The multiplying movement: the state of the children’s savings field 2022

The Multiplying Movement: The State of the Children’s Savings Field 2022 shares findings from Prosperity Now’s 2022 Children’s Savings Account (CSA) program survey. The report highlights the incredible growth of the field with over 4.9 million children and youth with CSAs across the US. In addition, this report analyzes trends among CSA programs and spotlights new programs across the country. As you will see in the report, the CSA field shows no signs of slowing down.

Hunger, Poverty, and Health Disparities During COVID-19 and the Federal Nutrition Programs’ Role in an Equitable Recovery

The health and economic crises brought on by the coronavirus 2019 (COVID-19) pandemic has made the federal nutrition programs more important than ever. An unacceptably high number of people in America do not have enough to eat, and it is likely that the economic recovery for families who struggle to put food on the table will take years.

Recovery will be particularly challenging for those groups that have suffered disproportionate harm from COVID-19. Inequities, also referred to as disparities, “adversely affect groups of people who have systematically experienced greater obstacles […] based on their racial or ethnic group; religion; socioeconomic status; gender; age; mental health; cognitive, sensory, or physical disability; sexual orientation or gender identity; geographic location; or other characteristics historically linked to discrimination or exclusion.”

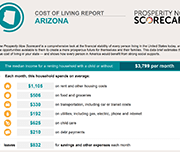

Prosperity Now Scorecard Cost-Of-Living Profiles by State

Prosperity Now has created state-level Cost-of-Living profiles as new features on their Scorecard website. The Prosperity Now Cost of Living profiles provide a comprehensive look at the financial stability of every person living in the United States. Each state profile can be downloaded and used to determine the true cost of living is in the state, based on median monthly income and discretionary spending left at the end of each month after expenses. These values determine what is left over for emergency expenses and long-term aspirational expenses. This video presents the cost of living in Georgia.

Pandemic to Prosperity – January 21, 2021: One year after the first announcement of Covid on U.S. soil

The National Conference on Citizenship (NCoC) developed the Pandemic to Prosperity series. It builds on NCoC’s data infrastructure and advocacy network developed for its national Civic Health Index, with The New Orleans Index, which informed many public and private decisions and actions post-Katrina. This series is designed to enable a solid understanding of the damage to lives and livelihoods as the pandemic continues to unfold, as the United States enters the era of vaccines, and the nation grapples with new shocks and stressors such as disasters and civil unrest; it will also examine aspirational goals around strong and accountable government, functioning institutions from child care to internet access to local news availability, effective civic participation, and outcomes for people by race regarding employment, health, housing, and more. With each new report in the series, indicators will change as the recovery transitions. This report highlights mostly state-level metrics with breakdowns by race, gender, and age where available, relying on both public and private data sources.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling. This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Beware of scams related to the coronavirus

Scammers are taking advantage of the coronavirus (COVID-19) pandemic to con people into giving up their money. Though the reason behind their fraud is new, their tactics are familiar. It can be even harder to prevent scams right now because people 62 and older aren’t interacting with as many friends, neighbors, and senior service providers due to efforts to slow the spread of disease. This blog post presents consumer protection toolkit resources produced by Consumer Financial Protection Bureau in addition to tips for consumers regarding COVID-19 related scams.

New Risks and Emerging Technologies: 2019 BBB Scam Tracker Risk Report

The Better Business Bureau Institute for Marketplace Trust (BBB Institute) is the 501(c)(3) educational foundation of the Better Business Bureau (BBB). BBB Institute works with local BBBs across North America. This report uses data submitted by consumers to BBB Scam Tracker to shed light on how scams are being perpetrated, who is being targeted, which scams have the greatest impact, and much more. The BBB Risk Index helps consumers better understand which scams pose the highest risk by looking at three factors—exposure, susceptibility, and monetary loss. The 2019 BBB Scam Tracker Risk Report is a critical part of BBB’s ongoing work to contribute new, useful data and analysis to further the efforts of all who are engaged in combating marketplace fraud. Update February 24, 2022: BBB Scam Tracker- Risk Report 2020

Prosperity Now Scorecard

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to jump-start a conversation about solutions and policies that put households on stronger financial footing across five issue areas: Financial Assets & Income, Businesses & Jobs, Homeownership & Housing, Health Care and Education.

Income Volatility: Why it Destabilizes Working Families and How Philanthropy Can Make a Difference

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique role for philanthropy. This brief helps grantmakers understand the enormous challenges income volatility presents in America and provides an array of strategies for philanthropy to leverage both investments and leadership to empower families to protect themselves from volatility’s worst effects.

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

Elder Fraud Prevention and Response Networks Development Guide

This guide provides step-by-step materials to help communities form networks to increase their capacity to prevent and respond to elder financial exploitation. The planning tools, templates and exercises offered in this guide help stakeholders plan a stakeholder retreat and training event, host a retreat, reconvene and establish their network, and expand network capabilities in order to create a new network or to refresh or expand an existing one.

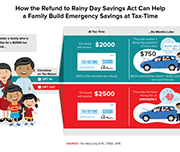

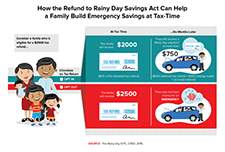

How to use your tax refund to build your emergency savings

If you file your taxes in the United States, you can learn how your tax return can kickstart your savings. This guide from the Consumer Financial Protection Bureau walks you through some fast and easy ways to use your tax refund to increase your savings. This guide covers multiple topics including: why save your tax return, how to save money fast, affordable ways to file your taxes, and how to protect yourself from tax fraud.

Evaluating Tax Time Savings Interventions and Behaviors

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife (formerly EARN) during the 2019 tax season are presented. This analysis is unique in that it compares tax filers' outcomes over time across three different tax-filing and savings program platforms: volunteer income tax assistance (VITA) sites, online tax filing through the Turbo Tax Free File Product (TTFFP), and SaverLife's saving program.

The Collaborative to Advance Social Health Integration: What We’re Learning About Delivering Whole-Person Care

The Collaborative to Advance Social Health Integration (CASHI) is composed of a community of 21 innovative primary care teams and community partners committed to increasing the number of patients, families and community members who have access to the essential resources they need to be healthy. CASHI focused efforts to improve social health practices, spread them to additional sites, and work toward financial sustainability plans. This report discusses the key learnings and successes as a result of this 18-month collaboration to spread social health integration.

A Scan of Municipal Financial Capability Efforts

As the connection between financial capability and social mobility is made evident, both public and private actors are increasingly interrogating the drivers of personal financial health and investing in the innovation of products and services designed to improve the condition of economically vulnerable individuals. This high-level scan of existing U.S. financial capability initiatives and the ways they fit together lends insight into the role that cities and their core institutions can play in promoting residents’ personal economic growth. This study, funded by JPMorgan Chase & Co. and executed by Urbane Development (UD), leverages

primary and secondary research to explore features of the broad range of programs and policy efforts that make up the financial capability landscape of the U.S. This examination focuses particularly on programs deployed by and within municipalities.

Creating a Strong Foundation for Change

This guide is designed to be a resource for programs working with low income families to use when anticipating or implementing a new approach, such as coaching, to doing business. It helps you to systematically – and honestly – look at your foundational readiness for change, so that the improvements you want to make will take root and grow in fertile ground. Making time and space to look deeply into your organization can offer the opportunity to reconsider what quality service delivery looks like, help you discover how coaching (or other techniques) could be a tool, and plan efficiently on where it fits best into your existing context.

Video: Debt collection scams

Dealing with debt collection issues can be challenging—especially when you’re not sure if the person you’re being contacted by is a legitimate debt collector or someone trying to scam you. This video from the Consumer Financial Protection Bureau in the United States shares useful tips on spotting debt collection scams and protecting yourself from scammers.

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Removing Savings Penalties for Temporary Assistance for Needy Families

This brief discusses the savings penalties in public assistance programs in the United States, also known as asset limits, and that actions that can be taken to eliminate these limits and the barriers towards building savings for families living on low income.

Saving for Now and Saving for Later: Rainy Day Savings Accounts to Boost Low-Wage Workers’ Financial Security

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial shocks.

Running in Place: Why the Racial Wealth Divide Keeps Black and Latino Families From Achieving Economic Security

This report examines data from the Federal Reserve System’s 2016 Survey of Consumer Finances to understand how the wealth of median Black, Latino and White families have changed since the findings of its previous survey were released in 2013.

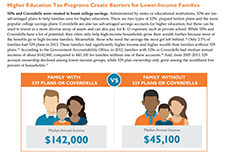

Expanding Educational Opportunity Through Savings

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and impact.

Spurring Savings Innovations: Human Insight Methods for Savings Programs

This brief uses the experiences of participants in a service design process called the Savings Innovation Learning Cluster (SILC) to gather key insights into client perspectives and how it can be used to better program design. Four human insights research and design methods are explored—client interviews, client journey mapping, concept boards and prototyping—which can be used to develop more effective savings programs.

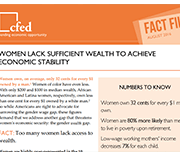

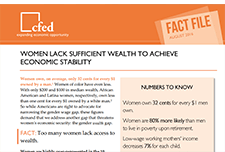

Fact File: Women Lack Sufficient Wealth to Achieve Economic Stability

Women own, on average, only 32 cents for every $1 owned by a man in America. Women of color have even less. Both the gender wage gap and the gender wealth gap need to be taken into account to address threats to women's economic security.

Tax Time: An opportunity to Start Small and Save Up

The Consumer Financial Protection Bureau’s continuing effort to encourage saving at tax time is now part of a larger Bureau initiative to support people in building liquid savings. The new initiative is called Start Small, Save Up. The vision for Start Small, Save Up is to increase people’s financial well-being through education, partnerships, research, and policy or regulatory improvements that increase people's opportunities to save and empower them to realize their personal savings goals. This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being.

The Present and Future of Bank On Account Data: Pilot Results and Prospective Data Collection

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This report details the Bank On Data Pilot, which collected and measured quantitative data on 2017 Bank On account usage at four pilot financial institutions with certified accounts: Bank of America, JPMorgan Chase, U.S. Bank, and Wells Fargo.

2017 Bank On Data Pilot: Accessing Local Data

Bank On coalitions are locally-led partnerships between local public officials; city, state, and federal government agencies; financial institutions; and community organizations that work together to help improve the financial stability of unbanked and underbanked individuals and families in their communities. The CFE Fund’s Bank On national initiative builds on this grassroots movement, supporting local coalitions with strategic and financial support, as well as by liaising nationally with banking, regulatory, and nonprofit organization partners to expand banking access. This tool details the 2017 Bank On Data Pilot and includes instructions for accessing the local Bank On data at the city and zip code level.

Enterprise Communities Plus: A network of financial capability services in low-income housing developments in New York City

In early 2018, Enterprise Community Partners (Enterprise) began a pilot program, Enterprise Community Plus (EC+), to provide financial capability services to residents in two neighborhoods in New York City. Enterprise is a nonprofit housing developer seeking to create opportunity for low- and moderate-income people through affordable housing in diverse, thriving communities. The pilot program seeks to develop a network of service providers dedicated to supporting the housing developments and introduce rent reporting for credit building and matched savings accounts to residents. Prosperity Now joined the implementation process in May 2018.

In this brief, we provide some initial information on the participants that currently are enrolled in the program and some lessons learned to guide other organizations in their efforts to provide financial capability services into housing programs.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

Short-term financial stability: A foundation for security and well-being

Short-term cushions are key to longer-term financial security and well-being. This report shines a light on the central role that short-term financial stability plays in a person’s ability to reach broader financial security and upward economic mobility, a measurement of whether an individual moves up the economic ladder over one’s lifetime or across generations. The insights presented in this report draw primarily on evidence provided by members of the Consumer Insights Collaborative (CIC), a group of nine leading nonprofits across the United States convened by the Aspen Institute Financial Security Program. These diverse organizations offer a window into the financial lives of the low- and moderate-income individuals they serve.

Trading Equity for Liquidity: Bank Data on the Relationship Between Liquidity and Mortgage Default

For many, homeownership is a vital part of the American dream. Buying a home represents one of the largest lifetime expenditures for most homeowners, and the mortgage has generally become the financing instrument of choice. For many families, their mortgage will be their greatest debt and their mortgage payment will be their largest recurring monthly expense. In this report, we present a combination of new analysis and previous findings from the JPMorgan Chase Institute body of housing finance research to answer important questions about the role of liquidity, equity, income levels, and payment burden as determinants of mortgage default. Our analysis suggests that liquidity may have been a more important predictor of mortgage default than equity, income level, or payment burden.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

VITA: A step-by-step guide to increase your impact

In this report, The Common Cents Lab and MetLife Foundation share findings from the experiments we have run over the past several years with VITA providers to improve tax-related outcomes. We encourage you to consider implementing these ideas and engaging in additional conversations about how to use behavioral science to increase financial capability for all taxpayers. The report outlines a series of interventions that exemplify

ways these best practices have been implemented in the field and

how to use behavioral science to further extend their impact. We’ve

organized these interventions into two categories:

Habit Change: Literature Review

Habits are incredibly powerful. Good habits can make people highly successful, and bad habits can ruin people’s lives. Still, it is important to go beyond the anecdotal evidence of the many self-help books on habit, and to take stock of the scientific evidence. This literature review discusses we discuss how habits are formed, how bad habits can be abandoned, how approach-avoidance training can help adopting good habits and abandoning bad habits, and, finally, how habits can be measured properly.

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.

Managing spending: Ideas for financial educators

As financial educators know, making day-to-day decisions on spending money is one of the biggest challenges consumers face in keeping their financial lives in order. Many people find it difficult to manage their household finances on a daily basis, let alone over the long term. This brief from the Bureau of Consumer Financial Protection identifies a few ideas to explore causes of over-spending and ideas to help prevent it.

Analyzing the Landscape of Saving Solutions for Low-Income Families

To address challenges around savings, the asset building and financial services fields have developed an array of solutions that attempt to support savings and wealth accumulation. However, the landscape of savings solutions is complex, difficult for households to navigate, and full of solutions that are not designed specifically for low-income and low-wealth households. This brief examines the savings challenges that households face, their underlying causes, and a vision for new solutions.

More Than Just Taxes

Tax time financial capability services offered at Volunteer Income Tax Assistance (VITA) sites range from encouraging taxpayers to save a portion of their refund to free credit reviews, to referrals to financial coaching, and others in between. This report from Prosperity Now summarizes research findings on VITA programs offering asset-building and financial capability services. Specifically, findings address barriers to be overcome, facilitating factors, and the opportunities for targeted outreach, tailored messages, and policy improvements to move the needle on Earned Income Tax Credit (EITC) take-up rates.

Consumer Insights on Managing Spending

The CFPB conducted research on consumer challenges in tracking spending and keeping to a budget. The research found that consumers aspire to manage their spending but for many reasons, many consumers spend more than intended and sometimes have\ difficulty in staying within their budgets. In addition, we found that although most people would like to use budgets and plans, they often don’t use them to guide spending decisions in the moment. Budgeting and tracking spending are often considered to be overwhelming or too much of a hassle, and even those consumers who have a budget generally do not benchmark their spending to their budget frequently or regularly.

An Evaluation of Financial Empowerment Centers: Building People’s Financial Stability as a Public Service

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free public service. The evaluation draws on data from 22,000 clients who participated in 57,000 counseling sessions across these first 5 city replication partners, and provides additional evidence of the program’s success.

Does State-Mandated Financial Education Affect High-Cost Borrowing?

Using pooled data from the 2012 and 2015 waves of the National Financial Capability Study (NFCS), this research finds that young adults who were required to take personal finance courses in high school were significantly less likely to borrow payday loans than their peers who were not. These effects do not significantly differ by race/ethnicity or gender, suggesting that financial education may be useful regardless of demographics.

Overview: Financial Empowerment Center Counselor Training Standards

This overview summarizes the Financial Empowerment Center (FEC) model’s Counselor Training Standards. The Standards delineate the breadth and depth of the financial content areas, counseling and coaching skills, practice and experiential learning, and socio-economic and cultural context setting necessary to serve the diverse needs and backgrounds of FEC clients. The Standards also include a Code of Ethics that promotes responsible, professional and ethical financial counseling, furthering the profession of one on-one financial counseling.

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

Innovative use of technology for VITA

In this presentation, German Tejeda, National Director of Financial Programs, Single Stop USA, shares results from the Virtual VITA Program in the United States since 2012. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Better Borrowing: How State-Mandated Financial Education Drives College Financing Behaviour

As student loan reform continues to dominate national discourse, a NEFE-funded study shows that financial education in states with state-mandated personal finance graduation requirements causes students to make better decisions about how to pay for college. It increases applications for aid, federal aid taken, and grants — all while decreasing credit card balances. Put simply, financial education makes better borrowers. This study examines positive effects of state-mandated financial education graduation requirements. As of 2017, 25 states have implemented mandates for personal finance education prior to graduation.

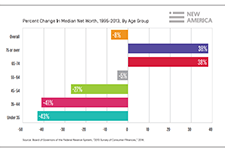

A Life-Cycle and Generational Perspective on the Wealth and Income of Millenials

Young adulthood is the life stage when the greatest increases in income and wealth typically occur, yet entering into this period during the Great Recession has put Millennials on a different trajectory. As a result, this generation will need to make very large gains in the years ahead to compensate for these shortfalls. Understanding the dynamics of how the recession has impaired the financial outlook of Millennials, such as identifying how far behind they are compared to previous

generations of young adults, the impact of the recession on their current wealth holdings and earning potential, and the pace at which they’re recovering, is essential to developing appropriate policy interventions that can put them back on track.

Your Money, Your Goals: Focus on People with Disabilities

This is a companion guide to the 'Your Money, Your Goals' curriculum by the Consumer Financial Protection Bureau (CFPB) in the United States. This guide- Your Money, Your Goals: Focus on People with Disabilities—contains information, tips, and tools based on the insights from people with disabilities and from organizations that serve the disability community. It is based on the core philosophy that everyone has the right to control their money and make their own financial decisions. Its specialized information and tools equip staff and volunteers to adapt training on and use of the toolkit and other resources to meet the needs of people with disabilities. It also includes information and tools to enable staff and volunteers to choose accessible locations, develop appropriate and considerate training activities, and plan to provide accommodations for diverse learning styles and other needs.

Financial Coaching Program Design Guide: A Participant-Centred Approach

This comprehensive resource from Prosperity Now supports organizations in developing a participant-centered financial coaching program. Grounded in a field survey, over 100 interviews, expert advice and beta-testing with six new financial coaching programs, the Coaching Guide highlights the strengths and limitations of financial coaching, offers designs tools, showcases promising models and practices, and includes resources from program leaders and financial coaches.

Who pays? A Distributional Analysis of the Tax Systems in all 50 States

Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States (the sixth edition of the report) is the only distributional analysis of tax systems in all 50 states and the District of Columbia. This comprehensive report assesses tax fairness by measuring effective state and local tax rates paid by all income groups. No two state tax systems are the same; this report provides detailed analyses of the features of every state tax code. It includes state-by-state profiles that provide baseline data to help lawmakers and the public understand how current tax policies affect taxpayers at all income levels.

Supporting Employee Financial Stability: How Philanthropy Catalyzes Workplace Financial Coaching Programs

More than half of all employees in the United States report that they are This report describes different workplace models, the common characteristics and challenges of programs, and provides recommendations for funders who want to invest in workplace approaches to help workers achieve financial stability.

financially stressed, and nearly one in three employees reports being distracted by personal financial issues while at work. This financial stress impacts individuals’ health, relationships, productivity, and time away from work.

Boosting the Earned Income Tax Credit for Singles

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income workers without dependent children. The program, which provides a bonus of up to $2,000 at tax time, is being evaluated using a randomized controlled trial in New York City and Atlanta. This report presents findings through three years from New York, where over 6,000 low-income single adults without dependent children enrolled in the study in late 2013. The findings are consistent with other research on the federal EITC, indicating that an effective work-based safety net program can increase incomes for vulnerable and low-income individuals and families while encouraging and rewarding work.

Measuring Financial Capability and Well-Being in Financial Coaching Programs

This brief describes the data collected and lessons gleaned from the Financial Coaching Impact & Evaluation Fellowship, which took place over the course of 10 months in 2017. Ultimately, this brief argues that the Financial Well-Being Scale and the Financial Capability Scale are promising tools for financial capability programs seeking to understand the impact of their programs.

Building consumer financial health: The role of financial institutions and FinTech

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Income volatility: Strategies for helping families reduce or manage it

In this video presentation David Mitchell from the Aspen Institute explains strategies for mitigating and preventing income volatility at the household level. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. View the full video playlist of all presentations from this symposium.

Up Close and Personal: Findings from the U.S. Financial Diaries

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) shares some of the findings from the U.S. Financial Diaries project. He explains how the households in the study experience multiple "spikes" and "dips" in income and spending over the course of a single year. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Income volatility: What banking data can tell us, if we ask

In this video presentation Fiona Greig from the JP Morgan Chase Institute explains what banking data can tell us about income volatility in the United States. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Household Financial Stability and Income Volatility

In this video presentation Ray Boshara of the Federal Reserve Bank of St. Louis explains how household financial stability has changed in the United States. He shows how education, age, and racial identity influence financial stability and wealth. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Financial Capability Scale

The Center for Financial Security (CFS) and Annie E. Casey Foundation have developed a short set of standardized client outcome measures to create the Financial Capability Scale (FCS). In 2011, CFS worked with four organizations to collect data on client outcome measures, with the goal of refining a small set of measures that can be used across programs. The project aimed to increase coordination across organizations so the financial coaching field can improve its capacity to demonstrate client impacts. The findings from the project extend beyond the coaching field and can be applied to other financial capability services.

My Budget Coach Pilot Evaluation

This pilot study explores the delivery and effectiveness of MyBudgetCoach, a financial coaching program designed to help low- and moderate-income adults develop budgeting skills, set financial goals, and work towards those goals. Specifically, this study compares two modes of program delivery, traditional in-person coaching and fully remote coaching. By testing financial coaching in these two contexts, this project seeks to generate a deeper understanding of the mechanisms that underpin coaching and the role technology may play in facilitating behavior change.

CFPB Financial Well-Being Scale Questionnaire

A financial well-being questionnaire developed by the Consumer Financial Protection Bureau.

Consumer Financial Protection Bureau Data Point: Becoming Credit Viable

Very little is known about the number or characteristics of credit This Data Point documents the results of a research project undertaken by Staff in the Office of Research of the Consumer Financial Protection Bureau (CFPB) to better understand how many consumers are either credit invisible or have unscored credit records and what the demographic characteristics of such consumers are.

invisibles or consumers with unscored credit records.

Gig Workers in America: Profiles, Mindset and Financial Wellness

The Gig Worker On-Demand Economy survey was conducted online by Harris Poll on behalf of Prudential from January 5 to February 18, 2017, among a nationally representative (U.S.) sample of 1,491 workers including 514 full-time and 256 part-time traditional employees and 721 gig workers. Gig work was defined as providing a service or labor, and did not include renting out assets. Survey respondents were selected from among adults aged 18+ who had agreed to participate in online surveys from the Harris Poll Online panel and preferred sample partners.

Family Centered Coaching: A toolkit to Transform Practice & Engage Families

The Family-Centered Coaching Toolkit offers a set of strategies, tools, and resources that can help programs, agencies, case managers, coaches, and others change the ways they work with families striving to reach their goals. This set of resources, can undo, and redo, how one approaches working with families – to see families holistically, even though the funding streams and programs within which we work may not.

Perspectives on Evaluation in Financial Education: Landscape, Issues, and Studies

Financial education plays an important role in guiding individuals to achieve their financial goals and contribute to the economic well-being of society as a whole. While the examination on the effectiveness of financial education has many factors to consider, the National Endowment for Financial Education (NEFE) has taken measures to improve evaluation studies—both for the practitioner and the researcher. These actions include the conception of two documents what will assist in guiding practitioners and researchers in planning high-quality evaluations. The first is the Financial Education Evaluation Manual that is designed to support the evaluation of financial education programs by helping educators to understand the purpose and goals of evaluation, and to provide a basic understanding of the evaluation process. This information is designed for program managers, educators, and decision-makers, in traditional school settings or community-based programs/non-profit organizations, who are implementing financial education programs

The Political Economy of Education, Financial Literacy, and the Racial Wealth Gap

This article examines the mismatch between the political discourse around individual agency, education, and financial literacy, and the actual racial wealth gap. The authors argue that the racial wealth gap is rooted in socioeconomic and political structure barriers rather than a disdain for or underachievement in education or financial literacy on the part of Black Americans, as might be suggested by the conventional wisdom. Also, the article presents a stratification economic lens as an alternative to the conventional wisdom to better understand why the racial wealth gap persists.

The Ever Growing Gap: Without Change, African American and Latino Families Won’t Match White Wealth for Centuries

This report examines the growing racial wealth divide for Black and Latino and the ways that accelerating concentrations of wealth at the top compound and exacerbate this divide. It looks at trends in wealth accumulation from 1983 to 2013, as well as projections of what the next thirty years might bring. It also considers the impact public policy has had in contributing to the racial wealth divide and how new policies can close this gap.

Implementing Financial Coaching

A presentation on how financial coaching is different, client interaction and program evaluation and coaching as presented by Richard Simonds of Family Services of Greater Houston.

An Evaluation of Financial Empowerment Centers Building People’s Financial Stability as a Public Service

This report provides information on the Financial Empowerment Center model, the people it served, the outcomes they achieved, the impact services had on nonprofit and city partners, and lessons learned for others looking to replicate or support this model. The evaluation was designed as a utilization-focused, foundational and exploratory study, aimed at creating an evaluation report that was useful to stakeholders. The report includes both qualitative and quantitative sources

A Missing Element of Financial Capability – Your Money Mindset

Leaders of workforce development programs have been taking the initiative to integrate financial literacy and capability services into their own curriculum and services. However, this requires resources, knowledge, and capacity that workforce development programs may not have. With support from JPMorgan Chase & Co., The Prosperity Agenda partnered with two workforce development programs with the goal of answering, “How might we improve the financial wellness of graduates in career development programs?”

We Tracked Every Dollar 235 U.S. Households Spent for a Year, and Found Widespread Financial Vulnerability

Income inequality in the United States is growing, but the most common economic statistics hide a significant portion of Americans’ financial instability by drawing on annual aggregates of income and spending. Annual numbers can hide fluctuations that determine whether families have trouble paying bills or making important investments at a given moment. The lack of access to stable, predictable cash flows is the hard-to-see source of much of today’s economic insecurity.

A Much Closer Look: Enhancing Savings Counseling at Financial Empowerment Centers

Building savings is a fundamental strategy for empowering individuals and families with low incomes. Even relatively small amounts of savings can serve as a buffer against inevitable financial shocks that can otherwise undermine social service efforts and successes – and short-term savings offer realistic first steps toward building longer-term savings and acquiring assets. The CFE Fund conducted a research pilot at municipal Financial Empowerment Centers to better understand how clients are saving, and inform new savings indicators for financial counseling success. This report explains the insights of this research pilot, and client outcomes in savings and goal setting.

Financial well-being in America

There is wide variation in how people in the U.S. feel about their financial well-being. This report presents findings from a survey by the Consumer Financial Protection Bureau (CFPB) on the distribution of financial well-being scores for the U.S. adult population overall and for selected subgroups defined by these additional measures. These descriptive findings provide insight into which subgroups are faring relatively well and which ones are facing greater financial challenges.

2017 Financially Underserved Market Size Study

How Improved Training Strategies can Benefit Taxpayers Using VITA Programs

Family-Centred Coaching Toolkit

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families. (Note: Accessing the toolkit requires submitting user information).

Do States Benefit From Restricting Safety-Net Eligibility Based on Wealth?

A Growing Movement: The State of the Children’s Savings Field 2016

The Children’s Savings Account (CSA) movement has taken off in the past few years. These programs provide long-term savings or investment accounts and savings incentives to help children build savings for their future. In 2016, CSA initiatives started in a diverse range of locations, such as Durham, NC; Boston, MA; and Worcester, MA. In 2017, we expect several more program launches, including in places like Oakland, CA, and Milwaukee, WI. Based on a recent survey, this document offers a snapshot of this growing field, illustrating the range of program models being customized to meet the needs of the communities and states these programs serve.

Cities and States Developing Creative Approaches to Fund Children’s Savings Accounts

Children’s Savings Accounts (CSA) are proving to be a powerful tool for growing college funds and building children’s aspirations for their future. CSAs are long-term, incentivized savings or investment accounts for post-secondary education that help promote economic mobility for children and youth. Advocates have found that the idea and goals of CSAs can be appealing to policymakers from across the political spectrum. However, while able to generate initial interest from policymakers, advocates often find that their efforts can stall when it comes to the question of how to fund a program. This paper provides advocates and policymakers with several funding options—including examples from the city and state-levels—for establishing publicly-supported CSA programs. For more information about CSAs in general, please visit savingsforkids.org.

Examining the Canadian Education Savings Program and its Implications for US Child Savings Account (CSA) Policy

This report analyzes the Canadian experience with education savings programs, as the US moves towards more comprehensive Children's Savings Account policy.

Virtual VITA: Expanding Free Tax Preparation. Program Insights

This brief highlights findings from a small-scale pilot that integrated Virtual Volunteer Income Tax Assistance (VITA) services at two New York City Head Start programs during the 2013 tax season. The New York City Department of Consumer Affairs Office of Financial Empowerment (OFE) coordinated the pilot in partnership with the Administration for Children & Families (ACF) Region Food Bank For New York City was the VITA provider. Participating Head Start programs included The Children’s Aid Society and Kingsbridge Heights Community Center (KHCC).

Financial Coaching: An Asset-Building Strategy

Financial coaching is a promising strategy to help people improve their financial well-being, but is often not yet universally understood. Practitioners are turning to coaching strategies to better facilitate behaviour change as opposed to the disappointing results often found when only financial education or financial access programs are introduced. Shared insights on financial coaching can help shape collective action by funders seeking to facilitate greater financial capability among targeted populations.

Your Money, Your Goals: A Financial Empowerment Toolkit for community volunteers

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money. Module 6-7: Debt and credit reports. Module 8: Money services, cards, accounts, and loans. Module 9: Protecting your money.

The Financially At Risk: Understanding the 12% of America That Experiences the Most Financial Stress

Lead By Design: Deepen Understanding of Program Design & Models to Better Meet People Where They Are