English

The Embedded Financial Coaching Pilot

The resources below introduce the Embedded Financial Coaching model in the context of workforce programs. They are designed to generate the interest of financial empowerment service providers and workforce programs about the promising possibilities of this model. Future phases of the toolkit will assist with initial planning and implementation stages for embedding FE into workforce programs.

- The Embedded Financial Coaching Primer gives a quick overview of the “what” and “why” of embedding financial empowerment into workforce programs

- The Integrating Financial Coaching into Employment Services Landscape Scan summarizes the literature and promising practices from the USA.

- The Literature review summarizes the promising practices to improve participant retention for multi session interventions that lead to deeper financial wellbeing outcomes (for detailed summaries refer to additional resources section).

Learn more about embedding financial empowerment

Canadian Publications

Prosperity Gateways: Cities for financial empowerment – Building the case outlines evidence for embedding FE.

US Publications

The US Department of Health and Human Services through its Office of Planning. Research and Evaluation supported MEF Associates and the Urban Institute to conduct a large-scale research project of the over 15 years of integrating financial capability and workforce programming. As part of this research project two research reports are highly relevant for attempts to replicate integrated service delivery in the Canadian context. The first report is a literature synthesis on Integrating Financial Capability into Employment Services. The second report is a summary of the approaches, motivations and types of services and participant perspectives on integrated services Understanding Financial Capability Interventions within Employment-Related Contexts for Adults with Low Incomes.

The Local Initiatives Support Corporation runs over 100 Financial Opportunity Centres across the USA. These FOCs deliver integrated financial empowerment and employment programs. A 2016 study evaluated the impacts of integrated service delivery… more recently LISC developed an Implementation Academy.

In 2015 The Administration for Children and Families, a division of the US Department of Health and Human Services, in collaboration with the Prosperity Now developed Building Financial Capability: A Planning Guide for Integrated Services. This resource is technical guide for community-based organizations that serve low- and moderate-income individuals.

Additional resources: Literature summaries

Citi Financial Capability Demonstration Project

Matched Savings Account Program Study

Financial Coaching Impact Evaluation

Pathfinders Re-Entry Mentoring Program

CFPB Financial Coaching Strategy

GreenPath Virtual Financial Coaching Pilot

Understanding Family Engagement in Home Visiting: Literature Synthesis

Study on Efficacy of Health Coaching and an Electronic Health Management Program

French

Financier intégré dans le contexte des programmes pour la main-d’œuvre

Les ressources ci-dessous présentent le modèle d’accompagnement financier intégré dans le contexte des programmes pour la main-d’œuvre. Elles ont été créées dans le cadre du projet pilote d’accompagnement financier intégré et sont destinées à susciter l’intérêt des fournisseurs de services d’autonomisation financière et des programmes d’emploi quant aux possibilités prometteuses du modèle. Les prochaines étapes de la trousse à outils contribueront à la planification initiale et aux étapes de mise en œuvre de l’intégration de l’éducation financière dans les programmes de formation de la main-d’œuvre.

- Le guide d’introduction à l’accompagnement financier intégré donne un aperçu du « quoi » et du « pourquoi » de l’intégration de l’autonomisation financière dans les programmes destinés à la main-d’œuvre.

- L’analyse documentaire sur l’intégration de l’accompagnement financier dans les programmes destinés à la main-d’œuvre présente une synthèse de la littérature et des pratiques prometteuses des États-Unis, ainsi que des connaissances acquises par les partenaires du projet d’accompagnement financier intégré.

- La revue de la littérature résume les pratiques prometteuses pour améliorer la rétention des participants dans le cadre d’interventions en plusieurs séances qui mènent à des résultats plus profonds en matière de bien-être financier.

En savoir plus sur l’intégration de l’autonomisation financière

Publications canadiennes

Sur la voie de la prospérité : les villes pour l’autonomisation financière (en anglais seulement)— Le dossier présente des données relatives à l’intégration de l’éducation financière.

Publications américaines

Le ministère de la Santé et des Services sociaux des États-Unis, par l’intermédiaire de son bureau de la planification, de la recherche et de l’évaluation a soutenu le cabinet MEF Associates et l’Urban Institute pour mener un projet de recherche de grande envergure (en anglais seulement) portant sur l’intégration des programmes de capacité financière et de main-d’œuvre sur une période de plus de 15 ans. Dans le cadre de ce projet de recherche, deux rapports de recherche sont très pertinents pour les tentatives de reproduction de la prestation de services intégrés dans le contexte canadien. Le premier rapport est une synthèse de la littérature sur l’intégration de la capacité financière dans les services d’emploi (en anglais seulement). Le deuxième rapport est un résumé des approches, des motivations et des types de services, ainsi que des points de vue des participants sur les services intégrés : Comprendre les interventions en matière de capacité financière dans les contextes liés à l’emploi pour les adultes ayant de faibles revenus (en anglais seulement).

La Local Initiatives Support Corporation (LISC) gère plus de 120 centres de ressources financières (Financial Opportunity CenterMD — FOC) à travers les États-Unis. Ces centres FOC proposent des programmes intégrés d’autonomisation financière et d’emploi depuis 2005. Une étude de 2016 a évalué les impacts de la prestation de services intégrés… La LISC a mis en œuvre un centre de ressources en ligne (en anglais seulement) pour les praticiens, qui comprend des ressources sur la prestation de services, l’accompagnement financier, leur système de gestion des clients Salesforce, ainsi que sur les opérations et l’administration. Récemment, la LISC a publié un résumé des résultats (en anglais seulement) à propos d’une académie de mise en œuvre visant à former les organismes de main-d’œuvre sur la façon d’intégrer l’accompagnement financier individuel dans leur modèle de prestation de services existant.

En 2015, l’Administration for Children and Families, une division du ministère de la Santé et des Services sociaux des États-Unis, en collaboration avec Prosperity Now, a élaboré le Guide de planification pour les services intégrés : Renforcer la capacité financière. Cette ressource est un guide technique destiné aux organismes communautaires qui s’occupent des personnes ayant de faibles revenus ou des revenus modestes.

Ressources Additionnelles : La synthèse de la littérature

Projet de démonstration de la capacité financière de Citi

L’étude portant sur le programme de compte d’épargne jumelée

L’évaluation portant sur les répercussions de l’accompagnement financier

Programme de mentorat pour la réintégration de l’organisme Pathfinders

Projet pilote d’accompagnement financier virtuel de GreenPath

L’efficacité de l’accompagnement en matière de sante et d’un programme de gestion en cyber santé

Empower U Financial Coaching

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and asset building intervention (although partners also contribute to the other interventions).

The Sustainable Livelihood Model identifies five distinct sets of assets including personal, human, social, physical and financial. The Empower U program activities are grounded by two overarching philosophies: Financial Empowerment (as defined by Prosper Canada) and the Sustainable Livelihood Model (adapted by the Canadian Women’s Foundation, based on the work of the University of Sussex Institute for Development Studies).

Focusing on financial literacy and coaching, Empower U has developed an individual financial coaching component to the overall program.

English

For frontline staff - Quick tools you can use with clients

Starting the conversation

Here are 7 questions to help you start a conversation about money with your client. Based on what you learn about your clients’ needs, the remaining links on this page to help you find answers and next steps.

Try this coaching readiness checklist to help your client ascertain if they have the time and are interested in receiving financial coaching.

Worksheets & tip sheets

Here are some “go to” worksheets and tip sheets that frontline staff have found very helpful with their clients. They focus on budgeting, saving, and debt management – common FE needs that come up. Try them out for yourself first and see which ones might work for your clients.

The Budget Spreadsheet is an excellent tool for capturing the full picture of an individual’s financial picture. The individual inputs information according to different categories and the tool calculates totals in a summary page to show how much money is left over at the end of the month. [Thunder Bay Counselling]

The Simple budget template is an alternative monthly budget tool clients can use. It includes links to an Income tracking worksheet and Expenses tracking worksheet. [Prosper Canada / Trove]

The Urgent vs Important worksheet can help clients prioritize their spending. This, in turn, can help them save or “find money” for necessary expenses. [Prosper Canada / Trove]

Knowing how to set a SMART goal is important for planning and achieving targets. In the Set a SMART financial goal, clients learn what a SMART goal is and write SMART financial goals that are important to them. [Prosper Canada / Trove]

Making a spending plan is a worksheet clients can use to create a spending plan for each week based on money coming in and out each month. [Prosper Canada / Trove]

Making a debt action plan is a worksheet to help your clients get a handle on their debt. [Prosper Canada / Trove]

Tips for Managing Debt and Bills is a reference sheet you can give clients during tough times when managing cash flow is a challenge.

Prioritizing bills helps clients prioritize what bills to pay when it’s not possible to pay for everything. Note that this tool is from the Consumer Financial Protection Bureau (CFPB), an American government agency and includes a link to their website. Let clients know the information on the website is geared to the US context. [Consumer Financial Protection Bureau]

Online sites and tools

Here are great online tools you can also share and use in your FE work with clients.

Benefits wayfinder [benefitswayfinder.org]

Support with access to benefits is another powerful FE intervention. The Benefits wayfinder is a simple, easy to use, plain language tool that helps people on low and modest incomes find and track benefits they could get. Clients can use it on their own or with your support.

Read the Benefits wayfinder fact sheet to learn more.

Then watch the How to use this tool video. It highlights and demonstrates how to navigate through the key features of the tool.

If you would like additional training on how to support your clients with access to benefits and use the Benefits wayfinder tool in your money conversations, you can sign up for Prosper Canada’s self-directed online course and/or live workshop.

Trove [yourtrove.org]

Trove is a free bilingual website that clients can visit on their own or with your support. Many of the tools you were introduced to above can be found on Trove, along with a wealth of other user-friendly financial tools, worksheets, and education information to help clients take charge of their spending, learn about tax filing and benefits, and manage debt.

Along with a link to the Benefits wayfinder, you can also find these online tools:

- My money in Canada is a website that can help clients build healthy money habits with simple, easy to use learning modules on a range of money topics. The site also includes videos and a financial wellness checklist for clients.

- The RDSP Calculator for Canadians can be used to assess the potential of opening and contributing to a Registered Disability Savings Plan.

For managers - Tools for getting started with financial empowerment

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Tool 1. Making the case for financial empowerment

For FE to be successful, it’s critical to get buy-in from staff and stakeholders.

Below are great resources to share with key players who are new to FE. They can help you get others quickly up to speed on what FE is and the value of embedding FE as you onboard them or work to build interest in FE in your municipality.

- Prosperity Gateways Primer gives a quick overview of the “what” and “why” of embedding FE into municipal services.

- FE Brochure provides a more detailed introduction to FE and embedding FE.

- Here are three case examples you can use to show the powerful impact embedding FE into municipal services can have:

- Case example: York region

- Case example: TESS

- Case example: Edmonton

Tool 2. Getting started: the internal scan

Take the time to learn about common FE interventions. Then, assess conditions, capacity and considerations in your municipality for providing these kinds of financial help to your clients.

This tool guides you through an internal scan as you envision what embedding FE might look like in your service delivery context. Consider Tool 2: Getting started: the internal scan a starting point that will continue to evolve as you move through the process.

Tool 3. Exploring partnerships: the external scan

Municipalities do not have to deliver FE supports themselves to turn their services into Prosperity Gateways. In many cases, especially at the outset, it may be more cost-effective and less resource intensive to establish referral pathways to other local service providers or to partner with non-profit organizations, foundations, or financial service providers to deliver the financial help to meet your clients’ needs.

Use Tool 3: Exploring collaborations and partnerships to perform a scan of FE services in your local community and identify potential collaborations and partnerships.

Two additional partnership resources are ‘Elements of Integration‘ and ‘Partnership Tip Sheet‘

Tool 4. Designing the initiative: the service blueprint

Having completed an internal and external scan of barriers and opportunities, you are now ready to design an FE initiative to suit your municipality’s context. Designing the initiative is an important phase where you work out the service model, clarify partnerships, and imagine the ideal client experience.

Tool 4: Designing the initiative guides you through choosing the best service delivery model for your context and designing the client and staff journey.

We hope this toolkit will grow and improve with use and feedback. Current ideas for upcoming tools include:

- Understanding your clients’ financial capability

- Building a successful team

- Supporting staff for success

- Setting up effective data collection and evaluation processes

Tool 5. Designing the initiative: a shadowing guide

Tool 5: A shadowing guide can help frontline staff understand the process from intake to service delivery.

Feedback / Suggestions

We’d love to hear your feedback and suggestions for tools that you would find useful. Please email: info@prospercanada.org.

Learn more about FE

Canadian Publications

Prosperity Gateways: Cities for financial empowerment – Building the case outlines evidence for embedding FE.

Read the report How financial empowerment services are helping Ontarians build financial health for more supporting evidence and personal stories.

Financial Empowerment – What is it and how it helps reduce poverty [national] suggests that FE is a critical missing piece of federal government policy that can significantly boost client outcomes when it is embedded into other programs and services.

Financial Empowerment – What is it and how it helps reduce poverty [Alberta] provides an overview of provincial government action on FE in Alberta. The Alberta government adapted the national document (by the same name) to use in their internal discussions with municipal decision-makers. Create a document that you can use for your internal discussions using this as an example.

U.S. Publications

The municipal integration of FE in Canada is grounded in influential work in the US by the Cities for Financial Empowerment (CFE) Fund. Launched in 2012 in New York the CFE Fund showed that embedding FE strategies into local government infrastructure can have a “supervitamin effect” on public programs, increasing the financial stability of low to moderate income households.

- Read the pioneering article: “Municipal Financial Empowerment: A Supervitamin for Public Programs”

- Learn more about their Financial Empowerment Centers model in this 4-minute video

- Visit their website to see resources and sign up for their quarterly newsletter

- See a three-year evaluation of the model in 5 cities across the US. “An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service”

The Urban Institute examined the cost of residents’ financial insecurity to city budgets in 10 American cities in this 2017 research. Across these cities, the costs range from the tens to hundreds of millions of dollars, suggesting that cities have an economic interest in improving their residents’ financial health.

A report by JP Morgan Chase reviews municipal efforts to integrate financial capability into public services in several US locations in “A Scan of Municipal Financial Capability Efforts.”

French

Pour le personnel de première ligne — Outils rapides que vous pouvez utiliser avec les clients

Amorcer la conversation

Voici sept questions qui vous aideront à entamer une conversation à propos de l’argent avec votre client. En fonction de ce que vous avez appris sur les besoins de vos clients, les autres liens de cette page vous aideront à trouver des réponses et à connaître les prochaines étapes.

Utilisez cette liste de vérification pour aider votre client à décider s’il a le temps et s’il souhaite recevoir un accompagnement financier.

Fiches de travail et fiches de conseils

Voici quelques feuilles de travail et des feuilles de conseils que le personnel de première ligne a trouvé très utiles pour ses clients. Elles portent principalement sur la planification budgétaire, l’épargne et la gestion des dettes — les besoins courants en matière d’AF qui se présentent. Essayez-les d’abord pour vous-même et voyez ceux qui pourraient convenir à vos clients.

La feuille de calcul du budget (anglais seulement) est un excellent outil pour saisir le portrait complet de la situation financière d’un individu. La personne saisit les données selon différentes catégories et l’outil calcule les totaux dans une page de synthèse pour montrer combien d’argent il reste à la fin du mois. [Thunder Bay Counselling]

Le modèle de budget simple est un outil alternatif de budget mensuel que les clients peuvent utiliser. Il comprend des liens vers une feuille de calcul de suivi des revenus et une feuille de calcul de suivi des dépenses. [Prospérité Canada/Trove]

La feuille de calcul Urgent versus Important peut aider les clients à établir des priorités dans leurs dépenses. Cela peut ensuite les aider à économiser ou à « trouver de l’argent » pour les dépenses nécessaires. [Prospérité Canada/Trove]

Il est important de savoir comment établir un objectif INTELLIGENT pour mettre en place et atteindre des objectifs. Avec l’outil Comment établir des objectifs financiers INTELLIGENTS, les clients apprennent ce qu’est un objectif INTELLIGENT et choisissent des objectifs financiers INTELLIGENTS qui sont importants pour eux. [Prospérité Canada/Trove]

La feuille de calcul Comment établir un plan de dépenses est un outil que les clients peuvent utiliser pour créer un plan de dépenses pour chaque semaine en fonction des entrées et sorties d’argent du mois. [Prospérité Canada/Trove]

La feuille de calcul Élaboration d’un plan d’action en matière de dettes est un outil pour aider vos clients à prendre le contrôle sur leurs dettes. [Prospérité Canada/Trove]

Conseils pour la gestion des dettes et des factures est une feuille de référence que vous pouvez donner à vos clients dans les moments difficiles où la gestion des fonds est un défi.

Le classement des factures par ordre de priorité (anglais seulement) aide les clients à déterminer les factures à payer en premier lorsqu’il n’est pas possible de tout payer. Notez que cet outil provient du Consumer Financial Protection Bureau (CFPB), une agence gouvernementale américaine, et comprend un lien vers son site Web. Expliquez aux clients que les renseignements figurant sur le site Web sont adaptés au contexte américain. [Consumer Financial Protection Bureau]

Sites et outils en ligne

Voici d’excellents outils en ligne que vous pouvez également faire connaître et utiliser dans votre travail en matière d’AF avec les clients.

Orienteur en mesures d’aide [benefitswayfinder.org/fr]

L’aide à l’accès aux mesures d’aide est une autre façon puissante d’intervenir en matière d’AF. L’Orienteur en mesures d’aide est un outil simple, facile à utiliser et rédigé en langage clair qui aide les personnes à revenus faibles ou modestes à trouver et à répertorier les mesures d’aide auxquelles elles peuvent prétendre. Les clients peuvent l’utiliser seuls ou avec votre aide.

Pour en savoir plus, lisez la fiche d’information sur l’Orienteur en mesures d’aide. (anglais seulement)

Ensuite, regardez la vidéo Comment utiliser cet outil (anglais seulement). Elle explique et démontre comment naviguer à travers les principales caractéristiques de l’outil.

Si vous souhaitez obtenir une formation supplémentaire sur la façon d’aider vos clients à accéder aux mesures d’aide et d’utiliser l’Orienteur en mesures d’aide dans vos conversations au sujet de l’argent, vous pouvez vous inscrire au cours autodidacte en ligne ou à l’atelier en direct de Prospérité Canada.

Trove [yourtrove.org/fr]

Trove est un site Web bilingue gratuit que les clients peuvent visiter par eux-mêmes ou avec votre aide. La plupart des outils qui vous ont été présentés ci-dessus se trouvent sur Trove, ainsi qu’une multitude d’autres outils financiers conviviaux, des feuilles de calcul et des renseignements éducatifs pour aider les clients à prendre en charge leurs dépenses, à se renseigner sur la déclaration et les avantages fiscaux et à gérer leurs dettes.

En plus d’un lien vers l’Orienteur en mesures d’aide, vous trouverez également ces outils en ligne :

- Mon argent au Canada est un site Web qui peut aider les clients à acquérir de bonnes habitudes en matière de gestion de l’argent grâce à des modules d’apprentissage simples et faciles à utiliser sur toute une série de sujets liés à l’argent. Le site comprend également des vidéos (anglais seulement) et un questionnaire relatif au bien-être financier pour les clients.

- La calculatrice du REEI pour les Canadiens peut être utilisée pour évaluer la possibilité d’ouvrir et de cotiser à un régime enregistré d’épargne-invalidité.

Pour les gestionnaires — Outils pour démarrer avec l’autonomisation financière

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Outil 1. Argumenter en faveur de l’autonomisation financière.

Pour que l’AF soit un succès, il est essentiel d’obtenir l’adhésion du personnel et des intervenants.

Vous trouverez ci-dessous d’excellentes ressources à faire connaître aux acteurs clés qui ne connaissent pas encore l’AF. Elles peuvent vous aider à faire comprendre rapidement aux autres ce qu’est l’AF et la pertinence d’intégrer l’AF lorsque vous les accueillez ou lorsque vous travaillez à susciter l’intérêt pour l’AF dans votre municipalité.

● L’abécédaire des passerelles pour la prospérité (anglais seulement) donne un aperçu de « qu’est-ce que c’est » et du « pourquoi » au sujet de l’intégration de l’AF dans les services municipaux.

● La brochure de l’AF (anglais seulement) fournit une introduction plus détaillée à l’AF et à l’intégration de l’AF.

● Voici trois exemples de cas que vous pouvez utiliser pour montrer l’impact puissant que peut avoir l’intégration de l’AF dans les services municipaux :

o Exemple de cas : Région de York

o Exemple de cas : Services sociaux et d’emploi de Toronto

o Exemple de cas : Edmonton

Outil 2. Commencer : l’analyse interne

Prenez le temps de vous renseigner sur les types d’interventions courantes en matière d’AF. Ensuite, évaluez les conditions, la capacité et les considérations dans votre municipalité pour fournir ces types d’aide financière à vos clients.

Cet outil vous guide à travers une analyse interne qui vous permet d’envisager ce que pourrait être l’intégration de l’AF dans votre contexte de prestation de services.

Considérez l’outil 2 : Commencer : l’analyse interne un point de départ qui continuera à évoluer à mesure que vous avancerez dans le processus.

Outil 3. Explorer les partenariats : l’analyse externe

Les municipalités ne sont pas obligées de fournir elles-mêmes des mesures d’aides en matière d’AF pour transformer leurs services en passerelles pour la prospérité. Dans de nombreux cas, surtout au début, il peut être plus rentable et moins exigeant sur le plan des ressources d’établir des liens de référence vers d’autres prestataires de services locaux ou de s’associer à des organismes à but non lucratif, des fondations ou des prestataires de services financiers pour fournir l’aide financière répondant aux besoins de vos clients.

Utilisez l’outil 3 : Explorer les collaborations et les partenariats pour effectuer une analyse des services en matière d’AF dans votre communauté locale et identifier les collaborations et partenariats potentiels.

Deux autres ressources à propos du partenariat sont les « Éléments de l’intégration » et les « Conseils pour le partenariat » .

Outil 4. Concevoir l’initiative : le plan de service

Après avoir effectué une analyse interne et externe des obstacles et des opportunités, vous êtes maintenant prêt à concevoir une initiative d’AF adaptée au contexte de votre municipalité. La conception de l’initiative est une phase importante où vous élaborez le modèle de service, clarifiez les partenariats et imaginez l’expérience client idéale.

L’outil 4 : Conception de l’initiative vous guide dans le choix du meilleur modèle de prestation de services pour votre contexte et dans la conception du parcours du client et du personnel.

Nous espérons que cette boîte à outils se développera et s’améliorera avec l’utilisation et les commentaires. Les idées actuelles pour les outils à venir incluent :

- Comprendrela capacité financière de vos clients

- Mettresur pied une équipe performante

- Soutenirle personnel pour qu’il réussisse

- Mettreen place des processus efficaces de collecte de données et d’évaluation

Outil 5. Concevoir l’initiative : un guide d’observation

L’outil 5 : Un guide d’observation peut aider le personnel de première ligne à comprendre le processus, de l’accueil à la mise en œuvre du service.

Commentaires et suggestions

Nous serions ravis d’entendre vos commentaires et vos suggestions d’outils que vous trouveriez utiles. Veuillez nous envoyer un courriel : info@prospercanada.org.

En savoir plus en matière d’AF

Publications canadiennes

Passerelles de prospérité : Les villes pour l’autonomisation financière — établir le dossier (anglais seulement) décrit les preuves qui sont pour l’intégration de l’AF.

Lisez le rapport intitulé Comment les services d’autonomisation financière aident les Ontariens à renforcer leur santé financière (anglais seulement) pour obtenir plus de preuves et de récits personnels.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [national] (anglais seulement) suggère que l’autonomisation financière est une pièce manquante essentielle de la politique du gouvernement fédéral qui peut considérablement améliorer les conditions de vie des clients lorsqu’elle est intégrée à d’autres programmes et services.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [Alberta] (anglais seulement) donne un aperçu de la démarche du gouvernement provincial en matière d’AF en Alberta. Le gouvernement de l’Alberta a adapté le document national (du même nom) pour l’utiliser dans ses discussions internes avec les décideurs municipaux. Créez un document que vous pourrez utiliser pour vos discussions internes en utilisant cet exemple.

Publications américaines

L’intégration municipale de l’AF au Canada est fondée sur les travaux influents réalisés aux États-Unis par le Fonds Cities for Financial Empowerment (CFE). Lancé en 2012 à New York, le Fonds CFE Fund a montré que l’intégration de stratégies d’AF dans l’infrastructure des gouvernements locaux peut avoir un « effet super vitaminé » sur les programmes publics, en augmentant la stabilité financière des ménages à revenu faible ou modéré.

- Lisez l’article pionnier : « Municipal Financial Empowerment: A Supervitamin for Public Programs » (anglais seulement)

- Apprenez-en davantage sur leur modèle de centres d’autonomisation financière (anglais seulement) dans cette vidéo de quatre minutes.

- Visitez leur site Web (anglais seulement) pour voir les ressources et vous inscrire à leur infolettre trimestrielle.

- Découvrez une évaluation de trois ans du modèle dans cinq villes des États-Unis. « An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service » (anglais seulement)

L’Urban Institute a examiné le coût de l’insécurité financière des résidents sur les budgets municipaux de dix villes américaines dans cette recherche de 2017 (anglais seulement). Dans ces villes, les coûts vont de dizaines à des centaines de millions de dollars, ce qui suggère que les villes ont un intérêt économique à améliorer la santé financière de leurs résidents.

Un rapport de JP Morgan Chase passe en revue les efforts déployés par les municipalités pour intégrer la capacité financière dans les services publics dans plusieurs villes américaines dans « A Scan of Municipal Financial Capability Efforts » (anglais seulement).

Financial Coaching Initiative: Results and Lessons Learned

In 2015, the Consumer Financial Protection Bureau launched the Financial Coaching Initiative, a pilot program that provided financial coaching services to veterans and economically vulnerable consumers. Professional coaches were embedded into 60 host sites across the country, where they provided free, one-on-one help to consumers to address their personal financial goals. A range of organizations served as host sites, such as one-stop career centers, social services organizations, and legal aid groups.

Over four years, the Financial Coaching Initiative served over 23,000 consumers, demonstrating that financial coaching can be successfully implemented at scale in many different settings for a wide range of consumers.

This report and summary brief describe the basic structure of the Initiative, present data about the program’s results, and summarize key lessons learned for practitioners and organizations interested in coaching.

Government response to the Countervailing Power: Review of the coordination and funding for financial counselling services across Australia

In 2019, a comprehensive review (The Countervailing Power: Review of the coordination and funding for financial counselling services across Australia) of financial counselling services in Australia was undertaken and recommendations to ensure the long-term viability of the financial counselling sector, including the establishment of a nationally coordinated approach, and industry funding to strengthen the predictability and stability of funding for financial counselling were made.

This document is the Australian Government's response to the review, outlining their response to each of the recommendations, and sets out their commitment to the following:

- commence work with state and territory governments and relevant stakeholders on a national approach for the funding and coordination of financial counselling (also relevant to the specialist, RFCS and small business financial counselling sector);

- introduce an industry funding model following consultations with industry and the financial counselling sector that will ensure predictability and stability of funding for generalist financial counselling services into the future. The Government’s preference is to reach agreement between the relevant industries in relation to an overall funding strategy. However, if this agreement is not reached, the Government will consider a compulsory mechanism. Industry contributions would ideally start in 2021-22; and

- support in principle the establishment of an independent body to be responsible for the national cooperative financial counselling effort, including delivery of funding.

Countervailing Power: Review of the coordination and funding for financial counselling services across Australia

In 2019, the Australian Government committed to additional actions to improve the financial outcomes of Australians, including undertaking an immediate review of the coordination and funding of financial counselling services that disadvantaged Australians rely on.

The review noted the benefits of financial counselling to the community, including early intervention and prevention of further financial hardship, advocacy support, and referral to other services for complex issues. The review also highlighted the challenges faced by the financial counselling sector, including increasing demand, fragmented delivery, and the array of complex situations and financial products that can lead to financial hardship.

The review:

- Assessed whether existing financial counselling services adequately support clients’ current, emerging or changing needs, including areas such as small business and natural disasters;

- Explored the most efficient and appropriate way to deliver financial counselling services;

- Considered how to improve the coordination and consistency of delivery of financial counselling services across all jurisdictions in Australia;

- Recommended options for improving the predictability and sustainability of funding financial counselling services, including by drawing on successful international funding models and considering options for industry funding; and

- Considered how the use of data can inform policy, service delivery and demand trends.

Practitioner tools for navigating financial exchanges with family and friends

Financial educators are particularly aware of the prevalence of these types of financial arrangements – otherwise known as family financial exchanges (FFEs). To support practitioners helping clients through these often sensitive conversations about these arrangements, the Consumer Financial Protection Bureau released the Friends and Family Exchanges Toolkit , a four-part guide for coaching clients in asking for financial help or changing an existing agreement due to their own financial hardship.

Resources

Project reports, journey maps, and toolkit

Reports

These slide decks describe the goals and outcomes of this project.

Socialization deck: Supporting the design of a remote financial help service (Bridgeable)

Client Journey maps

These journey maps offer a visual explanation of the process used by the 3 participating community agencies offering one-on-one client support.

Family Services of Greater Vancouver

SEED Winnipeg

Thunder Bay Counselling

Toolkit

This toolkit was developed in collaboration with community partners, and shares tools for coaches and clients in the virtual one-on-one process.

Virtual service delivery tools (Toolkit)

Responding to Client’s “Now, Soon, & Later” Needs

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their current and future needs are discussed.

2019 Financial Coaching Network Bi-Monthly Peer Call Series

These calls, featuring guest practitioners, cover a variety of topics most pressing to the financial coaching field, provide useful tips and resources and serve as a peer-learning platform.

Topics include:

OpportuNext (career transition online tool)

OpportuNext from The Conference Board of Canada is a free-to-use career tool created in partnership with the Future Skills Centre. The tool can be used by anyone looking to plan a career path with a similar skillset or for anyone providing employment services.

Investing in Financial Coaching with a Racial Equity Lens

In this moment, it is pivotal for philanthropy to support communities of color in achieving financial well-being. Combined with systems-change efforts that would create fairer economic opportunities and conditions, financial coaching is a vital component of providing needed support. Through background information, case stories, and key investment considerations, this brief focuses on financial coaching with a racial equity lens as an important strategy for helping people of color achieve equitable outcomes.

Real Money, Real Experts Podcasts

Real Money, Real Experts is a personal finance podcast written and produced by AFCPE (Association for Financial Counseling & Planning Education). Their membership community offers a place for financial counsellors and financial fitness coaches to share best practices, solve similar struggles, and access tools and resources.

Recent episodes include the following topics:

- Economic Self-Sufficiency: How Financial Professionals Support Individuals with Disabilities

- Empowering Communities after COVID-19

- Where Race & Gender Intersect: Why the Wealth Gap is Widening and How to Help

Achieving financial resilience in the face of financial setbacks

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling.

This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

Providing one-on-one financial coaching to newcomers: Insights for frontline service providers

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE interventions include financial coaching and supports that assist people to build money management skills, access income benefits, tackle debt, learn about safe financial products and services and find ways to save for emergencies.

This report shares insights on providing one-on-one financial coaching to newcomers captured through two financial coaching pilot projects that Prosper Canada conducted in collaboration with several frontline community partners.

Client Engagement and Retention—The Secret Ingredient in Successful Financial Capability Programs

Grantmakers and practitioners recognize the importance of financial security for individuals and families, and many organizations therefore offer financial capability programs aimed at strengthening the financial well-being of the people they serve. But good financial capability programs are often high-touch and costly to provide for program administrators, and time consuming for clients to participate in. To benefit fully from such programs’ offerings, clients must actively participate in the program’s coaching, counseling, or other sessions, and engage in related activities to boost their financial health.

Thus, understanding what drives client engagement is critical to helping programs improve program retention and outcomes, and concurrently, helps funders maximize the value of philanthropic dollars and customers’ time. Grantmakers concerned about best practices for funding effective financial capability efforts must therefore understand the vital role of client retention and the strategies for supporting the nonprofit sector to address this challenge.

The brief explains the importance of client retention and engagement for financial capability program success, describes three key barriers to effective program participation, offers strategies to overcome those barriers, and closes with recommendations for philanthropy.

Creating a Strong Foundation for Change

This guide is designed to be a resource for programs working with low income families to use when anticipating or implementing a new approach, such as coaching, to doing business. It helps you to systematically – and honestly – look at your foundational readiness for change, so that the improvements you want to make will take root and grow in fertile ground. Making time and space to look deeply into your organization can offer the opportunity to reconsider what quality service delivery looks like, help you discover how coaching (or other techniques) could be a tool, and plan efficiently on where it fits best into your existing context.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar

Access the handouts for this webinar:

Poster presentation: Financial Empowerment for Newcomers project

Infographics: Newcomer settlement stages, money matters, and client personas

Time-stamps for the video recording:

3:11 – Agenda and introductions

5:21 – Audience poll

8:25 – Introduction to Financial Empowerment for Newcomers project (Speaker: Glenna Harris)

11:25 – AXIS financial coaching program (Speaker: Sheri Abbot)

30:05 – North York Community House financial coaching program (Speaker: Noemi Garcia)

45:40 – Q&A

Money Circle toolkit

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a brief, interactive exercise, to initiate conversations about the feelings and personal relationships that shape financial choices.

My money in Canada

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes.

Clients can do the modules in the order they appear, or just the ones they want to use. The tool is intended to be used with clients and settlement workers together, but can also be used by the client on their own if they are comfortable.

An Evaluation of Financial Empowerment Centers: Building People’s Financial Stability as a Public Service

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free public service. The evaluation draws on data from 22,000 clients who participated in 57,000 counseling sessions across these first 5 city replication partners, and provides additional evidence of the program’s success.

Overview: Financial Empowerment Center Counselor Training Standards

This overview summarizes the Financial Empowerment Center (FEC) model’s Counselor Training Standards. The Standards delineate the breadth and depth of the financial content areas, counseling and coaching skills, practice and experiential learning, and socio-economic and cultural context setting necessary to serve the diverse needs and backgrounds of FEC clients. The Standards also include a Code of Ethics that promotes responsible, professional and ethical financial counseling, furthering the profession of one on-one financial counseling.

Financial Coaching Program Design Guide: A Participant-Centred Approach

This comprehensive resource from Prosperity Now supports organizations in developing a participant-centered financial coaching program. Grounded in a field survey, over 100 interviews, expert advice and beta-testing with six new financial coaching programs, the Coaching Guide highlights the strengths and limitations of financial coaching, offers designs tools, showcases promising models and practices, and includes resources from program leaders and financial coaches.

English

Financial coaching tools - Exploring client needs and priorities

Tools for exploring client priorities

Urgent vs. important – fillable PDF

Dreams for the future

Financial wheel of life

First coaching meeting checklist

My money priorities

Values worksheet

My ‘money personality’ – fillable PDF

Key coaching skills

Coaching skills: Active listening

Coaching skills: The art of acknowledgement

COACH-ing moments

Program support tools

These are some example tools to support the coach in assessing client readiness for coaching, guiding clients towards potential actions to meet their goals, and in discovering referral support in their community.

Milestones, actions, and tools

Client readiness assessment – PDF

Client readiness assessment – fillable PDF

Financial health pre-assessment – PDF

Financial health pre-assessment – fillable PDF

Developing a referrals network

Virtual tools for participant engagement

Resources:

Virtual service delivery tools

We are grateful to Family Services Greater Vancouver in British Columbia, Thunder Bay Counselling in Ontario, and SEED Winnipeg Inc. in Manitoba for their content consultation support and resource sharing.

Supporting client intake, triage, and referral in virtual financial help services

Virtual tools for participant engagement

Implementing a practice of self-care for practitioners – PDF

Implementing a practice of self-care for practitioners – fillable PDF

Participant tools:

Action plan – PDF

Action plan – fillable PDF

Contact list – PDF

Contact list – fillable PDF

Information to remember – PDF

Information to remember – fillable PDF

Action items – PDF

Action items – fillable PDF

Please note that some of the resources below were developed prior to the COVID-19 pandemic and serve as samples only. Current materials used by community agencies may have been revised to reflect updates to services and to meet public health guidelines.

Intake and assessment tools:

Intake Form – Family Services Greater Vancouver

First Financial Coaching Session Survey – Family Services Greater Vancouver

Financial Health Assessment – Thunder Bay Counselling

Financial Assessment Spreadsheet – Thunder Bay Counselling

Consent forms:

Consent to Service – Thunder Bay Counselling

Consent to Release and Obtain Information – Thunder Bay Counselling

Promotional materials:

Welcome and introduction to services brochure – Thunder Bay Counselling

Community Financial Helpline social media material (image 1, image 2, image 3) – SEED Winnipeg Inc.

Case studies and common questions

Use these case studies and common questions to practice or develop your coaching skills. Try them on your own or with your fellow staff.

Case study: Linda

Case study: Jacob

Case study: Nina

Common questions 1: “Just tell me what to do!”

Common questions 2: “There’s no point.”

Saving tools

Debt tools

Coaching conversation tips – Debt

Guide for talking to creditors

Determining debt payoff order (FC toolkit)

Debt list tool (FC toolkit) – PDF

Debt list tool (FC toolkit) – fillable PDF

Net worth tool (FC toolkit) – PDF

Net worth tool (FC toolkit) – fillable PDF

Payment arrangements worksheet (FC toolkit) – PDF

Payment arrangements worksheet (FC toolkit) – fillable PDF

Who do you owe? (FC toolkit) – PDF

Who do you owe? (FC toolkit) – fillable PDF

French

Outils de coaching financier

Fixation d‘objectifs et planification d’actions

Outils de déclaration de revenue

Supporting Employee Financial Stability: How Philanthropy Catalyzes Workplace Financial Coaching Programs

More than half of all employees in the United States report that they are

financially stressed, and nearly one in three employees reports being distracted by personal financial issues while at work. This financial stress impacts individuals’ health, relationships, productivity, and time away from work.

This report describes different workplace models, the common characteristics and challenges of programs, and provides recommendations for funders who want to invest in workplace approaches to help workers achieve financial stability.

Measuring Financial Capability and Well-Being in Financial Coaching Programs

This brief describes the data collected and lessons gleaned from the Financial Coaching Impact & Evaluation Fellowship, which took place over the course of 10 months in 2017. Ultimately, this brief argues that the Financial Well-Being Scale and the Financial Capability Scale are promising tools for financial capability programs seeking to understand the impact of their programs.

Financial Capability Scale

The Center for Financial Security (CFS) and Annie E. Casey Foundation have developed a short set of standardized client outcome measures to create the Financial Capability Scale (FCS).

In 2011, CFS worked with four organizations to collect data on client outcome measures, with the goal of refining a small set of measures that can be used across programs. The project aimed to increase coordination across organizations so the financial coaching field can improve its capacity to demonstrate client impacts. The findings from the project extend beyond the coaching field and can be applied to other financial capability services.

Financial Coaching Process Evaluation Report

This report presents the findings of the process evaluation of the Financial Coaching pilot, a part of the Financial Empowerment Collaborative in Calgary. In documenting the procedures and early thoughts of participating programs on the implementation of this pilot project, we assessed how well early goals are being met, documented some promising best practices, identified common roadblocks encountered by agencies, and compiled solutions developed in response to those roadblocks.

My Budget Coach Pilot Evaluation

This pilot study explores the delivery and effectiveness of MyBudgetCoach, a financial coaching program designed to help low- and moderate-income adults develop budgeting skills, set financial goals, and work towards those goals. Specifically, this study compares two modes of program delivery, traditional in-person coaching and fully remote coaching. By testing financial coaching in these two contexts, this project seeks to generate a deeper understanding of the mechanisms that underpin coaching and the role technology may play in facilitating behavior change.

Family Centered Coaching: A toolkit to Transform Practice & Engage Families

The Family-Centered Coaching Toolkit offers a set of strategies, tools, and resources that can help programs, agencies, case managers, coaches, and others change the ways they work with families striving to reach their goals. This set of resources, can undo, and redo, how one approaches working with families – to see families holistically, even though the funding streams and programs within which we work may not.

Implementing Financial Coaching

A presentation on how financial coaching is different, client interaction and program evaluation and coaching as presented by Richard Simonds of Family Services of Greater Houston.

An Evaluation of Financial Empowerment Centers Building People’s Financial Stability as a Public Service

This report provides information on the Financial Empowerment Center model, the people it served, the outcomes they achieved, the impact services had on nonprofit and city partners, and lessons learned for others looking to replicate or support this model. The evaluation was designed as a utilization-focused, foundational and exploratory study, aimed at creating an evaluation report that was useful to stakeholders. The report includes both qualitative and quantitative sources

A Much Closer Look: Enhancing Savings Counseling at Financial Empowerment Centers

Building savings is a fundamental strategy for empowering individuals and families with low incomes. Even relatively small amounts of savings can serve as a buffer against inevitable financial shocks that can otherwise undermine social service efforts and successes – and short-term savings offer realistic first steps toward building longer-term savings and acquiring assets.

The CFE Fund conducted a research pilot at municipal Financial Empowerment Centers to better understand how clients are saving, and inform new savings indicators for financial counseling success. This report explains the insights of this research pilot, and client outcomes in savings and goal setting.

MPower Money Coaching Program

This is the final report on the MPower Money Coaching Program. This program was a unique collaboration that brought together Prosper Canada, a national charity, Canada’s leading investment firms and investment industry associations, and the City of Toronto’s Employment and Social Services Division (TESS) to provide neutral, high quality financial help to people living on low incomes.

Family-Centred Coaching Toolkit

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families.

(Note: Accessing the toolkit requires submitting user information).

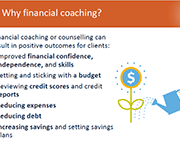

Financial Coaching: An Asset-Building Strategy

Financial coaching is a promising strategy to help people improve their financial well-being, but is often not yet universally understood. Practitioners are turning to coaching strategies to better facilitate behaviour change as opposed to the disappointing results often found when only financial education or financial access programs are introduced. Shared insights on financial coaching can help shape collective action by funders seeking to facilitate greater financial capability among targeted populations.