English

Soaring with savings - Tips and tools to help you save

SWS Worksheet #1 – The importance of saving (Fillable PDF)

SWS Worksheet #2 – Create a savings goal (Fillable PDF)

SWS Worksheet #3 – Savings support network (Fillable PDF)

SWS Worksheet #4 – Saving for emergencies (Fillable PDF)

SWS Worksheet #5 – Saving for unstable income (Fillable PDF)

SWS Worksheet #6 – Saving for education (Fillable PDF)

SWS Worksheet #7 – Saving for retirement (Fillable PDF)

Soaring with Savings- Full booklet

Soaring with savings - Training tools

French

Encourager l’épargne - Conseils et outils pour vous aider à épargner

Encourager l’épargne - l’aide d’animation

Ressources

CELI calculatrice, La Commission des valeurs mobilières de l’Ontario

REER, La Commission des valeurs mobilières de l’Ontario

Épargnez plus facilement, CVMO

Investir et épargner pendant une récession, La Commission des valeurs mobilières de l’Ontario

The impact of COVID-19 on financial capability and asset building services.

The forced transition from in-person to online activities as a result of the COVID-19 pandemic has had a profound impact on how families and communities buy groceries, acquire medical care, and utilize social services. This rapid shift has raised important questions about how to address access and equity. AFN and the University of Wisconsin-Madison Center for Financial Security (CFS) conducted this study to better understand the transition to remote services among financial capability and asset building (FCAB) programs, which includes financial education, counseling, coaching, emergency assistance, benefits navigation, housing supports, workforce development, and other related services. The insights from this study can inform strategies for FCAB services going forward. This brief reviews recommendations for funders and organizations seeking to learn from the financial capability service delivery models employed in the COVID-19 pandemic, especially related to replication of findings that lead to more equitable delivery practices, improved accessibility of services, and greater financial improvements for clients. Six region-specific briefs complement the national findings - Indiana, Louisiana, North and South Carolina, Oregon, Texas, and Washington. This brief is generously supported by JPMorgan Chase & Co., MetLife Foundation, and Wells Fargo. If you missed the live webinar, watch the recording here.

Investing and saving during a recession

If a recession seems likely, consider how your investing and savings plans may be affected. Increases in the cost of living and borrowing, combined with the overall financial uncertainty over the impact of a potential recession, can be enough to cause personal and financial stress. There is no single best way to respond to such times.

Research study: Crypto assets 2022

This study by the Ontario Securities Commission examines Canadians’ crypto ownership and knowledge. It found 13% of Canadians currently own crypto assets or crypto funds. The study also found most Canadians did not have a working knowledge of the practical, legal and regulatory dimensions of crypto assets. Crypto assets were believed to play a key role in the financial system by 38% of those surveyed. The study provides a profile of crypto owners, their reasons for purchasing crypto assets or crypto funds, the role of financial advice, impact of advertising, and the experience of crypto owners with crypto trading platforms.

Turning aces into assets

Ontario has just become the first province to open its legal gambling market to private internet gaming providers. As of April 4, 2022, Ontarians can play casino-style games online and place bets on sports, including single games, through sites regulated by iGaming Ontario. According to the provincial regulator, the launch of iGaming marks the triumph “of a legal internet gaming market” over “its previous grey market standing.” But as with all forms of gambling, this development has a dark side. It was only a matter of time before Ontario expanded its gambling market—not because of popular demand, but because the provincial government is addicted to gambling money and is eager to seize any opportunity to get more of it, regardless of the costs to the people it is supposed to protect. This report provides the background of gambling in Ontario, outlines the new risks with iGaming and offers four policy options.

How to build financial health in Native communities

American Indian and Alaska Native (AI/AN) peoples have long faced barriers to asset building. More than half of AI/AN populations are un- or underbanked, financial services often don’t operate on reservations, and access to capital is difficult. Native peoples have been excluded from financial wealth accumulation through government asset stripping, industry redlining, and simple neglect, thanks to historic (and ongoing) discrimination, exclusion, and racism baked into government and private-sector policies. Solutions are within reach. Recently, the Financial Security Program, the Oklahoma Native Assets Coalition, Inc (ONAC), and the Center for Native American Youth hosted an event featuring Native leaders representing various geographies, experiences, and tribal affiliations. The group discussed experiences in building assets and Indigenous perspectives on generational financial wealth. Finally, the speakers gave recommendations on how foundations, corporations, non-profits, and others can partner with tribal governments and Native-led nonprofits to build financial wealth in Native communities. ONAC has produced a “List of Eighteen Suggestions to Better Support Native Practitioners Administering Asset Building Programs in their Communities”.

Tools for 2022: Tamarack’s Top 10 Resources Published in 2021

The Tamarack Institute develops and supports collaborative strategies that engage citizens and institutions to solve major community issues across Canada and beyond. Our belief is that when we are effective in strengthening community capacity to engage citizens, lead collaboratively, deepen community and end poverty, our work contributes to the building of peace and a more equitable society. This toolkit contains the top ten resources they published in 2021 including: index of community engagement techniques, the community engagement planning canvas, a guide for community-based COVID recovery, a guide for engaging people with lived and living experience, asset-based community development, a guide for advancing the sustainable development goals in your community and much more.

Why the Time is Right for a Guaranteed Income with an Equity Lens

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders involved in GI initiatives including practitioners, government representatives and philanthropy were heard. Panelists shared outcomes and new research results from some of the most successful GI pilots in the country (Stockton and Mississippi); goals for the newly launched Mayor’s for Guaranteed Income; how philanthropy can play a catalytic role and what this moment tells us about the future of guaranteed income initiatives.

The Wealth of Unattached Men and Women Aged 50 and Older, 1999 to 2016

The evolution of the wealth, assets and debts of various groups of Canadians since the late 1990s has been documented in several studies. Yet little is known about the evolution of the wealth holdings of unattached men and women aged 50 and older, who make up a large part of the population. This study assesses how the wealth holdings of unattached men and women aged 50 and older evolved from 1999 to 2016 using data from the Survey of Financial Security of 1999, 2005, 2012 and 2016, and fills this information gap.

Innovations in Financial Capability: Culturally Responsive & Multigenerational Wealth Building Practices in Asian Pacific Islander (API) Communities

The Innovations in Financial Capability report is a collaborative report by National CAPACD and the Institute of Assets and Social Policy (IASP) at Brandeis University’s Heller School for Social Policy and Management, in partnership with Hawaiian Community Assets (HCA), and the Council for Native Hawaiian Advancement (CNHA). This survey report builds upon the 2017 report Foundations for the Future: Empowerment Economics in the Native Hawaiian Context and features the financial capability work of over 40 of our member organizations and other AAPI serving organizations from across the US. IASP’s research found that AAPI leaders are adopting innovative multigenerational and culturally responsive approaches to financial capability programming, but they want and need more supports for their work.

Get Smarter About Money: Financial Literacy 101 videos

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos covers different financial literacy topics., including:

Children’s Savings Account: Survey of Private and Public Funding 2019

Children’s Savings Account (CSA) programs offer a promising strategy to build a college-bound identity and make post-secondary education an achievable goal for more low- and moderate-income children. CSAs provide children (starting in elementary school or younger) with savings accounts and financial incentives for the purpose of education after high school. Beyond their financial value, CSAs are associated with beneficial effects for children and parents, including improved early child development. child health, maternal mental health, educational expectations, and academic performance. Many of these benefits are strongest for children from low-income families. This report shares a snapshot of the scale and makeup of the funding for the CSA field in 2019. It follows similar AFN reports on CSA funding in 2014-2015 and 2017 and captures the following data on CSA programs’ financial support in calendar year 2019:

Creating Financial Security: Financial Planning in Support of a Relative with a Disability

This handbook covers the following topics:

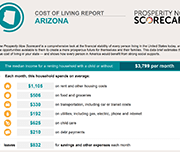

Prosperity Now Scorecard Cost-Of-Living Profiles by State

Prosperity Now has created state-level Cost-of-Living profiles as new features on their Scorecard website. The Prosperity Now Cost of Living profiles provide a comprehensive look at the financial stability of every person living in the United States. Each state profile can be downloaded and used to determine the true cost of living is in the state, based on median monthly income and discretionary spending left at the end of each month after expenses. These values determine what is left over for emergency expenses and long-term aspirational expenses. This video presents the cost of living in Georgia.

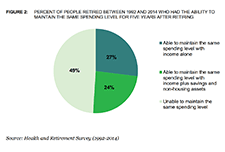

Retirement Security and Financial Decision-making: Research Brief

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level of spending for at least five consecutive years after retiring. The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring. In addition, the Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years. The study helps identify ways to protect retirees from overspending their savings in early retirement.

Cash Value: How The Financial Clinic Puts Money into the Pockets of Working Poor Families

Practitioners engaged in the nascent field of financial development lack a shared system of tracking and analyzing customer progress toward financial security. Practice leaders—ranging from direct service organizations such as the Chicago-based LISC to NeighborWorks America of Washington, D.C.—define customer progress by their individual outcomes frameworks. But without uniform outcomes measures to assess our customers’ progress—and thus, our own performance—the field as a whole is handicapped. Many factors contribute to this problem, two being most prominent: organizations are grounded in distinct theories of change, are funded by a variety of sources with their own expectations, and lack of clarity about how to measure aspects of our work.

Change Matters Volume 2: Assets

This is the second brief in a new series from The Financial Clinic. Change Matters leverages the data gathered through our revolutionary financial coaching platform, Change Machine, alongside the voices, wisdom, and lived experiences of Change Machine customers. We hope that our action oriented analysis will lead to positive social change. We believe we have a responsibility to ask the right questions, to use our data for good, and to inspire products, practice, and policy innovations that centralize the needs of the working-poor in building economic mobility.

The Pivotal Role of Human Service Practitioners in Building Financial Capability

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American experience—is one that far too often ensnares people at the insecurity stage, particularly those communities or neighborhoods that have historically been marginalized and deliberately excluded from the traditional pathway towards prosperity. Fraught with debt and credit crises, alongside a myriad of predatory products and lending practices, to a sense of stigma and shame many Americans feel because of their economic status, financial insecurity involves navigating a world on a daily basis where everyday needs are at the mercy of unjust and uncontrollable variables.

Achieving Financial Resilience in the Face of Financial Setbacks

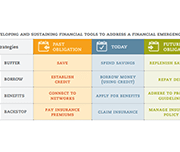

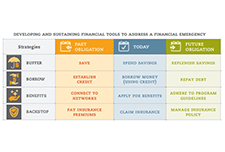

Financial shocks like these happen to financially vulnerable families every day. Such shocks destabilize household finances and can create hardships that threaten overall well-being. Having tools to manage financial emergencies is critical for people’s long-run financial security. The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Clipped Wings: Closing the Wealth Gap for Millennial Women

AFN’s latest report, in collaboration with the Closing the Women’s Wealth Gap (CWWG) and the Insight Center for Community Economic Development reveals the current economic reality for millennial women and the primary drivers contributing to their wealth inequities. The report, Clipped Wings: Closing the Wealth Gap for Millennial Women is the second in a series of publications that builds off AFN’s 2015 publication, Women & Wealth, exploring how the gender wealth gap impacts women.

From Surviving to Thriving – Ensuring the Golden Years Remain Golden for Older Women

This brief explores the drivers of economic insecurity for older women and sets forth a number of strategies and promising practices for funders to consider which address the needs of older women. Doing so will ensure this generation and future generations of men and women in this country can age financially secure and with dignity. This publication is the fourth in a series of briefs that build on AFN’s publication, Women & Wealth, to explore how the gender wealth gap impacts women, particularly low-income women and women of color, throughout their life cycle, and provides responsive strategies and best practices that funders can employ to create greater economic security for women.

Women and Wealth: Insights for Grantmakers

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for Grantmakers examines the causes and dimensions of the women’s wealth gap and provides recommendations and best practices for grantmakers to reduce the women’s wealth gap and improve women’s access to the wealth escalator. Improving women’s ability to build wealth is not only good for women, but is essential for the economic well-being of children, families, and our nation. The webinar, included Mariko Chang, PhD, K. Sujata, President and CEO, Chicago Foundation for Women, and Dena L. Jackson, PhD, Vice President – Grants & Research, Texas Women’s Foundation.

Making Safety Affordable: Intimate Partner Violence is an Asset-Building Issue

This brief explores three existing unmet needs that contribute to survivors’ inability to build wealth: money, tailored asset-building support, and safe and responsive banking and credit services. Within each identified need, specific issues facing survivors, strategic actions in response to those issues, as well as innovative ideas and existing promising practices to help funders take action to prioritize survivor wealth are discussed.

English

French

Set a Goal: What to Save For

America Saves, a campaign managed by the nonprofit Consumer Federation of America, motivates, encourages, and supports low- to moderate-income households to save money, reduce debt, and build wealth. Information and tips for setting a savings goal, making a savings plan, how to save automatically, and other tools and resources are included.

English

Introduction to asset building

Asset building for your future (fillable PDF)

Asset building for your future (print version)

My long-term goal action plan (fillable PDF)

My long-term goal action plan (print version)

Introduction to savings accounts

Registered savings accounts

Investing in registered accounts

Seven tips to help you stick to your goals

Glossary – asset building

Resources – asset building

Making it easier to save

Types of investments and types of accounts

Investing basics

How to manage financial stress and avoid burnout

Education savings

RESPs and how they can help

Before you open an RESP

Individual, family and group RESPs

Federal education grants and bonds

Provincial education grants and bonds

Family income to receive RESP government incentives

RESP sample scenarios

Plan for your RESP bank visit

My RESP action plan (fillable PDF)

My RESP action plan (print version)

Glossary – education savings

Resources – education savings

Employment and Social Development Canada (ESDC) resources for the Canada Learning Bond (CLB):

Canada Learning Bond Application for Adult Beneficiaries

Q&A about the Canada Learning Bond for adult beneficiaries

Revised income brackets for Canada Learning Bond (July 2022 to June 2023)

French

L‘accumulation d’actifs

L’accumulation d’actifs pour votre avenir – fillable

L’accumulation d’actifs pour votre avenir – nonfillable

Mon plan d’action axé sur mon objectif à long terme – fillable

Mon plan d’action axé sur mon objectif à long terme – nonfillable

Introduction aux comptes d’épargne

Comptes d’épargne enregistrés (REEI, REEE, REER et CELI)

Investir dans les comptes enregistrés :les options et les questions à poser à votre banque

Sept conseils pour vous aider à respecter vos objectifs

Glossaire – Accumulation d’actifs

Epargne-études

Les REEE : comment peuvent-ils vous aider?

Comment choisir entre unREEE individuel, familial et collectif

Les subventions et les bons d’études du gouvernement fédéral

Les subventions et les bons d’études du gouvernement provincial

Le REEE : comment peut-il vous aider à faire fructifier vos épargnes pour les études?

Arrivez préparé à votre rendez-vous à la banque pour ouvrir un REEE

Mon plan d’action en matière de REEE – fillable

Mon plan d’action en matière de REEE – nonfillable

Prosperity Now Scorecard

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to jump-start a conversation about solutions and policies that put households on stronger financial footing across five issue areas: Financial Assets & Income, Businesses & Jobs, Homeownership & Housing, Health Care and Education.

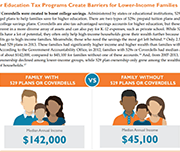

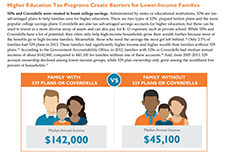

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of parents opening RESP accounts has increased steadily over time, as of 2016, participation rates remained more than twice as high among parents in the top income quartile (top 25%) compared with those in the bottom quartile. This study provides insight into the factors behind the gap in (RESP) participation between higher and lower-income families.

Low Income Retirement Planning

This booklet contains information on retirement planning on a low income. Topics include four things to think about for low income retirement planning, a background paper on maximizing the Guaranteed Income Supplement (GIS), and determining Old Age Security (OAS) and GIS eligibility for people who come to Canada as adults.

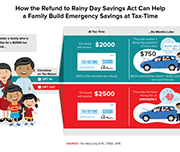

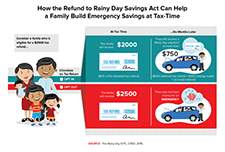

How to use your tax refund to build your emergency savings

If you file your taxes in the United States, you can learn how your tax return can kickstart your savings. This guide from the Consumer Financial Protection Bureau walks you through some fast and easy ways to use your tax refund to increase your savings. This guide covers multiple topics including: why save your tax return, how to save money fast, affordable ways to file your taxes, and how to protect yourself from tax fraud.

Canada Learning Bond – Get $500 for your child’s future

This two-page brochure describes the benefits of acting now to receive $500 to help start saving for a child's education after high school. The brochure is also available in the following Indigenous languages:

Retirement Literacy Website

The ACPM Retirement Literacy Program complements the financial literacy education efforts by the federal and provincial governments, and other organizations. The website contains a series of quizzes to help improve your knowledge of pensions and retirement savings plans as well as links to financial literacy resources.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

English

Download in English

French

Download in French

Canada Education Savings Program: Choosing the right RESP

This printable brochure from the Government of Canada explains the key details you need to know when choosing a Registered Education Savings Plan (RESP) for your child's education savings.

Incentivized Savings: An Effective Approach at Tax Time

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through a dedicated collaboration with ATB Financial, Aspire Calgary, Sunrise Community Link Resource Centre, Centre for Newcomers, and First Lutheran Church Calgary that made it all possible. This report shares results and highlights from the 2018 Tax Time Savings program. 93% of participants earned the maximum match of $500.

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

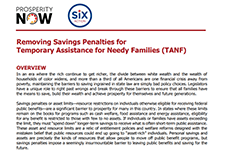

Removing Savings Penalties for Temporary Assistance for Needy Families

This brief discusses the savings penalties in public assistance programs in the United States, also known as asset limits, and that actions that can be taken to eliminate these limits and the barriers towards building savings for families living on low income.

Saving for Now and Saving for Later: Rainy Day Savings Accounts to Boost Low-Wage Workers’ Financial Security

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial shocks.

Running in Place: Why the Racial Wealth Divide Keeps Black and Latino Families From Achieving Economic Security

This report examines data from the Federal Reserve System’s 2016 Survey of Consumer Finances to understand how the wealth of median Black, Latino and White families have changed since the findings of its previous survey were released in 2013.

Expanding Educational Opportunity Through Savings

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and impact.

RDSP calculator

Enhance the quality of life for a family member with a disability. By answering a few simple questions, the RDSP Calculator can help you project the estimated future value of an RDSP, and the approximate value of future withdrawal payments. Run various scenarios to see how it would affect the value of your RDSP. The RDSP Calculator is a tool to help you assess the potential of opening and contributing to an RDSP. The estimates provided by the Calculator are for information purposes only. The profile of your RDSP may differ from the RDSP Calculator projection.

2017 Bank On Data Pilot: Accessing Local Data

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This tool details the 2017 Bank On Data Pilot and includes instructions for accessing the local Bank On data at the city and zip code level.

The Effects of Education on Canadians’ Retirement Savings Behaviour

This paper assesses the extent to which education level affects how Canadians save and accumulate wealth for retirement. Data from administrative income-tax records and responses from the 1991 and 2006 censuses of Canada show that individuals with more schooling are more likely to contribute to a tax-preferred savings account and have higher saving rates, have higher home values, and are less likely to rent housing.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

Video: Additional CPP

This short video from the Canadian Pension Plan Investment Board explains the new additional Canada Pension Plan (CPP).

Analyzing the Landscape of Saving Solutions for Low-Income Families

To address challenges around savings, the asset building and financial services fields have developed an array of solutions that attempt to support savings and wealth accumulation. However, the landscape of savings solutions is complex, difficult for households to navigate, and full of solutions that are not designed specifically for low-income and low-wealth households. This brief examines the savings challenges that households face, their underlying causes, and a vision for new solutions.

An Evaluation of Financial Empowerment Centers: Building People’s Financial Stability as a Public Service

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free public service. The evaluation draws on data from 22,000 clients who participated in 57,000 counseling sessions across these first 5 city replication partners, and provides additional evidence of the program’s success.

RRSP Savings Calculator

Use this tool by the OSC to estimate how much your registered retirement savings plan (RRSP) will be worth at retirement and how much income it will provide each year.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

RESP case plan – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP tracking sheet – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP quick reference sheet – webinar handout (from FSGV)

RESP sample letter to schools – webinar handout (from Credit Counselling Sault Ste. Marie)

Time-stamps for the video recording:

3:00 – Agenda and introductions

5:05 – Audience polls

9:00 – Importance of education savings (Speaker: Glenna Harris)

16:00 – Credit Counselling Services Sault Ste. Marie and District (Speaker: Allyson Schmidt)

33:00 – Family Services of Greater Vancouver (Speaker: Rocio Vasquez)

54:45 – Q&A

Asset Building: An Effective Poverty-Reduction Strategy

This brief explains the asset-building approach to poverty reduction. While many families who live on low incomes struggle to meet basic needs, they miss out on opportunities to save and invest - opportunities that are critical in overcoming poverty. Without income, people are unable to get by and without assets, people are unable to get ahead. At Momentum, we call opportunities to save or invest, Asset Building.

With financial assets, individuals can pay down debt, save more, earn a good credit rating, save for a down payment on a home, and build a sustainable livelihood.

Improving Education Outcomes through Children’s Education Savings

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career expectations, and future financial capability. This brief explains why RESPs are so important, and how parents can use RESPs to save for their children's education.

Increasing Take-Up of the Canada Learning Bond

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible population. The Impact and Innovation Unit (IIU), in collaboration with the Learning Branch and the Innovation Lab at Employment and Social Development Canada (ESDC) conducted a randomized controlled trial to test the effectiveness of behavioural insights (BI) in correspondence sent to primary caregivers of children eligible for the CLB. This trial demonstrates the effectiveness of BI interventions tailored to the particular behavioural barriers that affect specific populations in increasing take-up of programs like the CLB. If scaled across the eligible population, the best performing letter would result in thousands more children receiving this education savings incentive on an annual basis.

Boosting the Earned Income Tax Credit for Singles

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income workers without dependent children. The program, which provides a bonus of up to $2,000 at tax time, is being evaluated using a randomized controlled trial in New York City and Atlanta. This report presents findings through three years from New York, where over 6,000 low-income single adults without dependent children enrolled in the study in late 2013. The findings are consistent with other research on the federal EITC, indicating that an effective work-based safety net program can increase incomes for vulnerable and low-income individuals and families while encouraging and rewarding work.

The Omega Foundation and the SmartSAVER Program, Lessons in Taking Social Innovations to Scale

This case study is about the Omega Foundation’s SmartSAVER program. It has effectively elevated the Canada Learning Bond (a post-secondary education savings program for low income families) from a struggling idea to a fully-fledged and well-utilized national resource. In so doing, Omega and SmartSAVER have created new pathways out of poverty for thousands of Canadians. This story gives us significant insight into the process of bringing an innovative idea to life. It offers important observations about the barriers to launching and scaling innovative ideas. It also offers insights into the solutions that can overcome these barriers.

Group RESP Educational Materials

This document explains the basics of group RESPs, including what they are, what they may cost, what you need to know about your group RESP if you are already enrolled in a plan, and how to figure out your options. Read more about the research behind these materials here.

The Regulation of Group Plan RESPs and the Experiences of Low-Income Subscribers

Through the Group RESP Research and Education Project, SEED Winnipeg, Momentum (Calgary), the Legal Help Centre of Winnipeg, and an interdisciplinary research team studied the regulation of group plan RESPs and the experiences of low-income subscribers, and developed public legal education materials to support low-income RESP subscribers in understanding and making informed decisions about their RESP investments. This report presents the research component of this project. This report shows that group plan RESPs are complex, and while they can be beneficial, participation in a group plan may be detrimental to a subscriber's financial well-being if the plan is not well aligned with the subscriber's needs. Low-income subscribers continue to be significantly represented in RESPs held by group plan promoters.

A Much Closer Look: Enhancing Savings Counseling at Financial Empowerment Centers

Building savings is a fundamental strategy for empowering individuals and families with low incomes. Even relatively small amounts of savings can serve as a buffer against inevitable financial shocks that can otherwise undermine social service efforts and successes – and short-term savings offer realistic first steps toward building longer-term savings and acquiring assets. The CFE Fund conducted a research pilot at municipal Financial Empowerment Centers to better understand how clients are saving, and inform new savings indicators for financial counseling success. This report explains the insights of this research pilot, and client outcomes in savings and goal setting.

Investing in a Post Secondary Education Delivers a Stellar Rate of Return (TD Economics Topic Paper)

A Growing Movement: The State of the Children’s Savings Field 2016

The Children’s Savings Account (CSA) movement has taken off in the past few years. These programs provide long-term savings or investment accounts and savings incentives to help children build savings for their future. In 2016, CSA initiatives started in a diverse range of locations, such as Durham, NC; Boston, MA; and Worcester, MA. In 2017, we expect several more program launches, including in places like Oakland, CA, and Milwaukee, WI. Based on a recent survey, this document offers a snapshot of this growing field, illustrating the range of program models being customized to meet the needs of the communities and states these programs serve.

Cities and States Developing Creative Approaches to Fund Children’s Savings Accounts

Children’s Savings Accounts (CSA) are proving to be a powerful tool for growing college funds and building children’s aspirations for their future. CSAs are long-term, incentivized savings or investment accounts for post-secondary education that help promote economic mobility for children and youth. Advocates have found that the idea and goals of CSAs can be appealing to policymakers from across the political spectrum. However, while able to generate initial interest from policymakers, advocates often find that their efforts can stall when it comes to the question of how to fund a program. This paper provides advocates and policymakers with several funding options—including examples from the city and state-levels—for establishing publicly-supported CSA programs. For more information about CSAs in general, please visit savingsforkids.org.

Financial Coaching: An Asset-Building Strategy

Financial coaching is a promising strategy to help people improve their financial well-being, but is often not yet universally understood. Practitioners are turning to coaching strategies to better facilitate behaviour change as opposed to the disappointing results often found when only financial education or financial access programs are introduced. Shared insights on financial coaching can help shape collective action by funders seeking to facilitate greater financial capability among targeted populations.