English

Soaring with savings - Tips and tools to help you save

SWS Worksheet #1 – The importance of saving (Fillable PDF)

SWS Worksheet #2 – Create a savings goal (Fillable PDF)

SWS Worksheet #3 – Savings support network (Fillable PDF)

SWS Worksheet #4 – Saving for emergencies (Fillable PDF)

SWS Worksheet #5 – Saving for unstable income (Fillable PDF)

SWS Worksheet #6 – Saving for education (Fillable PDF)

SWS Worksheet #7 – Saving for retirement (Fillable PDF)

Soaring with Savings- Full booklet

Soaring with savings - Training tools

French

Encourager l’épargne - Conseils et outils pour vous aider à épargner

Encourager l’épargne - l’aide d’animation

Ressources

CELI calculatrice, La Commission des valeurs mobilières de l’Ontario

REER, La Commission des valeurs mobilières de l’Ontario

Épargnez plus facilement, CVMO

Investir et épargner pendant une récession, La Commission des valeurs mobilières de l’Ontario

About the Canada Learning Bond

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools, colleges, or universities. Learn more about eligibility requirements and the application process using this website.

Canada learning bond for 18 to 20 year olds

The Canada Learning Bond is money that the Government of Canada adds to a Registered Education Savings Plan (RESP) to help pay the costs of full- or part-time studies after high school. If you are eligible for the Canada Learning Bond and have not already received it in an RESP, you will receive $500 deposited into your RESP, plus an additional $100 for every subsequent year that you were eligible, up to the age of 15. This money can help cover the costs of tuition, books, tools, transportation, and housing. You do not need to put any money into the RESP to receive the Canada Learning Bond. This single page insert tells you everything you need to know to apply for the Canada learning bond. Disponible en Français.

Increasing education savings for families living on low incomes: An outcome harvest evaluation

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open Registered Education Savings Plans (RESPs) to access free government education savings incentives such as the Canada Learning Bond (CLB). Momentum subsequently partnered with community agencies and advocated for systems level change in order to reach more families and scale up CLB uptake. This report captures the collective efforts and outcomes of Momentum and community partners regarding increasing the Canada Learning Bond (CLB) uptake in Canada, as well as lessons learned. The report highlights include:

Children’s Savings Account: Survey of Private and Public Funding 2019

Children’s Savings Account (CSA) programs offer a promising strategy to build a college-bound identity and make post-secondary education an achievable goal for more low- and moderate-income children. CSAs provide children (starting in elementary school or younger) with savings accounts and financial incentives for the purpose of education after high school. Beyond their financial value, CSAs are associated with beneficial effects for children and parents, including improved early child development. child health, maternal mental health, educational expectations, and academic performance. Many of these benefits are strongest for children from low-income families. This report shares a snapshot of the scale and makeup of the funding for the CSA field in 2019. It follows similar AFN reports on CSA funding in 2014-2015 and 2017 and captures the following data on CSA programs’ financial support in calendar year 2019:

English

French

Set a Goal: What to Save For

America Saves, a campaign managed by the nonprofit Consumer Federation of America, motivates, encourages, and supports low- to moderate-income households to save money, reduce debt, and build wealth. Information and tips for setting a savings goal, making a savings plan, how to save automatically, and other tools and resources are included.

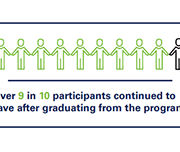

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

English

Introduction to asset building

Asset building for your future (fillable PDF)

Asset building for your future (print version)

My long-term goal action plan (fillable PDF)

My long-term goal action plan (print version)

Introduction to savings accounts

Registered savings accounts

Investing in registered accounts

Seven tips to help you stick to your goals

Glossary – asset building

Resources – asset building

Making it easier to save

Types of investments and types of accounts

Investing basics

How to manage financial stress and avoid burnout

Education savings

RESPs and how they can help

Before you open an RESP

Individual, family and group RESPs

Federal education grants and bonds

Provincial education grants and bonds

Family income to receive RESP government incentives

RESP sample scenarios

Plan for your RESP bank visit

My RESP action plan (fillable PDF)

My RESP action plan (print version)

Glossary – education savings

Resources – education savings

Employment and Social Development Canada (ESDC) resources for the Canada Learning Bond (CLB):

Canada Learning Bond Application for Adult Beneficiaries

Q&A about the Canada Learning Bond for adult beneficiaries

Revised income brackets for Canada Learning Bond (July 2022 to June 2023)

French

L‘accumulation d’actifs

L’accumulation d’actifs pour votre avenir – fillable

L’accumulation d’actifs pour votre avenir – nonfillable

Mon plan d’action axé sur mon objectif à long terme – fillable

Mon plan d’action axé sur mon objectif à long terme – nonfillable

Introduction aux comptes d’épargne

Comptes d’épargne enregistrés (REEI, REEE, REER et CELI)

Investir dans les comptes enregistrés :les options et les questions à poser à votre banque

Sept conseils pour vous aider à respecter vos objectifs

Glossaire – Accumulation d’actifs

Epargne-études

Les REEE : comment peuvent-ils vous aider?

Comment choisir entre unREEE individuel, familial et collectif

Les subventions et les bons d’études du gouvernement fédéral

Les subventions et les bons d’études du gouvernement provincial

Le REEE : comment peut-il vous aider à faire fructifier vos épargnes pour les études?

Arrivez préparé à votre rendez-vous à la banque pour ouvrir un REEE

Mon plan d’action en matière de REEE – fillable

Mon plan d’action en matière de REEE – nonfillable

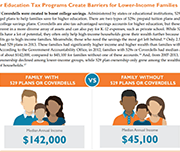

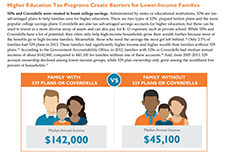

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of parents opening RESP accounts has increased steadily over time, as of 2016, participation rates remained more than twice as high among parents in the top income quartile (top 25%) compared with those in the bottom quartile. This study provides insight into the factors behind the gap in (RESP) participation between higher and lower-income families.

Canada Learning Bond – Get $500 for your child’s future

This two-page brochure describes the benefits of acting now to receive $500 to help start saving for a child's education after high school. The brochure is also available in the following Indigenous languages:

Canada Education Savings Program: Choosing the right RESP

This printable brochure from the Government of Canada explains the key details you need to know when choosing a Registered Education Savings Plan (RESP) for your child's education savings.

Canada Education Savings Program: Frequently Asked Questions

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans (RESPs).

Expanding Educational Opportunity Through Savings

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and impact.

It pays to plan for a child’s education

This fact sheet from ESDC explains how to open an RESP and access the Canada Learning Bond.

Proliteracy.ca: Plan Finances for University or College

Proliteracy.ca analyzes historical living expenses from over 160 cities and tuition from over 100 universities and colleges in Canada to predict the cost of post secondary education in the future. Their tool suggests financing options based on your profile. Learn about RESP, grants, scholarships and various government and commercial programs with their online resources.

Accessing the Canada Learning Bond: Meeting Identification and Income Eligibility Requirements

Not having a Social Insurance Number (SIN) and not filing taxes may represent challenges to access government programs and supports such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). Limited data availability has prevented a full assessment of the extent of these access challenges. This study attempts to address this knowledge gap by analyzing overall differences in SIN possession and tax-filing uptake by family income, levels of parental education, family type and Indigenous identity of the child and age of children using the 2016 Census data augmented with tax-filing and Social Insurance Number possession indicator flags.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

Accessing the Canada Learning Bond: Meeting Identification and Income Eligibility Requirements

Introduced in 1998, the Canadian Education Savings Program (CESP) was designed as an incentive to encourage education savings for the post-secondary education of a child. The program is centred on Registered Education Savings Plans (RESPs), where savings accumulate tax-free until withdrawn, to pay for full- or part-time postsecondary studies such as a trade school, CEGEP, college, or university, or in an apprenticeship program. The CLB was introduced in 2004 specifically for children from low income families. CLB provides, without family contribution being required, eligible families with an initial RESP payment which may be followed by annual payments up until the child is aged 15 years old. The objective of this paper is to assess the extent to which not tax-filing and not having a SIN for a child could pose a challenge to accessing the CLB and the CESG. This study will address the knowledge gap by analyzing overall differences in SIN and tax-filing uptake by family income, levels of parental education, family type and Indigenous identity of the child. The findings will help understand access issues related to the CLB but also to other programs with similar administrative conditions. En francais: Accéder au Bon d’études canadien: l’atteinte des critères d’identification et d’éligibilité selon le revenu.

Why Community Foundations Make Perfect Partners for Children’s Savings Account Programs

In this brief, we articulate why collaboration between community foundations and CSA programs is in their mutual interest. We describe the variety of roles that community foundations can play in promoting the growth and success of CSA programs, and then identify the primary challenges encountered by community foundations in supporting CSAs. The brief concludes with key lessons learned about collaboration between community foundations and CSA programs. This brief was designed primarily to educate CSA practitioners and community foundation staff about the benefits of collaboration. It may also be of interest to a wider audience in the fields of asset building and philanthropy. The ideas and findings in this brief are based primarily on in-depth interviews and in-person meetings with board members, executives and senior staff from three community foundations.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

RESP case plan – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP tracking sheet – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP quick reference sheet – webinar handout (from FSGV)

RESP sample letter to schools – webinar handout (from Credit Counselling Sault Ste. Marie)

Time-stamps for the video recording:

3:00 – Agenda and introductions

5:05 – Audience polls

9:00 – Importance of education savings (Speaker: Glenna Harris)

16:00 – Credit Counselling Services Sault Ste. Marie and District (Speaker: Allyson Schmidt)

33:00 – Family Services of Greater Vancouver (Speaker: Rocio Vasquez)

54:45 – Q&A

Improving Education Outcomes through Children’s Education Savings

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career expectations, and future financial capability. This brief explains why RESPs are so important, and how parents can use RESPs to save for their children's education.

Increasing Take-Up of the Canada Learning Bond

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible population. The Impact and Innovation Unit (IIU), in collaboration with the Learning Branch and the Innovation Lab at Employment and Social Development Canada (ESDC) conducted a randomized controlled trial to test the effectiveness of behavioural insights (BI) in correspondence sent to primary caregivers of children eligible for the CLB. This trial demonstrates the effectiveness of BI interventions tailored to the particular behavioural barriers that affect specific populations in increasing take-up of programs like the CLB. If scaled across the eligible population, the best performing letter would result in thousands more children receiving this education savings incentive on an annual basis.

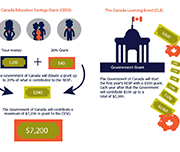

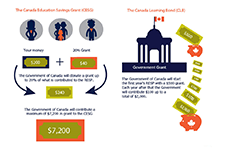

The Canada Learning Bond: What you need to know

This one-page fact sheet tells you everything you need to know to make your child's future possibilities grow! The Canada Learning Bond (CLB) is a grant of $500 up to $2000 from the Government of Canada to eligible families to help with the cost of a child’s education after high school. It is deposited directly into a child’s Registered Education Savings Plan (RESP). Children born January 1, 2004 or later, whose family’s annual income is less than $46,000 can receive the CLB.

The Omega Foundation and the SmartSAVER Program, Lessons in Taking Social Innovations to Scale

This case study is about the Omega Foundation’s SmartSAVER program. It has effectively elevated the Canada Learning Bond (a post-secondary education savings program for low income families) from a struggling idea to a fully-fledged and well-utilized national resource. In so doing, Omega and SmartSAVER have created new pathways out of poverty for thousands of Canadians. This story gives us significant insight into the process of bringing an innovative idea to life. It offers important observations about the barriers to launching and scaling innovative ideas. It also offers insights into the solutions that can overcome these barriers.

Group RESP Educational Materials

This document explains the basics of group RESPs, including what they are, what they may cost, what you need to know about your group RESP if you are already enrolled in a plan, and how to figure out your options. Read more about the research behind these materials here.

The Regulation of Group Plan RESPs and the Experiences of Low-Income Subscribers

Through the Group RESP Research and Education Project, SEED Winnipeg, Momentum (Calgary), the Legal Help Centre of Winnipeg, and an interdisciplinary research team studied the regulation of group plan RESPs and the experiences of low-income subscribers, and developed public legal education materials to support low-income RESP subscribers in understanding and making informed decisions about their RESP investments. This report presents the research component of this project. This report shows that group plan RESPs are complex, and while they can be beneficial, participation in a group plan may be detrimental to a subscriber's financial well-being if the plan is not well aligned with the subscriber's needs. Low-income subscribers continue to be significantly represented in RESPs held by group plan promoters.

Enhancing access to the Canada Learning Bond

This discussion paper responds to a request from ESDC to develop options for reforms to the Canada Education Savings Program and, more specifically to improve access to the Canada Learning Bond. It reviews individual and institutional challenges to participation in the current system and consider three approaches for reform. It presents a case study of the United Kingdom’s Child Trust Fund, which included an auto-enrolment default mechanism. It concludes that the model used in the UK is not suitable for Canada and instead make a series of recommendations for both incremental and more ambitious reforms to fulfill the Government’s commitment to improve access to the Bond.

SmartSAVER: Canada Learning Bond Infographic

An infographic highlighting how to attend post-secondary education with no student debt. It shows how a family eligible for the Canada Learning Bond, with average family savings, student earnings and available grants can cover the cost of post-secondary education (PSE) with no need to borrow.

A Growing Movement: The State of the Children’s Savings Field 2016

The Children’s Savings Account (CSA) movement has taken off in the past few years. These programs provide long-term savings or investment accounts and savings incentives to help children build savings for their future. In 2016, CSA initiatives started in a diverse range of locations, such as Durham, NC; Boston, MA; and Worcester, MA. In 2017, we expect several more program launches, including in places like Oakland, CA, and Milwaukee, WI. Based on a recent survey, this document offers a snapshot of this growing field, illustrating the range of program models being customized to meet the needs of the communities and states these programs serve.

Cities and States Developing Creative Approaches to Fund Children’s Savings Accounts

Children’s Savings Accounts (CSA) are proving to be a powerful tool for growing college funds and building children’s aspirations for their future. CSAs are long-term, incentivized savings or investment accounts for post-secondary education that help promote economic mobility for children and youth. Advocates have found that the idea and goals of CSAs can be appealing to policymakers from across the political spectrum. However, while able to generate initial interest from policymakers, advocates often find that their efforts can stall when it comes to the question of how to fund a program. This paper provides advocates and policymakers with several funding options—including examples from the city and state-levels—for establishing publicly-supported CSA programs. For more information about CSAs in general, please visit savingsforkids.org.

Examining the Canadian Education Savings Program and its Implications for US Child Savings Account (CSA) Policy

This report analyzes the Canadian experience with education savings programs, as the US moves towards more comprehensive Children's Savings Account policy.

“We’re Going to Do This Together”: Examining the Relationship between Parental Educational Expectations and a Community-Based Children’s Savings Account Program

This paper presents quantitative and qualitative evidence of the relationship between exposure to a community-based Children’s Savings Account (CSA) program and parents’ educational expectations for their children. First, we examine survey data collected as part of the rollout and implementation of The Promise Indiana CSA program. Second, we augment these findings with qualitative data gathered from interviews with parents whose children have Promise Indiana accounts. Though results differ by parental income and education, the quantitative results using the full sample suggest that parents are more likely to expect their elementary-school children to attend college if they have a 529 account or were exposed to the additional aspects of The Promise Indiana program (i.e., the marketing campaign, college and career classroom activities, information about engaging champions, trip to a University, and the opportunity to enroll into The Promise).