispanic Women

This paper provides an in-depth examination of the financial well-being of Black and Hispanic women and the factors contributing to it, using the 2018 wave of the National Financial Capability Study. Differences between Black and Hispanic women versus White women are documented, in that the former are more likely to face economic challenges that depress financial well-being. Controlling for differences in socio-demographic characteristics, there are important differences in the factors that contribute to financial well-being for Black and Hispanic women compared to White women. This includes distinct impacts of education, family structure, employment, and financial literacy. Results imply that extant financial education programs inadequately address the needs of Black and Hispanic women.

2020 Financial Literacy Annual Report

The 2020 Financial Literacy Annual Report details the United States' Bureau of Consumer Financial Protection's financial literacy strategy and activities to improve the financial literacy of consumers. Congress specifically charged the Bureau with conducting financial education programs and ensuring consumers receive timely and understandable information to make responsible decisions about financial transactions. Empowering consumers to help themselves, protect their own interests, and choose the financial products and services that best fit their needs is vital to preventing consumer harm and building financial well-being. Overall, this report describes the Bureau’s efforts in a broad range of financial literacy areas relevant to consumers’ financial lives. It highlights our work, including the Bureau's:

CPA Canada 2020 Canadian Finance Study

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these unprecedented times. Nielsen conducted the CPA Canada 2020 Canadian Finance Study via an online questionnaire, from September 4 to 16, 2020 with 2,008 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. Among the key pandemic-related findings:

Connecting to Reimagine: Money & COVID-19 webinar series

This webinar series released by the Global Financial Literacy Excellence Center (GFLEC) features speakers from the public, private, and academic sectors. Past and upcoming webinar topics include: Optimizing National Strategies for Financial Education Crafting Policies that Address Inequality in Saving, Wealth, and Economic Opportunities Investor Knowledge and Behaviors in Times of Crisis Increasing Financial Knowledge for Better Rebuilding Designing an Inclusive Recovery Millennials: Buttressing a Generation at Risk

Inter-generational comparisons of household economic well-being, 1999 to 2019

This study of data from the Distributions of Household Economic Accounts compares households' economic well-being from a macro-economic accounts perspective, as measured by net saving and net worth for each generation when the major income earner for a household in one generation reached the same point in the life cycle as the major income earner for a household in another generation. The study finds that while younger generations have higher disposable income and higher consumption expenditure than older generations when they reached the same age, their net saving is relatively similar. As well, younger generations' economic well-being may be more at risk due to the COVID-19 pandemic since they depend more on employment as a primary source of income, they have higher debt relative to income, and they have less equity in financial and real estate assets from which to draw upon when needed.

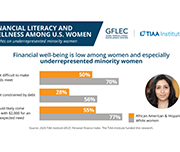

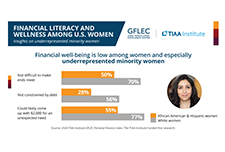

Financial Literacy and Wellness Among U.S. Women: Insights on Underrepresented Minority Women

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined understanding of financial literacy among women, including areas of strength and weakness and variations among subgroups, can inform initiatives to improve financial wellness, particularly as the United States moves forward from the pandemic and its economic consequences.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

Supporting the financial resilience of citizens throughout the COVID-19 crisis

This policy brief outlines initial the measures that policy makers can make to increase citizen awareness about effective means of mitigation for the impact of the COVID-19 pandemic and its potential consequences on their financial resilience and well-being.

Launch of the OECD/INFE 2020 International Survey of Adult Financial Literacy

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018 OECD/INFE toolkit to collect cross-comparable data. The survey results report the overall financial literacy scores, as computed following the OECD/INFE methodology and definition, and their elements of knowledge, behaviour, and attitudes. The data used in this report are drawn from national surveys undertaken using and submitted to the OECD as part of a co-ordinated measurement exercise; as well as data gathered as part of the OECD/INFE Technical Assistance Project for Financial Education in South East Europe.

The changes in health and well-being of Canadians with long-term conditions or disabilities since the start of the COVID-19 pandemic

This article examines how the self-reported health and mental health of people with long-term health conditions or disabilities has changed since the start of the COVID-19 pandemic explored by age, sex and type of reported difficulty. Additionally, the rates of health service disruptions are explored by type of service and region.

Wealth and Health Equity: Investing in Structural Change

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: On September 29th, AFN hosted a webinar to release the paper with featured speakers: Dr. Annie Harper, Ph.D., Program for Recovery and Community Health, Yale School of Medicine

Joelle-Jude Fontaine, Sr. Program Officer, Human Services, The Kresge Foundation

Dedrick Asante-Muhammad, Chief of Race, Wealth, and Community, National Community Reinvestment Coalition

Plan Institute Learning Centre

The Plan Institute Learning Centre presents workshops, webinars, publications and other resources for individuals and/or families of a person with a disability, support-care workers, and organizations.

Lifting the Weight: Consumer Debt Solutions Framework

Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified seven specific consumer debt problems that result in decreased financial insecurity and well-being. Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees. This report presents a solutions framework to address all seven of these problems. The framework includes setting one or more tangible goals to achieve for each problem, and, for each goal, the solutions different sectors (financial services providers, governments, non-profits, employers, educational or medical institutions) can pursue.

English

French

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Weathering Volatility 2.0: A Monthly Stress Test to Guide Savings

In this report, the JPMorgan Chase Institute uses administrative bank account data to measure income and spending volatility and the minimum levels of cash buffer families need to weather adverse income and spending shocks. Inconsistent or unpredictable swings in families’ income and expenses make it difficult to plan spending, pay down debt, or determine how much to save. Managing these swings, or volatility, is increasingly acknowledged as an important component of American families’ financial security. This report makes further progress toward understanding how volatility affects families and what levels of cash buffer they need to weather adverse income and spending shocks.

U.S. Financial Health Pulse: 2019 Trends Report

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning -- to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable”. The data in the Pulse report provide critical insights that go beyond aggregate economic indicators, such as employment and market performance, to provide a more accurate picture of the financial lives of people in the U.S.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Credit Characteristics, Credit Engagement Tools, and Financial Well-Being

This report presents results from a joint research study between the Consumer Financial Protection Bureau (CFPB) and Credit Karma. The purpose of the study is to examine how consumers’ subjective financial well-being relates to objective measures of consumers’ financial health, specifically, consumers’ credit report characteristics. The study also seeks to relate consumers’ subjective financial well-being to consumers’ engagement with financial information through educational tools.

Understanding the Pathways to Financial Well-Being

The National Financial Well-Being Survey Report is the second report in a series from the Understanding the Pathways to Financial Well-Being project. In order to measure and study the factors that support consumer financial well-being, in 2015, the Bureau of Consumer Financial Protection (the Bureau) contracted with Abt Associates to field a large, national survey to collect information on the financial well-being of U.S. adults. The present report uses data collected from that survey to answer a series of questions on the relationship among financial well-being and four key factors: objective financial situation, financial behavior, financial skill, and financial knowledge. In this study, we aim to enhance understanding of financial well-being and the factors that may support it by exploring these relationships.

Economic and Fiscal Snapshot 2020

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the country.

Employer Solutions: From Emergency to Resiliency

In light of COVID-19, the financial security of workers has never been more in question. The workplace is an important delivery channel for tailored financial products and services that can help meet employee’s immediate financial needs and build long-term financial stability. The workplace is a unique platform to identify, target, and meet the specific financial needs of employees. This webinar gives funders the tools and inspiration to respond effectively to the low- and moderate-income workforce in this moment and beyond.

When a Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy

This report sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs). Data suggests that EFWPs improve employees financial stability and help create a more productive work enviroment.

Advancing Health and Wealth Integration in the Earliest Years

Despite the well-documented connection between health and wealth, investing in this intersection is still a new approach for many grantmakers. With the goal of inspiring increased philanthropic attention, exploration, and replication, this new spotlight elevates responsive philanthropic strategies that support both health and wealth. This report focuses on the in utero-toddler stage of the life cycle (0-3 years). This age segment has some health-wealth integration activity, primarily through two-generation approaches. The goal is to inspire more philanthropic investment for this cohort by highlighting research and examples and offering recommendations.

Elder Fraud Prevention and Response Networks Development Guide

This guide provides step-by-step materials to help communities form networks to increase their capacity to prevent and respond to elder financial exploitation. The planning tools, templates and exercises offered in this guide help stakeholders plan a stakeholder retreat and training event, host a retreat, reconvene and establish their network, and expand network capabilities in order to create a new network or to refresh or expand an existing one.

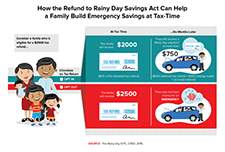

Evaluating Tax Time Savings Interventions and Behaviors

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife (formerly EARN) during the 2019 tax season are presented. This analysis is unique in that it compares tax filers' outcomes over time across three different tax-filing and savings program platforms: volunteer income tax assistance (VITA) sites, online tax filing through the Turbo Tax Free File Product (TTFFP), and SaverLife's saving program.

A Scan of Municipal Financial Capability Efforts

As the connection between financial capability and social mobility is made evident, both public and private actors are increasingly interrogating the drivers of personal financial health and investing in the innovation of products and services designed to improve the condition of economically vulnerable individuals. This high-level scan of existing U.S. financial capability initiatives and the ways they fit together lends insight into the role that cities and their core institutions can play in promoting residents’ personal economic growth. This study, funded by JPMorgan Chase & Co. and executed by Urbane Development (UD), leverages

primary and secondary research to explore features of the broad range of programs and policy efforts that make up the financial capability landscape of the U.S. This examination focuses particularly on programs deployed by and within municipalities.

Financial Health Index: 2019 Findings and 3-Year Trends Report

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from 2017 to 2019.

OECD/INFE Report on Financial Education in APEC Economies: Policy and practice in a digital world

This report responds to a call made by APEC Finance Ministers at their 23rd Ministerial Meeting in Lima in 2016 to advance “the design and implementation of financial literacy policies building on the expertise and standards developed by the OECD International Network on Financial Education”. The findings illustrate that the majority of APEC economies are well-advanced in their efforts to collect relevant data, implement appropriate financial education policies, and address the remaining issues related to financial literacy, inclusion and consumer

protection. They are applying international best practices and making good use of available tools and resources to develop and refine strategic approaches and specific initiatives. However, there is still some way to go in ensuring that everyone living in an APEC

economy has the financial literacy that they need and concerns about financial fraud or abuse, the high complexity of financial services and the low financial literacy of specific population groups are driving policy interest in improving financial education.

Using Research to Improve the Financial Well-being of Canadians: Post-symposium Report

The Financial Consumer Agency of Canada (FCAC) co-hosted the 2018 National Research Symposium on Financial Literacy on November 26 and 27, 2018 at the University of Toronto, in partnership with Behavioural Economics in Action at Rotman (BEAR). This report presents the key ideas and takeaways from the event, while shining a light on the research shaping new solutions designed to enhance financial well-being in Canada and around the world.

2018 White Paper: Financial Wellbeing Remains Challenged in Canada

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income variability and the extent to which Canadians have access to and lever their social capital (i.e. their family and friends who can provide financial advice and/or support in times of hardship). The study also explores consumer financial product and service usage, debt management and debt stress, access to financial products, services, advice and tools, usage of more predatory financial services (e.g. payday lending) and perceived levels of support by consumers’ primary Financial Institution for their financial wellness. The study also provides benefits of improved support for financial providers improving the financial wellness of their customers – including from a banking share of wallet and brand perspective.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

English

Download in English

French

Download in French

Canadians and their money: Key findings from the 2019 Canadian Financial Capability Survey

This report provides results from the 2019 Canadian Financial Capability Survey (CFCS). It offers a first look at what Canadians are doing to take charge of their finances by budgeting, planning and saving for the future, and paying down debt. While the findings show that many Canadians are acting to improve their financial literacy and financial well-being, there are also emerging signs of financial stress for some Canadians. For example, about one third of Canadians feel they have too much debt, and a growing number are having trouble making bill, rent/mortgage and other payments on time. Over the past 5 years, about 4 in 10 Canadians found ways to increase their financial knowledge, skills and confidence. They used a wide range of methods, such as reading books or other printed material on financial issues, using online resources, and pursuing financial education through work, school or community programs. Findings from the survey support evidence that financial literacy, resources and tools are helping Canadians manage their money. For example, those who have a budget have greater financial well-being based on a number of indicators, such as managing cashflow, making bill payments and paying down debt. Further, those with a

financial plan to save are more likely to feel better prepared and more confident about their retirement.

Financial well-being in Canada

Financial well-being is the extent to which you can comfortably meet all of your current financial commitments and needs while also having the financial resilience to continue doing so in the future. But it is not only about income. It is also about having control over your finances, being able to absorb a financial setback, being on track to meet your financial goals, and—perhaps most of all—having the financial freedom to make choices that allow you to enjoy life. The Financial Consumer Agency of Canada (FCAC) participated in a multi-country initiative that sought to measure financial well-being. FCAC conducted this survey to understand and describe the realities of Canadians across the financial well-being spectrum and help policy-makers, practitioners and Canadians themselves achieve better financial well-being. This is in keeping with the Agency’s ongoing work to monitor trends and emerging issues that affect Canadians and their finances.

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Saving for Now and Saving for Later: Rainy Day Savings Accounts to Boost Low-Wage Workers’ Financial Security

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial shocks.

Tax Time: An opportunity to Start Small and Save Up

The Consumer Financial Protection Bureau’s continuing effort to encourage saving at tax time is now part of a larger Bureau initiative to support people in building liquid savings. The new initiative is called Start Small, Save Up. The vision for Start Small, Save Up is to increase people’s financial well-being through education, partnerships, research, and policy or regulatory improvements that increase people's opportunities to save and empower them to realize their personal savings goals. This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being.

The Present and Future of Bank On Account Data: Pilot Results and Prospective Data Collection

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This report details the Bank On Data Pilot, which collected and measured quantitative data on 2017 Bank On account usage at four pilot financial institutions with certified accounts: Bank of America, JPMorgan Chase, U.S. Bank, and Wells Fargo.

2017 Bank On Data Pilot: Accessing Local Data

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This tool details the 2017 Bank On Data Pilot and includes instructions for accessing the local Bank On data at the city and zip code level.

Money stories: Financial resilience among Aboriginal and Torres Strait Islander Australians

This report builds on previous work on financial resilience in Australia and represents the beginning of an exploration of the financial resilience of Aboriginal and Torres Strait Islander peoples. Overall, we found significant economic disparity between Indigenous and non-Indigenous Australians. This is not surprising, given the histories of land dispossession, stolen wages and the late entry of Indigenous Australians into free participation in the economy (it is only 50 years since the referendum to include Aboriginal and Torres Strait Islander peoples as members of the Australian population). Specifically, we found: Severe financial stress is present for half the Indigenous population, compared with one in ten in the broader Australian population. Read the report to find out more about the financial barriers faced by Indigenous people in Australia, and the sharing economy in which money as a commodity can both help and hurt financial resilience.

Backgrounder: Preliminary findings from Canada’s Financial Well-Being Survey

This backgrounder reports preliminary findings from a survey of financial well-being among Canadian adults. Preliminary analysis of the survey data indicates that two behaviours are particularly important in supporting the financial well-being of Canadians. First, our analysis indicates that Canadians who practice active savings behaviour have higher levels of financial resilience as well as higher levels of overall financial well-being. In other words, regardless of the amount of money someone makes, regular efforts to save for unexpected expenses and other future priorities appears to be the key to feeling and being in control of personal finances. Secondly, Canadians who often use credit to pay for daily expenses because they have run short of money have lower levels of financial well-being. While this behaviour is likely symptomatic of low levels of financial well-being, our analysis indicates that a person can substantially improve their financial resilience and financial well-being by implementing strategies to reduce the frequency of running out of money and of having to rely on credit to get by.

Protecting vulnerable clients: A practical guide for the financial services industry

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial mistreatment. Because of the relationships they develop with their clients and the knowledge they acquire about clients’ financial needs or objectives over time, firms and representatives in the financial sector can play a key role in helping people who are in a vulnerable situation protect their financial well-being. They are instrumental in preventing and detecting financial mistreatment among consumers of financial services. Firms and representatives can also help clients experiencing financial mistreatment get the assistance they need. This guide proposes possible courses of action to protect vulnerable clients. Its purpose is to provide financial sector participants with guidance on the steps they can take to help protect clients’ financial well-being, prevent and detect financial mistreatment, and assist clients who are experiencing this type of mistreatment.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

Effective financial education: Five principles and how to use them