The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Outil 1. Argumenter en faveur de l’autonomisation financière.

Pour que l’AF soit un succès, il est essentiel d’obtenir l’adhésion du personnel et des intervenants.

Vous trouverez ci-dessous d’excellentes ressources à faire connaître aux acteurs clés qui ne connaissent pas encore l’AF. Elles peuvent vous aider à faire comprendre rapidement aux autres ce qu’est l’AF et la pertinence d’intégrer l’AF lorsque vous les accueillez ou lorsque vous travaillez à susciter l’intérêt pour l’AF dans votre municipalité.

● L’abécédaire des passerelles pour la prospérité (anglais seulement) donne un aperçu de « qu’est-ce que c’est » et du « pourquoi » au sujet de l’intégration de l’AF dans les services municipaux.

● La brochure de l’AF (anglais seulement) fournit une introduction plus détaillée à l’AF et à l’intégration de l’AF.

● Voici trois exemples de cas que vous pouvez utiliser pour montrer l’impact puissant que peut avoir l’intégration de l’AF dans les services municipaux :

o Exemple de cas : Région de York

o Exemple de cas : Services sociaux et d’emploi de Toronto

o Exemple de cas : Edmonton

Outil 2. Commencer : l’analyse interne

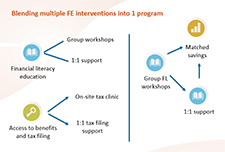

Prenez le temps de vous renseigner sur les types d’interventions courantes en matière d’AF. Ensuite, évaluez les conditions, la capacité et les considérations dans votre municipalité pour fournir ces types d’aide financière à vos clients.

Cet outil vous guide à travers une analyse interne qui vous permet d’envisager ce que pourrait être l’intégration de l’AF dans votre contexte de prestation de services.

Considérez l’outil 2 : Commencer : l’analyse interne un point de départ qui continuera à évoluer à mesure que vous avancerez dans le processus.

Outil 3. Explorer les partenariats : l’analyse externe

Les municipalités ne sont pas obligées de fournir elles-mêmes des mesures d’aides en matière d’AF pour transformer leurs services en passerelles pour la prospérité. Dans de nombreux cas, surtout au début, il peut être plus rentable et moins exigeant sur le plan des ressources d’établir des liens de référence vers d’autres prestataires de services locaux ou de s’associer à des organismes à but non lucratif, des fondations ou des prestataires de services financiers pour fournir l’aide financière répondant aux besoins de vos clients.

Utilisez l’outil 3 : Explorer les collaborations et les partenariats pour effectuer une analyse des services en matière d’AF dans votre communauté locale et identifier les collaborations et partenariats potentiels.

Deux autres ressources à propos du partenariat sont les « Éléments de l’intégration » et les « Conseils pour le partenariat » .

Outil 4. Concevoir l’initiative : le plan de service

Après avoir effectué une analyse interne et externe des obstacles et des opportunités, vous êtes maintenant prêt à concevoir une initiative d’AF adaptée au contexte de votre municipalité. La conception de l’initiative est une phase importante où vous élaborez le modèle de service, clarifiez les partenariats et imaginez l’expérience client idéale.

L’outil 4 : Conception de l’initiative vous guide dans le choix du meilleur modèle de prestation de services pour votre contexte et dans la conception du parcours du client et du personnel.

Nous espérons que cette boîte à outils se développera et s’améliorera avec l’utilisation et les commentaires. Les idées actuelles pour les outils à venir incluent :

- Comprendrela capacité financière de vos clients

- Mettresur pied une équipe performante

- Soutenirle personnel pour qu’il réussisse

- Mettreen place des processus efficaces de collecte de données et d’évaluation

Outil 5. Concevoir l’initiative : un guide d’observation

L’outil 5 : Un guide d’observation peut aider le personnel de première ligne à comprendre le processus, de l’accueil à la mise en œuvre du service.

Commentaires et suggestions

Nous serions ravis d’entendre vos commentaires et vos suggestions d’outils que vous trouveriez utiles. Veuillez nous envoyer un courriel : [email protected].