National Indigenous History Month 2021

In June, we commemorate National Indigenous History Month 2021 to recognize the history, heritage and diversity of First Nations, Inuit and Métis peoples in Canada. The Crow-Indigenous Relations and Northern Affairs Canada website contains resources on Indigenous history, promotional and educational materials, and information on how the Government of Canada is responding to the Truth and Reconciliation Commission's Calls to Action.

Introduction to Indigenous Peoples’ cultures online course

This free, on-demand, introductory course provides learners with insight into the history of First Nations, Métis and Inuit Peoples; an understanding of the devastation of colonialism on Indigenous communities and economies from an Indigenous perspective and how it is critical to reconciliation; and how culturally sensitive health care models help inform how accounting and finance education can be inclusive and supportive. This course was developed to provide the writers and facilitators of CPA education programs, cases and examinations with insight, knowledge and skills to better understand the perspectives of Indigenous students, to help support their success. It will provide all learners with a valuable introduction into the deep cultural and historical foundations upon which the future prosperity of Indigenous communities must be built.

San’yas Indigenous Cultural Safety Training

Cultural safety is about fostering a climate where the unique history of Indigenous peoples is recognized and respected in order to provide appropriate care and services in an equitable and safe way, without discrimination. This website includes information about the San’yas: Indigenous Cultural Safety Training Program delivered by the Provincial Health Services Authority of British Columbia.

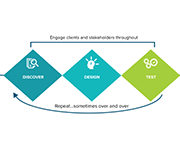

Human Insights Tools & Resources

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from clients’ point of view, designing solutions to meet those needs, and testing your ideas to ensure they bring about the needed change. Tools and resources are presented for each of the discover, design, and test phases.

Data literacy training

Statistics Canada presents a learning catalogue to share knowledge on data literacy. Data literacy is the ability to derive meaningful information from data. It focuses on the competencies involved in working with data including the knowledge and skills to read, analyze, interpret, visualize and communicate data as well as understand the use of data in decision-making. Their aim is to provide learners with information on the basic concepts and skills with regard to a range of data literacy topics. The training is aimed at those who are new to data or those who have some experience with data but may need a refresher or want to expand their knowledge.

Global Learning Partners: Shareable Resources

Global Learning Partners (GLP) helps individuals and organizations to learn by providing practical expertise in learning assessment, design, facilitation and evaluation. Their shareable resources cover a variety of topics in learning, taking a learning-centered approach, including: Learning Design, Needs Assessment, Facilitation, Evaluation, and others.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

Online financial tools and calculators (Prosper Canada)

Virtual tools for participant engagement (Prosper Canada)

Online delivery check-list (Momentum)

Jeopardy game template (SEED)

Time-stamps for the video recording:

3:26 – Agenda and introductions

5:10 – Audience polls

8:19 – Virtual delivery considerations (Speaker: Glenna Harris, Prosper Canada)

12:39 – Virtual workshops best practices (Speaker: Fatima Esmail, Momentum)

33:12 – Online money management training (Speaker: Millie Acuna, SEED)

49:07 – Q&A

Coaching and Philanthropy: An Action Guide for Nonprofits

The Coaching and Philanthropy Project was created by CompassPoint in collaboration with Grantmakers for Effective Organizations, BTW informing change and Leadership. This guide uses the data collected during the project to answer a few questions including: What is coaching? How can coaching contribute to my development as a nonprofit leader? What kind of coaching is right for me and my organization? How much is coaching? to assess and advance coaching as a strategy for building effective nonprofit organizations.

Money and Youth

The Canadian Foundation for Economic Education (CFEE) works collaboratively with funding partners, departments of education, school boards, schools, educators, and teacher associations to develop and provide free, non-commercial programs and resources for teachers and students – developed and reviewed by educators. The online version of their curriculum Money and Youth is organized into separate modules so that users can select individual topics that align with interests. An introduction to the topic, a teachers guide containing lesson plans, and parent resources are included within each module.

English

Financial coaching tools - Exploring client needs and priorities

Tools for exploring client priorities

Urgent vs. important – fillable PDF

Dreams for the future

Financial wheel of life

First coaching meeting checklist

My money priorities

Values worksheet

My ‘money personality’ – fillable PDF

Key coaching skills

Coaching skills: Active listening

Coaching skills: The art of acknowledgement

COACH-ing moments

Program support tools

These are some example tools to support the coach in assessing client readiness for coaching, guiding clients towards potential actions to meet their goals, and in discovering referral support in their community.

Milestones, actions, and tools

Client readiness assessment – PDF

Client readiness assessment – fillable PDF

Financial health pre-assessment – PDF

Financial health pre-assessment – fillable PDF

Developing a referrals network

Virtual tools for participant engagement

Resources:

Virtual service delivery tools

We are grateful to Family Services Greater Vancouver in British Columbia, Thunder Bay Counselling in Ontario, and SEED Winnipeg Inc. in Manitoba for their content consultation support and resource sharing.

Supporting client intake, triage, and referral in virtual financial help services

Virtual tools for participant engagement

Implementing a practice of self-care for practitioners – PDF

Implementing a practice of self-care for practitioners – fillable PDF

Participant tools:

Action plan – PDF

Action plan – fillable PDF

Contact list – PDF

Contact list – fillable PDF

Information to remember – PDF

Information to remember – fillable PDF

Action items – PDF

Action items – fillable PDF

Please note that some of the resources below were developed prior to the COVID-19 pandemic and serve as samples only. Current materials used by community agencies may have been revised to reflect updates to services and to meet public health guidelines.

Intake and assessment tools:

Intake Form – Family Services Greater Vancouver

First Financial Coaching Session Survey – Family Services Greater Vancouver

Financial Health Assessment – Thunder Bay Counselling

Financial Assessment Spreadsheet – Thunder Bay Counselling

Consent forms:

Consent to Service – Thunder Bay Counselling

Consent to Release and Obtain Information – Thunder Bay Counselling

Promotional materials:

Welcome and introduction to services brochure – Thunder Bay Counselling

Community Financial Helpline social media material (image 1, image 2, image 3) – SEED Winnipeg Inc.

Case studies and common questions

Use these case studies and common questions to practice or develop your coaching skills. Try them on your own or with your fellow staff.

Case study: Linda

Case study: Jacob

Case study: Nina

Common questions 1: “Just tell me what to do!”

Common questions 2: “There’s no point.”

Saving tools

Debt tools

Coaching conversation tips – Debt

Guide for talking to creditors

Determining debt payoff order (FC toolkit)

Debt list tool (FC toolkit) – PDF

Debt list tool (FC toolkit) – fillable PDF

Net worth tool (FC toolkit) – PDF

Net worth tool (FC toolkit) – fillable PDF

Payment arrangements worksheet (FC toolkit) – PDF

Payment arrangements worksheet (FC toolkit) – fillable PDF

Who do you owe? (FC toolkit) – PDF

Who do you owe? (FC toolkit) – fillable PDF

French

Outils de coaching financier

Fixation d‘objectifs et planification d’actions

Outils de déclaration de revenue

Managing your money: Tools and tips to help you meet your goals (English)

MYM Worksheet 1: Your money goals

MYM Worksheet 1: Your money goals – Fillable PDF

MYM Worksheet 2: Tracking your regular income

MYM Worksheet 2: Tracking your regular income – Fillable PDF

MYM Worksheet 3: Tracking your spending

MYM Worksheet 3: Tracking your spending – Fillable PDF

MYM Worksheet 4: Tracking your bills

MYM Worksheet 4: Tracking your bills – Fillable PDF

MYM Worksheet 5: Monthly budgeting

MYM Worksheet 5: Monthly budgeting – Fillable PDF

MYM Worksheet 6: Setting a savings goal

MYM Worksheet 6: Setting a savings goal – Fillable PDF

MYM Worksheet 7: Preparing for tax filing

MYM Worksheet 7: Preparing for tax filing

About the ‘Managing your money’ resource

All ‘Managing your money’ worksheets

Facilitator resources (English)

Gérer votre argent: Outils et conseils pour vous aider à atteindre vos objectifs (French)

Feuille de travail #1: Vos objectifs en lien à l’argent (MYM)

Feuille de travail #2: Suivi de votre revenu régulier (MYM)

Feuille de travail #3: Suivi de vos dépenses (MYM)

Feuille de travail #4: Suivi de vos factures (MYM)

Feuille de travail #5: Budget mensuel (MYM)

Feuille de travail #6: Fixer un objectif d’épargne (MYM)

Feuille de travail #7: Préparation pour la déclaration de revenus (MYM)

Note pour les communautés et les organismes (MYM)

Feuilles de travail complètes

Ka-paminit kisôniyâm (Plains Cree)

Handout 9-13: Consumerism glossary

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Glossary of terms relating to consumerism. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-8: Dealing with consumer problems

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Examples of how to deal with consumer problems. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-7: Common frauds and scams

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Common consumer frauds and scams to look out for. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-5: Cell phone information

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Information about cell phone plans and what is involved when you purchase one. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-3: Smart shopping tips

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Smart shopping tips. To view full Financial Literacy Facilitator Resources, click here.

Handout 9-2: Advertising techniques and sales tactics

This handout is from Module 9 of the Financial Literacy Facilitator Resources. Explanation of different advertising and sales techniques. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-11: Consumerism goal setting

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Setting goals related to consumerism. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-10: Rate your financial knowledge, part 2

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Use this quiz to rate your financial knowledge. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-9: Complaint letter

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. A template for writing a consumer complaint letter. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-6: Cell phone checklist

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. A checklist of questions to answer when you are getting a cell phone. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-4: Find the better deal

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Figure out which item is the better deal by calculating the unit cost. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 9-1: Consumer quiz

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. What kind of consumer are you? Take the quiz. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-10: Debt glossary

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Glossary of terms about debt. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-9: Debt resources

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Web resources about debt in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-6: Collection rules

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Debt collection rights and what a collection agency has the right to do and not to do. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-5: Dealing with creditors

This handout is from Module 8 of the Financial Literacy Facilitator Resources. Tips for dealing with creditors over the phone or by mail, or for creating a debt repayment plan. To view full Financial Literacy Facilitator Resources, click here.

Handout 8-4: Steps to debt repayment

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Steps for debt repayment. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-8: Goal setting

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Goal setting for debt. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-7: Debt collection role play

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Role play activity about debt collection. To view full Financial Literacy Facilitator Resources, click here.

Activity Sheet 8-3: Ladder of debt repayment options

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Print these pages and cut into individual ‘rungs’ for use in the activity. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-2: Debt do’s and don’ts

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Group activity to talk about debt do's and don'ts. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-1: How much is TOO much?

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. How much debt is too much debt? Consider the 20/10 rule. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-13: Credit reporting glossary

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Glossary of terms for credit reporting. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-12: Credit reporting resources

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Web resources for credit reporting in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-10: Ways to improve your credit score

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Ways to improve your credit score. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-8: Correcting common errors on credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. How to correct common errors on credit reports. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-5: Credit scores

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A credit score is a score between 300 and 900 that credit bureaus use to rate the information in your credit report. Credit bureaus use a mathematical formula based on many factors to arrive at your credit score. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-4: Reading a credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. The information in an Equifax credit report varies slightly from a TransUnion credit report, but both contain the same basic sections. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-3: Sample Equifax credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A sample of a credit report received from Equifax. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-2: Credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus summarize your credit use in a report. The credit report is one of the main things lenders look at when they decide whether or not to give you credit. A credit report contains your history of credit use, and your credit ratings. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-1: Credit bureaus

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus are agencies that collect information about how we use credit. They produce personal credit reports. Credit bureaus are private companies. They are regulated by the province, but they are not part of the government. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-11: Goal setting and credit reports

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Practice setting goals related to credit reports. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-9: Credit score scenarios

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Credit score scenarios to practice learning. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-7: TransUnion sample request form

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the TransUnion request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-6: Sample Equifax request sheet

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the Equifax request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-7: Credit glossary

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Glossary of terms related to credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-6: Credit resources

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Web resources for credit and credit cards. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-4: Managing credit

This handout is from Module 6 of the Financial Literacy Facilitator Resources. Tips for managing credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-3: The cost of credit

This handout is from Module 6 of the Financial Literacy facilitator curriculum. The cost of credit for different payment methods.

Handout 6-2: Credit card features

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The features of credit cards and what they mean. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-1: Types of credit

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The different types of credit and their lending conditions. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 6-5: Goal setting and credit

This activity sheet is from Module 6 of the Financial Literacy Facilitator Resources. Practice setting goals related to credit. To view full Financial Literacy Facilitator Resources, click here.

Handout 5-10: Saving resources

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Website resource list for saving. To view full Financial Literacy Facilitator Resources, click here.

Handout 5-6: Savings tools (basic)

This handout is from Module 5 of the Financial Literacy facilitator curriculum. Basic description of savings accounts and financial products available in Canada. To view full Financial Literacy facilitator curriculum, click here.

Handout 5-11: Glossary for saving module

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Glossary of savings terms. To view full Financial Literacy Facilitator Resources, click here.

Handout 5-7: Savings tools (detailed)

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Explains details about different kinds of savings accounts and financial products typically available in Canada. To view fill Financial Literacy Facilitator Resources, click here.

Handout 5-4: Compound interest

This handout is from Module 5 of the Financial Literacy Facilitator Resources. Explains compound interest. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-9: Goal setting for saving

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Review the activities you did early in this session to help you get ideas about savings goals. Also, think about other goals you can set, like doing more research or making an appointment with a financial advisor. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-8: Savings tools quiz

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Savings tools quiz. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-5: Christine and Aparna

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Saving scenario with Christine and Aparna. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-3: Finding money

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Use this chart to list some of the things that you buy a lot. Note how often you buy them in a month. Put down how much they usually cost (“average price”). Then figure out how much you spend on them in a month. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-2: Needs and wants

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. List some of the things you have spent money on in the last two weeks. Which items are needs and which are wants? To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-1: Setting savings goals

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Steps to setting a savings goal. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-12: Glossary for banking and financial services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Glossary for banking and financial services. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-11: Banking and financial services resources

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Resource list of websites about banking and financial services. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-8: Alternative financial services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Alternative financial services are outside of the traditional, regulated banking system. They do not take deposits like a bank or credit union. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-7: What are my rights?

This handout is from Module 4 of the Financial Literacy Facilitator Resources. What are your rights when opening a bank account in Canada? To view full Financial Literacy Facilitator Resources, click here.

Handout 4-6: Opening a bank account

This handout is from Module 4 of the Financial Literacy Facilitator Resources. How to open a bank account in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-4: Bank accounts and services

This handout is from Module 4 of the Financial Literacy Facilitator Resources. The different kinds of bank accounts and services available. in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-5: Choosing a bank and choosing an account

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Choosing a bank and choosing an account based on your banking needs. To view full Financial Literacy Facilitator Resources, click here.

Handout 4-2: Deposit insurance at credit unions

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Deposit insurance amounts from credit unions in different provinces. To view full Financial Literacy Facilitator Resource, click here.

Handout 4-1: Banks and credit unions

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Banks and credit unions are places where you can safely deposit your money, cash your cheques, pay your bills, ask for a loan or credit card and use a variety of saving and investment tools. This chart explains the differences between banks and credit unions. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-10: Goal setting

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Take a few minutes to set one or two SMART goals for your use of banks and alternative financial services. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-9: Comparing alternative financial services to banking services

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Why use alternative financial services? Why use banking services? List the reasons for using the services that your group was assigned. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 4-3: Banks and banking services quiz

This activity sheet is from Module 4 of the Financial Literacy Facilitator Resources. Banks and banking services quiz: In pairs, match the items in column A to column B. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-12: Budgeting glossary

This handout is from Module 3 of the Financial Literacy Facilitator Resources. Glossary of budgeting terms. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-11: Resources – Money management websites

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Resource websites for money management. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-9: Financial record keeping

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Here are some important papers and records. You should keep them in a safe place and organize them so that you can find what you need. The chart shows their “shelf life” – how long you should keep them. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-8: Budgeting tips

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Different types of budgeting tips to help you stay on track. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-10: Goal setting

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Take a few minutes to reflect on how this workshop relates to your life. Set one or two SMART goals for your personal budgeting and financial record-keeping. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-6: Making your own budget

This activity sheet is from Module 3 of the Financial Literacy facilitator curriculum. Steps involved in making your own budget. To view full Financial Literacy Facilitator Resources, click here

Activity sheet 3-4: Budgeting scenarios

This activity sheet is from Module 3 of the Financial Literacy facilitator curriculum. Using the Monthly Budget Worksheet, put together a budget for the person in your scenario. Feel free to make up more details. You can also change or add categories to the budget to match your person’s situation. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-3: Budgeting expense categories

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Tracking your different categories of expenses. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-2: Income sources

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Tracking your income sources. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-1: The ‘B’ word – budget

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. What do you think about when you hear the word “budget’? To view full Financial Literacy Facilitator Resources, click here.

What words or feelings come to mind?

Handout 2-8: Glossary

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Glossary for income and taxes module. To view full Financial Literacy Facilitator Resources, click here.

Handout 2-7: Resources

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Resource list for income and taxes module. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 2-6: Income and taxes

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Goal setting for filing your income taxes. To view full Financial Literacy Facilitator Resources, click here.

Handout 2-4: Filing your taxes

This handout is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. How to file your taxes. To view full Financial Literacy Facilitator Resources, click here.

Handout 2-3: Reading a pay stub

This handout is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. How to read a pay stub. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 2-2: Reading David’s pay stub (quiz)

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Reading David's pay stub - a quiz. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 2-5: Maria and Fernando’s story

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Maria and her husband Fernando worked together cleaning a big office building at night. They were hired by a man who ran a large cleaning company. They each got a paycheque twice a month. In February, it was time to do income tax for their previous year’s income. To view full Financial Literacy Facilitator Resources, click here.

Managing your money #7: Preparing for tax filing

Even if you make no money, you should file a tax return each year. You may be eligible for a refund (money back). Filing your taxes triggers access to government benefits that you can’t get any other way. This worksheet will help you gather the information you will need at tax time. You will need a file folder, an envelope, or a small box to put all of your paperwork in. This is worksheet #7 from the booklet 'Managing your money'.

Managing your money #6: Setting a savings goal

Setting a savings goal means that you have decided how much money you can put away, and what you are going to save for. This activity can help you write down some money goals and when you would like to achieve them. You can build savings by putting aside small amounts on a regular basis. This is worksheet #6 from the booklet 'Managing your money'.

Managing your money #5: Monthly budgeting

When you make a budget, you give yourself a clear picture of your financial situation. A budget compares your income to your expenses, all in one place. This is worksheet #5 from the booklet 'Managing your money'.

Managing your money #4: Tracking your bills

Knowing what bills you have and when they are due can help you plan your spending. This activity will help you to be aware of two things: how much you owe each month, and at what time of the month that money is due. This will help you to pay bills on time, and avoid late fees. This is worksheet #4 from the booklet 'Managing your money.'

Managing your Money #3: Tracking your spending

Keeping track of where your money goes during the month is another helpful step towards making a budget. Then you will be able to compare your spending with your income. This is worksheet #3 from the booklet 'Managing your money.'

Managing your money #2: Tracking your regular income

Income is the money that comes into your household. This worksheet will help you see the ‘big picture’ of your income and other resources. Then you can think about how to plan your expenses. This is worksheet #2 from the booklet 'Managing your money.'

Unstuck: How to Get Out of Your Money Rut and Start Living the Life You Want. Complimentary Workbook

Your Money, Your Goals: A Financial Empowerment Toolkit for community volunteers

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money. Module 6-7: Debt and credit reports. Module 8: Money services, cards, accounts, and loans. Module 9: Protecting your money.

English

Module 1: Exploring your relationship with money

Module 2: Income and taxes

Handout 2-1 Government benefits

Activity Sheet 2-2 Reading David’s pay stub quiz

Handout 2-3 Reading a pay stub

Handout 2-4 Filing your taxes

Activity Sheet 2-5 Maria and Fernandos story

Activity Sheet 2-6 Goal-setting

Handout 2-7 Resources

Handout 2-8 Glossary

Video: Tax Deductions Credits and Benefits (video transcript) *NEW*

Module 3: Budgeting

Activity Sheet 3-1 The “B” word-budget

Activity Sheet 3-2 Income sources

Activity Sheet 3-3 Expense categories

Activity Sheet 3-4 Budgeting scenarios

Activity Sheet 3-5 Monthly budget worksheet

Activity Sheet 3-6 Making your own budget

Handout 3-7 Budgeting strategies

Handout 3-8 Budgeting tips

Handout 3-9 Financial record keeping

Activity Sheet 3-10 Goal-setting

Handout 3-11 Resources

Handout 3-12 Glossary

Module 4: Banking and financial services

Handout 4-1 Banks and credit unions

Handout 4-2 Deposit insurance at credit unions in different provinces

Activity Sheet 4-3 Banks and banking services quiz

Handout 4-4 Banks accounts and services

Handout 4-5 Choosing a bank and choosing an account

Handout 4-6 Opening a bank account

Handout 4-7 What are my rights?

Handout 4-8 Alternative financial services

Activity Sheet 4-9 Comparing alternative financial services to banking services

Activity Sheet 4-10 Goal-setting

Handout 4-11 Resources

Handout 4-12 Glossary

Getting government payments by direct deposit

Module 5: Saving

Activity Sheet 5-1 Setting savings goals

Activity Sheet 5-2 Needs and wants

Activity Sheet 5-3 Finding money

Handout 5-4 Compound interest

Activity Sheet 5-5 Enzo and Tess

Handout 5-6 Introduction to saving and investing

Handout 5-7 Saving and investing tools (basic)

Handout 5-8 Saving and investing tools (detailed)

Handout 5-9 Preparing for old age

Handout 5-10 Saving and investment support

Activity Sheet 5-11 Goal-setting

Handout 5-12 Resources

Handout 5-13 Glossary

Interest rates and how they impact your finances, CIRO

Module 7: Credit reporting

Handout 7-1 Credit bureaus

Handout 7-2 Credit reports

Handout 7-3 Sample Equifax credit report

Handout 7-4 Reading a credit report

Handout 7-5 Credit scores

Activity Sheet 7-6 Equifax credit report request form

Activity Sheet 7-7 TransUnion credit report request form

Handout 7-8 Correcting common errors on credit reports

Activity Sheet 7-9 Credit score scenarios

Handout 7-10 Ways to improve your credit score

Activity Sheet 7-11 Goal-setting

Handout 7-12 Resources

Handout 7-13 Glossary

Module 8: Debt

Activity Sheet 8-1 How much is TOO much

Activity Sheet 8-2 Debt do’s and don’ts

Activity Sheet 8-3 Ladder of debt repayment options

Handout 8-4 Steps to debt repayment

Handout 8-5 Dealing with creditors

Handout 8-6 Collection rules

Activity Sheet 8-7 Collection role play

Activity Sheet 8-8 Goal-setting

Handout 8-9 Resources

Handout 8-10 Glossary

Video: Debt Solutions (video transcript)*NEW*

Module 9: Consumerism

Activity Sheet 9-1 Consumer quiz

Handout 9-2 Advertising techniques and sales tactics

Handout 9-3 Smart shopping tips

Activity Sheet 9-4 Find a better deal

Handout 9-5 Cell phone information

Activity Sheet 9-6 Cell phone checklist

Handout 9-7 Common types of frauds and scams

Handout 9-8 Tips to protect yourself from fraud and scams

Handout 9-9 Dealing with consumer problems

Handout 9-10 Complaint letter

Handout 9-11 Making a complaint about an investment

Activity Sheet 9-12 Rate your financial knowledge part 2

Activity Sheet 9-13 Goal setting

Handout 9-14 Resources

Handout 9-15 Glossary

CERB and other COVID-19 scams

Protect yourself against fraud during COVID-19

Types of fraud

Fraud prevention month

The many faces of elder abuse

French

Module 1 : Explorer votre relation avec l’argent

Feuille d’activité 1-1 « Trouvez quelqu’un qui… »

Feuille d’activité 1-2 « L’argent c’est… »

Feuille d’activité 1-3 Messages relatifs à l’argent

Feuille d’activité 1-4 Imaginez un peu

Feuille d’activité 1-5 Évaluer vos connaissances financières

Feuille d’activité 1-6 Comment établir des objectifs INTELLLIGENTS

Feuille d’activité 1-7 Établissement d’objectifs

Module 2 : Revenus et impôts

Document 2-1 Prestations gouvernementales

Feuille d’activité 2-2 « Lire le relevé de paie de Jeanne (questionnaire) »

Document 2-2 Lire un relevé de paie

Document 2-3 La déclaration de revenus

Feuille d’activité 2-4 « Le cas de Maria et Fernando »

Feuille d’activité 2-5 « Établissement d’objectifs »

Document 2-6 Ressource

Document 2-7 Glossaire

Déductions, crédits d’impôt et avantages fiscaux – Transcription de la vidéo **NOUVEAU**

Module 3 : L’établissement d’un budget

Feuille d’activité 3-1 Le mot qui commence par un « B » – budget

Feuille d’activité 3-2 Sources de revenus

Feuille d’activité 3-3 Catégories de dépenses

Feuille d’activité 3-4 Scénarios de budget

Feuille d’activité 3-5 feuille de travail pour le budget mensuel

Feuille d’activité 3-6 feuille de travail pour le budget mensuel

Document 3-7 Les stratégies budgétaires

Document 3-8 Conseils budgétaires

Document 3-9 Tenue des dossiers financiers

Feuille d’activité 3-10 Établissement d’objectifs

Document 3-11 Ressources

Document 3-12 Glossaire

Module 4 : Services bancaires et financiers

Document 4-1 Banques et caisses populaires ou coopératives de crédit

Document 4-2 Assurance-dépôts dans les caisses populaires ou coopératives de crédit selon les provinces.

Feuille d’activité 4-3 Questionnaire sure les banques et les services bancaires

Document 4-4 Comptes et services bancaires

Document 4-5 Choisir une banque et un compte

Document 4-6 Ouverture d’un compte de banque

Document 4-7 Quels sont mes droits?

Document 4-8 Services financiers parallèles

Feuille d’activité 4-9 Comparaison des services financiers parallèles avec les services bancaires classiques

Feuille d’activité 4-10 Établissement d’objectifs

Document 4-11 Ressources

Document 4-12 Glossaire

Obtention des paiements gouvernementaux par dépôt direct

Module 5 : L’épargne

Feuille d’activité 5-1 Établissement d’objectifs d’épargne

Feuille d’activité 5-2 Besoins et désirs

Feuille d’activité 5-3 Trouver l’argent

Document 5-4 Intérêt composé

Feuille d’activité 5-5 Bill et Bob

Document 5-6 Outils d’épargne (notions de base)

Document 5-7 Outils d’épargne (notions détaillées)

Feuille d’activité 5-8 Questionnaire sur les outils d’épargne

Feuille d’activité 5-9 Etablissement d’objectifs

Document 5-10 Ressources

Document 5-11 Glossaire

Module 6 : Les notions de base du crédit

Module 7 : Rapports de solvabilité

Document 7-1 Les bureaux de crédit

Document 7-2 Les dossiers de crédit

Document 7-3 Exemple d’un dossier de crédit d’Equifax

Document 7-4 La lecture d’un dossier de crédit

Document 7-5 Les pointages de crédit

Feuille d’activité 7-6 Equifax demande de mon historique de crédit

Feuille d’activité 7-7 TransUnion formulaire de demande de fiche de crédit

Document 7-8 Corriger les erreurs communes inscrites sur les dossiers de crédit.

Feuille d’activité 7-9 Les scenarios sur le pointage de crédit

Document 7-10 Façons d’améliorer votre pointage de crédit

Feuille d’activité 7-11 L’établissement d’objectifs

Document 7-12 Ressources

Module 8 : Les dettes

Feuille d’activité 8-1 Quel montant faut-il éviter de dépasser?

Feuille d’activité 8-2 À faire et à éviter

Feuille d’activité 8-3 L’échelle des options de remboursement des dettes

Document 8-4 Les étapes pour rembourser des dettes

Document 8-5 Traiter avec les créanciers

Document 8-6 Règles en matière de recouvrement

Feuille d’activité 8-7 Jeu de rôle – Recouvrement

Feuille d’activité 8-8 Établissement d’objectifs

Document 8-9 Ressources

Document 8-10 Glossaire

Les dettes – Transcription de la vidéo **NOUVEAU**

Module 9 : Le consumérisme

Feuille d’activité 9-1 Questionnaire du consommateur

Document 9-2 Techniques de publicité et tactiques de vente

Document 9-3 Conseils pour magasiner de manière intelligente

Feuille d’activité 9-4 Trouver la meilleure aubaine

Document 9-5 Information sur le téléphone cellulaire

Feuille d’activité 9-6 Liste de vérification du téléphone cellulaire

Document 9-7 Les fraudes et les arnaques communes

Document 9-8 Gérer des problèmes de consommation

Feuille d’activité 9-9 Lettre de plainte

Feuille d’activité 9-10 Évaluez vos connaissances financières, partie 2

Feuille d’activité 9-11 Établir des objectifs

Document 9-12 Ressources

Document 9-13 Glossaire

Escroqueries liées à la PCU et autres fraudes courantes durant la pandémie de COVID-19

Protégez-vous contre la fraude durant la pandémie de COVID-19

Types de fraude

Mois de la prévention de la fraude