Social influencers and your finances

Just because someone has a lot of followers doesn’t mean their advice is right for you. Social media influencers are increasingly sharing information about investing. This can be done by ordinary people or by celebrities who have taken an interest in a specific product or investment. They are often called “finfluencers” — financial influencers whose media accounts are focused on money and investing. This article will outline some questions to ask yourself before you choose to invest.

Pilot study: Buy now, pay later services in Canada

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have resulted in a steady increase in retail e-commerce sales over the past several years, and the COVID-19 pandemic has had a significant impact on how consumers make retail purchases. Retail e-commerce sales reached record levels during the pandemic. This has further contributed to the proliferation of buy now, pay later (BNPL) services in Canada.

101 solutions for inclusive wealth building

Having wealth, or a family’s assets minus their debts, is important not just for the rich— everyone needs wealth to thrive. Yet building the amount of wealth needed to thrive is a major challenge. Nearly 13 million U.S. households have negative net worth. Millions more are low wealth; they do not have the assets or liquidity needed to maintain financial stability and invest in themselves in the present, nor are they on track to accumulate the amount of wealth they will need to have financial security in retirement. This report examines what it will take to create truly shared prosperity in the United States. It is focused on solutions that would grow the wealth of households in the bottom half of the wealth distribution, and it explores reparative approaches to building the wealth of Black, Indigenous, and other people of color (BIPOC).

Together, these groups represent at least half of all U.S. households.

Encouraging tax filing at virtual clinics

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual clinics.

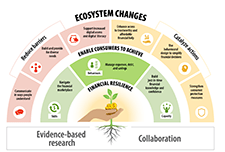

Make Change that Counts: National Financial Literacy Strategy 2021-2026

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in meaningful ways. The National Strategy is focused on how financial literacy stakeholders can reduce barriers, catalyze action, and work together, to collectively help Canadians build financial resilience.

Investing and The COVID-19 Pandemic: Survey of Canadian Investors

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and trading activity of retail investors. Key findings include that 32 per cent of investors have experienced a decline in their financial situation during the pandemic while 16 per cent have experienced an improvement. Half of investors have not done any trading during the pandemic, but of those who have been trading, 63 per cent have increased their holdings.

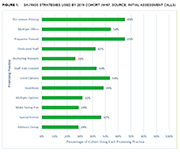

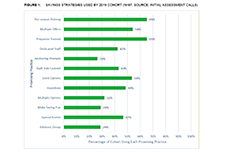

Tax Time: An opportunity to Start Small and Save Up

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being. This paper also provides a few examples of how Volunteer Income Tax Assistance (VITA) programs creatively used Bureau tools, resources and technical assistance to encourage savings as well as some of the results they reported. It provides insights from a subgroup of the programs in the cohort that collected additional information from consumers on their intent to save, the various types of accounts into which they saved, and the goals they were striving for by saving. Finally, this paper offers recommendations on some strategies that can be employed to increase people’s interest and commitment to saving during the tax preparation process.

Behavioural insights: key concepts, applications and regulatory considerations

There are numerous factors that influence the decisions that people make. Behavioural insights (BI) recognizes this and, through a combination of psychology, economic and more recently other behavioural research, examines how people are often neither deliberate nor rational in their decisions in the way that traditional models, strategies and policies assume. Behavioural insights recognize how people actually behave versus traditional economic and market theory of people as rational actors. This report discusses how leading practitioners and regulators around the world are using behavioural insights to address issues in capital markets and improve outcomes for investors and market participants.

How to really build financial capability

Recent years have seen an explosion in interventions designed to improve financial outcomes of participants. Yet on-the-ground evidence suggests that not all financial education programs are equally successful at achieving this aim. This paper examines the difference between interventions that work, and those than do not. It attempts to answer the question: “How do you actually build financial capability?” In doing so, we aim to help interested parties enhance the effectiveness of their programs and policies by providing them with evidence-based recommendations to drive positive outcomes in participants.

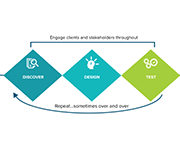

Human Insights Tools & Resources

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from clients’ point of view, designing solutions to meet those needs, and testing your ideas to ensure they bring about the needed change. Tools and resources are presented for each of the discover, design, and test phases.

Financial Health Index: 2019 Findings and 3-Year Trends Report

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from 2017 to 2019.

Consumer Perspectives on Fintech

This brief raises consumer perspectives on financial technology (fintech), and offers guidance for fintech developers on how to best serve low- to moderate-income clients.

Money Circle toolkit

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a brief, interactive exercise, to initiate conversations about the feelings and personal relationships that shape financial choices.

Managing spending: Ideas for financial educators

As financial educators know, making day-to-day decisions on spending money is one of the biggest challenges consumers face in keeping their financial lives in order. Many people find it difficult to manage their household finances on a daily basis, let alone over the long term. This brief from the Bureau of Consumer Financial Protection identifies a few ideas to explore causes of over-spending and ideas to help prevent it.

Consumer Insights on Managing Spending

The CFPB conducted research on consumer challenges in tracking spending and keeping to a budget. The research found that consumers aspire to manage their spending but for many reasons, many consumers spend more than intended and sometimes have\ difficulty in staying within their budgets. In addition, we found that although most people would like to use budgets and plans, they often don’t use them to guide spending decisions in the moment. Budgeting and tracking spending are often considered to be overwhelming or too much of a hassle, and even those consumers who have a budget generally do not benchmark their spending to their budget frequently or regularly.

Canadian Millenial Social Values Study

A major national survey conducted in 2016 reveals a bold portrait of Canada’s Millennials (those born between 1980 and 1995), that for the first time presents the social values of this generation, and the distinct segments that help make sense of the different and often contradictory stereotypes that so frequently are applied to today’s young adults. Key findings from the survey explore Millennials' relationship with money, education, work and career interests, voting turnout, and engagement with social justice.

Building consumer financial health: The role of financial institutions and FinTech

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Handout 9-12: Consumerism resources

This is the resources handout for Module 9: Consumerism, from the Prosper Canada Financial Literacy Facilitator Resources. To view full Financial Literacy Facilitator Resources, click here.

2017 Financially Underserved Market Size Study

Handout 9-13: Consumerism glossary

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Glossary of terms relating to consumerism. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-8: Dealing with consumer problems

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Examples of how to deal with consumer problems. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-7: Common frauds and scams

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Common consumer frauds and scams to look out for. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-5: Cell phone information

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Information about cell phone plans and what is involved when you purchase one. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-3: Smart shopping tips

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Smart shopping tips. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-2: Advertising techniques and sales tactics

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Explanation of different advertising and sales techniques. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-11: Consumerism goal setting

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Setting goals related to consumerism. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-10: Rate your financial knowledge, part 2

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Use this quiz to rate your financial knowledge. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-9: Complaint letter

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. A template for writing a consumer complaint letter. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-6: Cell phone checklist

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. A checklist of questions to answer when you are getting a cell phone. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-4: Find the better deal

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Figure out which item is the better deal by calculating the unit cost. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-1: Consumer quiz

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. What kind of consumer are you? Take the quiz. To view full Financial Literacy Facilitator Resources, click here.

Do States Benefit From Restricting Safety-Net Eligibility Based on Wealth?

English

Module 1: Exploring your relationship with money

Module 2: Income and taxes

Handout 2-1 Government benefits

Activity Sheet 2-2 Reading David’s pay stub quiz

Handout 2-3 Reading a pay stub

Handout 2-4 Filing your taxes

Activity Sheet 2-5 Maria and Fernandos story

Activity Sheet 2-6 Goal-setting

Handout 2-7 Resources

Handout 2-8 Glossary

Video: Tax Deductions Credits and Benefits (video transcript) *NEW*

Module 3: Budgeting

Activity Sheet 3-1 The “B” word-budget

Activity Sheet 3-2 Income sources

Activity Sheet 3-3 Expense categories

Activity Sheet 3-4 Budgeting scenarios

Activity Sheet 3-5 Monthly budget worksheet

Activity Sheet 3-6 Making your own budget

Handout 3-7 Budgeting strategies

Handout 3-8 Budgeting tips

Handout 3-9 Financial record keeping

Activity Sheet 3-10 Goal-setting

Handout 3-11 Resources

Handout 3-12 Glossary

Module 4: Banking and financial services

Handout 4-1 Banks and credit unions

Handout 4-2 Deposit insurance at credit unions in different provinces

Activity Sheet 4-3 Banks and banking services quiz

Handout 4-4 Banks accounts and services

Handout 4-5 Choosing a bank and choosing an account

Handout 4-6 Opening a bank account

Handout 4-7 What are my rights?

Handout 4-8 Alternative financial services

Activity Sheet 4-9 Comparing alternative financial services to banking services

Activity Sheet 4-10 Goal-setting

Handout 4-11 Resources

Handout 4-12 Glossary

Getting government payments by direct deposit

Module 5: Saving

Activity Sheet 5-1 Setting savings goals

Activity Sheet 5-2 Needs and wants

Activity Sheet 5-3 Finding money

Handout 5-4 Compound interest

Activity Sheet 5-5 Enzo and Tess

Handout 5-6 Introduction to saving and investing

Handout 5-7 Saving and investing tools (basic)

Handout 5-8 Saving and investing tools (detailed)

Handout 5-9 Preparing for old age

Handout 5-10 Saving and investment support

Activity Sheet 5-11 Goal-setting

Handout 5-12 Resources

Handout 5-13 Glossary

Interest rates and how they impact your finances, CIRO

Benefits of having a financial plan, CIRO

Module 7: Credit reporting

Handout 7-1 Credit bureaus

Handout 7-2 Credit reports

Handout 7-3 Sample Equifax credit report

Handout 7-4 Reading a credit report

Handout 7-5 Credit scores

Activity Sheet 7-6 Equifax credit report request form

Activity Sheet 7-7 TransUnion credit report request form

Handout 7-8 Correcting common errors on credit reports

Activity Sheet 7-9 Credit score scenarios

Handout 7-10 Ways to improve your credit score

Activity Sheet 7-11 Goal-setting

Handout 7-12 Resources

Handout 7-13 Glossary

Module 8: Debt

Activity Sheet 8-1 How much is TOO much

Activity Sheet 8-2 Debt do’s and don’ts

Activity Sheet 8-3 Ladder of debt repayment options

Handout 8-4 Steps to debt repayment

Handout 8-5 Dealing with creditors

Handout 8-6 Collection rules

Activity Sheet 8-7 Collection role play

Activity Sheet 8-8 Goal-setting

Handout 8-9 Resources

Handout 8-10 Glossary

Video: Debt Solutions (video transcript)*NEW*

Module 9: Consumerism

Activity Sheet 9-1 Consumer quiz

Handout 9-2 Advertising techniques and sales tactics

Handout 9-3 Smart shopping tips

Activity Sheet 9-4 Find a better deal

Handout 9-5 Cell phone information

Activity Sheet 9-6 Cell phone checklist

Handout 9-7 Common types of frauds and scams

Handout 9-8 Tips to protect yourself from fraud and scams

Handout 9-9 Dealing with consumer problems

Handout 9-10 Complaint letter

Handout 9-11 Making a complaint about an investment

Activity Sheet 9-12 Rate your financial knowledge part 2

Activity Sheet 9-13 Goal setting

Handout 9-14 Resources

Handout 9-15 Glossary

CERB and other COVID-19 scams

Protect yourself against fraud during COVID-19

Types of fraud

Fraud prevention month

The many faces of elder abuse

Pensions, FSRA

Credit Unions and Deposit Insurance, FSRA

French

Module 1 : Explorer votre relation avec l’argent

Feuille d’activité 1-1 « Trouvez quelqu’un qui… »

Feuille d’activité 1-2 « L’argent c’est… »

Feuille d’activité 1-3 Messages relatifs à l’argent

Feuille d’activité 1-4 Imaginez un peu

Feuille d’activité 1-5 Évaluer vos connaissances financières

Feuille d’activité 1-6 Comment établir des objectifs INTELLLIGENTS

Feuille d’activité 1-7 Établissement d’objectifs

Module 2 : Revenus et impôts

Document 2-1 Prestations gouvernementales

Feuille d’activité 2-2 « Lire le relevé de paie de Jeanne (questionnaire) »

Document 2-2 Lire un relevé de paie

Document 2-3 La déclaration de revenus

Feuille d’activité 2-4 « Le cas de Maria et Fernando »

Feuille d’activité 2-5 « Établissement d’objectifs »

Document 2-6 Ressource

Document 2-7 Glossaire

Déductions, crédits d’impôt et avantages fiscaux – Transcription de la vidéo **NOUVEAU**

Module 3 : L’établissement d’un budget

Feuille d’activité 3-1 Le mot qui commence par un « B » – budget

Feuille d’activité 3-2 Sources de revenus

Feuille d’activité 3-3 Catégories de dépenses

Feuille d’activité 3-4 Scénarios de budget

Feuille d’activité 3-5 feuille de travail pour le budget mensuel

Feuille d’activité 3-6 feuille de travail pour le budget mensuel

Document 3-7 Les stratégies budgétaires

Document 3-8 Conseils budgétaires

Document 3-9 Tenue des dossiers financiers

Feuille d’activité 3-10 Établissement d’objectifs

Document 3-11 Ressources

Document 3-12 Glossaire

Module 4 : Services bancaires et financiers

Document 4-1 Banques et caisses populaires ou coopératives de crédit

Document 4-2 Assurance-dépôts dans les caisses populaires ou coopératives de crédit selon les provinces.

Feuille d’activité 4-3 Questionnaire sure les banques et les services bancaires

Document 4-4 Comptes et services bancaires

Document 4-5 Choisir une banque et un compte

Document 4-6 Ouverture d’un compte de banque

Document 4-7 Quels sont mes droits?

Document 4-8 Services financiers parallèles

Feuille d’activité 4-9 Comparaison des services financiers parallèles avec les services bancaires classiques

Feuille d’activité 4-10 Établissement d’objectifs

Document 4-11 Ressources

Document 4-12 Glossaire

Obtention des paiements gouvernementaux par dépôt direct

Module 5 : L’épargne

Feuille d’activité 5-1 Établissement d’objectifs d’épargne

Feuille d’activité 5-2 Besoins et désirs

Feuille d’activité 5-3 Trouver l’argent

Document 5-4 Intérêt composé

Feuille d’activité 5-5 Bill et Bob

Document 5-6 Outils d’épargne (notions de base)

Document 5-7 Outils d’épargne (notions détaillées)

Feuille d’activité 5-8 Questionnaire sur les outils d’épargne

Feuille d’activité 5-9 Etablissement d’objectifs

Document 5-10 Ressources

Document 5-11 Glossaire

L’avantage d’avoir un plan financier

Module 6 : Les notions de base du crédit

Module 7 : Rapports de solvabilité

Document 7-1 Les bureaux de crédit

Document 7-2 Les dossiers de crédit

Document 7-3 Exemple d’un dossier de crédit d’Equifax

Document 7-4 La lecture d’un dossier de crédit

Document 7-5 Les pointages de crédit

Feuille d’activité 7-6 Equifax demande de mon historique de crédit

Feuille d’activité 7-7 TransUnion formulaire de demande de fiche de crédit

Document 7-8 Corriger les erreurs communes inscrites sur les dossiers de crédit.

Feuille d’activité 7-9 Les scenarios sur le pointage de crédit

Document 7-10 Façons d’améliorer votre pointage de crédit

Feuille d’activité 7-11 L’établissement d’objectifs

Document 7-12 Ressources

Module 8 : Les dettes

Feuille d’activité 8-1 Quel montant faut-il éviter de dépasser?

Feuille d’activité 8-2 À faire et à éviter

Feuille d’activité 8-3 L’échelle des options de remboursement des dettes

Document 8-4 Les étapes pour rembourser des dettes

Document 8-5 Traiter avec les créanciers

Document 8-6 Règles en matière de recouvrement

Feuille d’activité 8-7 Jeu de rôle – Recouvrement

Feuille d’activité 8-8 Établissement d’objectifs

Document 8-9 Ressources

Document 8-10 Glossaire

Les dettes – Transcription de la vidéo **NOUVEAU**

Module 9 : Le consumérisme

Feuille d’activité 9-1 Questionnaire du consommateur

Document 9-2 Techniques de publicité et tactiques de vente

Document 9-3 Conseils pour magasiner de manière intelligente

Feuille d’activité 9-4 Trouver la meilleure aubaine

Document 9-5 Information sur le téléphone cellulaire

Feuille d’activité 9-6 Liste de vérification du téléphone cellulaire

Document 9-7 Les fraudes et les arnaques communes

Document 9-8 Gérer des problèmes de consommation

Feuille d’activité 9-9 Lettre de plainte

Feuille d’activité 9-10 Évaluez vos connaissances financières, partie 2

Feuille d’activité 9-11 Établir des objectifs

Document 9-12 Ressources

Document 9-13 Glossaire

Escroqueries liées à la PCU et autres fraudes courantes durant la pandémie de COVID-19

Protégez-vous contre la fraude durant la pandémie de COVID-19

Types de fraude

Mois de la prévention de la fraude

Les régimes de retraite

Assurance-dépôts et credit unions, ARSF