Financial Health & Wealth

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money. Money is a big way that others control and influence our lives. Sometimes we need to depend on others to give us money and tell us what to do with money. Opening a bank account, understanding where your money is coming from, and saving money will help you to become financially independent and financially healthy. This report from The Native Women's Association of Canada covers the importance of financial health and has sections on financial information covering bank accounts, insurance, budgeting, saving, credit cards, car loans, income taxes and housing.

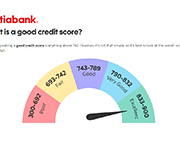

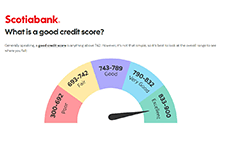

Credit scores and credit reporting in Canada

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...), bankruptcies... Watch this video by Scotiabank to learn what a credit score is and why it matters. Then learn how to check your credit score for free in Canada. You may also learn how borrowing can impact your credit score. If you check your credit report and your credit score is low, follow these tips for how to help increase credit scores.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

Navigating Finances: Paying Down Debt vs. Investing, CIRO

Loan and Trust, FSRA

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

Managing your money in a changing world

Managing your finances means finding the right balance. Inflation and higher interest rates signal that you may need to adjust your budget to find the right balance between daily spending and paying down debt. The right balance will depend on your financial situation and goals. This selection of tools from the FCAC provides information and tips on: How to manage your money when interest rates rise Make a plan to pay off your debt

Financial literacy self-assessment quiz

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other Canadians.

Pilot study: Buy now, pay later services in Canada

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have resulted in a steady increase in retail e-commerce sales over the past several years, and the COVID-19 pandemic has had a significant impact on how consumers make retail purchases. Retail e-commerce sales reached record levels during the pandemic. This has further contributed to the proliferation of buy now, pay later (BNPL) services in Canada.

Financial literacy around the world: insights from the S&P’s rating services global financial literacy survey

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey is based on interviews with more than 150,000 adults in over 140 countries. In 2014 McGraw Hill Financial worked with Gallup, Inc., the World Bank Development Research Group, and GFLEC on the S&P Global FinLit Survey.

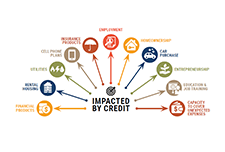

Advancing equity: the power and promise of credit building

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that anyone has access to credit and can build economic security, wealth, and intergenerational transfer. This brief will analyze what is not working within our credit system and identify what philanthropy can do to reimagine a system that builds economic security and mobility for everyone, especially people of color and immigrants. An equitable credit system would create pathways to narrow the racial wealth gap instead of continuing to widen it. Solutions include nonprofit organizations and community A webinar is also available and you can view the webinar slides here.

development financial institutions (CDFIs) delivering financial products that are designed for the people who have been most excluded from the credit system, seeding their journey toward economic security, as well as systemic changes to make economic security and mobility more fairly attainable.

Empower U Financial Coaching

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and asset building intervention (although partners also contribute to the other interventions). The Sustainable Livelihood Model identifies five distinct sets of assets including personal, human, social, physical and financial. The Empower U program activities are grounded by two overarching philosophies: Financial Empowerment (as defined by Prosper Canada) and the Sustainable Livelihood Model (adapted by the Canadian Women’s Foundation, based on the work of the University of Sussex Institute for Development Studies). Focusing on financial literacy and coaching, Empower U has developed an individual financial coaching component to the overall program.

Money Mentors’ free financial education programs

Money Mentors’ free online courses are available to everyone. The 1-2 hour narrated courses make it easy to learn at your own pace. These online courses provide the same great content as our in-person presentations, but at the touch of a finger. They cover a variety of topics including budgeting, debt, credit, fraud, life events and one course even focuses on managing money and understanding credit for high school students. Read more about Money Mentors' free financial literacy presentations to provide K-12 students with money concepts and skills here.

National Report on High Interest Loans

ACORN Canada undertook a study focusing on high interest loans, especially when taken online. For the purpose of the study, high interest loans were defined as loans such as payday loans, installment loans, title loans etc. that are taken from companies/institutions that are not regular banks or credit unions. The study was conducted to examine the experience of lower-income consumers in the increasingly available online high-cost credit markets. The study was divided into three phases - conducting a literature review and webscan which was undertaken by Prosper Canada; legislative scan to understand the regulatory framework; and a national survey to capture experiences of people who have taken high interest loans, especially online.

Creating Change: Momentum’s Contribution to High-Cost Credit Reform in Alberta

As part of Momentum’s systems change planning process that was grounded in both participant and community experience, the issue of payday loans and other forms of high-cost credit (e.g., pawn, installment, rent-to-own, title and car loans) emerged as a priority issue for Momentum to address the financial barriers for people living on low incomes to exit poverty and build sustainable livelihoods.

To evaluate its work for high-cost credit reform in Calgary and Alberta in the period of 2012 to 2019, an outcome harvest was conducted. This evaluation reflects the collective efforts of multiple partners, identifies outcomes achieved as well as Momentum’s contribution to these outcomes.

Money Mentors – Savings & Debt Resources

Collection of money management resources, including how create effective budgets, realistic spending plans, deal with your debts, save more money, build a stronger credit rating, and prepare for retirement.

Bien choisir son crédit : un guide pratique [A Practical Guide to Making Smart Credit Choices]

A guide comprised of 12 fact sheets for consumers to learn more about credit, grouped into the following topics: general information, warnings, credit products, and comparison tables. (Please note this is a French-language resource.)

Targeting credit builder loans: Insights from a credit builder loan evaluation

This report presents the results of a Consumer Financial Protection Bureau (CFPB) funded evaluation of a Credit Builder Loan (CBL) product. CBLs are designed for consumers looking to establish a credit score or improve an existing one, while at the same time giving them a chance to build their savings. The study used random assignment to explore four research questions:

The Early Effects of the COVID-19 Pandemic on Credit Applications

This report documents the early effects of the COVID-19 pandemic on credit applications, which are among the very first credit market measures to change in credit report data in response to changes in economic activity. Using the Bureau’s Consumer Credit Panel, how applications for auto loans, mortgages, credit cards, and other loans changed week-by-week during the month of March, compared to the same time in previous years was studied.

Roadblock to Recovery: Consumer debt of low- and moderate-income Canadians in the time of COVID-19

Almost half of low-income households and 62 per cent of moderate-income households carry debt, with households on low incomes spending 31 per cent of their income on debt repayments, according to a new report published by national charity, Prosper Canada.

This report analyzes the distribution, amount and composition of non-mortgage debt held by low- and moderate-income Canadian households and explores implications for federal and provincial/territorial policy makers as they develop and implement COVID-19 economic recovery plans and fulfill their respective regulatory roles.

Making Safety Affordable: Intimate Partner Violence is an Asset-Building Issue

This brief explores three existing unmet needs that contribute to survivors’ inability to build wealth: money, tailored asset-building support, and safe and responsive banking and credit services. Within each identified need, specific issues facing survivors, strategic actions in response to those issues, as well as innovative ideas and existing promising practices to help funders take action to prioritize survivor wealth are discussed.

Lifting the Weight: Consumer Debt Solutions Framework

Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified seven specific consumer debt problems that result in decreased financial insecurity and well-being. Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees. This report presents a solutions framework to address all seven of these problems. The framework includes setting one or more tangible goals to achieve for each problem, and, for each goal, the solutions different sectors (financial services providers, governments, non-profits, employers, educational or medical institutions) can pursue.

Debt settlement and financial recovery companies: too risky an option?

This report presents a study of the debt settlement and financial recovery industry and examines Canadian consumer issues from these services. Data is gathered from company websites and contracts as well as customer surveys and questionnaires completed by governmental and non-governmental organizations. A comparative study of legislation applicable to the industry is also conducted.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling. This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

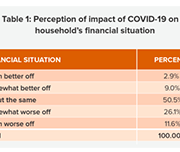

How Are the Most Vulnerable Households Navigating the Financial Impact of COVID-19?

The COVID-19 pandemic has already had an unprecedented impact on the financial lives of households across the United States. During June and July 2020, Prosperity Now conducted a national survey of lower-income households to better understand the circumstances these households are confronted with and the strategies they use to secure resources to navigate this crisis.

U.S. Financial Health Pulse: 2019 Trends Report

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning -- to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable”. The data in the Pulse report provide critical insights that go beyond aggregate economic indicators, such as employment and market performance, to provide a more accurate picture of the financial lives of people in the U.S.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Credit Characteristics, Credit Engagement Tools, and Financial Well-Being

This report presents results from a joint research study between the Consumer Financial Protection Bureau (CFPB) and Credit Karma. The purpose of the study is to examine how consumers’ subjective financial well-being relates to objective measures of consumers’ financial health, specifically, consumers’ credit report characteristics. The study also seeks to relate consumers’ subjective financial well-being to consumers’ engagement with financial information through educational tools.

When a Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy

This report sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs). Data suggests that EFWPs improve employees financial stability and help create a more productive work enviroment.

Financial Health Index: 2019 Findings and 3-Year Trends Report

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from 2017 to 2019.

Short-term financial stability: A foundation for security and well-being

Short-term cushions are key to longer-term financial security and well-being. This report shines a light on the central role that short-term financial stability plays in a person’s ability to reach broader financial security and upward economic mobility, a measurement of whether an individual moves up the economic ladder over one’s lifetime or across generations. The insights presented in this report draw primarily on evidence provided by members of the Consumer Insights Collaborative (CIC), a group of nine leading nonprofits across the United States convened by the Aspen Institute Financial Security Program. These diverse organizations offer a window into the financial lives of the low- and moderate-income individuals they serve.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Access the handouts for this webinar:

How we help people – An overview (Webinar handout) – Credit Counselling Society

Our services (Webinar handout) – Credit Counselling Society

Debt solutions 101 (Webinar handout) – msi Spergel Inc

Time-stamps for the video-recording:

4:13 – Agenda and introductions

7:00 – Audience polls

12:31 – Debt in Canada (Speaker: Glenna Harris)

15:20 – Credit Counselling Society on debt management plans (Speaker: Anne Arbour)

34:05 – Spergel Msi on Consumer Proposals and Bankruptcy plans (Speaker: Gillian Goldblatt)

56:00 – Q&A

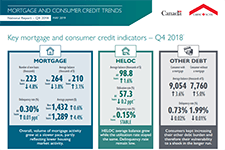

Mortgage and Consumer Credit Trends Report

The Canada Mortgage and Housing Corporation (CMHC) publishes a quarterly report on Canadian trends relating to mortgage debt and consumer borrowing. Find out the level of Canadian household indebtedness, and emerging trends in outstanding debt balances in different urban areas and by age group.

An Evaluation of Financial Empowerment Centers: Building People’s Financial Stability as a Public Service

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free public service. The evaluation draws on data from 22,000 clients who participated in 57,000 counseling sessions across these first 5 city replication partners, and provides additional evidence of the program’s success.

Mortgage Calculator

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment schedule.

Tout Bien Calcule

Pour souligner leurs 50 ans d’histoire, les Associations de consommateurs du Québec s’unissent pour offrir à la population québécoise un portail qui rassemble toute une gamme d’informations et d’outils développés au fil des années grâce à leur expertise en finances personnelles. Cette porte d’entrée donne accès à des services spécialisés en finances personnelles offerts par les associations, propose des outils adaptés, et à travers les différentes sections, offre une information claire, objective et critique afin de vous guider vers de meilleurs choix de consommation et une meilleure santé financière.

Debt and Consumer Rights: Credit repair

This educational brief from CLEO explains what a credit report is, and what to do if you want to fix your credit report or work with a credit repair agency.

Your Money, Your Goals: Focus on People with Disabilities

This is a companion guide to the 'Your Money, Your Goals' curriculum by the Consumer Financial Protection Bureau (CFPB) in the United States. This guide- Your Money, Your Goals: Focus on People with Disabilities—contains information, tips, and tools based on the insights from people with disabilities and from organizations that serve the disability community. It is based on the core philosophy that everyone has the right to control their money and make their own financial decisions. Its specialized information and tools equip staff and volunteers to adapt training on and use of the toolkit and other resources to meet the needs of people with disabilities. It also includes information and tools to enable staff and volunteers to choose accessible locations, develop appropriate and considerate training activities, and plan to provide accommodations for diverse learning styles and other needs.

Supporting Employee Financial Stability: How Philanthropy Catalyzes Workplace Financial Coaching Programs

More than half of all employees in the United States report that they are This report describes different workplace models, the common characteristics and challenges of programs, and provides recommendations for funders who want to invest in workplace approaches to help workers achieve financial stability.

financially stressed, and nearly one in three employees reports being distracted by personal financial issues while at work. This financial stress impacts individuals’ health, relationships, productivity, and time away from work.

High-Cost Alternative Financial Services: Policy Options

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or credit union, access comes at a steep price and with a high degree of risk. On its own, one high-cost loan has the potential to trap a borrower in a cycle of debt, not only amplifying their short-term problem, but also limiting their ability to secure the income and assets needed to thrive in the long term. The policy recommendations presented in this brief, and summarized in the chart on page two, are inspired by the regulatory initiatives across the country, and reflect ways in which all three levels of government can contribute to better consumer protection for all Canadians.

Debt and High Interest Resource Portal

This is ACORN Canada's debt and high-interest lending resource portal. It contains links and resources on debt, credit, banking, and other topics.

Financial well-being in America

There is wide variation in how people in the U.S. feel about their financial well-being. This report presents findings from a survey by the Consumer Financial Protection Bureau (CFPB) on the distribution of financial well-being scores for the U.S. adult population overall and for selected subgroups defined by these additional measures. These descriptive findings provide insight into which subgroups are faring relatively well and which ones are facing greater financial challenges.

2017 Financially Underserved Market Size Study

Handout 7-13: Credit reporting glossary

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Glossary of terms for credit reporting. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-12: Credit reporting resources

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Web resources for credit reporting in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-10: Ways to improve your credit score

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Ways to improve your credit score. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-8: Correcting common errors on credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. How to correct common errors on credit reports. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-5: Credit scores

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A credit score is a score between 300 and 900 that credit bureaus use to rate the information in your credit report. Credit bureaus use a mathematical formula based on many factors to arrive at your credit score. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-4: Reading a credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. The information in an Equifax credit report varies slightly from a TransUnion credit report, but both contain the same basic sections. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-3: Sample Equifax credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A sample of a credit report received from Equifax. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-2: Credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus summarize your credit use in a report. The credit report is one of the main things lenders look at when they decide whether or not to give you credit. A credit report contains your history of credit use, and your credit ratings. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-11: Goal setting and credit reports

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Practice setting goals related to credit reports. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-9: Credit score scenarios

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Credit score scenarios to practice learning. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-7: TransUnion sample request form

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the TransUnion request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-6: Sample Equifax request sheet

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the Equifax request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-7: Credit glossary

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Glossary of terms related to credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-6: Credit resources

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Web resources for credit and credit cards. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-4: Managing credit

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Tips for managing credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-3: The cost of credit

This handout is from Module 6 of the Financial Literacy facilitator curriculum. The cost of credit for different payment methods.

Handout 6-2: Credit card features

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The features of credit cards and what they mean. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-1: Types of credit

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The different types of credit and their lending conditions. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 6-5: Goal setting and credit

This activity sheet is from Module 6 of the Financial Literacy Facilitator Resources. Practice setting goals related to credit. To view full Financial Literacy Facilitator Resources, click here.

Financial Coaching: An Asset-Building Strategy

Financial coaching is a promising strategy to help people improve their financial well-being, but is often not yet universally understood. Practitioners are turning to coaching strategies to better facilitate behaviour change as opposed to the disappointing results often found when only financial education or financial access programs are introduced. Shared insights on financial coaching can help shape collective action by funders seeking to facilitate greater financial capability among targeted populations.

Your Money, Your Goals: A Financial Empowerment Toolkit for community volunteers

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money. Module 6-7: Debt and credit reports. Module 8: Money services, cards, accounts, and loans. Module 9: Protecting your money.

English

Module 1: Exploring your relationship with money

Module 2: Income and taxes

Handout 2-1 Government benefits

Activity Sheet 2-2 Reading David’s pay stub quiz

Handout 2-3 Reading a pay stub

Handout 2-4 Filing your taxes

Activity Sheet 2-5 Maria and Fernandos story

Activity Sheet 2-6 Goal-setting

Handout 2-7 Resources

Handout 2-8 Glossary

Video: Tax Deductions Credits and Benefits (video transcript) *NEW*

Module 3: Budgeting

Activity Sheet 3-1 The “B” word-budget

Activity Sheet 3-2 Income sources

Activity Sheet 3-3 Expense categories

Activity Sheet 3-4 Budgeting scenarios

Activity Sheet 3-5 Monthly budget worksheet

Activity Sheet 3-6 Making your own budget

Handout 3-7 Budgeting strategies

Handout 3-8 Budgeting tips

Handout 3-9 Financial record keeping

Activity Sheet 3-10 Goal-setting

Handout 3-11 Resources

Handout 3-12 Glossary

Module 4: Banking and financial services

Handout 4-1 Banks and credit unions

Handout 4-2 Deposit insurance at credit unions in different provinces

Activity Sheet 4-3 Banks and banking services quiz

Handout 4-4 Banks accounts and services

Handout 4-5 Choosing a bank and choosing an account

Handout 4-6 Opening a bank account

Handout 4-7 What are my rights?

Handout 4-8 Alternative financial services

Activity Sheet 4-9 Comparing alternative financial services to banking services

Activity Sheet 4-10 Goal-setting

Handout 4-11 Resources

Handout 4-12 Glossary

Getting government payments by direct deposit

Module 5: Saving

Activity Sheet 5-1 Setting savings goals

Activity Sheet 5-2 Needs and wants

Activity Sheet 5-3 Finding money

Handout 5-4 Compound interest

Activity Sheet 5-5 Enzo and Tess

Handout 5-6 Introduction to saving and investing

Handout 5-7 Saving and investing tools (basic)

Handout 5-8 Saving and investing tools (detailed)

Handout 5-9 Preparing for old age

Handout 5-10 Saving and investment support

Activity Sheet 5-11 Goal-setting

Handout 5-12 Resources

Handout 5-13 Glossary

Interest rates and how they impact your finances, CIRO

Benefits of having a financial plan, CIRO

Module 7: Credit reporting

Handout 7-1 Credit bureaus

Handout 7-2 Credit reports

Handout 7-3 Sample Equifax credit report

Handout 7-4 Reading a credit report

Handout 7-5 Credit scores

Activity Sheet 7-6 Equifax credit report request form

Activity Sheet 7-7 TransUnion credit report request form

Handout 7-8 Correcting common errors on credit reports

Activity Sheet 7-9 Credit score scenarios

Handout 7-10 Ways to improve your credit score

Activity Sheet 7-11 Goal-setting

Handout 7-12 Resources

Handout 7-13 Glossary

Module 8: Debt

Activity Sheet 8-1 How much is TOO much

Activity Sheet 8-2 Debt do’s and don’ts

Activity Sheet 8-3 Ladder of debt repayment options

Handout 8-4 Steps to debt repayment

Handout 8-5 Dealing with creditors

Handout 8-6 Collection rules

Activity Sheet 8-7 Collection role play

Activity Sheet 8-8 Goal-setting

Handout 8-9 Resources

Handout 8-10 Glossary

Video: Debt Solutions (video transcript)*NEW*

Module 9: Consumerism

Activity Sheet 9-1 Consumer quiz

Handout 9-2 Advertising techniques and sales tactics

Handout 9-3 Smart shopping tips

Activity Sheet 9-4 Find a better deal

Handout 9-5 Cell phone information

Activity Sheet 9-6 Cell phone checklist

Handout 9-7 Common types of frauds and scams

Handout 9-8 Tips to protect yourself from fraud and scams

Handout 9-9 Dealing with consumer problems

Handout 9-10 Complaint letter

Handout 9-11 Making a complaint about an investment

Activity Sheet 9-12 Rate your financial knowledge part 2

Activity Sheet 9-13 Goal setting

Handout 9-14 Resources

Handout 9-15 Glossary

CERB and other COVID-19 scams

Protect yourself against fraud during COVID-19

Types of fraud

Fraud prevention month

The many faces of elder abuse

Pensions, FSRA

Credit Unions and Deposit Insurance, FSRA

French

Module 1 : Explorer votre relation avec l’argent

Feuille d’activité 1-1 « Trouvez quelqu’un qui… »

Feuille d’activité 1-2 « L’argent c’est… »

Feuille d’activité 1-3 Messages relatifs à l’argent

Feuille d’activité 1-4 Imaginez un peu

Feuille d’activité 1-5 Évaluer vos connaissances financières

Feuille d’activité 1-6 Comment établir des objectifs INTELLLIGENTS

Feuille d’activité 1-7 Établissement d’objectifs

Module 2 : Revenus et impôts

Document 2-1 Prestations gouvernementales

Feuille d’activité 2-2 « Lire le relevé de paie de Jeanne (questionnaire) »

Document 2-2 Lire un relevé de paie

Document 2-3 La déclaration de revenus

Feuille d’activité 2-4 « Le cas de Maria et Fernando »

Feuille d’activité 2-5 « Établissement d’objectifs »

Document 2-6 Ressource

Document 2-7 Glossaire

Déductions, crédits d’impôt et avantages fiscaux – Transcription de la vidéo **NOUVEAU**

Module 3 : L’établissement d’un budget

Feuille d’activité 3-1 Le mot qui commence par un « B » – budget

Feuille d’activité 3-2 Sources de revenus

Feuille d’activité 3-3 Catégories de dépenses

Feuille d’activité 3-4 Scénarios de budget

Feuille d’activité 3-5 feuille de travail pour le budget mensuel

Feuille d’activité 3-6 feuille de travail pour le budget mensuel

Document 3-7 Les stratégies budgétaires

Document 3-8 Conseils budgétaires

Document 3-9 Tenue des dossiers financiers

Feuille d’activité 3-10 Établissement d’objectifs

Document 3-11 Ressources

Document 3-12 Glossaire

Module 4 : Services bancaires et financiers

Document 4-1 Banques et caisses populaires ou coopératives de crédit

Document 4-2 Assurance-dépôts dans les caisses populaires ou coopératives de crédit selon les provinces.

Feuille d’activité 4-3 Questionnaire sure les banques et les services bancaires

Document 4-4 Comptes et services bancaires

Document 4-5 Choisir une banque et un compte

Document 4-6 Ouverture d’un compte de banque

Document 4-7 Quels sont mes droits?

Document 4-8 Services financiers parallèles

Feuille d’activité 4-9 Comparaison des services financiers parallèles avec les services bancaires classiques

Feuille d’activité 4-10 Établissement d’objectifs

Document 4-11 Ressources

Document 4-12 Glossaire

Obtention des paiements gouvernementaux par dépôt direct

Module 5 : L’épargne

Feuille d’activité 5-1 Établissement d’objectifs d’épargne

Feuille d’activité 5-2 Besoins et désirs

Feuille d’activité 5-3 Trouver l’argent

Document 5-4 Intérêt composé

Feuille d’activité 5-5 Bill et Bob

Document 5-6 Outils d’épargne (notions de base)

Document 5-7 Outils d’épargne (notions détaillées)

Feuille d’activité 5-8 Questionnaire sur les outils d’épargne

Feuille d’activité 5-9 Etablissement d’objectifs

Document 5-10 Ressources

Document 5-11 Glossaire

L’avantage d’avoir un plan financier

Module 6 : Les notions de base du crédit

Module 7 : Rapports de solvabilité

Document 7-1 Les bureaux de crédit

Document 7-2 Les dossiers de crédit

Document 7-3 Exemple d’un dossier de crédit d’Equifax

Document 7-4 La lecture d’un dossier de crédit

Document 7-5 Les pointages de crédit

Feuille d’activité 7-6 Equifax demande de mon historique de crédit

Feuille d’activité 7-7 TransUnion formulaire de demande de fiche de crédit

Document 7-8 Corriger les erreurs communes inscrites sur les dossiers de crédit.

Feuille d’activité 7-9 Les scenarios sur le pointage de crédit

Document 7-10 Façons d’améliorer votre pointage de crédit

Feuille d’activité 7-11 L’établissement d’objectifs

Document 7-12 Ressources

Module 8 : Les dettes

Feuille d’activité 8-1 Quel montant faut-il éviter de dépasser?

Feuille d’activité 8-2 À faire et à éviter

Feuille d’activité 8-3 L’échelle des options de remboursement des dettes

Document 8-4 Les étapes pour rembourser des dettes

Document 8-5 Traiter avec les créanciers

Document 8-6 Règles en matière de recouvrement

Feuille d’activité 8-7 Jeu de rôle – Recouvrement

Feuille d’activité 8-8 Établissement d’objectifs

Document 8-9 Ressources

Document 8-10 Glossaire

Les dettes – Transcription de la vidéo **NOUVEAU**

Module 9 : Le consumérisme

Feuille d’activité 9-1 Questionnaire du consommateur

Document 9-2 Techniques de publicité et tactiques de vente

Document 9-3 Conseils pour magasiner de manière intelligente

Feuille d’activité 9-4 Trouver la meilleure aubaine

Document 9-5 Information sur le téléphone cellulaire

Feuille d’activité 9-6 Liste de vérification du téléphone cellulaire

Document 9-7 Les fraudes et les arnaques communes

Document 9-8 Gérer des problèmes de consommation

Feuille d’activité 9-9 Lettre de plainte

Feuille d’activité 9-10 Évaluez vos connaissances financières, partie 2

Feuille d’activité 9-11 Établir des objectifs

Document 9-12 Ressources

Document 9-13 Glossaire

Escroqueries liées à la PCU et autres fraudes courantes durant la pandémie de COVID-19

Protégez-vous contre la fraude durant la pandémie de COVID-19

Types de fraude

Mois de la prévention de la fraude

Les régimes de retraite

Assurance-dépôts et credit unions, ARSF